Good morning from Paul & Graham. Today's report is now finished.

Many thanks for your suggestions yesterday. Although I had to laugh at some of the suggestions! But we'll see what we can do, based on the number of your thumbs ups.

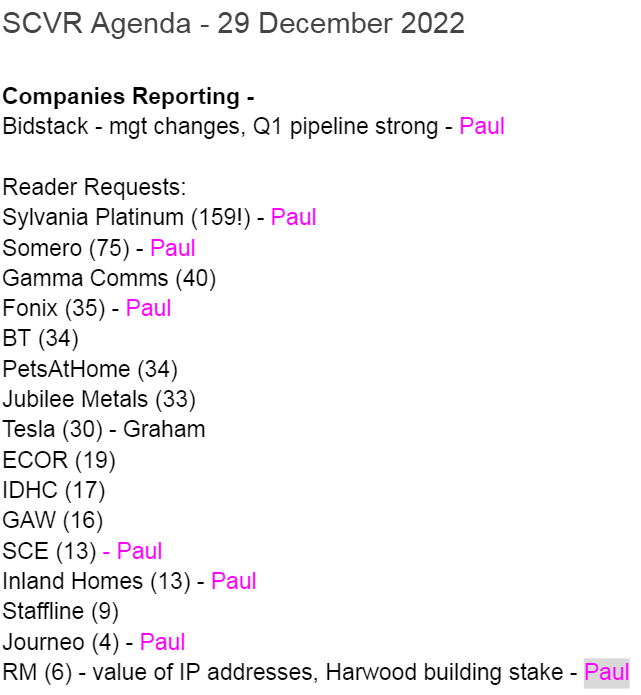

Agenda

Here's an initial list (below) of yesterday's reader requests, with the number of thumbs ups in brackets. It's not realistic to ask us to look at most of the mid/large caps, as that would take too long researching things from scratch, but I've noted below the small cap ones that I can give a relatively quick view on. Graham's looking at Tesla, as he knows it well and it got a lot of thumbs ups from you (sorry if this triggers anyone, having a mega cap US stock in a UK small caps report LOL! Look at it this way, It's Christmas, and rules are made to be occasionally broken!) -

Paul’s Section:

Bidstack (LON:BIDS) (2.8p - mkt cap £37m) [quick comment] - announces that its Managing Director is resigning, but staying on as a Strategic Adviser. Also, a 13.5% shareholder Irdeto BV, which made a £5m “strategic investment” in Oct 2022 is seeing its CEO become a NED at BIDS. Does this all hint that things might not be going so well, possibly? COO Camila Franklin is joining the main board, and the comments sound as if she’s more experienced than the CEO - maybe he’ll be stepping down next?

CEO comments eulogise on the outgoing MD, and claims that the “business has never been in better shape”, and “...our pipeline of revenue for Q1 looking stronger than ever…”

BIDS raised just over £10m in a 2.85p fundraise in Oct 2022. It raised a similar amount in 2021, and burns cash prodigiously.

My opinion - I’m keeping an eye on BIDS, as it sounds an interesting concept (selling ads within computer games), and there’s been lots of bullish jam tomorrow news from the company, although nothing of commercial substance so far. H1 results in FY 12/2022 remained heavily loss-making. But at least it’s not likely to run out of cash again for now, and probably has enough cash to keep going through 2023. Could be interesting, if the product takes off, but there’s no firm evidence of that happening yet. (no section below)

Somero Enterprises (LON:SOM) (370p - mkt cap £207m) [quick comment] - 75 readers voted yesterday for us to look at this long standing SCVR favourite. Unfortunately, there’s not much more to say, as the last trading update came with interim results, which Roland reviewed positively here on 7 Sept 2022. Somero confirmed on 5 Oct 2022 that Hurricane Ian had not caused any material damage or disruption to the company or its staff.

