Good morning, it's Paul here with Thursday's SCVR.

There's not a lot of small cap news again today, so I'll have a ramble about markets generally a bit later, and pad out company sections with other thoughts. As always, just skip any sections that you find tedious - nobody is obliged to read everything!

Estimated time of completion - I should be able to achieve the 1pm official finish time today.

Edit at 14:05 - the main report was done by 1pm, but I've added some extra bits on micro caps at the end.

Today's report is now finished.

Warpaint London (LON:W7L)

Share price: 83p (up c.4% in early trading, at 08:21)

No. shares: 76.7m

Market cap: 63.7m

Trading update

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to provide a trading update in respect of the financial year ended 31 December 2019, together with details of certain corporate initiatives.

Background - this share has failed to recover its previous levels, after a profit warning in Oct 2018. My impression is that, whilst nicely profitable, the company does seem rather accident-prone. Growth has stalled, but free cashflow is good, and the dividend yield of 5.7% looks attractive, if it can be maintained.

Trading update today -

Subject to audit, the Company expects to report revenue of £49.3 million and adjusted profit before tax (excluding amortisation in connection with acquisitions, share incentive scheme costs and exceptional items, which the board expects to total approximately £2.8 million) of £5.2 million for the year ended 31 December 2019, in line with the guidance provided in the Company's trading update on 20 December 2019.

That's actually a revenue miss of £0.7m, or 1.4% below the previous guidance of £50.0m. Not a huge miss, but coming right at the end of the year, it would be a proportionately larger miss if seen in isolation for December's sales.

The adjusted profit of £5.2m is towards the lower end of the previous company guidance of £5.1 to £5.5m.

I should say that achieving £5.2m adj profit on £49.3m revenues is a good profit margin of 10.5%.

