Good morning, it's Paul here with the SCVR for Thursday.

Timing - I have to finish by about 2pm today. Update at 13:33 - sorry I'm completely bogged down in JOUL (I hold) results, so that (big!) section should be up by 2pm. Please bear with me.

Update at 14:35 - I spent absolutely ages on JOUL, so haven't got round to the other stuff, and have to go out now for an appointment. I'll catch up this evening, to go into tomorrow's report first thing. Apologies for any inconvenience. Hence, today's report is now finished.

Agenda - The first 3 companies I'll be looking at are all things that I either hold, or am considering buying, namely -

Pci- Pal (LON:PCIP) (I hold) - Trading update for 6m to 31 Dec 2020 - (done)

Joules (LON:JOUL) (I hold) - CFO leaving, and interim results 26 wks to 29 Nov 2020 - "Accelerating digital sales support delivery of profits ahead of expectations for the Period". At first glance this looks good. The key point is that Joules is more than recouping lost physical sales with online growth. That's very important, and not something I've seen with other similar companies. It mentions higher costs of export to the EU, something we've recently been discussing here. - (done)

De La Rue (LON:DLAR) - Trading Update - FY 03/2021 to date - guides ahead of expectations £36-37m adj op pr, vs £34m mkt exps) (to do)

Other things on my to do list, which I may or may not get round to covering, dependent on time, are these: BLV, ACSO, TRB, MMTO, Fonix, EMR - so please don't request them, as I'm already aware. Update - sorry these are going to have to wait until tomorrow.

As usual, I welcome readers giving your own opinions on companies reporting, in the comments, if backed up by facts & figures. Some of you know your companies inside-out, if so, do contribute your views here, it's a team sport after all.

Pci- Pal (LON:PCIP)

(I hold)

61p (up 4% at 09:05) - mkt cap £36m

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, announces a trading update for the six months to 31 December 2020.

This is niche software, which integrates into call centres, enabling operators to take credit card payments over the phone in a secure way, which means the operator doesn’t see or hear the credit card number, thus eliminating fraud. Apparently PCIP is a specialist in this area, and has very little competition. Hence its product is selling well (from a low base), especially in the USA, mainly through resellers.

.

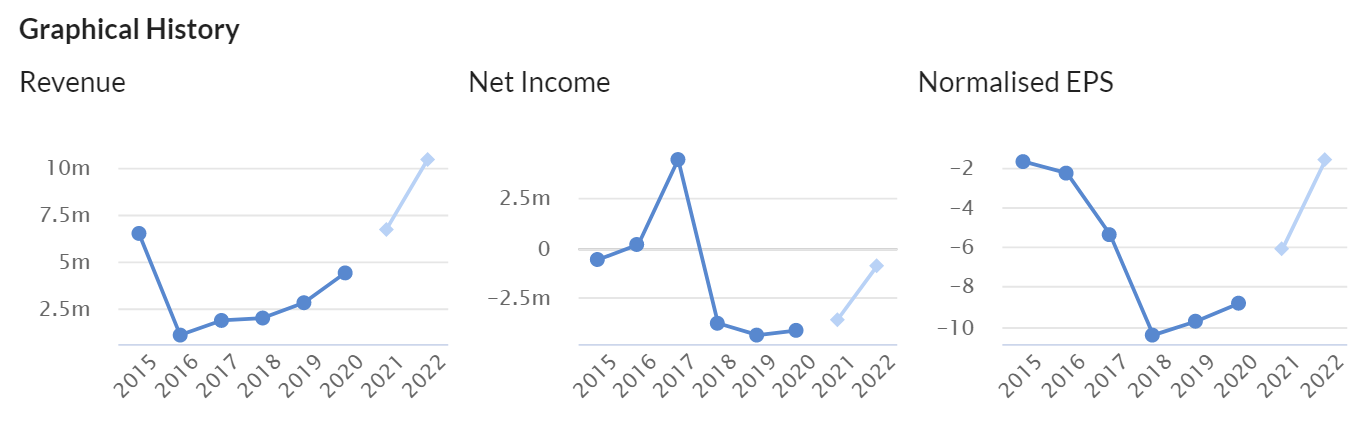

As you can see above, this share looks rubbish on the historic numbers, but you have to dig a little deeper, and look into the future, to see the opportunity (lighter coloured blobs are forecasts, darker colour actuals).

