Good morning folks,

I'm feeling slightly better off this morning, after numbers from Volvere (LON:VLE). But there are plenty of other stories to discuss, and I haven't forgotten about stories missed on Tuesday.

- Volvere (LON:VLE)

- Goco (LON:GOCO)

- Northern Bear (LON:NTBR)

- Pelatro (LON:PTRO)

Volvere (LON:VLE)

- Share price: 1250p (+9%)

- No. of shares: 1.8 million

- Market cap: £23 million

(In case anybody was not aware, I have a long position in VLE.)

Volvere has published some decent interims - happy days.

This is an investment company which currently has just a single operating subsidiary, Shire Foods, after all the other subsidiaries were sold for handsome profits.

Shire, in Leamington Spa, seems to be doing nicely. I attended Volvere's AGM this year, and reviewed my notes from it this morning. At the AGM, Volvere management talked about Shire's capacity constraints and its expansion push in terms of production lines and cooking vessels.

The H1 revenue increase at Shire is even better than I would have hoped for, at 39%. This helped to offset margin pressure from raw materials and wage inflation. The overall jump in Shire's adjusted PBT was from a £170k loss to a £240k gain.

Shire supplies frozen food to discount supermarkets, and this is a nice sector to be in right now (e.g. Aldi expansion).

As far as developing its product portfolio is concerned, Shire is focused on the vegan segment - another growth area:

We are actively responding to the increased demand for vegan products and have agreed several new products with retail customers. In addition, we have launched our own brand - Naughty Vegan - into the foodservice market.

Time for a few calculations.

Last year, Shire produced an adjusted PBT result in H2 of about £1 million (based on a £170k loss in H1 and an £850k profit for the full year).

If it matches that this year, it is on course for adjusted PBT of £1.24 million. But given the strength of H1 this year, the end result could (should?) be materially better than this. Maybe £1.5 million is a reasonable guess. Volvere says that additional opportunities will be sought for Shire in 2020, on the back of its increased capacity.

Another little tidbit that is worth noting: the "majority" of Shire's expansion is being funded externally, i.e. Volvere is keeping its own powder dry for acquisitions, rather than funding Shire.

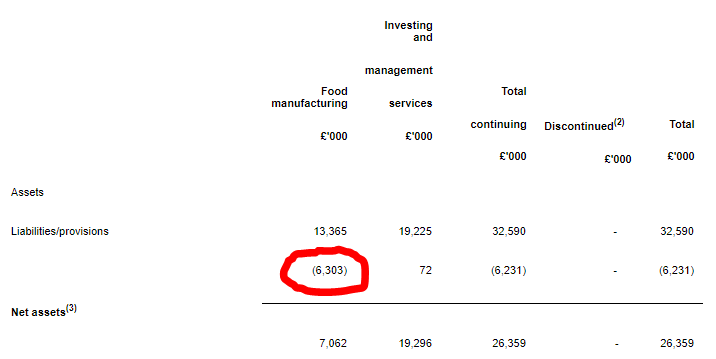

The balance sheet is spelled out here:

If you can read these, you'll see that Shire ("Food manufacturing") has more than £6 million in liabilities/provisions (up from £4.4 million a year ago).

Evidently, Volvere wants to keep that £19 million cash pile available for takeover opportunities, rather than funding Shire unnecessarily.

But Shire seems able to carry this leverage, at least for now. You can see from the above table that it still has net assets of £7.1 million (including freehold property).

Volvere HQ, meanwhile has no debt and is sitting on £19 million of cash. Volvere management have said previously that about £20 million is the most they need to execute their strategy.

Outlook

The Chairman says: "We remain positive about the outlook for our business and believe that the current economic and political uncertainty will provide further investment opportunities."

The logic here is that uncertainty can create buying opportunities for value investors such as VLE.

The CEO says (and I've added the bold):

Our strategy throughout 2019 remains as before - to deliver shareholder value through improving trading performance of our existing portfolio, identifying new opportunities, and investment realisations. The level of deal opportunities has increased since 2018 and we remain optimistic that we will identify new businesses in which to invest.

My view

The only slight worry is that there hasn't been an acquisition for some time. It looks like the last one was in March 2015.

But having said that, I am much happier for Volvere to remain patient and to wait until it gets something that it is very confident in, rather than doing something for the sake of it. So I really don't mind if deal news is slow. Better to be slow than to get it wrong.

As for the current valuation, I am inclined to believe that Volvere is worth central cash (£19 million) plus the value of Shire. Some investors might then apply a discount given the administrative overhead and the uncertainty over future investment performance.

