Good morning from Paul & Graham!

Today's report is now finished at 12:56.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

I'm happy with that, we covered lots today - with plenty left over for me to scrutinise tomorrow too.

Summaries

(more detail below, in main sections)

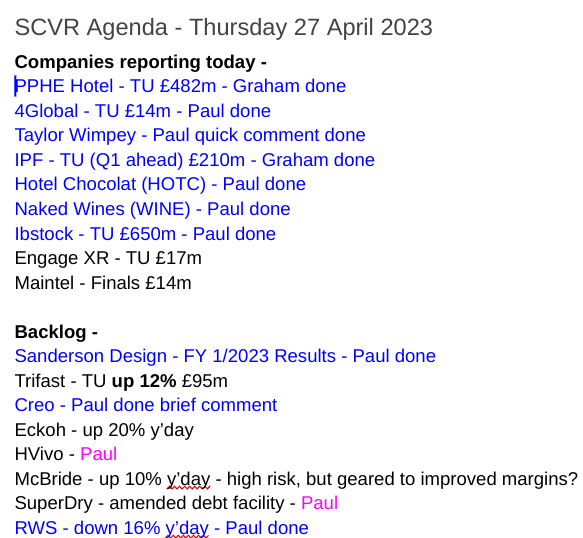

Sanderson Design (LON:SDG) - down 8% y’day to 134.5p - Paul - GREEN

FY 1/2023 results in line with expectations. FY 1/2024 outlook also in line. I review the numbers in detail below. SDG remains one of my favourite value/GARP shares.

International Personal Finance (LON:IPF) - up 3% to 98.9p (£221m) - Graham - GREEN

Q1 update is ahead as all divisions are performing at this international lender. Impairments ticking up but still below their pre-Covid levels. Good growth in lending and receivables and the company is ready for new Poland regs. A risky share but the value keeps me interested.

£PPHE - down 2% to 1120p (£474m) - Graham - AMBER

Solid trading in Q1 from this hotel group with summer bookings giving it confidence for the full-year revenue outlook. Occupancy is still lagging and needs to improve to pre-Covid levels before I can have any faith in the written-up valuation of its balance sheet.

Quick comments

Taylor Wimpey (LON:TW.) - 125.6p (pre-market) - £4.4bn - Paul - GREEN

Trading update (in line exps) today - interesting for read-across to small caps. Very similar to Persimmon yesterday - continued recovery in demand, FY 12/2023 guidance reiterated, good mortgage availability, toughest for first-time-buyers, house prices resilient, build cost inflation 9-10% but is/expected to moderate, bottlenecks in planning system.

Paul’s view - as mentioned yesterday, the whole sector looks interesting, because the bad news appears in the prices, and the next cycle could be recovery/upgrades. NTAV = market cap, and 7.2% fwd divi yield. Looks good, but TW. has already had a strong bounce.

Creo Medical (LON:CREO) - 24.75p (£87m) - FY 12/2022 Finals - Paul - RED

Revenue of £27m, and a £31m opertating loss for 2022! It was heading for insolvency, but shareholders saved the day with a £28.5m placing at 20p in Feb 2023. So it must have a strong story to have got away a big fundraise at a reasonable price. But there’s nothing here that I can value, as any value in the shares is entirely based on hopes for the future, with the past just being heavy losses. High risk yes, maybe high reward, who knows? Not really relevant for a value report, so let’s move on.

4Global (LON:4GBL) - down 4% to 51p (£13m) - FY 3/2023 TU - Paul - AMBER/RED

Just a quick comment on this tiny, obscure software company related to sports. I was expecting to dismiss it, but there might be something worthy of research here. Big improvement in revenues in H2, as previously indicated would happen, so FY 3/2023 is £5.6m revenues (H1: £1.4m). Adj EBITDA of £0.9m. Cash looks tight, at £1.1m (down from £2.1m at H1). Some impressive contract wins internationally, and it says the sales pipeline is large at £30m. Might be of interest to micro cap investors maybe? Although a red flag (given recent shenanigans at IBPO) - the CEO here owns 51% - which I think means I’ll have to go more towards red than amber.

