Good morning, it's Paul here with the placeholder for Thursday's SCVR - designed to provide a place for your early morning 7am RNS comments. In particular for MrContrarian's brilliant early morning summaries - I think we should do a whip round for him at Christmas actually, for the sterling service he selflessly provides to the investing community.

Estimated timings - TBC (let me look at the RNS and then I'll publish a totally unrealistic deadline, fall asleep after lunch, and miss it by miles!)

Today's report is now finished.

To get you started today - I added a few more sections to yesterday's SCVR throughout the afternoon, so it now covers 6 companies, including 3 reader requests. Several of which look potentially interesting actually, so thanks for flagging, and do please take a look & let me know your views.

.

Pubs

It's been a while since I've talked about pubs, but have been doing a bit more research this week about pub re-openings in London. My local, the Lord Clyde, has been open for a little while, so I went there on Tuesday night, and was surprised to find that it only had cider and Guinness on tap - it's quite understandable that breweries are having trouble scaling up production, and in any case I love Guinness, so had a few pints of that. This is an easy, quick fix, so doesn't matter.

It was table service, which is fantastic, this must become the new norm. I normally sit outside anyway, in the fenced-off pavement area, so I can watch all the traffic near-misses, and expletive-laden arguments between motorists. But social distancing makes it all the more sensible to sit outside, if you want to avoid covid. I'm in two minds. If antibodies only last 3 months, then surely I should be exposing myself to covid again, in order to refresh my immunity? I have felt a bit peaky this week actually, so have been wondering if the disgusting old man in a local cafe on Monday, with the runny nose, might have temporarily re-infected me?

Also, it's quite fun to see the local care in the community lady, called May, who shuffles down the road, getting free food and drink from all the local shopkeepers (either very smart, or genuine, I can't decide). She's a cheerful soul, typically booming out at all the men,, "Hello! How's your wife?!" She usually asks us to adjust her collar, or hold her hand and walk her across the road. She's pretty harmless, in the main. I assured May that my (imaginary) wife is very well, which pleased her, then sat down to enjoy some lager this evening, as rumour had it that fresh barrels were arriving today at the Lord Clyde. A freshly poured pint of Amstel, dancing beautifully with swirling clouds of tiny bubbles, was pure heaven. So I had 4 of them.

Also, a little tip is to ask for a wedge of lime, and smear it all over your hands. Not to disinfect them, but just to enjoy the lovely scent of lime for the next few hours.

Why was I mentioning this? Oh only to say that the London pub was very quiet, I would say well under half normal occupancy. As I tottered up for my 4th or 5th pint, the barman asked, "Same again?". Yesh please, I replied, "I'm trying to make up for all the missing customers!". A local quipped, "They'll be back soon - just like chlamydia!" How common, I thought to myself, but you often have to hold your tongue in this part of London, and make a quick decision that it's probably best not to engage. Hence I feigned deafness.

As I enjoyed my final pint of gorgeous bubbly liquid, 4 young, middle class bearded millennials sat down at the table behind me. I try not to eavesdrop, but if they're very close, and talking loudly, you can't avoid it. To set the picture, one was called Oli, and another Will. That tells you everything you need to know. I could barely stifle my laughter when Will said;

"Oli, I'm like not really OK with this whole table service thing. Isn't that like, slavery?" (with upward inflection of course)

"Will, you don't like actually like own the waitress. Or waiter. So, no not really"

Glad they've got that pertinent issue resolved! It wasn't said ironically either.

Then they went on to discuss 5-aside football. What happened to the 5th person, I wondered. Then they talked about fights, and headbutting someone, so I rapidly decided they weren't the nice middle class chaps I thought they were, and tuned out.

There was something else leading on from this, ah yes;

Face Coverings

A shares blog is definitely not the place to discuss policy on face masks or coverings. However, I just wanted to make a couple of subsidiary points;

1. Will the new requirement to wear face masks stop people going shopping? My view is that it might, for some people. But for others, it might reassure them. My feeling is that once you get used to wearing a face covering of some kind, it becomes quite reassuring. I spent a 2 hour train ride to London recently, with the carriages maybe just a quarter full, if that, and everyone complied, wearing face coverings as required. It seemed to work fine.

2. Find a face covering that you find comfortable. Even if it's just a formality, it's not worth fighting against it, just wear the damn things. I started with the paper, concertina ones, and they're uncomfortable, and made my glasses steam up. 10 minutes was enough. However, I since paid £25 on Amazon for 50 cloth face coverings, and they're absolutely fine to wear for a few hours. You forget it's there after a while.

