Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

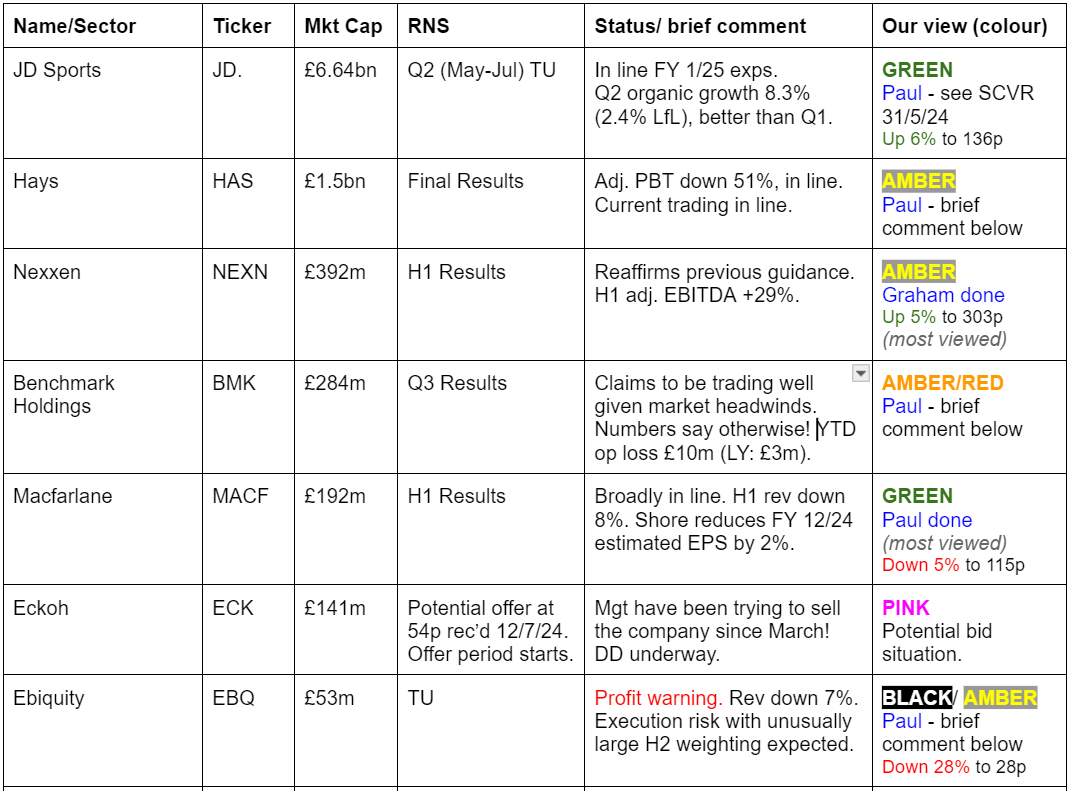

Companies Reporting

Summaries

Costain (LON:COST) - up 7% to 101p (£281m) - H1 Results - Paul - GREEN

From yesterday, I give a thumbs up again to this contracting group, which is planning on significantly increasing its operating margin from current low level of 2.5% to hopefully 5%+ over the next few years. It has a notably strong balance sheet with loads of cash. Don't forget the sector risk though! Webinar on IMC is 10am today.

Proton Motor Power Systems (LON:PPS) - 1.45p (pre-market) - Financing Update - Graham - RED

The lenders to this hydrogen energy company have indicated that they will no longer support the company’s working capital needs, from January 2025. Their loans are repayable in December 2025. Unfortunately the financial performance of this business has been abysmal and it is very likely to need more funds next year. Unless they can find someone new to throw good money after bad, the equity looks set to reach its terminal value in an accelerated manner.

