Good morning, it's Paul here.

Please see the article header for the companies whose trading updates I am covering today.

Debenhams (LON:DEB)

Share price: 28.9p (down 18.8% today)

No. shares: 1,227.8m

Market cap: £354.8m

Trading update - the department store group announces trading for the 17 weeks to 30 Dec 2017.

The problem with updates from retailers, is that too much emphasis is put on like-for-like ("LFL") sales. However, there is no consistency in how this measure is calculated - some include refurbished shops (e.g. Moss Bros (LON:MOSB) ) which I think is clearly incorrect. The whole point of refurbishing a shop is to increase sales, so it's not a LFL comparison once it's been refurbished. Other retailers merge retail sales and online sales in their LFL calculations, which muddies the water. Farcically, Mothercare (LON:MTC) even reports customers in-store ordering on one of their tablets as online sales!

For these reasons, I'm increasingly just focusing on forecast profit. After all, that takes into account everything - sales, gross margins, and costs. The guidance given today is as follows;

Looking ahead, should the current competitive and volatile environment continue into H2, FY2018 profit before tax is now likely to be in the range of 55m to 65m

To put this into context, timing-wise, FY2018 is the year to end-Aug 2018.

Broker updates - I've got several in my inbox this morning. To give a flavour, one has reduced its PBT forecast from £79.0m to £55.4m - a reduction of 30%.

The key thing is to consider that this is based on forecast revenues of almost £3bn. So Debenhams profit margin is wafer thin, at about 1.8%. What that means, is that only a small further deterioration in sales & gross margins could easily tip the company into losses, and possible insolvency (if shareholders refuse to refinance it).

More details from today's RNS;

- Digital sales are up 9.9%, giving 2 year growth of 22%. So optimists might latch onto the possibility of Debs transforming itself into an eCommerce company with some big stores also acting as warehouses. The new CEO is ex-Amazon, so who knows what might happen in this area?

- UK LFL sales down 2.6% in the 17 weeks to 30 Dec 2017. The basis on which this figure is calculated is not explained - does it include digital and stores, or just stores?

- Gross margin in H1 is down 150 bps, which is a lot in cash terms - annualised, that's about £45m less profit on £3bn revenues. The problem seems to be that Debs is having to do price promotions to drive sales - not good.

- Cost savings of an additional £10m over previous guidance have been found, with another £10m in future years. As with all retailers, costs are rising (especially wages, and imported goods), but revenue & gross margin are falling. That's a really toxic combination.

My opinion - I agree with the bearish consensus on Debenhams. It's being squeezed from all directions, and is only marginally profitable now. Therefore, the most likely outcome seems to be a continuing deterioration in profitability, possibly moving into losses next year & beyond.

To survive, let alone prosper, I think retailers need cost flexibility, as mentioned in yesterday's section on Next (LON:NXT) . Next has short leases, which means that any loss-making stores are only a temporary problem, with renegotiated rents now only costing it 5% of revenues (previously 7%) - a very low level. To preserve profits, the rents have to come down, for almost all retailers. Apparently Debs has long leases, and the conventional lease structure in the UK is for upward-only rent reviews. Therefore, I think its leases could potentially bring down the whole company, and force it into a CVA in future, perhaps?

Forex is another key question mark over Debs. I recall that it had very long forex hedges, resulting in favourable cost prices for product. These favourable forex hedges (at pre-Brexit vote levels of £:$) are expiring in 2018. That could mean further gross margin pressure in 2018, as more expensive product begins to flow through.

Overall then, I feel the bears have probably called this right, and we could be witnessing the beginning of the end for Debenhams, perhaps? Upside potential could possibly come from something transformational happening, but it's difficult to see what. The trouble with department stores, is that they're so big, the ongoing capex spend is massive, and relentless. To transform performance often requires a very expensive refit. I don't think Debs has the financial firepower to do that, and its balance sheet overall looks weak.

So overall, I can't see anything positive here - it looks doomed to eventual failure.

EDIT: I would also treat the big dividends as being past their sell-by date. A dividend cut (possibly to zero) now looks inevitable. The company cannot afford to keep paying out big divis as well as refurbishing its stores.

