Good morning, it's Paul here with the SCVR for New Year's Eve.

Timing - I had another lie in this morning, as there's no company news of any interest. However, I'm in the mood to do a bit of writing, so will conjure up something. Likely finish time - later today. Update at 12:40 - today's report is now finished. Goodbye to 2020, you won't be missed!

.

AGM votes

A couple of interesting situations cropped up earlier this week with AGM votes. Usually everything goes through with near-unanimous votes, but occasionally shareholders rebel, e.g.

Quiz (LON:QUIZ)

(I hold)

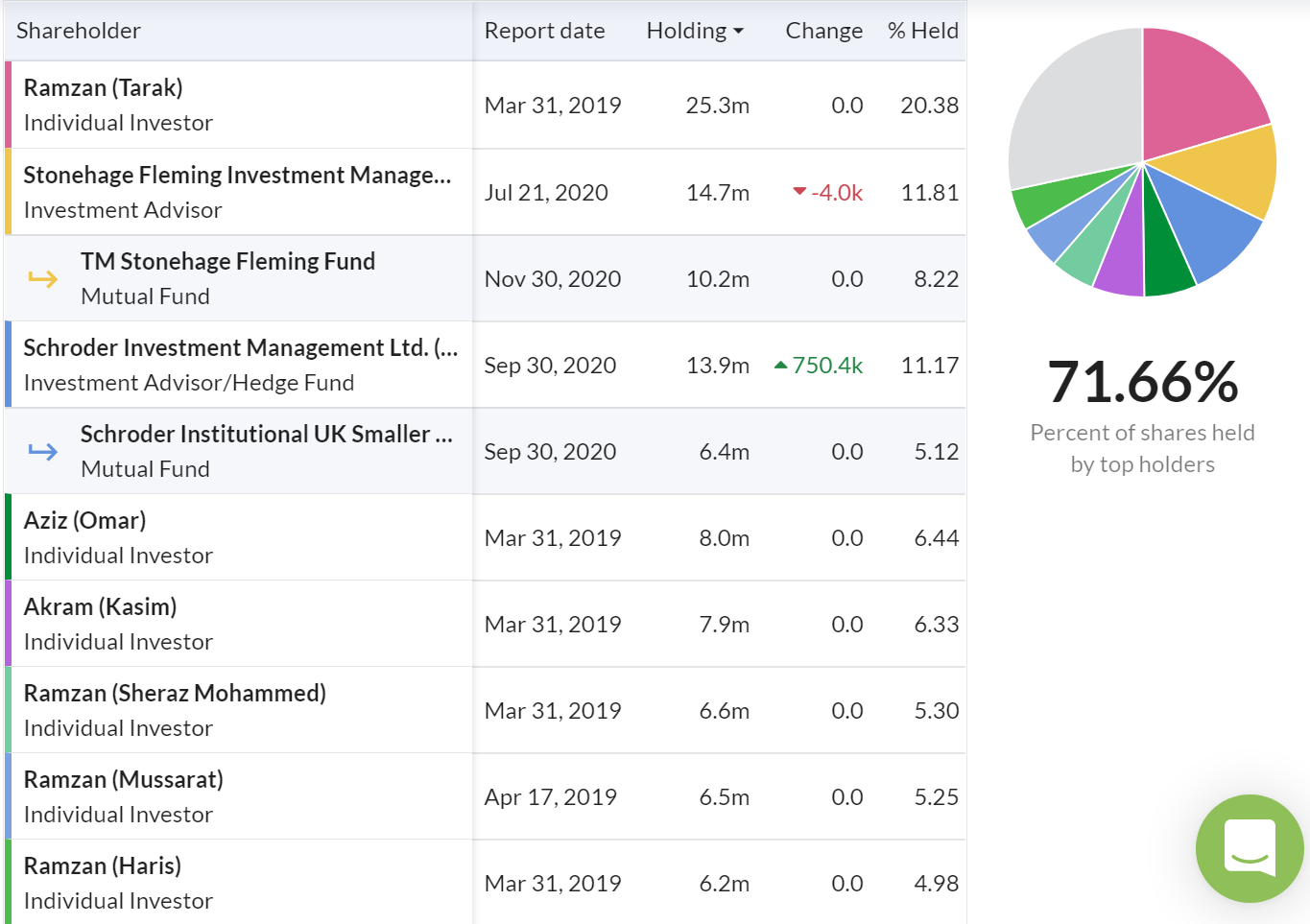

Still about 50% owned by the founders, as you can see from the Stockopedia graphic below. Therefore quite a small free float.

