Good morning from Paul & Graham.

Right to reply - XP Factory (LON:XPF) - we're always happy to talk to companies if they think we've got something wrong in the SCVRs. I had a call yesterday from a rather miffed CEO of this experiential leisure company. He said that the deficit on the lease entries on its balance sheet was due to netting off landlord contributions (creditors - for rent-free periods and reverse premiums) against the Right of Use Asset. That sounds plausible, so I've asked for more information, and will publish that here when it comes through. Just wanted to flag it straight away.

Here we are, XPF's CFO explains the lease entries - many thanks for this - it certainly puts a much better picture on the lease entries on XPF's balance sheet. So my apologies for jumping to an incorrect assumption about these entries in yesterday's report. I think we're all learning as we go along re IFRS 16, which almost everyone agrees is a terrible accounting standard, a big backward step!

Subject: Response to Paul Scott's comment

Whilst I will leave you to form you own opinions on the XP Factory performance, there is at least one factual inaccuracy in your comment which I believe is misleading. You state that the “balance sheet shows a large deficit on the lease entries, suggesting BOOM must have a significant number of loss-making sites”. The company has been the beneficiary of significant cash contributions from landlords on the majority of its Boom sites and on some Escape Hunt sites. Under IFRS 16, these landlord incentives are netted off against the Right of Use asset. Ordinarily, at the lease inception, the right of use asset would exactly set off the leasehold liability. However, when a landlord contribution is received, the Right of Use Asset is reduced by the contribution, meaning it will be smaller than the lease liability. Once the lease commences, the lease and the right of use asset will amortise down and slightly different rates, depending on the rental payment profile, which will lead to a further mismatch. However, the substantial majority of the difference in the case of XP Factory is due the cash benefit from landlord contributions – ie a benefit to the company. It has nothing to do with the performance of the individual sites, which within Boom generated an 18% EBITDA margin – 23% in H2 - after fully accounted rent charges as set out in the statement.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Getech (LON:GTC) - up 15% to 9.5p (£6m) - Trading & Technology Update - Paul - AMBER

A serial disappointer over many years, losses almost every year. I don’t understand why it’s listed. Today it says 2024 has started well. ARR has risen to £2.9m. Reducing costs by £2m pa sounds sensible, as previously announced in Sept 2023 H1 results (heavy loss). I doubt investors would be interested in any more fundraises. It’s hoping to reach positive EBITDA and cashflow. Mentions property assets. Had £3m NTAV at June 2023. No mention of current cash position in today’s update. Looks like it might survive, but I doubt this company can scale up - it’s spent almost 20 years trying, and got nowhere.

Pollen Street (LON:POLN) - up 12% to 600p (£343m) - positive reaction to 2023 Results and increased future guidance from this “alternative asset manager” founded in 2013 and floated recently in Jan 2024. We haven’t looked at it properly in the SCVR yet. Says its AuM will exceed £4bn in 2024, and aspiration is to grow to £10bn within 4-5 years. Raising cash for private equity funds. Announces £30m share buyback today. Sounds quite interesting.

Silver Bullet Data Services (LON:SBDS) - up 8% to 160p £28m) - Contract wins & renewals worth £1.7m with Greene King and Heineken. It’s not clear if these were already in the forecasts or not. No recent broker notes available. Interesting-sounding company with impressive client list, in a fashionable investing area - mentions AI 4 times in today’s announcement. Shares have c.6-bagged since summer 2023, impressive! I did a quick review here on 27/2/2024. I suspect it’s going to need another fundraise, but maybe from a position of strength?

