Good morning, it's Paul here, with Thursday's SCVR.

Estimated time of completion today is 2pm - there are lots of announcements, so I might possibly defer a couple until tomorrow.

EDIT at 14:22 - today's report is now finished.

Middle East tensions - the risk of all-out war between USA & Iran seems to be receding. Tehrans's "firework display" (as one newspaper put it) which doesn't seem to have actually killed any Americans, allows it to save face & back down. No doubt lower level tensions & deniable attacks are likely to continue, but for now anyway this is going down my list of worries in respect of the stock market.

Early snippets (pre market open)

Marks and Spencer (LON:MKS) - Q3/Xmas update looks OK. Eked out +0.2% LFL sales. Full year guidance unchanged, which in current circumstances is not bad at all. Decent yield of almost 5%. Turnaround happening I think, but very slow. Shorts are wrong on this - I see MKS as a long-term winner, due to: strength of food offering (best there is), upside from Ocado partnership selling food online, highly cash generative still, store closures should greatly boost profits because of eliminating losses but also adds +20% sales to nearest remaining store. I reckon this share could gradually recover in 2020, maybe to c.300p?

EDIT at 08:38: the market doesn't seem to share my sanguine view on this, with the shares down 8% to 200p at the time of writing. I'm tempted to open a new long position at that level, will do some more work on it later today, once this report is out of the way. On the downside, the turnaround is a long-term thing, and have I got the patience to sit & wait? There might be better uses for my cash in the meantime maybe? End of edit.

Card Factory (LON:CARD) - (I am long this share - looks like I jumped the gun!) - a mild profit warning today. LFL sales only slightly down YTD at -0.6%. However, when last reported, this was +0.7% YTD. This implies a negative performance in Q4 to date, of maybe -3-5%-ish? I don't like the way the company has obscured this by not revealing Q4 performance separately - a poor show. Revised EBITDA guidance of £81-83m - a nuisance that the RNS doesn't indicate how much of a reduction this is - again, not very user friendly. U/l EBITDA last year FY 01/2019 was £89.4m, and £94.0m the year before that.

Vague but interesting-sounding comments about investment in future strategy. Sounds like divis might be reduced in future to pay for whatever that is. I'm braced for a drop in share price today. Still a fantastically cash generative business though.

Card Factory (LON:CARD)

Share price: 109.5p (down 21% today, at 09:10)

No. shares: 341.5m

Market cap: £373.9m

(at the time of writing, I hold a long position in this share)

Trading Statement (profit warning)

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, provides the following update in respect of the eleven months ended 31 December 2019.

The company's attempt to obscure the figures for Xmas trading clearly hasn't worked, along with muddled messaging on the divis, makes this a very poor announcement. Clarity is everything, and I'd certainly like to see trading updates improved at CARD.

The quarterly trading updates are good in principle - all companies should have a structured, regular approach to updating shareholders, and quarterly makes sense. Too many companies update almost randomly, whenever the AGM happens to be, then a long gap until the next interim/final results. So I like quarterly updates.

Where CARD is going wrong, is changing the format, and using confusing terminology, with too many footnotes. What it needs is just a table. Showing each quarter, the performance broken down for the quarter itself, and YTD, separately disclosing stores, online, wholesale, etc.. Keep the format of the table exactly the same each quarter, then investors can quickly see how the business is performing.

A separate table should show the EBITDA guidance, previous guidance, compared to last year, etc.

Basically, CARD (and all other retailers) just need to look at what Next (LON:NXT) does, and copy their disclosures to the market. Another, simpler example, is how Topps Tiles (LON:TPT) reports its LFL sales per quarter. CARD needs to do the same, as the current, wordy format, is confusing & is inconsistent, in particular...

Failure to disclose key sales information - the key measure that investors look for, is LFL sales performance. CARD knows this, and usually discloses it. However, for Q4 to date, the number has been withheld. Looking back, this is what was previously disclosed;

Q1 update on 5 June 2019 - LFL sales +2.3% (seems to include online sales & store sales)

Q2 update on 13 Aug 2019 - LFL sales +1.5% for the half year. Therefore, Q2 LFL must be negative, but isn't separately disclosed.

Q3 update on 14 Nov 2019 - YTD LFL sales +0.9%. This time however, the company discloses Q3 LFL openly, as being -0.4%. Fine, that's the way it should be done.

Q4/Xmas update today - YTD LFL sales -0.6%, which means Nov & Dec must have been pretty awful, to have dragged down the YTD figure from +0.9% to -0.6% in just 2 months out of 11 in total. Yet this time, the actual figure is withheld - presumably because the company doesn't want to show investors how bad Nov & Dec trading really was. This is unacceptable!

