Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Live prices tracking spreadsheet for Paul & Graham's 2024 share ideas (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs) - search on any podcast provider for "Paul Scott small caps", or web link here.

Summaries

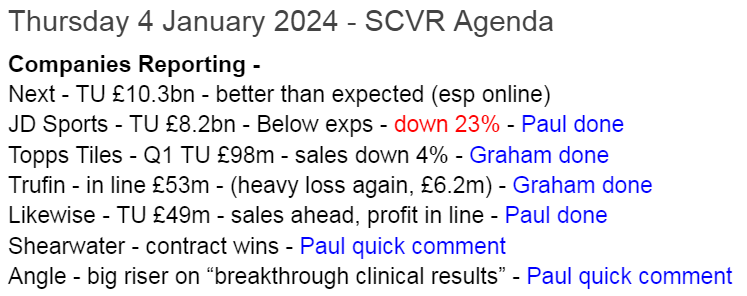

Likewise (LON:LIKE) - Up 15% to 23p (£56m) - Trading Update (in line) - Paul - AMBER

The market clearly likes today's upbeat tone, although it's only in line with expectations on profit. I can see the potential for operationally geared upside here, as it gains market share, and (maybe) demand recovers from depressed levels. On a value basis I prefer larger competitor Headlam (LON:HEAD) but LIKE is certainly a thorn in its side, and may have greater growth potential. A race to the bottom on already low margins is possible though.

Trufin (LON:TRU) - down 6% to 47p (£50m) - Trading Update (revenue miss) - Graham - RED

This group of three companies misses its revenue forecast by a wide margin after delays in commercial agreements at its video game business. The cash balance is still substantial and might withstand upcoming losses but the investment case remains far from clear to me.

Quick comments on today’s movers -

Angle (LON:AGL) up 55% to 20.5p (£53m) - “breakthrough clinical results” - Paul - RED

This jam tomorrow share ("world-leading liquid biopsy") has been around a long time (20 years on AIM!), and burned through lots of cash, funded by repeated dilutive fundraisings. Said on 9/11/2023 that “cash runway extended into Q2 2025”. Could be an interesting, higher risk punt, who knows, but price spikes on nice updates have fizzled out every time previously. [no section below]

Shearwater (LON:SWG) - up 9% to 50p (£12m) - Contract wins - Paul - AMBER

Quite an interesting update from this cyber-security services company, with a $3.2m (over 3 years) deferred contract with a global bank now signed. Plus a £0.8m deal with a UK Govt department, 3 years again. I like to see deals with major customers, as they can act as good reference sites for further contract wins. I’ve not looked at it since profit warning in Mar 2023, when I thought it might be cheap. Last balance sheet seems adequate. Could be worth a fresh look?

Topps Tiles (LON:TPT) - down 7% to 46.1p (£91m) - Q1 TU (revenues soft) - Graham - AMBER

Full-year estimates for 2024 and 2025 are unchanged, but investors might struggle to have faith given that Q1 revenues show year-on-year weakness towards the end of the quarter, and there is likely to be a large second-half weighting. Cheap but maybe priced right here.

JD Sports Fashion (LON:JD.) - Down 23% to 119p (£6.2bn) - Trading Update (profit warning) - Paul - BLACK (profit warning), but GREEN on fundamentals (it’s cheap now!)

I delve into the profit warning from this FTSE 100 sports retailer, and come to the conclusion that it's looking attractive value now. A possibly interesting entry point, I wonder?

Paul’s Section:

Likewise (LON:LIKE)

Up 15% to 23p (£56m) - Trading Update (in line) - Paul - AMBER

Likewise Group plc (AIM:LIKE), the fast growing and progressive Flooring Distributor…

This is the challenger flooring distributor, set up by a former CEO of the sector leader, Headlam (LON:HEAD) . I gave it a tentative thumbs up here on 13/1/2023, but cooled to amber on 30/5/2023 with an in line update. The business needs to scale up some more, to generate meaningful profits I think. This was confirmed when I had a call with the CEO last summer, who indicated more acquisitions, and pushing more volume through the existing facilities is the strategy to grow profits.