.

Given this shareholding structure, I was really surprised to see the AGM vote results here. All but 1 of the 11 resolutions went through with over 99% support. However, the last resolution (to disapply pre-emption rights when issuing new shares) got a 27.7% no vote. As it was a special resolution (needing 75% yes vote under company law), it failed to reach that threshold.

Of the 124m shares in issue, 72.9m of them were used in the AGM votes.

Given that many private investors are effectively disenfranchised, through the nominee system making it impractical to vote at AGMs, even by proxy. Plus people like me hold shares indirectly via derivatives (CFD, spread bets, etc) hence also don't get a vote. Then this implies the big institutional shareholders, Stonehage & Schroders, might have voted "no" to resolution 11. If so, good for them! It's long overdue for institutions to start thinking like owners, not traders, and to effectively oversee companies they hold shares in, instead of just waving through everything without scrutiny.

Quiz responded;

Resolution 11 required a minimum of 75% of votes cast to be in favour of the Resolution for it to be passed. Further to the vote noted above this Resolution was not passed.

The Board will consult with our shareholders to understand and seek to address any concerns they may have.

That's excellent, and how things should be done. I imagine the concern is that disapplying pre-emption rights could allow management to dilute existing holders if the company needs to raise more cash. As a holder myself, I would want to participate in any future fundraising, not be diluted on potentially adverse terms. So it makes sense for shareholders to push back on this matter.

I feel it is wrong for companies to routinely disapply pre-emption rights. It's a core principle of company law that existing shareholders should be allowed to protect their % shareholding in any fundraisings, with an automatic right to buy new shares pro rata to existing holdings. I think it's wrong that this principle is so routinely waived by companies. What we need is a modernised system, to allow fundraisings to be done much more quickly, cheaply, and electronically. I can feel a letter to my MP coming on.

In a post-Brexit world, the UK needs to be much more competitive, and reforming & simplifying the system for listed companies should be high up the list of priorities, so that decent international companies want to list in London. Rather than countries exporting their frauds to London, as one commentator on CNBC put it!

.

Altitude (LON:ALT)

