Good morning, it’s Paul and Jack here with the SCVR for Thursday.

Please bear with us this week, as we’re experimenting with new ideas for how to seamlessly contribute sections into the same article. Yesterday seemed to work out well. I enjoyed having a good rummage into the weird put options at M&c Saatchi (LON:SAA) which turned up a potentially nasty dilution situation. So be careful with that one. If anything looks odd, in the accounts, it really does need to be properly checked out.

Timings - Jack did an early section, many thanks for that. Now I'll be producing the usual 4 or 5 sections throughout the day. Likely to be finished late afternoon, as some of these sections take a long time to dig into, and write up! Let's aim for 4pm finish. Update at 16:26 - the main sections are now done, but I'll do a bit more to look at one or two more companies. Extended finish time now 6:30pm. Today's report is now finished.

Agenda - these results/trading updates have caught my eye;

Foxtons (LON:FOXT) - Trading statement

Begbies Traynor (LON:BEG) - Red Flag Report

Proactis Holdings (LON:PHD) - Final results

Christie (LON:CTG) - Interim results

Redde Northgate (LON:REDD) - from yesterday, several people have asked if I’d look at it

.

** This first section contributed by Jack Brumby **

Hornby (LON:HRN)

Share price: 37.4p

Shares in issue: 166,927,838

Market cap: £62.4m

(Jack writing)

This developer, producer, and supplier of hobby products probably has some goodwill with certain investors who have used Airfix and the rest before.

Long-suffering shareholders might be less fond of the company as a listed entity, however.

It’s a potentially interesting case here.

What some once assumed to be the likely fate of Games Workshop (LON:GAW) has happened at Hornby: from 2015, Hornby (LON:HRN) has reported declining financial results due to a sustained fall in collecting customers and the rise of video gaming.

A brief summary of recent trading:

Shares dropped by more than 50% in a year in 2015/16 and Hornby announced it would cut more than half its less profitable toy ranges. In the year to 31 March 2017, revenues fell further to £47.4m from £55.8m, while underlying losses widened to -£6.3m from -£5.7m.

In July 2017, its largest shareholder Phoenix Asset Management (PAM) bought 17.6m shares for 32.375p for a 55.2% holding. This triggered a mandatory takeover offer of valuing Hornby at £27.4m and led to the resignation of Chairman and CEO later that year.

PAM then brought in a new management team to oversee the turnaround. Since then, the shares have been stubbornly range-bound despite (presumably) ongoing operational progress.

PAM picks up some interesting companies. Another one that comes to mind is Stanley Gibbons (LON:SGI) , the antiques and coins dealer.

Neither share price has come good as of yet, but PAM is a dedicated deep value investor so I do keep checking in on progress. Today Hornby releases its interim results.

Highlights:

- Group revenue +33% to £21.1m,

- Operating PBT has swung from a loss of £2.5m to £0.2m,

- The group has gone from net debt of £8.4m to net cash of £4m

The soundbite from Lyndon Davies, CEO, runs:

Hornby has moved into profitability, the growing sales and margins built on the back of the introduction of some fantastic new products, new technology and the changing environment.

And, later on,

...we have not only weathered this shattering storm [the pandemic], our sales have increased by 33% in the first half of 2020 (compared to prior year), moving Hornby back into profitability. The growth built on the back of the introduction of some fantastic new products, new technology and the changing environment. And this was in the 'quieter' half of the year; traditionally 55%-60% of our sales fall into the second half.

This sounds surprisingly upbeat and the headline figures look really positive.

The statement also reads like quite an engaging and characterful update.

Turnarounds rarely turnaround, and the ones that do often take longer than expected. This is proving to be the case here but the company has now registered a small profit, which could be an important psychological milestone.

What’s important here is the strategy, and this is ticking some boxes particularly with a planned migration to online:

No-one could have foreseen the acceleration in online shopping that took place this year. We want to engage more with our existing customers and to recruit new ones, and we all know that retail will never be the same again. We need to create 'Community' and have more direct engagement, where customers come to us to learn about our products... over time each of the brands will develop their own identity and will move in the direction that best suits their needs. As we move forward our website will feature rich content with images and videos generated by ourselves and our customers, a place where we can interact.... Foremost in my mind is 'Community'.

If Hornby really can accomplish this and use its brands and IP to create an engaged and loyal online community, then there might be life in the old dog yet.

