Good morning from Paul & Graham!

Thank you to Roland for covering my 2 days off. I was meant to be going to Dubai for a week, but travel companions had to cancel at late notice, so I didn't go, which was actually a great relief - it's far too hot (about 40oC) there at the moment, so I'm much happier in Bournemouth than Dubai! (not something you hear people say very often, admittedly).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

tinyBuild (LON:TBLD) - down 72% to 9.8p (£31m) - AGM TU - Graham - AMBER

An awful RNS with the double whammy of a profit warning and CFO resignation, plus lots more. There’s little promise of short-term improvement as the company blames conditions facing indie games in general. For new investors the cash balance reduces risk at this level.

SysGroup (LON:SYS) - 31.5p (£15m) - Final Results - Paul - AMBER

A backlog item, Paul reviews its annual accounts below. Looks OK, but bank debt has increased due to acquisitions. I go off at a tangent and discuss multibaggers!

Tandem (LON:TND) - down 11% to 187p (£10m) - AGM TU - Graham - AMBER

At Tandem, the more things change, the more they stay the same. They have a new CEO and the company continues to struggle with a range of economic and industry challenges. Expectations for the year are unchanged but I change my stance from Green to Amber.

PPHE Hotel (LON:PPH) - up 5% to 1112p (£471m) - Trading update - Graham - GREEN

I’m going green on this one as it sounds like occupancy is on its way back to pre-Covid levels. The company announces a very strong REVPAR metric for H1 and it expects to beat both revenue and EBITDA forecasts this year. At a big discount to NAV, I’m interested.

Moonpig (LON:MOON) -

Paul’s Section:

De La Rue (LON:DLAR)

36.5p (pre market) (£71m) - FY 3/2023 Results - Paul - AMBER

This group prints banknotes, and has another division which makes security authentication products and software to prevent or detect counterfeit goods.

This share should be seen as a high risk, special situation.

At first glance this announcement looks reassuring, I’m writing this at 07:57, so don’t know how the share price will react, but I think it could bounce today, because -

FY 3/2023 results are in line with expectations,

Outlook/current trading also in line (although H1 weak, H2 weighting expected, which isn’t great)

Order intake sounds OK, and

Net debt far too high, but terms renegotiated with bank,

Pension fund trustees have agreed deferral of large cash injections,

Going concern “material uncertainty” seems to have been removed.

Still loads of problems to resolve, but I think we could be set up for a bounce today, might be an interesting one for any traders reading this, so I’ll pop this up at 08:00 and do more detail a bit later.

Water Companies

A topical issue that I had a look at last night. Press reports that Thames Water could be crumbling like a Victorian sewer, under its £14bn debt pile. They suggest the Govt is supposedly preparing contingency plans to take it into some special, temporary, administration type regime, if it financially fails.

We’re all no doubt disgusted by the horrible reports of water companies discharging raw sewage routinely, and frequently, into our rivers and beaches. Clearly something drastic has to be done. Is nationalising water companies the answer? Who knows, but I thought I would investigate the accounts of a sample listed water company, Severn Trent (LON:SVT) to see if it’s true that greedy management and shareholders are stripping it of cashflow, and starving it of capex.

The numbers show a rather different picture.

Consider the multi-year cashflow statements from SVT below. What this shows (the top two rows highlighted) is that substantially all of the operating cashflow is spent on capex (i.e. ploughed back into improving/renewing the water/sewerage system) -

The bottom 3 highlighted rows show that dividends and debt interest are mostly funded by issuing more debt, and (in 2022) equity.

As a friend pointed out, you could just as easily argue that the increased debt was funding some of the capex, and divis are paid out of operating cashflow. A fair point. However, what I’m interested in, is whether nationalising SVT would lead to unleashing a fresh pot of money to increase capex (fixing the leaks & the sewerage discharges, over the long term), funded by stopping dividend payments to shareholders. Whilst that is a nice populist narrative, you can see from the numbers above, that it’s false. If nationalised, SVT would indeed not have to pay divis to shareholders, but that would not give it any significant extra money to spend on capex.

The divis are being funded by growing the debt pile each year.

Hence this share might be a good one to short, if you’re a risk-taker (shorting is not something I would recommend to anyone, unless you’re a professional risk-taker, and know what you’re doing), since it seems to me the divis in the sector look unsustainable, and politically it might be better for the Govt to let the companies fail, and then nationalise them.

