Good morning, it's Paul & Jack here with the SCVR for Thursday.

Agenda -

Paul's Section:

Pci- Pal (LON:PCIP) - strong progress in H1, but patent infringement allegations hang over the company, so risky until that's resolved.

Essensys (LON:ESYS) - share price has crashed this week, on disappointing growth. This software company is engaged in a risky strategy with high cash burn, but so far growth has disappointed.

Kitwave (LON:KITW) - a low margin distributor, which seems to be trading OK. 4% dividend yield appeals.

De La Rue (LON:DLAR) - good news on reduced pension scheme funding requirements. This should boost the share price.

Unbound (LON:UBG) - results to 31 Jan 2022 are the closing figures for Electra Private Equity, so are of little relevance to the new version of this company. However, the commentary provides a lot of background information on the new strategy for Unbound.

Dotdigital (LON:DOTD) - shares plunge further, on wobbly outlook comments accompanying interim results. Very strong balance sheet. I crunch the numbers, and based on earnings growth now having stalled, it's difficult to justify the current price, let alone any upside.

N Brown (LON:BWNG) - down 20% on a not-too-bad update. Although cost pressures mean it expects profits to dip about 18% in FY 2/2023. After the recent collapse of Studio Retail, I now see this business model an uninvestable. There's also a big legal case, which is not mentioned today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Pci- Pal (LON:PCIP)

57p - mkt cap £38m

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to announce its unaudited interim results for the six months to 31 December 2021.

I like the figures here, the story is progressing as planned - with rapid organic revenue growth, high margins, and losses reducing. Enough cash in the bank too.

H1 revenues: £5.5m (up 72% on H1 LY)

Gross margin also up from 73% to 81%

Operating loss reduced from £(2.15)m in H1 LY, to £(1.1)m this H1

Cash £5.5m, so no immediate risk of a placing/dilution

Low customer churn of 3.5%, so a key appeal of this share is it’s building predictable, recurring, high margin revenues.

Current trading - in line with expectations.

Strong visibility for full year to FY 6/2022

IMC webinar is today, 3 March.

Balance sheet NAV: £2.5m, less intangibles of £2.5m, so NTAV is 0 - doesn’t really matter, as recurring revenue software companies get paid up-front by customers.

The big issue - is a patent infringement legal case brought against PCIP by a competitor. PCIP refutes it, as baseless. But to me it’s a material uncertainty.

My opinion - if there was no ongoing patent legal case, I would buy this share like a shot (and have previously held it).

So it all hinges on whether you’re prepared to take a risk on that patent legal issue, or not.

.

Essensys (LON:ESYS)

94p (down 25% today, in addition to c. halving yesterday) - mkt cap £61m

There are some staggering share price collapses going on at the moment, in what seem like distinctly bearish market conditions for UK small caps.

ESYS floated on AIM in May 2019, and seems to provide SaaS software for the commercial real estate sector.

My first point of call when reviewing any share, is to check the historical performance on the StockReport, and this looks lousy to me - no profits in the last 6 years, and forecasts are for losses to balloon in FY 7/2022 and FY 7/2023.

.

.

The share price has lost two thirds of its value in just the last 3 months. From a record high, to a record low.

Trading Update (published yesterday)

essensys plc (AIM:ESYS), the leading global provider of mission critical software-as-a-service (SaaS) platforms and on-demand cloud services to the flexible workspace industry, announces an unaudited trading update for the half year ended 31 January 2022 ("H1 FY22").

H1 revenue guidance £10.9m (up 3%)

Profit warning -

The Group's expansion and acceleration of its go-to-market activities has been delayed by continued COVID related uncertainty. This has also resulted in extended sales cycles leading to lower than anticipated sales bookings year to date. As a result, the Group's trading for FY22 is expected to be below current consensus market expectations.