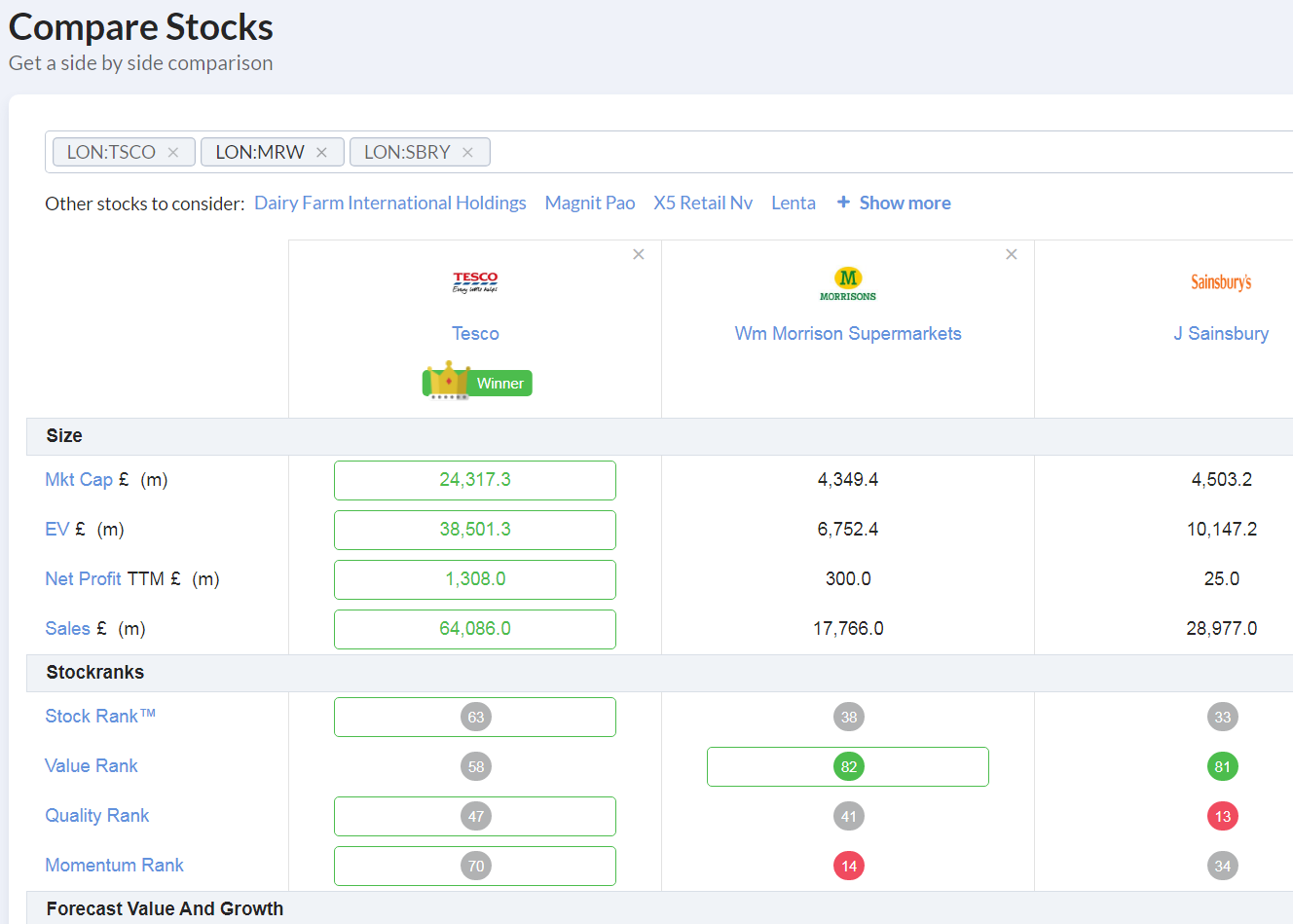

I tend to find that around 10% is the cut-off where companies are starting to demonstrate good pricing power - i.e. a company must have a good product/service, if it can generate 10p profit in every £1 of sales. After all, if we look at highly competitive sectors, with little pricing power, such as supermarkets, they only make 2-3% operating profit margins typically, and require huge capital to achieve that.

Here's a link (click on picture below) to a Stockopedia comparison tool for Tesco, Sainsbury & Morrisons - quite interesting. This feature can be found on any company's StockReport under the drop-down "Tools" menu. It's very long, so I can only fit the top part of it into the screenshot below, hence I've added a clickable link to the picture.

On the same theme of low profit margins, consider contracting businesses, which typically make 0-5% profit margins, only by taking on enormous risk that large contracts might go wrong & overrun on costs, which they often do (look at Carillion & numerous other contracting businesses that ended up going bust, it's a hideous sector).

Broker research & company guidance

I like it when companies issue guidance directly to the market like this, rather than via a broker. There's no reason at all why all companies cannot do this. Some brokers seem to tell their clients that they're not allowed to give guidance to the market. That is complete rubbish! Plenty of companies already do give revenue & profit guidance, and all companies should do so, because that is best practice. Shareholders and commentators greatly appreciate it when companies do give clear profit guidance. It helps us understand the business, and avoids nasty surprises which hit the share price hard. Companies & advisers need to be reminded that it's private investors who create the market liquidity & set share prices. Therefore we should be the top priority for receiving accurate & full information, not an afterthought, or worse still deliberately denied access to information.

If regulatory hurdles are the problem, then how come finncap, N+1, Liberum, and many other brokers have managed to provide us with decent information?

I suspect that the only reason some brokers try to stop their clients giving clear guidance directly to the market, is so that the broker remains the gatekeeper to information, thus enabling them to sell or give privileged access to research information to attract & retain dealing clients. When in fact their corporate clients have already paid for the research, so it should be distributed as widely as possible, not restricted! It's infuriating, and also morally wrong. If a company's broker won't let you inform the market properly, then sack them & find a broker that will.

Thankfully things are changing, with brokers such as finncap leading the way, which has its own research portal to distribute its research. Recently finncap started providing links to their research in trading updates from their clients - which is absolutely brilliant.

Quality brokers like Cenkos, N+1, Liberum, and others, make their research available on Research Tree, which is an essential tool for the serious investor in my view. It's really handy having everything in one place too, which saves me having to search multiple sites, try to get on email lists, etc., or find a back door to restricted research.

Back to Warpaint

What else does today's update say?

Supermarket - looks like a trial of 50 stores only, in bespoke free-standing display units. There's a prize of a 50p Brexit coin (haha!) for anyone who first identifies which supermarket it is, and posts a picture here in the comments section of one of these freestanding display units.

It's in discussions with other large UK retailers.

I don't see this as particularly price-sensitive, because we don't yet know whether this strategy will work. If sales are poor, then supermarkets will quickly find an alternative use for their space. Plus it's notoriously difficult to make a profit supplying supermarkets - they famously don't like suppliers making more money than they do!

Strategy consultant - a management consultant called Ward & Hagon, which is linked to Paul Hagon, an existing NED of Warpaint, has been appointed to assist Warpaint grow in the UK & USA. This concerns me. It suggests that Warpaint doesn't have the necessary knowledge & experience in-house, to develop the business. On the other hand, you could argue that the company admitting this, and bringing in the necessary talent from outside, could be a positive step.