Macfarlane (LON:MACF) - down 5% to 114p (£182m) - H1 Results - Paul - GREEN

Packaging distributor that reported soft trading back in May now says it's slightly behind FY 12/2024 expectations. Shore trims its estimated EPS by 2%, so no great shakes. I see this as a good business, reasonably priced, so remain positive.

James Latham (LON:LTHM) - 1,355p (£272m) - AGM Statement - Paul - GREEN

In line TU from yesterday, for this wood products distributor (eg fencing). A recap on the figures reminds me what a nice cash generative company this is, with an astonishing balance sheet groaning with surplus cash. Valuation looks reasonable, so I'm happy staying at GREEN.

Nexxen International (LON:NEXN) - up 5% to 302.8p (£411m / $539m) - Q2 and H1 2024 Results - Graham - AMBER

Full-year guidance has been maintained by this advertising platform. I’m taking an upgraded view of AMBER here, compared to Paul’s AMBER/RED, as I think that the company’s aggressive use of buybacks (including a $50m buyback announced earlier this year) could keep the positive share price momentum going. But fundamentally I don’t trust this company’s performance metrics and I wouldn’t want to hold it long-term.

Quick Comments

Hays (LON:HAS)

Up 2% to 96.7p (£1.54bn) - FY 6/2024 Results [in line] - Paul - AMBER

Staffing companies are really struggling. Poor FY 6/2024 results today, with adj PBT down 51% to £95m, adj EPS down 53% to 4.0p, but that’s as expected, after its profit warning on 9/1/2024. Fwd PER is high at 22.4x, as the market anticipates the still-elusive recovery in sector outlook. This is not just a UK problem, other large markets are also struggling, including Germany and Australia. More cost savings announced. Current trading sounds a little wobbly, with it saying Sept is key month, but “too early to assess trends”. Headcount down 18% in the year. OK balance sheet.

Paul’s view - trading should improve as a cyclical recovery begins, but I feel the share price is asking me to pay too much up-front for a recovery that hasn’t even started yet. I’m not convinced HAS deserves a premium over smaller staffing companies. Although Pagegroup (LON:PAGE) and Robert Walters (LON:RWA) are on fairly similar forward PERs. SThree (LON:STEM) appeals to me most in this sector, as it’s much less cyclical, and reasonably priced.

Benchmark Holdings (LON:BMK)

Unch 38p (£281m) - Q3 Results - Paul - AMBER/RED

Issues Q3 results, as required by its unsecured green bond. Another operating loss - £(6.5)m in Q3, worse than £(4.0)m op loss in Q3 LY.

Net debt (excl leases) has risen to £63.9m June 2024, was £56.8m just 3 months earlier, so cash burn looks an ongoing problem. Says it has plenty of liquidity though.

9 month YTD revenues down 17% to £111m. YTD operating loss of £(10.2m) worse than £(3.0)m LY comparative. Note the very large finance costs, so operating profit is not a reliable number. It made a £(17.3)m LBT in the 9 months to June 2024. Balance sheet looks OK overall, with NTAV £66m, but the debt £64m net debt worries me as it’s expensive. You would need to carefully check the terms - any covenants, repayments, etc?

Paul’s view - I remain utterly perplexed as to why BMK is so richly valued. It must have something special which is not yet apparent from its historical trading results, which have been consistently loss-making. It’s not even growing any more, with revenues going backwards. I’d say time is running out here, and personally wouldn’t touch it, so I’ll remain at AMBER/RED. Can any readers explain in the comments why this share commands a £281m market cap? What am I missing?

Calnex Solutions (LON:CLX)

Up 1% to 53p (£46m) - AGM Statement [in line] - Paul - AMBER

Calnex Solutions plc (AIM: CLX), a leading provider of test and measurement solutions for the global telecommunications and cloud computing markets…

This warned on profits in Oct 2023. The chart seems to be bottoming out at around 50p. Graham and I were both AMBER when we previously looked at it. Calnex was previously a decently profitable growth company, but then performance crashed in FY 3/2024 to a small loss, vs a £7.2m profit in the previous year. So the question here is whether it can recover back to previous levels of profitability?

