Good morning, it's Paul & Jack here with the SCVR for Thursday. Today's report is now finished.

I typed up my mystery shop of TGI Fridays, in the coffee shop of a garden centre, yesterday afternoon, waiting for my Daimler Double Six to be MoT'd (Edit: I only drive it under 1k miles p.a. by the way, and average 18 mpg, before Greta Thunberg rolls her eyes at me, and hisses some insult). The good news is that the Daimler passed with flying colours, with the MoT tester telling me the car is in "mint condition" underneath, despite being 30 years old. The bad news is that my TGI's review is really boring, but I'll post it later, once I've thought of something a bit more interesting to liven it up.

Fed tapering - the US indices (esp. tech & small caps) took a knock yesterday, due to minutes from the last Fed meeting, which indicate the Fed is set to start reducing QE more aggressively than some previously thought. Stimulus from central banks has certainly been a big boost for equity and bond markets, by artificially suppressing interest rates. So if that stops, then it's likely to be bearish, especially for highly valued, more speculative shares. Bond yields (on Govt debt) look ludicrously low to me, but it's a rigged market, so why anyone would voluntarily hold bonds that yield far below inflation, is a mystery to me. That said, all of this is already known, so nothing new. Bitcoin also took another sharp fall, so it looks as if speculative assets could be coming under pressure. Maybe punters might rotate into value? Who knows. Anyway, we're heading for a down day, with FTSE 100 futures set to open c.100 points down.

Agenda -

Paul's section:

Sosandar (LON:SOS) (I hold) a reassuring, in line with expectations update for the peak Q3 period (Oct-Dec 2021). Not cheap for a business that's still (slightly) loss-making, but it's the stellar organic growth (at high gross margins) that makes this share interesting.

M&c Saatchi (LON:SAA) - announces it's now in takeover talks with Vin Murria (a recent major shareholder & Director).

Ten Entertainment (LON:TEG) - FY 12/2021 has ended at the top end of market expectations (not specified). Thankfully the vagueness of the trading update is made up for by Liberum's update note. Looks good value to me, assuming no further lockdowns.

Jack's section:

Digitalbox (LON:DBOX) - small micro cap (only around £11m even after this morning's c20% jump) so will not appeal to a lot of investors, but it's a 'significantly ahead' update for the owner of The Daily Mash and The Tab today. There has been change here over the past year or two and it looks like a new strategy is allowing the company to more effectively monetise its digital assets. Worth looking into for those that do dabble in micro caps (which always have to come with a health warning!)

Made.com (LON:MADE) - online homeware retailer looks like it should be able to recover from recent supply chain issues. It's down c25% on the IPO price and stands to take share from the likes of John Lewis in what is a big market. But growth forecasts are fairly aggressive and the company remains loss-making for now. More detail will be provided in the preliminary results on 8th March so I'm waiting for that and keeping it on the watchlist in the meantime.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

Sosandar (LON:SOS) - I hold

31.5p (pre market open) - mkt cap £70m

Sosandar, the online women's fashion brand, is pleased to provide the following trading update covering the three-month period ended 31 December 2021.

Sosandar’s current financial year is FY 03/2022. Q3 is the busiest trading period, with mgt having previously told us that Oct & Nov are the peak trading months.

Company summary says -

Record trading with revenue up +122% year on year, first EBITDA positive quarter and trading in line with the recently upgraded market expectations *

Highlights - some decent stats in here, especially the excellent gross margin, and cash pile remaining static (no cash burn), plus positive trading with the 3 key third parties -

.

Other key points -

All 3 months (Oct, Nov, and Dec) were EBITDA positive.

(On this point, I’ve already emailed the Directors, to say that many investors are suspicious of EBITDA, including Charlie Munger & Warren Buffett with these brilliant comments (do click on this video link, it’s superb) on EBITDA. In Sosandar’s case, there’s hardly any difference between EBITDA and Profit Before Tax, since the depreciation & amortisation charges are minimal. Therefore I think it’s an own goal in this case to use EBITDA as a key profit measure. I’ve suggested they quote both EBITDA and Profit Before Tax, to satisfy everyone, in future trading updates).

Returns rate - now lower than pre-pandemic, due to broader product range, an important, positive point.