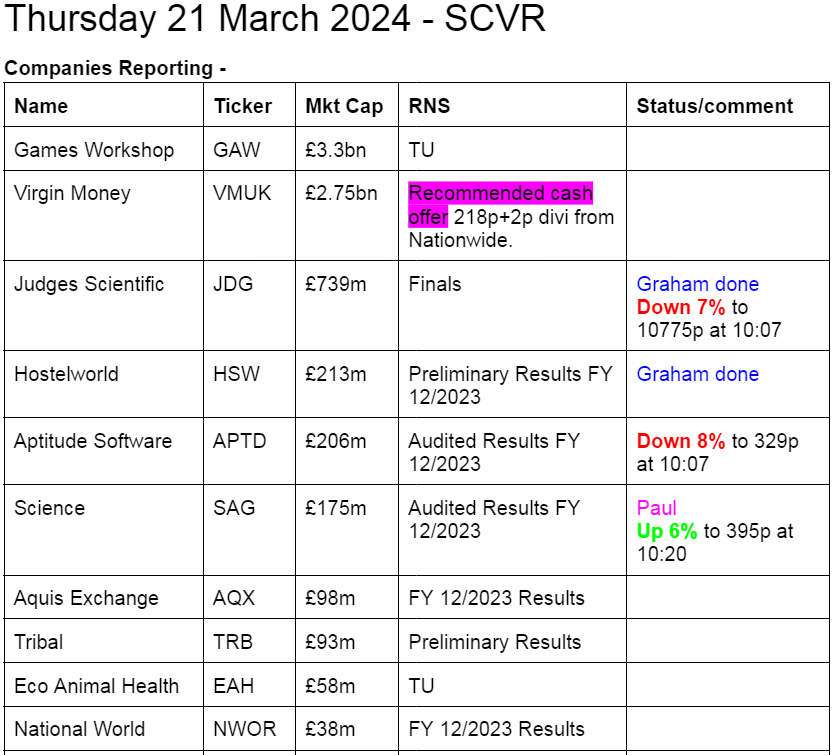

Summaries of main sections

Judges Scientific (LON:JDG) - down 6% to £108.9p (£721m) - Final Results - Graham - AMBER

Judges says it is “comfortable” with market expectations, and brokers have nudged up estimates for 2024. However, order intake is marginally behind 2023. More fundamentally, I’m concerned about the deterioration of quality metrics and a sky-high valuation.

XLMedia (LON:XLM) - up 62% to 10.1p (£26m) - Sale of assets for up to $42.5m - Paul - AMBER

A large disposal has put a rocket under XLM shares today. This transforms its stretched balance sheet into a cash positive situation with an intention of making a shareholder return with some of the cash. Not a very good business though, and XLM shares are still down 95% from the peak. Still at least long-suffering shareholders have something to celebrate today.

Hostelworld (LON:HSW) - down 2% to 167.5p (£207m) - Preliminary Results - Graham - AMBER

Excellent results from Hostelworld, as expected. The company can hopefully look forward to a future with low debt levels and sustainably positive net income and cash flow. I compare valuations with the owner of Booking.com and decide that a neutral stance is justified.

Paul's Section:

XLMedia (LON:XLM)

Up 62% to 10.1p (£26m) - Sale of assets for up to $42.5m - Paul - AMBER

The share price of this digital media company have gone bananas after a large cash disposal was announced at about 10:50 today. “Binding agreement” to sell some of its gambling-related marketing sites to Gambling.com Group Ltd. $35.0m cash net of costs (£27.5m) - $20m 1/4/2024, $10m in six months, and $7.5m in one year. Instalments do make me a bit nervous. Plus a potential $5.0m earnout. Gosh the £29.4m initial payments are more than the market cap, after I adjusted it up for the +62% share price. Could there be further upside I wonder? Looks possible. It mentions “transition costs”, but doesn’t quantify that.

Use of the cash -

The Group intends to use the proceeds of the Transaction to cover asset transition costs, pay the final deferred US acquisition payment [$4m] and settle outstanding tax provisions [Cavendish est. $5m] and provide working capital to support the North America business while returning cash to shareholders.

Cavendish reckons the remaining group will produce c.$5m EBITDA annually. We haven’t yet got forecasts for the remaining group, but adj PBT was previously forecast to be less than half EBITDA, so it doesn’t look like there will be much genuine profit in the continuing business. After the various costs above it looks like there should be about £20m cash left over, so my guess would be that they might return say half of that to shareholders, which would work out at about 3.8p per share. Not madly exciting.

Paul’s quick view - when I last looked at XLM on 29/9/2023, I flagged up its weak balance sheet, so colour coded it amber/red. Also the shares have been a dismal performer since the late 2017 peak, down 95% since then. Profits largely evaporated, and divis stopped in 2019. There’s rarely any sustainability to companies like this in digital advertising, they make a few years of bumper profits by exploiting some online advertising algorithms that are then changed by Google or whatever, and profits collapse - that’s happened to many similar companies.