Valuation looks really cheap, with a fwd PER of 7.4, and an 11.0% dividend yield. The balance sheet is also bulletproof, and Somero has a fantastic track record of cash generation. Why is it this cheap? Clearly the market (assuming it’s being rational, which is not necessarily the case), is pricing-in a cyclical downturn in business. Investors still seem obsessed with the near-death experience in 2008, when credit dried up. SOM is now much better financed than back then, and would such a drastic crash in demand be likely to repeat? Who can say? If profits halved, back down to 2017 levels for example, we’d still be on a PER of about 15, which is probably a fair price. So there’s a lot of downside already priced-in. Also, readers have pointed out that both Chairman and CEO are getting on a bit, and the shareholder structure is very fragmented, so SOM looks an obvious candidate for a takeover bid. Personally I wouldn’t be a seller here, if I held. Although we do have to be aware of the risk that forecasts might need to come down if a significant recession happens in the USA, its main market. (no section below)

Fonix Mobile (LON:FNX) Fonix (213p - mkt cap £213m) [quick comment] - Subscriber Helvellyn requested this share in yesterday’s reader comments, and 35 of you gave it a thumbs up, so let's have a recap on it. Fonix provides telephone voting IT for popular reality TV shows, and charities such as Children In Need. It has very sticky clients, and is very rare in actually having delivered on its promises when it floated in Oct 2020. I did a fairly detailed review of the admission document, and talked to the CEO, reporting back to you here in Feb 2021, with a positive view on the company, but I didn’t know it well enough to want to buy any shares at the time, and was a bit nervous about client concentration risk, although that has not been a problem since.

The latest news looked encouraging, and I gave this share a thumbs up here on 23 Nov 2022. Overall, this looks a really nice business, with an excellent track record, and every reason to believe it should keep churning out good profits and cashflows. You have to pay for that though, with a fwd PER of 23.3, so there’s no room for disappointment. Divis are pretty good, with a fwd yield of 3.5%. Balance sheet is fine, and in any case it's a capital-light business model - another positive. Fonix gets another thumbs up from me. (no section below)

Sylvania Platinum (LON:SLP) (104p - mkt cap £276m) [quick comment] - Jack used to report on this value share. I know very little about resources companies, so all I can really do is flag up the wonderful value attributes on the StockReport - super low fwd PER of 4.9, big dividend yield of 7.2%, and decent asset backing with a P/TBV of 1.31 (the lower the better, with this measure).

Why is it cheap? I don’t know, but obvious things might include perceived risk from operating in South Africa. Also risk from volatility of price, and demand for its metals (e.g. would the move to electric vehicles reduce demand for metals used in catalytic converters?). What is the life of the mines remaining?

Q1 results (Jul-Sep 2022) look impressive, with $139m cash held, and $18.6m “net profit”. Last balance sheet at June 2022 looks amazing! Stuffed full of cash, and no debt. Love it!

My opinion - I can only comment on the numbers, not the business model or the outlook. The numbers look fantastic. So if profitability/cashflow can be maintained at anything like the current level, then this share looks great value. The low valuation is clearly the market telling us that it doesn’t think current profit/cashflow is sustainable. Is that right or wrong? I have no idea, that’s your decision.

Saga (LON:SAGA) SAGA (132p - mkt cap £186m) (I hold) [quick comment]

This was also mentioned yesterday by reader eParo (and got 34 thumbs up), who pointed out that a new >3% shareholder had just declared, and that the share price has risen over 50% from recent lows. It seems to be rising every day at the moment, which is very welcome, but also unsettling when there’s been no trading update for a while. Is this just a speculative move, or do the buyers know something we don’t? Has everyone likely to sell already exited? Who knows.

The downward trend in broker forecasts stopped about 3 months ago. They’re now only expecting breakeven for FY 1/2023, which seems gloomy compared with the last outlook comments from SAGA (which I reported on here in late Sept 2022) indicating FY 1/2023 profit of £20-30m. I see that the 2026 bond, which plummeted to a low of 63 in early Oct, has since partially recovered to 73. Still weak, but better than it was. The 2024 bond looks fine now, with a running yield of 3.8%, and a price of 90. The company already has enough cash to pay off this 2024 bond in full.