I've never heard anyone say that they're glad they brought in management consultants. Usually people say that management consultants were expensive & clueless. Maybe it will be different here?

My view - makeup is a good sector, with high margins. Despite some mis-steps, Warpaint makes decent profits, pays good divis, and has a nice solid balance sheet. It's attractively valued on a lowish PER of 11.7 - perhaps factoring in some discount given that it has repeated forecast misses?

See the broker forecasts below, and yes I am repeatedly nagging the team at Stocko HQ to get that y-axis labels sorted! It's no use at all with just one value on the y-axis! So you can make sense of it, the darker blue line (FY 12/2019 fc EPS) goes from 16.6p on the left, down to only 6.2p on the right.

Clearly something is going wrong then. I'd need to properly understand why earnings forecasts are coming down so much, before considering a purchase of this share.

If there's any sign of earnings stabilising, and a credible plan being hatched to drive growth up, then this share might be worth a punt at some point.

I hopefully won't mis-gender or offend anybody (which seems to be punishable by death these days) if I ask for feedback from readers if you or someone you know has tried the product? What's it like? That ultimately drives long-term sales success here - the product and branding have to be good enough to attract repeat purchases from fashion-conscious customers.

Here's the 2-year chart (I've switched to the new site charts, which are good now that the labels on the axes are a larger font!). I always remind IT developers that they are young people with great eyesight & large screens. Whereas their customers are mainly older people with smaller screens! So fonts need to be a comfortable size for us visually challenged folk to see them.

System 1 (LON: SYS1)

Share price: 225p (down 22% today, at 09:43)

No. shares: 12.6m

Market cap: £28.4m

Trading update (profit warning)

Just FYI, if a share drops sharply on a trading update, then I add the words "profit warning" next to the RNS link, so that it will come up for anyone searching for profit warnings.

System1 Group PLC (AIM: SYS1) (the international online market research agency), announces today the following trading update for its financial year to the end of March 2020.

An interesting point to note here, is that today's 22% fall in share price is only reversing a recent spike up. With something as small & illiquid as this, it only takes one person to repeat buy over a few days in the market to drive the price up a lot. But such moves are often very flaky & easily reversed, as in this case.

My review here on 7 Nov 2019 of its interim results is a quick way to get up to speed, which I'm reading now (covering c.500 companies in the SCVRs, I can't possibly remember all the detail!). I did wonder in that report if the company was "putting down a marker for a possible H2 warning?" in its outlook comments.

Q4 profit warning today;

After H1 single-digit growth, followed by modest further progress in Q3, trading in Q4 to date has been disappointing, [Paul: Q4 is Jan-Mar 2020] due in the main to the ongoing transition of sales talent, and subsequent disruption and decline in adhoc revenue from smaller clients.

Given the limited visibility in some areas, it is difficult to predict the full year outturn, but the Board believes Gross Profit will be slightly down compared to the prior year.

The company has mentioned problems with lack of visibility before. With only 2 months to go to year end, it's a real concern that they don't even know how things will pan out over such a short timeframe.

The underlying reason of key sales staff leaving, is a big concern. Why are they leaving? Are there problems within the business, or are competitors offering them more money to jump ship? Whatever the reasons, it's bad. One of the advantages of a stock market listing, is to lock in key staff with generous share options. Why hasn't that been done?

Gross profit - I'm not interested in that, I want to know what the profit before tax is going to be (underlying is fine, as long as the adjustments are sensible). That's the key number, not gross profit, nor EBITDA. What is wrong with people who write RNSs, that they don't seem to understand, or are perhaps deliberately obscuring the key information that investors & commentators need? This wastes so much of my time, having to then dig out the key information, because it's missing from the trading update. Maybe it's time for more structure, and rules on trading updates? I might draft something on that, when time permits, after all I spend my life trawling through all these things, trying to make sense of them!

Broker updates - there's nothing on Research Tree unfortunately, so I'm now completely in the dark. Let's try and work things out. Last year's numbers looked like this;

Revenue £26.9m

Gross profit £22.0m

Underlying overheads £20.6m

Underlying profit before tax £1.5m (which includes losses of £2.2m for AdRatings, its loss-making startup division)

What have we been told for this year?

Gross profit slightly down on prior year. Let's guess at £21.5m

Underlying overheads up 4-6% on PY, let's guess at £21.6m

Good grief, that wipes out profit altogether! A slight loss of £0.1m, or roughly breakeven.

