Good morning, it's Paul & Jack here with the SCVR for Thursday.

Today's report is now finished.

Agenda -

Paul's Section:

Pebble Beach Systems (LON:PEB) - a quick review of interim results from this micro cap. Performance & outlook look quite good, although dilution risk remains, due to excessive debt. It's making progress though, so could be worth a closer look possibly?

Gear4music Holdings (LON:G4M) (I hold) - an in line with expectations trading update for the AGM. Some supply difficulties re Brexit, but being resolved with new European warehouses opening shortly. Acquisition also announced, which looks a good fit, and reasonably priced. All looks good to me.

Cenkos Securities (LON:CNKS) - a very quick look at its interim results. Profitable, cash rich, paying divis, and a modest market cap. Looks quite interesting.

National World (LON:NWOR) - a reader request (after my interest was engaged with some details provided in the comments section). This is the new holding company for the collapsed Johnston Press newspaper businesses. Still profitable, although print obviously in decline. If they can talk up the digital advertising growth like Reach (LON:RCH) has done, then I see a potentially lucrative, speculative trade here! Not particularly high risk, as the balance sheet has been sorted out, with JPR's crippling debts gone.

Jack's Section:

Stv (LON:STVG) - Scotland's most watched TV channel with growing digital services and increasing content production. It looks like the right strategy in a rapidly evolving world of content delivery, and trading looks good, but there is a huge pension fund here and so there is a good degree of financial risk. The latest triennial valuation is ongoing.

Lookers (LON:LOOK) - It's a great time to be a car dealer. Lookers has had accounting issues in the past but favourable conditions have transformed the balance sheet. There could be further to run in the share price if it closes the gap to peers and the sector strength continues. But is this the company investors will opt for given the alternatives? Trust takes time to rebuild.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

Pebble Beach Systems (LON:PEB)

11.25p (up 9% at 11:05) - mkt cap £14.0m

A friend has goaded me into looking at this (!), but I’ll keep it brief due to the tiny market cap.

Pebble Beach Systems Group plc (the "Group", "Company" or "Pebble"), a leading global software business specialising in playout automation and content management solutions for the broadcast and streaming service markets, is pleased to announce its unaudited half-year results for the six months ended 30 June 2021.

H1 revenues are very modest still, but a good chunk is recurring -

Revenue up 9% to £4.9m (H1 20: £4.5m), recurring revenue up 10% to £2.05m (H1 20: £1.86m).

Profit before tax is the most meaningful profit measure to me, out of several other options, and is good, at £1.0m in H1 - a high profit margin of about 20%

Balance sheet - is still very weak. NAV is negative at £(2.46)m.

Deducting £5.3m intangibles, makes NTAV negative £(7.76)m, which is bad for the small size of the company.

The problem is debt - it has maxed out its £8.0m bank facility, and at some point this will need to be sorted out with an equity raise. That could result in considerable dilution potentially, which investors do need to factor into their valuation.

That said, the company has got this far through the pandemic without diluting shareholders, goodness knows how - a very accommodating bank manager clearly! Therefore the longer things go on, and with trading improving & share price rising, the risks are reducing.

It is still high risk though.

Current trading and outlook - this sounds positive -

· Sustained growth in the period with a further increase in our pipeline by 7% coming on top of a 64% increase in our order intake.

· Well positioned to sustain performance into second half and beyond.

· Considering ways in which to now further accelerate growth.

My opinion - this is a good update, and I think the company has clearly made progress. Debt remains far too high though, so I think it will need to sort out the balance sheet with an equity raise at some point.

Apart from that, everything else looks pretty good. I might possibly be interested in taking a little punt here, once it’s sorted out the balance sheet.

.

.

Gear4music Holdings (LON:G4M)

970p (close last night) - mkt cap £203m

AGM - Trading & Acquisitions Update

Gear4music (Holdings) plc, ('Gear4music' or 'the Group') (LSE: G4M), the UK's largest retailer of musical instruments and music equipment, will hold its Annual General Meeting at 10.30am today.

The current financial year is FY 03/2022.

Overall trading is in line - good, that’s fine -

Trading remains in-line with the Board's expectation

- UK revenue returned to growth during July and August 2021

- Slower European revenue impacted by post-Brexit challenges

I’m surprised at that. My impression was that, with distribution centres in Europe having already been set up prior to Brexit, that it wouldn’t have much, if any, impact for G4M. So I’d be keen to know why Brexit has suddenly become an issue, when it wasn’t before?

