Good morning! It's Paul & Jack here with the SCVR for Thursday.

Timing - TBC - lots to cover today, so we'll be busy all morning. Today's report is now finished.

I really liked Jack's simple & clear disclaimer, so we'll use that every day, since newcomers may not know the format. That's when I remember to include it of course, so probably every other day.

Quick note - a friendly reminder that we don’t recommend any stocks. We aim to cover notable trading updates & results of the day and offer our opinions on them as possible candidates for further research if they pique your interest. We tend to stick to companies that have news out on the day, and market caps up to about £700m. We avoid the smallest, blue sky type companies, and a few specialist sectors (e.g. resources, pharma/biotech).

A central assumption is that readers then DYOR (do your own research) and discuss in the comments below. The comments, incidentally, sometimes add just as much value as the articles. We welcome all rational views, whether bull or bear!

Agenda -

Paul's section:

Loungers (LON:LGRS) - strong trading in 4 weeks since re-opening. This is a quality outfit, with strong management, not cheap , but it is good.

Volex (LON:VLX) (I hold) - strong results & outlook, beating expectations. However, I've re-worked the EPS figures using a normalised tax charge, and reality is a lot lower than the distorted (from a deferred tax credit) headline numbers. I'm not impressed. Everything else though does look good, so it remains in my personal coffee can (long term holds).

Optibiotix Health (LON:OPTI) - accounts for FY 12/2020 are finally published. Some progress has been made. The (paper) value of OPTI's shareholding in SBTX is the most interesting thing about this share. Best seen as a jam tomorrow special situation maybe?

N Brown (LON:BWNG) - in line Q1 trading update. No change to guidance. I've decided to ditch my position, due to the news covered in yesterday's SCVR re large increase in scope of legal action with Alllianz over historic disputed insurance products.

Cake Box Holdings (LON:CBOX) - data breach announced.

Jack's section:

Record (LON:REC) - FY profits down slightly and revenue flat. Change in leadership has had an impact. Share price has been strong recently but this is a profitable company investing for growth, so worth keeping tabs on.

Sumo (LON:SUMO) - the global video games market remains strong but individual company valuations are high and M&A activity is heating up. A lot of growth can be expected, but a lot of growth is also already priced in for certain stocks.

Anpario (LON:ANP) - promising consumer defensives company providing animal feed additives internationally. Again though, the shares are highly rated. Raw material price inflation and supply chain disruption flagged.

Paul’s Section

Loungers (LON:LGRS)

268p (yesterday’s close) - mkt cap £275m

Trading Update

Loungers, the operator of 173 neighbourhood café / bar / restaurants across England and Wales under the Lounge and Cosy Club brands, announces the following update.

New sites - 5 have been opened since 19 April 2021 (start of its new financial year). So this is a roll-out of an excellent format, and with highly rated management (according to my hospitality sector guru, who says they are the best in the sector).

Current trading - figures are only given for the period since indoor trading was allowed on 17 May 2021. For the 4 weeks since 17 May, sales have been +26.6% on the 2019 (before covid) comparator.

That strikes me as excellent, since there are still some restrictions in place, now due to end on 19 July.

The company says it’s “still early days” - an important point, as 4 weeks is too short a period to draw any longer term conclusions, as it benefits from pent-up demand, and the (partial) VAT reduction.

Directorspeak - positive, encouraged by performance.

Net debt - excellent disclosure here. NB all companies must tell us what their stretched creditors are, otherwise the cash/debt figures are misleading, so well done to Loungers here -

Net debt (excluding IFRS16 lease liabilities) at 18 April 2021 was £34.6m, with a further £12.9m of outstanding rent and deferred liabilities to HMRC.

My opinion - I mystery shopped a Loungers site recently, with a SCVR reader, and we were really impressed (Delfino in Poole). Everything was very well run, lovely food & drinks, outstanding staff. It had the feel of a well-oiled machine. Talking of well-oiled, so were we by the time our mystery shopping finished - the main mystery being how I got home.