3. Many people have disgusting hygiene habits - I'm sure you've seen many people cough into the air, or even directly into our faces. I just give them a filthy look, and maybe even tut, or mutter "honestly!" under my breath. But these pig ignorant people have no idea that they are pig ignorant. Hence making them wear a mask can only be a good thing, and me wearing one keeps these disgusting creatures one layer of fabric further away from my bloodstream. Yes I hate the public. Or "lumpen proles" as my mother accurately describes them. I've just googled that, and discovered it's a Marxist term! Typical, I always suspected her of left-wing leanings. My Dad learned to speak Russian, and took Mum to the USSR and most of the Eastern bloc countries in the mid 1970s, so I've always suspected my parents of being Soviet spies. We did have a long wave radio, with a large antenna rigged up in the attic. But he's so right-wing, maybe he was an American double agent? Or not sure either way? Maybe it was a bluff? We will never know. The toys they brought home for me after that Communist trip were so shoddily built and unappealing, that I knew, even at the age of 8, that the USSR was going to lose the Cold War.

I was brought up having it drummed into me that "coughs and sneezes spread diseases". Why? because in the 1970s, there were enough people around who survived the 1918 Spanish Flu pandemic, to drum those lessons into younger people. Once the old people had all died, the importance of hygiene also died. Now we're having to re-learn from scratch. It's the same pathetic reason that vaccines have gone out of fashion - because the threat from the awful diseases was eliminated, hence the next generation were too stupid to realise the threat could re-surface any time.

That's probably enough ranting for one evening. See you in the morning!

Right, I'd better do some work now, instead of rattling on after the pub.

Eagle Eye Solutions (LON:EYE)

Share price: 188.5p (up 11.2%)

No. shares: 25.7m

Market cap: £48.4m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services, today provides an update on trading for the year ended 30 June 2020 (the "year").

It's got one of those headings which tells us what to think;

Strong trading performance, successful international expansion and continued innovation combined with business resilience

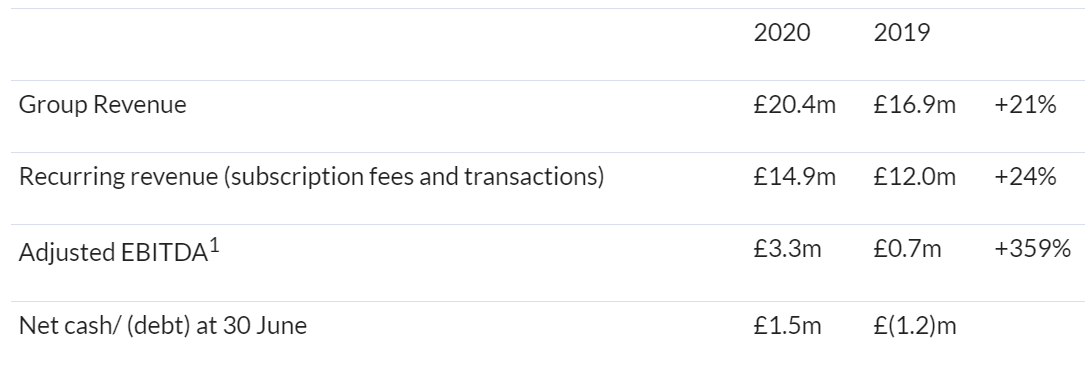

The highlights table shows decent growth (all organic I believe), what it calls recurring revenue (which would probably be better described as repeating revenues), meaningless EBITDA number, and a tight cash position;

.

EBITDA - this figure is meaningless because the company capitalises a lot of its costs onto the balance sheet. This was £2.6m last year, and increased to an annualilsed run rate of about £3.0m in the last interim results. That swallows up nearly all of EBITDA, so in reality the company is trading just slightly above cashflow breakeven. They're not keen to tell us that though, I had to figure it out.

Contract wins & extensions - the list of clients is very impressive (big supermarkets). and it's not just UK, there are international customers too. Volumes of vouchers have risen strongly;

Redemption and interaction volumes increased by 135% to 2.1bn (2019: 847m).

I don't know how they are defining "interaction" volumes? Probably loosely, as it's very apparent that this announcement is a bit rampy - i.e. over-PR'd.

