Good morning!

Lots of updates today, including a shocker from Purplebricks (LON:PURP).

- Purplebricks (LON:PURP) - trading update

- Premier Technical Services (LON:PTSG) - statement re: share price movement

- McBride (LON:MCB) - half year report

- Macfarlane (LON:MACF) - final results

- Innovaderma (LON:IDP) - half year report

- Keywords Studios (LON:KWS) - acquisition

Also, please see comment #7 in the thread below by Carcosa, who is something of an expert on Avation (LON:AVAP) and provides us with analysis of its interims. It's not worth my while studying it for you guys when he has already done the work!

Thanks for the comments - and for all your excellent contributions.

Purplebricks (LON:PURP)

- Share price: 123p (-25%)

- No. of shares: 303 million

- Market cap: £373 million

Trading update and management changes

The wheels have been coming off this online estate agent's growth story for a while - see its coverage in the SCVR archives.

My point of view on this stock has been straightforward enough: the company hasn't made enough progress in the UK to justify a large international growth spree. Aside from poor numbers in black and white, there have been a few red flags:

- the company's aggressive treatment of negative reviews and the websites which host them

- question marks over how it accounts for revenue

Today's update indicates that the company is struggling in several geographies:

- UK: revenue still expected up 15-20% this year despite a challenging market. The UK CEO leaves after two years in the job.

- Australia: revenues will miss expectations

- USA: revenue will miss expectations. The US CEO leaves after two years in the job.

- Canada: set to meet expectations.

In December, guidance for the year ending April 2019 was reduced. This guidance is now reduced dramatically again (bolding is mine):

As reported at the interim results, the Company updated its revenue guidance for the 2018/19 financial year to £165-175 million under IAS 18. Given the reasons noted above, the Board believes revenue for the current financial year will now be in the £130-140 million range under IFRS 15.

It seems to me that this paragraph uses the change in the accounting standards to obfuscate what is going on - it wouldn't be so hard for it to compare like for like, i.e. to compare guidance under the same accounting standard.

And if we scroll back to the presentation of the interim results, IFRS 15 wasn't supposed to make a big difference anyway. The company said: "The adoption of IFRS 15 will result in an approximate 2% downward adjustment to our guidance, with a minimal impact on profit and no impact to cash."

H1 revenue was £70 million, so the expectation for H2 must have been £95 million - £105 million.

This has now been reduced to £60 million - £70 million. Using the midpoints, this is a 35% reduction in the H2 sales forecast. If what the company says about IFRS 15 is true, then the change in the accounting standard should have only made a small difference to this.

The H2 sales miss is actually worse than what this suggests, when we consider that the guidance given in mid-December should have taken into account the performance through November and early December.

Performance Obligations

As a reminder, IFRS 15 is the new accounting standard which requires companies to precisely define their "performance obligations" to customers, and to only recognise revenue as those performance obligations are satisfied. It makes life trickier for Purplebricks, which had previously been booking revenues even though there were follow-on tasks promised to customers that it had not yet performed.

There are seasonal factors at play (people not moving around Christmas time) but even still, the rapid growth story at Purplebricks seems difficult to sustain at this point. Sales do continue to grow, but not at the scorching pace which investors previously hoped for. Meanwhile, the losses and cash burn continue to accumulate.

The company's own brokers are forcasting large negative adjusted EBITDA through FY 2020, with the cash balance (currently £70 million) falling to less than £10 million by April 2020. The broker suggests that the company will be cashflow positive from that point onwards. Based on the track record and my scepticism in the business model, I'd much rather bet on another placing/fundraising taking place before that happens.

Premier Technical Services (LON:PTSG)

- Share price: 119.5p (+4%)

- No. of shares: 123 million

- Market cap: £147 million

Statement re share price movement

PTSG, the building services group, has seen its share price take a dive from 145p to 115p, without any obvious reason. The shares are illiquid, so one large and determined seller is all it would take to cause this fall.

Nonetheless, the company decides to reassure the market with a quick update:

- net debt £11.9 million at December 2018

- "strong cash collection and improved debtor days on invoiced sales"

- first six weeks of current year are strong, acquisitions are in line with expectations.

This share is not in my investable universe:

- Not an easy sector for me to analyse

- Low margins

- Difficult to get paid by customers

- Race to the bottom in pricing

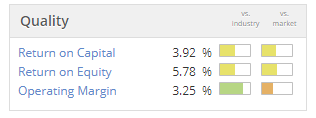

Stocko gives it a decent quality rank despite these metrics:

But for those who do follow it or hold the shares, I would take some reassurance from today's update. The recent share price fall probably has more to do with a noisy seller than any deterioration in the value of the company.

McBride (LON:MCB)

- Share price: 88p (+1%)

- No. of shares: 183 million

- Market cap: £163 million

This is the accident-prone manufacturer of cleaning products we discussed yesterday.

I can't see much to comment on here, except that the interim dividend is maintained, in a sign of confidence that profitability will be sustained. If the final dividend stays flat too, then the total dividends for the year will be 4.3p for a yield of almost 5% on the current share price. The company intends that dividends will be covered between twice and three times.