Fast growth is actually happening now, with each new sale bolting on high margin, sticky (low customer churn) monthly recurring revenues. On a mainly fixed cost base, that should deliver excellent operational gearing. It’s a lovely business model, and if revenue growth continues at high levels, then the company should move into sustainable profits in 2022.

The best briefing is here on InvestorMeetCompany, which I'm watching again now in the background to refresh my memory. The presentation is over an hour long, so a comprehensive explanation of the business, its results for FY 06/2020, and its prospects.

I consult a sector expert, who knows the contact centre space inside-out, and he tells me this share is the real deal. That adds to my conviction on the numbers. It’s important to talk to people who know individual sectors well, then monitor how well their ideas perform. Then talk more to the people who tend to get things right!

It’s important to do my own research properly as well as consulting experts. This is because I find drawing on other peoples’ conviction rarely works for me. I tend to sell too quickly, rather than riding out any short term price drops. Whereas if I’ve done my own research properly, then I’m more inclined to ride out any short term volatility, buy the dips, and make a good profit longer term.

Days like today are a good example - a few people get spooked by the US markets dropping 2-3%, and we can suddenly buy good quality UK companies that have reported strong trading recently, 5-10% cheaper! Also, I like down days because companies that report good trading tend to be ignored, allowing me to buy early, before a price rise that otherwise would have happened on a more normal day.

Anyway, moving on from the general points above, what does PCIP say today?

H1 trading update -

H1 revenues up 56% to £3.19m - which doesn’t sound much. However, it’s the strong rate of growth that matters most, because each new contract is adding monthly recurring SaaS revenues. Hence the more informative measure is:

Total Annual Contract Value (TACV) - this is the run rate of annual revenues from this point in time. Note that it includes existing contracts, plus deployments going live in the next year. So it’s forward-looking, giving us clear visibility for revenues to come. This is up a very impressive +59% to £8.28m.

New contract wins have accelerated: 93 customers (up from 51 in H1 LY), adding £1.68m of recurring annual revenues.

Customer churn is low

Cash - £4.22m gross, but there is some debt, so net cash is £2.1m, down about £1m in 6 months. I’m hoping it won’t do another placing, but we need to be alive to the possibility that there could be one. A (say) £3m equity raise would only dilute 10%, so I’m relaxed about this issue, as cash burn should now be fast reducing as monthly revenues build. Raising a little more cash would be a doddle given the superb growth rate. I worry about placings where companies are not generating enough growth, or burning cash at prodigious levels. That’s not the case here.

Outlook - sounds good to me -

"With a strong pipeline and growing ecosystem of partners, we are now growing this business at pace and we can look forward with confidence to the second half of the year, with strong revenue visibility against market forecasts for the full year."

Diary date - H1 results due out week commencing 8 March 2021.

My opinion - as you’ve probably gathered, I like this a lot.

The current valuation is probably fair, at this point in time. However, I’ve pencilled in a 2-3 bagger on the share price (up to c.£100m market cap) over the next 2-3 years, if strong growth continues, and assuming the current bull market (which values growth companies highly) also continues.

There’s a good update note today from Finncap, many thanks to them. It explains the business model & the opportunity better than I’ve managed above! Also it gives some forecasts, showing the move into breakeven should occur in FY 06/2022. Today’s update reassures that the growth is real, and not a pipe dream.

Therefore I’m happy to tuck away my existing holding for the next few years, and am fairly confident it should do well. Not sure I want to chase up the share price higher than 60p, I was happy buying up to about 50p, so hopefully we might see a pullback in price if the US markets continue selling off, to top up this position. It's quite illiquid, so not one to try and trade in & out of. My buy orders were normally scaled back a lot, and I had to repeatedly buy scraps a while back. Hence why I'm not planning on top-slicing if it goes up a lot, I'll just sit tight.

I appreciate this share won’t appeal to many readers, who prefer to buy companies which are profitable now, rather than ones which are aiming to be profitable in a couple of years’ time.