One way or another though we, the end customers, will have to pay more for our water/sewage disposal than we are now, if we want things cleaned up. The cashflow statement clearly shows that there is not a bonanza to be had by stopping dividend payments to shareholders,as they’ve been funded from debt, not from cashflows.

Water bills have always struck me as too cheap. I only pay about £500 pa for a whole year’s supply uninterrupted of clean, drinkable water, and disposal of all my sewage. That doesn’t seem much considering what’s involved, less than £2 per day is crazily cheap I think.

It’s always worth going to the numbers, and forming your own opinion. As in this case, the result is often completely different to what I expected to see, and what all the politicians & commentators are saying!

Here’s the trend on SVT's balance sheet, of ever growing fixed assets, and debt. So the truth is they’re spending a lot on the infrastructure, but it’s clearly still not enough (although I haven’t checked whether SVT in particular is guilty of sewage discharges, and I picked this share at random from the several listed utilities) -

Anyway, I just thought this was interesting.

Personally I never invest in any regulated, formerly public sector shares. The debt amassed by the water companies looks a serious problem, hence the shares could be severely punished. I wouldn’t want to be holding any of them.

I suppose with zero interest rates, it made sense for water companies to keep racking up cheap debt. Now though, as bonds mature, it's a whole different ball game. Thames Water bonds are apparently way into junk territory now.

SysGroup (LON:SYS)

Down 3% to 33p (£16m) - Final Results - Paul - AMBER

SysGroup plc (AIM:SYS), the multi award-winning technology solutions provider, is pleased to announce its audited final results for the period ended 31 March 2023.

I only seem to look at this share once a year, at this time of annual results.

The figures look OK. My brief notes from a quick skim -

Revenues up a lot, +47% to £22m, mainly from acquisitions, plus +6% organic.

Adj PBT £2.2m, up 9%

Statutory loss £(0.1)m PBT.

Normally I would switch off at this point, but in this case most of the adjustments look OK, being mainly a £1.7m non-cash amortisation charge of customer relationships, which is goodwill by another name - related to acquisitions, not internal capitalised payroll (of which there seems to be very little).

Acquisitions - bank debt (£8m Santandar facility) has been drawn down for acquisitions, it’s making surprisingly material deals given its market cap - risky perhaps in the current climate?

Balance sheet - not good. Very top heavy with £28m intangible assets (see note 9), practically all goodwill & customer relationships (which is the same thing basically). Write off the intangibles, and the related deferred tax, and NTAV is negative £(5)m. The company says its balance sheet is “very healthy”, but it isn’t. The justification is that net debt of £1.3m (excludes deferred consideration though!) is only 0.4x EBITDA. I should meet them and give them a lesson in balance sheets! (sounds like they need it)

Outlook - current trading is in line.

Multibaggers - Megan did a recent talk on Mello, and series of articles here about finding multibaggers, which got me thinking. Acquisitive groups can occasionally produce some stunning multibaggers. Especially through combining both earnings growth, and PER multiple expansion. So buying when it's on a lowish PER is important for a multibagger, arguably.

However, it’s all about having CEOs (and others) who are brilliant dealmakers - think Ideagen, Judges Capital, and SDI - buying good businesses on the cheap, and getting the acquirer's shares highly rated as a growth company, hence each acquisition creates shareholder value. Volex (I hold) is doing exactly the same strategy right now, but has yet to be rewarded for it with a decent rating. Often the companies acquired are retirement sales of private companies.

With all 3 of those shares mentioned above, there was absolutely nothing in the figures early on to suggest they would be multibaggers. It was all about spotting & backing great management. This is often just a hunch, eg. David at Ideagen is a lovely chap, but was all over the place most of the time, yet still managed to pull off a series of shrewd deals over the years, creating a multibagger, and selling it at the top of the market.

To get multibaggers, I've noticed that not selling your shares along the way, even when the shares got over-valued, is another common trait. Easier said than done.

Trouble is, for every Judges Scientific, there are probably dozens of companies that failed to deliver shareholder value from acquisitions - eg remember Vislink?! Look how often large swathes of goodwill have to be impaired after acquisitions have gone wrong. Many management teams do acquisitions to empire build, and grow the business so they can pay themselves more, I reckon. If this is done using debt, it can be disastrous, and result in heavy dilution or insolvency if things go wrong. Management can just walk away, but shareholders suffer the losses.

