Good evening/morning, it's Paul here with the SCVR for Thursday.

Estimated timing - should be done by 1pm

Update at 11:26 - I've got to pop out for a while, so will add a couple more sections after lunch. Hence revised finish time is 3pm.

Update at 15:52 - I've conked out now, so today's report is now finished.

I'm preparing this first bit on Weds evening, because I have to take some time out on Thursday to get the XJS fixed, ready for its 3rd attempt at this year's MoT. Nothing serious, just a weak handbrake (not needed on automatic transmission cars anyway), and slightly excessive emissions, so she needs an engine tuneup.

Let's start with short comments on some open tabs on my browser that got left behind earlier this week;

Portmeirion (LON:PMP) (I'm long) - a small number of shares in this decorative pottery, candles, etc, group appeared in my Spreadex account yesterday. That must mean the placing went ahead. I somehow got involved in this placing, but was more interested in meeting management and hearing their story. It's a share I previously liked a lot, but it's gone distinctly off the boil in recent years. This is all ringing a bell, have just remembered I wrote it all up here on 10 June. The more I think about it, the more I like its new strategy, to focus on eCommerce sales. This must be one of many companies that is now kicking itself for paying out generous divis in the past, and now needed to raise fresh equity at a low price. Overall, I'm not excited about the upside here, but think risk:reward could be OK, with patience (several years, is my intended holding period).

Comptoir (LON:COM) - a very small E.Mediterranean themed casual dining chain. Only £5m market cap at 4.2p. Although as with so many hospitality companies, you have to ask yourself, is it worth anything now? Its update this week (30 June) couldn't be more blunt in its message to landlords: start re-opening some restaurants from 4 July .... not completed its review as to which restaurants it may decide never to re-open.... support it receives from landlords to influence how many restaurants the company operates going forwards". It's probably easiest to do a pre-pack administration. There might be some value in the shares, if it is able to jettison all the problem leases via a pre-pack. As an investor, I'm mainly interested in buying shares in completely clean hospitality or retailing groups. A good recent example was Quiz (LON:QUIZ) (I'm long), which has done a pre-pack on its physical stores, thus getting rid of all the lease problems at a stroke.

Driver (LON:DRV) - I wrote about this small cap consultancy business here on Tuesday.

Many thanks to sharw who flagged up this link to the results presentation from Driver.

I can only embed video links here if they are in YouTube or Vimeo format.

See you in the morning :-)

Primark

Owned by Associated British Foods (LON:ABF) updates the market today. On re-opening of Primark stores, it says;

Trading in our reopened stores has in aggregate been reassuring and encouraging....

As indicated in our update of 1 June, most of our regional stores are performing well, especially in retail parks.

Our stores in the centre of big cities are suffering from the current absence of tourism and much lower commuter footfall.

Sales have been held back to some extent by a number of operating restrictions which vary by country but continue to evolve.

Primark gives full year profit guidance as follows;

Nearly all Primark stores are now trading again and we estimate that, absent a significant number of further store closures, adjusted operating profit for Primark, excluding exceptional charges, will be in the range £300-350m for the full year compared to £913m reported for the last financial year.

That's a savage drop in profitability, but it should bounce back next year, some or all of the way back to previous levels of profitability. The read-across for other garment retailers, is that if the best in the sector is seeing profits down by two thirds this year, then the weaker sector players are likely to report thumping great losses. I wouldn't touch any of the retailers that were struggling before covid-19 started, e.g. Ted Baker (LON:TED) and Superdry (LON:SDRY) spring to mind. The shutdown is likely to have caused further, serious damage to their profitability.

Primark doesn't sell online, which is a decision it might regret. Other retailers could at least keep business ticking over with online sales during the lockdown.

Recent sales performance strikes me as good;

Since the reopening of the first stores on 4 May, cumulative sales for the seven-week period to 20 June were £322m and were 12% lower than last year on a like-for-like1 basis.

Sales in the week ended 20 June, with over 90% of our selling space reopened, were £133m and trading in England and Ireland were ahead of the same week last year.

We have continued our policy of offering the best prices, and markdowns for the period since reopening have been minimal.

My opinion - Primark's announcement today seems reassuring to me, and should have good read-across for other retailers, and other shares which are part of the "re-opening trade".

Note that the most recent week's trading is above the equivalent week last year. That's fantastic news. Given that city centre stores are sluggish, then the rest of the estate must be doing a roaring trade, to bring the overall total to a positive LFL result.