I think this should have been made a lot more clear than what the company actually says;

The lower than expected Gross Profit and increased costs are expected to result in a normalised 2019/20 Profit Before Tax (i.e. excluding Share Based Payments and AdRatings) materially below the current market expectation.

The company splits out the loss from AdRatings in its announcements, on the basis that it could be closed down if it fails to gain traction. I suppose that's fair enough. It's better for investors to have the breakdown of the two divisions, than not. I'd want some reassurance that the divisions are generally separate, not sharing the same overheads.

Cash position - is OK, but I'm not sure it's wise to spend a chunk of this on buybacks, when the share is already so illiquid, and it's hardly a massive amount of surplus cash anyway;

The Company has £4.2m cash, and no debt, and in line with the Company's approach to capital allocation, the Board intends to conduct a share buyback program of up to £1.5m of the Company's shares, following its normal post year-end Trading Update in April, subject to the Company's share price and cash balance at the time. This would be by way of market purchases.

That's just over 5% of the equity to be bought back.

My view - I'm irritated that I had to go round the houses, and waste time, in putting together the true picture.

Moreover, there was no information given on what market expectations were, and what they are now! Overall then, a rather poor job was done in writing this announcement. Canaccord - please try harder in future!

Despite the above grumbles, I do think this company still looks potentially interesting. You just have to look at the chart above, to see what happened when it was delivering strong growth a couple of years ago.

It remains on my watchlist, although I now have less inclination to buy, knowing that current trading is poor, and key staff have left (worryingly called "ongoing"). As the issue seems to be with staff leaving, I've had a quick look on Glassdoor here. I don't know how much reliance to put on this, but some of the comments are pretty awful, and very critical of management.

OnTheBeach (LON:OTB)

Share price: 413.5p (up c.3% today, at 11:28)

No. shares: 131.2m

Market cap: £542.5m

Trading update (AGM)

On the Beach Group plc (LSE: OTB.L), the UK's leading online retailer for beach holidays, today issues the following trading update for the four months to 31 January 2020, in advance of its Annual General Meeting to be held today.

This is for the first 4 months of FY 09/2020.

My summary of today's update, with my comments in brackets;

- Unprecedented opportunity to take market share, after Thomas Cook collapse

- Cost of flights has risen due to Thomas Cook failure, and Boeing 737 Max problems - not expected to fully normalise this year (are they able to pass on extra costs, or does this mean lower margins for OTB?)

- Focus on being price competitive (lower margins then, possibly?)

- More than doubled offline marketing spend (i.e. non-internet - it doesn't mention online spending, or give the split. Why not?)

- Strong sales growth for summer 2020, but no figures given (we're not given enough information to be able to judge the effectiveness of additional marketing spend. What are the key LTV/CAC figures like?)

- International websites doing well - evaluating entering new markets

- Classic Package Holidays - OTB's new portal for travel agents has signed up 2,300 agents. (no info on how this compares to budget. Oh hang on, the CEO says they are "delighted" with its performance)

- Interim results out on 12 May 2020

My view - this is a hopeless update, which tells us nothing of any use in how to value the shares!

It's not a financial release, it's a press release which I would expect a company to send to journalists, when they want a puff piece written. Memo to Simon Cooper (its CEO) - investors need figures, and/or a clear statement whether the company is trading below/ in line/ above market expectations (and a footnote stating what those expectations are). I know people say that if nothing is said, we can assume trading is in line. But in my experience, we later find out that is often not the case!

There's no broker update on Research Tree, so I don't have anything to work with.

Reading between the lines of this update, it sounds like the company might be seeing a squeeze on its margins, and higher marketing spend. That might put pressure on short term profitability, which the company has declined to update us about today.

It's interesting that OTB didn't say anything about coronavirus fears affecting bookings. Therefore it sounds as if, for now anyway, this is not a problem for a mainly UK-based, short haul holiday business. I see the share price is down from c.500p at end 2019, to 415p today. That could be a buying opportunity, if you're not concerned about Coronavirus spreading to Europe. Or, if you're thinking long-term and looking through the short-term risk.

Broker forecasts have been steadily falling in the last year, before coronavirus. It sounds like the company is having to spend more on marketing to attract more business. We need to know if customer acquisition results in a one-off purchase, or how many customers come back again? That's absolutely key in determining whether marketing spend is worthwhile or not in the long-term.

Again, sorry about the y-axis labels below. The dark blue line goes from 31.4p on the left, to 25.0p on the right - quite a sizeable reduction in forecast profits. Some of that is from discretionary increased marketing spend, so it's not necessarily a problem for long-term investors.