Hotel Chocolat (LON:HOTC) - down 10% to 158p (£217m) - profit warning FY 6/2023 - Paul - RED

Poor recent trading means that forecast PBT of £5.5m previously, now becomes a negligible profit of £0.2m for FY6/2023. Yet this announcement reads like it’s a triumph! The only positive is £23m cash in the bank.

Remember the international expansion strategy has been an expensive failure, so they’re now trying to maximise the UK, with no sign of any progress at all so far. We’re told not to worry, this was just a “transitional year” and that magnificent profits are in the pipeline for the future.

Latest forecasts are profits soaring from nothing this year, to £18.5m next year, and £30.7m the year after, on little change in revenues. Will it really be possible to achieve such stellar increases in profit margins? Given the company’s poor track record (giving a good impression of a badly managed business, with terrible capital allocation in the past), I think you would need to be a tremendous optimist to believe the current forecasts.

Hence in my opinion, risk:reward still looks poor, although the share price has come down a lot. So if you believe the hype and the ambitious forecasts, then it could do well, who knows. Personally I would rather buy a business that is already nicely profitable, rather than buy one where I’m having to hope that it can become profitable.

Note also the ownership structure, with management having a controlling stake, so outside investors can't remove them. Hence high delisting risk I think, if the news continues to worsen.

RWS Holdings (LON:RWS) - up 5% to 266p (£1,028m) - H1 TU - Paul - GREEN

This share dropped sharply, from 286p to 239p earlier this week on publication of a poorly received H1 update. It’s bouncing now, and readers seem interested, so I’ll give it the once over.

It’s a mild profit warning with FY 9/2023 guidance indicated towards the lower end of analysts range of £128-137m, that’s for adj PBT, so real profits.

Reasons given are challenging market conditions, organic constant currency revenues down 6.8%, but helped by forex to overall 2.5% up. Softer client activity and slower decision-making are mentioned.

H1 is £54m adj PBT.

H2 weighting is still expected, and reasons given sound sensible.

Taking cost actions. Net cash position of £57.5m (end March 2023). I’ve reviewed the last balance sheet - it’s got massive intangible assets of £1,080m, but even if we write those off, NTAV is still positive. So no issues with debt, it all looks OK to me.

Active acquisition pipeline, and it looks to have the firepower to acquire without dilution, I reckon.

Paul’s opinion - this is only based on a quick review, and little to no understanding of what the company actually does! I think this looks very interesting. The fwd PER is only 9.8, and there’s a nice 4.9% dividend yield. Plus it seems to be self-funding growth through acquisitions, and there’s no net debt to worry about.

Thumbs up from me! This looks like it could be a nice entry point for a long-term position. I would query how AI will affect it - this is talked about in the update, but I'm not clear if it will be a net positive, or negative? Will computers be able to replace people? Maybe that's why the shares are cheap?

Naked Wines (LON:WINE) - up 2% to 116p (£86m) - FY 3/2023 TU - Paul - RED

This sounds mixed -

Positives - revenue of £350m in line exps. Adj EBIT at top end or slightly above £15-18m range. Net cash £10m. Reducing inventories. Cost control actions.

Negatives - inventories provision gone up from £8m to £14m (tip of the iceberg maybe?). Poor payback on marketing at 1.6-1.8x over 5 years - is this a viable business model?

Paul’s opinion - sceptical still. I’d need to see the full numbers. In the past, the excessive inventories was enormous, and that alone puts me off, as massive inventories can often be a can of worms. I’m happy to look at the numbers with fresh eyes when they’re published, but it doesn’t interest me at this stage. Not really any evidence this is a viable business model, or a growth company.

Ibstock (LON:IBST) - 167p (flat) (£656m) - AGM TU FY 12/2023 - Paul - GREEN

We saw recently that brick distributor Brickability (LON:BRCK) put out another positive update. IBST says it's the UK's largest brick maker, and it also sounds quite upbeat - rather surprisingly maybe, given macro worries. It says Q1 saw subdued demand, but it still performed marginally ahead of expectations, which seems a little confusing. Forecasts have come down a fair bit though.

