Good morning! It's Paul here with the SCVR for Thursday.

See the header above for the company updates that look interesting this morning. There might be room for more, depending on how I get on.

.

Cloudcall (LON:CALL)

(I'm long)

I really enjoyed the investor presentation yesterday afternoon - apparently the video isn't quite ready. I'll add the correct link here when it's ready. It's well worth watching if you're interested in the company, or not entirely sure what they do (which seems to be the case with a lot of people who comment on the company!).

What I particularly liked is that 4 Directors/senior staff spoke. Usually investor presentations are just the CEO & CFO. In this case, the CEO effectively interviewed his own team, including CFO, CMO & CRO. I asked what CRO means, and how it differs from a Sales Director, just to make the point that investors may not all be familiar with these abbreviations. All speakers struck me as straight-talking, which made the presentation useful, as opposed to just PR fluff.

Key points which I put an asterisk next to, in my notes;

- "Huge, painful, and rapid" drop-off in business due to covid, but recovering strongly now - the way they talked about this gave me more confidence, as it's clearly a one-off. Also, the company and its clients are better prepared, should a second wave hit.

- CRO indicated that his goal is to "triple or quadruple" sales, to a run rate of £50m p.a., and that he's done this before, at a startup that was subsequently sold.

- Product demos are key. CloudCall has a conversion rate of 43% from demo to sales. "Incredibly high". Therefore focus is on generating more sales leads & product demos, very simple! (Cleaver: "we need more sales, and quickly", CRO: "I hear you!")

- Shareholder register is now 40% American investors. Not intending to move listing to USA (where valuations on tech cos are so much higher), but "Never say never"

- Microsoft Teams integration (beta launch in August) is very important

- Interesting product developments in pipeline - e.g. "we have 10 billion minutes of client data". If we could use AI and machine learning to interpret that data, and provide new services for clients (e.g. instant transcripts, measuring tone & sentiment of calls, etc.), this could open up new revenue streams

- Cash burn remains high

There was lots more information, but those were for me the stand-out points.

My overall impression was very good. I think, with patience, this could be a good investment.

EDIT - I've just remembered another key point. CALL showed a chart between the UK (where revenues crashed in April, then began recovering), and USA (where revenues dipped much less). This was blamed on the UK's furlough policy - i.e. paying people to stay at home doing nothing. Whereas in the USA people continued working from home. More evidence that our furlough scheme looks to have been a serious mistake, and did unnecessary damage to businesses, in some cases anyway. Let's hope, if there is a second wave, that businesses are encouraged to keep people working (from home), and not made idle again. Or furlough could be reserved for specific sectors such as retail & hospitality only, where staff have to be physically present in order to work. All interesting to ponder anyway, and write to our MPs about these things, in the hope that it might influence future Govt policy. End of edit.

Another edit: there was some confusion over what LTV/CAC is (a key metric). I've asked the company to clarify, and they've just responded to say the correct figure is 7, and not 10 as a reader thought. End of another edit.

.

Gear4Music (G4M)

Share price: 490p (up 21%, at 08:07)

No. shares: 20.95m

Market cap: £102.7m

(I do not currently hold this share)

Am kicking myself for taking profits on this share recently, as it's put out a lovely trading update today.

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces an update due to strong trading in the first quarter of the current year which is now expected to be ahead of the Board's expectations.

This is Q1, since the year end is 31 March 2021. Clearly there will have been a strong boost from lockdown, but even so these figure below are very impressive. Particularly as the company's strategy has been to focus more on growing the gross margin, as opposed to chasing sales growth. Hence there should be a double benefit to the P&L, from much higher sales, combined with a higher gross margin. All very impressive.

.

.

The CEO Andy Wass sums things up nicely, and this all sound positive;

"As previously reported, the COVID-19 lockdown created an exceptionally strong period of trading for the Group during April and May 2020, and further strong trading in June resulted in Q1 revenue growth of 68% compared with the same period last year.

The strong trading momentum has continued into July, and we continue to achieve higher gross margins and with a lower marketing cost than we would typically expect, alongside a controlled cost base.

As a result, and whilst still early in the current financial year, the Board is confident that a significant improvement in profits will be achieved for the full financial year, which are now expected to be meaningfully ahead of our previous expectations."

.

