Hi, it's Paul here!

I'm thinking of ditching the 7-8am quick view format, because;

1) Very few subscribers here seem to read the SCVRs early (usually only about 15 reads by 9 am),

2) It's very stressful for me, starting the day running flat-out, against a short (self-imposed) deadline, and drains a lot of my energy, for little benefit to everyone.

3) Mr Contrarian posts an excellent initial view every day which usually covers the main points (so I'm pointlessly duplicating his work, arguably)

Therefore, providing there are no serious objections, I'm minded to go back to the old format, of me having less time pressure, and taking my time to rummage through, and report on, the most interesting RNSs of the day, by mid morning towards lunchtime. Then later, more in-depth articles, if it takes my fancy, and needs more work (typically 2-4 hours per company results statements).

I think that's what most subsribers want anyway, but there's no harm in experimenting with different formats & ideas. Then settling with whatever format we all like the best.

Staffline (LON:STAF)

Share price: 116p (down c.23%, at 10:43 - volatile, so likely to change)

No. shares: 27.9m existing + new shares: 34m placing + 7m open offer (if fully taken up) = 68.9m

Market cap: (assuming placing & open offer fully taken up) £79.9m

This is a financial distressed staffing agency. It made too many debt-fuelled acquisitions (7 in 2018 alone), and then ran into serious difficulties once it emerged that it had underpaid staff in breach of minimum wage regulations. The shares were suspended for a while, but (bizarrely) resumed trading whilst the current fundraising was progressed.

There are 2 announcements today (so far);

Final Results - for the year ended 31 Dec 2018. The deadline for publication is 6 months, so Staffline has only narrowly avoided the shares being suspended again. The RNS today is just 6 pages long, as it's a summary only. The full annual report is here on Staffline's website. I'll plough my way through that later.

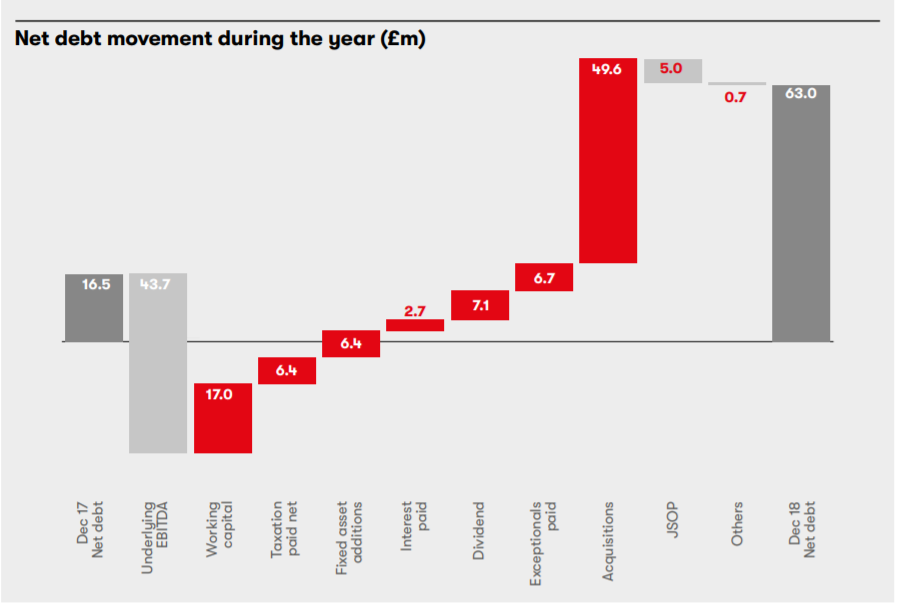

On an initial skim, this net debt bridge is very interesting, as it clearly shows where management went wrong - taking on too much debt to fund a reckless acquisition spree;

There's some other really interesting stuff in the annual report, e.g. the risk heatmap on page 40 (too large to reproduce here). We don't have to read the whole annual report from cover to cover. Very often, I just dip into it, or skim through it looking for interesting bits. The CTRL+F function in our browser is extremely useful too, to search for key words like "outlook", "freehold", "expectations", etc. I use that a lot when reading all results RNSs too, to find the most important bits quickly.

There's not much point in dwelling on the 2018 results, because they're pretty much as expected (the house broker says today "broadly in line") - see their update note on Research Tree. NB the broker has not yet crunched the numbers to reflect dilution from the fundraising, so forecast EPS will drop dramatically, due to dilution. I'll crunch the numbers below.