It says cost inflation is now slowing, and energy costs hedged (although at higher prices than last year).

Outlook is confident about achieving FY 12/2023 expectations. Expecting conditions to improve as 2023 progresses.

Paul's opinion - I think this whole sector looks interesting, with MBH, BRCK, FORT also worth considering & comparing. I'm not entirely sure how, but they don't seem to (yet?) be suffering from reduced housebuilding - although the upbeat statements from the builders indicate maybe we should be looking through the hiatus caused by the clumsy duo Truss & Kwarteng?

Stockopedia figures show a fwd PER of 11.5, a nice 5.0% yield, and good asset backing too. So I like IBST as a sensible value share.

I see from the long-term chart, it tends to trade in a 150-300p range. So given it's near the bottom of that, maybe it could be time to think about dipping our toes in here? BRCK looks cheaper on a PER basis, but doesn't have asset backing.

Paul’s Section:

Sanderson Design (LON:SDG)

134.5p (down 8% y’day)

Market cap £96m

The figures/outlook didn’t seem to impress the market yesterday, down 8%, but the chart below shows this is little more than a blip.

The downtrend in share price from autumn 2021 to autumn 2022 was I think just the general market bearishness towards small caps, and nothing company-specific.

My overall view of SDG is positive, with Lisa Montague having demonstrated a strong turnaround since taking over in 2019, and guiding the group well through the pandemic.

I interviewed her here in Oct 2022, which got great feedback from listeners, and is still relevant as an overview of the business and the strategy.

On to the FY 1/2023 results -

Revenue flat at £112.0m, so given higher inflation, that’s effectively a real terms decline.

Profit matters more than revenue, and underlying PBT is up 1% at £12.6m, which I think is fine given the tough macro backdrop.

Underlying EPS is 14.2p (LY: 13.8p), giving a PER of 9.5 - a modest valuation in my view.

Licensing revenue (which is almost pure profit) is the star performer, up 25% to £6.5m

The other better performers were: Morris & Co brand, and USA region (a key focus for growth).

This EPS actual result is ahead of forecast (13.8p) but that’s due to a lower tax charge, so trading is effectively in line with expectations.

Dividends flat vs LY at 3.75p total - a yield of 2.8%

Balance sheet - is really excellent. NAV of £81.3m becomes NTAV of £54.9m, which is plenty for the size of business. This includes cash of £15.4m, and no bank debt.

Working capital is extremely strong, with £43.1m net current assets.

Pension scheme - has swung from an accounting surplus of £2.6m in Jan 2022, to a deficit of £2.5m at Jan 2023. There’s been a substantial drop in asset values as with many pension schemes over the last year. That does concern me a bit. Just because the method of valuing the liabilities has also resulted in a fall there, the actual liabilities haven’t fallen, the way I look at things. The cashflow statement seems to show £2.4m being paid into the pension schemes, so this looks to be an ongoing, and quite material cash outflow each year, so it can’t be ignored.

Overall though, an extremely robust balance sheet, so little to no risk of dilution or insolvency.

Cashflow statement - a stand out number is the increase in inventories, which look high now at £27.8m, which absorbed £4.9m cash. Singers expects this to reverse in the current financial year.

The main other uses of cashflow are increased capex, at £4.8m (incl. £0.7m intangibles), and payment of divis. Overall the cash pile reduced by £3.7m to £15.4m - not a concern, but the item I’d like to see reduced in future is that £27.8m inventories.

Current trading - input costs still increasing. USA doing well. Licensing strong. Hospitality contract orders “encouraging”. Excited about new product launches (the deal with Disney to revive archive designs sounds interesting).

Licensing - there’s an interesting section explaining this. NEXT is becoming increasingly important (I wonder if it might bid for SDG?)

Strategy is very clear - with a big focus on increasing licensing deals, more in the pipeline. Also continued growth in the USA, where SDG is hardly scratching the surface of a huge market.

Outlook - expectations for FY 1/2024 unchanged, but we’re not told what they are!

Brokers are obviously given a steer by all companies, so going by Singers update (many thanks for this, very helpful) expectations for FY 1/2024 look quite modest, with adj EPS expected to fall from 14.3p to 12.9p. That looks cautious to me, and I’d hope to see forecasts beaten.