Unfortunately I banked a profit on this share some time ago, after buying a few for my SIPP during the worst of the pandemic, confident that it would recover. Given strong re-opening trading, it’s tempting to buy back in. Pity the share is so illiquid though. I think this is a good long-term, tuck away forever type of share, even though the current valuation might seem a bit steep. Successful roll-outs do tend to command a premium, and it's justified here, in my view.

.

.

Volex (LON:VLX)

(I hold)

364p (up 2.5% at 08:27) - mkt cap £552m

Preliminary Results

Volex plc ('Volex'), a global provider of integrated manufacturing services and power products, today announces its preliminary results for the 52 weeks ended 4 April 2021 ('FY2021').

PR heading -

Strongest performance in 20 years underlines our potential

As you can see below, the financial highlights look impressive, especially considering the year in question would have seen a lot of disruption from the pandemic -

Adjusting items - to arrive at underlying results as presented - see note 3, $5.2m of this is acquired intangibles amortisation, which is fine - almost all companies & analysts adjust this out, because it’s just a non-cash book entry required by accounting standards relating to acquisitions (goodwill amortisation as it used to be called).

The other major adjustment is share-based payments, of $6.6m this year, and $8.7m last year. That’s more questionable as it’s management bonuses really, paid in shares. But on the other hand, that is separate from the actual trading performance of the business, so you could argue this either way.

Tax credit - Note that the 76.4% increase in underlying basic EPS is heavily flattered by a negative tax charge. Hence why there’s such a big difference between u/l PBT, and u/l EPS (much higher). When that happens it’s usually due to tax. Note 4 shows that a $10.94m deferred tax credit turns the $3.68m tax charge, into a $7.27m tax credit overall. To my mind, that should have been adjusted out in the underlying figures, which are misleading, since they include what is presumably a one-off tax book entry, and is not related to underlying trading in my view.

Re-working EPS -

Crunching the figures myself, using note 4 (tax), I work out EPS like this, normalising the tax charge:

$41.55m underlying PBT

Change the tax credit of $7.27m to a tax charge of $3.53m (to strip out deferred tax)

Gives $38.0m underlying profit after tax (i.e. earnings)

Divide by 162.5m diluted shares (taken from note 5)

Results in 23.4 cents normalised EPS (much lower than the 32.1 cents underlying basic EPS provided in the highlights). The StockReport shows consensus normalised EPS forecast of 22.0 cents. So we have a beat of about 6% against forecast, which is good, but nowhere near as good as the highlights section suggests, with the distorted figure of 32.1 cents). A big thumbs down for how Volex has presented this, which strikes me as misleading. We shouldn't have to dig through the notes & re-work EPS, to get the true picture. For a start, there isn't time between 7-8am, so people might have been buying early on a false impression of a massive EPS beat, which actually wasn't real, due to a tax credit.

Divide by 1.4 to convert dollars into sterling = 16.7p diluted EPS - I think this is the figure we should be using to value the company

What’s the upshot of this? What initially looked like a massive EPS beat, is actually a much lower beat. I feel the 32.1 cents figure provided in the highlights is a misleading figure.

Underlying operating margin up from 8.1% to 9.7%

Copper price - as mentioned before, the company can pass on price rises, so we don’t need to obsess over the copper price -

Covid-19 has had an impact on the cost of some of our raw materials. In the first half of FY2021, the price of copper dropped as there was uncertainty about global requirements. As demand improved in the second half of the year, copper prices increased. Our contracts with our power cord customers, where copper is a significant percentage of the bill of materials, allow us to pass these costs through to the customer, although there can be a short delay to allow the pricing changes to be implemented.

Acquisitions - Turkish power cords maker DE-KA looked an excellent deal. This has only contributed a few weeks into the FY 03/2021 profits, so should boost FY 03/2022 profits since it will contribute a full year. Hence EPS should go up again.

More acquisitions are in the pipeline, and Volex says it has access to funding.