So what is management at SYS like? Do they display signs of being brilliant dealmakers? I’m about to watch an IMC webinar from Sept 2022, but note today that the CEO is stepping down. So that rather means we can’t judge whether SYS might become a multibagging acquisition vehicle until a new CEO is found. Hence I wouldn't pay a premium for it right now. I don't know why the CEO is stepping down, but surely he would be llikely to stay on, if an exciting growth story was developing?

Overall though, I can’t see anything particularly wrong with SYS. It looks an OK business, with maybe a bit too much debt for my personal liking. It’s not clear to me at this stage though, where the upside potential is? Let's keep an eye on it though.

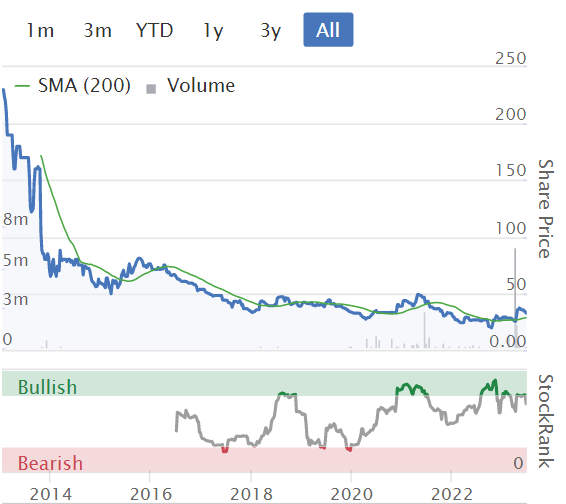

SYS has a poor share price track record since if floated in 2013, so something would need to change to convince me it's now a growth company -

Moonpig (LON:MOON)

Up 6% to 146p (£500m) - FY 4/2023 Results - Paul - AMBER/RED

This is mainly the online greetings cards/gift business Moonpig (admit it, you just sang the jingle in your head!), which is 70% of revenues, Greetz (17% revenues) - similar to Moonpig, but in the Netherlands, and newly acquired Experiences business (13% revenues) - which was acquired in July 2022, called Buyagift - acquisition details here.

I’ve previously been negative on this share, because it wrecked its balance sheet with the ill-timed acquisition of the Experiences business, and is now struggling with too much debt, and consumer demand has turned down. Plus it looked over-priced still, even after a major drop from the 350p IPO in Feb 2021, where selling shareholders somehow convinced institutions to value it at £1.2bn. Their remaining original shareholders may still be an overhang possibly? It looks like another opportunistic, and over-priced 2021 float where a pandemic boost was passed off as structural growth. Still buyer beware, nobody is forced to buy new issues, and we’re always highly sceptical of nearly all of them here at the SCVR, which has proven a sensible rule.

Anyway, here are the main points I jotted down whilst reviewing the accounts published today for FY 4/2023 -

Revenue up 5% to £320m. However this includes £41.6m from the acquisition of Experiences. Reverse this out, and organic revenue fell 8.5%

Very good profit margin (adjusted), with £48.0m adj PBT (LY: £51.5m). However, again the notes show that £11.4m PBT came from the Experiences acquisition, so organic adj PBT fell from £51.5m to £36.6m, down 29% - not good at all!

Adjustments are quite large, at £c.£13m, of which £9m relates to bonuses & share options pre-IPO.Share-based charges overall are too high, at £8m this year and last year. I think that’s taking the proverbial, given that’s almost a quarter of the profit (pre acquisition contribution). It really grates to see management rewarding themselves heavily with share options, when the share price has tanked. Yet we see that at many companies. So often at the moment, I open an RNS marked as Director transactions, hoping they're buying with their own money, but nearly always it's Directors giving themselves free options at our expense, despite presiding over a plunging share price. What planet are these people on? Talk about entitled!

EPS is 7.7p diluted (statutory), and 10.9p adjusted. So a PER of 13.4x on the adjusted earnings number might appeal to some investors.

Bank debt has to be taken into account though, and is too high at £148m net bank debt, although that has come down from £189m just 6 months earlier (Oct 2022). The commentary says debt reduction is a priority, so there are no divis.

Interest costs seem to have been hedged just before the mini-budget kerfuffle last year, a smart (and/or lucky) move!