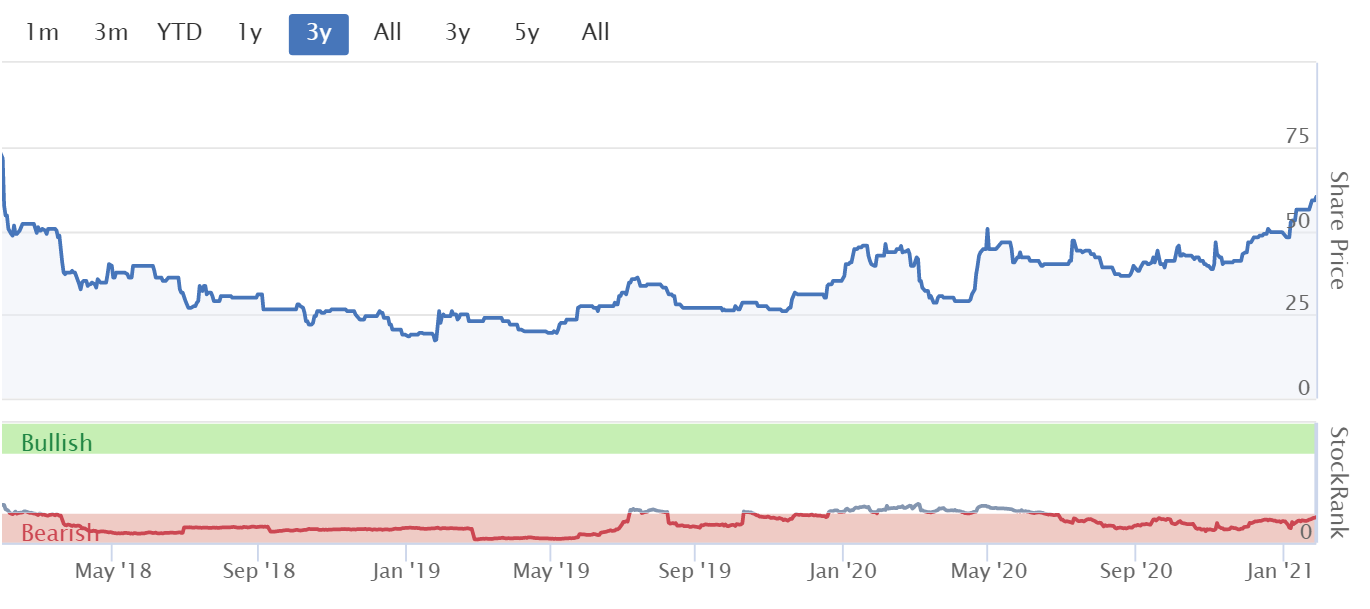

Stockopedia doesn't like it, with a StockRank of just 21, and it qualifies for 2 screens, both bearish! That's understand able though, as Stockopedia is designed to steer us away from more speculative stocks, since many of them don't work out as planned.

.

.

Joules (LON:JOUL)

(I hold)

151p (down c.3% at 11:18) - mkt cap £164m

I’m a bit surprised the share price has dipped a little this morning, as my initial skim of the interim results (as mentioned above) was positive. Let’s have a closer look, I might have missed something.

CFO leaving - after 5 years’ service, the CEO Marc Dench is leaving to join a private-equity backed growth company called HealthHero. He’s staying on until a successor is found, by end May at the latest, to allow for a smooth transition. Based on this information, it sounds like a reasonable and civilised departure for pastures new, rather than something which rings alarm bells, so I’m satisfied with this explanation.

Covering the 26 weeks to 29 Nov 2020, so that’s June-November inclusive. Most of the shops are likely to have been open, apart from a few weeks at the start, and the November lockdown. It says that of the 26 weeks, stores were closed for 10 of them. Hence a fairly badly disrupted half year.

Surprisingly perhaps, it’s remained profitable (ahead of expectations the company says), and there’s a big improvement in the cash pile vs a year earlier -

.

.

Compare this performance with say Superdry (LON:SDRY) or Ted Baker (LON:TED) - larger more well-known brands, but they’re performing very much worse than JOUL, fighting for survival arguably, whereas JOUL is romping along quite nicely.

JOUL will have benefited from Govt support schemes, in particular furlough when shops are closed, to cover a lot of the cost of retaining staff, and business rates relief. The cash pile may have been helped by creditor stretch too, re landlords & taxes. Hence future profits may not necessarily go up from this level, even if revenues do recover the 15.3% shortfall this year.

eCommerce sales - this is the thing to focus on, and it’s the main reason I’ve been building up a position in JOUL. Fashion brands have to crack the internet, if they want to thrive. JOUL is doing that. Gross digital sales are up 55%.

Look at how dominant eCommerce has become during the half year, remarkable stuff -

.

Therefore, we should be thinking about this share as a predominantly online business, with some physical showrooms as well. Mind you, I imagine physical stores are likely to bounce back once trading returns to normal.

