Good morning! Graham and Roland here. Another busy day for H1 updates and interim reports!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

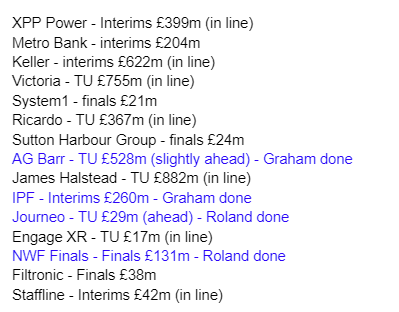

The following companies issued announcements:

Summaries

International Personal Finance (LON:IPF) - up 3% to 119.4p (£270m) - Half-Year Report ("ahead of plan") - Graham - GREEN

I remain positive on IPF as the company has (in my view) impressively handled the high inflation in Eastern Europe and to a lesser extent in Mexico. Regulatory change has been met with confidence. A good cheap financial stock: high risk, high potential reward.

NWF (LON:NWF) - down 1% to 263p (£130m) - final results - Roland - GREEN

Strong results from this fuel, food and feed distribution group, albeit with earnings down from last year’s record level as energy market conditions normalise. I think this is a good business at a reasonable price, although I think near-term upside could be limited.

A G Barr (LON:BAG) - up 2% to 480p (£538m) - Trading update (ahead of expectations) - Graham - GREEN

This beverage company announces that it expects full-year profit to be above the top end of analysts’ expectations - pleasant news for shareholders who have seen the share price drift over the past year. I remain positive on this one: cash-rich, high-quality and performing well.

Journeo (LON:JNEO) - up 7% to 193p (£32m) - trading update (ahead of expectations) - Roland - AMBER

This AIM technology stock has significantly upgraded its revenue guidance for this year, but profits growth is more modest. I have concerns about falling margins and the profitability of the core business, but I can see some potential if performance can be maintained.

Graham’s section:

International Personal Finance (LON:IPF)

- Share price: 119.4p (+3%)

- Market cap: £270m

I’ve been interested in this story since last October, when the share price was 79p. In addition to the share price gains since then, there has also been a 6.5p dividend.

More recently, in March, I wrote up a list of bull and bear points around this stock. I also covered it in April.

IPF is a lender to individual customers in Eastern Europe and Mexico - customers who typically do not have access to bank loans. There’s no denying that this is a high-risk activity, but the incentive with the shares is the value on offer:

Today’s results are ahead of plan but we already knew from the Q1 update that the company was trading ahead of its original internal plans, so these strong results should not come as a complete surprise:

PBT up 12% to £37.8m, “ahead of internal plans”.

Interim dividend up 15% to 3.1p (this is not a surprise)

Net receivables £893m, up 10% at constant exchange rates.

Impairment rate 11.4% is in line with expectations.

Operationally, the company has issued 53,000 credit cards in Poland. At the Q1 update, it had only issued 20,000! So that product certainly appears to be taking off. The Polish market has been affected by a ban on non-interest fees on home credit loans such as those offered by IPF. That makes credit cards an important part of the new strategy of selling into that country.

Here’s a table confirming some of the key numbers. It’s interesting that customer numbers haven’t budged at all - and when you consider inflation, the c. 10% growth in the loan book (when measured in GBP) is perhaps less impressive? With most companies these days, if I see revenue growth of 8%-10%, I am chalking it up to inflation.

Even so, not every company is able to pass on inflationary increases to its customers and when you have a stock valued as cheaply as IPF, every six months that passes by without incident should be seen as a win.

The CEO comment is quick to mention inflation:

Notwithstanding the negative impacts of high inflation, all three divisions delivered great performances…credit quality remained good… We made significant progress with the rollout of our new credit card in Poland and further strong growth in Mexico through both our face-to-face and digital channels.

Funding/debt is an important factor here, as IPF does use significant amounts of leverage. However, they argue that they have “a very conservatively capitalised balance sheet and robust funding position”, and they do make a good case for that in my view.

