Good morning!

I've been having a listen to the Facebook ($FB) earnings call this morning.

Mainstream media is talking about an imminent "bloodbath" in tech stocks, as the Facebook share price is set to fall c. 20% and the other FANG stocks (Amazon, Netflix, Google), and tech stocks in general, are set to drop back. Some hysterical language is being used (CNBC).

A 20% fall in the Facebook share price would indeed be huge in dollar terms, as the market cap was previously in excess of $600 billion.

I think It's still much too soon to announce the death of FANGs/tech, however. The Facebook share price will still be up compared to where it was a year ago.

If you look at the bare numbers, you see that Facebook's Q2 2018 revenues are up 42% compared to Q2 2017. The disappointment relates to the outlook, as the rest of the year is likely to see growth slowing down. But I don't see why long-term Facebook holders would be panicking.

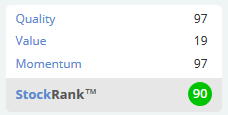

Stocko algorithms like it very much, too. It will have a bit more value later today (although slightly less momentum, I guess)

As someone who is a net buyer rather than a net seller of stocks, it would suit me personally to see a big sell-off in the NASDAQ and for this to spread FUD (fear, uncertainty and doubt) to other stock markets. But I reckon it's still too soon to call the top.

Incidentally, If you're interested in US stocks, and maybe haven't traded them much before, it's important to familiarise yourself with the EDGAR company filing system at the SEC. The terminology of the system does take a little bit of getting used to. It's worth it, though. I have found that US company disclosures are very clear.

Right. onto some UK stocks, which is what you're all here for!

Today, I'm planning to look at:

- Franchise Brands (LON:FRAN) - half year results

- Bonmarche Holdings (LON:BON) - trading update

- Arrow Global (LON:ARW) - acquisition & trading update

- Kape Technologies (LON:KAPE) - trading update

In big-cap land, British American Tobacco (LON:BATS) (in which I currently hold a long position) reported good interim results and the shares are up 5%.

The interest bill for the six-month period came to almost £800 million, but with the help of some finance income and £4.4 billion of operating profit, it was easily able to cover it.

Total leverage is significant as the stock comes with £46 billion of net borrowings attached.

It's a medium-sized position for me. I view it as a lazy bet that the world will not change all that much and that when big tobacco shares look cheap, accumulating them will be profitable.

Franchise Brands (LON:FRAN)

- Share price: 86p (+5%)

- No. of shares: 78 million

- Market cap: £67 million

This group owns four brands:

- Metro Rod - drain clearance and maintenance

- ChipsAway - car paintwork repair

- Ovenclean - oven cleaning service (clue is in the name). ChipsAway and Ovenclean are "effectively run as one business out of our Kidderminster location".

- Barking Mad - pet care while owners are away

Paul covered it last year. He said it was tricky to value, as the company had grown via acquisition and was investing heavily for the future. So potential buyers of the stock didn't have relevant historical results to work with, and needed to satisfy themselves with forecasts for the future.

Now we have some more numbers to work with. Note however that the headline growth rates mentioned in this announcement are probably irrelevant in terms of organic growth. Metro Rod was acquired in April 2017, so it only made a partial contribution to H1 2017.

Performance summaries today:

Metro Rod - progress made on a range of fronts, it is "capable of significant growth".

ChipsAway, Ovenclean and Barking Mad - "performed solidly, delivering high levels of cash conversion".

Overall performance is in line with expectations. "All of the additional revenue" this year has come from Metro Rod. The other three businesses look to be mostly flat, therefore. Their combined EBITDA contribution has grown by just 2% compared to last year.

Outlook is "very positive".

Interim dividend is increased by 24%.

My view - I think this is an interesting story. Regular readers will know I'm a fan of the capital-light franchise model. Another company doing this sort of thing is Filta Group (LON:FLTA), a US-headquartered company that cleans fryers for commercial kitchens (among other services).

Franchise Brands has achieved net income of £1.4 million in six months, from adjusted EBITDA of £1.8 million. That's a better-than-average conversion of adj. EBITDA to the bottom line!

I can't find any reference to seasonality. I would expect that July, August and December would be strong months for pet minding services. Perhaps the oven cleaning services would be stronger in H1? I have asked for clarification on this point.

Unless there is seasonality I am unaware of, the latest broker forecasts look to me as if they are more than achievable, with £2.8 million of adj. PBT targeted for 2018. Perhaps we might see some upward revisions in due course.

Putting it all together, the current share price does not look extreme to me, given the level of profitability in H1 and the strong outlook.