Outlook -

“As anticipated, the telecoms market has remained challenging throughout the first four months of FY25. While activity levels across the sector are generally expected to stay at subdued levels for the remainder of the year, the fundamental need for the Company's testing solutions remains strong. The Board is encouraged by the early successes of Calnex's new product launches, which are expected to underpin the Company's return to growth in H2 FY25.

Calnex continues to maintain tight cost control measures and benefit from a healthy balance sheet and the Board anticipates that the Company's performance in FY25 will be in line with market expectations.”

Cavendish leaves its forecasts unchanged today. This shows only a very slight recovery in profitability from £(0.4)m adj PBT actual in FY 3/2024, to £0.4m positive adj PBT in FY 3/2025. That doesn’t get me interested at all, especially as it seems to hinge on an H2 weighting from new products. Remember the market cap is £46m, which is a lot for a company that’s only now trading around breakeven.

The balance sheet is strong, with the 3/2024 situation being £13.2m NTAV, including net cash of £11.9m - although that fell considerably from £19.1m a year earlier, due to negative working capital movements and a large £(5.6)m of capitalised R&D (greater than the £4.1m amortisation charge, flattering profit by £1.5m compared with cashflow), so make sure you ignore the overstated EBITDA numbers.

Paul’s opinion - I wish them well, but there’s no sign yet of any significant trading recovery, and we’re being asked to pay too much for a company that’s only around breakeven on the P&L, and has negative cashflow. So for me it’s AMBER at best.

Ebiquity (LON:EBQ)

Down 30% to 26.5p (£36m) - Trading Update [profit warning] - Paul - BLACK / AMBER

Ebiquity plc ("Ebiquity" or the "Group"), a world leader in media investment analysis, announces a trading update for the first half year ended 30 June 2024 ahead of its interim results which will be issued on 26 September 2024.

H1 revenues down 7% to £37.9m, due to reduced demand from large customers. Fixed costs, so operational gearing is “acute”. Adj EBIT for H1 expected to be £2.3m, down 61% on H1 LY. Visibility over 80% of FY 12/2024 revenues. Depending on a big uplift in Q4. Net debt at 30 June was £15.3m, but plenty of liquidity - and year end net debt expected to be similar, peaking in Q3. Ample headroom on covenants. Expects “significant profits” in H2, underpinned by contractual visibility & pipeline. Acknowledges the execution risk. Warns that overall FY 12/2024 profit will be below previous expectations, but doesn’t say by how much. Sees Sept & Oct as “crucial months”. Panmures says likely FY 12/2024 outturn at EBIT level is £10-11m, vs previous £12.6m expectations, so not a disaster.

Paul’s view - looks an interesting business, worth doing some more research on it, for risk-tolerant investors. Everything hinges on whether you favour the heavily adjusted profits, or the statutory losses! Balance sheet looks stretched, with too much bank debt, and negative net tangible assets. The profit warning today and dependence on a big recovery in H2 makes this look like it might warn on profit again in H2, I worry. For those reasons I’m going to sit on the sidelines here with AMBER.

Paul’s Section:

James Latham (LON:LTHM)

1,355p (£272m) - AGM Statement - Paul - GREEN

This is a family-run distributor of timber products, fencing and such like.

It’s trading in line with expectations -

“Revenue for the first four months of the current financial year, namely 1 April to 31 July 2024 is £127m compared with £128m for the same period last year. Volumes are up 3.1% on the same period last year. Margins remain consistent with the second half of the previous year. Overheads and resulting profit are in line with market expectations.”

Outlook - sounds encouraging -

“Most of our customers remain busy and are more confident than at the same time last year.”