Sopheon (LON:SPE)

Share price: 440p (up 21.6% today at 10:31)

No. shares: 10.0m

Market cap: £44.0m

Sopheon, the international provider of software, expertise, and best practices for Enterprise Innovation Performance, is pleased to announce an initial indication of the Group's performance in 2017.

Today's update will have resulted in lots of happy shareholders, including a friend of mine who has been nagging me for ages to buy some of these shares! I tried, but it was so illiquid that I couldn't get any, unfortunately.

Anyway, the company is performing well, and has a positive outlook;

In our interim report issued on 24 August 2017, we highlighted continued building of momentum and enhanced market recognition of the Company's product set. We are pleased to report that this has again translated into solid growth, with particular strength in the closing quarter of the year.

As a consequence, early indications are that revenues, EBITDA and pre-tax profits for the year ended 31 December 2017 will all exceed market expectations.

In addition, we expect improved recurring revenue and visibility into 2018.

Capital structure - an important point to note is that the company normalised its capital structure in Dec 2017. So the 10.0m shares in issue shown above, is no longer subject to dilution from loan stock which has now coverted into share. So that problem is solved. However, bear in mind that the EPS calculations for 2017 will use a weighted average number of shares in issue, hence will overstate ongoing EPS. Therefore this issue still needs careful checking, when looking at EPS calculations & forecasts.

Another issue to consider is how you treat the company's brought forward tax losses. Personally I like to normalise the tax charge, to avoid over-paying for any share.

Note also that the company reports in US dollars.

My opinion - the company sounds like it's on a roll - this is a good update today.

I'd like to get properly stuck into the figures, which are due out on 22 Mar 2018. It's difficult to work out the valuation & upside potential, with very little research available on the company.

So for now, I'll park this one to one side, even if that means potentially missing out on any further possible share price appreciation.

Churchill China (LON:CHH)

Share price: 1240p (up 9.3% today, at 11:31)

No. shares: 10.96m

Market cap: £135.9m

Churchill China plc (AIM: CHH), the manufacturer and distributor of performance ceramic and related products to hospitality and retail markets worldwide, is pleased to announce the following trading update for the year to 31 December 2017.

I hadn't noticed what a terrific run this share has had, since the dip in Nov 2017;

Given that there had already been such a big move upwards, I'm a little surprised that today's slightly ahead update has pushed it up another 9.3% today.

We have continued to make solid progress against our long term objectives throughout 2017. Revenue growth has again been good in export markets. As a result the Board now expects that operating performance will be slightly ahead of current market estimates. Additionally, cash and deposit balances are also expected to exceed current market expectations.

Valuation - I see that one broker has slightly raised its 2017 EPS forecast to 55.8p. That equates to a PER of 22.2 times - quite a rich rating, given that only modest increases in profitability are forecast for 2018 and 2019.

My opinion - this is a good company, in my view - excellent products, innovative, and selling well into Europe, aided by weak sterling. It also has a strong balance sheet, with net cash. Note there is a pension deficit too, but it's not excessive.

In my view the price seems up with events, so I wouldn't be interested in buying at this level.

Cambria Automobiles (LON:CAMB)

Share price: 60.5p (down 0.8% today at 11:47)

No. shares: 100.0m

Market cap: £60.5m

AGM trading update - and franchising developments.

This is a group of car dealerships. It has a 31 Aug year end, so is today updating us on trading in Sep-Nov 2017.

The Group's trading performance in the first three months of the current financial year has been in line with the Board's expectations, albeit behind the corresponding period in 2016/17, both on a total and like-for-like basis. This trading performance in the first quarter continues the trend highlighted in the Group's preliminary results on 22 November 2017 and means that the Group is trading in line with market expectations for the full year.

Other points in today's update seem to be consistent with existing trends - i.e. tough new car market, mitigated by reasonable performance from used cars & aftersales;

New car sales down 14.4% on an LFL basis. Gross profit per unit also down - sounds a nasty combination.

Used vehicle sales down 2.8% on an LFL basis. Improvement in gross profit per unit.

Aftersales - LFL profitability up 5.9%.

Outlook - it's interesting that the group seems to be focusing more on the luxury car market;

The Board remains cautious about the new car market in light of the general uncertainty in the consumer environment and the pressure that vehicle manufacturers are under as a result of the current Sterling exchange rate.