When bars & restaurants open this Saturday on 4 July, combined with reassuring news on declining new covid cases, I'm coming round to the view that the re-opening trade is back on!

I wonder if the public will figure out that, with so many stores closing from the devastating impact of the lockdown, if we don't get out there and spend money in High Streets, and shopping centres, then they could disappear forever, and with it goes shopping as a leisure activity. Use it or lose it, springs to mind.

Other news

Reports from Germany are positive for retail spending on easing of lockdown, which beat forecasts apparently. That could have read-across for other consumer-driven economies like the UK.

American markets have also been strong, possibly propelled by encouraging news from Pfizer about a successful vaccine trial . This comes with all the usual caveats, that it's early stage, hasn't been peer reviewed yet, etc.. But as Jim Cramer pointed out on CNBC, Pfizer is not some promotional, rampy small cap. It's a highly credible major company, and just would not put out this news unless it were true.

For now anyway, all the above (encouraging re-opening figures, and hopes for a vaccine/treatment) seem to be outweighing the rising clusters of cases in the USA. It is starting to feel as if mankind may be beginning to control this thing. That's certainly what US markets are pricing-in. US markets seem to be looking beyond covid, whereas in the UK, small cap investors still seem mired in gloom. They can't both be right.

Is the V-shaped recovery back on? Recent comments from the respected Andy Haldane, from the Bank of England, made surprisingly bullish comments this week about a V-shaped recovery. He's got all the numbers to hand, so knows what he's talking about.

Broker research notes are starting to re-appear, with new forecasts that take into account the impact of covid. These are nearly always behind the curve. Going into a crisis, the forecasts are months behind reality, so we have to slash, or completely ignore broker forecasts going into and during a crisis. On the way out of a crisis, brokers tend to be overly pessimistic about how earnings are likely to recover. Therefore we need to anticipate this, and adjust forecasts accordingly. Recent research I've seen forecasts a sluggish recovery in earnings in 2021. If the economic recovery is good, then there could be an opportunity here, to buy stuff which is likely to beat 2021 forecasts. As always, we have to delve into the detail, and not take any forecasts at face value. They have to be assessed for either excessive optimism, or it now seems some are showing excessive pessimism. But it depends on the sector.

Overall, I think this could be a good time to be buying overlooked UK small caps - selectively, as always, as a lot of them are rubbish.

.

Air Partner (LON:AIR)

Share price: 89.5p (up 6.4% today, at 08:35)

No. shares: 63.6m

Market cap: £56.9m

Sorry for the slight delay, I nodded off.

Air Partner, the global aviation services group, is today providing an update on trading to 30 June 2020. This is the fifth update released during the COVID-19 pandemic and we anticipate communicating our next update to shareholders at the Group's Annual General Meeting (AGM) on 15 July 2020.

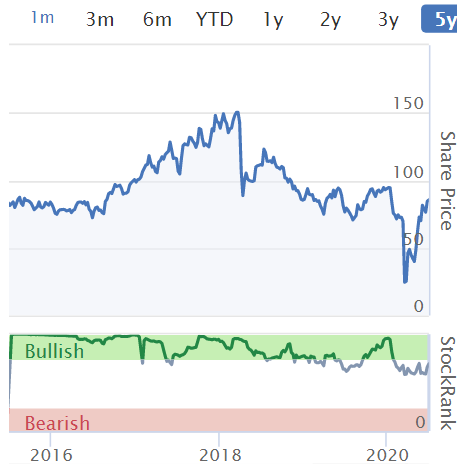

This is an interesting aviation services company, which charters planes, and acts as a broker for freight and private jets. Conventional wisdom might be that anything to do with aviation has had a terrible year, but this little company is a stand-out exception. So well done to shareholders who stuck with it, or bought at the bottom, look at this for a spectacular rebound;

.

.

As you can see above, the panic sellers in late March actually as it turns out, handed a wonderful gift on a plate, to people who had the balls to buy at that time of extreme crisis.

Today's update - another good one, but with a cautious outlook for H2;

Current trading overview

The business continued to perform significantly ahead of budget in June and the unaudited management accounts show an expected underlying profit before tax of at least £10.0m for the first five months of the year to 30 June 2020.