Thankfully, the issue is explained further, and sounds like a temporary problem that will be fixed shortly -

European sales have remained behind last year, primarily as a result of post-Brexit cross border shipping challenges creating a less competitive delivery proposition in some of our European markets.

Our two new distribution centres in Ireland and Spain will be operational by H2 FY22 as planned, and should eliminate most of the remaining post-Brexit challenges, significantly improving our European delivery proposition to provide a platform for further growth in our European markets by Q4 FY22.

Acquisition of AV Distribution Ltd - this looks to be the largest acquisition made to date, and the EBITDA multiple (which seems to be how acquisitions are generally valued) looks reasonable -

.

I’ve had a quick look at the last published accounts for AV Distribution Ltd (company number 05385699) on Companies House website. There’s not much information available, as it has only published a balance sheet, under the small companies exemption rules.

This shows a robust balance sheet, with NTAV of £3.3m (all generated from retained profits), and includes £1.2m property, and a modest level of bank debt.

Inventories might give an indication of the size of the business, at £2.17m are fairly decent-sized. If that stock turns over say 5 times per year, then that would be just over £10m revenues. That’s a complete guess though, because we’re not told what the stock turn is. I’m just trying to get to a rough idea.

Retained profits (i.e. after tax) was £345k for FY 03/2020.

I’ve just spotted more info about AV in the RNS, and turns out that my guess on revenues wasn’t far off the mark!

AV Distribution Ltd trading as AV Online ('AV Online'), an online retailer of Home Cinema and HiFi equipment and, separately, the acquisition of the website domain name 'AV.com'. AV Online increased revenues by 54% to £8.6m during the last financial year to 31 March 2021, generating adjusted EBITDA of £1.3m.

Operating in a £400m UK audio video market that is currently dominated by high-street based retailers, the Board believes that AV Online will greatly benefit from being transferred onto the Group's highly scalable European e-commerce platform and being rebranded to 'AV.com'.

Based on the information provided, this sounds a sensible deal.

The price being paid for the business is £6.2m, plus an additional £3.0m for the AV.com domain name, which is being purchased separately (and isn’t currently in use).

The Board notes that these acquisitions will significantly increase the Group's addressable market size and believes there are significant synergies between the market in which Gear4music operates, and the closely related but separate AV market, which is currently dominated by high-street based retailers such as Richer Sounds.

The Board is confident that by moving the AV Online business onto Gear4music's highly scalable bespoke e-commerce platform, rebranding the business to AV.com, developing its product ranges, and expanding into Europe, AV.com can quickly grow its revenues and profits. The Board expects that the acquisitions will be earnings per share enhancing from FY23 onwards.

My opinion - everything looks fine to me. I like the look of the acquisition - clear logic for doing it, and the price seems attractive.

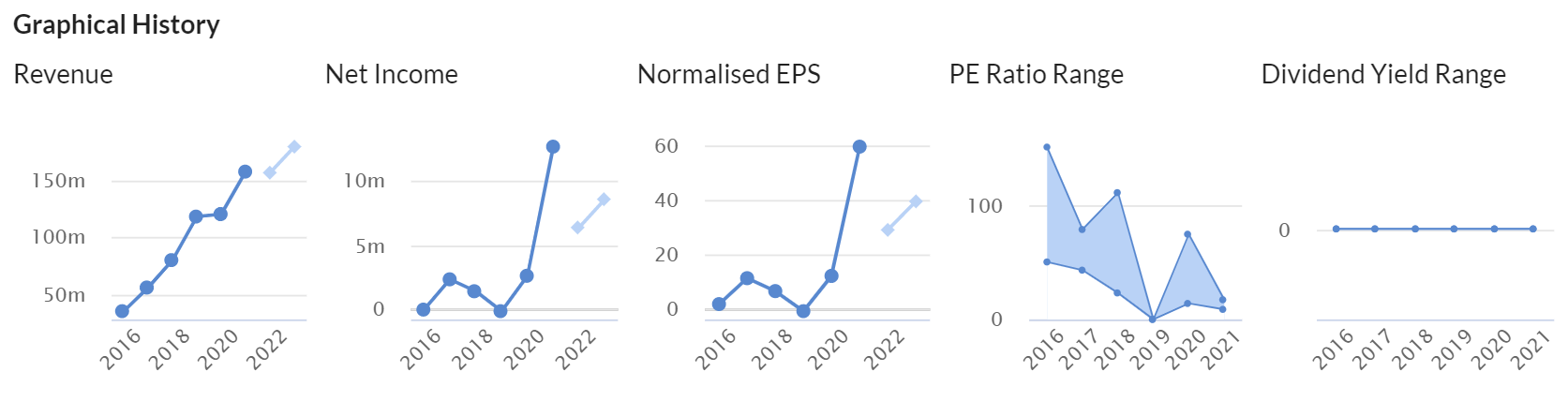

As you can see from the graphs below, forecasts have been set well below last year’s exceptional performance in the pandemic lockdowns. Having up-to-date confirmation today that trading is in line with expectations, is reassuring.