Cash - position has improved to net cash of £1.5m, but some of this (not quantified) are one-off benefits that are expected to unwind in the new financial year. Bank facilities of £5m are due to expire in May 2021 - the company is in "advanced discussions" with Barclays about extending this facility. I think it should raise some equity, to strengthen the balance sheet. Companies that are not really profitable yet, shouldn't have debt on the balance sheet, in my opinion.

Outlook - confident, sales pipeline growing. However, there are hints below that growth might be a little sluggish in the short term perhaps? Also "invest" below means more costs!

While new business decision making is likely to continue to be delayed during this period of uncertainty, our sales pipeline continues to grow, and we are engaged in positive discussions across multiple geographies.

In the year ahead, we will invest in product development, sales and marketing, and in new geographies to capitalise on the momentum being achieved in the US and Australasia, while continuing to manage the business carefully during the COVID-19 period. The Board, therefore, continues to be confident in the long-term growth opportunity for Eagle Eye.

My opinion - this seems a long-winded update, with quite a lot of waffle in it, and too much spin. I think this should have been edited down to just the key points.

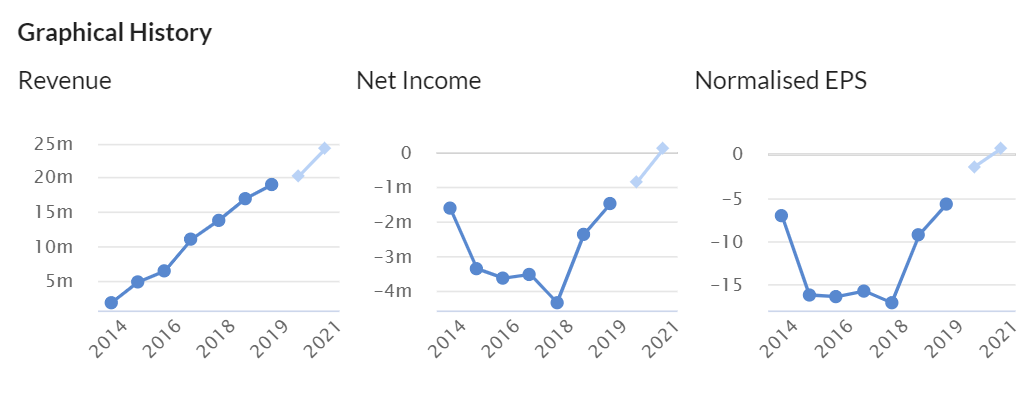

The Stockopedia graphs below nicely cut through all the PR, and tell the real picture - that this company has spent a long time struggling to get to breakeven. But it's achieved it, and the business model starts to get interesting once we layer on more clients - although I suspect costs are likely to keep increasing as revenues build. That's normally what happens with growth companies.

I like this company, and think its client list is very impressive - which should make it easier to win new clients. I'm not 100% convinced that the growth is fast enough to justify taking the market cap higher than £48m currently. But we're in a bull market for tech shares, so this is the right space to be in at the moment.

.

Loopup (LON:LOOP)

Share price: 180.5p (up 10%)

No. shares: 55.4m

Market cap: £100.0m

LoopUp Group plc (AIM: LOOP), the premium remote meetings company, is pleased to provide the following trading update for the six months ended 30 June 2020.

