Good morning,

I didn't get round to commenting on Marks and Spencer (LON:MKS) results yesterday, which a reader asked me to do. I haven't looked at MKS properly for a long time, so thought it would be interesting. So here goes, this is what I wrote last night;

Marks and Spencer (LON:MKS)

Share price: 307p (up 5.2% yesterday, on results day)

No. shares: 1,624.8m

Market cap: £4,988m

Results for 52 weeks ended 31 Mar 2018

It would take too long to comment on everything, so here are just some interesting points that I jotted down whilst reading the results.

- Revenue up slightly, 0.7%, to £10,622m

- Adjusted profit remarkably resilient, at £580.9m - down only 5.4% in a market where much of the competition is seriously struggling.

- Adjusted free cashflow is a stand out item, at £582.4m - remember this is after capex, so MKS remains a highly cash generative business.

- Huge adjustments though, covering various reorganisational costs, totalling £514.1m - so how you view these results depends on whether you accept the adjustments or not.

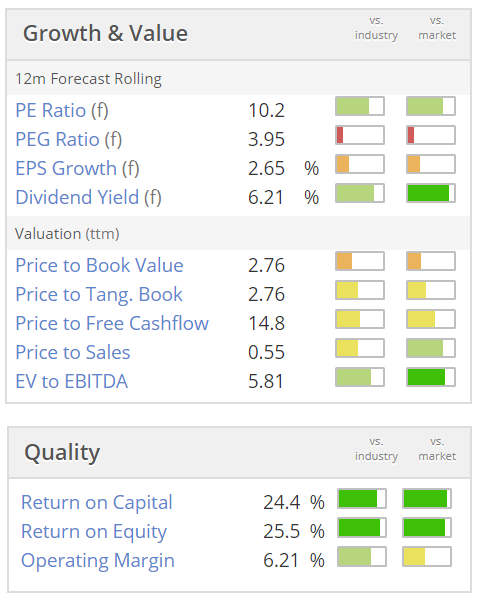

- Adjusted EPS of 27.8p = PER of 11.0

- Net debt is £1.83bn - large, but I think MKS has a substantial freehold property portfolio. I would normally disregard debt that relates to freehold properties

Property - the 2017 Annual Report shows "land & buildings" with a book value of £2,588m at 1 Apr 2017. The word "freehold" is not mentioned anywhere in the Annual Report. I've googled it, and this article from 2013 suggests that 65% of MKS's retail space was freehold. If anyone has more information on what MKS's freehold properties might be worth, then please post it in the comments below.

MKS seems to be permanently reorganising, but the narrative with yesterday's results sounds impressive for its directness - admitting that many things are wrong with the business, but can be fixed.

International profit has more than doubled to £135.2m, due to exiting from loss-making sites/countries, and forex benefits. That's an impressive improvement. I wonder what profit growth might be possible from overseas expansion?

Store closures - this is being accelerated, and will result in 25% of the "legacy" clothing and home space being closed. Whilst brutal, this should considerably boost future profits, I imagine. It also means there will be less competition in many towns for mid-market rivals such as Next (LON:NXT) (my largest long position currently). Store closures will also free up working capital, so cashflow positive. A very interesting comment is made re closures;

We have been encouraged by the proportion of sales transferred to nearby stores from those which have closed.

That is very important. It means that a store closure not only eliminates the losses from the problem store, but it also boosts the profits of its neighbouring MKS store(s). Don't underestimate how positive that will be for profits. I remember in the 1990s, my former employer had 3 shops in Oxford. All of them were loss-making. When our CEO finally disposed of the 2 surplus stores, the 1 remaining store was a goldmine, as many of the customers from the other 2 shops started using the 1 remaining local shop.

Therefore, I think that MKS's store closure programme could significantly boost its profits. Unfortunately though, I think it could also hollow out many town centres, where the presence of an MKS store is a big draw for older, affluent shoppers, who may simply stop going into town altogether, and order online instead?

Dividend - held at 18.7p per share, with a statement saying this will be maintained. More importantly, the cashflows are perfectly adequate to fund this level of payout - a sustainable (I think) 6.1% yield - not bad!

Cost-cutting - MKS has long been seen as a bloated, inefficient company. That is more-or-less confirmed by the refreshingly self-critical commentary alongside these results. The interesting angle on this, is that stripping out excess costs means that MKS should be able to absorb the well known other rising costs affecting all retailers, mainly labour-related. So this is a good reason to believe MKS might be more resilient than most, as it becomes more efficient through the current reorganisation.