The key bullet points around IPF’s funding that I would draw from today’s report are:

Equity to receivables ratio is 51.8%, which is much stronger than the company’s target ratio of 40%. It plans to reduce this ratio.

Balance sheet equity is £463m, and total borrowings are £523m (a mix of bonds and bank facilities).

Total debt facilities are £609m. There is headroom of £80m+.

IPF’s blended cost of debt is 14% - very high and traditionally I would see this as a red flag. But the company fairly notes that base rates in Hungary and Mexico are 13% and 11.25%. In Poland it is 6.75%. The company hedges its borrowings into local currencies and so it effectively ends up paying these base rates, plus a margin.

Outlook

The company repeats what it said previously - “Whilst there has been no discernible impact from the rising costs of living on customer demand or repayment performance, we will continue to monitor this closely and maintain a cautious approach to lending given the macroeconomic backdrop.”

Graham’s view

I don’t have the time to go over every part of this report right now, but I think that the investment thesis here is fully intact. Maybe even strengthened? PBT is up impressively and the company appears to be confident for the full year, with still no serious impact on trading from inflation. The changed lending regulations in Poland are a hurdle that the company seems to be dealing with very well, although I guess we will need to see full-year results to finally confirm this.

It’s an adventurous and risky choice but I’m going to continue giving this stock the thumbs up.

A G Barr (LON:BAG)

- Share price: 480p (+2%)

- Market cap: £538m

A.G. BARR p.l.c., a branded multi-beverage business with a portfolio of market-leading UK brands, including IRN-BRU, Rubicon, FUNKIN and Boost, today announces a trading update for the 26 weeks ended 30 July 2023.

I’ve been positive on BAG shares for about a year (see here and here) but the share price has not been cooperating:

Fortunately, the company seems to be performing well. Here are the key points from today's H1 update:

Revenue c. £210m, up 10% on a like-for-like basis, up 33% in total.

Revenue and volume growth, helped by higher pricing and good weather in June.

Profit margins “remained under pressure but in line with expectations”

H2 outlook - full year profits are expected to be “marginally above the top end of analyst expectations”. Shore Capital have upgraded their pre-tax profit forecast for the year from £45.5m to £47.5m.

H2 will be busy:

We exit the first half with strong brand momentum. The Scottish deposit return scheme delay provides us with a more stable and certain consumer environment and enables the accelerated execution of our innovation plans. We now have a number of exciting brand launches planned for the second half of the year.

CEO comment reassures that progress is being made in rebuilding the company’s operating margin. Here is the StockReport’s view on operating margin from 2018 (left hand side) to 2023 (right hand side):

Graham’s view

I didn’t realise that Scotland’s planned deposit return scheme was being delayed for so long. According to the BBC, “MSPs have been told it won’t be rolled out until at least October 2025”.

That’s one fewer headache for A.G. Barr to worry about. Although it looks like it will eventually have to deal with it, as England and Northern Ireland are also planning similar schemes for 2025.

As for the merits of these shares, I don’t need to change my view after today’s update: I was positive before, so I’m not going to change my mind after an “ahead of expectations” update!

Let me remind you that this is a cash-rich company: they had net cash of almost £53m in January 2023. That’s around 10% of the market cap so it is material, and it helps to explain why the company might trade at a premium rating. However, the rating looks distinctly average to me:

There is a QualityRank of 96. A.G. Barr traded well even through the Covid-impacted years and has consistently earned good ROCE, ROE, etc. These metrics, along with the operating margin, do have some room to improve back to their former levels, but I think that rampant inflation is a good excuse for their current relative weakness.

In a separate RNS today, A.G. Barr announces that its CEO will resign at some point in the next 12 months. He has been Chief Executive since 2004 so that is a reasonable stint by anyone’s estimation!

Roland's Section

NWF (LON:NWF)

- Share price: 265p (pre-market)

- Market cap: £131m

This distribution group supplies fuel, agricultural feed and ambient groceries to the customers of its three operating divisions. The fuels business is the largest and NWF has benefited from elevated prices and volatility in the energy market over the last 18 months.

The company has upgraded its earnings guidance more than once over the last year, most recently in June.