Balance sheet - note the small pension deficits, including one acquired with DE-KA.

Due to the acquisitions strategy, note that goodwill & other intangibles have risen a lot. As has working capital, reflecting the fact that it’s a larger group now.

NAV is $183.9. Deduct intangibles totalling $105.1m, gives NTAV of $78.8m, which looks OK to me. So I have no issues with the balance sheet.

Cashflow statement - looks fine to me. The group is generating strong cashflows, which are being used mainly for acquisitions.

One item which does jar with me, is that $6.0m was paid in dividends, but a larger figure of $9.0m was spent buying shares for Director/employee share schemes. That doesn’t feel right to me, although you could argue that divis are low because the company is focusing on growth.

Note also that new loans of $37.2m were raised (and $3.1m repaid).

I don’t see the gearing as excessive, and net debt is negligible for the size of business, at only $7.2m (ignoring lease liabilities).

Outlook - sounds good -

· We have delivered a strong start to the new year across all regions with continued momentum in Electric Vehicles and Complex Industrial Technology

· There is an exciting pipeline of acquisition opportunities and strong financial flexibility

· The longer-term prospects for our business remain strong and we continue to invest in capacity and strengthening our capabilities with a particular focus on growth areas

As a result, the outlook for our business is positive with strong trading during the first two months of FY2022 and continued demand from our customer base as our strategy of strengthening our capabilities pays off. We have built a business with excellent customers and exceptional assets and are well placed to continue our drive for continuous improvement as we look to make targeted investments in order to deliver on our long-term growth plans and achieve our five year plan set out in October 2019 to achieve $650 million in revenues and $65 million of underlying operating profit by 2024."

My opinion - the misleading presentation of EPS has taken the shine off things for me. You can’t show an unusually high EPS figure of 32.1 cents, as underlying, when it’s not! Normalising the tax charge brings that materially lower to 23.4 cents. So slapped legs for management there!

Nevertheless, it’s still a “cracking” set of numbers, as the Chairman (with tons of skin in the game) promised us last year.

By my calculations, we should be looking at 20p+ EPS this year, due to the benefit of growth, and acquisitions. Hence at 367p currently, the PER of 18.4 looks perfectly reasonable.

There’s scope for more acquisitions, hence we should see forecasts go up further when more deals are announced.

Rising raw materials prices are not a problem, as they can be passed on - a key point to ask all companies about, as inflation rears its ugly head.

Overall then, it’s looking good, and continues to be a “coffee can” long-term hold share for my personal portfolio.

Note there is an InvestorMeetCompany presentation at noon today. They're usually recorded too.

It's been a superb turnaround in recent years, and although we might have to get used to a slower pace of share price rises in future, the outlook & valuation both seem reasonable to me.

.

.

Optibiotix Health (LON:OPTI)

47p (down 1% at 10:45) - mkt cap £41m

Final Results

We don’t have a happy history here at the SCVR, with this jam tomorrow company. I’ve been critical of it in the past - because the figures were rubbish, and all the puff about contract wins didn’t seem to convert into meaningful financial progress. Plus the CEO once sent me a rude, personally abusive email. But never mind, it’s understandable that people want to shoot the messenger, and anyway I don’t hold grudges, life’s too short.

Checking the archive here, I last looked at OPTI here on 18 Feb 2021, concluding that there were at last some signs of progress - it has been listed since 2011, so better late than never.

Final Results today are very late, being for FY 12/2020 -

Revenues £1.52m (up 104% on a 13-month prior period)

Cost reductions

Operating loss of £1.1m (improved from £(2.17)m prior year)

Big profits booked for disposal of an associate & gain on investments - totalling £7.17m profit

Profit before tax of £5.7m - how real, or rather realisable into cash, those profits are, is open to discussion.

OPTI’s core business looks as if it is making progress, albeit still loss-making. It’s not really of interest to me, because it’s taking too long to get anywhere, and revenues are still tiny.