Directors have been buyers over the past couple of years, which is encouraging.

Conclusion

Hornby has net cash and solid liquidity scores. There are no huge flags in its balance sheet but the group continues to bleed cash on the cash flow statement. It looks like it has had to go, cap in hand, to shareholders fairly consistently to fund its turnaround.

The group has many years of losses so the track record is pretty dire - but no brokers are following it, so if the group really is turning around then that could present a substantial opportunity for retail investors.

The shares are very illiquid though, so you’d have to do your research and be sure of your convictions before building a stake as I imagine it’s very easy to get trapped here if trading heads south.

The two figures below suggest a buy or sell of around £4k but this could easily change if everybody starts buying or selling at the same time.

In all though, this is an interesting case and probably worth following in more detail. Timing could be key - if you’re too early then you’re just another long-suffering shareholder funding a turnaround that is - surprise, surprise - taking longer than expected.

The risks are pretty clear but there are some promising signs that Hornby is approaching some sort of inflection point. ‘The boy who cried wolf’ and all that, but the stocks that get it right can observe a dramatic and material rerating.

So on that basis, it’s probably worth further investigation.

.

Foxtons (LON:FOXT)

Share price: 32.3p (down 6% today, at 10:04)

No. shares: 275.0m

Market cap: £88.8m

(I do not currently hold)

Disclosure: I previously had some FOXT in my spread betting account, but had a margin call earlier this week, so had to cull one or two lower conviction holdings, including this one. Therefore I do not currently hold any position in Foxtons. At some stage I'll probably buy back in, when funds permit, as I continue to like this share for its recovery potential.

Foxtons Group plc (LSE: FOXT), London's leading estate agency, today issues its trading update for the third quarter ended 30 September 2020.

It looks as if there’s been a strong bounce-back in Q3 (July-Sept 2020), after the lockdown period ended;

Business activity significantly increased in the third quarter with valuations, instructions, applicant numbers and viewings all considerably up on last year across both Lettings and Sales. The business returned to full capacity by the end of September, with no use of the Coronavirus Job Retention Scheme (CJRS) in October.

That’s encouraging, although of course with the sales department, it takes time to rebuild the pipeline of transactions. Therefore actual revenues are down on last year;

Group revenue for the period was £28.5m, down 10% on the prior year (Q3 2019: £31.7m1), and over the first nine months of the year was £68.9m, down 18% on the prior year (2019: £83.5m1).

Lettings department - this is quite interesting;

Revenue for the third quarter was down 8% to £19.5m (Q3 2019: £21.3m). Whilst volumes in the London lettings market over the summer months returned to close to pre-pandemic levels, average revenue per tenancy was lower due to fewer high value short-term lets and a significant reduction in the number of overseas student tenants and corporate relocations.

I’ve heard that rents are coming down in London, often quite substantially, due to some people relocating to the countryside, given that working from home has become so much more prevalent, and could be semi-permanent in future, who knows?

Sales department - encouraging signs here;

Revenue for the quarter was £6.9m, down 18% (Q3 2019: £8.4m) due to depressed levels of exchanges, a hangover from the spring lockdown. However, sales activity, including the number of instructions and number of offers accepted, has been significantly higher than the same period last year, driven by pent-up demand post lockdown and Stamp Duty relief. This started to convert into revenues in September, which were up 9% on prior year.

At the end of the quarter, the sales commission pipeline, based on the value of properties 'under offer', was up around 30% on the same time last year. However, as has been widely publicised, transactions are taking longer to move through to exchange and the economic uncertainty is also driving higher than normal transaction fall-through rates.

That’s a bit mixed. I’ve heard that there are bottlenecks with local authority searches, causing long delays. This is apparently causing some buyers to pull out, if they don’t think they can complete by the end of the reduced Stamp Duty period. Sounds like Chancellor Rishi Sunak needs to extend the Stamp Duty discount - or make it permanent even. My perception is that he seems to do the right thing, but only at the last minute, after a public outcry, and when some damage has already been done. Let’s get those letters rolling into our MPs!

Liquidity is excellent. Remember Foxtons did a placing earlier this year, to eliminate its bank debt, so it’s in a comfortable position;

At the end of the period, the Group's cash balance was £43.2m, benefitting from VAT deferral of £3.5m and lease deferrals of £3.2m, part of which will be repaid in the remainder of the financial year. The Group has no external borrowings.