Based on c.40p EPS, the PER is 24, which I think looks reasonable for a growth company with a strong track record.

Gross margins tend to be low in this sector, so it’s not likely to attract new, disruptive competition.

Fashion eCommerce businesses have seen a nasty de-rating this year, e.g. Asos (LON:ASC) and Boohoo (LON:BOO) - both of which I hold have seen very poor share price performances. Possibly due to worries about emerging competition, e.g. Chinese firm Shein?

It did cross my mind that G4M could also see new competition from China, if Chinese factories began selling direct into UK & European markets? That’s something to watch out for in future.

So far so good. I’m happy to continue holding G4M - it’s performing well, and looks reasonably priced. I also like today’s acquisition. Shares look fairly priced to me, with further upside possible longer term, as the business continues to grow.

.

Cenkos Securities (LON:CNKS)

79p (down c.1% at 08:54) - mkt cap £45m

Cenkos Securities plc (the "Company" or "Cenkos" or the "Firm"), the independent institutional stockbroking firm, today announces its results for the six months ended 30 June 2021.

H1 results have improved against last year - hardly surprising, as market conditions have improved so much. Although remember that last year many companies were frantically raising fresh equity after the pandemic hit, thus earning fees for brokers.

H1 underlying profit is up 44% to £2.8m

Outlook - “reasons for optimism for the remainder of 2021 & beyond”

Note that staff costs are up very considerably - the split between staff and shareholders is always an issue with this company, and other financial services companies for that matter.

Net trading gains - rose from £806k to £2.4m, so it looks as if that made almost all the profit possibly? Although that depends if there are costs associated with this activity not taken into account in this number?

Balance sheet - strong.

My opinion - the glory days of raking in huge fees from big IPOs bought by Woodford, are long gone. However, Cenkos is still profitable, has a lovely cash rich balance sheet, a fair bit of clout & strong brand name, and its market cap is only £45m, which doesn’t seem a lot.

It pays divis too, with a 1.25p interim divi declared. Quite interesting overall.

.

National World (LON:NWOR)

39.7p (up 12% at 09:12) - mkt cap £103m

I’m not familiar with this company, but several readers have posted interesting points about it below in the comments, and the share price is up 12% on publication of interim results, so that’s engaged my interest.

I’ve not looked at NWOR before. It seems to be the reincarnation of Johnston Press, whose demise we chronicled here over many years, as it drowned in debt (expensive bonds), despite having a nicely profitable core business. This article of mine from 2017 set out the reasons why JPR shareholders would probably be wiped out, and the business owned by the bondholders, which seems to be what happened. It’s since been re-floated into a shell company, and has become National World.

The highlights show a decent 10% adjusted profit margin, and good profits in H1 -

.

Note that £3.3m restructuring costs took the statutory profit into a small loss (plus listing costs). Restructuring is ongoing in this sector, as newspapers have to constantly cut costs, laying people off, closing offices, etc, all of which has an up-front cost. So are the underlying figures reality, or the breakeven statutory numbers? I’d say the statutory numbers reflect reality better, because restructuring is not one-off, it’s ongoing in wave after wave of cost cutting, essential for the business to survive as revenues fall.

Obviously newspapers are in slow, terminal decline. Personally I don’t buy the argument that the digital advertising is hugely exciting and valuable, so Reach (LON:RCH) doesn’t interest me. The reason being that RCH doesn’t split out where its profits come from (dying print, or up & coming digital). I suspect the profits are overwhelmingly from print, which is in terminal decline. Also Reach has a horrendous actuarial pension deficit, sucking out cash for years to come. Higher inflation could see liabilities expand further maybe?

That said, RCH has been a fabulous trade in the last year, and lots of people have done very well on it, which is great to see. What happens longer term, we don’t know, time will tell.