As has been the case throughout the COVID-19 crisis, this performance has been driven by strong activity in our Freight and Group Charter divisions. Early indications for July are showing an adjustment in our business mix to pre COVID-19 levels, with a recovery in both Private Jets and Safety & Security.... However, visibility for the second half of the year remains limited

Liquidity - looks fine to me;

June 2020 placing - raised £7.5m (before fees), which significantly reduced debt, and provided good working capital. Normalised cash of £16.0m at end June (doesn't include client cash). Access to £14.5m bank facilities, only £3.0m drawn down at end June. Seems very good overall, I have no solvency worries here.

Helpfully, there is a brief (6m30s) video update today from our AIR, via our friends at PIWorld;

.

My opinion - the update today doesn't give me much in the way of specifics, other than the underlying profit of £10.0m in the first 5 months of this sound, sounds really impressive. But the narrative indicates there are some one-offs in there (e.g. repatriation flights) without quantifying how much of the profit is one-off in nature. Could it be that AIR has benefited from the covid crisis, and business could return to normal? I don't know.

Checking back to last year's interim results to 31 July 2019, it made an underlying profit of £3.0m in H1, which compares with £10.0m this year (in just 5 months)! Therefore there's been a huge benefit this year from covid-related issues. I'd therefore be cautious and not value the business on a high multiple of a bumper year's profits.

I've just had a chat with Lord Lee, who has announced a 4.72% disclosable stake in the company today. He likes it a lot, and has obviously been buying recently. He points out that demand for private jets should remain strong, as those that can afford it would rather charter their own jet, than hang around in airports with masks on, and end up getting sick. Plus, sporting fixtures are now resuming, and private jets are widely used by sports teams, to avoid hotels & airports before flights, which could potentially make the whole team ill. Lots of things to like about AIR, it looks good to me.

.

.

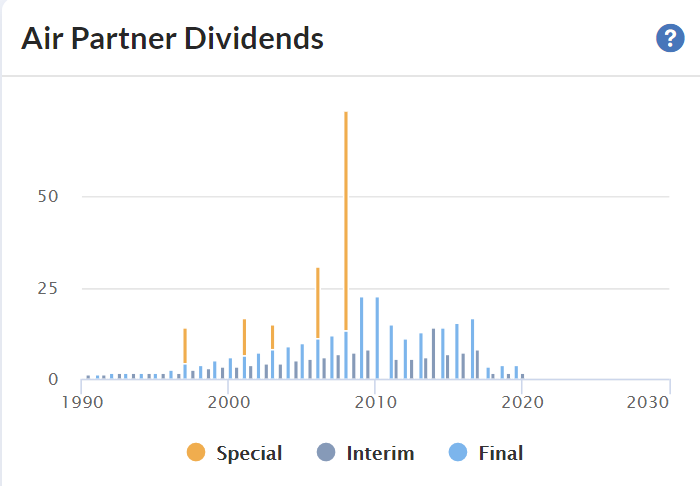

Looking at the 5-year chart above, it's basically traded sideways overall. Although dividends have been generous over that time period, totalling a remarkable 64.2p since 2015. Although that was dominated by 47.7p paid in 2015 & 2016, with the payouts from 2017 onwards have been much lower, as you can see from the Stockopedia divis chart below (which has been future-proofed with space up to 2030!);

EDIT: Many thanks to Geoff, who comments as follows about AIR's dividends;

Paul - thanks for the write up on AIR and indeed all your recent writings - both company specific and MACRO.

Just on the high dividends in 2015 & 2016 & apologies for being a pedant - looking at my records (having held since 2013 - it's been very bumpy on 2 occasions now !), these were before a 5 for 1 split in Feb'17 and therefore need a similar adjustment when comparing with today's shareprice ?

That sounds a very valid point, and explains why the divis were so huge prior to 2017. Many thanks for pointing out this useful information, much appreciated. End of edit.

.

Overall, AIR gets a thumbs up from me.

US Jobs data

US futures are up strongly again, on better-than-expected jobs data.

Nearly 5m new jobs were created in June, with the unemployment rate falling from roughly 13% to 11%. This is a big deal, and shows recovery is happening faster than expected.

More mounting evidence that major economies are over the worst. Stock markets look forwards, hence why some share prices are anticipating recovery. Maybe the market has been right to look beyond covid? It's starting to look as if that might indeed be the case, although I can't help feeling the market has overshot on the upside on recovery hopes, but what do I know?!

I like this comment from one commentator on CNBC on the US economy;

A return to normalcy is is on the horizon

The pockets of irrational exuberance continue to be fuelled by retail buying, e.g. Tesla is now valued at more than Toyota!