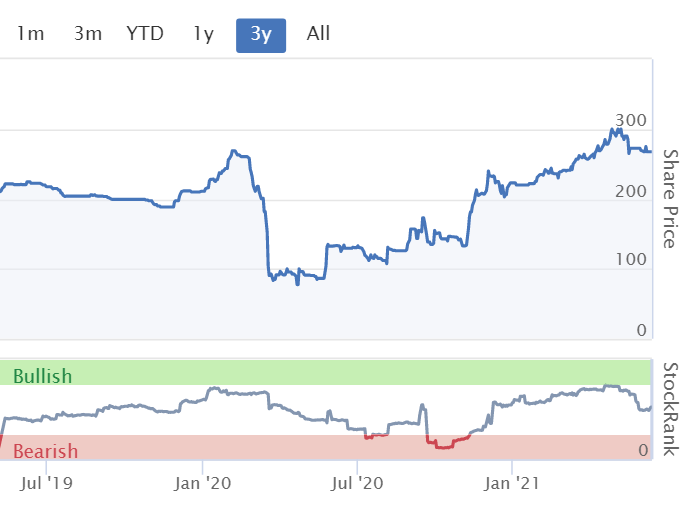

However, OPTI’s investment in a spin-off company called Skinbiotherapeutics (LON:SBTX) has shot up in value this year. Normally one jam tomorrow company spinning off another jam tomorrow company wouldn’t be of interest, but look at the share price of SBTX below, which now has a market cap of £98m - so we could see OPTI shares as a special situation where the main value could be its holding in SBTX - now (on paper) worth c.£25m, compared with OPTI’s market cap of £41m. Deduct the SBTX shareholding, and that values OPTI’s business (ex its SBTX investment) at c.£16m - still a lot for a loss-making company though -

NB. The chart below is for SBTX -

.

The company says it sold £901k-worth of SBTX shares after the year end, so this could provide a nice slush fund to keep OPTI’s cash burn going, and mean it doesn’t have to dilute its own shareholders to keep operating.

My main worry is that SBTX shares could just be in a speculative bubble, and end up being worth next-to-nothing, which is usually what happens in this type of situation, in my experience. I've seen that happen with junior resource stocks, where spin-off shareholdings end up almost worthless in the long run.

If OPTI could ditch its entire SBTX stake for cash, that would be a game-changer, giving it proper funding.

My opinion - it’s not of interest to me, but there are interesting elements to the story. The narrative is full of the usual ramping about future prospects. After 10 years of such gushing talk, does anyone actually believe it now? Maybe, who knows. OPTI's own share price looks stale at the moment, so plenty of previous bulls must have given up to chase fresher stories maybe? If they couldn't get the share price moving in the boom-time market conditions we've had since Oct 2020, then that leaves a lot to be desired.

.

.

N Brown (LON:BWNG)

(I've decided to sell my position here, as we were discussing yesterday)

Q1 trading is in line with expectations.

Full year guidance unchanged.

Hence not a lot to say beyond that.

I've decided to sit on the sidelines and watch, to see if the turnaround works or not. As we discussed yesterday here, I was rattled by the news yesterday of a large increase in the potential cost of a complex ongoing legal dispute with Allianz. This is a material uncertainty, and I've decided to take a hit, and sell up. On the basis that I can always buy back in at any time in the future, once there's greater clarity on the likely outcome of the legal action, and indeed how trading develops.

I'm prepared to risk missing out on a takeover bid, which does look possible, from the controlling family.

For me, I want to be guessing as little as possible, when holding investments. Hence I'd rather park my money in shares where there's a clearer picture about performance, and no worries about large ongoing legal claims. It was a mistake buying this in the first place, because I knew about the Allianz legal action but decided to ignore it. Part of the trouble, is that when our portfolios are doing really well, as in the last 6-7 months, then we often end up lowering our standards and buying lower quality shares, only to end up with losses on them. Lesson learned, I need to tighten up my buying criteria again.

