Good morning from Paul & Graham!

Today's report is now finished, at 12:51.

We're planning on having a backlog clearing day today, so probably shorter sections in this report, to cover more ground.

I see US interest rates went up yet again yesterday. My view remains that this is reckless, and very damaging, plus there's no democratic accountability for this powerful role of central banker - and central banks are notoriously bad at setting rates anyway - far too low, for far too long, causing all sorts of distortions, and now overly rapid increases seemingly in a bid to crash the economy in order to remove inflation which is already falling. It doesn't make sense to a humble shares blogger here anyway, and isn't going to exactly help the pressures on the banking system either. Oh well, we'll just have to see what happens.

With "risk-free" interest of 5%, all of a sudden a 5% dividend yield from shares doesn't look enticing any more. So for the first time in c.15 years, equities are now competing for peoples' savings with decent returns on cash deposits (below inflation, but probably not for long, as US inflation is falling quite rapidly, and ours is set to follow suit from the summer, according to the Bank of England). This doesn't seem a positive backdrop for equities. Or, will this just be a short-lived spike in interest rates? If so, then equities could still be a good place to invest. It will be fascinating to see how all this pans out!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Summaries

(larger sections below)

Mothercare (LON:MTC) - down 20% to 7p (£39m) - Trading update - Graham - RED

Terrible news here as the company needs to once again seek revisions to its loan. This is just a £19.5m loan but it’s currently charging over 18%. It also needs to hope that pension deficit payments are revised lower. I view this as a bargepole stock in its current form.

Smiths News (LON:SNWS) - down 4% in 2 days to 51p (£122m) - Interim results - Paul - GREEN

Good numbers, and only 5x PER. Lovely 8% yield, that could rise further once bank restrictions are lifted. Balance sheet is adequate for a capital-light business. I ponder the various scenarios for the future, of this slowly declining business. Overall, the value/yield win through for me, but only just!

Ashtead Technology Holdings (LON:AT.) - 384p (£296m) - FY 12/2022 Results - AMBER

Excellent numbers for 2022, and a "materially ahead" outlook for 2023, no wonder the share price has been so strong of late. Although in the section below, I ask some questions about how it's possible to earn such large profits from an old, small hire fleet, and whether those profits are sustainable? Note it was a private equity float in late 2021 - but so far looks much better than its contemporaries from that sour vintage!

Quick Comments

(no additional detail below)

Virgin Wines UK (LON:VINO)

39p pre-market (£22m) - Profit Warning - Paul - AMBER/GREEN

Another profit warning today from this Virgin branded subscription wine service. The announcement mentions all the things that are being done to improve the position, and some signs of trading stabilising. Plus there are signs of inflationary pressures easing. But the bottom line, literally, is that u/l PBT profit guidance for FY 6/2023 is reduced again, to £0.5-1.0m range (Liberum previously forecast £1.7m PBT). It’s confidently expecting a return to double digit sales growth in FY 6/2024, and EBITDA also rising - which strikes me as optimistic. Although the current year has suffered from warehouse disruption after an IT project went wrong, impacting operations, and that should be a one-off.

A bearish view might be that with profitability having almost evaporated, and the pandemic boom long gone, maybe this is just a marginal business with little value to shareholders? A more bullish view might see potential for a recovery, and with a market cap of only £22m, that could provide nice upside for a say 50-100% bounce in this share at signs of things improving maybe? I reviewed its interims here in March. Note the strong balance sheet, so there’s no solvency or dilution risk in my view.

Paul’s opinion - it’s getting into buying range I think, so any further plunge from today might be an opportunity, for knife-catchers! The business is still profitable (just), and has sound finances. Note Gresham House owns 41%, and the CEO 8%, so unofficially the business might be up for sale to a bidder, perhaps? I’m viewing this as amber, but leaning towards green if it drops further, as a value/recovery trade.

Zytronic (LON:ZYT)

Down c.30% to 98p (£10m) - profit warning - Graham - AMBER

This touch-screen maker issues a trading update for the H1 period (ending in March) and for April. Unfortunately, the issues that have dogged it continue to do so and conditions are now apparently even worse, with “unpredicted significant turmoil in its Gaming market”.