It's anybody's guess how long it is before the inevitable correction occurs. This reminds me so much of late 1999, early 2000, just before the TMT boom turned to bust.

I'm not saying the entire market, or the quality mega caps, should necessarily fall in price, we can justify high valuations on quality companies like Apple, Microsoft, etc. But Tesla being valued at $226bn (at $1219 per share) is just utter madness. I think we could be getting close to a big correction on the bubble stocks like this. Once shares detach from reality, and can no longer be valued rationally, then there's nothing to stop them going even higher, in a self-fuelling bubble. All it needs is a good story.

Castlepoint Shopping Centre

This is a large outdoors shopping centre (retail park) on the outskirts of Bournemouth. It happened to be on my way back from the Jaguar garage, so I stopped off at about 12:30 today, to check it out. Primark (as noted above) said the retail parks are trading well. This is backed up (admittedly only a sample size of one!) with my impression of Castlepoint. The car park was close to full, although about a quarter of it was fenced off for building work.

I bought some sale items in Next, which only had a few rails of reduced price clothes. Most of it was full price. The (large) shop looked immaculate, and there was a steady stream of customers, keeping apart well. A few wore masks, but not many. Some staff had perspex visors, and there was prominent sanitising gel on the door.

Then I went to M&S, and it's a similar story there. Subjectively, both stores looked as if footfall was close to normal for a Thursday lunchtime. I'd say older people were more likely to be wearing masks, and a few younger people were too.

The very large ASDA looked busy.

My trip today was not scientific in any way, but it reinforced to me what Primark is saying, that shoppers are indeed coming back, and are keen to spend. So for me, the re-opening trade is definitely back on now. I think when cafes, bars & restaurants are able to re-open too, then this could give town centres a nice boost too. Tourism is just starting to resume too.

Hospitality sector expert Mark Brumby of Langton Capital (sign up here free for Langton's brilliant daily email), has just emailed to point out that data from Germany is looking good for bars re-opening - this is what Mitchells & Butlers (LON:MAB) reported today;

- The experience in Germany. Signage, 1.5m distancing and the requirement to wear masks was common across the Federal states. The businesses were not allowed to operate buffets. Sales are now c70% of pre-Covid.

- This varies between city centre (40% to 45%) and suburban (some at 100%). A repeat of this in the UK would ‘delight’ the company and exceed expectations.

Therefore, I think this could be a good point for risk-tolerant investors to buy some shares in pubcos. If the re-opening goes well in the UK too, then I think these shares could rally nicely from next week.

.

Appreciate (LON:APP)

Share price: 30p (up 9% today, at 14:52)

No. shares: 186.3m

Market cap: £55.9m

Appreciate Group plc (the 'Group'), the UK's leading multi-retailer redemption product provider to corporate and consumer markets, today provides an update on current trading and financing and notice of its final results.

Appreciate (used to be called Park Group) has a 31 March year end.

Sales are on an improving trend, but still well down on last year;

YTD: 48% down on LY, split out monthly as follows;

- April: 70% below last year

- May: 47% down on LY

- June: 35% down on LY

There's no change in the position of the Christmas Savings part of the business, which is 10% below LY.

Outlook - sounds reasonably positive;

... we anticipate improved trading in the coming months and as lockdown is further eased.

Liquidity - this is self-explanatory, and reads well;

Update on bank financing

As stated in the 30 April trading update, the Board has reviewed several financial scenarios of the potential impact of COVID-19 on the business and, in each of those scenarios, the Group retains positive free cash this financial year.

Total billings are currently marginally ahead of our mid-range scenario and as at the end of June free cash stood at £18.8m.

If the company currently has £18.8m free cash, then retaining positive free cash this year doesn't sound much of a challenge. Although I would have to look into the seasonality of the business - e.g. a Xmas savings club would build up cash during the year, and then see it spent by customers just before Xmas, presumably. Does free cash include customer cash, I wonder?

My opinion - I'm not getting enough of a positive feel from the trading update, to want to delve any deeper. With only limited time, and so many companies to look at, I have to prioritise things that really grab me in terms of potential upside.

Lord Lee also likes this company, we discussed it today, and thinks its move to digital products is promising. It could be an interesting turnaround under its new CEO.

It certainly looks cheap on a low PER basis, and high divi yield, if it is able to recover to pre-covid earnings maybe next year?

.

All done for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.