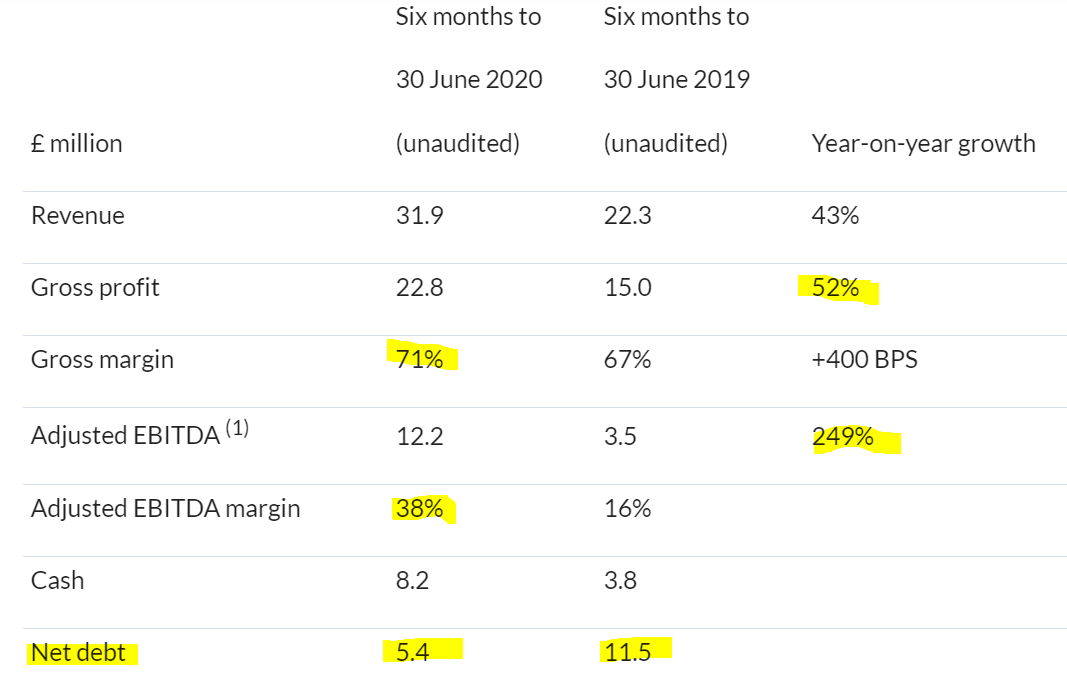

Some very impressive figures below for H1;

.

Key points;

Very strong rise in revenues

High gross margin, so nice operational gearing

Adjusted EBITDA again - this is NOT a valid measure of profits! Checking back to 2019, the depreciation & amortisation charge in the P&L was substantial, at £7.5m. Or looked at another way, it capitalised £5.0m of expenses into intangible assets on the balance sheet EBITDA ignores both types of costs, hence is an artificially inflated number. I prefer to work on a cashflow basis, so if we take the H1 2020 adj EBITDA of £12.2m, and assume that development spend is running flat, at £2.5m per half year, then we get £9.7m positive cashflow in H1 this year - that's highly impressive - although the commentary points out that H1 is seasonally stronger.

Net debt - this has come down a lot, to £5.4m, and no longer seems a problem. Net debt was £11.4m 6 months earlier, at 31 Dec 2019, so it's dropped by £6.0m in the last 6 months. Again, highly impressive.

Outlook - sounds good;

Although it is difficult to predict near term developments in working practices and business climate, and also noting that seasonal usage is naturally H1-weighted, we expect to exceed market expectations for the current financial year to 31 December 2020 in terms of revenue, EBITDA and cash generation.

My opinion - I've been critical of management in the past, because they've made lots of mistakes. But when the facts change, then I change my mind. This update today is really excellent. The big question mark is obviously whether this is a flash in the pan from covid-related home working? Most people seem to think that things have (at least partially) changed permanently, with more people likely to want to work from home at least some of the time in future. As my sector expert pointed out in a phone call earlier, if just one key person is working from home, then the only option is a remote meeting.

LOOP is a niche specialist, so it's offering more secure conference calls (with a video option) than say Zoom, which is coded in China apparently, and has widely-known security issues. LOOP seems particularly popular with firms of lawyers and accountants, which are sticky customers. Hence I see LOOP as more a niche product, than mass market.

We can see how the product works on 29 July, with a results webinar.

Overall, I think this looks very interesting, and I've turned positive on this share again, due to the impressive figures published today.

Note below how the StockRank plunged into red territory when the problems began in 2018;

.

Xaar (LON:XAR)

Share price: 62.4p (up 13%)

No. shares: 78.2m

Market cap: £48.8m

This formerly highly profitable specialist maker of inkjet print heads, has gone horribly wrong, as you can see from this history 5-year chart. It was heavily reliant on one product, for Chinese tile printing machines. New products which sounded promising, failed to take off in the same way.

.

I've always wondered if XAR might be able to resurrect itself with new products, hence why I keep an eye on it. The share rising 13% today has piqued my interest.

Xaar plc ("Xaar", "the Group" or "the Company"), the leading inkjet printing technology, today announces a trading update for the six months ended 30 June 2020.

Update today - this sounds reasonable, given that covid is bound to have had some impact;

The Board is pleased to announce that trading for the six months ending 30 June 2020 has been in line with expectations and good progress has been made implementing our strategy. Revenue for the period is expected to be £23.7m, representing a decline of 7% relative to H1 2019 and in line with H2 2019....

Outlook - a bit mixed, as is the additional detail in the RNS, which I won't repeat here;

As a result of the continued uncertainty surrounding economic conditions globally, the Board will not be providing guidance at this time.

The short-term order book is healthy, and the business is well placed to withstand the difficult trading environment.

The Board remains focused on the medium-term strategy to return the business to profitability and growth and will provide more details on our future plans at the half year results in September.