Cash on the balance sheet is strikingly high, at about half the market cap - could this provide some support for the share price? -

Net cash at half year end at £30.5m was significantly better than management expectations due to delayed deployment of funds

Outlook & guidance -

The Board remains confident in the Group's future growth which is underpinned by long-term structural drivers. Despite a delay in accelerated bookings growth due to the prolonged challenges caused by COVID, the pipeline for FY23 and FY24 is strong. The Group has seen pipeline opportunities continue to grow, particularly amongst large multi-site property organisations. Larger flexible operator customers are starting to expand once again.

The Board now expects revenues for FY22 will not be less than £23.5m (FY21: £22m), with an adjusted EBITDA1 loss of not more than £7m.

My opinion - I know very little about this company, but it seems to have embarked on an accelerated growth strategy, increasing costs heavily. The trouble is, there hasn’t as yet been much tangible progress in terms of sales growth. Hence the stock market has smashed the share price down by two thirds. That’s an astonishing, and very rapid, loss in market confidence. Loss-making, growth companies are an awful place to be invested right now.

Could there be a buying opportunity here?

I very much like that half the market cap is cash. However, looking at an update note from Singers out today (many thanks for that), the cash is being burned at a prodigious rate, and is expected to be down to only £5m by end FY 7/2023, and gone altogether by end FY 7/2024. Therefore for valuation purposes, I can’t include anything for the cash pile, since the intention is to burn through the whole lot - a risky, even reckless strategy?

Still, at £60m mkt cap, as opposed to nearly £200m a few months ago, there could be a punt here. The next step would be to properly research ESYS’s software, and its competitive landscape. If you think it might recover, and generate faster growth, then who knows the shares might re-rate back up again?

For me, I don’t know enough about it to form a view, so will declare myself neutral.

.

.

Kitwave (LON:KITW)

153p - mkt cap £106m

Final Results (published 28 Feb)

Kitwave Group plc (AIM: KITW), the delivered wholesale business, is pleased to announce its final results for the twelve months ended 31 October 2021.

This one’s a reader request.

IPO - on AIM, in May 2021.

Raised £64m for the company (but on closer inspection, this was used to repay debt), and £17.6m for selling shareholders.

For a recent IPO, the share price has held up better than most -

.

Results for FY 10/2021

Traded in line with expectations.

Some impact from covid.

Low gross margin: 18%

£380.7m revenues

Costs include IPO costs, and pre-IPO debt financing costs

Govt support of £2.3m

Prior period comparatives are for 18 months

Put all that together, and it’s rather difficult to interpret these numbers.

Outlook sounds fairly positive -

Having overcome what is expected to be the worst of the COVID-19 pandemic, the outlook for the Group's customer base is much more positive. As we have seen time and time again, our independent customers have proven their resilience through adapting their business models where necessary and are now looking to return trading back to pre-pandemic levels.

Following a strong second half of the year, as is usual for our business, we look to 2022 with optimism. Barring any further lockdown restrictions, we expect the Group to operate in the current year at efficiency and volume levels similar to those prior to the pandemic. The Group has at its disposal a pipeline of exciting opportunities and is well placed to accelerate both organic revenue and profit growth through its buy-and-build strategy. We look forward to capitalising upon these opportunities in the year ahead.

Balance sheet - nothing special either way. NAV is £61.6m, less £31.7m intangibles, gives NTAV of £29.9m.

My opinion - do I want to own a low margin distributor? Not really, no.

The valuation metrics look quite good though, and a 4% dividend is worth having.

Time will tell if the acquisition strategy creates shareholder value or not.

.

.

De La Rue (LON:DLAR)

110p (pre-open) - mkt cap £215m

This looks a very positive announcement.

The company has agreed with the pension scheme trustees to reduce the scheduled deficit recovery payments.

The actuarial deficit calculations have improved, and been brought forward from 31 Dec 2022 to 5 April 2021.

