Good morning!

Graham here.

its going to reach 24 degrees today, so I'll to have to get this report done early, before the heat kicks in. One of the few benefits of corporate offices, that I do miss in the summer, is the powerful air conditioning!

Building a list for today:

- Tandem (LON:TND)

- Filta Group (LON:FLTA)

- Strix (LON:KETL)

- Character (LON:CCT)

- Tclarke (LON:CTO)

All done at 5pm.

Boohoo (LON:BOO)

In mid-caps, I see that Boohoo (LON:BOO) has attacked the bear argument head-on and bought out the rest of PrettyLittleThing for £320 million. The certainty this provides and the lower-than-feared valuation should be received positively, I think.

Market open - Boohoo is up 11% and is threatening to break out to an all-time high.

Shadowfall's research note speculated that the cost of buying out PrettyLittleThing could have been almost £1 billion, if Boohoo waited until 2022 and if it paid a very high EV/EBIT multiple (in line with stock market multiples for Boohoo, Asos and German peer Zalando)

The much, much lower price paid is terrific news for Boohoo shareholders and takes away the fear around this impending deal. I think it makes sense that the Boohoo market cap has increased by over £400 million - that accounts for most of the difference between the worst-case PLT scenario, and the reality which has transpired.

Boohoo argues that it is using its existing cash to fund the £162 million cash portion of the deal, not the £200 million it recently raised from investors.

Since all money is the same, regardless of where it came from, this is stretching things! The facts are that it recently raised £200 million, and it is spending £162 million in cash (plus more in shares) to buy out the Chairman's son.

And it could have bought the PLT stake several years ago, at a much lower level, but chose not to.

Conclusions - this short attack looks to have failed within 48 hours, in my opinion.

I do want to make it clear that I think Matt Earl is a brilliant analyst. He has scalped companies before and will do it again.

In this particular instance, it looks like the weight of the bear argument wasn't strong enough, and it has been counter-acted by decisive management action.

Generally, shorting is difficult for companies which are:

- profitable

- cash-rich (Boohoo has cash, no debt)

- not frauds

If a company ticks these boxes, then it might not matter how overvalued it is. It might not matter if there are some related-party transactions or if there is some confusion about how results are being presented (which is the main thrust of the argument by Shadowfall against Boohoo). You need a meatier argument than this.

Otherwise, if there is no obvious catalyst for the share price to collapse, there is always the possibility that it won't collapse, and your short trade won't lead anywhere.

Shorting can still make sense as part of a long-short portfolio where risks in one part of the portfolio are being hedged by trades in another part.

But if you make a large bet on one particular short, then I do think you need to be more careful - personally, I don't short anything, any more, unless there is a near-term catalyst.

Market comment

I find it very interesting that the FTSE is back around 6200.

Another 250 points higher by September, and I'll be in profit for the spread bet which I placed just before the crisis kicked off. That would be quite a result!

I've been sitting on this trade through the entire disaster, even watching the FTSE slide all the way to 4900 and continuing to hold. I stubbornly stuck to my guns.

The optimism is justified, I think. So many European countries have opened up, with no real evidence of a "second wave" (I've got strong opinions on this topic, which I'll reserve for my Twitter account!).

It's true that UK/Ireland are way behind Continental Europe in lifting lockdown, but even so, there is great cause for optimism with all UK retailers opening back up very soon. The economic pain will still be with us, but the worst of the catastrophe will be over.

In the US, I understand that several states have re-opened and they also haven't seen any "second wave" (Georgia, Florida, Texas).

I can't wait to get back to normal conditions when every article and every RNS doesn't have to be put in the context of the recent disaster.

The movement of the FTSE over the last two months is consistent with the view that those conditions are not so very far away.

Tandem (LON:TND)

- Share price: 237.5p (-6%)

- No. of shares: 5 million

- Market cap: £12 million

Please note that I have a long position in TND.

This is a share I have some history with.

I owned it from 2015 to 2017, a period in which the company went from one accident to another, and I sold out for a painful loss after deciding that I had got it wrong. My experience with it was one of the reasons I abandoned "value" investing for my larger positions.

Last year, I noticed that the company was doing rather well, so I bought in again, but this time for a much smaller stake (2% of portfolio).

This purchase was really an emotional hedge, designed to prevent me from experiencing disgust if it went on to succeed after I had researched it heavily and then moved on.

Background

It's a bike and toy distributor based in Birmingham. It also sells mobility scooters, gazebos, party tents, etc. It owns a range of long-established bike brands and has licenses for Disney, Batman and Peppa Pig.

The problem is that the value in the business hasn't accrued for shareholders - management are very well remunerated, and in contrast the dividends to shareholders have historically been very small.

For 2017-2019, for example, total EPS was 106.5p. Dividends for these three years add up to 15p. The dividends for 2019 were increased by over 50%, from a very low base, after shareholder pressure.

Dividends shouldn't matter, of course, if retained earnings are being used wisely. One of the reasons I originally sold out of Tandem was my concern that acquisitions had failed to deliver much by way of increased profits, and my fear that future retained earnings would be wasted on more poor-quality acquisitions.

