Good morning from Paul & Graham!

Here's the link for my latest discussion (recorded on Tuesday this week) with Paul Hill of Vox Markets - a highly accomplished small caps investor (far better performance than me!) who I always enjoy chatting to, about my latest small cap ideas, and wider investing themes too.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Macfarlane (LON:MACF)

106p (pre market open)

Market cap £168m

Macfarlane Group PLC has been listed on the Premium segment of the Main Market of the London Stock Exchange (LSE: MACF) since 1973 with over 70 years' experience in the UK packaging industry. Through its two divisions Macfarlane Group services a broad range of business customers, supplying them high quality protective packaging which help customers reduce supply chain costs, improve their operational efficiencies and enhance their brand presentation.

Results for FY 12/2022 are published promptly today, key numbers (continuing operations only, which excludes a disposal in 2021 (see note 6) -

Revenue up 10% to £290m

Profit before tax (PBT) up 7% to £19.9m

Diluted EPS 9.84p (2021: 8.62p) - up 14% (helped by a lower tax % charge in 2022)

Two acquisitions helped the 2022 numbers.

Inflationary pressures largely passed on to customers - only a slight drop in gross margin from 32.4% in 2021, to 32.1% in 2022 - I’m impressed by this, as it shows a resilient business in tough conditions.

The smaller manufacturing division is the star performer, with operating profit rising from £3.7m in 2021, to £5.2m in 2022.

The larger distribution division saw operating profit almost flat at £19.9m (2021: £19.7m).

Net bank debt is insignificant at £3.4m, and plenty of headroom within a £30m facility limit.

Pension scheme is showing a £10.2m accounting surplus, so this needs careful scrutiny. Deficit repair payments are set at £1.3m pa until May 2024. So in the real world, it’s still a deficit, although it’s only consuming a small % of profits. See note 11 for more details on pensions.

Dividends - total 3.42p, a yield of 3.2%

Amortisation - this is an important point, in that MACF does not present adjusted profit numbers, instead it absorbs a £3.6m amortisation charge (see note 2), which looks as if it relates to acquisitions (goodwill and similar). It is customary to adjust this out, which would boost reported PBT from £19.9m to £23.5m, a substantial increase of 18%. If I apply a similar % increase to EPS, then the adj EPS figure would go from 9.84p to 11.6p, and it’s the higher figure which I would use to value the shares. Apply a PER of say 12-15 (not demanding), and I get a valuation range for this share of 139p-174p. Hence it looks very cheap at the current price of c.108p. I don’t understand why the market puts this share on such a low rating, when it’s a good quality business, performing well.

Shore Capital has issued an update note today (many thanks) and it arrives at adj EPS of 12.1p, and says this is a 4% beat against forecast, so ahead of expectations.

It looks as if Shore’s figures include leases as debt, which is unusual, as most people strip those out. I regard the company as roughly cash/debt neutral.

Outlook -

We anticipate that 2023 will be another challenging year with uncertainty over the impact of the increase in the cost of living on customer demand, rising operating costs, particularly related to labour and energy, and increasing interest costs. Despite these challenges, with the effectiveness of our strategy, the resilience of our business model and the experience and commitment of our people, we expect Macfarlane Group to continue to deliver further growth in 2023.

Balance sheet - looks fine to me. NAV is £106.0m. Take off intangible assets of £75.7m, results in NTAV of £30.3m. Lease entries roughly net off to zero, so we can ignore those. Working capital is adequate, but not strong - the current ratio being 1.22, although that goes up to 1.34 if I remove the current lease liabilities figure of £6.6m. There’s no non-current interest-bearing debt.

So overall, it’s an OK balance sheet, but I wouldn’t describe it as particularly strong.

My opinion - is there something I’ve missed here? I cannot understand why this share is so cheap. It’s a good company, performing well, with negligible net bank debt, and only a small pension scheme actuarial deficit, that’s just beaten market expectations, and yet it’s valued on a PER of only 9 - that doesn’t make sense to me at all.

Therefore I remain strongly positive on this share, and repeat my previous conclusion that this share appears inexplicably cheap. I could be wrong, but it seems to me there’s a significant undervaluation here, which gives investors an opportunity to make a perhaps 20-50% profit, sitting on a plate, if/when the share re-rates to a more appropriate valuation. You might have to be patient though. Sometimes cheap shares remain cheap.

