Good morning! It's Paul here.

Mello South - 14 June

Following the amazing success of Mello Derby a few weeks ago, David Stredder has organised another, slightly smaller, one-day investor event - this time in Hever, Kent. For those travelling from London, the direct train from London Bridge only takes 42 minutes. By car, it's near the M25. The surrounding area looks lovely, so it would make a nice mini-break.

The theme is "meet the fund managers", with keynote speakers including Mark Slater, Andy Brough, Ralph Baber, and others.

There will also be 30 companies exhibiting, most of which will be different to the ones at Mello Derby, to avoid duplication. Remember that David hand picks quality companies only, so you won't find a load of junk resource companies trying to part you from your money at any Mello event.

To give you a flavour of what an outstanding event Mello Derby 2018 was, here is a short video from our friends Tamzin & Tim at PIWorld. Hopefully you can see the tremendously positive energy that David injects into his events. The community feel is what it's all about, as well as interesting speakers & good quality companies.

It will be a terrific day out, so is highly recommended. Here's the link for more information, and to book your ticket.

Betting companies

I heard on Radio 4 this morning that the Government is apparently going to cut the maximum stake size on highly addictive fixed odds betting terminals (FOBTs) from £100 to £2. This is likely to have a big negative impact on some gambling companies, but seems to have been widely anticipated - hence share price falls today of only about 2-3%.

GVC Holdings (LON:GVC) says today that the financial impact will be very considerable;

Expected financial impact

The focus in the UK Retail operation over the last two years has been to create a business that is well placed to face these structural and regulatory headwinds. As such we expect to be able to reposition the business within two years following implementation, with an anticipated fully mitigated impact of cGBP120m on Group EBITDA secured by the end of this period.

In the first full year the impact on Group EBITDA is anticipated to be in the region of GBP160m. Therefore, we expect to retain a profitable and highly cash generative UK Retail estate. Furthermore, our proven leading multi-channel expertise presents additional opportunities to drive online growth.

I generally try not to invest in any regulated industries, as you never know what bombshells might wreck an investment.

Portmeirion (LON:PMP)

Share price: 1,125p (up 0.7% today)

No. shares: 10.85m

Market cap: £122.1m

(at the time of writing, I hold a long position in this share)

AGM Statement (trading update)

This is a Stoke-on-trent headquartered manufacturer & distributor of decorative ceramic tableware, accessories, and candles.

It has a heavily H2-weighted seasonality to profits, so H1 performance is of limited significance.

Even so, today's update seems reassuring;

"Total Group sales are up 15% for the four months ended 30 April 2018 relative to the same period last year, driven by strong growth in both ceramic and home fragrance product divisions. On a constant currency basis total Group sales are 20% ahead of last year.

We are delighted with the start to the year, however due to the seasonal nature of our business and the importance of second half trading we continue to expect full year profit before tax to be in line with market expectations."

It's only an in line overall statement, however I think strong current trading probably increases the likelihood of the company subsequently beating market expectations. It's always good to have things this way around - as opposed to companies which are broadly in line, and struggling to make up the shortfall.

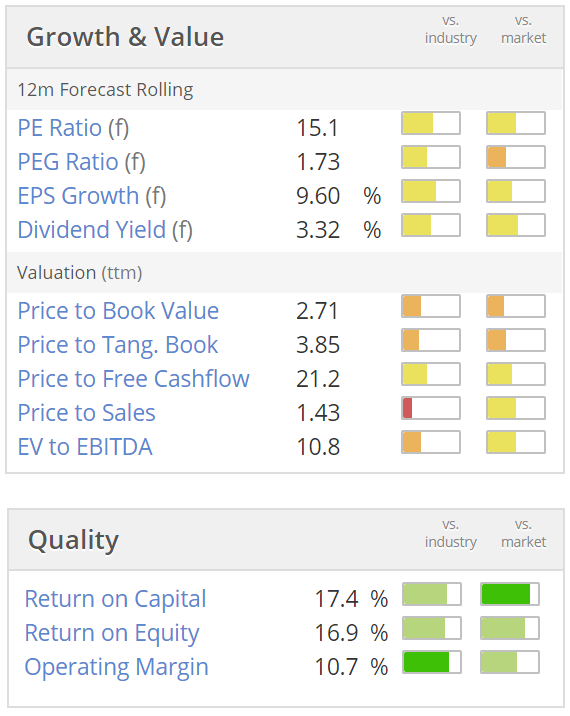

Valuation - looks in the right ballpark to me. Note the high quality scores, and decent asset backing (P/TBV of 3.85)

