Good morning from Paul and Roland!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Roland’s Section:

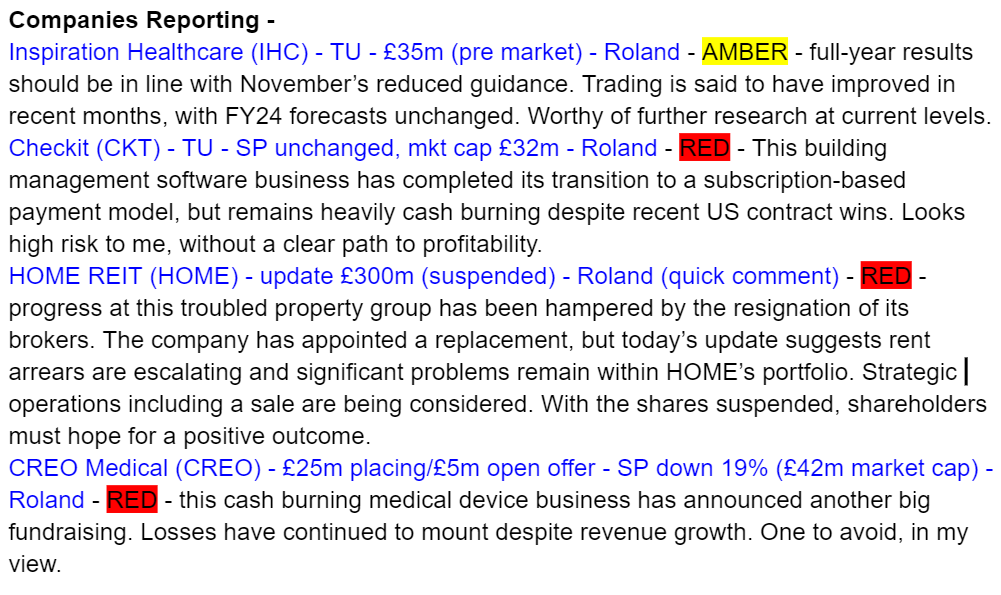

Inspiration Healthcare (LON:IHC)

51p (pre-open)

Market cap £35m

This company provides medical technology for critical care, with a focus on neonatal intensive care. Inspiration Healthcare’s own-branded solutions include non-invasive respiratory management and thermoregulation, while its UK distribution business supplies solutions for surgical procedures and infusion therapies.

Graham covered November’s profit warning from this medical equipment manufacturer here. To recap, the company said that problems in China meant that a number of orders would slip back into the following financial year.

Results guidance: Today’s full-year trading update confirms results for the year ended 31 January should be in line with revised expectations from November.

“following the close of the financial year ended 31 January 2023, the Group is expecting to report revenues of approximately £41.2 million representing an increase of 0.4% compared to the prior financial year and in line with market expectations. Adjusted EBITDA* is also expected to be in line with market expectations.”

An updated broker note from Cenkos is available on Research Tree this morning. Cenkos analysts estimate EBITDA of £3.8m for the current year, valuing the business at around 10x EBITDA.

Cenkos forecasts are consistent with the consensus estimate on Stockopedia for adjusted earnings of 0.7p per share for the year ended 31 January.

Current-year trading update: Chief executive Neil Campell (who is a 6% shareholder) says that recent months “have seen increased order flow” and “a high level of interest in our products”.

Mr Campbell says that external disruption effectively stalled the group’s growth last year, but he now believes the group is well placed to return to growth.

Cenkos analysts remain positive and have left their FY24 forecasts unchanged. These align with those on Stockopedia, suggesting revenue could rise by 10% to £45m this year, supporting earnings of 3.6p per share.

These estimates price the stock on 14 times FY24 forecast earnings, which does not seem too unreasonable to me.

It’s worth noting that the group has minimal debt and is expected to pay a (slightly) increased dividend of 0.63p per share this year.

My view: I’ve followed this company intermittently for a number of years, after being impressed by management at a ShareSoc presentation. I think it’s fair to say that progress has been a little frustrating and inconsistent, but in my view this remains an interesting business, with strong management ownership and support from some leading small-cap specialist fund managers.