Looking back at last year's Q4/Xmas update, that didn't give LFL sales for Nov & Dec either, but the narrative did say that these were consistent with the Q3 update.

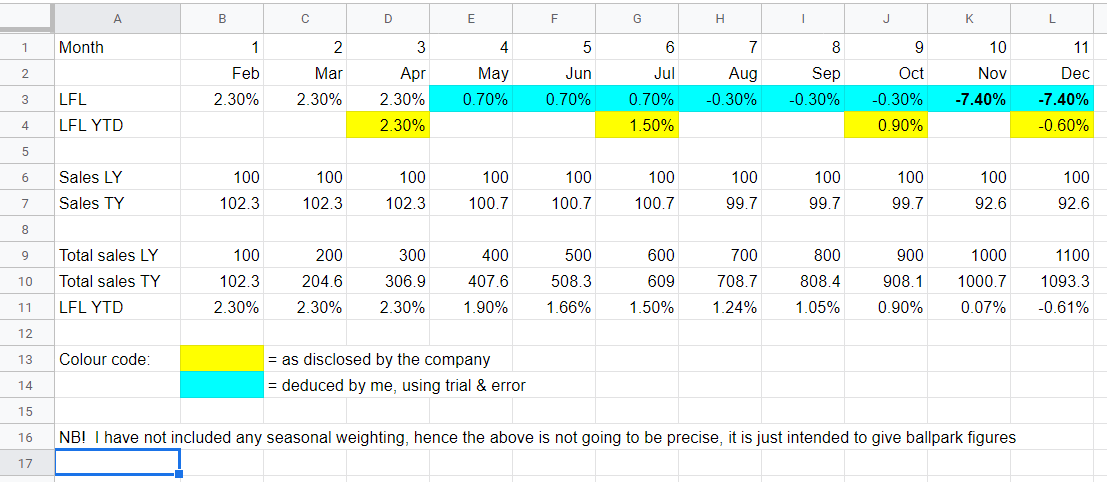

As you can probably gather, this unsatisfactory reporting of LFL sales is really bugging me, so I'm going to have a stab at estimating the Nov/Dec 2019 sales decline, on a spreadsheet.

OK, this is what I've arrived at. It should be fairly easy to follow, what I've tried to do is work out the LFL sales change each quarter, where it hasn't been disclosed by the company. NB this is not accurate, because I haven't included seasonality of trading, in particular Dec 2019 would probably be peak trading. This is only intended to produce a ballpark LFL figure for Nov & Dec 2019, which as you can see looks pretty horrendous, with my estimate (possibly over-stating the fall), at -7.4% in cells K3 & L3 below;

Even if my figures are too pessimistic, I reckon Nov & Dec must have seen at least -5% LFLs, to have dragged down the YTD LFL performance from +0.9% (over 9 months) to -0.6% (over 11 months).

Now I can see why the company didn't want to come clean, and disclose such bad figures. But that's not good enough - they should, and must, be transparent with the market in future, whether it's good news, or bad.

If my figures are wrong, then I challenge the company & its PR people, to disclose the correct figure to the market, a figure which they have deliberately withheld so far.

I've had to waste half the morning on this, to work out estimates of key information which should have been disclosed by the company.

New store openings - the company says it is on track to open 50 new stores this FY 01/2020, which are said to be trading well, in today's RNS. The company must be getting excellent deals on new sites, as there are so many empty shops. Generally, landlords are offering long rent-frees, and reduced rents. Plus existing sites should be seeing rent reductions on lease renewals (Shoe Zone (LON:SHOE) indicated yesterday that its rents are falling about 24% on lease renewals).

Note that the profits from new stores will be flattering overall profits - i.e. profits on the existing stores will be falling faster than the fall in company total profits.

EBITDA guidance - current year FY 01/2020 guidance is now £81-83m. What was the previous guidance? I don't know, because the statement today doesn't tell us. More time needs to be wasted to find out.

Here is the recent trend in underlying EBITDA (which is a good proxy for cashflow, with retailers);

FY 01/2018: £94.0m

FY 01/2019: £89.4m

FY 01/2020e: £81-83m

As you can see, that means the trend of falling EBITDA is now firmly established, and looks to be accelerating this year.

That said, this remains an astonishingly profitable & cash generative business, and has one of the highest operating profit margins of any retail chains.