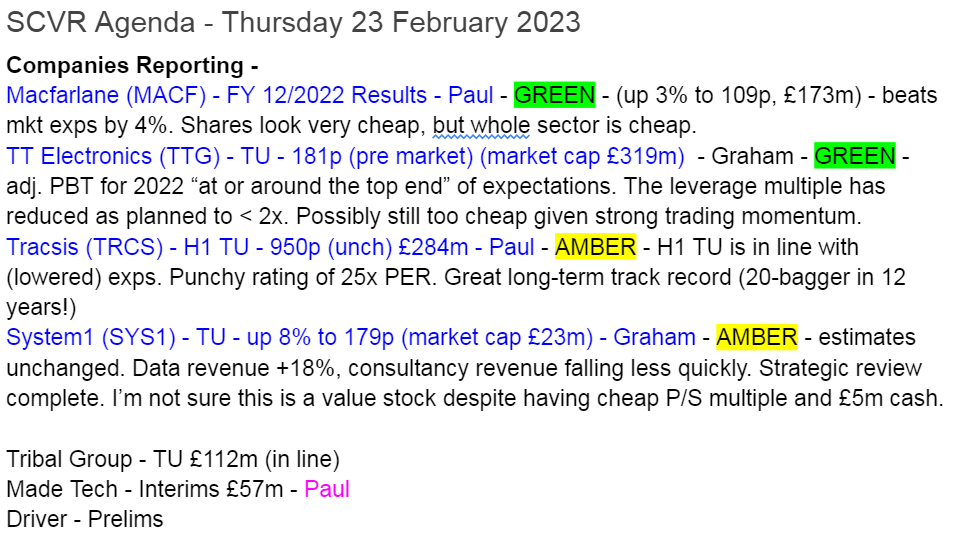

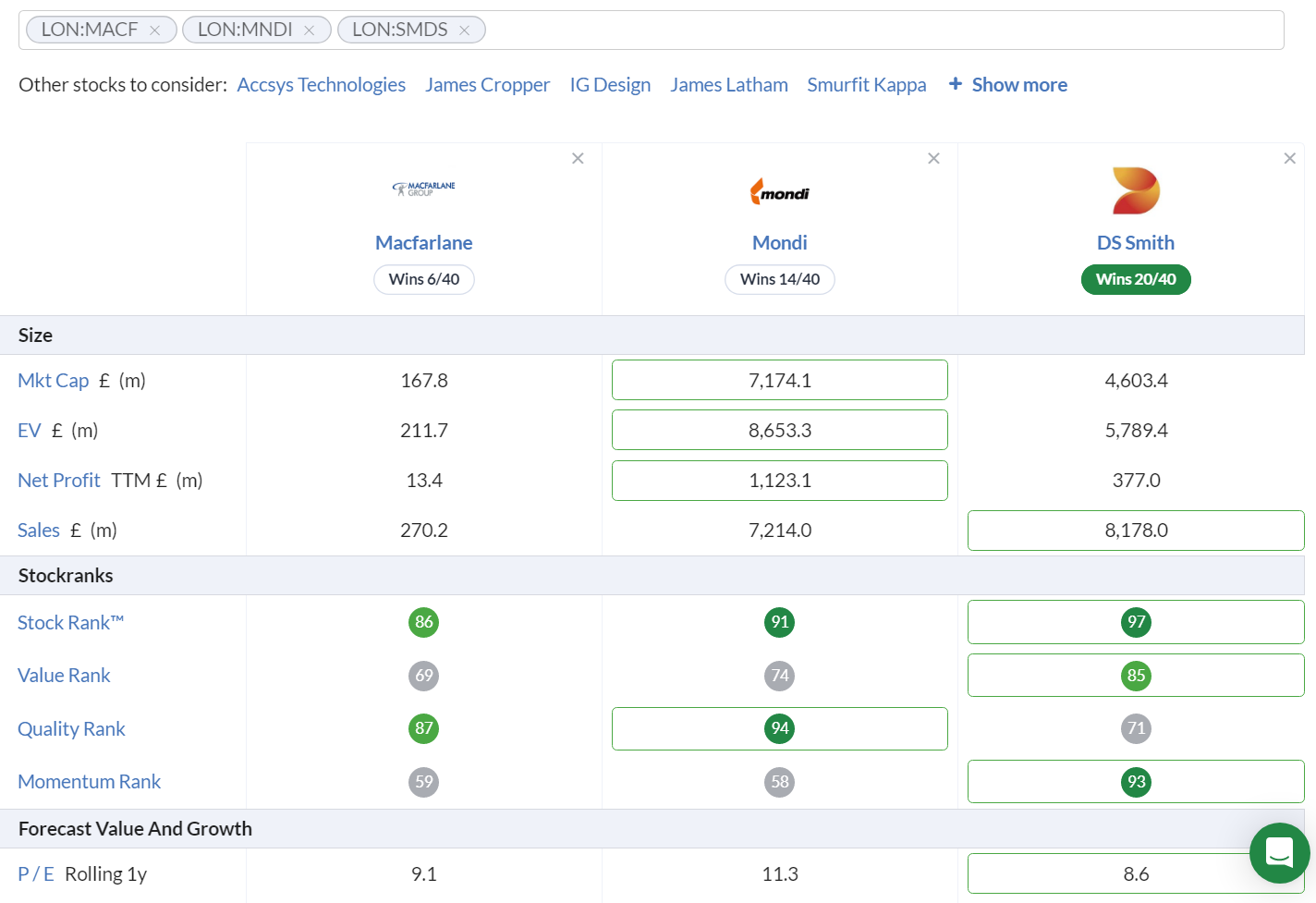

At this price, I’d say MACF looks a sitting duck for a takeover bid from a larger competitor. There again, Mondi (LON:MNDI) is only rated on a fwd PER of 11.3, and DS Smith (LON:SMDS) a fwd PER of only 8.6, so it looks as if this is just a cheap sector. Maybe MACF isn’t out of line with those valuations after all?

Stockopedia likes all 3 of these, with sector StockRanks currently:

Macfarlane: 86

Mondi: 91

DS Smith: 97

I like the sector comparison tool on Stockopedia, to give a quick & rough idea about where to prioritise sector research, and it likes DS Smith best, screenshot (with clickable link) here -

.

Tracsis (LON:TRCS)

950p (unchanged at 09:18)

Market cap £284m

Tracsis, a leading provider of software, hardware, data analytics/GIS and services for the rail, traffic data and wider transport industries, is pleased to provide the following trading update for the six months ended 31 January 2023.

H1 has traded in line with expectations.

Expectations for FY 7/2023 remain unchanged (but not stated what these are!)

Strong revenue growth in H1 (£39m+, up c.34%)

H1 EBITDA expected to be up >20% on last year’s £6.2m, so c.£7.4m

Finncap’s forecasts suggest FY 7/2023 adj EBITDA £16.0m, and adj PBT £14.2m, adj EPS of 37.3p (giving a PER of 25.5x)

Commentary today refers to - “Growing pipeline of opportunities”, restructuring done, accelerating technology investment.

Cash is c.£17m - considering further acquisitions.

Balance sheet - I always like to check, and TRCS last reported NAV of £60.4m at 7/2022. Take off £65.9m intangibles, and the (probably related) £10.7m deferred tax liability, and I get to adj NTAV of only £5.2m. So it’s a fairly thin balance sheet. The cash comes from customers paying up-front, rather than being surplus cash. That's usually the case with software businesses, so nothing untoward.

Note that there’s £8.6m of contingent consideration payable in the current financial year - worth noting that this is about half the cash pile spoken for (assuming this is payable in cash, and not shares). Although there should be fresh cash generation to rebuild cash this year, so it’s not a problem, but should be taken into account.

My opinion - Tracsis has an excellent long-term growth track record, and that’s reflected in a punchy rating of 25.5x this year’s forecast EPS. Note also that forecasts were lowered a few months ago, which is not something I would expect to see at a high PER share -

For me personally, I’d be more comfortable with a valuation nearer 500-600p per share, so the current price of 950p seems much too racy. That said, the company’s long-term track record is fantastic, and shares have 20-bagged over the last 12 years, so quibbling over valuation can sometimes be short-sighted!