One customer is said to have overstocked Zytronic’s curved touch sensors, and might not have any more orders until the next financial year (FY September 2024). Meanwhile, other customers are suppliers to a company called Aruze Gaming, which is in bankruptcy. An article on casino.org suggests that Aruze should be able to bounce back, but I’m not sure how long that might take. The hit to Zytronic includes the loss of expected orders in H2 and the loss of existing receivables/work-in-progress (£0.5m value). Hopefully the situation will go back to normal in FY 2024?

New expectations: revenues of £8 - 8.8m this financial year. That compares to £12.3m last year and expectations before today of £13.5m. There will almost surely be another loss on the income statement

It’s a huge slash to estimates and while the problems might just be temporary, I can’t help worrying that there could be more fundamental problems relating to competition or demand. With £5.4m of cash I can’t give this stock the thumbs down but I’m not entirely sure that the core business can support the enterprise value here so I stay neutral. As a punt on eventual recovery these shares could have merit.

Morgan Sindall (LON:MGNS)

Up 2% to 1733p (£821m) - trading update - Graham - GREEN

I don’t usually cover construction/regeneration companies, but this one popped up on a screen for me recently and I’m curious to see if it’s as good as its metrics suggest.

Today’s update is in line with expectations (for FY December 2023), with more of a first-half weighting (this is more reassuring than a second-half weighting!). General conditions have “continued to ease, with inflation falling in certain areas”.

Performance by division is generally good. I like the way management mentions how much capital is employed in some of the divisions - they could expand this.

Order book - the “secured workload” is £8.8 billion, up 4% since year-end, and up 2% versus the prior year.

Average daily net cash - as noted previously by Paul, Morgan Sindall is one of the companies that reports its cash balance according to best practices, instead of using a (potentially window-dressed) period-end balance. Average daily net cash for the first four months is £281m, very slightly higher than last year.

Management - the apparent quality of this construction group, if true, is likely related to the fact that it's run by a founder, John Morgan, who still has plenty of skin in the game with a 7% stake.

My view - I admit that I haven’t studied this stock in detail but I’m going to tentatively give it the thumbs up based on its quality metrics, the clarity of its reporting, stable management, and a solid track record. It’s cheap too, with a PER of 7.5x, contributing to a StockRank of 94.

Next (LON:NXT)

Up 2% to 6648p (£8.5bn) - Q1 TU - Paul - AMBER

We usually try to look at this fashion bellwether, for context when the smaller ones report - it's often striking how other companies in the sector blame all sorts of macro issues outside their control, which Next seems to cope with effortlessly!

Q1 saw full price sales (not the same as revenue, but this is how Next always reports) down -0.7% vs LY. Not good, when inflation is c.10%, and selling prices have risen, so this must be a significant drop in volumes of clothing sold. However, as always, Next guides expectations superbly, and this -0.7% is better than its expected -2%.

Profit guidance (PBT) for FY 1/2024 is maintained at £795m, 502p EPS, so a PER of 13.2, which looks about right to me.

Outlook is cautious at -5% drop guided for Q2 sales, due to tough prior year comps (which benefitted from pent-up demand after lockdowns ended).

Expected sales this full year are guided at up 18.7% vs pre-pandemic, which is good, but needs to be good, because a lot of costs have risen in the last 4 years.

Paul’s view - NEXT shares look priced about right to me. It’s good to hear nothing horrible is going on, and I imagine it might be nudging expectations upwards as this year progresses. It’s not really a growth share thought, with the trend of EPS being essentially flat over 8 years from 2018 to 2025 forecast. I think this is a very good share to trade - it always bounces back after large drops.

Paul’s Section:

Smiths News (LON:SNWS)

51p (down about 4% since results published yesterday morning)

Market cap £122m

The numbers from this newspaper/magazine distributor look pretty decent to me, in the context of what is a declining volume business (unless they find some other products to bolt on to this rapid overnight delivery network).

We’ve followed the turnaround story of SNWS here in the SCVRs for several years, and it’s worked very well - all the legacy issues (e.g. pension deficit, excessive bank debt, problem Tuffnells division) dealt with successfully. It’s now a financially stable business, paying bumper dividends. The only question is, how much longer can it keep this up, given the declining circulations of newspapers/magazines? It’s already surprised the sceptics though, with cover price increases offsetting volume declines for now, but not likely to repeat.