Nevertheless, the franchising progress that has been made through 2017 and into 2018 has further enhanced the Group's excellent portfolio of dealerships and leaves the business well positioned with strong representation in the high luxury segment of motor retail.

Valuation - this whole sector looks dirt cheap at the moment, so it's a good hunting ground for value investors. It all depends what view investors hold about the future. There are some amazing deals around on secondhand cars, and new cars are now mostly sold on cheap personal leases. There's considerable uncertainty now about the future of diesel, with electric cars starting to creep into the market. So considerable changes are happening. What that holds for the dealers, who knows? They might adapt, or become extinct in the long-run, I have no idea - few people accurately predict the longer-term future.

Given that all car dealers can be had on a low PER, then I think focusing on balance sheet strength is very important, particularly freehold property assets, which might have good alternative use value. There might be consolidation in the sector, with takeover bids at some point?

My approach is to stay away, and buy on any plunges. So I picked up some Pendragon (LON:PDG) at 22p last year, and have a nice profit on that now. Similarly, I'm inclined to watch on the sidelines, and try to repeat that process - by buying shares in any other financially strong dealerships which also spike down on negative trading updates. Most in this sector look to be much of a muchness, although I like Vertu Motors (LON:VTU) in particular for its balance sheet (don't currently hold any, but am considering a purchase).

Walker Greenbank (LON:WGB)

Share price: 140p (down 2.1% today)

No. shares: 70.9m

Market cap: £99.3m

(at the time of writing, I hold a long position in this share)

Walker GreenbankPLC(AIM: WGB), the luxury interior furnishings group,provides an update following the announcement on 6 December 2017 regarding a machine fire at the Company's Loughborough wallpaper factory, Anstey Wallpaper Company.

A "minor fire" damaged one of 6 wallpaper printing machines in their factory. The company previously said that the maximum impact on profits in y/e 01/2018 would be £0.5m. That figure is reiterated today;

As previously announced, the maximum potential impact on profitability in the current financial year is expected to be less than 0.5m.

The repair to the embossing machine, and fire damage to a small amount of stock, is covered by the Company's comprehensive insurance policy.

It doesn't mention business interruption insurance, so I'm not sure if that is covered too - since some orders have been delayed into the new year (not quantified). EDIT: broker coverage suggests there will be no loss of profit, just a deferral into the new financial year.

No other information is given in today's update, therefore I assume we must be in line with revised guidance given after the profit warning which I covered here on 15 Nov 2017.

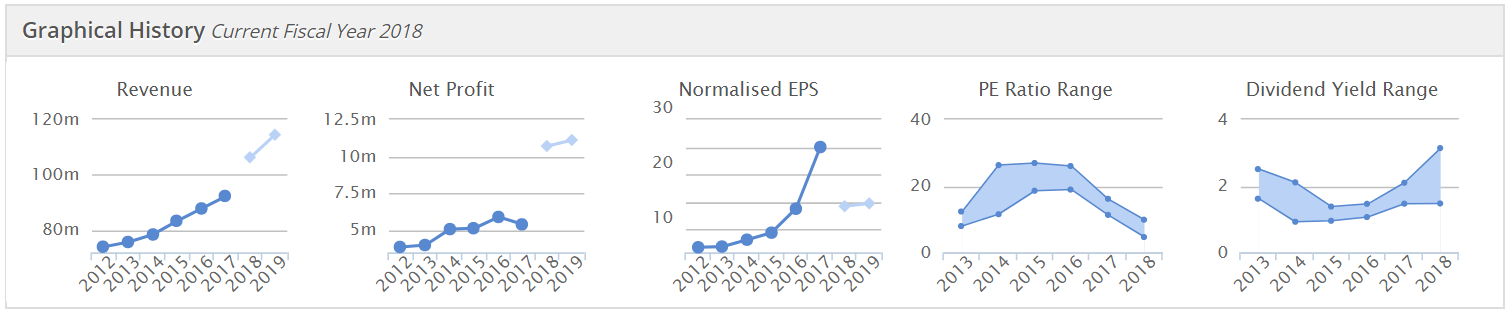

Valuation - helpfully, there's an updated note today from a high quality broker, available on Research Tree. Adjusted, fully diluted EPS forecasts are as follows;

y/e 01/2018 13.6p giving a PER of 10.3

y/e 01/2019 15.3p giving a PER 9.2

That seems a very modest rating for what remains a good quality business, operating in a profitable niche.