Supply chain - no material impact.

Current trading - reassuring -

Trading throughout the period, including post-Christmas and into early January, has been strong. Demand has followed trends of expected seasonality…

Overall trading - in line, and thank you for the really helpful footnote (below) - all companies should be clearly stating what market expectations are, in this way. There’s no reason not to, and it’s extremely helpful to investors. Apparently some brokers try to resist this approach, in which case they should be replaced with a more sensible, investor-friendly broker!

As a result, the Board confirms that the Company continues to trade in line with recently upgraded market expectations* for the current financial year.

*Sosandar believes that market expectations for the year ending 31 March 2022 are currently revenue of £27.1 million and an EBITDA loss of £0.9 million.

Conference call - if you read this in time, it’s at 09:30 today, and is open to anyone. Another sign of an investor-friendly company, allowing in private investors. Register here. I’ll be on the call, and will report back if there’s anything interesting to add to the above.

EDIT: I missed the middle section of the half hour webinar, due to my internet going down, but did pick up on a couple of useful points from the Q&A -

- Update note from Singers is available on Research Tree - I’ve just had a read of this, and the analyst Matthew McEachran sees potential for SOS to achieve £75-100m revenues and >10% EBITDA margin, by FY 03/2025. If so, then I think that would justify a share price of maybe 3x the current level, possibly?

- Clean inventories position - pretty much sold out of Xmas stock, so didn’t need to do a January clearance sale - similar to Next - sounds good.

- Overseas growth? Still in “research mode”, which they’ve said before, but see a “massive opportunity” to expand overseas via third parties.

- Shein (Chinese clothing app) - not a threat, because it’s targeting 18-30, undercutting on price. Whereas SOS is older customer, not price-driven, strong emotional engagement with customers, and unique designs/imagery/communications, etc.

- CFO - there’s a substantial opportunity to grow more. Quality of customers acquired is key, not looking for one-off transactions.

- Next update in April, for FY 3/2022 year end.

End of edit.

My opinion - I like this update, but given that it’s in line with expectations, then it’s reassuring, rather than fuel for another big move up in share price.

As mentioned before, I feel the market cap at Sosandar is reasonable - it’s a punchy price for a company that’s still hovering near breakeven, but it’s the extremely rapid organic growth (over 100% Y-on-Y) that is so exciting. Obviously that growth rate has to moderate in time, as the numbers get bigger.

In terms of the business model, I feel Sosandar is now proven beyond doubt. Being a mainly eCommerce business, costs are highly flexible in a downturn, as we saw during 2020, a big advantage over bricks & mortar retailers. SOS could switch off (or reduce) marketing (a major cost) any time, and operate at cashflow positive. Although that would obviously erode sales growth over time.

The wholesaling to the 3 big name third party websites is lovely business with more-or-less guaranteed profitability. Plus it enhances the Sosandar brand & drives organic growth.

Overall, I remain a happy long-term holder.

I do like Sosandar’s distinctive product, and USP of targeting fashionable, over 30s women, with targeted product and fit. The high gross margin demonstrates that this is real, rather than having to discount generic products in a race to the bottom with lots of other similar companies.

As with all high growth businesses, it’s not cheap, but you have to pay up for rapid growth. If something goes wrong, and growth stops, that’s the main risk here. No sign of that being a problem so far though. I don't think there are likely to be any more placings, due to a decent cash pile, and cash burn having been eliminated now.

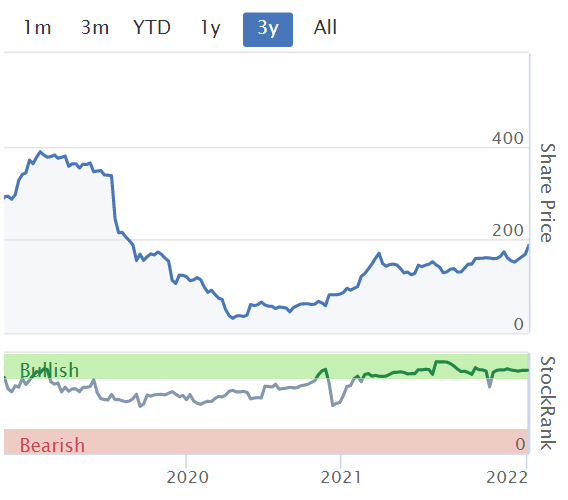

Note the StockRank has clawed its way out of the red too, reflecting improving fundamentals.