The bull argument is that this business could possibly continue for many years to come, and even get transformed if it identifies & exploits other product distribution niches.

H1 to 2/2023 numbers & my comments -

Clean profit figures, no adjustments this H1.

Revenue up slightly, to £550m for H1.

Very low gross margin of 6.9%, which keeps out competition, and means this business is all about efficiency and keeping overheads minimised.

H1 Profit before tax (PBT) is £17.1m, up 12% on LY (adj)

Diluted EPS is 5.3p, up from 4.8p H1 LY

There’s not much seasonality, so this means the 10p annualised EPS figure mentioned previously by management as being a reliable expectation, looks intact. PER is only 5x - very cheap, if earnings can be sustained at this level (a big “if”!)

Balance sheet - not the best, with negative NTAV of £(27)m. However, there’s very little in fixed assets, and low inventories (since product mostly comes in & goes straight out again to customers). Therefore it doesn’t actually need any net asset backing.

Working capital is a large debit (receivables from customers, which I can see approximates to about 1 months revenues if you add VAT), which is fine. That’s mostly offset by a large trade payables number. All as I would expect, nothing untoward about this balance sheet.

Net debt - great to see SNWS adopt best practice that I’m delighted to see slowly emerging in company reports generally, in providing the average net debt (I presume daily?) of £26.3m, down 55%. This is a much more reliable number than a one day snapshot at period end, which is £22.9m. Shareholders don’t need to worry about this modest level of bank debt, although I see the divis are still restricted to £10m pa under the current banking arrangements.

Outlook - looks fine -

On-track to meet market expectations for the full year

Good visibility from contracts renewed to 2029+

Dividends - broker forecast of 4.13p for the year equates to about £9.7m total cost, so they might pay a little more than that. The company indicates it intends to pay £10.0m in divis. This is about 2.5x covered by earnings, so this c.8% yield could rise considerably, once the bank has been paid down enough to remove the restriction. Is that yield sustainable long-term though? Possibly not.

Yield is therefore a big attraction, although less so now that we can earn a 4-5% risk-free return on cash.

Contractor model - I have misgivings with the business model SNWS uses - it doesn’t employ the drivers, they are self-employed contractors. So there is a risk, even if only small, that HMRC might take issue with this, and deem them to be employees - which of course would involve having to pay employers NICs, which could be a big number if it’s back-dated. It’s up to you to assess this risk, I’m just saying it’s another reason why some people might be a little wary of this share maybe?

M&A - interesting that the company spent £0.6m on a deal that did not proceed. Previous management made a disastrous mess of M&A, which almost brought the company down, and took years to fix. So I can understand that current management have been wary of any new deals. Although that’s got to be the way to turn this share from a cigar-butt with a few big puffs left, which could remain profitable for a few more years, into something with a more sustainable long-term future. Hence I think M&A could be key.

Product lines - this is helpful, but not a game-changer -

In addition, we continue to pursue our strategy of exploring and trialing new profit streams from a range of adjacent opportunities that complement our core operations. Notably, in the period, we have increased the supply of DVDs and books to leading supermarkets and will be reviewing the potential for similar offers across our customer base. Meanwhile, the additional rental income we secured in FY2022 from third party logistics suppliers has repeated and continues to make a small, but welcome, contribution to reducing overheads.

Cost-cutting - a lot of the costs are variable, so the business model does allow for gradually declining revenues. However, I remember asking previous management how long they can keep stripping out costs? The answer did ring alarm bells. They said that depots had been closed, amalgamated, thus driving out costs, but that process had almost reached its natural end point, with any further closures not being realistic due to having to cover an entire geography within a certain timeframe for overnight deliveries. So it will be increasingly difficult to drive out fixed costs. Hence I’m worried (and clearly the market is too) that 10p EPS might not last much longer.

Competition - with supermarkets, big retailers, and Amazon developing increasingly large & fast delivery networks, combined with gradual decline in volumes of newspapers & magazines, I wonder if SNWS will still be needed, or still even exist in 5-10 years’ time?