My opinion - I've always quite liked this business, but most of the time it has looked too expensive for me. Therefore, I used the profit warning last autumn as an opportunity to buy. I just waited a few days for the share price to stop falling, then picked up some stock at 123p, which for once was nicely timed. It's recovered about 14% since then.

The big question is whether the profit warning was just a blip (said to be due to subdued demand in the UK, but not overseas). Or, whether there's something bigger going wrong, e.g. products going out of fashion, or not price competitive?

On balance, I'm prepared to give it the benefit of the doubt, because the forecast PER is now very low, and it has a sound balance sheet, plus should continue to pay a reasonable dividend yield of about 3.3%.

The joker in the pack is the potential for an overseas takeover bid. Prestige British brands are attractive to Americans in particular, and US companies on high ratings arguably need to buy in growth to justify those ratings. So I foresee the possibility of Walker Greenbank (LON:WGB) and possibly Portmeirion (LON:PMP) (both of which I hold personally) becoming bid targets at some stage, maybe, who knows?

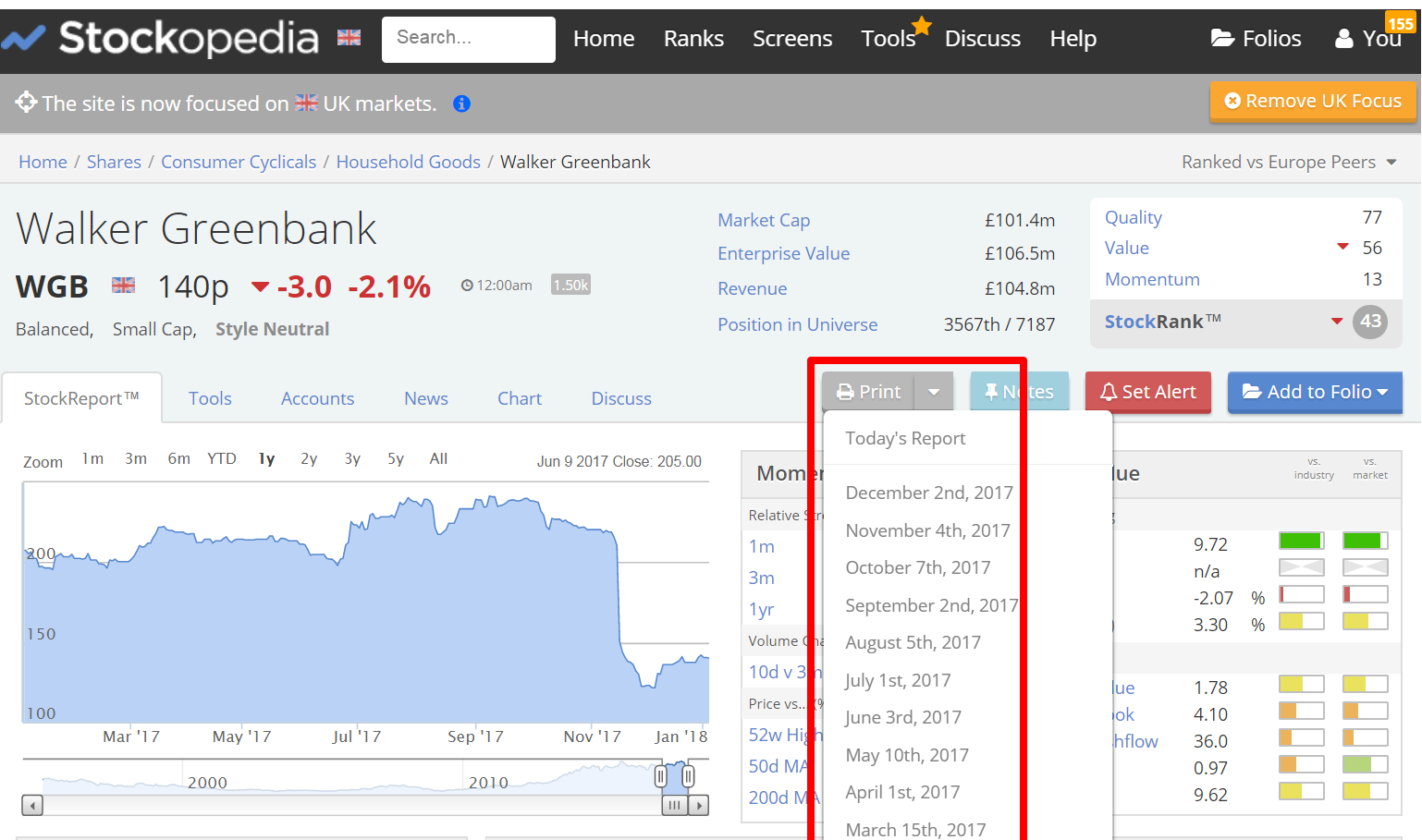

I always sense-check my views against the StockRanks. In this case the Stockopedia computers are not convinced, as you can see below, with a poor momentum score dragging down the overall rating;

In this case I'm prepared to ignore the low StockRank, as I believe that momentum could return, if trading stabilises. Although a low StockRank will usually act as a brake on the position size I'm prepared to apply to a purchase. So in this case, I only bought a fairly standard sized position in it, and probably won't increase that unless & until current trading has improved.

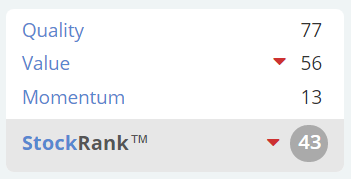

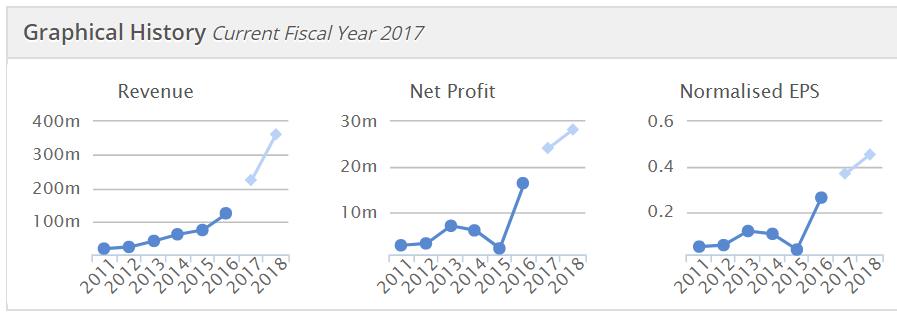

The StockRank was 69 immediately before the profit warning. You can check historic StockReports by clicking on the "Print" button - this then gives you a drop-down menu of historic data to choose from, which is very useful I find;