Finance costs are very high, at £13.6m, which is taking a big chunk out of profits - although that could be seen as future upside, as it deleverages (or hopes to anyway).

Outlook - in line with expectations so far in FY 4/2024. Only expecting negligible growth in H1, but an acceleration in H2. Not really an exciting growth stock, more a value share now, that might deserve a single-digit PER, because earnings are falling.

Balance sheet - is awful.

NAV is negative at £(34)m, including £210m of intangible assets. Write that off, and NTAV is mind-bending negative £(244)m. The group has heavily negative working capital (hardly any inventories or receivables, and customers pay cash up-front). Despite this favourable setup, it also loaded up on bank debt, with £170m in long-term borrowings. Debt really does need to come down a lot. The multiple to EBITDA looks fine, but EBITDA is a nonsense number at this company - e.g. it capitalises 23% of its total staff costs onto the balance sheet (see note 7). So I think the bank debt is a bigger worry than the company thinks.

Cashflow statement - £12.9m capitalised development spend (payroll) stands out. Also £88m paid for the acquisition of Experiences.

Going concern statement is clean. Being an online business, it does benefit from variable cost, unlike bricks and mortar business with fixed costs, which find it harder to cope with a downturn in demand.

Acquisition - last time it seemed to me they had overpaid for the Experiences acquisition, but the notes say it made £11.4m in this period, and a full year pro forma would be profit of £13.4m, which is not bad at all. It’s doing a great job of masking the deterioration in performance of the original business too!

Merchant accrual liability of £56m has appeared in note 16. This relates to cash paid up-front (and I think recognised as revenue & profit) by buyers of the Experiences vouchers. Not all of them are redeemed, which makes that element pure profit (but probably also unhappy customers). But it also means that MOON should have a ring-fenced cash pile of £56m relating to experiences vouchers note yet used, which it doesn’t. That’s rather aggressive accounting, and I think there’s a strong argument for regulations to be changed to keep customer cash segregated.

Paul’s opinion - underwhelmed. Underlying performance has deteriorated a lot, obscured by the new profits from the acquisition. I don’t suppose postal strikes have helped. There are other companies in this space, and a resurgent Card Factory (LON:CARD) (I hold - a recent opening purchase) might chip away at MOON’s business, whilst it is focusing on generating cash to pay down its bank debt.

Overall then, I can’t see why anyone would want to chase MOON shares any higher, but they might, people buy for many reasons.

RED seems a bit harsh, so I’ll shift to AMBER/RED.

Graham’s Section:

tinyBuild (LON:TBLD)

Share price: 9.8p (-72%)

Market cap: £31m

There have only been two mentions of this video game company in the SCVR archives: first by myself in January (share price: 80p) and then by Paul in March (share price: 52p).

The market has been pricing in disappointment as the shares continued to slide, reaching 34.5p last night:

This morning, we have a horrible profit warning:

First-half performance below expectations due to lower contribution from platform deals and the underperformance of Red Cerberus and Versus Evil has resulted in a material reduction to FY consensus revenue and a more acute reduction in Adj. EBITDA in 2023 and 2024.

The reference to “platform deals” is elaborated upon as follows:

As witnessed across the industry, distribution platforms have been significantly downsizing the amount of investments in non-AAA games. Platform deals have been an important driver of tinyBuild's growth and profitability over the past few years, and the Board expects this downward trend to materially impact revenues.

Remember that TinyBuild is a publisher of “indie” games, i.e. games that are not mainstream and are unlikely to be at the cutting edge of software. I noted previously that I had never heard of any of the games in TinyBuild’s portfolio.

On top of that, two businesses acquired in November 2021 are underperforming. “Strategic options are under consideration”, which sounds ominous. And various other possible reorganisations are being considered for the company’s over a dozen game studios..

Cash at the end of 2023 is expected to be $10 - 20 million, versus prior expectation of over $26.5m.

That range of possibilities for the expected cash balance is very wide but I suppose it’s better to be approximately right than precisely wrong!

In more bad news, the CFO resigns for personal reasons.

He had already taken a period of leave, and so the company is ready with a chosen successor: their current Head of M&A, who is a former equity research analyst.

As Head of M&A, I wonder if he takes responsibility for the poor performance of the November 2021 acquisitions?

They also appoint a Chief Commercial Officer, another internal hire.

