Good morning!

Some companies with updates today:

- Hollywood Bowl (LON:BOWL)

- Gateley Holdings (LON:GTLY)

- Tungsten (LON:TUNG)

- StatPro (LON:SOG)

- HSS Hire (LON:HSS)

- Premier Asset Management (LON:PAM)

Cheers,

Graham

Market overview

A quick word on where we are in big-picture terms.

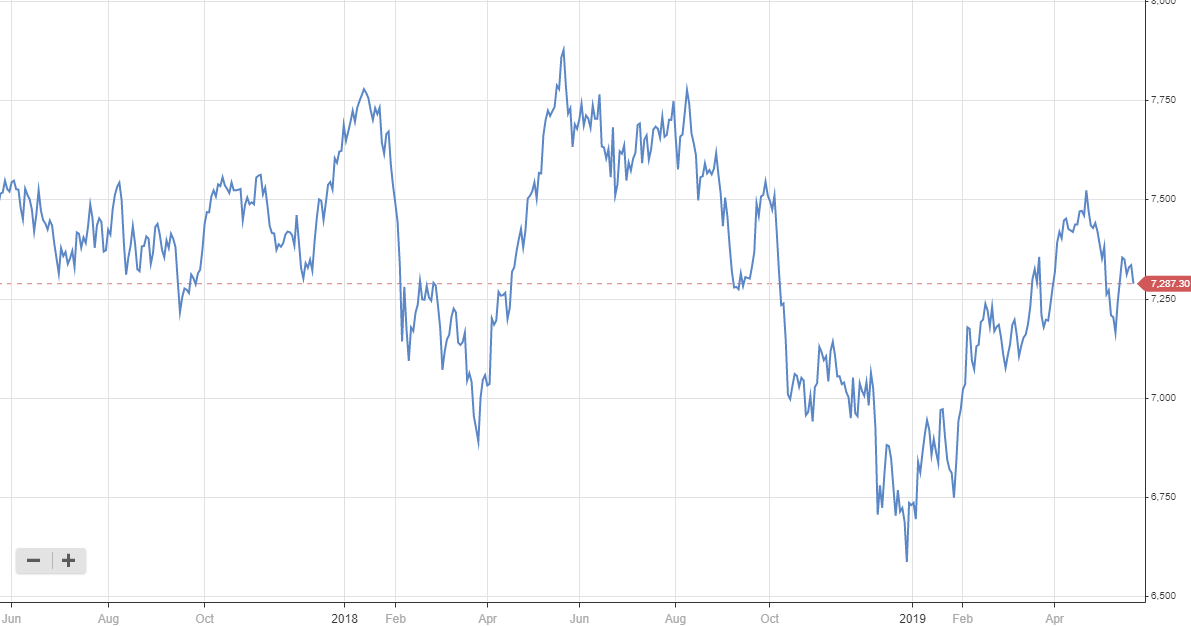

The FTSE is bang in the middle of its range over the past two years. We can all see in hindsight that December 2018 was a super buying opportunity, and I'd wish I'd been more aggressive at the time:

(Stockopedia chart.)

Looking back on my trade history during that month, I did the right thing by partially switching out of fixed income and into shares, but I didn't fully capitalise on the opportunity.

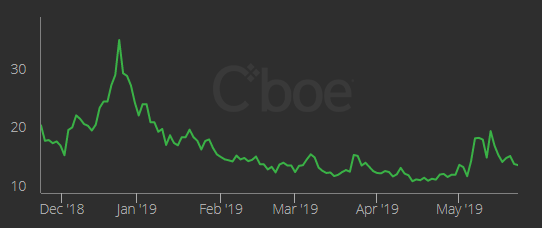

As far as the current situation is concerned, I am amazed by the complacency in markets at the moment, at least as it is expressed by the VIX and VFTSE indexes.

The last six months have seen "fear" declining in VFTSE, the FTSE's volatility index, the trend only reversing a little in recent weeks:

This is relevant for IG Group (LON:IGG) (in which I have a long position). The spread betting companies have all blamed low volatility for poor trading in recent months. But IG said yesterday:

"In the first three weeks of May market conditions have been more favourable and the Group's high quality and loyal client base have identified and taken opportunities to trade."

For what it's worth, I was encouraged by the IG update - while I'm not expecting a big financial improvement in the current financial year, I'm excited by what could be achieved over a 2-3 year timeframe.

In the UK, with elections in which a new political party is likely to win, the expected departure of the current Prime Minister, etc., I'd have guessed there would be a little bit more "fear" (expected volatility) to be written into UK markets.

But it seems that most market participants expect that little of any real substance is going to change on the political front for the foreseeable future, and shares are priced accordingly.

This makes it difficult for me to be very enthusiastic about opening up new positions. The "quality" stocks have been bid up, and mouth-watering opportunities are scarce. But the search for them goes on.