The strong growth in eCommerce here is telling us something important - that customers want this product, and will seek out the brand, even when the stores are shut. That augurs very well for the long-term future, in my opinion. It also tells me that JOUL is good at digital marketing.

The usual fashion sector caveat applies, that product has to remain relevant, and not go off the boil. Brands can be quickly destroyed if the designers & buyers go haywire & lose sight of what their customers want. With the founder still active in the business, that’s not likely here. It’s not high fashion either, it’s traditional, country, preppy, influenced stuff - not rocket science, and the core look of JOUL doesn’t change much from one year to another. Hence the fashion risk is probably quite limited.

Current trading - 7 weeks to 3 Jan 2021 - strong eCommerce sales more than offset store closures. That’s really impressive, and greatly de-risks the shares. I think a key point here is that JOUL product, brand image, is very distinctive. It’s not just another me-too fashion brand, this is a product that I think customers seek out, and are prepared to pay a premium price for. I’ve been buying various items from JOUL website recently (in the end of season sale, as I wouldn’t pay their full prices!), and like the product very much - it’s good quality, with nice detailing. One cotton shirt was so good, I went back and bought 2 more of the same style! And 3 of the same light raincoats (well it’s so easy to lose them in pubs & trains, might as well stock up for future misplacements).

Active customers are up to 1.6m - that’s a lot.

Friends of Joules (“FoJ”) marketplace is interesting, going well. This is a curated selection of products from third party vendors. It says there are 10,000 products, which surprises me because my perusal of the site seemed to show quite a limited range of products. I bought a scarf, which arrived promptly, and is good quality, so it works. Joules earns a commission from FoJ - does anyone know what the fees are? Would be interesting to find out. I’m pretty sure the third party vendors look after everything, dispatch, returns, etc. So JOUL should just be earning a pure commission with no costs, lovely additional business. It’s reported within “other revenue”, which more than doubled, from £0.9m H1 LY, to H1 TY at £2.0m. This could become a lucrative business in the future. There’s also brand licensing income within that £2.0m.

Wholesale revenues down sharply (-44%) at £17.1m in H1, which sounds about right, given that customers would have seen store closures, and a need to de-stock.

New Head Office - in Market Harborough - has been a large capex project, which the company expects to move into between now and its 31 May 2021 year end. I wonder if they’ll be doing a shareholder site visit later in the year, to show off the new facilities? That would be a good idea, when possible. The warehouse has also been expanded. I seem to recall they were outsourcing logistics to Clipper Logistics (LON:CLG) as well, after distribution problems a while back?

Admin costs - the stand-out item for me here, as mentioned before, is that Joules spends very heavily on its Head office - £13.4m in the half year (down from £14.9m LY H1, helped by furlough funding). I know the design side of things is important, in making the brand & product distinctive, but an annualised HQ spend of £27m, which is probably mostly salaries, does seem rather excessive. The business needs to grow into that high central cost I think.

Property leases - good progress here, with the underlying cost reduced from £13.8m annualised, to £10.6m. Excludes one-offs, like rent waivers.

Dividends - nothing as yet, but will resume divis when appropriate. That’s fine, I don’t think it’s good for companies to be paying divis at the moment, whilst this covid situation. I’d rather see companies strengthening their balance sheets, and building up financial reserves for the future, in case something like this happens again. Covid has surely revealed that many companies were running too lean, in terms of balance sheet strength.

Bank facilities - I’m running out of time, so won’t cover this. Suffice it to say, that the facilities look ample, and are mostly undrawn. I can’t see any reason why the bank would not be co-operative when it comes to renewing the facilities, so not an issue in my opinion. Moving on.

Brexit - a very topical issue, this has read-across for other eCommerce retailers selling into the EU, so here it is in full -

BREXIT

The Group was well prepared for the additional operational and administrative requirements that came into effect at the end of the transitional arrangement with the EU on 1 January 2021. Notwithstanding this preparation the Group has experienced disruption and delays as well as higher costs on some of its exports from the UK into certain EU markets, with Germany being particularly impacted. The disruption is expected to reduce in time as the courier networks and supply chain intermediaries adapt to individual EU country import requirements.

The new trading arrangement will result in higher costs for certain of the Group's exports to the European Union as a result of higher duty charges, higher courier costs and increased administrative costs. The annual impact of these increased costs is estimated to be in the range of £0.8 to £1.0 million, which is broadly in line with the Board's expectations.

The Group will continue to evaluate and implement options to mitigate the adverse impact including a potential increase in selling prices and structural changes to the Group's logistics.