Today’s final results show a slight fall in profits compared to last year, but still appear to be slightly ahead of the latest consensus forecasts.

I have plenty of respect for NWF and would quite like to own the shares. But I think we have to consider whether profits are likely to return to more normal levels now that energy market conditions appear to be normalising (for example, BP Q2 figures out today show profits down 50% vs Q1).

Let’s take a look at today’s numbers.

Financial highlights: NWF’s financial year ends on 31 May, so today’s results do not include March-May 2022, when energy prices spiked and were very volatile. Perhaps for this reason, NWF’s profits fell slightly last year compared to the record prior year:

Revenue up 20% to £1,053.9m

Headline operating profit down 3.7% to £21.0m

Headline earnings per share down 9.8% to 31.3p

Total dividend up 4% to 7.8p per share

Headline earnings of 31.3p appear to be slightly ahead of the consensus shown on Stockopedia of 29.9p per share.

Remember that revenue reflects a large element of pass-through costs for a distribution business like this.

I’ve used the headline profit figures here, because last year’s statutory profits were distorted by an impairment charge. In this case, I think the headline numbers are more representative of operating performance.

Operating margins are low, as is the norm with distribution businesses. But my sums show a return on capital employed of 19.3%, suggesting NWF earns excellent returns on its capital. This level of profitability is a little higher than the long-run average, though:

Cash/balance sheet: Net cash excluding leases rose by 81% to £16.3m last year.

Although interest paid of £1.4m suggests the company does sometimes need to draw down debt, last year’s results show free cash flow of £20.4m, according to my calculations.

After adjusting for a net working capital inflow of £4.1m, this represents 110% cash conversion from after-tax profit of £14.9m – an excellent performance.

NWF’s financial strength and cash generation is reflected in the dividend, which has now risen for 12 consecutive years and has not been cut for 25, according to Stockopedia data:

I don’t have any real concerns about NWF’s financial performance or balance sheet.

CEO retirement: today we also have news that CEO Richard Whiting will retire next year, after 15 years in the role. He’ll be replaced by former CFO Chris Belsham, who has been with NWF since 2017.

This succession seems well organised and should provide good continuity. I don’t see anything to be concerned about.

Operating commentary: trading was positive across the group’s three divisions last year.

Fuel: headline operating profit fell to £12.9m (FY22: £17.2m) - a mild winter and high energy costs resulted in reduced demand for heating oil. However, the company was able to benefit from localised shortages by moving supplies around the country.

This business operates as a consolidator in what remains a fragmented sector. Two further acquisitions added 39m in annual volumes.

Food: headline operating profit rose to £4.2m (FY22: £2.8m). NWF’s Food business consolidates and delivers ambient groceries for large customers such as supermarkets. Last year saw an increase in loads and warehouse utilisation.

Feed: headline operating profit doubled to £3.9m (FY22: £1.8m), helped by record milk prices and a “desire to optimise yields through nutritional advice”. Also benefited from commodity price gains in the summer months, which resulted in increased margins on existing inventory. Feed volumes fell slightly, however, due to a milder winter.

Outlook: the company is positive about the outlook for continued growth and says that performance to date in the current financial year has been in line with expectations.

However, consensus forecasts suggest a sharp fall in profits this year, back towards more typical levels:

These estimates price the shares on 12 times forecast earnings, with a 3.0% yield.

Roland’s view

The StockRanks like NWF and the shares currently earn a Super Stock rating.

However, NWF’s share price is down slightly at the time of writing, despite the quality of today’s results. This reflects my own view that the shares are up with events at current levels.

Although NWF’s P/E ratio is lower than it has been in recent years, the dividend yield is currently at the lowest level since at least 2017.

For a mature, low-growth business with cyclical exposure, I see this as a more objective indicator of valuation that reflects the likelihood (in my view) that profits will now return to more typical levels:

Despite this concern, I think NWF is a good, well-run business at a reasonable price. Although my feeling is that patient investors may get better opportunities to buy over the next 12 months or so, I think the current valuation remains reasonable.