It struck me while recording a live-stream yesterday that my portfolio is very heavily weighted to stocks with counter-cyclical characteristics:

- Volvere (LON:VLE) - sitting on a huge pile of cash which it could use more profitably in an atmosphere of financial distress.

- H & T (LON:HAT) - benefits from a higher gold price and from demand for short-term consumer loans.

- IG Group (LON:IGG) / CMC Markets (LON:CMCX) - these CFD companies thrive in periods of high financial market volatility.

Despite their counter-cyclical nature, I hope these shares will continue to do reasonably well even in "normal" conditions! Heads I win, tails I don't lose too much.

Looking at the international picture for a moment, trade tensions between the US and China have rattled US investors just a little. The VIX Index for the S&P 500 is at 16.2 (rather than 13.1 for the FTSE-100). You can see in the chart below that it is still very calm compared to six months ago. The major indices sit near their all-time highs.

My plans?

Well, I am researching some new and old companies but am in no particular rush to place new trades currently. Indeed, it's been a month since I placed a trade (and that was a short!). And my next trade is likely to be index-related, rather than buying any individual shares.

Like the baseball player in the Warren Buffett analagy, I'm happy to wait a while for the next "fat pitch"!

Hollywood Bowl (LON:BOWL)

- Share price: 238p (+5%)

- No. of shares: 150 million

- Market cap: £357 million

Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, is pleased to announce its interim results for the six month period ended 31 March 2019 ("H1 FY2019").

These look like solid numbers.

- Like-for-like revenue growth comes in at 4.4%. Not bad.

- Total revenue growth >5%. Two new sites opened (60 in total).

EBITDA per site is up 4.7%, which seems more relevant than the EBITDA margin - will readers agree with me on that? But if I was running the company, I think I'd care more about the former than the latter (all other things being equal).

Worth noting that a lot of refurbishments are taking place, and these costs are typically measured in depreciation - the "D" in EBITDA! So it's really important to look at operating profit / PBT / net income, not just EBITDA.

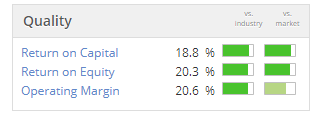

The company has nice metrics when it comes to achieving returns:

And while I don't know exactly how it measures this, it says that it's earning a good return on its refurbishments:

The average return on investment from the most recent 13 refurbishments and rebrands is 46.5 per cent, notably above our targeted 33 per cent.

One of its latest bowling centres is at Intu Lakeside (£INTU). I noticed a few weeks ago that Intu Properties (LON:INTU) is trading at a unusually weak P/B ratio - switching retail properties over to "experiences" is an important part of its current strategy.

There is a lot of work at BOWL optimising its pricing for games, and its strategy for food, drinks and amusements. It seems to be doing a good job, overall.

Outlook - on track to meet expectations.

My view - I retain my positive view of this company and am pleased to see its continued progress. Management seem to be very focused on the right sorts of areas.

I remarked previously that I thought the company was carrying too much cash/not enough debt, given the strength of its cash flows. Net debt remains very low.

But to give credit where it is due, I note today that there was another special dividend paid out in February. So I think management are on the ball when it comes to cash management too, and aren't letting surplus cash hang around for too long. Full marks.

Gateley Holdings (LON:GTLY)

- Share price: 165.5p (-3%)

- No. of shares: 111 million

- Market cap: £184 million

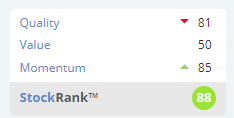

This law firm has done well for investors since its IPO in 2015. Momentum remains positive:

The Board is delighted with revenue and profit growth in the year which has enabled the Group to not only increase its dividends to shareholders but, also, to invest further in the business.

It is growing organically and by acquisition, and the acquisition pipeline "remains strong".

While Gateley is a perfectly fine business for all I know, I don't invest in professional services companies and especially not ones which grow by acquisition. I will leave this opportunity for investors with sector expertise and who are comfortable owning shares in such a labour-intensive company.

The StockRank is excellent: 88. The only thing holding it back is the ValueRank (P/E ratio 12x, but P/B ratio 8x).

Tungsten (LON:TUNG)

- Share price: 38p (unch.)

- No. of shares: 126 million

- Market cap: £48 million

Instead of analysing it, I've assumed up until now (on the basis of headline results and the commentary around it) that this is just a worthless fintech company.

Today's results offer some encouragement: there is positive EBITDA of £2.5 million for FY 2019 (excluding a division which is to be sold), on the back of a 6% increase in revenues. Transactions being handled by the company increased by just 3%.

The modest top-line growth and growth in transactions will fail to excite many investors but the cost savings initiatives do appear to be working, with more savings to come in FY 2020.