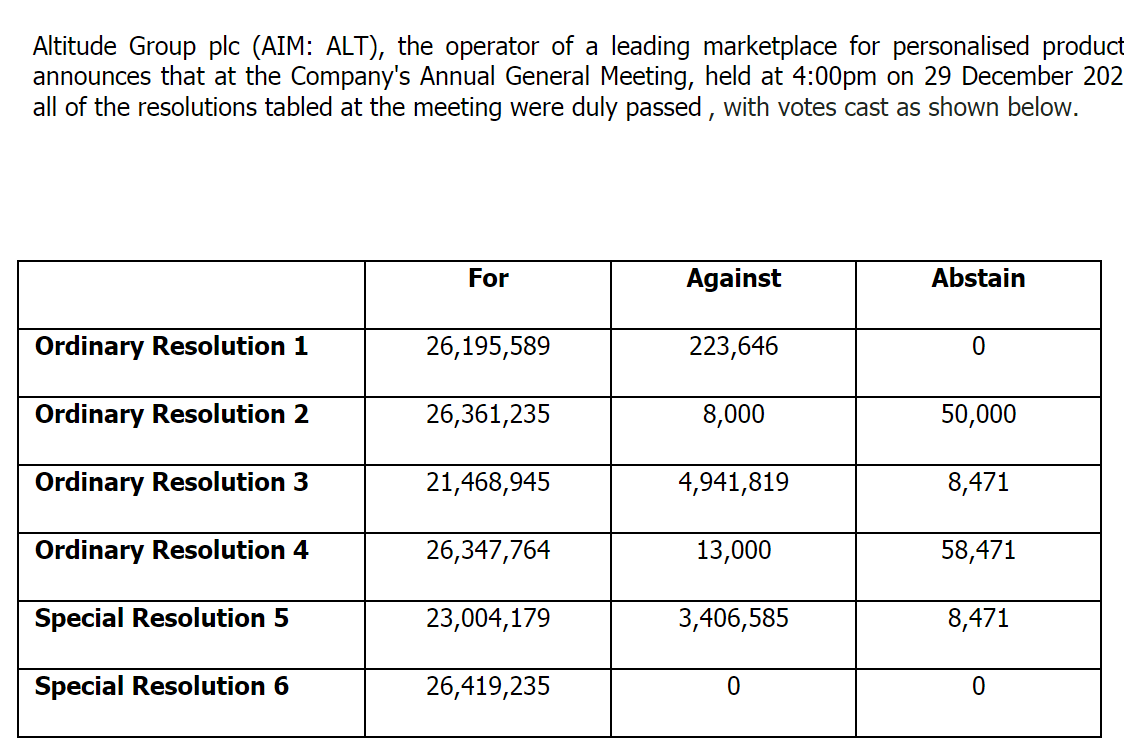

This "Result of AGM" statement deserves scrutiny for a lack of clarity. It just lists the votes, with no explanation as to what each vote is for! This aroused my curiosity, because it looks like the company is trying to hide the detail. That may not be the intention, but it wastes time for the reader, if an RNS lacks the detail or clarity it needs.

.

.

I ended up going on a wild goose chase, and having to download the last Annual Report, to find the AGM notice at the back. The significant "no" votes relate to;

Resolution 3 - to re-appoint Grant Thornton (19% no vote) - seems odd. I wonder what shareholders dislike about Grant Thornton? A 19% no vote is pretty significant, and clearly indicates that some shareholders think something is wrong.

Resolution 5 got a 12.8% no vote. This resolution allows Altitude to disapply pre-emption rights. Good to see some shareholders pushing back on that, but not enough to make it fail.

On another matter, Altitude has delayed its interim results (for 6 months to 30 Sept 2020) to end Jan 2021, seemingly because it doesn't know if customers are going to pay money owed or not.

It last reported net cash of £1.9m as at 28 Oct 2020. There was a going concern note with full year results published on 30 Oct 2020, saying;

The impact of Covid-19 could still possibly result in revenue and resulting cash inflows that are less and later than modelled potentially creating a need to secure additional funding. Notwithstanding that these factors represent a material uncertainty that may cast significant doubt about the Group's ability to continue as a going concern, the Board has a reasonable expectation that the Company has adequate resources to continue in operational existence for the foreseeable future.

That sounds a bit contradictory to me.

For a company that has performed so badly, it's astonishing to see "Share-based payment charges" of £1.4m, and £736k in the last 2 financial year/periods. What happened to rewarding success? These look like rewards for failure. I reckon most shareholders are relaxed about management lining their pockets with options, etc, if the share price is booming. But why is management being rewarded here?

.

.

My opinion - it looks like Altitude might need to raise fresh cash in 2021.

