Good morning all,

Time for a quick public service announcement.

David has informed me that there are still a few tickets remaining for the Mello South conference which is taking place exactly one week from today (on Thursday, 14th June) in Hever, Kent.

Among the speakers will be Leon Boros, David Stredder and fund managers Mark Slater and Andy Brough. I will be there too, live-blogging the SCVR. And of course there will be a wide variety of quality companies for you to speak with.

It promises to be another hugely interesting Mello Event, this time in the south of England and for one day only. I recommend grabbing the last few tickets. Here's the link.

Ok, time for some analysis.

Today we had interesting announcements from:

Ramsdens Holdings (LON:RFX)

Veltyco (LON:VLTY)

CMC Markets (LON:CMCX)

Plus500 (LON:PLUS)

Inland Homes (LON:INL)

Ramsdens Holdings (LON:RFX)

(Formatting is broken, so I can't put the share price here - apologies.)

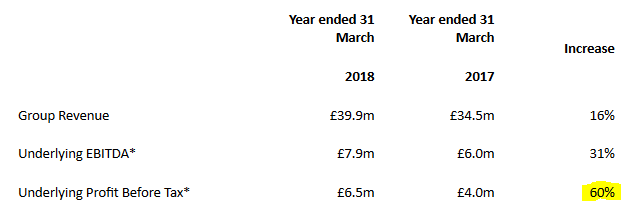

Great headline numbers from this diversified financial services provider, headquartered in Middlesbrough:

Foreign exchange is leading the way and profitability per customer has improved, so I'm guessing that people are using Ramsdens more frequently or for larger transactions - a great sign of customer satisfaction.

Margins in this segment have also improved (and it just goes to show how uncompetitive banks are at doing this, that a company can steal their market share so profitably.)

The number of FX customers is up 13%, but FX revenues are up 26%.

(As an aside, it might be worth noting that the vast majority - 86% - of Ramsdens' total customers are using the FX service. It's inevitably a lower-margin activity than pawnbroking and precious metal dealing.)

As with H & T (LON:HAT), the pawnbroker in which I hold shares, Ramsdens is also doing very well in jewellery. Sales in that segment are up 35% to £8 million. Up until a few years ago, it seems that pawnbrokers didn't realise quite what a big opportunity they had in jewellery retail. It was always just something they did on the side. Ramsdens and H&T are both now selling jewellery online.

The Marsdens pawnbroking loan book is a good deal smaller than H&T's but it's still an important source of gross profit (stable at 25% of the total). Ramsdens earned a yield of 112% on its average loan book during the year.

As anticipated, main shirt sponsorship of Middlesbrough FC will come to an end, but the name will still appear on the reverse of the shirt. That will make for slightly less name recognition, I guess, but probably not a big deal.

Perhaps this is one of the reasons Ramsdens tends to beat expectations:

The sterling gold price remained steady throughout FY18, which was ahead of the Board's budgeted expectations.

I don't mind the company being conservative and assuming that the gold price will decline.

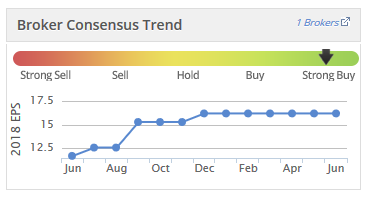

This is how expectations evolved during the year:

The outlook is very positive:

We have a strong platform on which to continue to build... I am confident in Ramsdens' ability to deliver on our strategic objective and continue to grow.

When you dig into the numbers just a little bit, you find they are very clean. The only adjustment made to PBT to get the "underlying" PBT is the addition of £161k of share-based payments.

So the actual PBT of £6.3 million is very close to the underlying PBT of £6.5 million.

My opinion

I've just done another quick calculation to figure out Ramsdens' return on tangible capital employed for FY2018, and I think it's about 13%.

I view pawnbrokers (or "diversified financial services providers"!) as small hybrid banks, so I'm not expecting or requiring massive returns. A solid and predictable return without too much risk is fine with me.

So in that context, I'm entirely satisfied by this result. 13% year in and year out would result in a fine outcome for shareholders. I've not adjusted for leases, which would reduce this return percentage.

Stocko algorithms think that the quality metrics are even better than I do and give it a StockRank of 91, since it's also not too expensive and has excellent momentum:

So if I wasn't already quite heavily invested in H & T (LON:HAT) (which I am still very happy to own), I would probably want to open or enlarge a long position in Ramsdens!

Veltyco (LON:VLTY)

This is a marketing company for the gaming (casino/sports betting) sector. Last time I covered it, I said that I felt compelled to take a bullish stance on it, since the sales momentum was just so strong.

The shares have remained on a cheap valuation, which I guess reflects the high-risk nature of the business. As described in its admission document, it was reliant on the revenues generated by a small number of high rollers it had brought to its marketing customer Betsafe.