Outlook - importantly, the company reiterates its last guidance for 2019, so things don't seem to be getting any worse;

On 17 May 2019 the Group issued a trading update referencing headwinds faced in both of its training and recruitment divisions. The Group's outlook for 2019 remains challenging but, following a weak start to 2019, we are trading in line with revised market expectations.

The Board continues to expect the Group to report underlying operating profits for the year ending 31 December 2019 in the range of £23-28m

and, before proceeds of any equity capital raise, net debt at year end to be in line with current market expectations.

A cynic might say that, at the time of doing an emergency fundraising, Directors have to be confident about the outlook. It might therefore be prudent to assume that the risk of missing the guidance might be higher than usual here.

There's a lot of detail given about how the various parts of the group are performing, and I have to say that to me it generally reads OK. Management seem to be doing sensible things to improve the business, if you read through all the narrative in today's announcements. Plenty has gone wrong, as we already know, but there doesn't seem to be any fresh bad news today.

Current trading - OK, but note the dreaded H2-weighting comment below, which increases the risk of another profit warning later this year, perhaps (although sensible reasons are given as to why the H2 weighting will be more than usual this year);

Trading has continued as expected since 17 May 2019. The Board reiterates the above underlying operating profit guidance for the full year but expects a greater weighting toward the second half of the year than normal due to the transformation in PeoplePlus and the difficulties the Recruitment business has faced in the first half.

Forecasts - the company reiterates the £23-28m range for underlying operating profit. The interest charges are quite high, so the latest broker note forecasts £21.7m in adjusted PBT for 2019.

If we assume say 20% tax, that gives 2019 earnings of £17.4m

Divide that by the (estimated) new share count of 68.9m (corrected figure - my apologies, as I earlier showed this as 79.9m which was an error), and that gives my estimate for 2019 EPS of 25.3p

That works out at a 2019 PER of 4.6 - based on the low point of the forecast profit range, of £23m.

There will still be quite a lot of debt after the placing, but it should come down over time, since there won't be any dividends or acquisitions, and steps are being taken to get customers to pay more quickly.

There are reasons to be optimistic about an improvement in profitability in 2020, if you read through all the narrative published today. That's because new Govt contracts will be kicking in, to replace the now defunct Work Programme.

Although there are various headwinds too, e.g. companies giving staff permanent positions, instead of using temps, due to a tightening labour market.

The problems this year must have disrupted the business considerably. So if the fundraising today is successful (no guarantees it will be, as it's not underwritten), then it's reasonable to assume that business should improve over time. At first I was sceptical about this point, but thinking it through, I can imagine competitors using Staffline's financial problems to win business.

Moving on next to the second announcement today;

Proposed placing & open offer - normally this type of "bookbuild" deal is done & dusted when the initial RNS comes out. However, in this case, my broker tells me that the book is still open (at 11:59), or at least that he's not been told it's closed, and there hasn't been a follow-up RNS. That suggests to me that Liberum might possibly be struggling to get this deal done? Which is obviously very worrying for existing shareholders, as if they can't get the deal done, then the company's bust.

As I mentioned in a previous SCVR here, my view is that Staffline shares are uninvestable until the fundraising has been agreed. The EGM vote on 15 July should be a formality. As today's announcement says, it's vital that this vote is passed (I'm sure it will be).

Here are the main points about today's fundraising;

- Proposed placing of 34m new shares at 100p each

- Placing should raise £34m gross, and £32m net of fees

- Open offer for existing shareholders, of 1 new share for 4 existing shares, also at 100p - to raise up to £7m

- Bank revolving credit facility amended to reduce from £120m to £110m on 15 Nov 2019, and to £100m on 15 Nov 2020

- Bank covenants relaxed, then a gradual reduction in Net debt: EBITDA covenant to 2.x by 31 Dec 2020

- Expiry date of bank facilities remains unchanged at July 2022

- An amendment fee & future exit fee (unspecified amounts, but I bet they're hefty!) have been agreed with the bank - fair enough I guess, as the lending is now a lot more risky than originally intended

- Management are stumping up only £253k for placing shares. That doesn't seem much of a commitment, especially considering they have negligible existing holdings

My opinion - I feel that there's a quite good business here, worth saving.

The £34m fundraising is not exactly a fortune, and it's reasonable to imagine that trading should gradually improve, with uncertainty removed.

The bank support looks fair to me. Also, remember that STAF's receivables book is mainly blue chip customers. So lending against that, should actually be quite low risk for the bank, as it's good security.