.

.

M&c Saatchi (LON:SAA)

209p (up 10%, at 10:25) - mkt cap £255m

Checking back through previous SCVRs, we began to turn positive on this PR group from June 2021 onwards, reacting to legacy issues being resolved, and a series of positive trading updates throughout H2 of 2021.

An eagle-eyed subscriber here, called slopsjon, posted a comment on Tuesday’s SCVR here, pointing out that big trades (about 15% of the company apparently) in SAA had just been printed after hours, priced at 200p, well above the prevailing share price of 167p. That was a great spot, well done slopsjon, as big trades at a premium usually means someone is building a stake, and might be about to bid for the company. I’ve seen that happen before at other companies in the past.

SAA shares gapped up to 200p the next day (Weds 5 Jan 2022), drifting down to 190p later on Weds. All has become clear today -

Statement regarding possible offer

The Board of M&C Saatchi notes the recent press speculation and confirms that it has received a preliminary approach from AdvancedAdvT Limited, a vehicle connected with Vin Murria, a director of the Company, which may or may not result in an offer for the Company.

No proposal has been received but the Board has been told to expect one in the near term…

This sounds more like a summary of previous trading updates, than a new one -

The Board confirms that the new strategy announced in Q1 2021 is already delivering, with the Company's performance consistently exceeding expectations, demonstrated by a succession of positive trading upgrades.

Takeover Panel rules have now kicked in, with all the usual disclosures now being required.

My opinion - unfortunately I sold my shares recently, thinking it looked fully valued (which it does, based on broker forecasts, even if you allow for further out-performance). There’s no point in crying over spilt milk, when you sell just before a takeover bid, these things happen. In a way it’s a positive, to have recognised the turnaround, and to have bought the share in the first place. Selling is always the toughest decision for all of us, and frequently turns out to be wrong, with hindsight.

However, the bidder clearly sees value in SAA, and is happy to pay up (200p+), and being a Director of the company, Vin Murria obviously has an informational advantage over other investors, and is very highly regarded as an investor, so I’m sure she’s right.

SAA is now priced at a premium, at c.209p, which looks logical, given that the bidder has to pay at least 200p if a takeover bid goes ahead. Also, even if the bid is rejected, this share should be fairly well underpinned at 200p, if the (now largest) shareholder was happy to pay that.

It will be very interesting to see how this pans out.

We need to keep an eye on Vin Murria’s activities, and consider buying shares in anything else where she pops up with a disclosable stake maybe?!

The share price has 6-bagged since the March 2020 pandemic lows, but that's because the fundamentals, performance, macro backdrop, and outlook of the company have improved so much in that time.

.

.

Ten Entertainment (LON:TEG)

257p (up 5% at 11:12) - mkt cap £176m

Trading Update (Full Year)

Ten Entertainment Group plc ("TEG" or "the Group"), a leading UK operator of 46 bowling and family entertainment centres, today announces a trading update for the 52 weeks to 26 December 2021.

The company’s summary says -

A compelling recovery with sector-leading sales growth.

Profits to be at the top end of expectations.

Where’s the footnote to specify what expectations are?? There isn’t one.

Thankfully we have Anna Barnfather at Liberum, who comes to our rescue, with a helpful update note today, available on Research Tree.

FY 12/2021 forecast PBT is raised 25%, but it’s only a small number, so the percentage isn’t as exciting as it sounds. Given that sites were shut for most of H1, then 2021 numbers are not really very important, with only £3.1m PBT (Profit Before Tax) forecast.

Strong LFL (like-for-like) sales growth of +29% (vs pre-pandemic 2019 sales) from May 2021 re-opening until year end, is really impressive - demonstrating strong, and sustained pent-up demand. Although bear in mind this will have benefited from many households abandoning summer holidays in 2021, hence having more money & time to spend on UK leisure activities.