I was previously worried that the bumper profits made during the pandemic (when a boom in DIY collided with restricted supply chains) allowed Lathams to do a roaring trade temporarily, but would see profits return to normal. That’s pretty much what has happened, with EPS now looking more normal at c.100p -

Stockopedia shows the forward PER as 12.8x, which looks reasonable to me.

Balance sheet - it says that “cash balances remain strong”. That’s something of an understatement! The last balance sheet at 31/3/2024 was astonishingly good. For example net current assets totaled £165m, including £76m cash!

Considering it operates from lots of depots, the lease liabilities struck me as modest, at only £8.7m. So it must have lots of freehold property, and it does. The last annual report shows £26m in freehold property, in the books at cost. Given that Lathams has been around for donkey’s years, what’s the betting that the market value of its freeholds is well above book value?

Calculating EV, the market cap is £272m, and net cash is £75m, so EV is £197m.

EBIT (FY 3/2024) was £26.1m, add back £4.3m depreciation & amortisation, giving EBITDA of £30.4m.

Hence EV/EBITDA is 6.5x (I could have just looked on the StockReport, which has a similar number!)

The cashflow statement shows that LTHM doesn’t spend a great deal on capex relative to its cash generation, so I would say this is quite high quality EBITDA, compared with say a software company capitalising a ton of its payroll costs, where EBITDA bears no relation to real world cash generation. Here at LTHM it does. So I think that’s quite an attractive valuation.

I imagine LTHM probably gets plenty of approaches from private equity, looking to strip out its cash and gear it up with debt, but the family probably tell them where to go I imagine, it’s that type of company. But you never know, at some stage maybe it might be sold, and the family shareholdings are not individually large, there could be more under 3% though -

Paul’s opinion - I was green on 28/3/2024, and a fresh look at the numbers today reinforces my opinion.

It’s GREEN again.

Zooming right out to 20 years, you can see what an excellent long-term investment Lathams has been (plus divis on top) -

Macfarlane (LON:MACF)

Down 5% to 114p (£182m) - H1 Results - Paul - GREEN

This Scottish-headquartered packaging group (mainly distribution, but also small amount of manufacturing) is one of our favourite value shares here, and it has a very good long-term track record if you zoom out on the chart - c.7-bagging in the last 12 years, whilst paying divis and self-funding bolt-on acquisitions.

It’s s struggled a little this year though. Checking my previous notes -

29/2/2024 - Paul - GREEN - 123p - Good FY 12/2023 results. Shares look good value.

7/5/2024 - Paul - GREEN - 131p - TU, weak Q1, expecting H2 recovery, so FY 12/2024 exps unch.

Today’s H1 results indicate a slight reduction in FY outlook -

“Resilient performance in the period; trading broadly in line for the full year”

The Chairman sounds sanguine -

“Aleen Gulvanessian, Chair of Macfarlane Group PLC, commented on the interim results: "As outlined in our AGM trading update in May, the challenging market conditions experienced in the latter part of 2023 have continued in 2024.

The management team has responded effectively through an improvement in new business growth, the management of price deflation and actions to control operating costs. In addition, the Group continues to execute its strategy, making two further high-quality acquisitions.

The strength of our balance sheet and the cash generative nature of our business underpins our ongoing investment in actions to grow sales both organically and through acquisition and increase the interim dividend.

Despite market headwinds, our operational and strategic performance is progressing, and the Group is well-positioned to benefit as the macroeconomic outlook improves."

Broker update - Shore Capital kindly gives us the detail, and it’s only slightly reduced FY 12/2024 estimated adj EPS by 2%, to 12.0p (down from 12.8p actual adj EPS achieved in FY 12/2023). Hence at 114p/share, the current year PER is 9.5x

H1 results - a little soft, but a 3% drop in adj PBT doesn’t unduly worry me -

“Continued weak customer demand and price deflation have been partially offset by the benefit of the acquisitions of Gottlieb in April 2023 and Allpack Direct in March 2024.”

