Good morning, it's Paul here with Thursday's SCVR.

No preamble today, as I've run out of material.

In case you've not seen it, I added a section on Wincanton (LON:WIN) yesterday afternoon, to yesterday's report here.

Estimated timings - the main report has to be finished by 12:45, as the car needs to go back in for an MoT re-test. But I'm hoping to add a couple more sections later today. Today's report is now finished.

I'll start at 7am, and will start with the scheduled results from Newriver Reit (LON:NRR) (I'm long)

De La Rue (LON:DLAR)

A friend rang me yesterday afternoon, and ran through the bull case for DLAR. It sounds very good. Therefore, I think I've made a mistake by selling my 40k shares yesterday. Happily, it turns out that the open offer entitlement of 7 new shares for each 16 existing shares, was set at 8am yesterday. I sold after that time, therefore still have the entitlement. This means I'll be entitled to 17,500 new DLAR shares priced at 110p. The market price is currently 160p, therefore there's an instant profit of 50p * 17,500 = £8,750. Very nice indeed. I had intended opening a short on DLAR for 17,500 shares, to lock in the 50p profit (and then close it when the new shares come through), but my friend convinced me that would be another mistake. He's really very bullish on the potential for the company, with new contracts coming through now, and costs drastically reduced. He's normally very thorough with his research, and tends to make money overall from the market, so I've decided to take notice of his view, and stick with DLAR, with a view to buying more if it dips back down.

The problem I have, is that I look at so many companies here, that it's difficult to find the time/energy to really focus on the best ideas. Therefore I do tend to lean on my long-standing network of investor friends, and ask the shrewdest & sector-relevant people what they think of particular shares, as in this case. Over time, you gradually learn who usually gets things right more often than not, so they're the people to listen to.

.

Newriver Reit (LON:NRR)

Share price: 70.0p (down c.1% today, at 11:09)

No. shares: 306.1m

Market cap: £214.3m

(I'm long, at the time of writing, but have decided to sell - see below)

When covid struck, I scoured the sector for property REITs which could benefit from the re-opening of retail. There were 2 buying criteria for me;

- Strong balance sheet, with little debt (and loose covenants, long expiry, etc)

- Excessive discount to NTAV, such that even if property values dropped heavily, the shares would still be cheap

The two shares which met my criteria were Hammerson (LON:HMSO) (bought at 56p, since sold at avg. c.120p), and Newriver Reit (LON:NRR) (bought avg. 65p, sold half at about the same level).

The obvious problems with owning retail sites are;

- Tenants not paying rent, due to lockdown

- Tenant insolvencies likely to come thick & fast

- Rents are far too high, and need to come down, thereby reducing landlord's balance sheet valuation of properties & potentially triggering default with lending (that's the risk facing Intu Properties (LON:INTU) at the moment)

However, there's potential for the market to have thrown out the baby with the bathwater, as all retail property REITs have been slammed in price.

From today's results from NRR, all I'm really looking for, is;

- Confirmation that the company's balance sheet is still rock solid, with plenty of liquidity & no danger of breaching banking covenants. From my initial skim, this does indeed seem to be the case, and

- The discount to NTAV, even after anticipating further property write-downs, is still attractive

- What's going to happen with divis, and how do REITs retain their tax status if they're not complying with the requirement to pay out at least 90% of profits as dividends?

Liquidity - this sounds fine;

At 31 March 2020 we had £177 million of cash and credit facilities available to the Company which, together with our unencumbered balance sheet, gives us confidence in our ability to remain cash positive and debt covenant compliant even in a scenario of very significant cashflow disruption and valuation decline.

That's good, and isn't a surprise. The reason I bought this share, is because I'd checked out the balance sheet, and borrowing arrangement, and found them to be comfortable. Hence there's never really been any doubt that NRR should sail through this crisis without any risk to solvency, even in the event tenants were very slow in paying rents, and likely tenant insolvencies too.

A couple of other good features of NewRiver;

- Its retail tenants are focused on value retail, and quite a few were supermarkets, hence over one third remained open throughout covid.

- Its pubs portfolio valuation is underpinned by alternative use value - hence even if many tenants don't re-open, the pubs can be converted into residential, and hence keep most or all, of their book value (after a time lag to get planning consent, and convert them). The company has a history of being very active in developing its properties.

- Limited exposure to department stores, mid-market fashion, and casual dining.