It's also interesting to note (from chart no.4 below) that in the last few years this share was given a much higher PER by the market (before the profit warning). Therefore I see a potential opportunity here for the multiple to expand back up again, if confidence in the company returns.

Taptica International (LON:TAP)

Share price: 490p (up 5.4% today)

No. shares: 62.4m

Market cap: £305.8m

Taptica (AIM: TAP), a global end-to-end mobile advertising platform for advertising agencies and brands, provides the following update on trading for the year to 31 December 2017.

The key part of today's announcement says;

... the Company expects to report adjusted EBITDA for FY 2017 ahead of market expectations and revenue broadly in line with market expectations demonstrating a higher-than-expected EBITDA margin.

The Company remains confident of delivering solid year-on-year EBITDA growth for 2018 in line with market expectations.

So, revenues a bit below, but EBITDA ahead. That sounds OK, providing you're happy with EBITDA. What a pity the company couldn't stick to proper metrics, like profit before or after tax, EPS, etc. It's such a nuisance when companies report on EBITDA, because that then forces investors to check the accounts, to make sure that EBITDA is a safe figure to rely on. The trouble is that, very often with tech companies, EBITDA is not a safe figure to rely on (due to often excessive capitalisation of costs into intangible assets).

Having checked the last interim results, I'm pleased to say that Taptica seems to capitalise very little development spend - only $555k in H1.

So the cashflows look real to me. The company seems to be using its healthy cashflows to pay modest divis, and make further acquisitions. The track record of growth looks stunningly good, with particularly impressive growth kicking in from 2015 onwards;

Valuation - is modest, because I think the market doesn't generally trust overseas AIM stocks, especially where many investors won't necessarily understand how the company generates its profit & growth (I'd put myself in that category).