Acquisitions in 2019 and 2020 resulted in some dilution for shareholders, and it’s disappointing that this has not yet translated to a consistent step up in profits. However, the circumstances around the pandemic were exceptional. I don’t see any obvious reason why a more stable performance won’t now follow.

One area I’d like to understand more about are the profit margins on different product ranges. According to previous broker notes, November’s profit warning had such a severe impact on profits (88% eps reduction) because it related to the loss of higher-margin sales.

At current levels, Inspiration is trading on a price/sales ratio of less than one, with minimal debt and a track record of reasonable profitability.

This situation isn’t without risk, but my feeling is that the stock could offer value at current levels and is probably worthy of further research.

Checkit (LON:CKT)

31p (+4% at 08.30)

Market cap £32m

Company presentation: Checkit’s CEO and CFO are giving a presentation on the Investor Meet Company platform at 12pm today.

This software business helps monitor the productivity of “deskless workers” in sectors such as hospitality and healthcare, by monitoring their interactions with “critical equipment and buildings”.

Growth took a hit during the pandemic when many such businesses were closed. However, Checkit is now back in growth mode and expanding into the US market.

Trading update: the company has been converting its customers to a subscription model and says this process is now complete. Full-year revenue is said to be slightly ahead of expectations:

Annualised recurring revenue (ARR): £11.5m (+28%)

Revenue from continuing operations: £10.3m (+22%)

Net cash at 31 January 2023: £15.6m (31 July 2022: £19.5m)

Checkit is expanding into the US market and says that ARR from US clients rose by 91% to £2.8m last year. Recent wins include “biopharma customers and a new contract with a large resort and casino operator”.

The US business is said to be on track to be the largest revenue contributor to the group. Given that US ARR only accounted for 24% of ARR last year, this seems to suggest either that US growth remains very strong, or that declines are expected elsewhere.

Cash: Checkit’s post-pandemic growth may be encouraging, but I’m more concerned about the group’s continued high cash burn rate.

Net cash fell by £3.9bn in six months between July and January. Today’s statement does not provide any fresh guidance on a pathway to profitability, although a further update is promised for April.

At the current rate of cash burn, I’d say that Checkit would need to raise funds in the next 12-18 months, to avoid a cash crunch.

Broker forecasts from Edison (paid research) are unchanged today and suggest an aggregate pre-tax loss of £12.8m for FY23 and FY24.

My view: I’d be interested to learn more about the size of the market opportunity here and about potential competitors.

However, until Checkit’s management can provide clear guidance on a pathway to profitability and cash flow breakeven, this business remains too speculative and high risk for my appetite.

Stockopedia’s algorithms concur, awarding a Sucker Stock classification and a StockRank of just 14.

Creo Medical (LON:CREO)

23p (-18% at 09.15)

Market cap £43m

Placing and subscription to raise a minimum £25m

Creo Medical is focused on the “emerging field of surgical endoscopy”.

This loss-making business has announced a £25m placing and £5.2m open offer today. That’s a fairly hefty level of fundraising, for a business that had a market cap of £50m at last night’s close.

The StockRanks are highly sceptical of this business, highlighting its speculative status:

Fundraise: £25m of shares are being placed with institutional investors at 20p. Existing shareholders will also be able to apply to buy new shares at this price through a £5.2m open offer.

Share price spike: the 20p placing price is broadly in line with the level the shares have been trading at over the last month. But the stock spiked up by around 40% yesterday, which looks a little odd to me. Perhaps news of the fundraising leaked?

My view: Paul warned about the worrying rate of cash burn at this early-stage medical device business in January and August. The need for a fundraise was also flagged in a recent broker note from Edison (paid research). Hopefully no Stockopedia subscribers have been caught out by today’s news.

Creo Medical’s revenue has risen from £0m to £25m since 2019, suggesting the company is selling growing quantities of product into its target markets. However, there’s no sign yet of this growth converting into profits. Losses have ballooned during this time.

The share count has risen too, due to repeated fundraising:

I don’t have any insight into the potential size of the market for the company’s products. But shareholders who have stayed loyal to this story have paid a high price. The shares have lost 90% of their value over the last two years:

From an equity perspective, Creo remains uninvestable in my view, until the company can demonstrate profitability and positive cash flow.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.