Outlook -

“The actions taken in H1 2024 and continuing through the remainder of the year should enable the performance of the Group to be broadly in line with market expectations for 2024.”

Balance sheet - NAV is £117m. Goodwill is £89m, so NTAV modest at £28m. That looks OK to me, as fixed assets at MACF are only £10m, so it doesn’t require much in the way of physical assets, being mainly a distributor. Inventories are also nice and low.

Note the £10m pension accounting surplus. It has 1 owned, and 52 leased sites, so possibly some inefficiency from so many depots, I wonder?

Bank debt is modest, and fully offset by cash, so it had net funds of £0.8m on 30 June 2024. The bank facility of £35m runs to 31/12/2025, and there’s ample liquidity.

Paul’s opinion - this looks fine to me, the fundamentals of the business remain good I think.

However, current trading is a little soft, but the 2% trim to estimated EPS today by Shore is not a concern to me. It’s such a small adjustment that I won’t flag it as a profit warning.

I think the value/GARP credentials here are good, and this is a fundamentally sound business. Therefore I’m inclined to see recent share price softness as more an opportunity for investors, rather than a threat.

I’m comfortable to stick at GREEN on the good long-term fundamentals. A slightly soft patch in current trading doesn’t alter the big picture that this is a good business, at a reasonable price.

Good StockRank too, although it’s slipped a little as momentum declines -

Costain (LON:COST)

Up 7% to 101p (£281m) - H1 Results - Paul - GREEN

We like Costain here at the SCVR, a contracting group in several sectors (eg road, rail, energy, utilities). Our coverage this year being -

10/1/2024 - 67.8p - Paul - AMBER/GREEN - FY 12/2023 traded in line. Contract win in water. Y/e net cash above expectations at £164m. Quite interesting, PER only 5.4x. Note pension scheme. Paul doesn't like sector.

17/5/2024 - 81p - Paul - GREEN - In line TU. Very good cash position, and improving margins mean this looks to be headed for useful increases in EPS. Still looks cheap, providing nothing goes wrong, even after strong recent gains.

Now we’re up to 101p, is it still such good value? Let’s find out!

The wafer thin 2.5% operating margin above stands out as showing that COST is terribly busy doing a lot of work, for only a tiny scrap of profit.

However, this share is all about margin improvement, as mentioned here last time on 17/5/2024.

Note that PBT is above operating profit, due to interest received on the big cash balance.

This bit is key -

“On course to meet margin targets of 3.5% and 4.5% during FY 24 and FY 25 respectively. Adjusted operating margin1 increase of 20bps to 2.5% (H1 23: 2.3%), with margin growth in both divisions.”

Assuming that margin improvement is delivered, then it could result in operating profit almost doubling.

That doesn’t seem to be forecast in the FY 12/2025 broker consensus, which only shows a modest improvement on FY 12/2024 forecast, hence I’m thinking this share looks well set up to potentially beat the current forecast for 2025 -

It did 5.6p actual in H1 2024, so 12.0p forecast EPS for FY 12/2024 sounds achievable.

Outlook excerpts -

“Having secured a significant volume of work in H1 24, our high-quality forward work position stood at £4.3 billion at the end of the first half, with at least a further £500 million of new work with Southern Water secured post period end and further wins expected in the second half. The quality and volume of our forward work gives us good visibility on future revenue and margin…

While we remain mindful of the macro-economic and geopolitical conditions and their importance for near-term government priorities and the timing of spending, we are well positioned for further cash generation and growth in profits [Paul: excellent clarity, and not the usual meaningless “profitable growth” we hear from other companies!]

We remain on track to deliver an adjusted operating margin run-rate of 3.5% during the course of FY 24 and 4.5% during the course of FY 25, in line with our ambition to deliver margins in excess of 5.0%.

Our expectations for FY 24 remain unchanged.”

Note that the higher margins it talks about are “run rate”, ie an improving trend, but the annual total will be lower.

