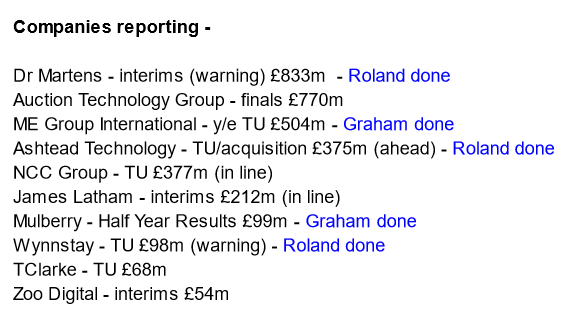

Good morning, it's Graham and Roland here with today's report. We also have a section from Paul covering Plexus Holdings (LON:POS).

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions

on them as possible candidates for further research if they interest

you. Our opinions will sometimes turn out to be right, and sometimes

wrong, because it's anybody's guess what direction market sentiment will

take & nobody can predict the future with certainty. We are

analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Agenda

Summaries

Mulberry (LON:MUL) - down 15% to 140p (£84m) - Half Year Results - Graham - GREEN

These are poor H1 results as various costs increase. It remains unclear whether the company will benefit from a switch to retailing instead of wholesaling/franchising in certain markets. This is a high-risk choice and in net debt. Valuation (price/sales) extraordinarily low.

ME International (LON:MEGP) - down 4% to 128.5p (£485m) - Year End Trading Update - Graham - GREEN

Full-year revenues are slightly below the bottom end of the range of expectations and this is likely to weigh on growth expectations for now, but this photo booth/laundry machine operator has recovered well post-Covid and continues to offer a high-quality proposition.

Wynnstay (LON:WYN) - down 15% to 363p (£83m) - trading update (warning) - Roland - AMBER/GREEN

A profit warning from this well-run agricultural supplies group suggests earnings may be c.9% lower than expected this year. However, with the shares now trading at a significant discount to book value and offering a 4.5% yield, I suspect there’s value here.

Ashtead Technology Holdings (LON:AT.) - up 17% to 565p - trading update/acquisition (ahead) - Roland - AMBER

This offshore equipment rental group has announced a decent-sized acquisition and reports trading ahead of expectation for 2023. We don’t have any updated guidance, but I’ve been impressed with this business and do not see any major concerns with the acquisition.

Dr Martens (LON:DOCS) - down 26% to 84p - interim results (warning) - Roland - AMBER/RED

This footwear brand is continuing to suffer problems in the US. These seem to be related to both market conditions and operational execution. Repeated profit warnings and rising debt mean that I’m cautious here, although I think it’s a fairly decent brand.

Plexus Holdings (LON:POS) (Paul holds) - down 9% to 20p (£21m) - prelims FY 6/2023 - Paul

Graham's section

Mulberry (LON:MUL)

- Share price: 140p (-15%)

- Market cap: £84m

Mulberry Group plc (the "Group" or "Mulberry"), the British sustainable luxury brand, announces unaudited results for the twenty-six weeks ended 30 September 2023...

This announcement comes with an unusual PR headline:

Investments will power future growth

Instead of being provided with some numbers straight away, we get CEO comments with the following final paragraph (emphasis added):

"Looking ahead, we are well placed to capitalise on the important festive trading period and expect the usual second half weighting to trading.

"There is no doubt, however, that the macro-economic environment has deteriorated, and this has had a knock-on effect on consumer sentiment. At Mulberry we have ensured that we are prepared to navigate this tricky environment, and we are confident in our ability to continue to execute our strategy. I continue to believe that offering VAT-free shopping in the UK would be one of the most effective ways to encourage business growth in this country. The fact this has not been reinstated is creating challenges for all sectors; impacting not only the luxury players, but also hospitality, travel and tourism…”

And then we get the numbers, not expecting very good news:

Revenues +7% to £70m. There is a major shift from franchise/wholesale to retail, as Mulberry has taken many international stores into direct ownership.

In the Asia Pacific region, “underlying” (i.e. like-for-like) retail sales decreased by 7% “due to the challenging China macro-economic climate and reduced footfall across the region”.