The good news is that acquisition activity has calmed down, and the company has instead been paying off the mortgage on its £3 million property in Castle Bromwich.

The most recent balance sheet showed net assets of £14.3 million, or TNAV (tangible net assets) of nearly £9 million. This should support the market cap, I think.

It still needs to work on reducing its pension deficit but there are signs that, if it wanted to, it could start paying very large dividends (compared to the market cap) within a short few years. This is highly uncertain, of course!

Latest update

I never expect RNS announcements from Tandem to be positive, and today's announcement is unfortunately another disappointment.

The UK government told people to basically "get on their bike" instead of using public transport, and it has been boom-time for bicycle demand.

Has Tandem capitalised on this? Yes, but there are problems.

Key points from today's AGM update:

- bicycle sales +77% year-to-date

Doing very well here but there are supply problems due to global lockdown, the company is "working hard to replenish stocks as quickly as possible".

- online sales "strong", including outdoor products which have sold "well"

Tandem says the supply chain from China is now "broadly back to normal with regular supplies being received".

My own quick investigation suggests there are still supply problems in this division. Hedstrom outdoor products, for example, has very limited supply at Argos.

- national retailer business - problems here as most toy shops are closed. Orders delayed and new orders slow to arrive Order book down 21%.

Conclusion:

Year to date Group revenue is slightly ahead of the prior year, although the overall Group order book is approximately 3% behind last year. We therefore expect Group revenue to fall behind the prior year during the Summer period as a result of the lack of national retailer FOB orders and a limited supply of bicycles.

AGM - cannot be attended in person.

My view

I'm planning to stick around here, for the foreseeable future.

The company earned an operating profit of £3 million last year, and the average annual operating profit over the last six years is £1.9 million.

Over this time period, the worst annual result was £1.2 million.

I have no idea if it can solve its supply problems in the short-term, but I think it should be able to, since the world is opening up. It is of course a terrible missed opportunity, that it is failing to fully capitalise on the demand this summer.

My expectations here are genuinely very low, but I'm happy to stick around at a £12 million market cap. Stubbornness has a habit of paying off.

Filta Group (LON:FLTA)

- Share price: 108p (+1.4%)

- No. of shares: 29 million

- Market cap: £31 million

This company offers a range of services - it owns FiltaFry (fryer management/cooking oil filtration) and FiltaSeal (refrigeration seal replacement). Does it get more boring and unpleasant than that?

As an investment, it's not so boring. Organic revenues were up 16% for FY December 2019, and were boosted by acquisition revenue, so that total revenue was up 75%.

Adjusted EBITDA is +20%, adjusted PBT is +7%.

However, I am disappointed to see no mention at all, in the headline numbers, of the fact that reported operating profit is down 32% and reported PBT is down 46%.

Why the huge discrepancy?

Two main reasons.

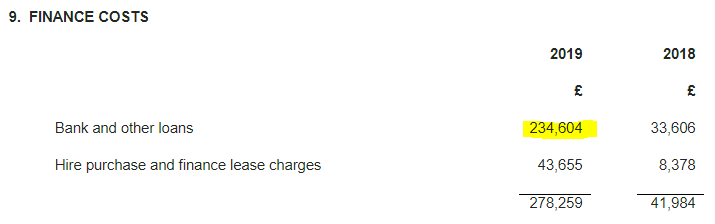

Firstly, finance costs related to loans shot up:

Secondly, depreciation and amortisation charges increased by £1 million. These charges increased in each of the group's operating segments.

Digging into it a little, I see that amortization of customer relationships and customer contracts jumped massively.

If I was a shareholder here, I'd be asking the company what is happening with these intangibles. The higher charges are probably to do with the most recent acquisition.

Worth noting that Filta's balance sheet is laden with various intangibles. Strip away intangible assets, goodwill and "contract acquisition costs", and you are left with tangible equity of c. zero (at least it's not negative!)

Covid-19

Lockdowns have been a major problem - "a significant part of the Group's activities are focussed on the entertainment and leisure industries and our business has been affected by these events".

In response, the company launched a new service, "FiltaShield", to protect customers from COVID-19. This is in its early stages.

There is very little hard info given in terms of current trading and outlook, we can only presume that the situation is currently very poor. The company is optimistic for a return to normality:

With the strong pipeline of potential franchisees prior to the lockdown and based on the continuous and positive discussions that we have had with franchisees and key customers during the last 2 months, your Board is confident that when social distancing restrictions are lifted and more normal trading conditions are resumed, revenues and margins will return to the levels being experienced in the first quarter of the year.

My view

This one doesn't tick enough boxes for me personally, and the StockRanks don't see much value in it.

However, I like it a lot more at the current level than I did at 250p+. If everything goes to plan, this could be a very reasonable entry point.

Strix (LON:KETL)

- Share price: 189.4p (+3%)

- No. of shares: 199 million

- Market cap: £377 million

AGM Statement and New Banking Facilities

This company designs, manufactures and sells safety controls for kettles (for which it owns global patents).

In recent years it has moved into coffee, water filtration, and other related areas.