Digital growth - is good, but if 21% digital growth only partially offsets the 9% fall in print revenues, then that tells us digital is much smaller in overall terms than print. This is the problem. It says lower down that digital revenues are only £5.8m in H1, only 14% of total revenues.

· Strong digital revenue growth

Digital publishing revenue on a proforma basis grew by 21% year on year, partially mitigating the 9% fall in publishing print revenue.

Cost-savings - similar to Reach, profitability is held up by continuous rounds of cost-cutting, to offset declining revenues from circulation & advertising -

The Group remains on track to deliver at least £5.0 million of annualised cost savings (net of National World management costs) with restructuring costs of c.£4.0 million.

Balance sheet - this is what killed off the shares in this company’s previous incarnation, JPR. So I need to see a much better position in NWOR.

The good news is that this balance sheet looks clean, with the legacy issues seemingly gone. NTAV is positive, at £11.9m.

There don’t seem to be any significant fixed assets, so maybe production is outsourced, or assets might have been acquired at written down value, does anyone know?

Note the 2 lots of £2.5m deferred consideration payable, which would reduce cash accordingly.

Overall, this is a vastly better investment proposition than the old JPR, because the crippling debt has gone. Hence insolvency risk looks low.

Outlook - seems OK -

During July and August 2021 revenue on a proforma basis is broadly in line with 2020 and in line with management's expectations. Whilst there remains volatility in the trading environment following the lifting of government-imposed restrictions due to the COVID-19 pandemic, the Board anticipates trading for the full year to be in line with market expectations despite a significant increase in newsprint prices in the second half of the year mitigated by further cost savings.

My opinion - as mentioned before, I’m sceptical about dying newspaper publishers transmogrifying into glamorous, highly rated digital advertising companies. However, the market has lapped up that story with Reach (LON:RCH) and produced stunning profits for investors.

Therefore, it’s logical to assume that NWOR could sing from the same hymn sheet, and see its shares soar too. There doesn’t seem to be any complication with a pension deficit at NWOR either, whereas the pension scheme at RCH has a gigantic actuarial deficit, and sucks a lot of cash out of the business.

On fundamentals I’d say NWOR looks priced about right. However, as a trading punt, on a potentially large re-rating from the digital advertising story becoming popular amongst punters, I reckon NWOR could be a good speculative trade - a mini Reach.

If it does anything like what RCH shares have done, then we might see this share double, or even triple (it’s already doubled from the float remember). Then I would sell half, and run the rest for free, if that scenario does play out.

There's only a small free float too, so buyers could chase this higher easily.

Jack’s section

Stv (LON:STVG)

Share price: 342p (+1.33%)

Shares in issue: 46,722,499

Market cap: £159.8m

STV is Scotland’s most watched TV channel in Scotland, with a growing digital library. It’s in quite a unique position, which makes it an interesting stock to monitor, but with the way people consume media evolving so rapidly and some huge players becoming more active here, there are some business model risks.

Judging from the past few updates, STV appears to have settled on a good strategy that is ensuring it remains relevant in these changing times. Its video on demand service, STV Player, is growing quickly, both signing up and creating its own new content.

Financial health is an issue here though - note the Z-Score.

Cash and equivalents of just £7.6m compared to current liabilities of £28.9m does not leave much room for maneuver, and the group could really do to build in some more security through a larger cash pile in my view, particularly when we get to the liabilities.

Trade payables of £27.3m are roughly balanced with trade receivables of £27.4m, but then there is £25.2m of borrowings, £8.5m of lease liabilities, and £42.1m of pension obligations. It’s this last point that is an unknown for shareholders - the obligation is down from £70.3m in the prior year, so swings here can be quite severe. It’s a key risk for investors to consider, and a stretched balance sheet saddled with a large pension deficit is never a comfortable position.

The 2020 triennial valuation of the defined benefit pension schemes is on-going. It’s the kind of behind-the-scenes discussion with pension stakeholders that could really impact the cash flows attributable to shareholders in the years ahead, so this upcoming valuation and any changes in terms for the company funding the deficit are an important unknown right now.

Today’s interim cash flow statement shows a £4.6m pension deficit recovery plan payment alongside a £0.3m contingent cash payment. That’s more than 50% of cash generated from operations being spent on the pension fund situation. I’m surprised the company pays a dividend at all with that kind of commitment.

It’s probably the main reason for the persistently poor cash conversion we can see in the Financial Summary, with operating cash flow per share way below normalised earnings per share over the years.