Today's announcement provides the results for the period to December 2017.

Momentum continues: revenues were up 165% in 2017, and are up by another 60% in Q1 2018.

Note that the company has grown with the help of some acquisitions since Q1 2017, so the 60% growth rate in Q1 is not entirely organic.

Veltyco has made a couple of purchases, of which the most noteworthy is a 51% stake in the sportsbook "Bet90" (bet90.com), for €2 million. Despite the low price, this website is forecast to be "a key driver of further growth in 2018".

It has also bought a database of 26,000 active financial traders and they will be on the receiving end of marketing for a new online trading brand to be launched by Veltyco later this year.

The strategic vision is to own its own brands:

The majority of our revenue continues to be derived from online marketing activities but we are also seeking to increase the level of operational control we have by owning our own brands.

This would make it a significantly higher-quality stock - owning its own internet assets, rather than acting as a helper for bigger companies.

The company still has some cash reserves despite making these various acquisitions, and proposes a maiden dividend of 0.25p.

Receivables & cash flow

Banks have been a source of difficulty and this does sound like a worry, although the company says it does not expect that this will be a problem going forwards:

The Group has experienced some operational difficulties in receiving agreed marketing commissions within the online financial trading vertical due to internal processes applied by the Group's banks, however, the Directors have received written confirmation from the operators that the commissions are due and payable to the Group. The Directors started the process of restructuring the Group's banking relationships during 2017, in order to collect the receivables from all trading operators in different locations, without any restriction and the benefits are already being seen and are expected to increase in the coming months.

Banks may have been worried about money laundering and regulatory issues, I wonder?

Since the year-end, the outstanding receivables balance caused by these banking problems has been significantly reduced:

Since the year end, the Group's total receivable balance of €14.1 million as at 31 December 2017 has been reduced to €4.9 million, all of which relates to the online financial trading vertical

How the balance was reduced is a little tricky to unpack.

For example, €4 million of receivables were cancelled by the debtor giving Veltyco the financial database mentioned above.

Another €2.5 million of receivables were cancelled by setting them off against a loan that Veltyco had received from a company owned by its COO (although the Board didn't know this at the time).

My opinion

This is an Isle-of-Man headquartered, fast-growing and high-risk online gaming stock.

I still feel compelled to take a bullish view on the shares, given the strength of trading momentum. The performance has been superb and the potential for further growth is excellent. So I'd be open to making a small investment in this.

I do think it will take some time for the company to earn trust from investors, given the recent complications with receivables and related party transactions.

CMC Markets (LON:CMCX)

This is another financial stock where I own its larger rival. I am a shareholder in spread betting/CFD giant IG Group (LON:IGG) (many of us are clients of IG, too).

CMC shares have produced a more than 100% return for shareholders, including dividends, since the height of regulatory fear in December 2016.

These results are excellent: net operating income up 16% to £187 million and PBT up 24% to £60 million.

Regulatory comment

I think that regulations have mixed effects on an industry - the overall effect on the larger players can be rather good, as competition gets muted. Understanding and complying with a complex set of rules becomes another barrier to entry, and limits the ways in which new entrants can compete for business.

As a shareholder in the industry, therefore, I'm not too scared by the new margin requirements on spread betting and CFDs.

CMC's view on recent regulatory measures:

The Group welcomes many of the requirements, and is pleased that we now have clarity; many of the ESMA requirements have already been in place throughout the Group for some time. Whilst these changes are likely to have some short-term adverse effect on the Group as clients adjust their trading behaviour to these new requirements, the Board believes that a stronger and better industry will emerge. In that process the Group will be a clear winner through its focus on high value clients, service and technology.

The important thing to remember about spread betting companies (and the same is true for online casinos), is that most of us are irrelevant to them, and they don't really want to deal with us. It's the high rollers who determine the financial success or failure of the operation.

Focusing on high-value clients

CMC has adopted the IG strategy of letting low-value clients head for the exits, instead focusing on those who are going to be active and in big size. Its internal measure of "premium clients" increased to 10% of the total client base.

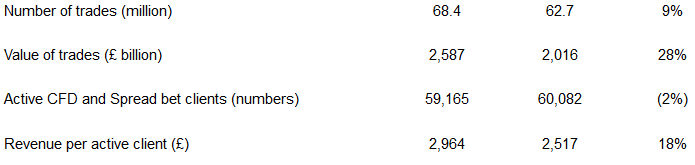

Left-column is FY 2018, middle column is FY 2017:

The value of trades is up by a higher percentage than the number of trades - good.

Active clients down, revenue per client up - good.

So the company has more high-value trades and a more valuable set of clients - perfect.