My main concern is that LIKE might be eroding margins at HEAD through competing for business, leaving both in a lacklustre position maybe? Although I included HEAD in my top 20 share ideas for 2024 due to its very low valuation, large freehold asset base, and scope for profit recovery as consumer demand may return to a more normal level (about 20% higher than current depressed demand, HEAD has said previously).

Both businesses are pretty basic - they buy carpets in bulk, with a very wide range, store them in large warehouses, then supply independent carpet retailers on a room-by-room basis for each customer order, charging a fairly modest mark-up. So it’s really all about scale, plus efficiency & managing the logistics & sales operation well.

So far, LIKE has expanded rapidly, and only made modest losses during the rapid growth phase. The reason I’m following LIKE is because in a bull market, I could see the rating expand to anticipate more growth, and profit margins could rise as it achieves greater scale, so as I said on 30/5/2023 it’s possibly one to watch?

FY 12/2023 is forecast to be profitable, but only a modest profit margin -

Today’s news -

Trading update - FY 12/2023.

Revenues ahead of expectations.

Underlying profitability is in line with market expectations.

Outlook -

The Board is confident of achieving the current market expectations for FY24 as the Group continues to develop its position in the UK Flooring Market…

The Group has invested heavily in Point of Sale Displays and Sampling to significantly increase its market presence over the last three years in conjunction with establishing the Logistics Infrastructure. The final quarter of 2023 demonstrated the success of this strategy to date with the ability to generate increasing Sales Revenue whilst providing the Operational expertise to service customers effectively.

This strategy will continue into 2024 as the Group is confident in continuing to gain market share and through operational gearing, improve profitability.

Dividends - 3 small divis have been paid since it listed - 0.2p (8/7/22), 0.2p (7/7/23), and 0.1p (17/11/23) according to the data. Although the commentary today refers to a “maiden interim dividend” declared in Sept 2023. ”Committed to a progressive dividend policy in line with profitability”.

Balance sheet - I’ve checked the last one, as at 30/6/2023, and it looks OK to me. There’s some freehold property in there, and a tiny net bank debt position. Lots of working capital, but debits and credits balance up. No concerns here, although note the price to NTAV of about 1.8x (after adjusting for today’s share price rise) is much higher (ie. worse) than the exceptionally cheap 0.87x of larger competitor HEAD. In other words, buying HEAD shares provides a lot more balance sheet downside protection than LIKE shares.

Broker updates - there are 2 today, WH Ireland and Zeus, very helpful, thank you to both.

Zeus has 0.9p adj EPS for FY 12/2023, rising to 1.1p in FY 12/2024.

At 23p/share that gives PERs of 26x and 21x - not cheap, but PERs can be a clumsy measure at growing companies. Obviously the bull case rests on more growth, improving market conditions, increased market share, and hence operationally geared upside to earnings.

Paul’s opinion - this update is only in line with expectations, so the 15% share price rise is a little surprising. Although the confident-sounding outlook may draw some investors to conclude that there’s upside on existing forecasts?

I think it looks a credible growth company, although it has yet to demonstrate that it can generate meaningful profit margins.

After today’s update, I think the valuation looks about right, so I’ll stick with AMBER for now - ie some good points (growth potential), but also some less good aspects (limited profits to date, and competitive, low margin sector).

JD Sports Fashion (LON:JD.)

Down 23% to 119p (£6.2bn) - Trading Update (profit warning) - Paul - BLACK (profit warning), but GREEN on fundamentals (it looks cheap now!)

For newer subscribers not aware, at this time of year I like to cover updates from mid and large caps in the retailing sectors, to assess the general health of the consumer (more than half of GDP). This one is in the FTSE 100, and still will be, despite shedding a scary £1.85bn in value this morning.