I’ve just had a quick look at the last reported balance sheet, and it’s fine overall. There’s a lot of goodwill/intangibles, and a large deferred taxation creditor (which might relate to intangibles, I’m not sure, I tend to just ignore deferred tax).

Outlook comments - here are the key points;

We have successfully re-built the sales commission pipeline to its highest level in 3 years, delivered a resilient lettings performance and progressed our lettings book acquisition strategy.

Although the London residential market has gained momentum, we remain cautious as economic uncertainty causes more sales transactions to fall through and is putting downward pressure on rents.

My opinion - I like this share, for a future recovery, and it’s resilient enough to survive. Lease liabilities are quite high. The problem is that reduced Stamp Duty is the key driver for the London property sales market, and that could be withdrawn fairly soon. Hence the risk is that Foxtons could face a bleak 2021. We do have a highly interventionist Government though, so there is probably a decent chance that Stamp Duty reductions may be extended. It would be worth doing some googling on that.

The shares are hitting new lows, which seems at odds with a relatively perky Q3 update today. Hence a cautious thumbs up from me, for the long term recovery potential. Although I don’t know how the shorter term outlook will pan out.

.

Begbies Traynor (LON:BEG)

Given the circumstances, I’m actually quite surprised these figures are not far worse;

.

Clearly Govt support measures, unprecedented in their scale, are keeping many businesses afloat which might otherwise have failed.

Although this is ominous, and suggests the underlying picture is a lot worse than the figures suggest;

... backlog of court action preventing many CCJs and winding up petitions being issued…. The rise could have been much higher, were it not for reduced court activity due to the coronavirus pandemic, which has limited the number of CCJs and winding up petitions being issued against indebted companies and the ban on winding up petitions for Covid related debts.

Data shows there were 26,244 CCJs lodged against companies during July, August and September in 2019, with only 10,045 lodged during the same period in 2020, a fall of 62%. The situation is even more acute with regard to more serious winding up petitions. During July, August and September 2019, 1,019 were lodged compared to 101 during the same period in 2020, a fall of 90%.

With so many businesses limping along there could be a flood of insolvencies when the courts do get back to anywhere near normal capacity and attempt to clear the backlog of pending cases. This in itself, combined with the end of the furlough scheme and other government support measures, is likely to have a material impact on the UK business failure rate.

There’s more of the same in the rest of the report. It paints a very gloomy picture, which won’t be a surprise to any of us.

My opinion - what I’m seeing almost every day, when writing these reports, is that most companies do seem to be recovering. Generally speaking most UK listed small caps seem to be surviving, and recovering, and not under insolvency pressure. Therefore I feel the Begbies report paints a rather skewed picture, it’s important to remember that Begbies focus just on companies in financial trouble, not the economy as a whole. Hence it might be overly gloomy.

I think we’re likely to see continuing forms of Govt support. Maybe not on the huge scale of the schemes launched in the spring/summer, but it wouldn’t make sense for the Govt to switch off the taps, and stand back whilst large numbers of companies go bust.

Casting my mind back to the 2008/p financial crisis, I recall that a huge wave of insolvencies was predicted then too, but actual insolvencies were far less than expected. This was because interest rates were cut to near-zero, which meant that banks were often prepared to be lenient with problem borrowers, since the cost of keeping borrowings static was so low. As long as borrowers could pay the modest interest charges, then it made sense for the bank to wait for better times, rather than foreclose and sell off assets in a fire sale. Many "zombie" companies survived against the odds, and did manage to gradually reduce debts in subsequent years.

Whereas in the 1990-93 economic downturn, interest rates were sky high, causing banks to be brutal in forcing many businesses into unnecessary insolvencies. I worked for PWC at the time, in a junior role in the insolvency department, and I saw many businesses destroyed which would have survived, if interest rates had been low. The banks got often very poor recoveries on their debts by using expensive insolvency procedures, and I think they learned from that, and have been very reluctant to pull the plug on companies unless they're complete basket cases.

Overall then, I’m not convinced the outlook is necessarily quite as gloomy as Begbies suggests. Although it very much depends on what support measures the Govt implements. Time will tell.

.