Paul’s opinion - I’m moderately positive, but it’s difficult to see much upside on the current share price of 51p, and the PER of 5x. Although there are catalysts - if the banking arrangements see the limit on divis removed, then the yield could go well into double digit %s. If management launch some other initiative, or make a good acquisition or two (without dilution), then this could morph into a bigger & better business. Possibly. Or they might gear up for an acquisition that goes horribly wrong, as previous management did.

Overall, I’ll give my opinion as still being GREEN, but only just!

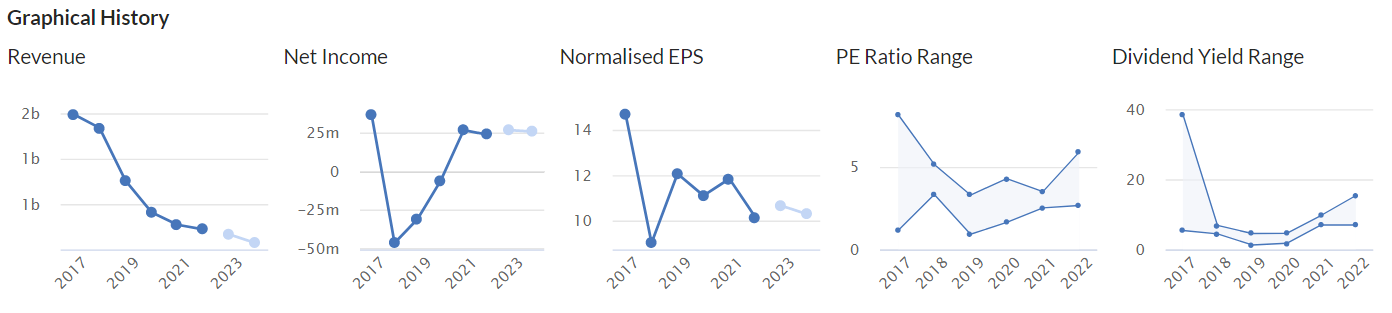

The Stockopedia graphs tell the story very well - structurally declining revenues, a painful turnaround succeeded over 4 years, EPS held up well thanks to cost-cutting, a permanently low PER, but divi yield returning and now very generous.

The algorithms love it - a StockRank of 99.

Long-term chart below looks nice, with a multi-year base put in. The share count hasn't changed much, so no dilution adjustments need to be made to the chart -

Ashtead Technology Holdings (LON:AT.)

384p (£296m) - FY 12/2022 Results (y’day) - Paul - COLOUR

Ashtead Technology Holdings plc (AIM: AT.), a leading subsea equipment rental and solutions provider for the global offshore energy sector, announces its full-year results for the period ended 31 December 2022…

This share has been doing very well, so I must take a look.

FY 12/2022 Results -

Good organic growth, powering most of the +31% revenues of £73.1m

Adj EPS up 48% to 19.6p = PER of 19.6x

Bank facility increased in April 2023 to £100m (+£50m accordion).

Outlook - all sounds good, with strong demand, pricing & utilisation up. Passing on inflation to customers.

“Materially ahead” of expectations for FY 12/2023 so far.

InvestorMeetCompany webinar is on 12 May, at 11:00 - so might be an interesting one, to find out more about the company.

Balance sheet - very little asset backing, NTAV is only £9.8m.

The figures look odd for an equipment rental business - there’s only £32m in fixed assets, and hardly anything in inventories. So how is it possible to generate £16.6m PBT from such a slim asset base? Wouldn’t competitors just buy some similar kit, and rent it out cheaper?

Note 11 shows that Ashtead’s assets were old in 2021: £105m original cost, but £86m depreciated, so NAV only £19m. That has been boosted in 2022 with £13m additions, so NBV of the hire fleet was £30m at end Dec 2022 - which still seems very small to be so highly profitable. Hence these figures look odd to me, and more digging would be needed on how a small, old fleet of equipment, makes so much profit, and is that sustainable?

It looks as if this company might be getting a bonanza from possibly offshore energy, wind farms, etc? Will that last, or will competitors move in?

The only company like this that I’ve seen before, is Gulf Marine Services (LON:GMS) which got into trouble with too much debt.