Anyway, on to the results;

EPRA NAV - the key measure of net assets, at 201p per share. This is down 23% on prior year, a heavy reduction. I think we have to assume that NAV is likely to continue falling, as some tenants go bust, and empty units have to be re-let at lower rents. The current share price is only 70p, a huge discount to NAV. Therefore the market is anticipating a large further fall in property values, which might be overdone possibly?

Loan to value - another key measure for property companies. This has risen, because asset values have been reduced, and is now 47% at 31 March 2020, up from 37% prior year. Not in dangerous territory yet, but my concern here is that reduced property valuations in a downturn tend to lag behind reality. Therefore, LTV is likely to go above 50% this year I imagine, which would start to be a concern. The company mentions disposals, but what sort of valuation could be achieved in the current environment? It wants to get LTV below 40% through disposals. That's looking an uphill task, given that valuations are likely to take another leg down this year.

My opinion - I've only partially read the results statement. My initial feeling is that it looks solvent, with no worries about liquidity/cashflow. However, the increased LTV has spooked me a bit, so I've decided to step back onto the sidelines from now, and do some more thorough research/thinking, and buy back in at a later date if I'm satisfied that risk:reward is still favourable. Or not go back in, if I conclude otherwise.

The online results presentation is just about to start, so I'll tune it to that now.

.

NRR results presentation webinar

This was absolutely excellent. Management (CEO & CFO) ran through some presentation slides here. The whole thing came across very well, and management impressed me with their openness & honesty.

Then they did a comprehensive Q&A.

I jotted down the key points, as below, but only for things that are additional to what I've written above;

- Divis - no Q4, nor Q1 divis (Q1 is Apr-June 2020, new financial year). Firm intention to resume divis.

- REIT status - I asked how can they remain a REIT if not paying divis as required? Answer - REIT status is applied for annually. Have 12 months to file tax papers for FY 03/2020. Don't expect any problem with this. Company has "firm intention" to resume divis as soon as possible.

- Low rents - average is only £12.66 per square foot (that's really low, e.g. £12.7k p.a. rent for a 1,000 sq.ft. shop) - so more tenants should survive than at e.g. highly rented shopping centres.

- March quarter -75% of rents either collected, or alternatives agreed (although that is very broad in scope!)

- Pub estate - most have not paid rents, but trend is improving. All expected to open on 4th July.

- Business interruption insurance claim has been lodged.