How interesting. It’s clearly an important issue, that is likely to hurt lots of businesses in the short term, but looks fixable to me. The obvious solution is to open a distribution centre within the EU, and have product sent there directly by the manufacturers, cutting out the UK completely for goods destined for the EU. It would clearly be a hassle to organise that, but once it’s set up, then it’s done, and wouldn’t necessarily be duplicating costs (2 smaller warehouses = 1 large warehouse?)

Looking at the last Annual Report, page 100 gives the geographic split of sales. It’s UK: £161.3m, International £29.5m. It’s not stated what element of international is the EU. At a complete guess, maybe half? That would be c.£15m revenues. So to be incurring almost £1m extra costs as noted above, is quite significant. That would require a rise in selling prices of about 7% in order to recoup it. So that’s the obvious way forwards for UK eCommerce businesses - raise prices for EU customers. Which in turn would be likely to knock back sales volumes, depending on the price elasticity of demand (yay, I managed to slip in some O-level economics there!)

Outlook -

Good - strong eCommerce sales, offsetting lost store sales. Better than expected H1 profits. Cost reductions at HQ, and rent reductions.

Bad - ongoing store closures & cancellation of country shows (but as expected there), higher costs re EU sales,

Overall -

… the Group's strong balance sheet, combined with the strength of its brand, product proposition and digital platform (reflected in the recent strong growth in active customers) will enable it to navigate the current climate and emerge in a strong position.

That’s fine by me, I don’t see anything worrisome in the outlook, all as expected. JOUL is a particularly strong proposition if covid continues to be a problem, as it’s now mostly selling online.

Going concern note - these are really useful, so I’m grateful to the rarely-praised (for good reasons!) auditing profession for requiring these disclosures. JOUL has traded, and continues to trade ahead of its original base case scenario last year.

Latest update -

The updated Base plan forecast indicates that the Group will remain within its available committed borrowing facilities and in compliance with covenants throughout the forthcoming 12-month period, and that the current national lockdown will not impact on the Group's ability to continue as a going concern.

That’s fine, I don’t have any going concern worries about Joules at all. It should be a safe investment.

Balance sheet - NAV is £40.6m. I normally adjust out all intangible assets, which are £18.7m here, giving NTAV of £21.9m - - adequate, but not particularly strong. Although it might include some property (the new HQ site)?

Cash (gross) is £28.6m, which looks flattered by creditor stretch, so I would expect to see cash come down a lot in the next year, as things normalise.

The current ratio is 1.10, which is OK for this type of business, but not what I would regard as strong. For example, special situation Quiz (LON:QUIZ) (I hold) which we looked at yesterday, has a much stronger current ratio! Not what people might expect, but that’s what the figures say.

Liabilities - trade & other payables have shot up from £41.7m a year earlier, to £56.7m at 29 Nov 2020. I can’t find a breakdown of the total, but it’s likely to be mostly trade creditors (i.e. garment manufacturers), tax, and rents owed. It’s probably safe to assume that the increase of £15m vs last year is probably creditor stretch (late payments) that would need to be caught up with at some point in the future. That would reduce gross cash from 28.6m to a more normalised £13.6m.

Overall, that looks OK to me, nothing to worry about here.

I reiterate my point above, that I’d like to see JOUL hold back divis, and instead build up its balance sheet strength, and clear all debt. Businesses of the future need to be stronger financially.

My opinion - I really like this company, that’s why I’ve bought a long-term position in it (medium-sized within my portfolio). My intended holding period here is open-ended, maybe 5+ years?

I don’t really know how we should be valuing this share right now. PER is not the right basis, in my view, as conditions are so abnormal, impacting sales, margins, costs, etc in unusual and hopefully one-off ways.

Thank you to Liberum, who have made a very useful note available by its analyst Wayne Brown, summarising the RNS better than I’ve done above! He’s not changed forecasts today, which are for 2.6p this year 05/2021, rising to 6.7p NY, and 9.2p in 05/2023. At about 150p per share now, the market is already pricing-in a full recovery 2 years ahead. I can see why that wouldn’t appeal to some investors.

For me, it’s not about PERs. I think there’s something special here, in terms of the brand, the online growth, and a bigger, longer-term opportunity for investors, looking years ahead. Hence why I’m happy to hold at what appears to be a high valuation in the short term.

.

I've run out of time for today, will catch up with the backlog tomorrow. Sorry about that, but I wanted to spend time on the most interesting company, with a deep dive into JOUL.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.