Actuarial deficit falls to £119.5m

As a result, the scheduled deficit recovery payments are amended favourably for the company -

As a result of this new valuation, the Scheme Actuary has confirmed that the deficit can be funded through contributions remaining flat at £15m per annum from April 2022 to March 2029.

Therefore, the Company and the Trustees have agreed a new schedule that avoids the 'step up' in contributions from £15m to £24.5m for the period April 2023 to March 2029. The Company will make deficit repair contributions of £15m annually during that period. In aggregate, this agreement will result in a £57m reduction in cash payments to the Scheme by De La Rue.

My opinion - there’s more detail in the announcement, but on the face of it this looks really positive for shareholders. £15m p.a. is still a big drain on cashflow, but avoiding that step up to £24.5m p.a. is a clear positive.

Logically, this good news should put c.10-20%+ onto the share price, but we’re not in particularly logical markets, so anything could happen!

DLAR strikes me as a fundamentally good business, but it recently disappointed with news that the turnaround was taking longer than expected.

.

.

Unbound (LON:UBG) (I hold)

48p (pre market open) - mkt cap £20m

These figures are not of much interest, because they’re the closing numbers (16 months to 31 Jan 2022) for the previous incarnation of this share, namely Electra Private Equity. Then from 1 Feb 2022, the company became Unbound, and became a conventional trading company, no longer an investment trust.

Trading results for the new incarnation of Unbound (with Hotter Shoes being its trading subsidiary) are expected in May 2022, so I’ll cover it in more detail then.

Today we’re given this update on Hotter Shoes -

Hotter Shoes Update

· As announced on 17 February 2022, Unbound Group's foundational trading business, Hotter Shoes, reported unaudited results for the year to January 2022 (FY22) in line with expectation - with revenue of approximately £51.9 million (FY21: £44.5 million) and profit before tax and exceptional items (on an IFRS basis) improved by over £6.0 million from FY21 to return to a small positive

· Hotter's trading in FY23 to date in line with expectations

· Partnership with M&S also announced on 17 February 2022 builds on recently established e-commerce partnerships with John Lewis, Next and The Very Group

Balance sheet - this is interesting, and implies that once disposals have been done, of odd assets left over from Electra, then net debt would be £5m.

· Group banking net debt after all admission related costs of £8.7 million

· Non-core assets held for disposal valued at additional £3.7 million as at 31 January 2022

· Banking facilities (Hotter) extended to December 2024 pre admission

Commentary - today’s statement contains quite a detailed explanation of what Unbound does, and its strategy going forwards. I’ll read that later, because am already familiar with the story, which is to broaden products & services to older customers beyond just shoes.

I’m very keen on companies which serve the older (affluent) demographic, whom I think generally have more resilience & disposable income in the face of higher inflation, energy bills, etc.

My opinion - the demerger of TGI Fridays into Hostmore (LON:MORE) (I hold) and the change of Electra Private Equity into Unbound was a good strategy, but to date the stock market has shown absolutely no interest in either as standalone companies.

Ignoring market sentiment, and just focusing on the fundamentals, I reckon MORE could be worth 50-100% more than its current market cap, so a very good value opportunity there. We just have to be patient, and as with everything, hope that nothing goes wrong.

As for UBG, I like the concept, and high margins. Time will tell whether it works as a standalone investment, or not. I’m not particularly worried about the current woefully low market cap, as longer term the company fundamentals will drive the market cap, not short-term sentiment. Also, today's bombed out market caps may be the multibaggers of the future. That's the usual bear-bull cycle.

Another issue with UBG is that I reckon some of the previous Electra shareholders simply wouldn’t be interested in holding a micro cap. Hence institutional shareholders may want to sell because it's too small. So as we’ve discussed before, it’s likely to take time for the shareholder register to adjust. I didn't anticipate any of this, as I only focused on the company fundamentals.

.