- Retail portfolio - 60% now open, confident of improving rent collection

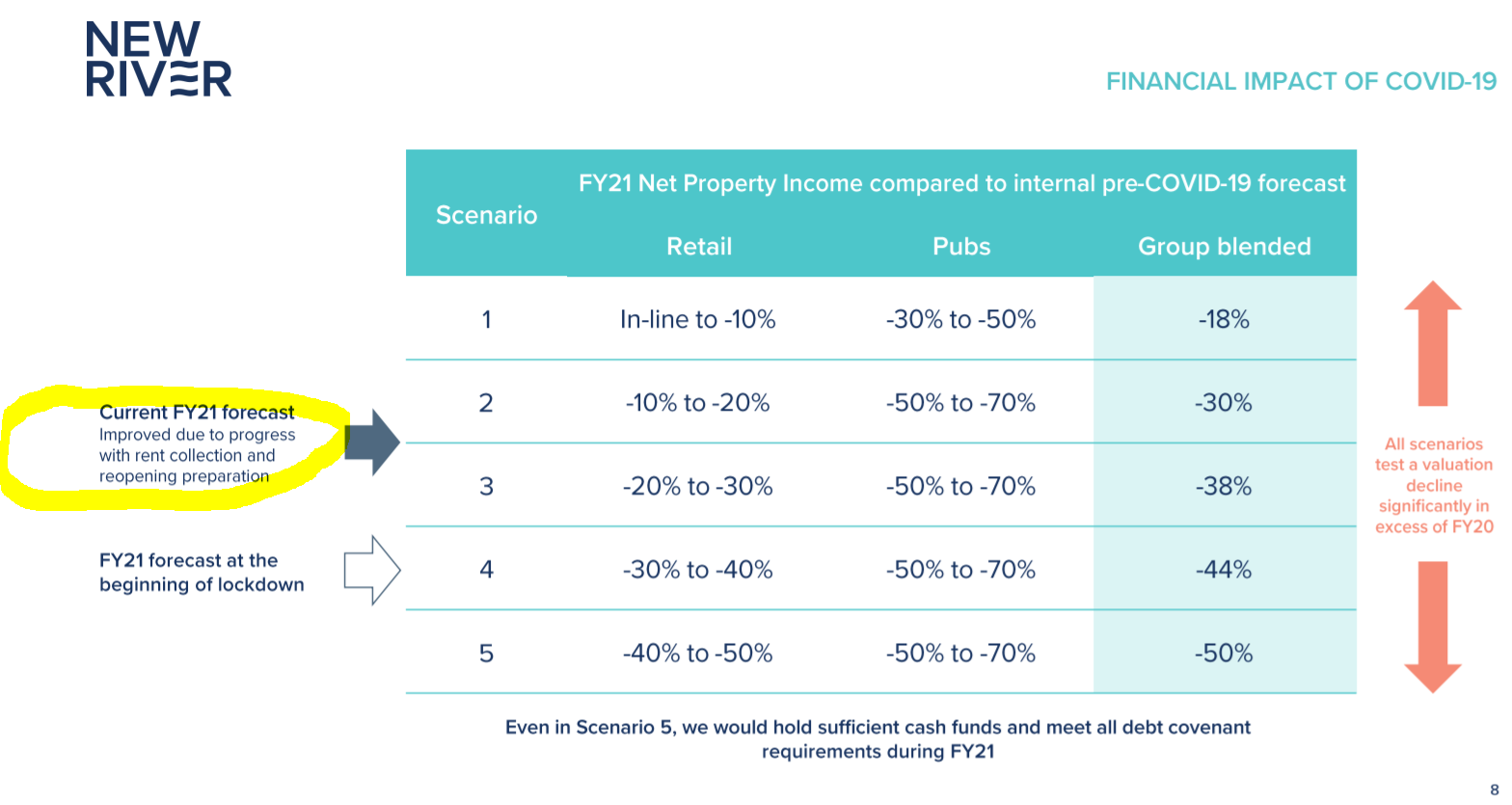

Scenario planning - key point - originally thought NRR would be c. scenario 4. Now think this has improved to somewhere between scenarios 2-3, see this slide;

.

- Refinancing - none until 2023 (and 2028 for bonds) - luckily they refinanced at the perfect time in 2019, with lenient covenants, and all debt is unsecured

- In all the above scenarios, would comply with covenants for FY 03/2021

- Pubs generally have outside space, and are wet-led, which is ideal for social distancing. 75% intend to re-open on 4 July

- Disposals - targeting £80-100m this year. £30m agreed so far. These are generally small, attractive assets, there is still demand from buyers.

- LTV covenant is key one. Set at 60-65%, so 47% level is not close. Would need a 22% further decline in property values, to reach that level - unlikely due to nature of assets - i.e. small, local shopping centres are more resilient, pubs have strong alternative use value. etc

- Great confidence in value of assets

- Created enormous goodwill by assisting tenants - 97% pub tenants say NRR met, or exceeded their expectations for support during covid

- UK pubs sector can bounce back

- Alternative use valuations are overall 12% below book value

Q&A

- Covenants - several questions asked about this. LTV is the key test, as have tons of headroom on others. Ensure we won't breach this, with more disposals. What happens if you do breach it? Have 90-day grace period to fix it. Would do more disposals, and ultimately might need a small placing. Don't expect this to happen.

- Alternative use - retail parks might turn into logistics centres. Also high demand for housing in towns. Pub portfolio - mgt are confident current valuations can be maintained. Shopping centres are the assets most likely to decline further in value. Would have to fall 30% further to trigger LTV covenant breach next year.

- Bonds - Fitch has reaffirmed BBB+ stable outlook

- Non-essential shops re-opening day on Monday this week, footfall was up 69% (remember all the centres were open anyway)

- Recession risk? Our tenants are mainly essential, or value-focused retailers. So should do relatively OK.

Conclusion - I was very impressed with management, who are clearly on the ball, and answered all questions thoroughly & openly. Nothing to hide, was my impression.

It largely addressed my concerns, and I'll probably be buying back into NRR shares shortly. It's often best to sleep on it, before making a decision I find, as presentations are always putting forward the most bullish points.

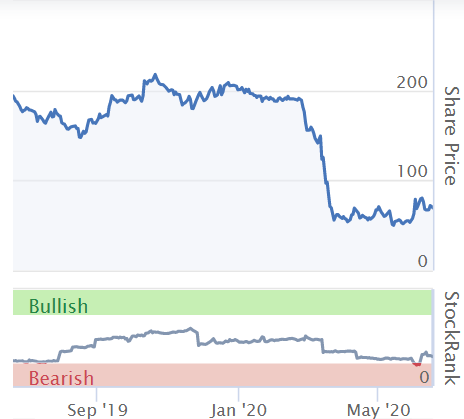

Chart below - there's not been much of a rebound so far, but I doubt the share price would get back to previous levels in full.