In conclusion, I think that contrarian investors might see this as a buying opportunity - it's a reasonably-priced growth company in my view - forward PER of about 15.

More cautious investors probably wouldn't want to be buying any travel-related shares with so much uncertainty over the coronavirus.

Talking of competition, I see that Easyjet has recently entered the package holiday market, perhaps seeing how much profit that Dart (LON:DTG) is making? The profit margins in this sector do seem very high, so I could see competitive pressure eroding that over time. AirBnB is another competitive threat.

Quick sections now, for less interesting updates, and I'm nearly ready for lunch!

Filtronic (LON:FTC) - I've followed this company for years, as a result of which I would never buy shares in it - because performance has been too erratic, and it seems to rely on limited-life products. So there seems permanent restructuring going on, and large lumpy contracts being needed, with little to nothing in reliable/recurring profits. That said, there's the occasional flurry of excitement, and punters who bought at the lows can make a nice turn.

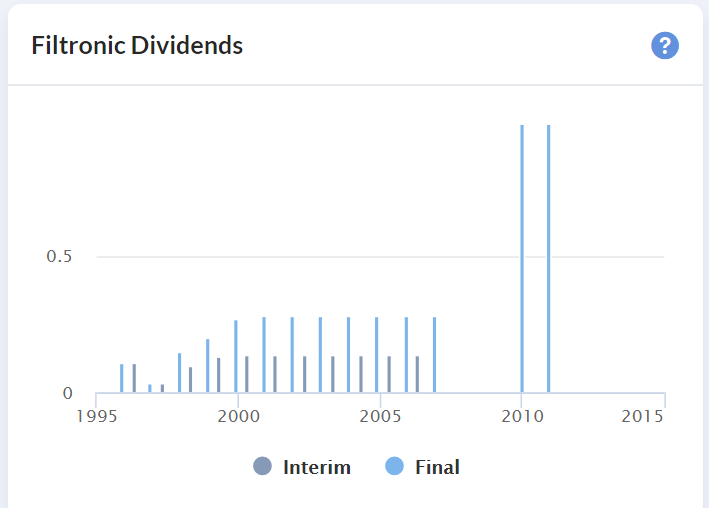

The market cap of £21m looks pricey for a micro cap with such a patchy track record. Look at the divis for example (last one paid in Nov 2010);

So a nice share for socialists - because it exists purely for the benefit of its staff, Directors, and paid advisers! Harsh but true.

Interim results - it eked out a tiny adjusted operating profit of £286k in H1, before a whacking great £825k exceptionals charge.

Balance sheet - not too bad. The £3.8m assets held for sale turned into cash just after the period end, according to note 10 - completion of sale of a subsidiary. That should clear debt, leaving it in a net cash position that looks fairly OK to me.

Outlook - sounds OK. Trading in line withfull year expectations for FY 06/2020.

Healthy order book of over £10m. "Strong demand profile".

My view - doesn't interest me at all. Maybe it has good things in the pipeline, but I've heard that for years, and nothing much came of it.

Oh no, I've just lost 3 new sections due to a glitch with inserting the tickers. Drat! Will try to re-write from memory, as follows;

Dillistone (LON:DSG) - great reader comments below, see Wimbledonsprinter - who points out that there's no mention of the Gated Talent product, which was meant to be the company's big new thing. Also he questions whether restructuring costs may continue, due to the wording used in today's update I think he might be right. It's now so small, and hasn't delivered on its promise, that I wonder why DSG remains listed? Probably best to go private. To be blunt, I wasn't impressed with management, and wouldn't back them.

Image Scan Holdings (LON:IGE) - makes positive noises today, in line with expectations, but that's for a small loss. Again, I can't see why it's listed, being so small. I did well on this in 2017, when management talked up the share price, but they then disappointed in 2018 & 2019. Hence I don't trust any upbeat talk from the company any more. Also, I couldn't sell as there were no buyers back in 2018, so it was very unpleasant seeing a nice profit go up in smoke & unable to do anything about it. The share price of things this small can be completely artificial (usually too high) because the MMs won't buy in any size. Sometimes the market bid price is just there for show, to keep the price propped up, but isn't real in any size.

Onthemarket (LON:OTMP) - (I am long) - more positive news about web traffic, but I feel that the growth rate isn't enough. This company has a lot of promise, if you dig into the detail, as I've done. BUT it clearly needs to raise tons more equity, to go on a marketing splurge.

That's it for today, let's hope I can publish this without half of it disappearing again, grrr!

See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.