Clearly the lesson to be learned from this debacle, is not to go on a debt-fuelled acquisition spree, because that has massively destroyed shareholder value & left the company dangling by a thread in terms of solvency.

This is a great example of the risks of a geared balance sheet, with negative NTAV and too much debt - which is precisely why I have my balance sheet tests to avoid situations like this.

I hope the company survives today, but it's looking a bit dicey at the time of writing. If it does survive, then I imagine a share price recovery to say 150p is possible, as this year progresses, which would take it to a PER of about 6, which looks about right to me.

UPDATE at 12:46 - just spoken to a city contact (broker), who reckons the fundraising deal should get done today. He's believes that the minimum amount is already covered, but that we're likely to get an update later today, probably after the market has closed. That falls into the category of market rumour I suppose, we won't know for sure until the company issues another update on the RNS.

UPDATE at 18:03 - Good news for shareholders, the placing has been successful, in raising £34m, and is described as being "significantly oversubscribed". People often scoff at that claim, but it's true. I know, because my own allocation was scaled back to less than half what I applied for.

The next step is a General Meeting on 15 July 2019, which should just be a formality, to approve the fundraising.

As this fundraising is more-or-less in the bag, I think STAF shares are investable again. Although as mentioned in the comments below, arguably the company hasn't raised enough money, as it will still have a negative NTAV, even after the placing monies are received.

Tandem (LON:TND)

Share price: 172.5p (down c.14% today, at 13:01)

No. shares: 5.0m

Market cap: £8.6m

(at the time of writing, I hold a long position in this share)

Trading update (AGM)

This micro cap is a distributor of bicycles, other leisure equipment, and toys.

Graham flagged it up as potentially interesting here on 10 April 2019, (well worth reading to quickly recap on the company, which I've just done, thanks Graham!) on the basis that 2018 accounts showed a very strong performance in H2, and a really bullish outlook statement.

Moving forward to today's update, it starts off well, saying;

"We are pleased to announce that it has continued to be an encouraging year for the Group with revenue for the 25 week period to 23 June approximately 26% ahead of the same period in the previous year...

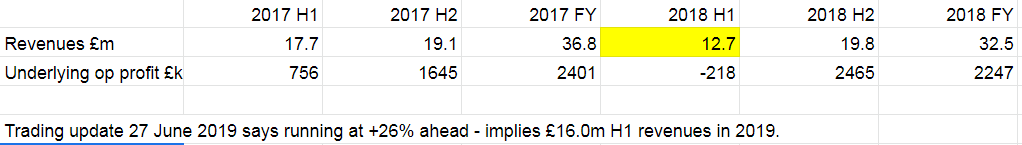

That sounds great, but bear in mind that the LY comparatives are weak, hence easy to beat. I've compiled a table of half year revenues and underlying pre-exceptional operating profit, as follows;

As you can see, implied H1 2019 revenues of £16.0m are nothing much to write home about (actually lower than H1 revs in 2017).

Various details are given about which product lines are doing well, and which not so well - see RNS if interested. It sounds like toys & leisure products are the growth areas. Demand for bicycles is reducing.

Outlook - the tone today seems to have become more cautious;

Whilst we can look forward to the rest of the year with some confidence there are a number of potential threats on the horizon.

Although we utilise various forward currency derivatives and benefit from a natural hedge from our US dollar denominated FOB business, a stronger US dollar is likely to impact on the profitability of the Group.

In light of the ongoing Brexit debacle, we are cautious with regard to future consumer spending which is discretionary for the type of products that we supply.

The longevity and success of most licences is also limited and transient. Whilst we continue to seek new, exciting and profitable properties there is no guarantee of this.

They clearly want to guide us lower - maybe H2 won't be as strong as H2 last year, even if H1 is better?

Earnings per share - last year the company did £1,886k in underlying earnings (after tax), which divided by 5.0m shares gives historic EPS of 37.7p

Some people were hoping for c.50p EPS (or even above) this year, but I think that possibility might have receded somewhat, given today's more cautious tone? It's largely guesswork though. I'd feel more comfortable pencilling in say 40p EPS for 2019. That would put the shares on a PER of 4.3 - which seems very cheap - especially considering the balance sheet is strong (although note there is a pension deficit).

My opinion - it looks cheap, although the more cautious tone today probably justifies the 12.5% share price fall today.

All done.

I've written a section on Airea in tomorrow's report.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.