On £1.2bn pa revenues, an operating margin of 5% in due course, maybe 2-3 years would imply operating profit of c.£60m, plus some interest income, hence maybe £6m, is £66m PBT, take off 25% corp tax, is £50m PAT, divided by 278m shares = 18.0 per share. Put that on a PER of 10, and I get to a valuation in several years time of 180p - nicely above the current price of 101p. Hence I see good further upside on this share, providing nothing goes wrong, and it is indeed able to achieve its target 5% margin. That may not be easy though, as presumably its contracts are won on competitive tenders, so if it keeps raising prices, the competition might undercut COST maybe?

Also as I always remind readers, in this low margin contracting sector, it’s only a matter of time before a contract goes wrong, with sometimes expensive cost over-runs, or remediation costs. Still, at least a 5% margin gives a better starting position for any future problems than the current 2.5%.

The share count is likely to fall, as a share buyback for £10m has just been announced, that’s about 3.6% of the existing shares.

Pension scheme - good news here -

“An assessment of the Scheme funding position was carried out on 31 March 2024 and, as the funding level (on a Technical Provisions basis) was more than 101%, contributions will stop from 1 July 2024 to 30 June 2025. These contributions would have amounted to £3.4m for the period if the Scheme funding level had been less than 101%.

In addition to contributions being stopped for a year, as the funding level is above 101%, "dividend parity" will be suspended for a year. Under the dividend parity arrangement, an additional matching contribution (the excess of the total dividend above the Scheme contribution) is paid to the Costain Pension Scheme when the total of the interim and final dividends (or other return of capital such as a buyback) is greater than the contributions paid into the Scheme in the previous Scheme financial year, which runs from 1 April to 31 March.”

Balance sheet - is excellent, as COST did a big equity raise during the pandemic. So it has surplus cash, which it is capable of returning to shareholders - hence the buyback, and also it means there’s substantial scope to increase divis, which are currently very stingy, for no apparent reason, at only 1.4% yield. I would work on the basis that divis are likely to substantially rise in the coming years, due to its strong, cash-rich balance sheet.

NAV is £230m. I’ll deduct £48m intangible assets and the £55m pension surplus, giving me NTAV of a nice healthy £127m.

H1 period end cash (and there’s no interest-bearing debt) was £166m.

I’d like all companies to disclose average daily cash. Although we can easily estimate it from the £3.5m H1 interest received on cash deposits shown in note 5. Annualise that to £7.0m, and I’ll estimate a 4% interest rate earned on cash, which implies average daily cash of c.£175m. That is very close to actual period end cash of £166m, so my reasonableness check suggests that the cash position is real, and not window-dressed to flatter the period end.

Cashflow statement - by the time you take into account lease costs and capex, there’s negligible remaining cash generated, only about £4m by my calculations, half of which was paid out in divis.

Paul’s opinion - I remain positive on Costain shares, and think there could be further upside if you’re patient and happy to wait a year or two.

I imagine broker forecasts are set low, and likely to be raised or beaten in 2025. Finances are very sound, with a really good, cash-rich balance sheet. Divis are mean, but with scope to be raised, and the share buyback of £10m announced today is equivalent to a one-off 3.6% dividend.

The downside risk is obvious sector risk of a contract going badly wrong, and being costly to remedy. I wouldn’t disregard that risk, no matter how good management are, these are large complex contracts and there will always be scope for human error either in the costings/bids, or execution.

Overall though I’m reassured by the numbers, and prospects, and remain positive, so it’s another GREEN from me!