Forecasts for FY 12/2022 and beyond are more interesting, as they (hopefully) won’t have enforced closures, and should see a more normal levelling out of demand throughout the year. So 2021’s strong performance from May, will be 2022’s tough comparatives.

EPS is forecast at 17.0p in FY 12/2022, and 20.0p in FY 12/2023.

At 257p, the PERs are 15.1, and 12.9 - pretty good value, and there’s always the hope that forecasts now might turn out to be too cautious in reality? That often happens in a recovery.

Current trading - a blip down in December, due to omicron, as lots of companies are saying, but it sounds short-lived -

Trading during December remained good, albeit understandably there was some softening of demand from large groups and parties driven by government messaging and the impact of the implementation of constraints in Wales and Scotland.

For the first week of FY22, immediately following Christmas, we returned to the previous trend, delivering the Group's highest ever sales for the Christmas and New Year period.

My opinion - there’s more detail in the update, which reads positively.

I think there could be further upside on this share, assuming no new lockdowns.

.

.

Jack’s section

Digitalbox (LON:DBOX)

Share price: 11.25p (+20%)

Shares in issue: 116,332,457

Market cap: £13.1m

A very small company, but one trading significantly ahead.

Digitalbox is in some ways like a mini-Reach in that it owns a couple of content websites that it is now looking to more concertedly monetise through digital advertising. Unlike Reach, there are only three sites though: Entertainment Daily, The Daily Mash, and The Tab (which itself has around 33 local university websites).

I was first introduced to it by Judith Mackenzie of Downing LLP, which now owns more than 20% of the group (see Major Shareholders).

Following the publication of its trading update on 2 December 2021 the Board of Digitalbox is pleased to report trading across Digitalbox's three brands was stronger than anticipated in December 2021, which is traditionally the Company's most important trading period. As a result, the Company expects revenue and EBITDA* for the year ended 31 December 2021 to be significantly ahead of the recently upgraded market consensus of EBITDA* of £850,000, with revenue now expected to be not less than £3.6 million.

The strong trading resulted from the continued positive trend towards mobile advertising inventory, and better-than-expected traffic from increased editorial investment over the period.

That looks to be around a 10% beat in terms of revenue. Assuming previous estimates were £3.3m of revenue and £850k of EBITDA, and assuming a static EBITDA margin (there could be some gearing here), then there might be closer to £930,000 in FY21 EBITDA.

After adjusting for net cash, I make that an EV/EBITDA multiple of around 12.6x, which looks better value than Reach (LON:RCH) or National World (LON:NWOR) .

Conclusion

Digitalbox is a particularly small micro cap so will not be appropriate for some, but it is an interesting one and it’s likely that the lack of liquidity means the share price jumps today. In fact you can see investors have been anticipating good news.

Edit - shares have opened up c20%.

Interestingly, at these levels, the group still qualifies for Stockopedia’s ‘New Lows’ screen (which looks at the share price over three years). That might change after today.

The balance sheet is dominated by intangibles - something to check, but could be justified given the online nature of the business. Presumably very little in the way of physical assets is required here.

This has been on my radar for a while due to the changing strategy, which revolves around replicating what other, larger companies have already proven, but it’s been lower down the watchlist due to its small size and liquidity.

Digitalbox is probably still off most investors’ radars so the ship hasn’t sailed quite yet. But relatively small volumes can produce big swings in the share price so volatility can be expected. There are more buyers than sellers presently, so should that reverse then share price gains could rapidly unwind.

Still, there’s been enough in recent updates to suggest the revamped digital strategy is bearing fruit and so it’s worth visiting for those who do engage with particularly small micro caps.

Made.com (LON:MADE)

Share price: 142p (+1.28%)

Shares in issue: 390,139,698

Market cap: £554m

Made is a recently-floated online retailer that has been hit by the widespread supply chain issues affecting everyone at the minute. Shares remain around 25% below the IPO levels.

It warned the market in the Autumn on gross margins which would persist into H2, with trouble in its Vietnam logistics, before warning again later in the year on deferred orders (to the tune of £35m). Not a great start to listed life, but the Made brand itself has a good reputation for products and it is taking share from the likes of John Lewis in the UK, with expansion underway in France and Germany.

