Good morning, Paul here. Looks like a quiet day for results & trading updates. Actually, scrub that, as loads more have just come through!

Volex (LON:VLX)

Share price: 83.6p (pre market open)

No. shares: 147.4m

Market cap: £123.2m

Volex plc, the global provider of cable assemblies, issues the following trading update ahead of the announcement on 13 June 2019 of its full-year results for the year ended 31 March 2019.

This reads positively;

Trading continues to be ahead of market expectations across the group, with the three acquisitions made during the year all performing to plan

Other points;

- Generated $10m in net free cashflow in H2

- Full year revenues to exceed $365m (which is c.$10m more than the broker consensus)

- Dividends to resume in the new financial year 03/2020

- Good results despite competitive, and cost inflation pressures

Outlook - sounds encouraging;

There remain substantial identifiable opportunities for both divisions to improve sales and margin performance through disciplined execution of our strategy, in both the short and longer term, and we expect to deliver a robust trading performance for the full year, ahead of the Board's expectations.

My opinion - this all sounds rather good! It looks worthy of a closer look.

The valuation metrics look cheap, so this share looks likely to rise in price today.

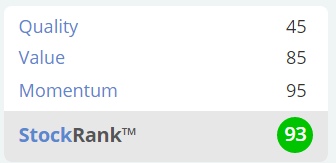

High StockRank too;

Volex has been trying to do a turnaround for years now, and it looks to be working out well now.

Fulham Shore (LON:FUL)

Share price: 11.25p (pre-market open)

No. shares: 571.4m

Market cap: £64.3m

(at the time of writing, I hold a long position in this share)

The Board of The Fulham Shore PLC ("Fulham Shore" or the "Company") is pleased to provide an update on trading ahead of the publication of the Company's results for the year ending 31 March 2019, which are expected to be released in mid-July 2019.

This group runs 2 casual dining formats, Franco Manca (sourdough pizzas), and The Real Greek. Both are successful formats, being gradually rolled out, but mainly in London at the moment.

Today's update sounds encouraging. Maybe the good news leaked out early, as there was a flurry of buying yesterday afternoon.

It's an in line update;

We expect to report that both revenue and headline EBITDA will be ahead of last year's figures and in line with market expectations. The growth has been driven by increasing customer numbers in our existing restaurants and new restaurant openings.

- A particularly strong trading performance towards the end of the financial year

- Early sites which had been hit by new openings cannibalising sales, are now recovering

- The Real Greek is also trading well, and benefited from outside space in the hot summer last year

- 4 new sites were opened in the year, ending with 61 in total

- Considering starting to pay dividends

- Looking to accelerate roll-out, mainly from internal cashflow

Outlook is positive;

Both businesses continue to trade well and in-line with the Board's expectations and we remain confident that the Group will continue to thrive over the coming years.

My opinion - this is the only restaurant share that I would consider investing in. Both formats are excellent, and distinctive. That the company is continuing to trade well in a very difficult, over-supplied sector, is proof of the pudding.

This is a wonderful time to be rolling out a successful format, as landlords are offering fantastic deals, in order to fill empty shops. I'm happy to continue holding, and think we could see the share price put in another increase today.

Scisys (LON:SSY)

Share price: 170p (pre-market open)

No. shares: 29.6m

Market cap: £50.3m

SCISYS Group PLC ("SCISYS" - AIM: SSY; ESM: SCC), the supplier of bespoke software systems, IT-based solutions and support services to the Media & Broadcast, Space, Government, Defence and Commercial sectors, is pleased to announce its unaudited Preliminary Results for the 12 months to 31 December 2018.

These figures look good. A few snippets;

- Adjusted operating profit up 16% to £5.1m (2017: £4.4m restated)

- Record order book of £98.6m (2017: £88.2m restated)

- Net debt reduced to £3.1m (2017: £5.9m) despite exceptional cash outflows.

- Adjusted basic earnings per share increased to 13.1p (2017: 9.3p) - so the PER is about 13, if you're happy with the adjustments (which looks reasonable to me)

Brexit - the company took the sensible step to establish an Irish group holding company, because it has important contracts with the EU

Outlook - sounds upbeat, but note the need for expansion capex, and opex;

... Moreover, our strong trading performance combined with steadily reducing levels of net debt and a record year-end order book provide a solid platform for delivering further progress in 2019 and beyond. To take advantage of the increased top-line momentum that we are now experiencing, we have adjusted our strategy to accommodate the anticipated higher revenue growth and are planning appropriate investments in facilities, infrastructure and personnel. This is reflected in our adjusted medium-term aspirations outlined in the Chief Executive's Review.

Based on current project performance and our order pipeline across the entire Group, the Directors remain fully confident in the prospects of the Group's future organic growth. We will also continue to look for opportunities- where there is a good market, product and cultural fit - to grow through acquisition.

Balance sheet - adequate, not particularly strong, but not a concern either.

My opinion - this seems a decent group, I like it. The valuation is not demanding, although historically this share has always had a fairly low PER.

This share can be very illiquid - I tried to buy some a couple of years ago, but couldn't get any decent size, so gave up.

Pebble Beach Systems (LON:PEB) - this company is what's left from the wreckage of Vislink.

An improved performance is reported today, but it's uninvestable for me, due to an extremely weak balance sheet, over-burdened with bank debt.

Time Out (LON:TMO) - 2018 figures out today look rather alarming to me. It's still heavily loss-making at the EBITDA level, and it's undertaking large capex for food & cultural markets. Looks high risk.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.