Estimating EPS - I can't find any broker notes, so have had to work out my own estimate for FY 01/2020, as follows;

EBITDA: £82m (mid point of guidance range given today)

u/l operating profit: £70.8m

(based on deducting £11.2m depreciation + amortisation of software, which compares with £10.9m actual last year - I've allowed a bit more for this year, to take into account depreciation on new stores)

u/l profit before tax: £66.9m

(assuming interest cost same as last year, of £3.9m)

u/l profit after tax: £54.6m

(LY tax charge was 19.4%, so I've estimated 1% less than this, so 18.4% for this year)

EPS: divide PAT of £54.6m by 341.5m shares in issue = 16.0p EPS (my estimate)

Trend of EPS - in last 3 years, this is clearly on a downward trend now;

FY 01/2018: 18.9p

FY 01/2019: 17.6p

FY 01/2020: 16.0p (my estimate)

If my EPS estimate is right, then the PER is 6.8 times, based on 109.5p current share price.

That looks very cheap, but we do have to consider that companies with declining earnings should be priced on a low PER, and there is also the debt to consider (see excellent post in reader comments, from rmillaree and Zipmanpeter - many thanks for your contributions)

Director buy - the CEO has just bought a paltry 10,000 shares today. If that was designed to show confidence, it's back-fired. If the CEO is only prepared to risk £11k of fresh money on buying shares, then that worries me, more than reassures me.

Dividends - there's rather mixed messaging here. This is what the company says today;

The board remains committed to its previously stated dividend policy, returning surplus cash to shareholders via ordinary and special dividends whilst maintaining year-end leverage in the range 1.0-2.0x (current target 1.7x).

The board does not anticipate that a special dividend will be paid in FY21.

The level of ordinary dividend in FY21 will be reviewed in the context of the cash flow profile associated with the refreshed business strategy. Further guidance will be provided in April.

That seems really badly worded - it seems to be saying, yes we'll keep paying big divis, but then says no we probably won't!

With hindsight, it strikes me that the company made a mistake paying special divis in recent years, and should have instead used surplus cashflow to reduce debt.

Forecast divis for this year are 13.2p, which is far too high (although should still be covered by earnings).

In my view, management should re-base the divis down to something like 6p, which would equate to a still excellent 6% yield, but would enable it to invest more in the business, and pay down debt at the same time.

My opinion - CARD has clearly had a lousy Xmas, and I wonder if it's time for new management to be brought in?

The share price has crashed to such an extent, that I'm seeing value here at the current price of 100p. Personally, I bought recently at 140p, so am trying to decide whether to double up, or sell out.

On the upside, this is still a remarkably profitable business, with a very high operating profit margin & great cashflows. New store openings are trading well (presumably on very low rents & long rent-free periods), and the new retail partnerships, e.g. with Aldi & Matalan, sound promising.

On the downside, it's had a lousy Xmas, and the trend in earnings is clearly downwards now. If management cannot arrest that decline, then maybe it's time to bring in new leadership? Or, perhaps declining profits are just inevitable, given rising costs, combined with declining footfall?

At the moment, I feel neutral on it, although it's very tempting to buy around 100p, because that level strikes me as an over-reaction to what is actually a fairly mild profit warning. The share price had already fallen beforehand, so arguably we're seeing double-counting of the bad news.

Having bought at 140p, if I double up at 100p, then that brings my average down to 120p, and I could see the price rallying to around that level fairly soon, giving me a chance to exit at breakeven.

This is a far from terminal situation, unlike many other retailers.

There's more detail in the trading update today, but I've spent enough time on this one, so will move on now.

Maintel Holdings (LON:MAI)

Share price: 283p (down 30% today, at 12:23)

No. shares: 14.3m

Market cap: £40.5m

Trading Statement (profit warning)

Maintel Holdings plc (the "Group" or "Maintel") today issues the following trading update for the financial year ending 31st December 2019.

Bad luck to holders here, it's warned on profits.

What's gone wrong? - contract deferrals & losses.

What's the damage? - revised guidance is given, but annoyingly (as with CARD above), the announcement fails to detail what the previous guidance was. Therefore everyone who reads this RNS has to rummage around, to try to find out the previous guidance. How many person hours does that waste, in aggregate?

For the year ended 31st December 2019, the Board now expects revenue of approximately £123m and adjusted EBITDA of approximately £10.8m excluding IFRS 16 adjustments and approximately £11.7m including IFRS 16 adjustments.

Looking back to the last interims, it did adj EBITDA of £6.5m in H1. Therefore, H2 has dropped to £4.3m.

Having wasted about 10 minutes looking for previous guidance, I've found it. In the interim statement, Maintel said it expected adj EBITDA of £13-14m for the full year. Therefore a drop to £10.8m now, is quite a hefty miss of £2.2 - £3.2m - and important to remember that all of that miss happened late in H2.

Outlook - sounds OK in tone. Given the political problems in late 2019, I can understand why some contracts might have been deferred by customers. So this could potentially be a buying opportunity, if things return to normal in 2020, maybe?

For the year ending 31st December 2020, the Board anticipates that the Group will deliver low single digit organic revenue growth, underpinned by the improved order intake in Q4 and a return to healthier levels of activity in the public sector.