Strong strategic momentum and financial performance ahead of pre Covid levels

Financial highlights:

- Revenue +35% to £60.3m,

- Operating profit +118% to £11.4m; operating margin up from 12% to 19%,

- Adjusted profit before tax +137% to £10.6m; PBT +273% to £8.5m,

- Adjusted earnings per share +79% to 19.2p; EPS +269% to 15.4p,

- Net debt reduced from £33.5m to £17.6m,

- Dividend per share +23% to 3.7p.

Adjusted figures come before exceptional items and IAS19 interest.

This looks like a strong recovery from one of the more interesting shares out there. STV is the most watched channel in Scotland and its lead over BBC1 is the largest it has been since 2008, so the company looks to be executing a successful strategy. It’s been six years in a row of viewing share growth now, with all time shares at 20.8%. In fact it reports ‘the highest growth of all of the UK's 500+ TV channels so far in 2021’.

Meanwhile, STV Player’s 66% increase in online viewing means it remains ‘the fastest growing UK broadcaster VOD service’, with monthly active users up 61% and registered users up 11% to 4m. VOD is video on demand. The group’s digital strategy is gaining traction and 11 new content deals have been signed in H1 (including Sony) adding more than 100 titles.

Advertising recovery continues, with Total Advertising Revenue (TAR) +32% in H1 and expected to be +25-30% for the 9 months to end of September. STV-controlled advertising continues to outperform the wider market, with video on demand (VOD) advertising on the STV Player +62% (2019: +83%) and regional advertising revenues +27% (2019: +4%) in H1.

Record audience growth maintained on both STV (+5%) and STV Player (+66%)

Good momentum in Studios, with further new commissions and an 8th creative label added. Studios revenue +265% on 2020 (2019: +202%), reflecting the recovery in production activity and recent commissioning momentum. There have been 15 new commissions so far in 2021 and 8 new returnable series.

Sale of lottery completed, with long term advertising contract in place.

3-year growth targets - these are to:

- Double digital viewing, users, and advertising revenue to £20m,

- Quadruple production revenue to £40m, and to

- Achieve at least 50% of operating profit from outside traditional broadcasting.

The latter point is being funded through a £30m investment programme.

Outlook - advertising trends continue to strengthen. Q3 TAR is expected to be up 20-25% and nine month TAR +25-30%. That’s split between +10-15% growth in regional and +40-45% in VOD. Studios is on track for its ‘best ever financial performance’ this year with confirmed revenues of £20-25m and good visibility of 2022 due to returning series with proven interest.

Conclusion

The way we watch content has changed dramatically over the past five years or so. It’s one of the reasons why I’ve given listed media properties like ITV and STV a wide berth, although I appreciate that they are in a way quite unique assets with potentially good value.

Focusing on content owners like Games Workshop has seemed a little more certain amid this huge shift - while the way content is being presented to us is changing, with big players setting up their own ring fenced digital streaming services for example, there will always be that fight for top quality content.

But STV looks to be carving out a place for itself in this rapidly evolving environment. Six consecutive years of viewing share growth, with STV's all time share at 20.8%, the highest growth of all of the UK's 500+ TV channels so far in 2021. The group also reports the acquisition of its eighth Studios label today, Hello Mary.

But the size of the pension fund deficit and the related recovery payments, along with STV’s low cash balances, poor cash conversion, dividend payments, and debt levels makes it very financially risky. Full details on the pension funds are in note 21 of today’s update. £426.7m of fund assets set against £468.8m of liabilities, so more than the company’s entire market cap.

Management knows more about the situation here than we do, and it’s possible that ongoing valuation discussions are favourable for the company. That’s something to watch out for. But, with net tangible assets a negative £9.6m it’s not something I’d feel comfortable banking on.

So while a forecast PE ratio of 8.7x might appear low at first, it is less attractive considering the financial risks. Cash should not be paid out to shareholders in my view, it should go towards at least partially de-risking the balance sheet.

That’s a shame as underneath all that is an attractive company with hard-to-replicate properties that has a solid strategy and is trading well. It’s still worth monitoring on account of upcoming news regarding its triennial valuation.