CMC expects that greater than 40% of UK & European revenue is generated by clients who will be classified as "professional", and therefore exempt from the rules on retail clients. This is another reason to expect a limited effect on results from the new rules.

(I think that IG still has a higher-value client base - it previously forecast that 50% of its revenues would be generated by professional clients.)

The company has only offered crypto trading since February, at a 50% margin, to professional clients. So whatever boost it had from that asset class was probably very small.

CMC also has a stockbroking arm and a partnership with ANZ Bank in Australia, which sounds like it is doing well. CMC is set to become the 2nd largest retail stockbroker in that country. Given its progress, I would expect CMC to expand its stockbroking activities in the future. Interesting that CMC and IG are both very active in this service now.

The dividend is unchanged and this likely reflects some caution ahead of the regulatory changes coming into effect over the next few months.

My opinion

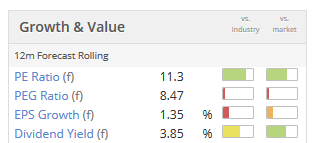

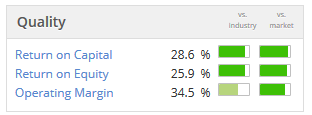

This is another stock which I would be happily buying if I didn't already own plenty of shares in its biggest competitor. The StockRank is 87 and take a look at these quality metrics:

Plus500 (LON:PLUS)

Plus500, a leading online service provider for trading CFDs internationally, is pleased to announce that its business continues to trade strongly. Accordingly, the Board has materially increased its expectations for the Group's financial performance for the year ending 31 December 2018.

This Israeli CFD provider continues to do spectacularly well.

Q1 was exceptional, thanks to market volatility and lots of crypto trading. Even though Q2 has returned to a more normal level of trading, it is still "materially ahead of management expectations."

Note however that guidance as to how ESMA regulations will affect Plus500 is much weaker compared to the guidance from CMC and IG:

As previously announced in the 1 May 2018 trading update, the full impact of the ESMA measures, which are now confirmed to take effect from 1 August 2018, are difficult to assess. Similarly, the Group's performance could also be impacted by the rate at which customers request to be reclassified, and are accepted, as elective professional clients.

I expect that very few Plus500 customers should qualify as professional clients. When you consider Plus500's enormous churn rates, you have to conclude that Plus500 serves the least knowledgeable, most amateur traders who are sucked in by an internet ad and quickly lose their entire account.

Cable Car Capital (with which I have no involvement) attempted to short Plus500 back in 2015, with a 76p price target. Clearly, that trade has not worked out particularly well so far. But I still share many of the concerns raised at the time.

My major concern is around Plus500's hedging policy. IG, for example, has residual exposure to client positions of close to 0%.

I doubt that Plus500 is properly hedged, which would help to explain its extraordinary profitability as it simply pockets the losses incurred by its clients.

There is no problem with that in the short-term but it significantly increases the risk levels in relation to black swan events when clients might be on the right side of the trade.

I could be wrong, but I suspect that this company will either blow up in a black swan event or be shut down by regulators at some point. The day is coming soon when it will have to deal with ESMA rules - that will be very interesting indeed.

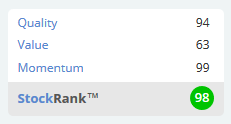

It enjoys a huge StockRank of 98 thanks to its amazing performance over the past several years, but I do think that a cheap valuation is more than justified:

Inland Homes (LON:INL)

£95 million sale and development of Ashford, Middlesex site

(Please note that I own shares in INL.)

A big sale to A2 Dominion, "one of the largest housing associations in the UK":

The transaction, which is the biggest land disposal by value undertaken by the Group to date, is for a total land and build consideration of £94.7 million, with the land consideration being £29.7 million in cash payable on completion. Inland Partnerships, the fast-growing construction arm of the Group, will undertake the development phase on behalf of A2 Dominion.

The CEO is very bullish about what this means for the continued progression of the business:

This deal, together with our pipeline and the supportive market backdrop, gives us confidence that within two years the Inland Group will complete the construction of over 1,000 residential homes per annum.

I was initially attracted to this by the discount to EPRA NAV (the net asset value including unrealised gains on properties). EPRA NAV was last seen at about 93p per share (today's share price is 69p).

Today's news offers additional confidence that NAV can climb (or at least not fall), while the discount in the share price has the potential to narrow from its current level. I would expect the discount to narrow somewhat as gains are realised (e.g. by today's deal) and show up in cold hard cash and physical assets.

The Stocko algorithms are very impressed by it, and I do think that we can get a pleasant return from this share, without taking on too much risk. Earnings will of course by cyclical. As always, please DYOR.

I might leave it there for now. If tomorrow is quiet, I'll come back to review Impax Asset Management (LON:IPX) and Onthemarket (LON:OTMP).

Thanks

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.