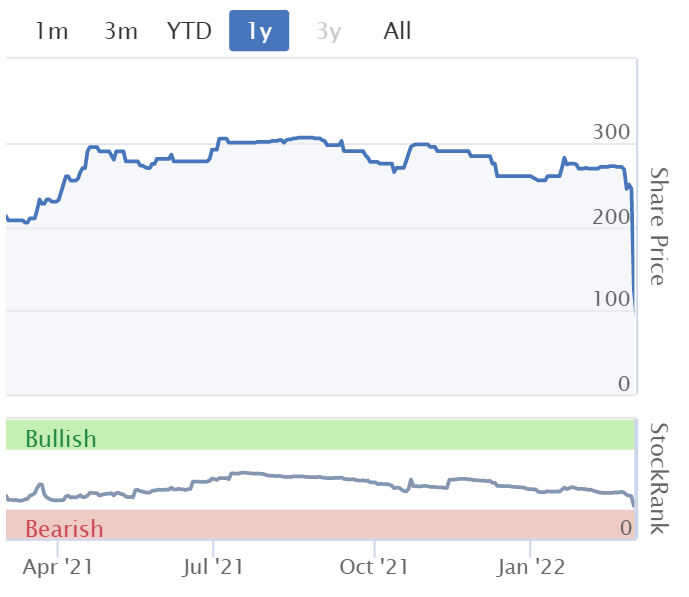

Dotdigital (LON:DOTD)

81p (down 46% at 09:01) - mkt cap £240m

This former tech darling has now dropped from almost 300p to just 81p in the last 6 months. That seems to be part of a widespread move to lower PERs on growth companies to more realistic levels, from excessive levels.

We’ve had reservations here at the SCVR about the underlying growth rate at DOTD for some time, but never imagined the shares would fall so much, and so fast. I wonder if it’s reached bargain basement territory or not?

Dotdigital Group plc (AIM: DOTD), the leading 'SaaS' provider of an omnichannel marketing automation and customer engagement platform, announces its unaudited interim results for the six months ended 31 December 2021 ("H1 2022").

My initial reaction on looking at these interim numbers, is that they look OK -

- H1 revenues up 10% to £30.9m

- 94% recurring revenues, so high quality

- High margins - adj operating profit margin of 29% is excellent

- Pots of cash on the balance sheet, at £40m - about 17% of the market cap

The problems seem to stem from the outlook comments, which mention -

- Market challenges, especially hiring - increasingly competitive, so more costly

- Unwinding of pandemic benefit

- Reduced demand for SMS messaging

- Guidance for revenue growth is lowered - so brokers have trimmed forecasts today (thanks to both Canaccord and Finncap for publishing updates on Research Tree)

Finncap makes a couple of good points - that DOTD is up against competitive pressures, especially some well-financed, private equity backed competitors, making a “land grab” for customers. That sounds serious to me, and I wouldn’t bank on it being a temporary phenomenon.

We had a good discussion here about DOTD a little while ago, and some of us were coming round to the view that DOTD is maybe now a bit old hat, with stronger newer competitors beginning to eat its lunch. I think today’s commentary reinforce that view in my mind.

Overseas operations - look subscale to me. Of the £30.9m H1 revenues, £23.6m is UK/Europe, so the balance of overseas operations (including USA) only generated H1 revenues of £7.3m. Is it worth continuing with a global strategy, if DOTD is increasingly looking an also ran?

Average revenue per user is up 19% to £1,422 per month. As mentioned before, this must mean that total revenue growth of 10% hides a declining customer base.

Balance sheet is excellent, with £40m net cash. NAV is £82.9m, less £26m intangible assets, makes NTAV £56.9m. That looks excessive to me, so there’s an opportunity for DOTD to do something earnings accretive with its surplus cash pile. Maybe the company needs to think about diversifying? Or if not, then give the money to shareholders, with a special divi and/or buybacks.

Cashflow statement - looks strong. Note about a quarter of cash generated is £3.4m capitalised as development spend in H1.