.

Cake Box Holdings (LON:CBOX)

264p (down 8%) - mkt cap £106m

Statement re Share Price Movement

Another data breach, we reported on another company suffering the same thing yesterday.

Here is what it says today, in full -

The Company notes the recent share price movement in its shares. It confirms that it has recently emailed customers in relation to a data breach experienced in 2020 as a result of which personal and financial information may potentially have been accessed. The Company has taken the appropriate steps to investigate the incident, repair the compromised systems and identify those customers that may have been compromised. The Company has also further strengthened the security of its systems to prevent future breaches.

We have contacted any customers whose personal information was potentially exposed during the incident to provide them with support where required. We have also informed the relevant authorities.

The Company is in the process of finalising a date for its 2021 full year results with its auditors and expects to confirm a date shortly. The Company confirms that the data breach is not expected to have a material financial impact and as per the announcement on 12 April 2021, full year results are expected to be in line with market expections [sic].

My opinion - data breaches are commonplace these days. Unless there are serious complications, I'm starting to view plunges in share price from data breaches as potential buying opportunities. These things generally seem to blow over. Although it does introduce uncertainty. The risk is that the situation could be far worse than originally thought, with unforeseen liabilities cropping up. For a small cap cake maker, I can't imagine any multi-million lawsuits would be launched by its customers!

Jack's section

Record (LON:REC)

Share price: 87.39 (-5.42%)

Shares in issue: 199,054,325

Market cap: £174m

Record (LON:REC) is a currency management firm. It’s an external manager for institutions such as pension funds and foundations, which have significant currency exposures and require an outsourced currency specialist to either passively hedge those exposures or more actively manage them in order to generate alpha.

Its services include Bespoke Currency Hedging, Currency for Return, and additional currency solutions and consulting services. The business was established in 1983 by Neil Record who previously worked at the Bank of England. He is currently the chairman and largest shareholder.

This is a very high Quality stock, with a Q Rank of 94. You can read more about what goes into that Rank here, but the short version is it looks for longer term signs of profitability and financial health such as long term ROCE, long term gross profits to assets, and the Piotroski F-Score.

You can see the double digit ROCE over time on the StockReport:

But strong returns on capital are only really half the picture. You need growth as well. This looks to be more of a problem for Record.

Nevertheless, the shares have rerated strongly over the past year and the group has a 1Y relative strength of 128%, meaning it has comfortably outperformed the market.

Highlights:

- Revenues marginally down from £25.6m to £25.4m,

- Growth in management fees of 8% to £24.9m (2020: £23.1m),

- 37% increase in USD Assets Under Management Equivalent (AUME) to $80.1bn at 31 March 2021, including strong net inflows of $9.7bn for the year,

- 23% increase in GBP AUME to £58.1bn at 31 March 2021,

- Performance fees for the year of £0.1m (2020: £1.8m),

- Profit Before Tax (PBT) -19.5% to £6.2m,

- Operating profit margin down from 30% to 24%,

- Basic EPS of 2.75p per share (2020: 3.26p),

- Total ordinary dividend held at 2.30p per share,

- Special dividend for the year of 0.45p per share (2020: 0.41p)

- Robust financial position with net assets of £26.8m at 31 March 2021 (2020: £28.2m).

The results put Record on an FY21 PER of 33.6 paying out a total yield (including special) of a shade under 3%. It’s a little pricey but the yield is respectable and brokers are forecasting good growth for FY22. If Record hits that FY22 EPS target, the PE ratio would fall to a much more attractive 20.6x.

That would be a 68% increase in earnings per share and would be quite a departure from the historical growth rates, so I wonder what’s behind that.

An additional thought: raising fees by 8% is useful and suggests a degree of pricing power in Record’s services. Either that, or this is an unsustainable method of growth and Record will lose business to cheaper passive strategies. I’m hoping it’s the former and clients are willing to pay more for value-added services. Record has delivered its highest ever AUME of $80.1bn this year, including diverse inflows of $9.7bn so it looks as though the demand is there.