I’ve mentioned extensively before, that I don’t see SAGA’s debt as a major problem - because most of it is just asset funding for the owned cruise ships (nearly new) which should now be beginning to earn their keep again, generating good cashflows. There’s no bank debt, just an unutilised RCF. There’s loads of gross cash on hand. So personally I don’t see liquidity as an issue at all - unless trading really falls off a cliff, and the company becomes loss-making - in which case the debt covenants could become a problem. We’ve had really good debates about this before, in the comments. I know some people see it as higher risk than me. A NED spent £200k on shares recently, at 94p.

My opinion - there’s some risk here with SAGA for sure, but if travel rebuilds as hoped (it’s recovery has been frustratingly slow so far), and the insurance business gets through regulatory issues without too much damage, then we might see a geared recovery in the equity price. Possibly. It’s not guaranteed of course, and we just have to wait and see what the next update says, and hope that it’s not more downgrades to forecast profit.

RM (LON:RM.) RM (52p - mkt cap £44m) [quick comment]

Several readers - rogerh, mojomogoz, Boon, AstonGirl, and planetx, all flagged interesting developments at RM in the reader comments to yesterday’s SCVRs. I generally find that when a number of smart investors converge on a particular share, it’s usually worth investigating.

RM has been in a dismal downward spiral, and when we last looked at it here on 17 Oct 2022, Graham rejected it as being too high risk, with both financial, and operational problems. The share price has since more than doubled, and there have been some interesting developments -

28 Nov 2022 it announced the proposed sale of 2 businesses, RM Integris (school admin management software), and RM Finance (school financial management software).They generated £2.0m in PBT for FY 11/2021. This disposal raises £12m in cash, plus a possible further £4m if competition clearance is achieved. It’s being done to reduce debt.

29 Nov 2022 RM announced the appointment of Investec, to join Peel Hunt, as joint broker. Neither of these brokers take any interest in private investors, so the only reason to employ them is to raise money from a larger pool of institutions. Hence I’d say a placing looks likely.

Does it need a placing? The last balance sheet at 5/2022 looks wobbly to me, with negative NTAV of £(29.9)m, once you write off goodwill other intangible assets, and the accounting pension surplus of £39.7m which is actually an actuarial deficit.

Bank net debt was £41.5m at 5/2022, and covenants had to be relaxed, suggesting debt is a problem. Although the £12-16m disposal noted above helps reduce that net debt.

28 Dec 2022 - this is the intriguing announcement that readers spotted, and flagged. RM has agreed to sell some IP addresses for a whopping $10.2m. It doesn’t say what these are, but clearly someone at the company was very shrewd, as they were acquired for no cost, and are hence not in the books at all as assets. It says an additional £4.1m of IP addresses were sold in FY 11/2022. This is remarkable news, and it says another 294,000 IP addresses remain owned by the company. We definitely need more information on this, as it’s something game-changing when a problematically indebted group suddenly finds, and sells £12.6m of assets which cost it nothing!

My opinion - I can’t find any broker notes unfortunately, but the disposals seem to greatly improve risk:reward for shareholders. So I think this share looks well worth re-appraising with fresh eyes.

Graham's Section:

Tesla (NSQ:TSLA) - I provide some analysis of the key points and questions surrounding Tesla stock. This inevitably requires some analysis of the character and track record of Elon Musk. Looking forward, I expect that Tesla’s margins are going to suffer as the company cuts prices in response to weakening demand. Questions about demand are central right now, as investors weigh up a weaker economic environment, higher borrowing rates, and the effects of Musk’s antics on Twitter. Regulators are taking a keener interest in Tesla’s claims to have “full self-driving” capabilities, and this may also weigh on the stock (unless Tesla can finally produce this technology). (lots more detail below!)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

None, as all my comments are in quick comments above, so I could get through lots more companies today.

Graham’s Section:

Tesla (NSQ:TSLA)

Share price: $113

Market cap: $353 billion

Disclosure: I do not currently have a position in $TSLA stock.

This is a stock I’ve shorted from time to time, but in recent days I’ve closed out my position in Tesla puts, so I’m currently flat, i.e. I currently have no position in the stock.