For these reasons, I’m going to go GREEN on NWF.

Journeo (LON:JNEO)

- Share price: 189p (+5% at 09.15)

- Market cap: £31m

Today’s half-year trading update includes upgraded full-year guidance for this technology company. Journeo provides systems such as CCTV for bus and rail operators and real-time information signs for passengers.

This is a new business to me, so I’ve dug into the archives and found a good summary from Paul in February.

The main highlight this year has been the acquisition of rail passenger information firm Infotec. This appears to have driven a substantial increase in revenue and profit.

Trading highlights: half-year trading appears to have benefited from a strong contribution from Infotec.

Revenue for the first half of the year rose by 145% to £21.8m. Helpfully, the company splits this out:

Organic: 41% revenue growth in core business (from £8.9m to £12.5m)

Infotec acquisition: £9.3m revenue (since 18 Jan 23)

Sales order intake has increased to £18m, including £4.2m from Infotec (H1 2022 order intake: £12.9m)

Profits: pre-tax profit for the half year has risen to £1.7m, from just £0.2m in H1 2022.

According to a new note from house broker Cenkos today, half-year revenue was “notably ahead of expectations”, but pre-tax profit was only “marginally” ahead. Cenkos says Journeo has expedited some larger contracts at the cost of lower margins.

I wonder how much of the profit contribution in H1 has come from Infotec. At the time of the acquisition in January, Journeo said Infotec was expected to contribute £12m of revenue and £2m of pre-tax profit in its first full year.

Today’s results appear to suggest that Infotec has already contributed three-quarters of this revenue in less than six months. That’s an encouraging performance, but if the same proportions apply to profits, then we might speculate that up to £1.5m of H1 pre-tax profit may have come from Infotec.

In other words, has Journeo’s organic pre-tax profit (excluding Infotec) really increased much from last year’s £0.2m figure?

I don’t know, but it’s certainly something I’d try to learn more about if I was considering investing.

Cash: the company had £11.3m of cash at the end of June. I estimate net cash at £5.1m, after subtracting advance customer payments of £3.5m and an invoice discounting facility balance of £2.75m.

The business is expected to be cash positive this year, so this seems fine to me at first glance.

Outlook (upgraded): revenue for the full year is now expected to be £41m, a 24% increase from previous expectations of £33m.However, Cenkos has only upgraded its FY23 earnings forecast by 8%, to 18.7p per share.

According to the company, the low-margin dynamic is expected to persist in H2. This is said to be due to component shortages and the mix of business. An improvement is expected in 2024.

Today’s upgraded forecast prices Journeo shares at about 10x forecast earnings, which may not be unreasonable.

Roland’s view

I think it’s useful to zoom out for a moment and take a look at this long-standing AIM firm over a slightly longer timeframe.

Journeo shares have tripled over the last three years, as the business has reported increased revenue and turned profitable:

However, Journeo’s share count has risen by 50% over this period, highlighting acquisitions and fundraisings.

As Paul commented in February, this business has been on AIM for a long time, but has a somewhat inconsistent record.

The acquisition of Infotec also seems to have been remarkably good value, as the £8.7m consideration appears to have priced the business at less than five times expected pre-tax profit.

My main concern is that this year’s rapid growth in revenue has come at the cost of lower margins and may not be entirely sustainable.

Today’s commentary includes the following paragraph, which seems to suggest that revenue growth will stall in 2024 and that some of this year’s contract wins may not be typical of future business:

Journeo expects to achieve £42m revenue in FY2024 and is targeting £50m in FY2025 with improved net profit margins, as we look to consolidate on some of the exceptional contracts in FY2023 and continue to drive bottom line profit growth.

I admit that I’m not very familiar with this business. But I’d like to understand more about what makes this year’s contracts exceptional and what differences are expected in future business wins.

On balance, I’m going to go AMBER on Journeo – a middling view that’s also reflected by the company’s StockRank:

I think that If Journeo can stabilise profits and deliver steady organic growth, the shares could be reasonably priced at current levels. However, I have some concerns and would certainly need to do more in-depth research before considering whether to invest.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.