Proactis Holdings (LON:PHD)

Share price: 31.8p (down 1% today, at 14:00)

No. shares: 95.5m

Market cap: £30.4m

Proactis Holdings PLC, the business spend management solution provider, today announces its audited results for the financial year ended 31 July 2020.

The company highlights positive KPIs, but the key results figures are poor. This included the covid/lockdown period, but software companies should have done better than most, due to having recurring revenues. So I’m not impressed with these numbers. In particular, the 56% drop in adj EPS;

.

It’s a £19.3m loss before tax at the statutory level, which includes a large £14.8m impairment of intangibles, and £10.7m regular charge for amortisation of intangibles.

Note that the impairment charge is not a one-off, there was an even bigger £27m charge last year. People say, oh it’s non-cash, but I challenge that. This was money that had previously been paid out for supposedly valuable acquisitions, which have now turned out to be not so valuable. So it’s still cash down the drain, just old cash, not new cash!

Debt - is much too high, in my view;

Net bank debt of £37.1m (31 January 2020: £35.6m) | |

· | Reset banking facilities with HSBC in order to support the Group's current business plan for the mid-term |

Outlook comments sounds quite upbeat overall, mixed with caution about the macro/covid situation, which is fairly standard stuff that most companies are saying.

Despite these challenging market conditions, we are prudently managing our costs such that the Board continues to expect to meet our earnings forecast for FY21.

[Paul: what are management's earnings forecasts? We're not told!]

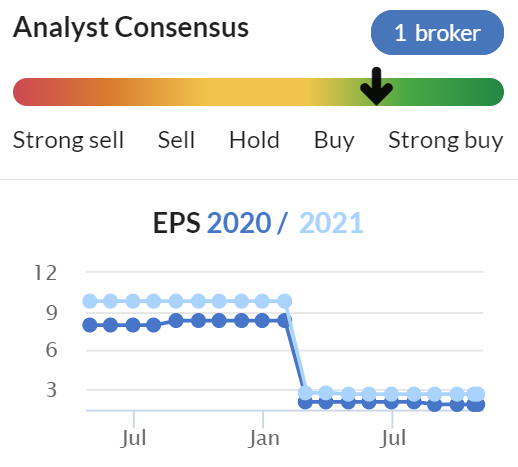

Brokers consensus (if these are up-to-date, guidance might have been withdrawn?) shows little improvement for the new financial year;

Notwithstanding this, the Group's new business performance is encouraging and combined with our return to organic growth in underlying ARR are material indicators of our progress.

Our business has proved to be robust through this extraordinary period and our pipeline and forward revenue visibility positions us well for the future. We're in an exciting growth market and are poised to accelerate our growth, earnings and cash flow over the coming years."

Balance sheet - looks awful to me. This is definitely a deal-breaker, and to me, it makes this share uninvestable.

NAV is £51.8m, but this includes £118.8m intangible assets, so NTAV is heavily negative, at £(67.0)m. It needs a big placing to fix that, which would involve heavy dilution for existing holders.

See note 6 - the £118.8m intangibles mainly relates to premiums over NAV paid for acquisitions. Hence it’s not really worth anything. Only about £20.0m relates to previous development spend, and software for own use, which I would argue are the only intangibles that justify a place on the balance sheet. An identical imaginary company that had grown solely organically, would not have £98.8m intangibles on the balance sheet, therefore why do we consider that this is an asset for Proactis?

Cashflow statement - again very revealing. This shows net cashflow of £8.0m. However, further down, £8.5m of development spending has been capitalised. Therefore, the company is not actually cash generative at all! This demonstrates what nonsense EBITDA is at software companies, as I frequently point out.

My opinion - this looks a precarious situation to me - way too much debt, and no genuine cash generation. That doesn’t usually end well. The company needs to drastically improve performance, and make a serious dent in the bank debt, before I would consider this share to be investable. As it stands, I think this needs a high risk warning to existing, or potential investors.

Also note that there were no takers when the company put itself up for sale.

The way I look at things, the equity probably has little to no value as things stand. You may disagree, but I’ve set out above the reasons that brought me to that conclusion.

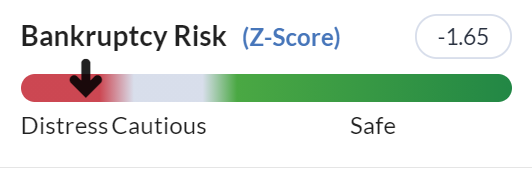

Altman Z-score confirms financial weakness;

Poor 5-year track record, as you can see below;

.