The balance sheet is conservative, with net assets of £26.8m including c£7m in cash and nearly £13m in money market instruments set against total liabilities of £6.8m.

Although the shares look pricey on these results alone, they are reasonably resilient given what has been a heavily disrupted year for many. The group has no debt, is cash generative, is investing for growth, and is paying out a special dividend.

In terms of new products, Record is close to launching the Record EM Sustainable Finance Fund, which has been developed in collaboration with a large Swiss Wealth Manager. Further investment has been put into IT infrastructure and technology. This modernisation work is continuing into the current year, with a further £0.8m investment anticipated.

There is a succession going on at Record. That’s a risk. The company says this is being managed but also adds that this ‘change in leadership has impacted on profits in the short term’. Progress has been made here with the restructuring of its Client Team and a change of CIO during the year

Commenting on the results, Neil Record comments:

As expected, the more immediate financial impact from implementing our wide ranging strategy in investing for growth has been a short-term decrease in profitability. However, looking forward, we start the year on our highest ever level of AUME, which is more diversified across our higher-margin products and provides us with an excellent platform for growth in FY-22. Added to this, we have been developing new products in collaboration with our clients, one of which, the innovative Record EM Sustainable Finance Fund, we anticipate launching by the end of this month alongside one of the largest Wealth Managers in Switzerland.

Conclusion

Record looks to be a company managed for the long term. Maintaining that culture is of key importance through this transition but it looks like it’s being carefully handled although profits have been impacted.

It has always generated high returns on capital, so the IT modernisation and the expansion of its product offering could be profitable growth drivers moving forward.

The growth in AUME is encouraging, as this comes in a tricky period where Record has had to deal with succession planning, Brexit repercussions, a global pandemic, and changes to its IT infrastructure. So I can imagine management is actually reasonably pleased with the outcome.

But the share price has been strong - it’s been a clear breakout and I wonder if the easy rerate has happened for now? The valuation makes me think twice so I’m watching from the sidelines.

As with more traditional asset managers, fees are based on AUM and so profits are presumably sensitive to the state of the financial markets.

That said, Record looks like a competent and innovative operator in a large market, investing in an increasingly diverse range of products which should allow it to capture more market share. If the share price softens I’ll become more interested. With Schroders also buying in recently, more institutions might be tempted to take a stake so that’s something to watch out for too.

Sumo (LON:SUMO)

Share price: 371.5p (-3.88%)

Shares in issue: 171,461,351

Market cap: £637m

Sumo (LON:SUMO) is a video games maker based in Sheffield. It now has four divisions: Sumo Digital, Pipeworks, Atomhawk and our recently created publishing division, Secret Mode.

The longer term dynamics in the video games sector are fantastic. As a media form, it is now more relevant than Hollywood and the film industry and that’s been a long time coming. If you look at how younger generations spend their time these days, it’s easy to see this trend continuing for many years.

The industry itself is maturing at pace and business models are evolving. It is becoming easier to build sustainably profitable enterprises in the sector. Back catalogues are now more easily monetisable and so IP is more valuable, which is as it should be. Game lives are extending with the help of post-launch improvements and support, so people are playing them for longer.

There’s less of a pressing need to find the next big hit (although this need still exists). And the UK has some fantastic talent in this sector with the likes of Sumo and Team17 (LON:TM17) .

It’s just the individual company valuations that can be hard to swallow. What’s more, there’s a lot of M&A in this hot sector at what could be frothy valuations. Sumo is not the only company of its type to trade at close to 10x earnings even as it approaches a £1bn market cap. That’s a fair amount of growth priced in.

But then there is a lot of growth to come. Some of these companies will be huge in ten years time and it will be worth paying up for the right stock. That requires vision and a bit of luck. It’s easier said than done.

The global video games market remains strong and the Group is performing in line with expectations in the year to date.