Valuation/forecasts - N+1 Singer previously (June) forecast 20.4p EPS for FY 03/2021. I can't find any update yet from them today, so have worked out the figures myself below. Equity Development has put out an update, but it only refers to EBITDA, which is largely useless because that excludes depreciation & amortisation (none of which is related to acquisitions, it's all capitalised development spend). Also, since IFRS 16 was introduced, finance costs now contain part of property rents, hence cannot just be ignored. Along with ignoring proper finance costs, and tax, all of which are cash costs. So how does EBITDA make any sense at all? It doesn't here, that's for sure.

Anyway, EBITDA forecast from ED is upped from £10.3m to £11.3m. I'll now adjust that to real world earnings, as follows;

EBITDA: £11.3m

Depreciation & amort: £(4.0m)

Finance exps: £(1.0m)

Profit before tax: £6.3m

Tax at 19%: £(1.2m)

Earnings: £5.1m, divided by 20.95m shares = 24.4p EPS

[NB. the above are my estimates, so may differ from broker forecasts]

At today's increased share price of 490p, the PER is currently about 20 - which doesn't look demanding at all, given the superb growth occurring.

My opinion - this company is performing brilliantly, and remember all the growth is organic too. The PER is now about 20, which still looks cheap for this rate of growth.

The only question is whether the growth might slow, or even reverse a bit, once we get into 2021, and (hopefully) lockdown is a thing of the past?

I'm absolutely kicking myself for selling my shares recently, which was clearly a mistake. I'll aim to buy back in, if the share price falls back once the excitement of today's positive trading recedes. Well done to holders, G4M is clearly on a roll. It's a very nice, well managed business, and still reasonably priced too.

.

Dotdigital (LON:DOTD)

Share price: 115.75p (up 4%, at 09:17)

No. shares: 297.9m

Market cap: £344.8m

dotdigital Group plc (AIM: DOTD), the leading 'SaaS' provider of an omnichannel marketing automation and customer engagement platform, is pleased to provide the following trading update ahead of the publication of its full year results for the year ended 30 June 2020 in November. The trading performance in this statement is based on unaudited management accounts.

(that leaves wiggle room for any audit adjustments)

I'd need to see the full year figures in November (ridiculously late), to get my head around what's going on here. As is often the case, cherry-picked numbers in a trading update don't give the full picture. In particular this is confusing;

Adjusted EBITDA1 from continuing operations is expected to be comfortably ahead of market expectations; | |

Adjusted operating profit2 from continuing operations is expected to be in line with market expectations; |

.

We have to remember that operating profit is not a relevant number any more, post IFRS 16. As mentioned above, some of the rental costs have now shifted (wrongly in my view) into finance costs, as a non-existent interest cost. Therefore quoting operating profit is wrong, because it ignores some of the rent costs. The figures we need are adjusted (if reasonable adjustments) EPS. That's the only measure which takes into account all costs, and strips out spurious (e.g. goodwill amortisation) and one-off/exceptional costs/income, to arrive at the most meaningful number. It's also the key number we need for valuation purposes. Yet many trading updates seem to withhold this key information, and just cherry pick whatever numbers they feel like showing us to mislead us into buying the shares! I do wish we had a standard format for trading updates, and not let the PRs get anywhere near the announcements. But we can draw our own conclusions about management, if they consistently put out misleading updates. Anyway. that's a general moan, not specific to DOTD.

Covid - DOTD says it had "minimal impact" in Q4 (Apr-Jun), which is encouraging. Whereas we saw yesterday that another high recurring revenues business Cloudcall (LON:CALL) saw a very big drop-off in revenues. It sounds as if not all recurring revenues are as recurring as they're supposed to be, so DOTD emerges here with credit.

Sorry for the delay, I'm getting a bit bogged down in this one, and can't decide if it's good or not. N+1 Singer to the rescue as its renowned tech analyst Kevin Ashton has published a brief update today (available on Research Tree) which nicely sums up the key points. He knows far more about the company than I do, so I'll just report the facts, and not give a personal view on it.

Forecast - consensus is for 4.0p adj EPS for FY 06/2020. That's a PER of 28.9 - normally I would consider that expensive, but bear in mind we're in a raging bull market for tech stocks, and DOTD has a nice cash pile, so it's far from outrageous in the current market.