Christie (LON:CTG)

Share price: 71p (down 11% today, at 15:32)

No. shares: 26.5m

Market cap: £18.8m

Christie Group plc ('Christie Group' or the 'Group'), the leading provider of Professional & Financial Services and Stock & Inventory Systems & Services to the hospitality, leisure, healthcare, medical, childcare & education and retail sectors, is pleased to announce its interim results for the six months ended 30 June 2020.

Clearly the company will have been hit hard by covid/lockdown over this period. These figures are ugly;

· Revenues amounted to £18.8m (H1 2019: £38.1m)

· Operating loss of £5.5m (H1 2019: £1.5m profit)

· Prudently foregone an interim dividend this year (H1 2019: 1.25p per share)

Liquidity looks good though;

· Strong cash balance at 30 June 2020 of £13.4m

Outlook sounds more encouraging for H2;

...all businesses have resumed to the extent now possible. Our third quarter trading has been encouraging and, if it continues, should lead to a much improved second half."

Balance sheet - a loss on the P&L has a knock on effect in reducing net assets. In this case, NAV has fallen to negative £(8.8)m at 30 June 2020, from only £(0.3)m 6 months earlier. Why such a large drop? The pension deficit has grown from £12.0m to £16.7m in the last 6 months - that’s not far off the market cap of the whole company, of £18.8m, so the pension deficit is a major issue here.

I’ve checked the 2019 Annual Report, and discovered that the pension deficit recovery payments are £1.47m p.a. That’s about a third of the typical £4m profit which the company makes in an average year. Hence it’s something that needs to be adjusted for, when valuing the shares - i.e. this share should probably be on a low PER, to take into account the reality that a lot of its cashflow is being sucked out into the pension scheme, hence not available to pay divis. That’s a long-term problem, made worse by low interest rates.

Also the heavy trading loss in H1 has dented the balance sheet further.

Take off the £3.0m in intangible assets, and NTAV looks weak at £(11.8)m. However, if we strip out the pension deficit, a manageable long-term liability, then the rest of the balance sheet looks OK.

The cash pile of £13.4m is a bit of a mirage though. That’s because lower trading means receivables have unwound, boosting cash generation in the short term. As business recovers, then receivables rise again, and the cash pile will reduce. Therefore I would regard the unusually high cash figure as a temporary aberration, so not something to use for valuation purposes. Enterprise value is a particularly dangerous concept at the moment, when companies are hoarding cash, and squeezing cash out of their working capital in the short term.

My opinion - pretty awful H1 figures, due to covid/lockdown, so not the company's fault, but it’s now recovering in H2.

Of all the shares on the London market, I don’t really know why anyone would choose this one. It’s an OK business, that makes about £3-4m profit in a good year, and pays reasonable divis. But there’s not really any growth, it’s cyclical, and obviously is operating in a difficult sector at the moment.

The broker forecast figures are old, pre-covid ones, so ignore those.

Once everything has returned to normal, in maybe late 2021, or 2022, then I could see earnings returning to c.10p. The share price could recover to say 100p, but is that interesting enough to make me want to invest now? Not really, and divis have been cut too, so there’s no income whilst waiting for the share price to recover.

Overall, it looks OK, but with little prospect of growth, and an expensive pension deficit to service, I can’t see much attraction to buying the shares now. It’s probably priced about right.

.

.

Redde Northgate (LON:REDD)

Share price: 178p

No. shares: 246.1m

Market cap: £438.1m

This was released yesterday, but I ran out of time, so am circling back to it today, as several readers said it looks interesting, and I have to agree!

The group calls itself a “leading integrated mobility solutions platform”!

I prefer to describe it as a merger of Redde (which provided rental cars for no fault accidents, to insurance companies), and Northgate, a company that hires out vans.

The merger only happened in early 2020, so we don’t yet have any full year results to go by. I suppose you could go back and manually combine the two companies’ results prior to the merger. Or use broker forecasts, if they are available and accurate. Obviously covid/lockdown is muddying the waters considerably, as with everything.

The market didn’t like yesterday’s update, and the share price has fallen about 10% in the last 2 days.