Price reductions - don't you just hate the buzz phrase "price investment"! Why not just call it what it is, price cuts. It's not an investment at all. MKS uses an even more elaborate phrase to tell us that it will be reducing some food prices;

Our repositioning will require renewed investment in trusted value. We believe however that this will be offset by cost reduction, volume optimisation opportunities, removing excessive packaging costs, and tackling issues which impact availability and waste.

I like the other stuff, about finding cost savings. This newish management does seem to be on the ball, or getting that way anyway.

Note also that wage cost increases & other inflation-related costs, were "largely offset" by a reduction in the large marketing budget, and through in-store efficiencies. This reinforces my earlier point that MKS is a bloated, inefficient company, but that's a good thing because it means there's an opportunity to make it much better, and hence more profitable. Or at least there's plenty of fat to be cut out, to absorb future cost increases, e.g.

Central costs increased in a number of areas including IT and the introduction of the Government's apprentice levy, however these were offset by reduced costs following the head office restructuring and lower incentive costs year on year.

Cashflow - this was a real eye-opener for me. Due to the huge depreciation charge (on previous years' capex), EBITDA works out at: Adjusted operating profit £670.6m + depreciation & amortisation £580.6 = Adjusted EBITDA £1,251.2m. Wow! The public perception of MKS as an almost failing business, seems to be wildly too pessimistic compared with its figures showing that it's actually still a real cash cow.

Pension fund - is ginormous! It has an IAS surplus of £948.2m. Yet the cashflow statement shows £41.4m was paid into it by the company. So there must be an actuarial deficit.

Scheme assets are £9,989.3m! Scheme liabilities are £9.029.6m, in the accounts. That's some pension scheme.

My opinion - before I looked at these numbers, I just assumed that MKS was a basket case, probably heading towards eventual failure. The figures & narrative paint a very much more positive picture.

Store closures (of loss-making sites) could increase profits considerably over the coming years. New management seem focused on delivering a serious reorganisation of the company. I'm amazed that MKS doesn't seem to do a proper Ecommerce food offering. All I could find was party food that you had to pre-order about 5 days early. How ridiculous! Why doesn't it do a proper groceries delivery service?

Most people seem to agree that MKS clothing is lamentable these days. So that's another potential area for improvement.

With all these problems, that MKS is still generating EBITDA of £1.25bn, says to me that there is a cracking business here, which is partially obscured by all its well-known problems.

I can scarcely believe myself saying this, but based on my review of these figures, I'm minded to go long of MKS shares - for the divis, and the recovery potential, plus the highly cash generative nature of the existing business.

Short covering? Here is the FCA latest list of disclosed short positions in MKS. It adds up to 12% of the whole company.

I reckon those shorters could well have got it wrong, and could become forced buyers, if they come to the same conclusion. That could create a very interesting short squeeze, and take the share price up considerably, as those shorts try to buy back 12% of the company. Just look at the short squeeze which happened at Ocado (LON:OCDO) recently.

I think MKS could have maybe 20-30% upside on it from the current price of 307p. The very generous divis, which are comfortably covered by cashflow, is also likely to attract buyers I think.

As usual please do your own research. I'd particularly like to hear from anyone who disagrees with me, and views MKS negatively, and your reasons why.

EDIT: I opened a long position on MKS the following day, after writing the above.

Even though larger caps are outside the remit of this report, people seemed to like the above section on MKS, judging by the number of likes (46 at the time of writing this). I'm pleased that people found it interesting.

On to today's smaller caps.

Shoe Zone (LON:SHOE)

Share price: 170.5p (down 0.9% today)

No. shares: 50.0m

Market cap: £85.3m

Shoe Zone plc ("Shoe Zone", the "Company" or the "Group") the leading UK value footwear retailer, is pleased to announce its Interim Results for the six months to 31 March 2018.

Interims for this company are only of passing interest, as it makes the overwhelming bulk of its profits in H2. So all I would really be looking for in the interims, is for profit to have gone up a little, or be about the same, combined with an acceptable outlook statement.

Revenue up 1.1% to £73.7m in H1

Gross margins are still good, at 60.6%, but down from 62.8% LY

Slight increase in the interim divi at 3.5p (LY H1: 3.4p)

Profit before tax rose from £309k in H1 LY, to £955k in H1 TY. The key driver seems to be a large fall in administration costs, from £7.1m to £6.1m. It's not clear from the narrative how they achieved such a large reduction.

Rent static at 12% of turnover - not particularly good, but OK when combined with the high gross margin

Very important point - SHOE has a flexible leasehold property portfolio - average lease remaining only 2.2 years.

Rent reductions averaging 22% on renewals.