Gross margin 69%, down from 71%

Underlying pre-tax loss is £12m (H1 last year: £3m) with a variety of new and additional costs including a SaaS project and new stores in Sweden and Australia.

Current trading:

The wider macro-economic environment and geo-political climate continues to present some uncertainty, but we are well positioned to navigate this given our beautifully crafted product, made in our Somerset factories and sold at the best value price point in the luxury market

A large H2 weighting is expected.

Net borrowings rose to £13.6m (H1 last year: £0.5m). In addition the lease liabilities are worth £53m. There are also some loans (£4.5m) from minority shareholders in China and Japan.

Graham’s view

I last covered this one in April, taking a positive stance on it at 210p.

Unfortunately, sentiment around this share has collapsed over the last two months, and it is now down at 140p:

The cash burn was a concern in April too, but I continued to rate it positively due to a very low price/sales multiple, totally out of kilter with the luxury sector.

According to the StockReport, Mulberry’s expected revenues for FY 2024 are £176m. Even if we chop that down to £170m, price/sales for Mulberry is still only 0.5x.

Burberry (LON:BRBY) (in which I have a long position) has seen its share price greatly diminished in recent months, but it still has price/sales of 1.65x. It previously traded at 3x. Kering (KER), the owner of Gucci and Saint Laurent, is at 2.3x. LVMH (MC) is at 4x.

I suspect that one of the main problems for Mulberry is that it is sub-scale, compared to the luxury giants, meaning that it can’t enjoy their efficiencies. The giants consistently earn tremendous operating margins, while the same cannot be said for Mulberry.

So where do I stand on Mulberry? I am tempted to abandon my positive stance, as the company has suffered a bigger H1 loss than last year and is now in a substantial net debt position.

EPS momentum is not encouraging:

Overall, while I acknowledge that this share is extremely high risk, I would like to stubbornly keep my positive stance on it until we have full-year results, including the stronger H2 season.

My positive stance comes with caveats:

This is not a historically high-performing company

Its cash position is now weak

The main reason I am positive on it is that I see it as a likely takeover target

Note that it is owned by a family (56% shareholding) and Frasers (37% shareholding), so they will ultimately decide its fate.

If the full-year results are very poor, then I’ll again have to reconsider my positive stance. For now I’d rather not change my stance after a poor H1, without seeing the full picture for the year including the stronger H2 period.

ME International (LON:MEGP)

- Share price: 128.5p (-4%)

- Market cap: £485m

ME Group International plc (LSE: MEGP), the instant-service equipment group, announces a post-year end update in respect of the 12 months ended 31 October 2023.

Here are the key points from the full-year update:

Revenue “marginally below the lower end of previous guidance but to be no less than £298 million” (guidance was £300m - £320m)

EBITDA in line with previous guidance (£100m - £110m) and “significantly above £11 million”.

PBT no less than £67m (guidance was £64m--£67m)

Some investors don’t mind seeing a revenue miss if the company still hits its profitability targets, although if you are more growth-oriented you will probably not fall into this category.

Strategic progress: next-generation photobooth rollout is underway, with a range of new features, initially focused in France. There are also various hardware and software upgrades.

After a cheap acquisition in Japan, they are now the leading photobooth operator in that market. Paul covered that deal here.

Laundry machines are expanding: 16% growth to 5,533 units.

Financial position: net cash £34m at the end of October (vs. £24m at the end of H1).

In November, MEGP paid an £11m dividend, so net cash will be lower now.

The shares do offer a nice yield:

Graham’s view

I’m inclined to keep my positive stance on this one. The shares are 40p cheaper since the last time I covered them, in July:

Earnings estimates have held up well, although of course there has been the revenue weakness mentioned above:

Returns remain impressive, painting a picture of a high-quality stock (QualityRank is 87):

So even if revenues are a little soft, I’m happy to stay positive on this one.

Roland's section

Wynnstay (LON:WYN)

- Share price: 363p (-15% at 08.10)

- Market cap: £84m

Unfortunately it’s a profit warning from this agricultural supplies and merchanting group:

the Group's results for the financial year are now expected to be below current market expectations.