This is what it said yesterday;

In the first five months of FY2021 the Group has seen sequential monthly improvements in trading, with a recovery in VOH to slightly above pre-COVID levels, strong used vehicle prices and disposal profits, but slower recovery than expected in Redde volumes due to several factors including local and regional lockdowns.

Absent a deeper or more prolonged impact of COVID-19 than currently expected, the Board is comfortable with the consensus of FY2021 analyst forecasts that have been updated since April 2020.

A footnote would have been helpful to specify what earnings forecasts are. But it's really useful guidance, as I can value the share with this information. See the brokers consensus graph below, the FY 04/2021 EPS figure is 27.34p (the darker blue line)

.

.

A share price of 178p, divided by 27.34p EPS forecast, gives us a current year PER of 6.5 - which looks very cheap. There must be something wrong then. If there is, I’ve not found it!

Usually shares this cheap on a PER basis have poor prospects, are in structural decline, and/or have weak balance sheets, often with big pension deficits. I can’t find any such problems with REDD, but do please bear in mind this is the first time I’ve looked at this merged group, so I might have missed something. Let me know if I have please.

Dividends - are being maintained, and are large (Redde was a high yielding share when it was a standalone company);

Shareholders are being asked today to approve a final dividend of 6.8 pence per share, which will be paid on 3 November 2020, to those shareholders on the register at close of business on 25 September 2020. This dividend, if approved, will result in a total ordinary dividend payable in respect of the year ended 30 April 2020 of 13.1 pence per share.

To be maintaining a big divi during current conditions, says a lot about the strength of the business, in my view. So this gets a big thumbs up from me.

13.1p divis, divided by 178p share price, is a yield of 7.4% - that’s very attractive for income seekers, if it can be maintained.

Balance sheet - I’ve reviewed the preliminary results for FY 04/2020, which are post-merger, hence the balance sheet is reliable as being for the merged group. Overall, I’m happy with the figures. As you would expect from a vehicle hire business, the vehicle fleet results in very large fixed assets at the top, financed by long-term borrowings at the bottom. I won’t go into all the detail now, but to my eyes it looks fine. Debt is manageable, and there’s good transparency about debt covenants, with good headroom, and the debt is very cheap too, costing around 2.0-2.5% p.a.

I like the capital banking, with a loan to value of only 48%, i.e. the vehicles are roughly half owned by REDD, with debt funding the rest, a comfortable position;

.

What’s interesting, is that the commentary says that the company is moving towards financing vehicle purchases in future on contract leases. This would remove some or all of the need for bank debt, thus making the group far more secure. It would simply sit between the manufacturers and the end user, matching monthly cash income with cash outflows, and making a similar profit margin as if it owned the vehicles. That appeals to me a lot, as it de-risks the business (not that risk is high anyway).

Negatives - obviously it’s not all rosy. Profits at Redde (the accident management business) have been hit by reduced journeys travelled, although that’s improving with more journeys now occurring, which sounds ghoulish to be seeing more profits from other people’s misfortune having accidents, but that’s life.

Further covid lockdowns, could cause some damage, and the current second wave that’s engulfing the UK and Spain, being the countries REDD operates in (Spain is very profitable, incidentally, at about 17% profit margin, vs c.10% in the UK). Yet I think white vans would still be in strong demand, given the upsurge in internet shopping, and need for a multitude of delivery drivers, who need vans.

If economies go into recession, then that could lead to bad debts, and abandoned vehicles maybe? Plus potentially lower resale values. Although there's no sign of that at the moment.

The other threat to the original Redde business, is insurance companies shopping around, and moving their business to cheaper competitors. I recall that was an issue a while back, with some uncertainty over large contract renewals.

My opinion - thanks to the readers who nagged me to look at this, I think it looks an excellent investment proposition - a very low PER of 6.5, based on confirmed forecasts for this year. A decent balance sheet, debt that looks fine, a lovely dividend yield which is being maintained - this strikes me as exactly the type of thing I like to invest in. So when funds permit, I’ll probably be picking up some stock myself.

I’m just a bit worried that it looks too good to be true. Have I missed anything? I’m worried that might be possible. Therefore if you think I’m too bullish on this, please post negative comments for balance!

Why is the share price continuing to fall? If it’s such good value, surely buyers would have overwhelmed sellers by now?

Stockopedia likes it too, note the high StockRank below.

.

.

All done for today!

Best wishes, Paul & Jack.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.