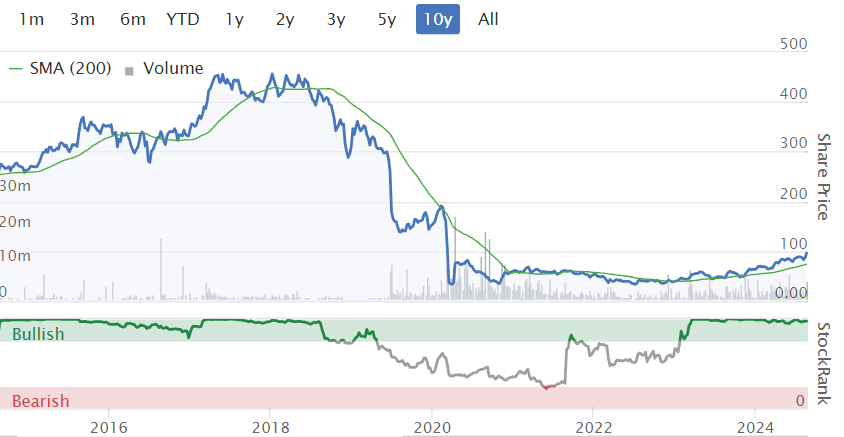

Excellent uptrend in the last year - and note the StockRank is jammed on maximum! -

Although zoom out to 10 years, and COST has destroyed a lot of shareholder value, and the share count has more than doubled in the last few years, so 200p would be the new 400p in market cap terms -

Graham’s Section:

Nexxen International (LON:NEXN)

Up 5% to 302.8p (£411m / $539m) - Q2 and H1 2024 Results - Graham - AMBER

NEW YORK, August 22, 2024 -- Nexxen International Ltd. (AIM/NASDAQ: NEXN) ("Nexxen" or the "Company"), a global, flexible advertising technology platform with deep expertise in data and advanced TV, announced today its financial results for the three and six months ended June 30, 2024.

This company was previously known as “Tremor” with the ticker code TRMR.

Paul took a dim view of the company in August 2023 and was unimpressed by the announcement of a new $50m buyback in May.

It’s not a company that I’ve ever been too interested in: it’s an Israeli online tech/advertising company (in the same category as XL Media, for example) and rightly or wrongly I tend to assume that these will end badly for investors. But that’s just my bias - let’s see what Nexxen has to say in these results.

The first financial highlight today for H1 is:

Record H1 Contribution ex-TAC of $152.8 million, up 4% year-over-year

What does this mean? You’re welcome:

Contribution ex-TAC for Nexxen is defined as gross profit plus depreciation and amortization attributable to cost of revenues and cost of revenues (exclusive of depreciation and amortization) minus the Performance media cost (“traffic acquisition costs” or “TAC”). Performance media cost represents the costs of purchases of impressions from publishers on a cost-per-thousand impression basis in our non-core Performance activities.

First off, I don’t like the attempt to avoid counting depreciation and amortisation. What is special about Nexxen that means investors should ignore these?

Secondly, this definition strikes me as overly complicated. Is there not a simpler way to present gross profits or value-added than this?

Let’s continue. Other key points:

H1 adjusted EBITDA $38.7m, up 29% year-on-year. No other measure of profitability is given in the highlights.

$20m of shares repurchased, and new $50m buyback launched, as I mentioned above.

$100m of long-term debt repaid.

Net cash is $152m as of June 2024.

CEO comment:

"In the second quarter we generated record Q2 Contribution ex-TAC, programmatic revenue and CTV [GN note: Connected TV] revenue while increasing Adjusted EBITDA by 27% year-over-year, benefitting from increased momentum post-rebrand, better sales execution, scaling CTV partnerships and improved market conditions…

Our platform's differentiated products are enabling customers to maximize reach, returns and efficiency, while also generating growing multi-solution partnership traction with industry leaders. We are confident in our positioning to accelerate growth and long-term market share gains and are pleased to reaffirm our full year guidance."

Guidance is unchanged for the full-year:

“Contribution ex-TAC” of $340-345m (last year: $332m)

Adj. EBITDA c. $100m (last year: $83.2m).

These numbers imply a much stronger H2 than H1, which Nexxen says is anticipated thanks to “enhanced sales execution and recently launched partnerships scaling”.