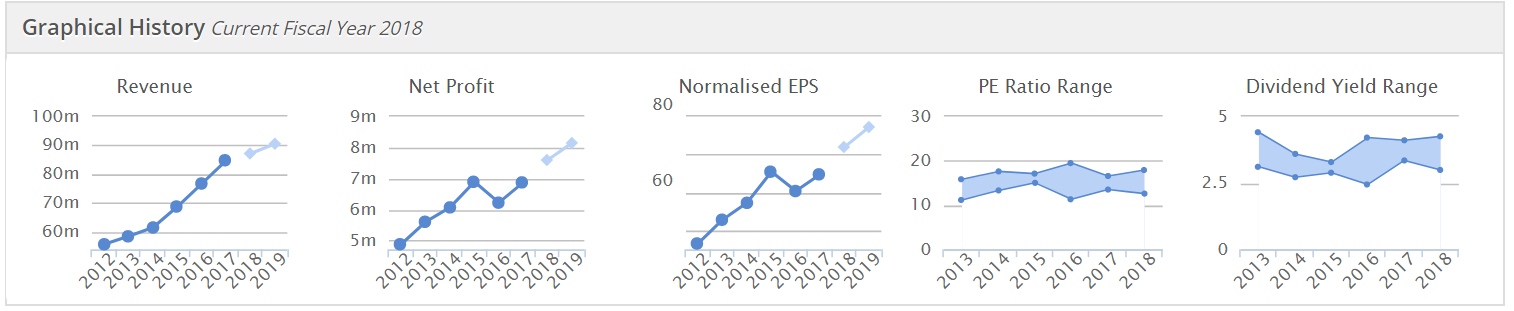

My opinion - this seems a well-managed, decent group of companies, delivering steady growth (some of which has come from acquisitions);

The PER looks reasonable, plus we are entertained with solid & growing divis - I'm coming round to the view that it's better to have a moderate, growing, and well-covered divi, rather than seeking out very high yields (where something is often going wrong).

There's also the wild card of a possible takeover bid. I remain of the view that PMP could be attractive to an overseas buyer, keen to buy in growth, and prestigious brands.

Overall then I like it, and the share price has been buoyant during a time of increased volatility, suggesting that someone may be in the background buying, and that existing holders are happy.

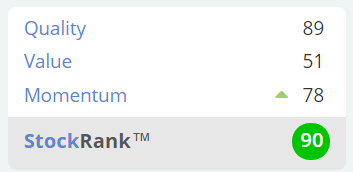

I see that PMP has a high StockRank, which gives me comfort (although it's not infallible of course, it's designed to move the odds in our favour, for a basket of stocks);

Churchill China (LON:CHH)

Share price: 1,050p (down 3.4% today, at 11:07)

No. shares: 10.96m

Market cap: £115.1m

AGM Statement (trading update)

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide...

Coincidentally, these two pottery companies (PMP and CHH) are having their AGMs on the same day.

CHH is also trading in line;

"I am pleased to report that we are making good progress against our objectives in the year to date. Trading since our Preliminary Results announcement in March 2018 is ahead of the comparable period last year and we remain confident that our full year performance will be in line with our expectations.

"We have made further progress in Europe and other export markets and UK sales continue to be supported by good levels of repeat business from our established customer base. New product introductions, an important part of our performance improvement in recent years, have been well received."

That sounds satisfactory.

The worry with CHH is bound to be that demand could fall, as the UK casual dining sector is struggling so badly at the moment. CVAs are taking their toll on the number of outlets, and that's likely to continue for the foreseeable future.

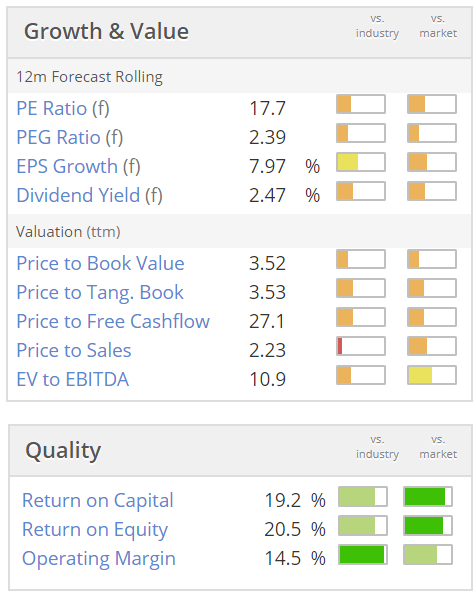

Therefore I'm not sure the premium to PMP is justified here.

A few quick notes, which I'll flesh out later (as I have to go out shortly, for a meeting);

Staffline (LON:STAF) - AGM trading update - has traded in line with the Board, and the market's expectations.

Three acquisitions have broadened geographic coverage.

Transition away from the Work Programme contracts "remains on track".

Strong pipeline developing in several areas - e.g. Apprenticeship Levy, devolved Government, and prison education.

All in all, this sounds like a solid update.

This sector (staffing companies) is cheap, and STAF is no exception - forward PER of 8.3, and a reasonable yield of just under 3%. Looks good value, I'm tempted to have a little dabble. The only thing that puts me off a bit, is that Andy Hogarth (longstanding CEO) sold his shares & disappeared into the sunset a while ago. That makes me wonder if there's much upside?

Foxtons (LON:FOXT) - London's main estate agent & lettings agency.

"Very challenging" conditions, with sales down on last year.

All 3 divisions saw sales down in Q1.

Pipeline is now improving, but still below last year.

Has net cash (amount not stated).

This one doesn't appeal to me - I ran through the figures last night, coincidentally. Trouble is, there's no reason why profits would return to previous levels, even if the market does improve. Online disruption must be hurting, and FOXT fees are widely seen as excessive.

That said, they do have a dominant position in London, so some recovery is possible. Maybe not just yet though?

Water Intelligence (LON:WATR) - good results, but looks very pricey to me, on a PER basis, after big recent rise in share price.

Indigovision (LON:IND) (in which I hold a small residual long position) - there's life in the old dog!

4m to end April 2018, sales up double digits on prior year.

Reduced losses.

Expecting to at least breakeven for this full year.

Timing of orders difficult to predict.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.