This refers to the company's financial year which ended on 31 October. Management says that sales have been hit by a combination of market conditions and wet weather:

The trading environment in the second half of the financial year was more difficult than the first, with lower farm-gate prices adversely affecting farmer spending patterns. In addition, the seasonally critical final quarter has been impacted by abnormally wet weather.

Due to the disruption caused by heavy rain, sales of winter seed products were lower than usual in October. Demand for feed and fertiliser was also lower due to lower farm-gate prices for milk, in particular.

Sales from the group’s merchanting division (country stores) were also down, due to reduced feed sales and lower demand for hardware products.

Frustratingly, Wynnstay doesn’t provide any indication of current expectations, nor of the likely shortfall in profits this year. That leaves investors on an uneven playing field, with only those who have access to broker notes able to gauge the likely impact.

Fortunately, there is an updated note available from house broker Shore Capital on Research Tree this morning - many thanks.

Shore’s analysts have cut their forecasts for FY23 adjusted earnings per share by 9% to 33.2p per share. That puts the stock on a forecast FY23 P/E of 11 after this morning’s opening drop.

Outlook: the company remains cautious in the short term but is confident of making progress next year:

Looking ahead, with uncertainty over milk and other farm-gate prices, farmer sentiment is likely to remain cautious in the short-term, but with a strong market position and balanced business model, the Board still anticipates that the next financial year will show an improvement over FY23.

However, Shore Capital’s forecasts for FY24 have also been cut and are down 7% to 38.3p per share, giving a P/E of 9.5 and implying 15% year-on-year growth from FY23.

Roland’s view

Wynnstay enjoyed record profits last year due to supply chain disruption, but a return to more normal trading always seemed likely to me.

On balance, I don’t think there’s too much to worry about here. However, there’s clearly a chance – or perhaps an expectation – that trading will remain more difficult for a little while.

Wynnstay shares are down sharply this morning, but have already de-rated significantly from last year’s highs:

At the time of writing, the shares are trading at 363p. That’s equivalent to a 38% discount to the net asset value of 590p per share reported with July’s interim results.

The share price slump also means that the forecast dividend yield on the stock is up to around 4.5% – I think a cut is unlikely, given that the c.17p payout should still be covered almost twice by earnings.

Wynnstay’s book value may be revised downwards in the full-year accounts, but has generally trended steadily higher over time:

My impression is that this is a well-run business with a coherent strategy. Notwithstanding the risk of further downgrades, I suspect that Wynnstay shares offer reasonable value at current levels.

Ashtead Technology Holdings (LON:AT.)

- Share price: 565p (+17% at 09.15)

- Market cap: £455m

Shares in this subsea equipment rental and solutions provider are up by 16% this morning, thanks to a short-but-sweet trading update contained within an RNS entitled “acquisition of ACE Winches”.

The Board continues to be very encouraged by the Group's performance through H2 2023 and now expects FY23 to be comfortably ahead of its previous expectations before taking into account the additional growth from ACE Winches.

This is clearly good news, but once again there’s no updated guidance on expected earnings.

There aren’t any updated broker notes on Research Tree either, so we’re left in the dark until updated consensus forecasts filter through to Stockopedia. Not ideal for a £450m company, as institutional investors will presumably have access to updated forecasts from house broker Numis.

Let’s move on and take a look at today’s acquisition.

ACE Winches acquisition: Ashtead has bought a business called ACE Winches for £53.5m from its founders, Alfie and Valerie Cheyne.

ACE has been trading for 31 years and specialises in equipment needed to install, maintain and decommission offshore energy infrastructure:

The company's in-house designed and assembled equipment rental fleet is one of the most comprehensive and diverse ranges of back deck machinery in the industry and is designed to deliver reliable, fully integrated solutions to address all complex lifting, pulling and deployment challenges.offers a fleet of in-house designed rental solutions to address all complex lifting, pulling and deployment challenges.

The company's website suggests its involved in some fairly large and complex projects.

The acquired business generates about 80% of its revenue outside the UK and has offices in Norway, the UAE and USA – so presumably this gives us an idea of its main markets.