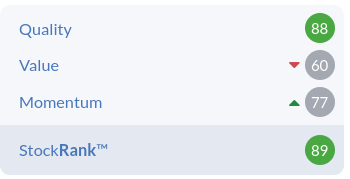

Paul’s opinion - this is one of my favourite value/GARP stocks for 2023 (and beyond), which made it onto my top 20 watchlist here, and is a strong performer so far, up 24% YTD. Obviously it’s early days though, and given the tough macro backdrop, we have to be realistic and expect a few profit warnings in any portfolio. If SDG does warn on profits from any macro-related setbacks later this year, I’d just treat it as a blip, and if anything would probably see it as a buying opportunity, depending on the circumstances.

The fundamental strategy is good I think, and it has demonstrated pricing power, with profitability undented despite cost increases, and softer demand. That’s pretty impressive I’d say. Also I see SDG as a potential bid target, from the USA maybe, or NEXT?

Overall then, it gets a thumbs up from me, as a very nice business, at a reasonable price, that I think should do well long-term. There could be turbulence on the way, due to macro factors, and timing of licensing deals, so we don’t know exactly how things will pan out.

Stockopedia also likes SDG, with a strong StockRank -

Looking for similar shares? Check out this screen which includes SDG. I like a lot of the shares on this list (click on link in picture below) -

Graham’s Section:

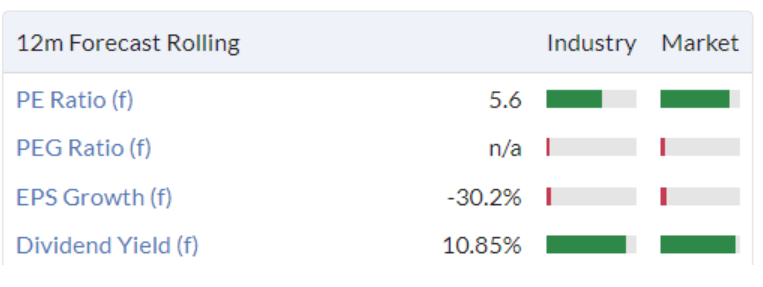

International Personal Finance (LON:IPF)

Share price: 98.9p (+3%)

Market cap: £221m

I’ve been taking an interest in this lender since last Autumn, when its value characteristics really started standing out to me! The last six months have seen the share price recovering to a higher level:

For an overview of the company and my thoughts on it, see the SCVR from March 1st .

Now let’s see what is new with today’s Q1 update:

Trading is ahead of internal plans

Customer lending is up 15% year-on-year

Customer receivables are also up 15% year-on-year.

Net receivables now £883m.

Revenue yield (the yield earned by IPF) is up from 48.5% to 53.4% year-on-year. It’s important that IPF is able to pass on higher interest rates to its customers.

Impairments: when it comes to fears around impairments, how is this for reassurance:

There has been no discernible impact from the cost-of-living crisis on customer repayment behaviour and our portfolio quality remains good.

The annualised impairment rate has doubled year-on-year to 10.5% but this is still good in comparison to pre-Covid impairment rates (see the impairments rates in 2019 for example).

If I check the unemployment rate in an economy like Poland where IPF operates, I find that it’s 5.4%. Maybe the cost-of-living crisis (caused by high inflation) doesn’t matter that much in comparison to the importance of low unemployment? So long as people still have jobs, I guess they will continue to make their debt payments?

Poland strategy: IPF has now issued 20,000 credit cards in Poland as it adjusts to new regulations which prevent it from charging non-interest fees on home credit loans like it used to.

All divisions are performing well: European home credit, Mexico home credit, and IPF Digital.

Excerpt from the CEO comment:

Whilst we remain mindful of the economic backdrop and continue to take a conservative approach to maintain credit quality, we now expect to deliver a result ahead of our original plans for the year as a whole.

Balance sheet: their bank lending facility continues to have about £80m of undrawn headroom and as I’ve said before, they may wish to increase their headroom sooner or later. But they still say their funding requirements are met until 2024.