AGM statement - the company has made "a solid start to 2020", and implemented measures "to limit the impact on the full year forecast".

Banking facility - increased from £49 million to £60 million. RSB is still involved, and HSBC is replaced by Bank of China.

My view - the core business at Strix should be ok in the near-term, I would have thought. The demand for kettles is hardly going to fall off a cliff!

Character (LON:CCT)

- Share price: 230p (-6%)

- No. of shares: 21.4 million

- Market cap: £49 million

This bears some similarities with Tandem - it designs and distributes toys and games and has some valuable licenses.

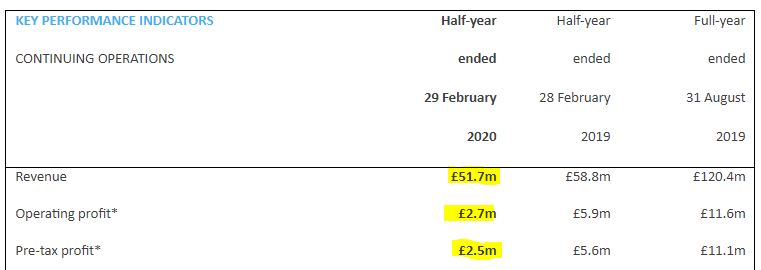

H1 to the end of February (pre-pandemic) was poor. Revenue down 12% and profit more than halved.

These numbers are before the impact of CCT's FX hedging. If you include those effects, the numbers are a bit worse:

H1 is said to have been affected by many issues:

- a large toy store going bust

- declining consumer spending on toys

- weak Sterling (since CCT is an importer)

- Brexit uncertainty.

H2 won't have been any easier. Sales have been "deeply impacted".

CEO comment:

"There is no disguising the fact that the severity and duration of the COVID-19 pandemic has considerably affected the toy sector globally and will affect our second half results for this financial year... we intend to be fully open for business and to re-establish our prior trading trajectory as soon as we are safely able to."

Balance sheet: net cash of £16.8 million.

Product portfolio - continued development in H1. Peppa Pig and Pokemon are still here, and lots of new brands have been added.

All of these toy brands have very silly names so I'll spare you the details. If you're interested, click here.

Dividend - 2p, down from 13p last year. Covered nearly 5 times by underlying earnings.

I consider it a green flag if a company continues to pay any dividends during this crisis. It suggests that A) it's still thinking about its shareholders, and B) it has probably not been devastated by lockdowns.

Outlook

This section includes some useul info:

..with the quality of our brand portfolio, the strength of our customer relationships and the resilience of our cash-generative business model, the Board expects to achieve a profit in the second half and, accordingly, for the current financial year as a whole.

With a sizeable cash balance and substantial unutilised bank and finance facilities of at least £50.0m, the Group has a strong balance sheet...

My view

I'd much prefer to own a company like this one, instead of the toy retailers it sells into (remember Toys R Us?).

Character needs to manage its inventories and its customer relationships, but it doesn't need to worry about vast fields of retail space and an army of employees (it has headcount of just 212, according to Stocko).

It will be a very difficult period, but I don't see why Character shouldn't emerge from this in reasonable shape.

The StockRanks tend to like it, because it's often quite cheap and it earns high ROCE/ROE. That is still the case today.

Tclarke (LON:CTO)

- Share price: 101p (+12%)

- No. of shares: 43 million

- Market cap: £43 million

This building services company announces that its June AGM will be for Directors only. This is evidently a trend.

Dividend - the Board recommends the proposed full dividend of 3.65p, up from last year's final dividends.

Q1 update - profitability remains "strong" and underlying operating margin of 3% was maintained (building services tends to be very much a low-margin business).

The good news is that Q2 is expected to be around breakeven on an underlying level, so the underlying H1 result will be an operating profit of £2 million (last year, the underlying H1 result was £5 million).

So there is no real damage expected, save for a quarter of missing profits.

Restructuring - one-off costs of £3 million have been incurred (which will be treated as exceptional), to generate annualised cost savings of £4 million. Sounds reasonable and appears to be part of a broader strategy, not just in response to Covid-19.

Order book - is up slightly compared to the start of the year. Described as "robust".

Balance sheet - CTO had net cash of £12.4 million at year-end, no debt. It reports today that it has maintained positive net cash through April and May, and has £25 million in RCF and overdraft faciltiies.

The balance sheet is quite big, so there could be big variations in cash flow. I'm thinking in particular of £85 million in payables at year-end. CTO says it "remains committed to the supply chain and is maintaining regular payments to our suppliers to ensure that their cash flow is supported".

Outlook

A number of possible scenarios have been modelled, each of which results in an underlying operating profit for full year. The current uncertainty and resulting range of possible outcomes means that it is not possible to give accurate market guidance for the full year at this time.

My view

Kudos to management for hitting their operating margin target, and staying focused on it this year. It appears to be maintaining its discipline when tendering for projects.

Visibility is of course extremely poor. Its net cash position and tendering discipline are likely to help it trade through this period, in my opinion.

That will do it for today. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.