Personally, I think that Volvere management have done more than enough to prove the soundness of their approach. They might make mistakes in future, and/or they might be unlucky, but I don't think there can be much doubt that their methods have been sound (at least historically).

Let's think for a minute about what Shire is worth. Book value is £7.1 million, and adjusted PBT (to exclude intra-Group management charges and interest) looks like it could hit £1.5 million this year. Let's call that net income of £1.2 million.

The ROE at Shire might therefore be in the region of 17%, thanks to the use of leverage.

It will be difficult for Shire to grow very fast very quickly, although if the "Naughty Vegan" brand were to take off, who knows how lucrative that might be?

Personally, I would value Shire today at around £10 million, or 8x after-tax earnings. That's a modest but fair multiple for a food manufacturing business, and not an outrageous premium to tangible book value. So I believe that this is a conservative estimate.

Volvere owns 80% of Shire, so I would put Volvere's stake at £8 million. The 20% that it doesn't own is important - it helps to incentivise the managers on the ground at Shire.

Add on the group cash balance and you get a Volvere valuation of £27 million. Feel free to disagree with this number.

You then have the great imponderable of future investing performance to consider. I think that Volvere management are very good at their jobs, and I'm happy to back them. Others might disagree, and might have no interest in VLE at all, or unless it is much more keenly priced.

Based on my £27 million estimate, VLE trades at a 15% discount to current fair value. The discount is more like 8% if you use the official NAV published today.

Both of these estimates are based on the mid-price. The bid-offer spread, as always, is huge, so short-term traders must stay away. This share is something to hold for years, to give management a chance to work their magic (or to fail miserably, as the case may be - but they haven't made too many mistakes so far!)

Despite this share representing 17% of my equity portfolio, I have no immediate plans to sell.

Goco (LON:GOCO)

- Share price: 79.4p (+5%)

- No. of shares: 418.5 million

- Market cap: £332 million

AutoSave live customers surpass 220,000

(Please note again that I have a long position in GOCO.)

A brief update from Goco. This has been issued by RNS, rather than by RNS-Reach, so it should be a material piece of news, even if it doesn't have the traditional headline of "trading update".

In summary, Goco's "AutoSave" business is growing faster than expected. Indeed, it seems to be growing much faster than expected.

At the interim results in July, Goco's CEO said that the company was targeting at least 25% growth in live AutoSave customers over the five months to the end of the year. The starting point was 170,000, being the combined customer base of Weflip and Look After My Bills (acquired in July for £8.5 million plus performance-based earn-out).

The combined customer base of these businesses is already 220,000, i.e. almost 30% growth in less than 3 months, triggering the need for an RNS to update expectations.

I've been invested in Goco since late last year, and have noticed the company's repeated emphasis of its belief that there continues to be a big opportunity in price comparison/price switching. The basis for this view is the observation that there are still vast swathes of people who don't bother getting the best deals every year (e.g. for their energy bills), and are leaving free money on the table. Finding these people and motivating them to bother is a big part of Goco's mission.

Comment from the company today:

The strong growth in live customer numbers demonstrates consumer appetite for a service that addresses the needs of infrequent switchers, representing an incremental 23m household2 opportunity in the UK whose needs are not being adequately met by the existing price comparison offerings.

Goco is now targeting 50% growth in live Autosave customers by December. That's 50% growth in five months and also "within the marketing spend previously outlined". Wow!

It will take a little bit of time for this to feed through to profits, but hopefully it will!

Our ambition is to rapidly scale customer numbers and maintain a disciplined approach to the cost of customer acquisition. We believe that this will lead to a significantly higher EBITDA margin profile for GoCo Group and be transformative to Group earnings by 2022

Look After My Bills earns a flat commission every time it switches a customer to a new energy company.

So while the core price comparison service (Gocompare) continues to trundle along, there is also the opportunity for recurring and fast-growing income at these new services.

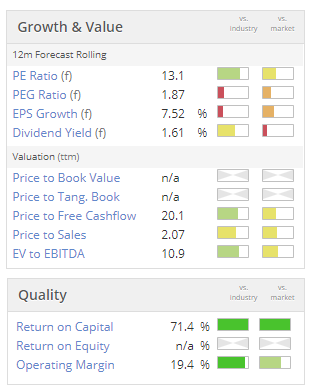

Valuation/Quality

The metrics are all quite average (except for the huge ROC, as you would expect from technology-enabled online services). At a modest P/E rating, I think this has the potential to outperform and am happy to continue holding it in small size.

I have also written before about the takeover potential at this company, and I believe that the likelihood of that happening is undiminished (particularly with Sterling at these levels).