Broker consensus forecast has been rising, probably helped by a £24m acquisition made in 2022, and increased capex. I can’t find any broker notes.

Paul’s opinion - the numbers certainly look interesting, so I think this would be worth members here researching it in more detail, to properly understand the business model, and whether the spectacular returns currently being generated on a small, quite old fleet of equipment, are sustainable? As it’s not something I know much about, I’ll sit on the fence with an AMBER view for now.

Buckthorn Partners (private equity firm) owns a dominant 35%, and it looks like this float in Dec 2021 was selling shares to a variety of institutions. So that's a bit of a warning, as such floats often go wrong. In this case though, no sign of any trouble so far, quite the opposite actually, with this "materially ahead" trading update, and excellent numbers for 2022.

Graham’s Section:

Mothercare (LON:MTC)

Share price: 7p (down 20%)

Market cap: £39m

I can’t find detailed comments on this in the archive since Sep 2021 when Paul looked at it. Today we have a full-year update for FY March 2023.

Sales by franchisees are up 8%, excluding Russia. However, Russia was a very significant contributor in the previous year, responsible for nearly a quarter of franchisee sales and for £5.5m of adj. EBITDA, nearly half of the £12m total!

In FY 2023, without any contribution from Russia, franchisee sales are down 16% and adjusted EBITDA falls to just £6.5 - 7m, which the company describes as “ahead of analysts’ expectations”.

At least the deficit at the pension scheme has reduced from £78m to £39m, though net debt increased slightly to £12m.

The company continues to use the scientific phrase “steady state” to describe the profitability that they will experience “in more normal circumstances”. However, according to Paul’s article from 2021, their steady state at that time involved more than £15m of operating profit.

They are currently saying that this figure is only £10m. Maybe the steady state isn’t so steady after all?

Loan facility: the company has a £19.5m loan from Gordon Brothers at 13% over the overnight rate, plus another 1% that accrues and rolls into the principal. The rate is currently an eye-watering 18.2%.

I have checked the most recent annual report and found that the terms attached to this loan were already revised to take into account the loss of Russian business.

But with rising rates and slower post-Covid trading than anticipated, another revision/refinancing is in the works:

…the Group may require waivers to future periods’ covenant tests. We have therefore commenced refinancing discussions with our lender to vary, renegotiate or refinance this debt facility. Additionally we are looking at various financing alternatives (including equity and equity linked structures) to give us both additional flexibility and reduced cash financing costs. For the avoidance of doubt the Group does not require (and is not seeking through this refinancing) additional liquidity.

The reference to not needing additional liquidity is designed to reassure investors that they aren’t about to run out of cash. However, breaching covenants can have serious ramifications, typically including the possibility that loans get called in - I don’t know if that is likely in this case, but waivers to covenants are always a serious situation.

To help give you some broader context, there is a NED at Mothercare who was CEO of the company from 2014 to 2020 (a period of time which saw a near-total collapse of the equity value of the company). He is also currently a senior MD at Gordon Brothers, the lender to Mothercare. I wonder what he makes of the current situation?

Pension scheme - the Gordon Brothers loan would be bad enough, but there’s also the pension scheme to think about. The current plan involves deficit recovery contributions of £7m in 2025, £8m in 2026, and £9m p.a. after that.

Hopefully contributions of this size won’t be necessary, as the deficit appears to have fallen since they were agreed. However, if these contributions were necessary, I would have very little confidence in Mothercare’s ability to make them without an equity raise.

Chairman’s comments appear to have a level of positivity and optimism that is detached from reality:

“Once again our results demonstrate the resilience we have introduced to the business over recent years, where we continue to generate both profit and cash…

Although our immediate priority remains to support our franchise partners as they emerge from a period of suppressed demand, ultimately for the benefit of our own business, we have also redoubled our efforts to restore critical mass.

My view

This one is getting the thumbs down from me. It looks extremely risky with lenders and the pension fund circling nearby, ready to gobble up any cash flow generated by the slimmed-down business.

Depending on how negotiations go, an equity raise may be needed in the short-term, in order to satisfy the lenders (and perhaps to pay into the pension fund, too). Buying shares in an equity raise at a low, low price could make sense, but I would never want to buy in before that happens.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.