.

.

Renold (LON:RNO)

Director buying

I mentioned this one in this Tuesday's SCVR, as a high risk company with speculative upside, given a reassuring update.

Note that this has been followed up with some Director buying y'day and today.

I'll try to take a closer look over the weekend, but thought it worth flagging to readers also, for your own due diligence.

.

Volex (LON:VLX)

Share price: 151p (up 8% today, at 12:08)

No. shares: 151.8m

Market cap: £229.2m

It's so good to see many companies providing proper investor presentations online. I found the one for NRR (above) tremendously useful & informative. It also levels the playing field between institutions & private investors, giving us access to meetings online that previously were difficult or impossible for PIs to attend in person.

Volex is doing an online results presentation through the excellent Investor Meet Company platform. It's at 10:30am on 23 June, Tuesday next week.

I had a quick call with the chaps behind IMC last week, and I'm fully supportive of their plans to open up communications from companies to investors. It builds on the excellent work that others are doing, such as Tamzin & Tim at PIWorld, whose podcasts & videos are superb. Last night I listened to a 1 hour podcast from Idox (LON:IDOX) whilst going for a brisk constitutional along the seafront. I actually prefer audio to video content, as I can then multi-task whilst exercising, or cleaning, or whatever.

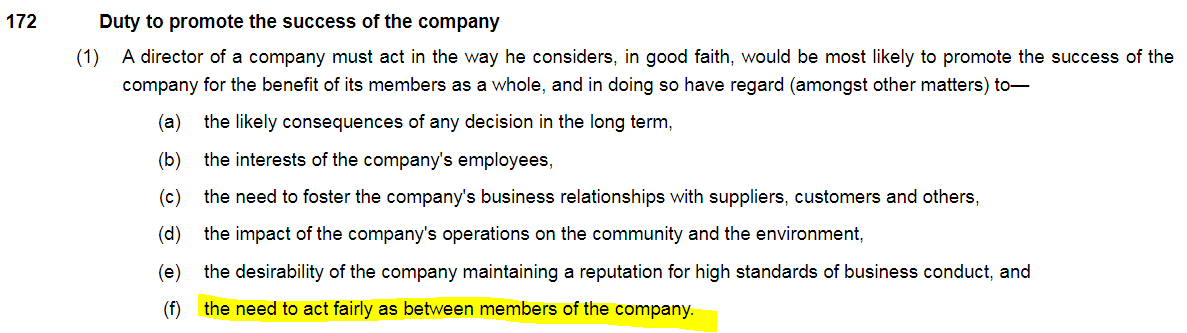

Well done to all companies & advisers who go down this route of giving presentations to the wider shareholder base, and other investors who might be interested in the company. To all other companies that are not giving online results presentations, why not? Surely by only giving presentations to institutions, and excluding other shareholders (members), you are in breach of S.172 of the Companies Act?

.

.

Clearly by doing this online presentation, Volex is honouring its legal obligations to all shareholders, so a hearty whoop whoop to Volex management!

I last looked at Volex here on 16 Apr 2020, and was impressed with its excellent update. Although I was nervous about chasing the price any higher at 138p. It's since continued rising, to 151p today.

To save time, I'll direct you to the N+1 Singer note on Research Tree. Key points;

Modestly ahead of expectations for EPS, at 17.3 US cents (up 36% on prior year - excellent stuff) - that's 13.8p in sterling, so a PER of 10.9 - it looks like I might have got confused by currency in my last report, although I thought I'd adjusted for that at the time. Maybe not.

Dividend - as mentioned last time, paying a 2p final divi sends a strong message that the company is coping well with covid

Net cash - is $31.6m as opposied to $31.7m in last trading update, just a rounding error, not a problem

Outlook - slightly hesitant in parts. Performed well up to May, although "now seeing areas of weakness" in medical equipment installations. Electric vehicles weak in Mar & Apr, but now recovering

Uncertain outlook, so not providing financial guidance for the current year, FY 03/2021.

My opinion - no change. I remain very impressed with the excellent turnaround at Volex, and it has a very good balance sheet too, so is financially secure.

The valuation looks reasonable, although an uncertain outlook is not great - but understandable in the current circumstances.

Overall - I like it - this seems a decent quality company, at a reasonable maybe cheap, valuation.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.