Sumo had an ‘extraordinary’ 2020, with 279 projects and 12 games including five Own-IP and its first major acquisition.

All divisions are trading well and the group is reviewing a considerable number of internally and externally sourced titles. The pipeline of new business development opportunities comprises a total contract value in excess of £500m, a significant increase on the £429m figure at 28 February 2021.

Its Own-IP title, Hood, launched in May and Sumo is now delivering the post launch plan including new content. Reviews so far appear to be mixed.

Little Orpheus, developed by The Chinese Room, has been awarded the Apple Design Award for ‘Delight and fun’ for its platforming, storytelling, music and for bringing console-like experience to an accessible game.

Pipeworks (a recent acquisition) will shortly open a new studio in Vancouver, which will be Sumo’s 14th studio.

Total headcount has increased from 1,043 at 31 December 2020 to 1,155 at 31 May 2021 and the acquisition pipeline remains strong. Sumo is pursuing a number of targets.

At 31 May 2021, the group had net cash of £8.0m up from £6.8m at 31 December 2020 following some earlier than forecast receipts.

That same day the group spent £5.5m funding the purchase of approximately 1.54m Sumo Group shares through the Employee Benefit Trust (the "Trust"), following the exercise of options under the Company's Long-Term Incentive Plan. These shares are to be held on the terms of the Trust to satisfy the vesting of options under the LTIP in the future.

Conclusion

Sumo looks well placed to take advantage of the strong growth in the global video games market.

But I’m slightly wary of the increased M&A activity. This is probably the most fraught use of capital allocation when it comes to generating long term shareholder value. It can be done, but in a ‘hot’ sector with high valuations, it strikes me as riskier still.

The board profiles suggest the CEO and CFO do have experience here, so hopefully they will be acquiring smartly.

I'm not invested in any video games makers (I last held Codemasters, which was bid for), although I understand the attractive industry dynamics. There could be a dip as lockdowns ease but that could just be short term noise.

There is clearly great potential, but expanding at pace and managing acquisitions brings execution risk. With valuations as they are there is little room for error, so I continue to wait.

Anpario (LON:ANP)

Share price: 677p (-1.88%)

Shares in issue: 23,180,083

Market cap: £156.9m

Anpario (LON:ANP) is an independent international manufacturer and distributor of natural animal feed additives for animal health, nutrition and biosecurity. Its additive technologies are sold in over 80 countries through established sales and distribution networks.

It sounds potentially attractive and the market thinks so too, with the shares having roughly doubled over the past year.

Again though, we stumble on valuation. The shares look expensive - a bit of a theme so far this morning. This can be justified by high growth potential, but the company does need to live up to that potential. And past growth has been steady not spectacular.

The company has delivered sales at a similar level to last year, which was strong as customers increased stock levels at the onset of the pandemic.

China is performing particularly well but South East Asia is weaker due to newer lockdowns and less tourism. The group is mitigating Brexit disruption with its new European stockholding hub.

In keeping with other industries, Anpario is ‘experiencing raw material price inflation and some disruption in our supply chains and global shipping operations.’ It looks like the company is able to pass these costs on via price increases but ‘expect[s] these challenges to continue until the last quarter of this year.’

The group notes its ‘unique formulation technology’ also benefits customers as it enables Anpario to offer more cost effective solutions than alternative competitor products.

Conclusion

Not one I know, but it looks at first glance to be one of the better listed companies out there. It’s got unique properties that add value for its customers, and the market is presumably large. I suspect there are good growth opps in such markets.

Clearly revenues are already international and the group’s sales and distribution networks are well established. The balance sheet is strong - net cash with barely anything in the way of liabilities barring £5m of payables - and cash generation is good. It regularly generates cash flow from operations in excess of earnings.

The only qualm is valuation, as noted above, especially when juxtaposed against the growth CAGRs. This looks like a good business - just one I would like to buy at a cheaper price.

I should probably set up a ‘Quality but Expensive’ watchlist for this type of opportunity. Perhaps others are already doing this?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.