Northern Bear (LON:NTBR)

- Share price: 70p (+14%)

- No. of shares: 18.5 million

- Market cap: £13 million

An unusual announcement. We have a tender offer but not from the company - from an entity which does not currently own any shares in NTBR at all!

The bidder is "Cedarvale Holdings". According to Companies House, Cedarvale was incorporated on 9 September 2019, i.e. less than 3 weeks ago. So we can assume that it was formed for the purpose of buying shares in Northern Bear (LON:NTBR).

The premium isn't too bad at 20%, but it can take a much bigger premium than that to pick up illiquid stock.

Based on my initial review of the shareholder register at NTBR, it does look as if there is a decent percentage of stock in the free float, so that at least should help Cedarvale to get some.

However, according to the StockReport, the free float is only 26%. I wonder how this was calculated?

If you check the Annual Report for 2018, you'll find that the largest five shareholders had about 32% of shares between them, which is roughly in line with the latest figures on the register that I can see. So I'll stick to the view that there is plenty in the free float, until I'm corrected.

The investor who controls Cedarvale is a Canadian value investor whose professional biography can be read here.

For its part, NTBR's Board has issued a response acknowledging the tender offer but taking no position on it. That is reasonable - it's a decision for the company's shareholders, not the Board, to decide if they want to sell some or all of their stake at the price offered (72p). The Board members do rightly observe that if Cedarvale gets the 29.6% stake it is looking for, then it will be able to block any future special resolutions.

My view

We have noted in the SCVR before that this company is cheap. According to Stocko, it was valued last night on a trading P/E multiple of less than 5x, and a trailing EV/EBITDA multiple of only around 2.4x.

These are pitiful numbers but if you remind yourself what NTBR actually does (building services), you'll remember that this is a competitive, accident-prone sector where things often goes wrong.

For example, if you check the historical record, you'll see that NTBR has itself been unprofitable for 3 out of the past 10 years.

So while its recent history is very positive, I still think that this type of company should be cheap. The man behind Cedarvale clearly thinks that the discount is now too extreme, and his source of funds is probably not the UK - so he gets an additional currency boost from the timing of this bid.

I'm not tempted to own shares in NTBR personally, but if I did own some, I'd probably not be inclined to offer very many in this tender offer. My attitude would probably be something like "I think that fair value for these shares is at X - you can buy them off me at X on the open market (i.e. on the stock exchange), if you want".

After all, we don't buy shares in tiny, dirt-cheap, micro-cap stocks for just a 20% gain, do we? Anybody holding shares in NTBR last night was probably hoping for a much greater than 20% return without having to wait very long to get it, I would bet.

Pelatro (LON:PTRO)

- Share price: 55.9p (-27%)

- No. of shares: 32.5 million

- Market cap: £18 million

Pelatro Plc (AIM: PTRO), the precision marketing software specialist, is pleased to announce today its interim results for the 6 months ended 30 June 2019.

Hmm. Precision marketing. Is that like performance marketing? No, it has its own unique definition.

The first thing I'm noticing is that revenue numbers ($2.71 million) are small relative to the market cap ($22 million), even after today's decline.

Revenue growth at 14% is far below what I'd expect for this sort of valuation.

On the positive side, "repeat revenue" has more than doubled, and is now 75% of revenues. An interesting shift.

Adjusted EBITDA has approximately halved to $0.8 milllion, "largely due to increased expansion for growth."

There is a lot of talk about contracts and customers and world class products, but I'm struggling to see what this company actually does.

On its website, it says that it has:

"a contextual marketing solution that is flexible and agile enough to meet your dynamic requirements and to help you understand each customer better. By leveraging the power of data, we will help you offer tailor-made promotions to every individual or segment."

Browsing its products, I see that it offers a marketing solution with:

targeted individual campaigns i.e. Segment of One or N=1. Offers are tailor made to suit the behaviour of the customer. This means every customer in the network gets a unique offer based on behaviour.

It sounds good but I just can't relate to it. As an investor, the very first hurdle that a company has to jump is: what do you do? If I can't get a clear answer to this, and I can't relate to the products, then it's a hard pass.

I also note that according to Stocko, it is supposed to be on a forecast P/E ratio of just 6x. This can't be right, surely, after today's result?

I've not had much time to study this yet, but it doesn't look great so far.

Have to dash now. Hopefully we get a relaxed RNS feed tomorrow, and I'll be able to catch up on Equals (LON:EQLS) and stories from Tuesday.

Have a great evening everyone! And here's a free health tip - enjoy reduced blood pressure by not watching the news tonight (or any night!)

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.