Today’s news is game-changing for the balance sheet, so I don’t need to keep a risk warning on this share any more. Also the deal done gives a useful benchmark that might mean its remaining business could be better than I thought, and worth more maybe? So I’m happy to go up to AMBER.

Incidentally, I was expecting to see big Director selling, but it's the opposite, all buys since 2019.

A nice move today -

Zoom out though, and it doesn't even register on the scale! -

Graham’s Section:

Judges Scientific (LON:JDG)

Share price: £108.90 (-6%)

Market cap: £721m

Judges Scientific (AIM:JDG), a group focused on acquiring and developing companies in the scientific instrument sector, announces its final results for the year ended 31 December 2023.

This share enjoyed tremendous momentum over the past six months:

These are fine results published today, at least in terms of the adjusted numbers, and seem to be ahead of expectations (e.g. vs. the StockReport and also ahead of the prevailing estimates from WH Ireland).

Revenue +20% to £136m (organic revenue +15%). Estimate was £130m.

Adjusted PBT +12% to £31.7m. Estimate was £30.5m.

Net debt reduces from £52m to £45m.

Full-year dividend is 95p, up 17%.

The unadjusted figures are where the results fall down:

Actual PBT is down 16% to £13.4m.

Actual earnings per share is down 26% to 145.8p.

The company has added a new line to its financial highlights this year, “Tax on Adjusted Earnings” (which is up +41%), so this is clearly something that it’s anxious to point out to investors. I don’t think the new corporate tax rate is sufficient to account for all of the increase in the tax charge, but it could account for most of it.

Outlook

The Board is “comfortable with current market expectations”:

Commencing 2024 with a solid Organic order book.

Timing of next Geotek Coring expedition and its revenue recognition in 2024 remains uncertain.

Supply chain now returned to normal.

YTD Organic orders marginally behind 2023 comparative period, which included exceptionally large post-lockdown contribution from China.

Estimates

WH Ireland have slightly nudged up their estimates for 2024, and are now looking for adj. PBT of £33.8 (previously £33.5m).

CEO comment from David Cicurel explains the headwinds facing EPS:

A full year of Geotek and two small acquisitions in the spring contributed to the Group's performance. As previously noted, this and the Organic achievements were largely absorbed by higher tax rates, increased borrowing costs and some dilution from the issue of new shares in respect of half of the Geotek earn-out.

During 2023, Judges had to pay £35m in an earn-out for Geotek, half in cash and half in shares.

Mr Cicurel also has a view on the outlook:

For the immediate future, the new year has started with a healthy order book; order intake for the first eleven weeks of the year has been marginally below the 2023 comparative which included an exceptionally large post-lockdown contribution from China. At this point, we are still envisaging another coring expedition during the course of 2024, however, Geotek has not yet contracted for this expedition and there is uncertainty regarding its timing and the amount of any related revenue to be recognised in 2024.

Graham’s view

I tend to view Judges as an A* star company but with a valuation that usually matches it. Whenever I have thought that the Judges share price has offered value in the past, I’ve said so, but usually it doesn’t seem to offer much value.

That remains the case today:

The StockRanks tell the story, categorising it as a High Flyer:

However, I’m a little concerned that the underlying quality of Judges might have dipped slightly in recent years.

The £80m acquisition of Geotek saw the company paying a high price for a company with volatile revenue recognition / lumpy orders and that was likely going to drag Judges’ quality metrics lower. It also agreed to dilute shareholders as part of the deal (not a typical part of the Judges strategy).

Judges calculates its own “Return on Total Invested Capital” (ROTIC) every year. Due to the negative impact of the Geotek acquisition, it estimates its ROTIC at 22.7% for 2023 and 20.6% for 2022. These aren’t bad numbers but they aren’t the sparkling figures that Judges shareholders might be used to or expect.

I also have to be fair when it comes to adjusting items: for most companies, I take a dim view when there is a large gap between adjusted and actual measures of profitability.