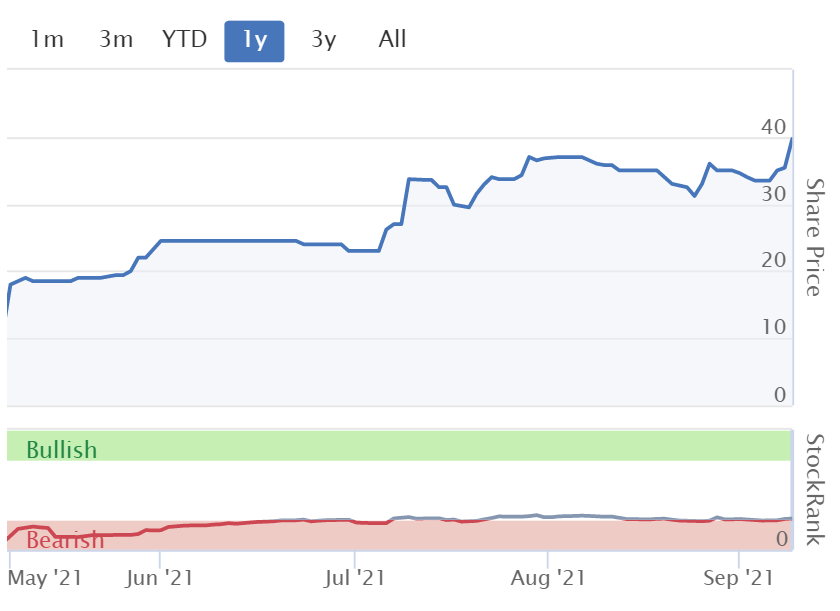

Lookers (LON:LOOK)

Share price: 69.2p (+0.14%)

Shares in issue: 391,739,982

Market cap: £271.1m

Car dealers are in a sweet spot right now, with chip shortages impacting new vehicle supply, which is in turn pushing up the prices on used vehicles. This is translating into surging profits for car dealers - it’s probably not sustainable growth, but it does mean 2021 is shaping up to be a bumper year for most of these companies.

While Lookers stands to gain from these dynamics, it has also been beset by a couple of more company-specific issues. The recent full year accounts were delayed this year and shares were suspended back in 2020.

Although the shares are currently strong due to the favourable trading environment, longer term performance lags the peer group.

Both Vertu Motors (LON:VTU) and Marshall Motor Holdings (LON:MMH) have been more reliable performers in recent years, with solid balance sheets and reliable dividends. The recent reratings do mean that Lookers trades on more of a discount to MMH than it has done previously though, so there could be an opportunity for Lookers to close that gap.

Record H1 performance against tough backdrop; repayment of CJRS receipts for H1 2021, and new Board appointments

Financial highlights:

- Revenue +37.1% to £2,153.2m with all divisions growing,

- Record underlying PBT of £50.3m, up from a loss of £36.5m,

- Strong cash generation leads to a swing from net debt of £40.7m to net cash of £33m,

- Underlying earnings per share of 10.44p, up from a loss of 7.58p,

- Property portfolio equivalent to 77.8p per share.

These are materially improved figures and clearly there is value here. The question is has the group put its accounting issues behind it? A company’s reputation in this regard can take a while to rebuild as a degree of trust is key for shareholders. It is possible that these bumper profits have come just in time to reset Lookers’ financial position and put it on firmer footing going forward.

There has been a board restructuring in light of recent events. Ian Bull comes in as non-executive chairman and Oliver Laird is the new CFO.

Outlook - Trading during July and August remained strong and exceeded expectations due to ‘unprecedented used vehicle margins’. Order take also remained robust and the group has a strong order book for September and the remainder of 2021. Due to new and used vehicle supply restrictions the timing of vehicle delivery dates and availability is uncertain, however. This is more or less in line with what other dealers have said.

Current expectations for underlying profit before tax for 2021 remain unchanged after having committed to fully repay all CJRS grants received for the current financial year before the end of 2021.

Conclusion

Lookers’ financial position has improved drastically so, of the listed car dealers, it has probably benefited the most from present conditions. These are of course very encouraging results and the outlook and current trading comments are also robust (while prudently noting potential issues around supply).

It’s the reputational damage done by accounting issues in the past that is the thing to consider here. Clearly it’s weighing on the share price when compared to peers who have not struggled to release their accounts on time. It’s possible that this opens up a rerating opportunity but VTU is also attractively valued and has been able to reliably update the market.

The sector is doing extremely well right now and a rising tide floats all boats, but is this the right company to invest in? A further rerating wouldn’t surprise me - there’s probably more recovery potential here than at other car dealers - but I also wouldn't be surprised to see investors opting for other plays in the sector. The company might need to string together a few on time updates to reassure the market.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.