A current review of measures to improve margins is expected to deliver benefits in the latter part of FY2020....

...An increase in public sector business coupled with a strong performance in order intake in Q4 2019 provides us with a good degree of confidence for 2020, when we expect to return to both revenue and EBITDA growth.

Low single digits means almost nil organic growth.

Dividends - this is what CARD should have said today, instead of its muddled messaging. Much greater clarity here from Maintel;

In recognition of the reduced profit expectations of the Group and to maintain balance sheet strength, the Board has made the decision to rebase the dividend. The Board expects to reduce the final dividend for FY 19 by 50% versus the final dividend for FY 18, to 9.8 pence per share.

Off this lower base, the Board intends to maintain a progressive dividend policy in the future.

Maintel actually has a terrible balance sheet, with NTAV negative at -£44.7m when last reported. So it shouldn't be paying any divis at all, in my view. I would regard even the rebased divis as being precarious. The company should be husbanding cash, to pay down its debts, instead of paying out unaffordable divis.

My opinion - I don't know the company or sector well, and Maintel's awful balance sheet puts me off.

That said, if you like the company, then today's sell-off, on negative factors which sound as if they may reverse somewhat in 2020, could possibly be a buying opportunity? So it could be worth a closer look. Bear in mind that the shares are highly illiquid, so very difficult to get in & out of. That said, after a profit warning there are often willing sellers.

Churchill China (LON:CHH)

Share price: 1955p (up 1% today, at 13:10)

No. shares: 10.96m

Market cap: £214.3m

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce the following trading update for the year ended 31 December 2019.

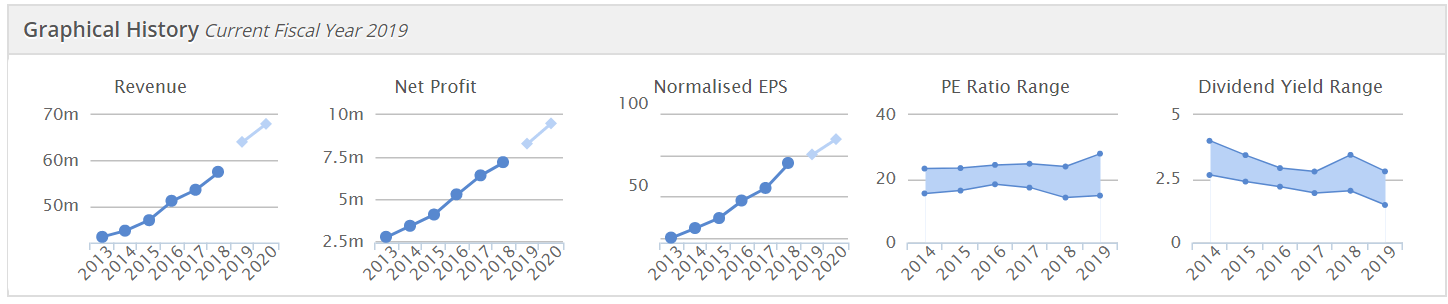

What a smashing business, check out this historical track record;

Positive trading update today - impressive clarity & brevity here;

We have made solid progress against our targets in the second half of the year with good levels of trading in both UK and export markets. As a result the Board now expects that operating performance will be slightly ahead of current market estimates.

Funny isn't it, how businesses that are doing well, don't need to say much. No excuses about Brexit, political uncertainty, or the weather here! Companies with good products, offered at attractive prices, tend to do well regardless of external factors.

My opinion - I've always baulked at the high valuation here, over many years now. I thought it looked too expensive 5 years ago. It's quadrupled in share price since then! Which is a great reminder that sometimes it's necessary to just pay up for quality - the best companies grow into a rich valuation.

Cambria Automobiles (LON:CAMB) - it's an in line update, so no need to do a full section.

The car dealership sector has faced well-known headwinds, including big decline in diesel sales due to confused Govt policy, emissions issues, etc. Plus there's more EU regulation in the pipeline apparently, on emissions, which is likely to lead to manufacturers facing fines. I don't know if that is likely to have any read-across to dealers?

Plus, the switch to electric cars seems fairly imminent, which in theory need less servicing than internal combustion engined vehicles. Autonomous vehicles are then lurking on the horizon maybe 10-15 years ahead?

On the other hand, many car dealership chains have great freehold property portfolios, which can often have high alternative use value. Therefore I see this sector as a hybrid, of car retailing/servicing, and property.

CAMB looks good value on a PER of 7, and note that its forecasts have actually risen in the last 12 months, so it could be worth a fresh look maybe?

Stockopedia likes it - Super Stock, and high StockRank;

That's me done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.