Forecasts/valuation - brokers have trimmed adj diluted EPS forecast to 3.8p (down from 4.1p) for FY 6/2022. At 81p per share, that makes the current PER 21 times. Adjust out the cash pile, and we’re in the high teens. That looks a bargain compared with previous stellar ratings on this share, but given EPS is forecast to barely change in the coming 2 years, why would we want to pay a higher, growth company PER?

Even though DOTD is expected to continue modest revenue growth, it looks as if increased costs (especially scarce tech staff) is likely to absorb most of the upside from modest growth.

Which leaves me wondering whether we should now rate this share as a mature, or even potentially declining company? That would only justify a PER of say 10-12. Add a bit for the cash pile, and I’d only be prepared to pay a PER of about 15 for DOTD, at the most. Which suggests a share price of about 57p.

Also bear in mind that DOTD achieved 2.3p in H1. So 3.8p for the FY 6/2022 implies a sequential decline to 1.5p EPS in H2. Annualise that to 3.0p, compared with 3.8p latest forecast, suggests there’s scope for another profit warning I reckon.

My opinion - it might bounce from buyers coming in, who are anchored to previous higher share prices, but I can’t see any fundamental reason why the share price should be any higher than it is.

Once profit growth stalls, then lofty tech valuations come crashing down, as we’ve seen with loads of former growth darlings, as I know only too well with my heavy losses on Boohoo (LON:BOO) .

It seems to me that DOTD’s best days might be behind it. The competitive threats are my main worry, which could lead to earnings falling in future.

.

N Brown (LON:BWNG)

29p (down 20% at 10:45) - mkt cap £133m

N Brown Group Plc ("N Brown" or the "Group"), a top 10 UK clothing & footwear digital retailer, today provides an update on trading for the 52 weeks ended 26 February 2022 ("FY22") and the outlook for the 53 weeks ending 4 March 2023 ("FY23").

Performance for FY 2/2022 reassures -

…for FY22 we expect to report all financial metrics in line with the guidance provided at the Q3 update on 20 January 2022 including Adjusted EBITDA2 between £93m and £96m.

As we’ve covered in the past here at the SCVR, the EBITDA figures published by BWNG are pie in the sky, and best ignored. That’s because most of EBITDA is consumed by heavy capitalised IT spending, and high interest costs on the bank debt required to fund its large customer receivables book.

Liquidity - looks ample, but the recent debacle of a similar business going bust, Studio Retail, highlighted how totally dependent this type of business model is in the confidence of the bank. STU’s banks pulled the plug, and the major shareholder preferred to grab the business for next-to-nothing from the administrator, rather than supporting an equity raise. That leaves small shareholders like us potentially lambs to the slaughter, at the whim of banks & big shareholders.

What’s to stop BWNG’s major shareholder doing the same thing? Not much. That makes it too risky.

Our robust balance sheet positions us well for the future, with net debt at year end of c. £260m and available liquidity of more than £200m comprising approximately £40m of cash, underdrawn securitisation facility headroom and the fully undrawn RCF and overdraft.

Forecasts - many thanks to Shore Capital for updating its forecasts, showing a dip in forecast EPS to 7.2p in FY 2/2022, then down again to 5.9p for FY 2/2023.

This shows BWNG is (as always) on a low PER. The trouble is, with this type of business model, the large receivables book can cover up a multitude of sins, which seems to have been the case at STU.

Legal case - is not mentioned today, but has previously been disclosed as large & complex. For me that’s a deal-breaker.

My opinion - I’ve never liked these hybrid business models of high cost credit, linked to online sale of goods. Against my better judgement, I foolishly got sucked into a positive story at STU, and only narrowly escaped a total wipeout, 2 weeks after I sold - on signs of liquidity trouble.

After this narrow escape, I will never buy any similar share again.

Hence for that reason, BWNG is uninvestable for me, at any price.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.