ACE Winches’ existing chief commercial officer will run the business, which will be integrated into Ashtead’s Mechanical Solutions offering. Founder Alfie Cheyne will remain with the business for 12 months as an advisor.

ACE Winches had gross assets of £55.7m at 31 March 2023. The business is expected to generate revenue of £43.4m and adjusted EBITA of £10m in 2023. This suggests an underlying operating margin of more than 20%, so it seems quite an attractive business.

Set against these metrics, Ashtead’s purchase price of £53.5m gives a multiple of about 5.3x EBITA. This doesn’t seem too expensive to me, assuming earnings are sustainable in the acquired business. In my view, this sounds like a retirement sale, so perhaps the sellers were also motivated by finding a good home for the business they’ve built over the last 31 years.

Ashtead’s management say they’re confident the acquisition will generate a return on invested capital “materially ahead” of the group’s weighted average cost of capital in year one.

I agree that the price paid for ACE Winches seems reasonable, but this is still a material deal for a £450m business such as Ashtead. The company says the purchase will be funded by drawing on its existing revolving credit facility (RCF).

The interim results indicate that the RCF had a total commitment of £100m at the end of June 2023, of which £31.5m was drawn. There was also an additional unusued £50m accordion facility.

The RCF carries an interest rate of 2.25%+SONIA, which is currently about 5.2%. So that’s a total cost of around 7.5%.

Assuming this situation hasn’t changed, funding the ACE purchase from the RCF seems reasonable to me.

Ashtead says that following the acquisition, group leverage is expected to be 1.4x EBITDA, reducing to less than 1x by December 2024. Cash generation seems quite strong in this business, so I don’t see any obvious concerns here.

Roland’s view

Ashtead Technology’s main customer base is the oil and gas sector, but the group also has a growing presence in renewables.

The shares have already three-bagged since the firm’s 2021 IPO, making it a rare standout performer among recent flotations. Congratulations to investors who spotted the opportunity early:

Today’s valuation seems a logical add-on to Ashtead’s capabilities at a fairly reasonable price.

However, in the absence of updated broker forecasts, it’s a little hard to take an informed view on valuation.

Prior to today, we know that Ashtead’s adjusted earnings were expected to rise from 19.5p in 2022 to 28.1p per share in 2023 – an increase of 44%.

Growth was then expected to ease in 2024, with an 8% increase in earnings to 30.5p per share expected

These forecasts priced the stock at around 16 times FY24 forecast earnings. If today’s share price reflects the expected increase in earnings – so the P/E remains the same – then I would say that Ashtead might still be reasonably valued, given the group’s excellent quality metrics and record of growth:

However, given the absence of updated guidance and the cyclical risks in this business, my preference would be to wait for the full-year results to get a more detailed understanding of the group’s trading and financial performance.

Paul went AMBER/GREEN on this stock following the interim results in September. For now, I’m going to go AMBER, reflecting the increased valuation since then and additional risk/complexity resulting from this acquisition.

Even so, I remain impressed with this business and fairly positive about the outlook.

Dr Martens (LON:DOCS)

- Share price: 84p (-25%)

- Market cap: £817m

Today we have interim results and another profit warning from this accident-prone bootmaker, which was floated at an exorbitant valuation by private equity in 2021. The shares have fallen by 80% since then:

Dr Martens problems seem to have been caused by a mix of poor operational management and slowing growth. Paul reported on a previous warning in January, when the company admitted that its US operations were causing serious operational problems.

Today’s profit warning also seems to be linked to the US:

“We saw a continued strong DTC performance in EMEA and APAC. In the USA, where there is an increasingly difficult consumer environment, our results have been more challenged, led by weakness in wholesale.“

The company has beefed up its US leadership team and they are focusing on marketing and ecommerce, but…

It is likely, however, that given the challenging backdrop it will take longer to see an improvement in USA results than initially anticipated.

Outlook: the current financial year ends on 31 March. The company still has the key Christmas trading period to look forward to but says that “widespread macro-economic caution” among US retailers has resulted in “a weaker order book than in prior years”.