Judges has reported £18m (pre-tax) of adjusting items for 2023, up from £12m for 2022. Most of this is amortisation of intangibles. Another large item relates to the increased market value of the Judges shares being paid out for the Geotek earn-out. These are acceptable items to adjust, but it’s something to be aware of.

The Judges balance sheet shows net assets of £83m, but after deducting intangibles and goodwill this number goes to zero.

I’ve always been price-sensitive when it comes to this share: there are times when I think it offers excellent value (rare) and there are times when I think it offers poor value (much more common). At its current valuation, I’m afraid I see poor value on offer here.

I still wouldn’t give it the thumbs down - it’s dangerous to do that to a company which has a long-term record of compounding value. But for a business with much more average quality metrics than it has ever had before, and which is likely going to have increased difficulty finding acquisitions that can move the needle in future, the current valuation makes little sense to me.

Hostelworld (LON:HSW)

Share price: 167.5p (-2%)

Market cap: £207m / €242m

Hostelworld, a leading global OTA focused on the hostel market, is pleased to announce its preliminary results for the year ended 31 December 2023.

We covered the full-year trading update for this company in January.

As we reported then, post-Covid momentum at this travel company has been tremendous and has taken its metrics to record highs:

6.5m bookings, up 37%.

GMV (gross value of bookings) €619m, up 32%.

Net revenue €93m, up 34%.

Marketing as a percentage of revenue falls from 58% to 50% (an important measure of profitability since marketing is the key expense).

Other operating expenses, excluding exceptional items, as a percentage of revenue fall from 35% to 27%.

So we get the following impressive progress in terms of profitability:

Adjusted EBITDA €18m (2022: €1.3m)

Net income €5m (2022: loss of €17m)

The financial recovery has been reflected in the long-term evolution of the share price. Remember that this was a healthy, profitable company pre-Covid.

Net debt: this company was struggling under the weight of excessive debt a few years ago, but that is no longer the case. In 2023, net debt fell from €22m to €12m. And since the beginning of 2024, an outstanding RCF has been fully repaid.

The remaining term loan only charges interest at 2.65% over EURIBOR (the margin has reduced as the company has deleveraged).

There is also c. €10m owed in back taxes which will be paid over the next three years.

CEO comment:

"I am very pleased to report another strong year of strategic progress for Hostelworld, which is reflected in our results. Over 2023 we grew market share, delivered record revenues, and increased operating leverage through a combination of reduced marketing spend (as a percentage of revenue) and continued operating cost discipline to deliver €18.4m EBITDA, which exceeded our guidance range of €17.5m - €18.0m.

Outlook

"With our record performance in 2023 and substantial progress in strengthening our balance sheet, I believe we are strongly positioned to deliver against our medium-term financial commitments published at our Capital Markets Day in November 2022. We have started 2024 with strong momentum, and I feel confident that we will continue our track record of profitable growth and value creation for our shareholders."

Social network?

The interesting strategy to create a social network for hostel travellers continues: the company offers city-based and hostel-based chat rooms, theme-based chat rooms, and local event catalogues, making it easier for people to meet each other on their travels. The Hostelworld social network now has over 1 million members.

While I don’t see this product threatening Facebook any time soon, I do think it’s an innovative idea that could differentiate Hostelworld from its rivals in the online hostel booking space.

Graham’s view

I remain deeply impressed by the financial recovery at Hostelworld, and intrigued by what their social network strategy might achieve in the long-term.

Would I buy these shares at the current level? The market cap is equivalent to 13x adjusted EBITDA, which to me is a little hot. Adding on net debt would bring the adjusted EBITDA multiple closer to 14x.

We do have a stock we can easily compare it with: Booking Holdings, the owner of booking.com and other similar websites. Booking.com is not limited only to hostels but let’s compare some metrics anyway:

Price to sales. Booking Holdings 5.7x, Hostelworld 2.8x

Price to 2023 EBITDA. Booking Holdings 17x, Hostelworld 13x.

On that basis, maybe Hostelworld is not so expensive? But it’s a much smaller company and less diversified than Booking Holdings, so Hostelworld probably should trade at a discount.

On balance, I’m going to take a neutral stance on Hostelworld.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.