Financial statements

I’m curious to see what numbers pass the accounting rules.

Firstly on the balance sheet: tangible equity is $173m.

There is a cash balance of $152m and a trade receivables balance of $189m.

That seems like quite a large amount of receivables - it’s more revenues than the company generated in the last six months.

On the income statement, the company makes an operating loss in H1, although it’s close to breakeven.

In H1 last year, it made an operating loss of $23m, despite very positive EBITDA.

In H1 this year and last year, finance expenses were higher than finance income, despite the company’s enormous cash balance.

On the cash flow statement, there is an impressive $59m income generated from operating activities. This was boosted to the tune of $23m by working capital movements, and boosted by $6m from the use of share-based compensation for employees.

Overall, I think these statements confirm that there are strange aspects to this company’s financial performance.

Graham’s view

I’m tempted to leave Paul’s AMBER/RED stance unchanged here. I could maybe be tempted to go for AMBER, on the basis that the numbers aren’t too bad. But I don’t fully trust what I’m reading from the company - it’s all too complicated and the questionable aspects of performance (e.g. the fact that it made an operating loss, and a pre-tax loss) are entirely glossed over.

The shares have performed strongly over the past year, and they have a StockRank of 97.

Since the share count is declining with the help of a buyback, I’m going to take an AMBER stance on this one today, as I think the buyback could help to propel this to even greater heights. But my instincts are that this stock is not a safe place to invest.

Proton Motor Power Systems (LON:PPS)

1.45p (pre-market) - Financing Update - Graham - RED

I’m sorry for anyone holding this hydrogen fuel cell company overnight, as it emerges that this company’s principal lender is no longer going to pour money into it.

The principal lender is the second name on this list: a 29% shareholder who is the brother of the CEO.

The first name on this list is a company connected to the CEO that is also a major lender to PPS.

The two brothers therefore own or control over 80% of the company’s shares, are connected with the company’s debt financing, and one of them is the CEO.

Financial results have been poor:

The company has a StockRank of 3:

The most recent annual report was replete with going concern warnings. For example:

Due to the continued losses incurred by the Group and lack of operational cash inflows, material uncertainty exists which may cast significant doubt upon the Group and the Company’s ability to continue as a going concern. The Directors firmly believe however that the Group and Company remain a going concern on the grounds that both SFN Cleantech Investment Ltd and Falih Nahab have continued to support both entities throughout recent years, as well as funding having been agreed by SFN Cleantech Investment Ltd and Falih Nahab for at least the next 12 months.

Paul briefly covered the stock in February this year, giving it a RED and observing that it had an “utterly bonkers balance sheet” and that “existing equity looks worthless to me”.

That is the context for today’s news:

Proton Motor Power Systems plc (AIM: PPS), the designer, developer and producer of electric hybrid systems with a zero-carbon footprint, announces that it has received notification from the Company's principal lender (the "Lender"), stating that the Company's working capital requirements will only be supported until 31 December 2024.

Amounts drawn from the Company’s principal lender were €110.4m as of the end of July, plus accrued interest of €37.8m.

Without any more money coming from the brothers, the company will need to find alternative sources of finance:

The Directors have been in discussions with other potential sources of finance and, in light of this new development, will accelerate those discussions in order that the business can continue as a going concern. Further announcements will be made in due course.

Graham’s view

I do not see why any other lender would want to get involved here.

PPS had an interest expense last year on its existing loans of over £6m, nearly three times its revenues.

And even if the existing lenders agreed not to receive any interest, I’m not convinced that PPS would be able to service any new loans in a sustainable manner.

So it will not be easy for the existing equity to survive here, even in the short-term. Do they have any chance of any equity fundraise?

In the long-term, the stock appears to be worthless due to the overhang of existing debt.

I can only hope that anyone holding this one was fully aware of the risk, and is prepared for their investment to become a zero.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.