Portfolio/pipeline: I think there’s a typo here, as the company talks about games it published in the first half of 2022. It says that back catalogue titles continue to perform well, and it has announced “a record number of new titles for future release”.

Outlook

As reported by other companies in the gaming sector, the market backdrop has become increasingly challenging with distribution platforms reducing investment. As a result of this impact and underperformance at Versus Evil and Red Cerberus, the Board is now expecting to be materially behind revenue market expectations in 2023 and 2024. This impact becomes more acute at the Adjusted EBITDA level as a result of increased development costs, amortisation charges and a less favourable revenue mix.

FY23 is expected to be a low point in terms of financial performance and cash levels and the Board is looking forward to the contribution of new larger budget games scheduled to launch in 2024 and 2025. Early indicators of consumer traction across the Company's pipeline, including the reception of recently announced games, are encouraging and bode well for the future.

CEO comment - he is filled with confidence due to the “incredibly strong pipeline of new games under development with the potential to create multiple new long-lasting franchises”.

Graham’s view

This is a true horror show RNS. It’s got everything:

Profit warning.

Cash warning.

CFO quits.

Internal hires to fix problems caused by the existing team.

Big-picture problems (fewer platforms deals) with no signs of this ending.

Possible reorganisations/restructurings across the company.

Typos

Do the shares deserve to be clobbered by 70%? Well this is an unforgiving market for UK micro-caps and that is what happens when confidence is lost in these conditions.

My own view is that with the company having (probably) over $10 million of cash by the end of the year, I can see the shares potentially enjoying balance sheet support at some point in the not-too-distant future.

Remember that this is a 2021 IPO - the year of many of the worst IPOs in living memory. Were the profits this company enjoyed in 2020/2021 a sign of things to come, or were they a short-lived side effect of Covid? At the moment, it looks like the latter.

But the market should look forward, not back. At a £30m market cap, this becomes very cheap on metrics such as EV/sales, although admittedly I don’t know how low sales might be this year (previous estimate: $69 million).

Therefore, I won’t give this stock the thumbs down: it is already cheap relative to its turnover, and I’m not sure that it needs to get much cheaper than this. So I’m neutral. My commiserations to anyone who held it overnight (including the CEO, who owns 38%).

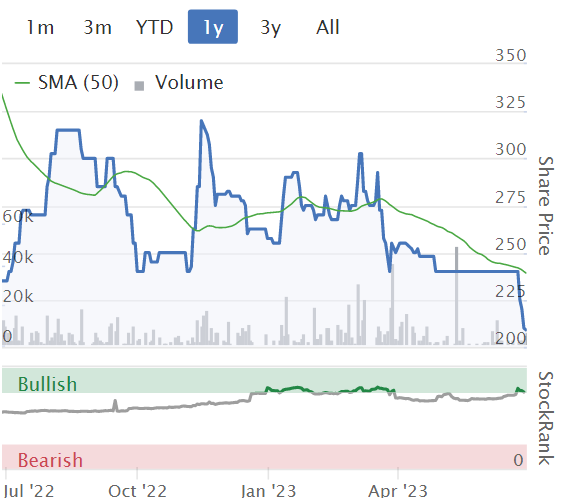

Tandem (LON:TND)

Share price: 187p (-11%)

Market cap: £10m

I gave this share the green light earlier this year (1st time, 2nd time) but hopefully I included enough warnings that things would probably not be plain sailing for shareholders! As a former holder of these shares, I know all too well how accident-prone they are.

Here is the latest bad news from Tandem: “cautious buying behaviour” continues. Trading conditions remain “persistently challenging”, further compounded by high interest rates and the cost of living crisis.

And furthermore:

We have also experienced a shift in the buying habits of national retailers who are transitioning from Free On Board (FOB) purchases to Direct Delivery (DD). This change naturally alters the pattern of our sales, aligning them more closely with the end customer's buying behaviour and therefore the timing difference in sales is to be expected to be weighted in favour of later in the year compared to prior periods.

Tandem’s goods are imported from China and under Free on Board arrangements, Tandem’s responsibilities end as soon as goods are loaded onto a ship. But without those arrangements, I think Tandem could be on the hook for a lot more responsibility when it comes to shipping - I would welcome any insights readers might have on this point.

This shift also seemingly introduces more seasonality, as sales aren’t made until later in the year, when the end-user is buying.