2.30 Update: I've received helpful clarification from the company's advisors that there is little seasonality in the business. Metro Rod is typically quite busy in winter, which falls both in H1 and H2, and had its busiest ever period following the "Beast from the East" in H1 this year. It's impossible to tell when we might have another cold wave.

Bonmarche Holdings (LON:BON)

- Share price: 116p (+5.5%)

- No. of shares: 50 million

- Market cap: £58 million

It's a Q1 update from this womenswear value retailer. Expectations for the full year are unchanged.

As has been pointed out in the comments, Bonmarche has a top rating from Stockopedia - it's a Super Stock, with particularly strong Quality and Value.

I've covered this one a couple of times before. Its key theme is the transformation to online sales.

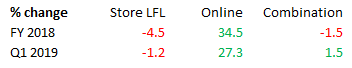

Last year, store like-for-like sales fell while online sales increased 34.5%. The combination of LFL stores and online was down 1.5%.

It's the same pattern for Q1 2019, but the combination of LFL stores and online sales is up 1.5%. Things could be getting better!

I've created a little table to illustrate:

As you can see, the growth rate for online in Q1 was lower than the growth rate achieved for Fy 2018. It's from a bigger base, so this is to be expected.

We also have a smaller deterioration in store LFLs in Q1 compared with the deterioration for FY 2018 as a whole.

So we have a few glimmers of hope in this update, hinting that online growth might now be big enough to replace the decline in store sales. Let's hope for more signs of this in subsequent quarters.

We also get a commitment from the Board to keep paying out generous dividends, with a reduction in the range of cover:

...dividends have remained comfortably covered by the Group's cashflow. In light of this, and of its confidence in the Group's prospects, the Board announces that it will continue to maintain a progressive dividend policy, but the guideline for the required earnings cover will be henceforth lowered to a range of 2.0x to 2.5x earnings.

That's a bullish move and it might wake people up to the c. 7% yield on offer from this stock.

My stance is unchanged. I'm happy enough with my Next (LON:NXT) position and not looking to add any more retailers to my portfolio. But if I was, I would be looking seriously at this one.

Arrow Global (LON:ARW)

- Share price: 248p (unch.)

- No. of shares: 176 million

- Market cap: £437 million

Norfin Acquisition and Trading Update

(Please note that I currently have a long position in ARW.)

This is a new one for me. Arrow is "one of the UK's largest and fastest growing provider of debt purchase and receivables management solutions".

In plain English, it buys up non-performing debts from banks, credit card companies, etc. and then intelligently pursues customers for payment.

According to its website:

We expect to collect approximately twice our investment over a period of 10 years

This means it is buying the debts at a very deep discount.

It has bought a portfolio of similar assets across Europe, and has diversified into asset management.

Recent figures

I've just quickly checked the Q1 results, where Arrow made a loss thanks to costs associated with its refinancing. Ironically enough, it is a highly leveraged operation itself, with a balance sheet leverage multiple approaching 8x. There are big costs associated with managing this position. It has net debt of £1 billion (as of March 2018).

Ignoring its own debt situation, Arrow made an operating profit during the three-month period of £22 million - not bad! (Previous year: £24 million.)

Today's update

Today we learn that trading is strong and in line with expectations.

It is acquiring a real estate investment manager in Portugal for £15 million, plus a large potential earn-out. This enlarges the asset management side of Arrow's business (which is still small, relative to the core operations).

Leverage will hopefully cool down:

...we will remain within our guided leverage range of 3.5x-4.0x secured net debt to adjusted EBITDA and continue to expect to reduce leverage by the end of the year. We expect leverage to fall further in 2019 as our high return back book, combined with our prudent balance sheet management, continues to generate strong cash flow.

I'm very curious to learn more about this company. You can pick it up now at a P/E ratio of just 7x.

I will need to investigate in more detail the rationale for it to move into asset management and to own regional asset management businesses such as this.

In general, I prefer when a company sticks to its core activity and doesn't get distracted by acquisitions in different sectors. International acquisitions are particularly distracting.

To help motivate me to give it a proper look, I have placed a tiny spread bet on ARW. I'll probably end up closing out the spread bet very soon, if my analysis doesn't come up with anything terribly exciting.

Kape Technologies (LON:KAPE) - I wanted to fit this in, but it looks like a complicated situation and I don't have the time to study it right now. It's in the cybersecurity sector and is trading on a very expensive valuation. The balance sheet is strong and it's divesting a non-core business, so this may help to explain why it looks so dear relative to earnings.

I'm afraid I'm out of time for today, thanks for all your comments and feedback.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.