As a result, full-year revenue is expected to decline by a “high single-digit percentage year-on-year, on a constant currency basis”. Profits are now expected to fall below expectations:

Assuming this revenue outturn, we expect FY24 EBITDA to be moderately below the bottom end of the range of consensus expectations, with PBT also impacted by c.£5m higher net finance costs in addition to this lower EBITDA *.

The company has helpfully included a footnote specifying current sell-side consensus estimates:

FY24 EBITDA: £223.7m-£240.0m

FY24 pre-tax profit: £128.7m-£148.0m

For context, the equivalent FY23 reported figures were EBITDA of £245m and pre-tax profit of £159.4m. So pre-tax profit was already expected to fall by around 13% this year, taking the mid-point of forecasts. My reading of today’s results is that a drop of 25%-35% in pre-tax profit from last year is now probably more likely.

Today’s half-year results do not make for very encouraging reading, either, in my view.

Half-year results summary: I’m not sure that the half-year numbers are all that much use at this stage as there's quite a lot of seasonality, but they do give us a picture of performance versus the same period last year.

Here’s a snapshot of half-year performance, to save me retyping all the numbers:

We can see here the impact of operating leverage in reverse. A 7% decline in sales results has resulted in a 55% fall in profits, due to the impact of the group’s fixed costs.

It’s worth noting that this profit slump happened despite a respectable 2.8% increase in gross margin to 64.4% during the period. The real killer for profits seems to have been an 11% increase in H1 operating costs, which rose to £214.6m (H1 22: £192.5m).

The other problem is rising finance costs – these doubled to £16.2m in H1, from £7.8m in H1 last year.

Cash flow / net debt: operating cash flow for the half year was -£23.5m, as the company spent a further £55.5m on inventories and saw receivables rise. This appears to be a typical seasonal pattern, with the second half of the year being more cash generative:

My sums suggest net financial debt (excluding leases) was £277m at the end of the half year (H1 22: £163m). Including lease liabilities, this increases to a statutory net debt of £484m.

The company says that this equated to a leverage multiple of 2x EBITDA at the end of the half year, but that this would reduce to 1.7x reflecting average cash balances through the year. Management expect to repay a £25m RCF drawdown by the financial year end.

My concern is that leverage can rise quickly when the denominator (EBITDA) falls. Dr Martens’ debt level doesn’t seem an immediate issue, but if profits fall too much further, then I could imagine debt becoming a problem.

Roland’s view

I think that a lot will depend on H2 trading and whether Dr Martens can finally get its US operations under control and performing effectively.

Although I think this is a decent brand with a reasonably positive future, I am not tempted to try catching this falling knife at the moment. I would prefer to wait for some signs of stability and a return to growth before considering an investment.

There might be an opportunity here -- I don’t know. But given the potential risks from rising leverage and the repeated disappointments this business has delivered since its IPO, I’m going to go AMBER/RED for now.

Paul's section

I’ve mentioned this innovative oil & gas sector engineering company a lot in my podcasts, but not much here because it’s previously been too small, and not even remotely a value share! With the market cap now about double our £10m lower limit, and some figures out today, I’ll get some details into the system here if people want to look it up. At present, the archive here has old coverage of it, but when N.Sea oil exploration dried up c.2015, Plexus’s track record of expansion, decent profits (£4-6m pa), and a peak valuation of about £300m went into a sharp decline, down to a low of just £2m in 2022, when everyone seemed to have just written off the company.

It’s coming alive again though, and has been a 10-bagger in the last year, by far the largest % gainer on AIM - here are the top 10 using a momentum view I created in the “Browse” section of Stockopedia - easy to do, and very useful! -

Results for FY 6/2023 - are in line with expectations (see note today from Cavendish) - with poor, loss-making figures, similar to the last c.7 years of continuous losses -

Revenue £1.5m (down from £2.3m last year)

Adj EBITDA (similar to operational cashflow, they say) of a £(2.5)m loss

Note the gross margin is good, at 73%, it just didn’t sell or hire anywhere near enough!

Loss before tax £(4.2)m.