Outlook -

We enter the new financial year with encouraging sales momentum, a robust pipeline, a strong balance sheet, a high proportion of recurring revenues and strong cash generation. Therefore it is our intention to invest as we look into 2021, to secure new business and grow revenue over future years.

"Invest" of course being used in the way popularised by Gordon Brown, as a cloak for spending more!

I'd be interested to find out what the key LTV/CAC (lifetime customer value, divided by cost of customer acquisition) is? Does anyone reading this know what that figure is?

Growth rate - this is my main concern with DOTD. Surely the growth rate should be booming in current conditions, and with the ongoing positive structural move towards online? Yet DOTD seems to be growing from milking existing customers, rather tan recruiting new customers. It says organic revenue growth is 12%, but also says ARPC is up 12%. This suggests that new customer wins are only replacing churn from exiting customers.

I'm therefore a bit concerned this company is looking ex-growth, in a booming sector.

Cash pile - very healthy, at £25.4m, which provides scope for ongoing payment of divis, and maybe an acquisition or two, to get the growth rate up?

My opinion - neutral, due to lacklustre growth. I can see the potential from Shopify & Magento integrations, but these seem modest so far.

I'll keep an eye on it, but would only be interested in buying if the growth rate significantly accelerates.

.

Simplybiz (LON:SBIZ)

Share price: 151p (up 1%, at 12:57)

No. shares: 96.8m

Market cap: £146.2m

SimplyBiz (AIM: SBIZ), a leading independent provider of compliance, technology and business services to financial advisers and financial institutions in the UK, today issues a pre-close trading update for the six months ended 30 June 2020.

Here are the highlights they give us. It keeps saying "strong", but it's down on last year. I thought this type of subscription business should not be affected by lockdown?

.

.

The last point above is the most useful one - other companies please take note. Just tell us what you're expecting full year EPS to be, or if unsure then give a range of possible outcomes. So bravo to SBIZ for its clarity. At least I don't have to waste load of time trying to unpick reality from a load of cherry-picked statements and numbers, as so often happens with trading updates. Maybe I should introduce a scorecard system for trading updates, and put them in a league table from good to bad? Probably too much additional work, but it would be good to help steer things rather than tearing my hair out trying to interpret the variable quality output of the City,

That 11.0p estimate for FY 12/2020 makes things very easy. It's down from 13.0p last year, despite acquisition(s). Given the weak balance sheet, personally I wouldn't want to put it on a PER much above say 12. Therefore for me, the price should be about 132p for me to feel comfortable, and consider buying some. At 151p the current share price is not far away from my valuation.

Another way of looking at it, is to say that earnings might recover to say 13-15p next year, providing covid doesn't return with a vengeance. Even if it does, the mostly recurring revenues should be pretty robust, with IFAs working from home.

Balance sheet - I'm not keen at all - it borrowed too much, to fund acquisitions, in my view. But net debt is down, as you can see from the highlights.

My opinion - neutral. The weak balance sheet puts me off, but the lower share price makes it potentially interesting as a recovery stock.

.

Getbusy (LON:GETB)

Share price: 89p (up 9% today)

No. shares: 48.9m

Market cap: £43.5m

To get up to speed, I've re-read my notes here from 3 Mar 2020, favourably reviewing GETB's 2019 results.

My notes from the reassuring trading update on 5 May 2020 are here.

Half Year Report- out today;

GetBusy plc (AIM: GETB), a leading developer of document management and productivity software products, announces its unaudited results for the six months ended 30 June 2020 (the "Period", "H1" or "H1 2020").