Graham’s Section:

TT electronics (LON:TTG)

Share price: 181p (pre-market)

Market cap: £319m

This electronics supplier treats its shareholders to another positive update today.

I still think it became noticeably undervalued during the depths of the small-cap bear market (see my comments in the archives). There has been a nice recovery since November:

Today’s update for FY December 2022 is ahead of expectations:

Group revenue growth in the final two months of the year continued to be strong, with organic growth for the year of 20% reflecting our successful positioning in structural growth markets and new project and customer wins.

Adjusted profit before tax for the year is expected to be at or around the top end of the range of analyst consensus expectations with the outperformance driven by our Global Manufacturing Solutions (GMS) business.

Analyst consensus expectations are for adjusted PBT of £36.5m to £39.4m.

Net debt - one of the reasonable concerns about this stock has been its debt load.

Last June, due to higher inventories and other factors which strained cash flow, net debt had increased to £142m (including IFRS 16 rents of £23m).

This resulted in a leverage multiple (net debt / EBITDA) of 2.4x.

Today’s update informs us that the leverage multiple has fallen back within the target range of 1x - 2x, as planned. So investors can breathe slightly easier.

Remember also that TTG offloaded its defined benefit pension scheme recently, which will have a £6m annual cash flow benefit.

We’ll have to wait longer to get a full outlook statement from the company. This is what the company says about 2023 for now:

We enter 2023 with good momentum, underpinned by a strong order book and will provide a full update with our Annual Results presentation on 8 March.

My view

In hindsight, I do think the “easy money” was made on the bounce from November levels until now. But I still like this company; it has a solid long-term record, is well-diversified internationally, and has managers who try to generate an acceptable ROIC for their investors (although it’s questionable whether or not they actually do this - see the quality metrics on the StockReport).

Given a valuation that is still, I think, on the cheap end of the spectrum, and the strong trading momentum, I’ll maintain my positive view on this one.

System1 (LON:SYS1)

Share price: 179p (+8%)

Market cap: £23m

It’s a Q3 update from this marketing company, covering October-December 2022.

Key points:

Data revenue +18% to £3.4m (quarter-on-quarter)

Consultancy revenue minus 21%, falling less quickly than before.

Total Q3 revenue minus 4% to £6.2m

As a reminder, this company has been shifting away from labour-intensive consultancy work to more automated data-driven products. Data revenue now makes up the majority of the total.

The year-to-date gross margin is 82.7%, but this doesn’t necessarily mean that we get a positive bottom line. There were no profits in this year’s interim results.

Cash continues to fall and is now just £5.1m. This is “partly” due to a working capital increase, but I wonder if financial losses may also play a role.

Capital Markets Day - next Tuesday on Investor Meet Company.

Estimates: Canaccord Genuity leave their estimates unchanged. They expect an adjusted PBT of £0.1m for the current financial year, and £0.8m for FY March 2024.

My view

In my previous comments on this company, I wrote that there was too much uncertainty hanging over its shares, while management carried out a strategic review.

That review is now complete, and I’m enthused by the results. The review “validated our existing successful focus” on testing/improving services for ads.

Looking forward, the company will “target the world’s largest advertisers”, will seek to grow US revenues, and be a “Rule of 40” company, i.e. revenue growth and adj. EBITDA margin should add up to more than 40%.

There’s lots more to digest in the review, but I think it’s good news that the company has settled on a continuation of its existing strategy, along with some new goals and points of emphasis.

The founder, who is also the largest shareholder, has moved from CEO to President, and the COO has been promoted to CEO. A logical succession plan.

So I can be more positive about this company than I was last time. But can I take an outright positive stance? I’m not sure.

It has been half a decade since the company earned profits of more than £2m:

Since this is a “value” report, I think I’ll have to stick to a neutral stance, since I don’t think outsiders can say with any degree of confidence that System1’s new strategy is going to succeed.

If I wanted to make a value argument for these shares, I could point to the price/sales multiple of less than 1x, and the cash balance of £5m. It’s possible that the shares are underpriced when you take those two facts into consideration, but I’ll stay neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.