It’s a stock that has caused enormous pain to short-sellers over the years and I too, in aggregate, have lost some money attempting to short it. The biggest difficulty with short-selling - timing the trade - has been a major problem for people betting against Tesla.

For example, many of us noticed that the company was close to bankruptcy in 2018 (see comments by Elon Musk himself on this). Given that bankruptcy was on the cards, and yet the valuation still appeared to be very high, how could any self-respecting short-seller not bet against it?

But the company pulled through and went on to have a multi-year period of extreme share price strength (and volatility).

To help illustrate the volatility that we are dealing with, the stock has a Beta of around 2, i.e. it has double the systematic risk of the market as a whole.

2022 has been the biggest win for the bears so far, with the stock down 72% year-to-date. However, only 2.3% of shares are currently sold short, as most bears have given up at this stage.

I remain keenly interested in the stock and I’m open to the possibility of trading it again. For context, here are the market caps (in USD) of some major car manufacturers:

Tesla: $350 billion

Toyota: $185 billion

Volkswagen: $71 billion

Mercedes-Benz: $70 billion

Stellantis: $45 billion

Ford: $44 billion

Now let’s see how many vehicles each of these companies have recently sold on an annual basis (source).

Tesla: 1.2 million vehicles sold since Q4 2021

Toyota: 9.6 million vehicles sold in 2021.

Volkswagen: 8.9 million in 2021.

Mercedes-Benz: 2.1 million in 2021.

Stellantis: 6.1 million in 2021.

Ford: 3.9 million in 2021.

Visually, this looks like:

And:

So Tesla has by far the largest market cap out of these manufacturers, but it produces the fewest cars.

We can divide market cap by vehicles sold to get valuation per vehicle sold:

It is clear that Tesla is still being treated as “special”: its valuation is many multiples of other car manufacturers, when you account for Tesla’s smaller production.

If you categorise Tesla as a luxury vehicle manufacturer, and restrict yourself to a comparison with Mercedes-Benz only, the relative valuation of Tesla is still nine times the value of Mercedes-Benz. Against the likes of Volkswagen and Stellantis, the Tesla valuation is 35x - 40x the valuation of these other brands.

Riding the waves of popular investment themes

For Tesla to still enjoy this extraordinary valuation premium against its rival manufacturers, it must be doing something very different. In a nutshell, Tesla has the following special traits:

Pure EV production: Tesla only produces battery electric vehicles. No hybrids.

Tesla enjoyed first-mover advantage when it came to collecting EV subsidies and tax credits in the United States and many other countries, and has nothing to fear from proposed moves to ban petrol and diesel cars in the EU, UK and California.

Autonomy: for many years, Elon Musk has promised that Tesla cars will soon be autonomous. Thousands of customers have bought a package called “Full Self Driving”.

Artificial intelligence: as Tesla claims to be a leader in self-driving cars, it also claims to have special AI technology. At the company’s AI Day in 2019, Elon Musk said that Tesla “is arguably the world’s biggest robotics company because our cars are semi-sentient robots on wheels”. The company now has a prototype for a humanoid robot.

Genius leadership: Elon Musk is widely considered to be a genius and a visionary, the modern-day equivalent of Thomas Edison. “Don’t bet against Elon” is often said.

My view

To prevent this article from getting too long, I’ll try to summarise my own view under each heading.

Electric Vehicles: I’ve always viewed Tesla’s use of subsidies as a temporary competitive advantage, that would unwind as the subsidies were cancelled and as rival manufacturers increased their EV production.

Here is a recent chart from ev-volumes.com, showing that Chinese company BYD is actually the biggest EV company in the world, and the likes of VW, GM, Hyundai and Stellantis are also large players in the space. The non-Tesla companies have grown to substantial size, from a standing start:

(Key: the first bars (green) are BEV (battery electric vehicle). The second bars (blue) are PHEV (plug-in hybrid electric vehicle)

Volkswagen’s new CEO seems determined to accelerate VW’s transition to EV production, including models that are cheaper than any Tesla. It’s conceivable that VW, rather than Tesla, will be the largest Western EV manufacturer in a few years.