Cash remaining is tight, at £1.45m (although a Lombard loan facility of £4m has been paid off, using up its remaining cash reserves)

“Material uncertainty” note re going concern, as a fundraise was flagged as necessary back in autumn 2022, when the CEO (mainly) put in £1.55m in a convertible loan. So this is high risk, but if you go through the company’s history, Plexus has an aversion to dilution, and in total the CEO has put in £3.2m in various loans & asset purchases - he’s the founder in 1987, and when I had a call with him, it’s obvious this company is his life’s work, and he’s deeply passionate about getting the oil+gas industry to use Plexus’s advanced wellheads, which are methane leak-proof.

Methane leaks - is becoming a massive global issue, as it turns out the O+G sector is polluting far more than previously realised, with widespread methane leaks, and this is a far worse greenhouse gas than CO2. Therefore Governments, environmental bodies, etc, are now beginning to prioritise improvements to ensure the sector cleans up its act. This is the big opportunity Plexus now has, with it’s patented & proven tech (a new suite of patents is being prepared, to give another 20 years protection). Potential markets are also opening up for Plexus is plug & abandonment of oil wells (of which there are many in the N.Sea, where Plexus has decades of experience & knowledge). Recent contracts have been won in this space.

So the upside case on Plexus is -

Proven, patent-protected technology that has been used, profitably in the past.

A new driver for demand, in legislation to stop methane leaks.

Wider markets, which now include plug & abandonment, CO2 storage facilities, and others.

Licensing deal with the world’s largest oil services group, Schlumberger, which is close to launching a new range of wellhead (and other) products, using Plexus’s tech - which should open a new royalty stream soon, of 3-6% of contract value.

Prospects for FY 6/2024 were transformed when Plexus won its largest ever contract of £5m, increased to £8m, and today it says this might be increased further. Amazingly, it’s a high margin rental deal, which is forecast to move Plexus into profit this year, Cavendish confirm this in a new note today (620% increase in revenues to £10.8m, and £0.3m PBT). I put it to you that this looks transformational, and could attract the attention of growth investors, or rather it already has done, with the market cap rising from an absurd £2m, to £20m now. If more contracts of size come in, then we could be only part-way through a serious re-rating. That’s my view anyway, which is why this (speculative) share is by far my largest personal position. Of course it’s risky, but I don’t think it’s necessarily as risky as some people might imagine based on the weak historic figures. I’m buying the future, not the past.

That’s probably enough for now. The best thing is just to read the full results commentary today, which explains what the excitement is all about. Then weigh up how this sits against the downside risks, and make up your own mind. I summarised the bull & bear points on another bulletin board this morning, and repeat this here, which I hope is fair -

BULL CASE -

Proven superior tech, patented & decades of knowhow, experience & contacts.

Previously profitable before drilling dried up in 2015, and valued at peak £300m.

Licensing deal with world's largest oil services group, with products to launch globally shortly = new royalty stream.

Environmental & legislation now prioritising methane leaks - precisely what Plexus's products do - a new & significant tailwind.

Current financial year move back into profit forecast by Cavendish & confirmed in today's commentary from Plexus.

Mgt own 59% and jealously guard the share capital & have backed co with £3.2m of own money in innovative funding recently - commitment & belief this will work.

BEAR CASE -

Needs more funding, hence going concern material uncertainty - dilution unknown.

Has 10x share price rise overshot? (or was starting price of 2p just ludicrously low?!)

Will £8m special project contract win this year be a one-off?

General uncertainty over execution & to what extent they can commercialise the tech?

Paul’s opinion - I think this has the most exciting upside opportunity for any company around this £20m market cap. I also think the risks should be manageable, and I’m anticipating about 15% dilution (which mgt say should come with an open offer for existing holders). That’s why I’ve taken a calculated risk on this share, and taken a large position. It may work out, or it might not, I accept the risk here.

Not the usual sort of thing for the SCVR, but I thought we’d get something up-to-date into the archive here, as obviously my coverage back in 2013-2016 here is now completely out of date! Although it does give a flavour for how valuable this share once was, when its products and services were in demand. Demand is now coming back, as the O+G sector and Governments, realise that gas in particular will be around for decades, and is a key fuel for energy security - instead of relying on imported gas from tyrants.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.