JD Sports has been a fabulous multibagger over the long-term, having grown very strongly, including international expansion. However, today its shares have given up the entire “everything rally” we saw in Nov-Dec 2023 - I thought charts were supposed to be predictive of performance, which certainly has not been the case here -

Profit warning this morning, summarising it -

Revised adj PBT guidance for FY 1/2024 (53 weeks to 3/2/2024) £915-935m.

Previous guidance on the RNS was £1.04bn (21/9/2023, within interim results), so this is an 11% shortfall in adj PBT.

Revenue growth in H2 (so far) was “slightly behind our expectations”. Reasons given - milder weather, cautious consumers, peak season “softer & more promotional” (ie having to offer discounts to shift stuff) than anticipated.

H2 (22 weeks) like-for-like revenue growth only 1.8%, well below inflation (and wages cost growth).

Gross margin lower than expected (due to discounting), but in line with last year.

Full year gross margin will be “slightly lower” than last year.

£7m profit hit from reclassifying capex into opex, and £8m lower interest income.

Inventories position is “comfortable”.

Are JD shares cheap now? This is all that matters!

Current forecast consensus is 13.3p EPS for FY 1/2024, so dropping that by 11% under-performance indicated today results in 11.8p EPS.

That’s a PER of 10.1x at today’s reduced 119p share price. This strikes me as a reasonable valuation, and it’s still earnings growth compared with the 10.6p normalised EPS shown for last year, FY 1/2023.

What’s the balance sheet like? It’s about £1.2bn NTAV at 7/2023, so not a great deal of asset backing compared with its £6.2bn market cap. The £1.3bn “Put and call option liabilities” look large & unusual - anyone got any ideas what that’s about?

It has net cash (excl leases) of £1.3bn, so cash & liquidity looks ample.

Paul’s opinion - NIKE reported softer sales recently, and its shares also gave up most of the autumn 2023 rally, but it’s valued at 26x forward earnings forecast. I know NIKE is not a retailer, but it sells trainers, like JD does. Medium term growth rates are similar. NIKE makes a higher net profit margin, but they’re not a million miles apart. So of the 2 companies, JD’s PER of 10x looks far more attractive to me.

I think this profit warning has brought JD Sports down to a fairly attractive valuation, on what looks like a fairly minor/temporary setback. Consumer demand could well accelerate in 2024 due to the now favourable macro factors in the pipeline (real wage rises in particular). So I see JD as a fairly decent GARP share. So it gets a thumbs up from me, due to the now much more attractive valuation today, for what has proven to be an excellent long-term growth share. GREEN on fundamentals, but it’s a profit warning so it has to be BLACK for my spreadsheet summary (which flags profit warnings in black).

Over the last 10 years, JD shares are up +648%, versus +182% for NIKE. Although if I shorten the timescale to 5-years, then they're both only up 20-30%, and have tracked each other really closely (second chart below) -

10-year chart -

And the 5-year chart -

Graham’s Section:

Trufin (LON:TRU)

Share price: 47p (-6%)

Market cap: £50m

We tend not to cover this one, and the StockReport instantly reveals why:

But let’s keep an open mind and see what today’s full-year update for 2023 has in store for us.

Here’s what Trufin does:

TruFin provides software and niche lending solutions to thousands of businesses across the UK via our companies Oxygen and Satago. We also have a significant interest in the mobile and console gaming company, Playstack.

Oxygen provides an early payment platform enabling businesses to get paid faster by public sector clients, and in general to “have more effective relationships with the public sector”.

In a similar vein, Satago is a platform for businesses to “avoid credit risks, improve debtor management, save time and stress on chasing payment and access invoice finance”.

So here is today’s news:

Oxygen and Satago performed in line with expectations, but Playstack missed expectations.

Revenue is therefore below expectations. Revenues are still up by at least 32% year-on-year to £20.2m.

The adjusted pre-tax loss is in line with expectations, being a loss of no more than £6.3m (last year: £8.2m loss).