That sounds as if it must still be loss-making currently?

Balance sheet - as at 31 Dec 2019. I've had a quick skim through the Annual Report, and Xaar's balance sheet is very strong, with plenty of cash. 2019 looks like a kitchen sink year, with big write-offs, and disposal of a heavily loss-making part of the business. Continuing operations still made a £15m loss, so hopefully costs have been cut more since then, otherwise the cash pile could deplete rapidly.

Cash - I'm reassured by this;

The Group retains a strong balance sheet and cash position. Cash and cash equivalents at 30 June 2020 were £23.9m with both the Printhead and Product Print Systems business improving their cash balance relative to 31 December 2019. The 3D business continues to be well positioned to fund its development and go to market needs. The Group maintains a strong cash focus and disciplined cost controls.

My opinion - there's a glimmer of hope here. It sounds like the company is focused on protecting its cash pile, which buys it time to execute the turnaround strategy. I don't see enough in today's update to make me want to rush out and fill my boots, but there do seem to be signs of life - i.e. it's not a basket case.

I'll put this on my watch list, and see if anything interesting happens in future. I'd want to see more evidence that financial performance is improving meaningfully before taking the plunge here.

.

Loungers (LON:LGRS)

Share price: 118p (up 2.5%)

No. shares: 102.4m

Market cap: £120.8m

This is very clearly explained;

Loungers has successfully re-opened 75 Lounges and 19 Cosy Clubs (from a total estate of 138 Lounges and 29 Cosy Clubs), following the relaxation of the Government imposed closure period due to Covid-19. We have been very encouraged by the reception from both our teams and our customers. The steps we have taken to ensure everyone's safety have been well-received and have not prevented us delivering our usual exceptionally high standards of hospitality and atmosphere.

As a result of the confidence we have gained from the trading at our re-opened sites to date, we have decided to accelerate our re-opening programme and will have the full estate re-opened by 5 August.

Two sites are not being re-opened at all.

Loungers will be participating in the Eat out to help out scheme.

VAT reduction recently announced will be a big help, as it applies to 65% of Loungers sales.

My opinion - it all sounds upbeat, but there are no figures given. I would have liked to see some figures on profitability of re-opened sites, LFL sales versus last year, etc. There's no guidance given at all in this announcement. So I guess we have to read between the lines. As the re-opening is being accelerated, then this must mean re-opened sites are trading at a satisfactory level.

The downside risk is obviously that covid resurges, and sites have to be re-closed. We're seeing that in a few states in America right now, so it's a very real risk. Many Loungers sites are quite small, so I'm surprised they are keen to re-open now. Cosy Clubs are larger, so should be able to better handle social distancing.

The upside is that if covid is defeated (maybe next year), and things can return to normal hopefully, then Loungers shares would probably more than double from the current level.

It did an equity fundraising a little while ago, so it's financially stable I think.

This is a straightforward punt on covid. Much like many other pubcos. Loungers is a very well run business, so should certainly be on the shortlist if you want to take a punt on this sector. This share is extremely illiquid, as it's tightly held. The quoted bid/offer prices are so wide you could get a bus through them, which is very off-putting. Until they can improve liquidity, this share lacks appeal for me.

.

.

Purplebricks (LON:PURP)

Share price: 58.2p (up 6%)

No. shares: 306.8m

Market cap: £178.6m

This is an announcement from yesterday. PURP is on the long list of UK companies which tried to conquer the world, and then was forced to retreat with its tail between its legs. The sale of its Canadian business has completed, and interestingly this now leaves it with a substantial net cash pile of £66m. This is to be "invested" in the UK business. So brace yourself for more of those incredibly annoying & misleading TV ads.

I bought a property through PURP, and it's nothing like a conventional estate agent. The business model is badly flawed in my view, and needs a re-think before they squander the cash pile on more ads.

That said, the valuation is looking quite interesting now, for the market-leading brand that everyone has heard of. I'm not sure how many competitors still exist.

My opinion - there could be speculative upside from this level, maybe? The huge cash pile provides a solid buffer too.

.

Boohoo (LON:BOO)

(I'm long) Breaking News - Directors have just bought over 7m shares in the market, at around 214.3p, splashing out £15m. That's not pocket change, and it sends a strong signal to the market.

I remain super-bullish on this share, and see it as a cracking buying opinion in my view. The trick is holding your nerve. I see negative opinions on this as background noise, best completely ignored.

.

That's it for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.