I also see that revenue growth must have improved a lot in H2, since it grew from just 2% in H1 to 6% for the full year.

The update is in line with expectations.

My view - I think this one might finally be worth looking into.

On a note of caution, the forecasts visible to me suggest that despite positive EBITDA, it will remain loss-making in the current financial year. Depreciation and amortisation add up to c. £4 - £5 million.

Perhaps it can beat these forecasts?

StatPro (LON:SOG)

- Share price: 131.25p (-1%)

- No. of shares: 66 million

- Market cap: £86 million

AGM Statement and trading update

StatPro Group plc, ("StatPro", "the Group", AIM: SOG), the AIM listed provider of cloud-based portfolio analysis and asset pricing services for the global asset management industry, is holding its Annual General Meeting today.

Trading is in line with expectations.

I've previously looked at this one in some detail. Unfortunately, I came to the conclusion that its software products, while enjoying stable demand from existing clients, were probably not cutting edge and were unlikely to generate significant revenue growth from new clients.

Today's update refers to a couple of contract wins but I'm just not convinced that there is a big opportunity with this one. It seems to be looking more at acquisitions and margin growth as routes to increased profitability. So I just can't get interested.

HSS Hire (LON:HSS)

- Share price: 37p (+4%)

- No. of shares: 170 million

- Market cap: £63 million

This is another stock where I have been very sceptical, due to its large debt load and failure to bank profits. It's an equipment hire business which was floated on the market (at an overvalued level) by a private equity group.

Today's results show a year-on-year improvement in trading. Adjusted EBITDA and adjusted EBITA for Q1 both increase by a couple of million pounds. This helps to bring about a significant improvement to the net debt leverage ratio (defined as net debt to trailing adjusted EBITDA).

Full-year guidance remains in line with expectations. A small profit is forecast.

My view - this still looks like it might be overvalued to me, even at a discount to book value. It has used enormous leverage but still hasn't generated a decent return for equity investors. Net debt was £235.6 million at December 2018, prior to a debt-reducing disposal.

I also find the focus on EBITDA to be quite annoying. It's an equipment hire company - surely depreciation is one of its key expenses!

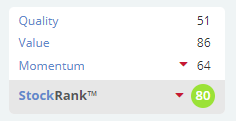

The StockRanks seem too forgiving in this case:

Premier Asset Management (LON:PAM)

- Share price: 210p (+1%)

- No. of shares: 102.6 million

- Market cap: £215 million

This fund manager continues to make progress, albeit at a slower rate than before. Net inflows for the last six months are £67 million (versus more than £400 million in H1 of the previous financial year).

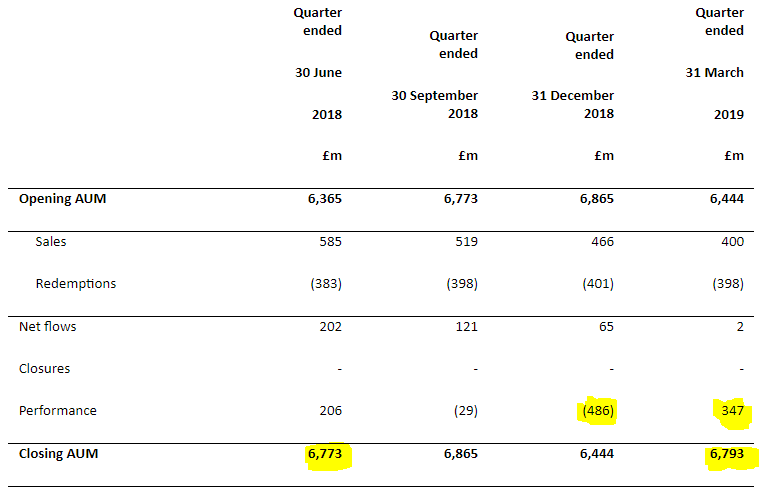

As for the effect of investment performance, it was good in Q2 (to March 2019) but that was insufficient to cover the downswing in Q1 (to December 2018). See below:

So AuM hasn't really gone anywhere in 9 months, though it is up almost 7% on a 12-month view.

I also see there has been a huge increase in share-based payments for this H1 period, from £285k to £1 million. This factor, plus some "exceptional" items, explain why PBT has actually fallen for this period, compared to H1 2018.

Outlook - "it is impossible to predict when investor confidence will improve". Another indicator that the overall investment mood in the UK is rather jaded. This is perhaps unsurprising when the FTSE has been stuck in a range since 2000!

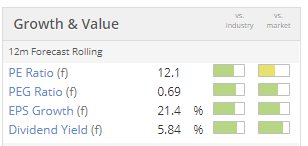

My view - I maintain my positive view on this fund manager, and leave it on my watchlist. Its metrics are fantastic and it could offer value at current levels:

That's it from me for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.