The disappointment at Playstack is explained by reference to “platform deals” being slow to conclude, which I think is an issue we have seen recently from other gaming companies.

Outlook for 2024: unchanged.

Year-end cash: at least £9m, of which unrestricted cash is at least £5.5m. Trufin says it is “fully funded to profitability”.

CEO comment provides a message on each subsidiary but the overriding message is:

"Whilst a delay in finalising Playstack's platform deals and the associated financial impact is frustrating to report, the Board is confident that the Group is well placed to deliver significant value for shareholders.

Graham’s view

A pre-tax loss of £6.3m doesn’t fill me with confidence that the company is fully funded to profitability, given that current unrestricted cash is less than this amount.

Checking the broker note from Liberum, I see that the revenue miss for 2023 is enormous: £27m was pencilled in, but only £20.2m has materialised, due to the delays at Playstack.

The fact that the company missed out on nearly £7m of revenues but this made no difference to bottom line profitability is also puzzling - did Trufin not expect to book any profits on these lost revenues?

2024 estimates suggest another loss is on the cards, before the company turns the corner to profitability in 2025.

I note that this stock passes two bearish stock screens, something I don’t see very often. Although this could change when the full-year 2023 numbers are published:

While I can accept that Trufin might be fully funded to profitability, it’s still not obvious to me how we can justify a £50m market cap. If Playstack was given an aggressive video game industry multiple, then maybe we could get there?

However, while I like the video game sector as a whole, Playstack is a publisher in the “indie” space and I struggle to see how companies in this sector can be worth premium valuations. Indie games tend to strike me as quick hits, not lasting franchises with wide appeal.

I’m therefore going to have to reluctantly give this share the thumbs down. Even if the balance sheet easily survives the next year or two of losses, the £50m market cap still seems ambitious to me.

Topps Tiles (LON:TPT)

Share price: 46.1p (-7%)

Market cap: £91m

Topps Tiles Plc ("Topps Group", or the "Group"), the UK's leading tile specialist, announces a trading update for the 13-week period ended 30 December 2023.

It’s a downbeat Q1 update from this tile specialist.

Q1 trading has “reflected the ongoing challenges to discretionary consumer spending”, particularly in the property RMI (repair, maintenance, improvement) sector.

Total group sales are down 4% year-on-year (of course down more than that in real terms).

Like-for-like sales at Topps Tiles are down 7.1%. Sales to trade customers are “more resilient” than sales to homeowners.

Parkside (the commercial tiles business) is “in line with expectations” and is “profitable in the year to date”.

The update doesn’t continue much longer, key points:

Cost base well controlled, cash flow strong.

Group profits to be weighted towards the second half (this had been previously flagged).

Company expects to have gained further market share in Q1.

Estimates

Edison have left their FY September 2024 and FY September 2025 estimates unchanged, on the basis that sales were only a little softer towards the end of Q1 than they were during the first two months of the quarter. They also note that Q1 last year was strong towards the end of the quarter, making for a difficult comparative.

So there is an adjusted PBT estimate of £13.2m for the current year, rising to £14.7m for next year, on gently rising sales.

Graham’s view

This sector always makes me nervous - volatile demand and lowish margins.

Given that the share price is down 6% despite full-year forecasts being unchanged, investors must share my anxiety over any negative news relating to the revenue trend here.

The company has struggled to maintain EPS forecasts over the past 18 months:

With a second half weighting flagged and a soft Q1, I’d be very cautious about another downgrade coming during the course of the year.

Of course the economy might surprise us to the upside over the spring and summer, and in any case the TPT share price might have already priced in another downgrade. But I’d have to assume that the most likely outcome here is for more bad news and for the estimates to get shaken again.

Against that, the company did report £23m of net cash (excluding leases) as of September 2023.

Value metrics are attractive, it has a StockRank of 87, and Roland has been positive on it (see here).

However, I can’t bring myself to give this one thumbs up, so I’m going to put a neutral colour on my stance here today. Sorry Roland!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.