Assuming this is a temporary blip in an underlying growth story, then now could be quite a good time to take a closer look. Made is a quality name and story, with a strong management team that has online pedigree and understands digital marketing in a way you might imagine John Lewis and some others might not.

There could be an opportunity for a dedicated online retailer to really offer a superior service here, with more nimble stocking and quickly refreshed collections:

Operating at the intersection of design and technology, proprietary algorithms take consumers on a journey: from outreach that makes designs discoverable to a frictionless digital shopping experience. Combined with an innovative 'just-in-time' order model, MADE provides a fresh and ever-changing range, with nine new collections launched every week and more than 8,000 active SKUs in the catalogue as at 31 December 2021.

Strong customer demand driving +38% year-on-year gross sales growth

- Both UK and Continental achieved +38% year-on-year growth (+40% at constant currencies).

- H2 gross sales of £220m represent one and two-year growth of +25% and +69%.

- +26% growth in active customers; repeat order mix +260bps to 44% and average order value up 8% year-on-year, partly driven by range expansion into higher price point products being adopted well by customers.

- Unaudited net cash at 31 December 2021 was £107m.

The group expects to achieve the target 3-4 weeks average lead time during H1 2022 and has worked hard on its warehousing and logistics. Additionally, supply of goods from Vietnam has now returned to close to normal levels, so all key suppliers are now operational.

The ‘marketplace’ could be promising and Made is moving to the next stage of development here. There are more than 100 designer makers, artisans and small brands onboarded and the group has completed the first phase of its marketplace technology infrastructure implementation.

Philippe Chainieux, CEO of MADE commented:

I am delighted with how well the business is performing, with strong customer growth in all markets and the self-help measures implemented in H2 2021 now mitigating the impact of industry wide supply chain issues. Indeed, by the end of H1, we expect average lead times to be significantly below pre-lockdown levels and, with the acceleration of the homeware product range, the company is well positioned to deliver its strategic initiatives in 2022.

Conclusion

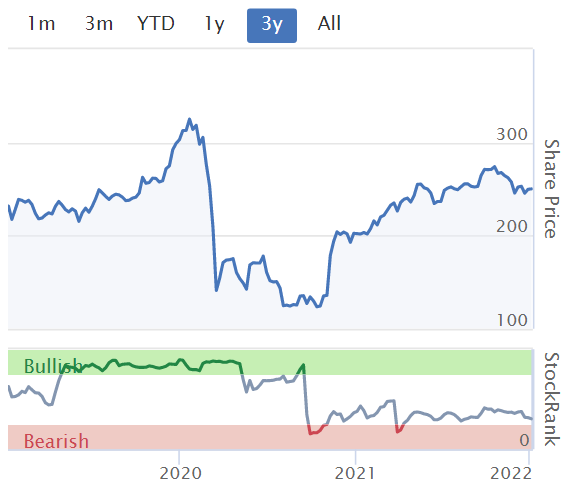

The StockRanks classify Made as a Sucker Stock, but it is quite a substantial one that is growing quickly and is taking share in large markets (£94bn in size, according to Liberum). Revenue is forecast to grow by some £148m in FY22E. I think the scale of anticipated top line growth alone warrants further investigation.

But the implied rate of growth also makes me slightly nervous as the base case still assumes quite a good performance. Made remains loss-making and there is that old refrain ‘sales are vanity, profit is sanity’.

The group has net cash, so it has the firepower and if it can continue its historic rate of revenue growth and customer acquisition then it’s not hard to see profit materialising and then growing quickly. I’m also of the opinion that recent slip ups are probably temporary and due to conditions beyond management’s control.

But say revenue grows to even around £1bn by FY25, implying a c30% CAGR, and Made generates a 5% profit margin (above the likes of Asos and Boohoo). Value it on a PER of 20x implying ongoing growth and that’s a market cap of £1bn, so maybe shares can double if everything plays out well.

I might be understating the growth potential or ultimate level of profitability - revenue growth and eventual EBITDA margin assumptions are key to valuing this and I don’t have a firm view on them. The forecasts are punchy and I’m erring on the side of caution for now.

On balance, I’d want a lower share price and more information below the gross sales level. Preliminary results will be published on the 8th of March. They’ll contain a lot more detail.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.