My view

I was already positive on this stock, due to its cheap rating and performance which appeared to be solid despite economic concerns.

After today’s ahead of expectations update, I’m clearly going to remain positive on it!

So that I don’t get too enthusiastic, allow me to remind you of the bear points:

Investing in Eastern Europe and Mexico is risky without local knowledge.

IPF’s borrowing costs are 13% and its bonds are rated junk by the ratings agencies.

The bad debt allowances are huge and the impairment rate could still produce a nasty surprise if the economies in which it operates deteriorate.

Regulatory risk won’t go away.

In exchange for taking on these risks, investors can get value metrics like these:

A high-risk, high-reward play in my book.

PPHE Hotel (LON:PPH)

Share price: 1120p (-2%)

Market cap: £474m

This group operates most of its hotels under the Park Plaza brand (owned by Radisson) and the “art’otel” brand.

Its post-Covid share price bounce appears to have fizzled out. It’s languishing far below pre-Covid levels:

Let’s check out their Q1 2023 trading update:

Q1 revenues of £69m have more than doubled compared to last year. I think I’ll just ignore comparisons with last year as they are irrelevant. Let’s use the Q1 2019 comparisons instead.

Against 2019, revenues are up 10%, “driven by higher rates”.

Input cost inflation for hotels since 2019 is a lot more than 10%, so revenues have failed to keep up with inflation.

The problem seems to be with occupancy rates, rather than pricing:

Pricing - room rates are up 24.5% vs. 2019. This seems fine.

Occupancy - despite improved pricing, the RevPAR (revenue generated per available room) is only up 9% since 2019.

A table at the bottom of today’s RNS shows that occupancy in Q1 was 66.9%, vs. 76.4% in 2019. So there’s still a lot of room for improvement on that front.

Strategic highlights: PPHE has been busy with a range of projects in Zagreb, Rome, London and Budapest.

Fund launch: the company is launching a new fund, whose name currently is the European Hospitality Real Estate Fund. It will be 51% owned by PPHE, who will “buy” this stake by contributing their Rome hotel. The other investor, an insurance company, will contribute €28m to buy a 49% stake in the fund

The fund wants to deploy up to €500m, using €250m of bank leverage and €250m of investor funds.

This seems like very exciting news to me! PPHE will earn fees from long-term hotel management contracts with all of the fund’s hotels, and will also earn incentives from achieving various targets with the fund (e.g. internal rate of return).

Current trading / outlook

Strong trends in Q1 have continued into Q2.

Forward bookings for summer underpin confidence for 2023, so the company is “on track to deliver further growth in revenue and EBITDA in line with recently upgraded market consensus”.

The company helpfully discloses that expectations are for revenue of £368 - 376m and EBITDA of £108 - 111m. However, I would throw out the EBITDA number as being irrelevant for a hotel group.

Graham’s view

It has been a while since I’ve looked at this one, but I’m open to the idea that it could be a value investment at current levels.

According to the most recent full-year results for 2022 (published in March), their assets were independently valued (using the “EPRA Net Reinstatement Value”) at £25.17 per share.

Even the more conservative EPRA measurements are at least £24 per share, i.e. more than double the current share price.

This is due to £750m of property revaluations (on top of the £315m in official balance sheet assets).

However, these revaluations assume that pre-Covid trends will be reached within a short timeframe. From the annual report:

The positive revaluation follows a significantly improved forward-looking cash flow profile, as the Company recovered from its COVID distorted trading sooner than expected. In their 2021 valuations, the independent valuers had assumed the Group's trading would be largely in line with 2019 from the 2024 financial year onwards; however, this has occurred sooner than they anticipated.

I’m concerned that these assumptions might be too optimistic, as the occupancy rates discussed earlier show that there is still a gap between current trading and pre-Covid occupancy rates.

Perhaps the summer bookings are so strong that the company is confident of a full post-Covid recovery in 2023, but I’d like to see it in black and white before betting on it.

So I won’t be able to give this share the thumbs up just yet, but I think it’s worth keeping an eye on. If they do get to pre-Covid levels of trading soon then it’s possible that their assets could be trading too cheaply.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.