Autonomy

In 2016, Tesla began claiming that all of its vehicles had full self-driving hardware. It has a very long history of wild claims and promises around full self-driving. The result has been a series of lawsuits and California has now banned Tesla from calling its software full self-driving.

My own view is that Tesla has similar autonomous capabilities to many other manufacturers - many other cars are also capable of parking themselves, have motorway lane assist features, etc. I believe the difference is in the marketing: Tesla has repeatedly claimed that its software is special, and many of its customers believe that it is special. But that is about as far as it goes.

All other manufacturers use a radar system called LiDAR in addition to cameras, but Musk has repeatedly claimed that LiDAR is too expensive and is unnecessary. His strong views on the subject might come back to haunt him: there are signs that Tesla wants to start using radar again.

For an example of actual autonomous driving, see Alphabet’s Waymo project. Members of the public in San Francisco and Phoenix are able to take autonomous taxi rides from Waymo right now (disclosure: I have a long position in Alphabet).

Artificial intelligence

Tesla’s AI humanoid robot has no commercial reality and is not worth addressing here.

Tesla’s leadership

I first started studying Elon Musk in detail around the time of the SEC lawsuit in 2018, after Musk tweeted (while the stock market was open), that he intended to take Tesla private at $420 per share, and that funding was secured for this deal.

Under the terms of the settlement reached with the SEC, Musk cannot deny that he committed fraud.

My personal view is that this tweet was, when you consider the many billions of dollars worth of Tesla stock being traded at the time, the single biggest act of securities fraud and stock manipulation in the history of finance. I also believe that any normal CEO would have immediately and rightly lost their job after committing such an act.

There are very many other aspects of Elon Musk that I could go into here. Books have been written about him, and many more will be written about him. But we don’t have time to go into every detail here.

One particular red flag for Tesla that has become more apparent this year is that the company does not have the full attention of its CEO.

Again, any normal company would require that its CEO position is a full-time job and that other commitments would be limited.

At Tesla, however, Musk has also simultaneously been the CEO of two other companies for many years: spacecraft manufacturer SpaceX and a construction company called The Boring company.

As if that was not enough, Musk decided to get involved with Twitter this year, buying it and becoming the CEO.

Whatever your views on Musk’s Twitter strategy, it’s clear that his time is now even more stretched and this can’t be good news for Tesla.

Additionally, there are the political consequences of getting involved with Twitter: Musk can’t resist sharing his opinions on controversial topics, and many people have strong views when it comes to Twitter’s policies around free speech/misinformation. Therefore, it is inevitable that Musk’s actions and policies on Twitter are going to alienate and upset some percentage of the public.

This is now a major concern for Tesla investors: are potential buyers of the product being turned off by Musk’s Twitter antics? Has the association with Musk - long considered an asset - become a liability? Does the Tesla brand risk becoming tarnished beyond repair?

Summary/Conclusion

I’ve been a sceptic of this company for many years, so I do need to work hard to maintain an open mind.

There is no denying that the company’s financial performance has improved:

I’ve been surprised and impressed by the company’s improved margins, although it must be said that substantial aspects of Tesla’s accounts are a matter of opinion, e.g. revenue recognition for FSD sales.

The “Quality” metrics are currently good, too:

Should I be weighing these factors more heavily in my analysis? Perhaps. But given how rapidly the economics around this company and the car industry can change, I’m not sure that I’m willing to place much importance on the recent financials.

With borrowers facing higher interest rates in the US and elsewhere, I think there are serious questions around the demand for luxury cars over the next few years, which could have a disproportionate impact on the demand for Teslas. The company has already unveiled steep price cuts this month in the face of weakening demand.

The immediate outlook, therefore, does not look positive at all.

At the end of the day, I think the key questions around Tesla haven’t changed too much:

Does the company have special autonomous driving technologies?

Will the company be able to expand production to maintain high market share in EVs?

Is Elon Musk a genius and a visionary, or a fraudster and a liability?

Will competitors capture the imagination of consumers in the same way that Tesla did?

I’ve come to my own conclusions, but I love reading about the company - either from bulls or bears - and I look forward to your comments.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.