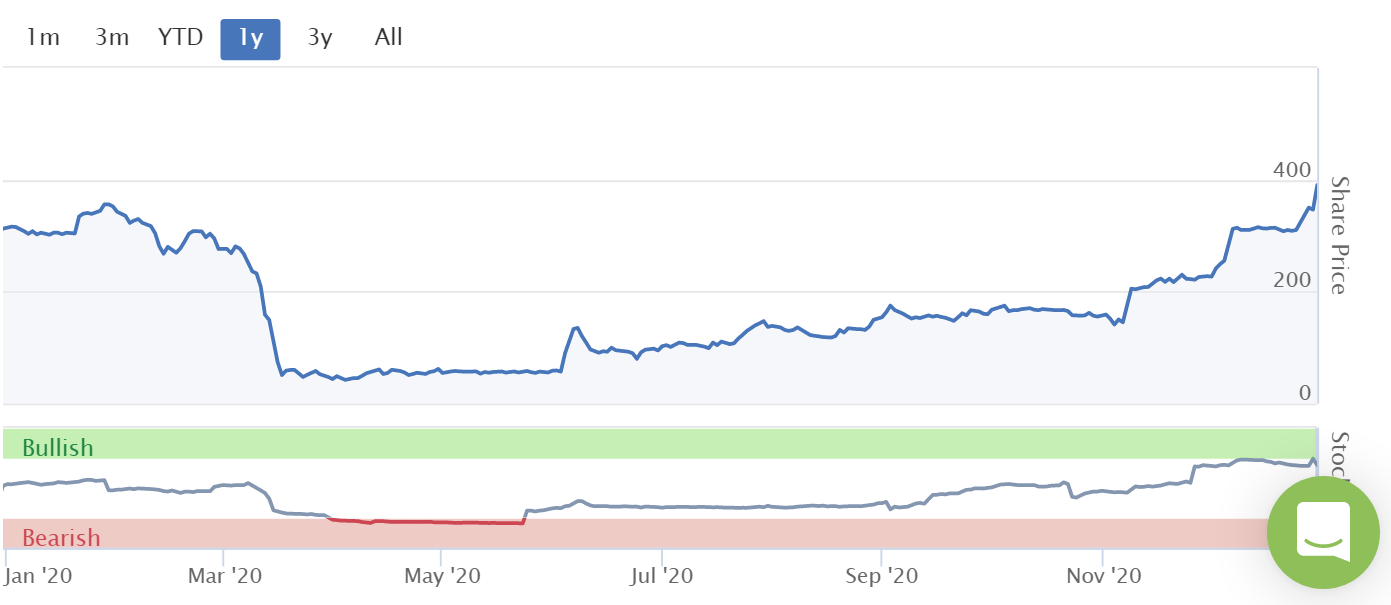

There was a lot of hype around this company from 2017-2019, but as you can see from the chart, it's all fallen flat because management hasn't delivered on the business plan. Covid is blamed for that, which is fair enough I suppose, to some extent.

With the market cap now down to £10m, this could be one to keep an eye on, because any signs of success could once again turn it into a multibagger maybe? Highly speculative though, and personally I'm not convinced that the business model is any good. But as always, I'll keep an open mind, because there can be good rewards for investors who spot a turnaround happening early.

.

Countrywide (LON:CWD)

We were discussing takeover bids yesterday.

This chain of estate agents has been a remarkable recovery share, as you can see from the chart below.

Competitor Connells has today upped its previous 325p cash offer, to 395p cash. That's a stunning outcome for shareholders. The share was almost priced to go bust back in the spring. That's because it had such a weak balance sheet, there was a real risk it might go bust. So investors who held through that period were taking a big risk, but it's paid off handsomely, so well done to them.

This has got me thinking about balance sheet strength. There are numerous situations where weak balance sheets resulted in dilution of shareholders through fundraisings during the crisis this year. Hence I'll never be convinced that lowering standards re balance sheet strength is a good idea.

However, banks are generally not pulling the plug on listed companies at the moment, because it makes sense to allow companies to recover, which then reduces risk for the bank better than forcing companies into administration. With interest rates near zero, it doesn't cost banks much to give companies time to recover. Government support often takes up the slack too, improving cashflow (time to pay arrangements have been extended in to 2022) and guaranteeing 80% of some loans.

Therefore I'm pondering whether I need to be so strict in my balance sheet rules, as I could end up missing out on more lucrative situations like Countrywide. It's something to think about over the new year break anyway.

Indebted companies with a weak capital structure could in some cases make good takeover candidates, providing the debt isn't wildly excessive. It's so difficult to predict which ones are likely to be the multibaggers though.

.

.

I think I'll leave it there for today, and for 2020 - a year I'm sure we are all pleased to see the back of. Although in terms of investments, it's a year where people who held their nerve during the crisis (and/or hedged with some shorts), have come out of things surprisingly well. I think we need to remember that equities are volatile, and it's part of the process to endure losses at times. It's not an actual loss until you sell of course.

Distinguishing between a company that is going fundamentally wrong, and a company that is just going through a sticky patch due to factors outside its control, is so important (ie. sell the former, buy/hold the latter). Also, suppressing sentiment is vital I think - decisions made through fear are usually wrong, and I always remind myself that I should sometimes be doing the opposite of what my emotions are telling me to do!

It's been mostly a pleasure writing these reports for you. The money is useful, but I do it mainly because I enjoy writing here. So let's keep it fun, mutually supportive, friendly, and not too serious, in 2021 and beyond hopefully. I know some people think it's clever to sound cynical & bad tempered about everything, but it's really not.

Special thanks to MrContrarian for his brilliant, and witty early morning snapshots, which help steer me towards the most interesting companies to cover in more depth.

Also, I must thank the team at Stockopedia HQ for putting up with my sometimes erratic personality, and helping to quietly resolve sometimes ridiculous problems created by a few subscribers. Still, it takes all sorts, and I understand that if people are having a bad day, or just are not very happy about life generally, then lashing out on the internet can be a tempting route to follow. I'm as guilty of that as anyone else, so I try not to let it bother me when people want to take potshots. The overwhelmingly positive feedback from readers is more important, and very much appreciated.

Have a super, socially distanced New Years celebration! Here's raising a glass to the wonderful scientists who've developed the vaccines much faster than imagined, and everyone else who has kept the country going in 2020!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.