The balance sheet carries £98 million of debt (as we reported yesterday). The company confirms it is "comfortably" within its banking covenants.

Outlook - as reported yesterday. Difficult environment, cost pressures, and adjusted PBT 10-15% lower this year compared to last yar.

Brexit - only 30% of its revenues are from the UK, and the company wants clarity on how its cross-border activities are going to work after Brexit.

My view - I think this is now trading around fair value. If I took my quality filters off, I'd even consider going long of MCB at this point, since the share price appears to discount the accident-prone nature of the business.

Adjusted PBT of £28-£30 million this year and reasonable forward prospects would allow for the gradual reduction of debt and a rising 5%+ dividend yield for shareholders.

Macfarlane (LON:MACF)

- Share price: 91.5p (-2%)

- No. of shares: 157.5 million

- Market cap: £144 million

Results from this solid Scottish packaging group are in line with expectations.

As mentioned in my discussion of its interims last August, Macfarlane has shown really nice evidence of operational leverage as small-ish revenue growth is being converted to large-ish profit growth.

Today, it reports a 10% increase in sales and a 20% increase in adjusted PBT, led by progress at its large Packaging Distribution division.

(The adjustment to PBT is no big deal, only a £330k charge relating to historic pensions.)

Outlook

No numbers but 2019 has started "well" and profits are "ahead of the same period in 2018".

There is a lot of information given in "future plans" - more of the same, I think. Sales growth, efficiencies, and more acquisitions.

My view

I find it hard to get excited about this company, which is perhaps a good sign. Boring is often good!

Unfortunately, the organic growth is slim: only 4% in Packaging Distribution. And the balance sheet is full to the brim with intangibles as a consequence of its acquisition strategy, as it bought growth rather than being satisfied with the dull organic growth.

It has a fine track record of profitability and is priced cheaply versus earnings, so it may appeal to some readers.

Innovaderma (LON:IDP)

- Share price: 88.3p (+4.5%)

- No. of shares: 14.5 million

- Market cap: £13 million

There have been some gaps in our coverage of the hair/skincare and life sciences group. We missed its AGM statement in November.

Despite the positive tone of that statement, it conceded that revenues for H1 would not grow, so that a big H2 weighting would be needed to meet reduced full-year expectations.

More recently, we have learned that H1 revenues are in fact down by 7.5%, a reduction the company describes as "modest".

What I find interesting is the effect of Facebook ($FB) improving the experience for its users by prioritising family and friend posts rather than businesses and brands (remember the way Facebook used to be?!). This makes it harder for Innovaderma to get seen in Facebook feeds, hurting its direct-to-consumer sales (DTC).

Today we learn that sales of Skinny Tan, the flagship brand at IDP, are therefore down by 21% in the DTC channel but up 15% in the High Street channel. Skinny Tan is about to be launched in Boots stores (it's already available in Boots Online), following expiration of an exclusivity agreement with SuperDrug.

Outlook

- Good start to H2, comparable sales up 37% in six-week period.

- DTC up 34% vs. a year ago as company responds to new marketing situation.

- New product launches and product extensions in the works.

Toward the end of the statement, we learn that cash has reduced to £0.7 million, and the company is in talks with a bank for some kind of debt facility.

My view

The share count has risen from 10.3 million in 2016 to 14.5 million today, and I wouldn't rule out the possibility that another equity raise could be on the way, particularly if H2 doesn't turn out to be as strong as anticipated.

For those with more faith in its plans to attack so many different product categories at once, the adjusted net income forecast for FY 2020 (from July 2019 to June 2020) is £1.7 million, implying that it could start to look like really good value (versus a £13 million market cap) before too long.

For what it's worth, there is a mismatch between the share price action today and the reaction from brokers. Brokers have reduced their profit forecasts by 12-13% for the next two years, and reduced their estimates for the company's cash balance by over 50% (net cash is forecast to be £1.5 million at June 2019). But investors seem relieved that things didn't turn out to be worse than that.

Keywords Studios (LON:KWS)

- Share price: £11.02p (unchanged)

- No. of shares: 64 milion

- Market cap: £706 million

It's been some time since we talked about this one, and we are probably overdue to give it a mention. The market cap has been drifting in the direction of small-cap territory once again.

Today's deal doesn't have a price tag attached. Keywords is buying a software platform with tools "that enable games developers to manage all social interactions between their game, their players and their friends' networks".

I'm fascinated to see what will ultimately happen at Keywords. Will a sustainable, profitable, cohesive group of gaming service businesses emerge from all of these deals?

It has been a turbulent period for the company and for the industry as a whole. There probably aren't many Fortnite players here (and certainly I'm not one) but it has been such a popular game, it has made life difficult for anyone who didn't produce it (i.e. most of Keywords' clients!).

This has been mooted as a possible reason for Keywords missing FY 2018 expectations, and for like-for-like FY 2019 EPS forecasts being scaled back by 7% in December.

It is now back at a "respectable" P/E multiple of 23x according to Stocko, so forward prospects are good if it can only get its mojo back (that's a technical term).

All done for today, have a great evening. I'm looking forward to hearing how Paul is getting on!!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.