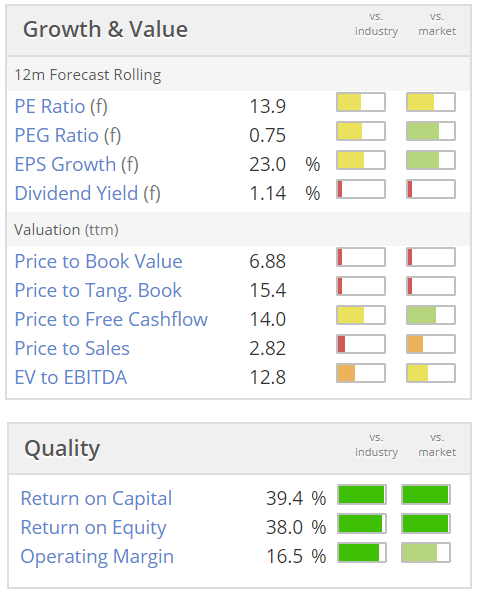

However, if you do understand the business model, and are happy with it, and if you think profits & growth are sustainable, then this share is cheap. Here's last night's growth & value data - which seems to be showing a growth company priced like a value share;

Updated broker forecasts- FinnCap have upped their 2017 adjusted fully diluted forecast for 12/2017 from 36.0c to 40.7c (30p). So at the current share price of 490p, the 2017 PER is 16.3.

In terms of 2018 forecasts, FinnCap has pencilled in 43.3c, or 32p - giving a forward PER of 15.3.

Tremor Video DSP - this was a big, $50m, acquisition made in Aug 2017. This seems to have used the entire cash pile, plus required a $30m HSBC facility. In today's update Taptica makes positive noises about this big acquisition;

...Tremor Video DSP performed better than anticipated, including achieving profitability during 2017 rather than in 2018 as initially expected.

My opinion - I like the numbers, but won't be investing again because I don't understand the business model or sector. The meltdown in the ad tech sector a couple of years ago scared me away from this type of business, because innovations can turn business models upside down, and it's such a fast-moving sector. Good luck to holders though, so far so good - it's been nearly a 10-bagger in the last 2 years, so fantastic returns for those who backed it.

Note that the Stockopedia computers like the numbers too - a strong StockRank of 90.

Ethernity Networks (LON:ENET)

Share price: 80.8p (down 38.6% today)

No. shares: 32.5m

Market cap: £26.3m

Trading statement (profit warning)

Ethernity Networks (AIM:ENET),a technology solutions provider that develops network data processing technology used in high-end Carrier Ethernet applications, today provides the market with an update on trading for the year ended 31 December 2017.

This company only listed on 29 Jun 2017, and has today issued a profit warning, barely more than 6 months after floating. That's diabolical, and probably one of the worst things a company can do, in my view. If the numbers were in any doubt, it should not have floated. Let's have a look at the Admission Document, and see who floated it - it was Arden Partners. The placing price was 140p, so it's already lost 42% of its original price.

I'm having a quick skim through the Admission Document. A few points;

- The company is domiciled in Israel - higher risk, but a country which does have a strong track record in producing impressive technology companies.

- This is a very small company - revenues only c.$2.2m in 2014, 2015 & 2016.

- Reason for flotation is good - raising fresh funds for the company, and not cashing out existing holders. Increased profile & balance sheet strength were sought to impress potential customers - which makes sense.

- Pro forma balance sheet (see page 86 of Admission Document) is very strong, with nearly $17m in net cash.

- Some of placing proceeds are being used to increase R&D, and increase sales & marketing. So expect losses in the short term (it was modestly profitable prior to floating).

- Management remain substantial shareholders - plenty of skin in the game.

There are some quite good things in the bullet points above. What a pity then that the company has had to warn on profits.

Profit warning - what's gone wrong then? I find the RNS today rather too technical in terminology, but it seems to boil down to expected contract wins or renewals not happening by the end of 2017.

It doesn't sound too bad though;

As a result of the above, the Company anticipates that revenues and profits for the year ended 31 December 2017 will be below market expectations, however the Company has significantly increased operating profits when compared to the previous year...