Other key points:

Total sales down 26% year-on-year

Toys, Sports and Leisure down 46% (partly due to overstocking and bad weather).

Bicycles down 20% although Q2 was ahead.

Home and Garden down 30%.

Emobility (including e-bikes) are up 51%.

Outlook

It’s a long outlook statement, and it finishes by saying “we therefore maintain our view of achieving market expectations of our performance for the full year”.

The expectations, as published by Cenkos, suggest revenues of £30m, adjusted PBT of £1.2m, and adjusted EPS of 17p.

This is despite “no signs of abatement” of the current, difficult market conditions.

Graham’s view

I previously gave this stock the cautious thumbs up, thinking that there was enough value on offer to justify a positive view.

It remains “cheap” today with a ValueRank of 86, which is before the latest share price weakness.

Unfortunately, there just isn’t much quality with this one and after reading today’s statement I wouldn’t be tempted to buy back in, even at lower levels than this. Today’s statement is a stark reminder that things are always going wrong with this one and conditions are always challenging - or if they aren’t now, then they will be again soon.

My positive view was also related to the appointment of a new CEO and a management shakeup, but those factors aren’t bearing fruit yet.

I am therefore changing my stance from GREEN to AMBER on this one.

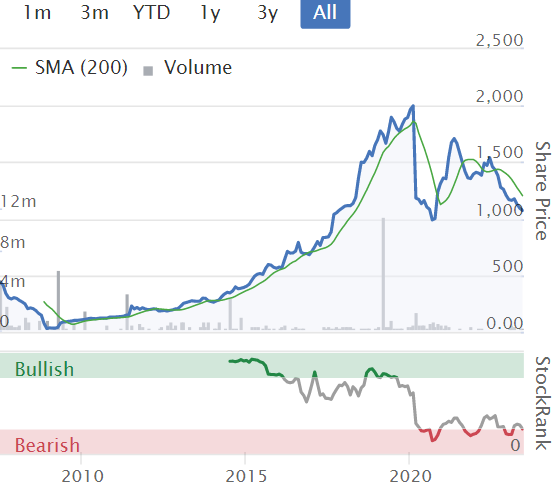

PPHE Hotel (LON:PPH)

Share price: 1112p (+5%)

Market cap: £471m

We discussed this in some detail in April: the shares were trading far below stated net asset value, but occupancy rates remained short of pre-Covid levels.

Today we have a trading update for Q2. Key points:

Strong trading conditions and forward booking momentum.

REVPAR is £109 (vs. £93 in pre-Covid 2019, i.e. up by 17%).

17% growth in REVPAR is highly encouraging to me as it suggests that occupancy is getting back to where it was pre-Covid. The company does say there has been “broad occupancy recovery” in the UK and Netherlands, though Germany had a slower start to the year.

Here is how I think about the key metric REVPAR (revenue per available room):

If cumulative inflation since 2019 has been c. 25%, then in order to match the performance of 2019 in real terms, PPHE needs REVPAR to be up by 25%.

This metric depends on two factors: occupancy and pricing. I think that PPHE’s pricing has matched inflation, more or less. So then it all comes down to occupancy.

Occupancy was over 76% in 2019, but still only 67% in Q1 2023. It sounds like Q2 was better.

We also get an outlook statement:

Forward booking momentum remains encouraging, and the revenue contribution from the recently refurbished and relaunched properties, including Grand Hotel Brioni in Pula, are expected to be significant.

As previously announced, the Group's EBITDA margins have been impacted by both broader operating cost inflation and, particularly, energy cost inflation over the last six months…

Taking all of these factors into account, the Group now expects to deliver FY 2023 revenue of at least £400 million and EBITDA of at least £120 million.

Previous expectations as compiled by the company suggested revenue of £352 - £370 million and EBITDA of £106 million to £111 million. So this is an impressive beat.

Graham’s view

It’s nice to be able to cover a positive news story today!

I wrote previously that this company could be trading too cheaply if it recovered to pre-Covid levels of trading soon.

While it’s not fully there yet, I now have confidence it is on the path to achieving this. I could be wrong, but that is my current belief based on the trends.

I am therefore happy to upgrade my stance on this from AMBER to GREEN, on the basis that it trades at a significant discount to NAV and is making its way back to prior performance levels. It also has the potential to generate nice returns from managing hotels and generating returns for the planned European Hospitality Real Estate Fund.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.