It's done a sale & leaseback on 5 freeholds for £1.2m net - they must have been very small properties! There are 14 remaining freeholds with a book value of £7.8m - so a nice little hidden asset there. I love freehold property - it greatly improves risk/reward for investors, and is often overlooked.

Balance sheet - absolutely fine. This includes £5.9m in net cash.

Note that there is a £6.0m pension deficit (down from £7.9m a year earlier). This is not big enough to be a deal-breaker, in my view.

Cashflow statement - fine, and very consistent with last year.

Outlook - the key bit of this section sounds fine;

Trading in the first half of the year was in line with management's expectations and this has continued into the second half.

We believe that the current growth strategy including management of the cost base and particularly the property portfolio means that we are confident that Shoe Zone is insulated against many of the structural issues faced by other retailers.

That's a key point, and it's what makes this share quite attractive, in my view.

A lot of people do like to try on shoes, for comfort & fit. So internet penetration may not be quite as severe in this sub-sector as elsewhere, perhaps?

Valuation - looks about right to me;

My opinion - I like this business, and it should be able to survive and prosper in the High Street because of its flexible leases, and low capex.

The main reason to buy this share is for the big dividend yield. But personally I can't see the point in buying a small, illiquid share for a 6% sustainable yield, when you can get the same from Next (LON:NXT) (including buybacks) and Marks and Spencer (LON:MKS) (as reported on above) - I hold long positions in both NXT and MKS.

The key advantage of holding the larger caps, is that you can buy or sell, in any size, whenever you want. So if something awful happens, and the markets plunge, you would be unable to unwind a medium size, let alone a large position in SHOE, and would have no choice but to take the losses. Whereas with NXT or MKS, you can sell any size instantly. That makes a big difference to risk:reward, if you have anything other than a small portfolio.

Headlam (LON:HEAD)

Share price: 466p (down 3.4% today, at 13:28)

No. shares: 84.85m

Market cap: £395.4m

(at the time of writing, I hold a long position in this share)

AGM Trading Update (mild profit warning)

Headlam Group plc (LSE: HEAD), Europe's largest distributor of floorcoverings, today provides a trading update in respect of the first four months of the financial year (the 'Period')

Trading throughout the Period was characterised by a soft UK market backdrop affecting revenue in both the residential and commercial sectors as well as a decline in revenue attributable to the Company's largest customer, as referenced in the Company's final results announcement dated 6 March 2018.

These factors resulted in a performance that was moderately below the Company's internal expectations for the Period.

The soft backdrop and decline with the largest customer was fairly consistent throughout the Period though, showing no further deterioration compared with that detailed in the final results announcement.

Given that the weather was particularly bad earlier this year, this probably isn't much of a surprise. The company confirms that footfall to its customers was indeed affected by the adverse weather in Feb & Mar 2018.

LFL revenue fell 6.3% in the UK, and rose 0.2%, giving -5.4% overall.

Largest UK customer (does anyone know who this is?) - caused 37% of the UK revenue decline. However, profitability for this customer was "broadly unchanged" due to higher margins and lower costs.

Current trading in May 2018 to date has shown an improvement, and is "broadly in line with the company's expectations".

H2 weighting - I think this section below means we should prudently assume that forecasts for 2018 need to come down a bit;

The Company's meeting of expectations for 2018 will largely be reliant on trading in the traditionally stronger second half of the year and the level of weakness experienced in the Period not continuing.

The company is also taking (unspecified) action to mitigate market weakness - so presumably cost-cutting and efficiency measures.

My opinion - I am fairly new to this company, as several readers helpfully flagged it up earlier this year.

I'm surprised the market has been so understanding today, with a share price fall of only 3.4%. There must be a buyer(s) in the background, using this as an opportunity to hoover up some more shares from sellers. I think normally, a bigger fall would have occurred - I was expecting 10-15% fall, which hasn't happened.

I've decided to play it safe, and reduce my position size, and will reassess it once revised broker notes are available.

The company a smashing balance sheet, with net cash, and pays out excellent divis. Therefore I still feel positive about the company, but it's not something that I want too much exposure too, in these uncertain times.

There again, the shares already adjusted downwards in price for the company's soft UK market conditions in early Mar 2018, as you can see from the 2-year chart below. So maybe the share's resilience today is a good sign that (so far anyway) shareholders are prepared to ride out the uncertain outlook?

I see today's announcement as more of a glitch than something of major concern.

I have to leave it there for today. Many thanks for your comments, and some smashing positive feedback, which gives me a warm glow! It's always pleasing when I know people have found my work interesting & helpful, that's what we aim for! :-)

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.