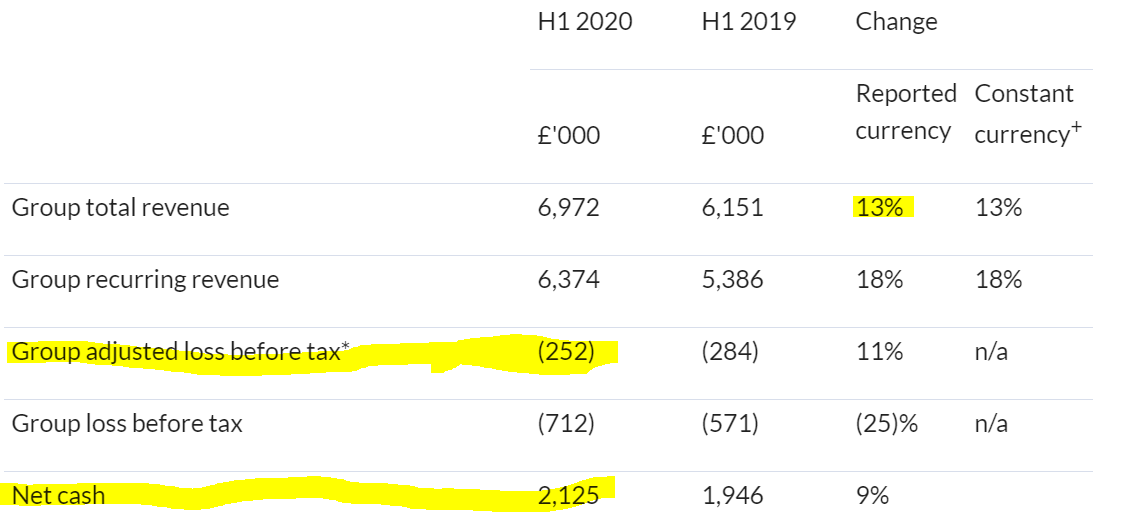

Considering that this includes the worst of the covid lockdown, these numbers look quite good to me. It reinforces the fact that recurring revenues, and work from home, have protected GETB from the covid impact, a very good thing;

.

It's running at a modest loss, which is not a particular concern, as the core business is nicely profitable, and subsidises the losses of the smaller, growth initiatives.

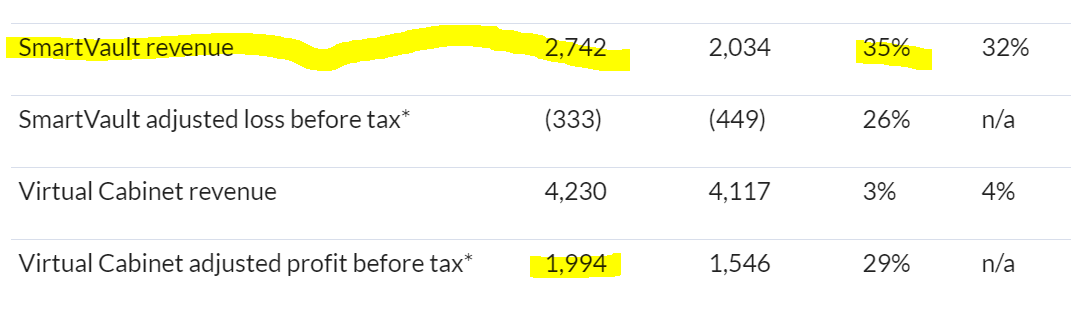

Looking at the divisional split, the core business has delivered increased profits, on a modest 3% rise in sales. The smaller division is growing nicely, so looks more interesting than before.

.

Note the extremely high 47% profit margin of Virtual Cabinet.

I've skimmed through the accounts, and here are my notes;

R&D tax refunds of £1.5m booked (4 years worth) - of which £682k cash received in the period, which covered more than the whole £547k cashflow used in operations.

Balance sheet is weak, with negative NAV of £(1.88m), less £565k intangibles, gives NTAV negative £(2.44m). Is that a deal-breaker? No, because customers generally pay up-front, i.e. the business is funded by deferred income. There is a risk that customers asking for monthly, in stead of annual fees, could squeeze GETB's cashflow. Note that deferred income fell by £429k in H1, probably for this reason. Therefore I feel that the balance sheet would benefit from another equity fundraise of say £4-5m, which would only be 10% dilution, so management should bite the bullet and get this done whilst the share price is high. My consultancy invoice is in the post!

Share options charge of £370k seems a bit steep relative to the other P&L figures, for a half year.

My opinion - as before, I like it. The recent rise in share price looks justified, and this is very much a topical share, which should benefit from the work from home (WFH) trends. Newer products look interesting, with SmartVault growing decently. GetBusy, the third division is not doing much at this stage.

Personally I don't want to chase up the share price any more, having missed my chance to buy at a keen price earlier this year.

.

.

Cohort (LON:CHRT)

Share price: 591p (up 3.5% today)

No. shares: 40.96m

Market cap: £242.1m

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.