Good morning, it's Paul here.

As usual, please see the header for the announcements which have initially caught my eye.

AO World (LON:AO.)

Share price: 93.25p (down 3.9% today, at 08:41)

No. shares: 471.9m

Market cap: £440.0m

AO World plc ("the Company" or "AO"), a leading European online electrical retailer, announces the following trading update for the twelve months to 31 March 2019 ("FY19").

A slight disappointment by the looks of it;

Group Adjusted EBITDA (excluding exceptional costs) is expected to be at the lower end of market expectations...

2 Company compiled revenue consensus of £892.6m, with a range of £876.0m to £904.2m and EBITDA consensus of £0.7m, with a range of £-0.4m to £2.0m.

Footnote 2 is very investor-friendly, so well done to AO & its advisers. It makes life so much easier for investors when companies include a footnote to explain what market expectations are. Every company could & should do this. It makes sense to help investors quickly & easily understand performance, as we're more likely to buy the shares, if information is presented in a readily-understandable way.

- Revenue growth is only 9% (organic) - not very impressive.

- Revenue of £900m, but it still can't make a profit even at the EBITDA level. So what exactly is the point of this business existing?

- Increased stocks ahead of Brexit

- Additional £2.5m in exceptional costs

- Outlook comments are mainly management-speak waffle

- Expanding into new categories, such as garden & DIY

- Also trying out product rental

My opinion - the original business model really hasn't worked. So why is this loss-making company still valued at £440m? It doesn't make any sense to me.

It's not clear how it will compete with Amazon Prime, etc.? Selling other people's stuff, at low margins online, just isn't a good business model. Online works better when product is unique, in demand, and high margin. That's not likely to ever be the case in electricals (nor garden & DIY either).

IMImobile (LON:IMO)

Share price: 316.5p (up 10.3% today, at 11:13)

No. shares: 66.7m

Market cap: £211.1m

IMImobile (AIM: IMO), a leading communications software and solutions provider, is pleased to announce the following update ahead of its preliminary results for the year ended 31 March 2019.

The highlights section reads positively, but omits to mention what (for me) is the most important performance measure - namely profit before tax (normal, and adjusted).

Instead we have to make do with EBITDA, which is not a useful measure at software companies which capitalise development spend;

Adjusted EBITDA for the full year is expected to be over £17.8m (2018: £13.4m) an increase of over 30% year on year.

Outlook - sounds upbeat;

Jay Patel, Group Chief Executive of IMImobile, commented: "We are pleased with the strong trading results and momentum we have in the business. This reflects the market dynamics shifting towards more automation and the use of digital channels for delivering better customer experiences. We have a great modular set of consumer engagement products and have invested significantly in IMIconnect, our Enterprise cPaaS offering, that we believe, in its category, is one of the best globally.

We have delivered strong growth in gross profit of over 20% and EBITDA of over 30% with high levels of cash generation and enhanced operating leverage whilst making strategic progress with several key partners and in new geographies.

We enter the new trading year with strong momentum and are confident in delivering continued organic growth across all parts of the business."

My opinion - I rate the CEO here, Jay Patel, highly - having met him a couple of times to learn about the business & its services. He comes across as a very driven, and intelligent CEO, just what I look for.

I'll wait to see what the full numbers look like, when they're published in late June 2019. Trading updates are interesting, but as a general point, they often gloss over important details, and cherry-pick the best things only.

This share has fully recovered from the recent across-the-board sell-off. It looks priced about right now, in my view.

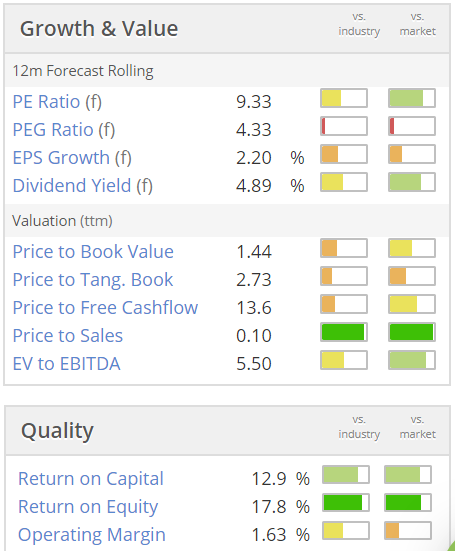

Interestingly, the StockReport shows that this share qualifies for a shorting screen;

Look at the 2-year chart below. It just goes to show that, price movements & charts for illiquid small caps can often be meaningless, and not reflective at all of how the company is trading.

NWF (LON:NWF)

Share price: 151p (up 8.6% today, at 11:52)

No. shares: 48.75m

Market cap: £73.6m

This group is a specialist distributor of fuel, food and [animal] feed across the UK

An acquisition is announced, but no financial details are given, so I assume it must be quite small. Curiosity got the better of me, so I've looked up the private company (Consols Oils) accounts at Companies House. It has NTAV of £646k, which is nearly all motor vehicles (fuel tankers, presumably). It's doesn't publish a P&L, as it's too small. It pays about £50k p.a. in corporation tax (within creditors), suggesting that it makes about £250k p.a. profits. So it doesn't look material to NWF's numbers.

Current trading is in line;

The Group is also pleased to report that current trading is in line with the Board's expectations for the full financial year ending 31 May 2019 after the completion of the important winter period. The Group expects to issue a year end trading update in mid-June in line with its prior year practice.

Valuation - looks about right to me;

My opinion - the divis are pretty good, at near to 5%.

That's about it. I can't see any particular reason to want to own this share, apart from the divis. There might be some merit in it consolidating small companies in the same sector, if it can buy them cheaply.

A few quick comments to finish off;

HSS Hire (LON:HSS) - 2018 results are out today. The headline figures look as if a remarkable turnaround is underway. Digging a bit deeper though, the continuing operations are only really generating enough profit to service the debt interest, not to actually reduce debt meaningfully. So how will the excessive debt be repaid? A disposal has sorted out some of it, but the balance sheet remains very stretched.

Adjusted EBITA (i.e. operating profit) has improved from -£6.8m in 2017, to +£22.1m in 2018 - a huge improvement. However, finance cost on the P&L is £20.4m, absorbing nearly all profits.

It isn't paying any divis - which makes sense, since it's financially distressed.

Overall, the group has survived thanks to its lenders being accommodating. That seems to have bought management the time to turn around the business. Whether the equity has much (or any?) value is another question. Far too risky, in my view. So still uninvestable. That could change for the better, if the turnaround in trading continues.

Mothercare (LON:MTC) - Q4 trading update today says in line with market expectations.

I can't see any point in reporting on this share any more. LFL sales continue to decline, so store closures are really just postponing the probably inevitable long-term failure of the business, in my view.

That's me done for today, there's nothing else of interest.

Tomorrow will be a catch-up day, for the loose ends I left behind earlier this week.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.