For comparison purposes, the Admission Document (on page 37) shows $339k operating profit for 2016. I can't find any updated forecasts today, but Stockopedia is showing broker consensus of a forecast net (i.e. after tax) profit of $1.31m for 2017, and $3.22m for 2018. From the information we have available, it's impossible to quantify how big a miss is likely, but at a guess it looks as if 2017 profits might be only around half the forecast, if that. So a substantial miss, I'd say.

My opinion - I know absolutely nothing about this sector, so have no idea whether the company's business model is any good or not.

I do however like that the company has a big cash pile relative to its reduced market cap - that nicely underpins the valuation at some level (maybe below where it is right now).

It's overseas, AIM, is very illiquid, and just warned on profits though, so for me it's best avoided. People who understand the technology, and rate it highly, might disagree though. Do we have any techies in the house, who can give an informed view on the merits of this company's products? If people think the tech is good, then I might have a little punt on it - as the decent cash pile protects some of the downside risk, and means that there's no risk of dilution or insolvency. Also the company is still profitable, albeit at a lower level than planned. So it wouldn't be a ridiculous punt.

Be Heard (LON:BHRD)

Share price: 2.23p (down 22.1% today)

No. shares: 981.9m

Market cap: £21.9m

Trading update (profit warning) - and Board changes.

Be Heard, the digital marketing services group, announces a trading update for the year ending 31December 2017 and the evolution of its management structure.

I've only reported on this company once before, here on 2 Aug 2017. My conclusion then was that a horrible balance sheet made it uninvestable to me.

Here is today's profit warning;

Whilst annualised revenues and new business wins provide an excellent platform for 2018, profitability for 2017 is expected to be below market expectations due to a number of unexpected factors...

The factors explained in more detail are basically contract deferrals, and a reduction of activity, which occurred too late to be mitigated with cost savings. There was also a problem with cost overruns on a substantial contract.

Forecasts - there is an update from one broker on Research Tree, but they haven't yet changed any forecasts. So we're in the dark about the extent of the 2017 profit shortfall. That's not satisfactory, and means that it's currently impossible to value the share on its 2017 results.

2018 forecasts remain unchanged, with a big rise in profitability pencilled in, to £3.5m. I'm not sure how realistic that is now looking, given that the company has failed to achieve its £2.0m forecast profit for 2017.

My opinion - if the company had a sound balance sheet, then it might be worth a look, as it is generating impressive organic revenue growth, and has some big name client wins. However, for me its the underlying financial strength which is essential before I'll invest - i.e. a strong balance sheet. That is conspicuous by its absence here, hence I fear that at some stage this company will probably need to do a discounted placing, to repair its balance sheet. I wouldn't consider investing unless & until that has been done.

Water Intelligence (LON:WATR) - this was a reader request. However, it's not a trading update, and gives no information on performance against market expectations, so I can't meaningfully comment on it. Sorry about that.

Cyanconnode Holdings (LON:CYAN) - I've just seen what looks like a profit warning from this company which has been promising great things relating to smart meters. The shares are only down 5.5% today to 18.9p, but in my view things are looking very wobbly here.

It says that a contract delay means that 2017 revenues will only be £1.2m. Stockopedia shows broker consensus of £2.1m 2017 revenues, and a gigantic forecast net loss of -£9.4m.

The company says that it had an end of year order book of $100m, and a pipeline of $320m. I'll believe that when I see it turn into real revenues & profits.

It says net cash was £5.5m, with receipts of £1.3m from tax credits also due, and funds yet to be received from its Sep 2017 fundraising. It's not clear what proportion of that £8.6m fundraising has not yet been received. The trouble is, the company has prodigious cash burn, so it looks like yet another fundraising is going to be needed around spring/summer 2018. Will investors have the appetite to keep pouring in money? Who knows - it's a fundamental uncertainty that makes me want to steer clear. I don't mind having the occasional punt, but only when companies have plenty of cash in the bank (e.g. Ethernity Networks (LON:ENET) above)

This thing looks very high risk to me. I hate under-funded jam tomorrow situations like this, so wouldn't go near this one. Occasionally punters hit the jackpot with jam tomorrow shares, but the vast majority disappoint, and destroy shareholder value, in my experience.

All done for today! Graham will be looking after you tomorrow, as is usual on Fridays :-)

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.