Good morning, it's Paul here with the SCVR for Tuesday.

Estimated timings - sorry, I nodded off mid-morning, having had a poor night's sleep, so am running a bit behind schedule. I should be finished by 3pm. Today's report is now finished.

I hope you enjoyed the long weekend. I made good use of the time to spruce up my flat a bit, which has gone to rack & ruin during lockdown. This year, my entire focus has been on covid, and trying to work out what on earth is going on with the markets, hence I had overlooked the fact that home had become an increasingly cluttered (buying stuff on Amazon all the time), unkempt, pigsty! It's slightly better now anyway, but won't be winning any Ideal Homes awards for the foreseeable future. As mother put it, "It's very you!"

Boohoo (LON:BOO)

I see the Guardian has really got it in for Boohoo (LON:BOO) with a couple more damning articles published on Friday, causing a plunge in its share price (I hold), before a rapid partial recovery. I'm amazed that repeated revelations about its supply chain are still having any impact at all on the share price. It's been known for decades that the fashion sector has a murky supply chain. Practically every garment that all of us have ever worn, will have probably been made by someone being paid very little for their labour, irrespective of whether it's cheap fast fashion, or high end designer clothing.

I've seen some ridiculous commentary from journalists & analysts who clearly don't understand this sector, speculating that BOO's profits are built on sweatshop labour in the UK. Hence profitability would collapse once suppliers are forced to properly pay minimum wage. This is nonsense. Even if the allegations are true that some of BOO's suppliers only pay £3.50-£4.00 per hour, this would still make UK production high cost, compared with overseas. The reason UK factories are used, is speed to market, and convenience (e.g. designers/buyers at BOO can check production samples by jumping in a car and inspecting production themselves).

As the Guardian suggests, BOO is apparently already moving production to suppliers overseas (Morocco and Turkey have been mentioned), which are cheaper production areas, because wages are even lower than in Leicester, and lorries can bring the product into the UK at reasonable cost & speed.

Hence I don't see this issue as having any lasting impact on BOO. Other than reputational damage with people who don't buy BOO's product anyway. How many people wearing a BOO figure-hugging polyester £7 dress read the Guardian?! Not very many, I would wager. The Guardian's readership is more likely to be wearing hemp, or have upcycled something from Oxfam.

So-called ethical investors should never have invested in the fast fashion sector anyway, as the issues concerning landfill, water usage in fabric production, low wages in factories & poor H+S overseas, etc, are long-standing & widely known. I salute the efforts of people trying to improve these things, but one way or another BOO's business model looks bulletproof to me, and the shares are likely to be big long-term winners as it extends its geographic reach, and adds multiple brands to the well-oiled machine.

.

Eat Out to Help Out (EOTHO)

This scheme during August seems to have been a rip-roaring success, judging from press reports of large take-up by customers. It seems to have galvanised plenty of people into returning to restaurants. What I like about this scheme, is that (at relatively small cost to the taxpayer), it has enabled many restaurants to re-open that might not have done otherwise. Therefore the Govt is getting people back to work (and collecting in payroll taxes again, rather than paying out furlough money). Combined with the temporary VAT drop in the sector, it gives the better operators a fighting chance of survival.

I've not seen any evidence that restaurants have been identified as places where the virus is spreading. So hopefully the social distancing measures are working, and of course this time of year windows & doors can be left wide open, creating airflow, which I imagine must help somewhat. Restaurants and pubs I've visited do seem to be taking additional cleaning measures too, with plenty of disinfecting & wiping down of surfaces in evidence. I am worried about what happens in the autumn/winter though, with colder temperatures, and more enclosed spaces.

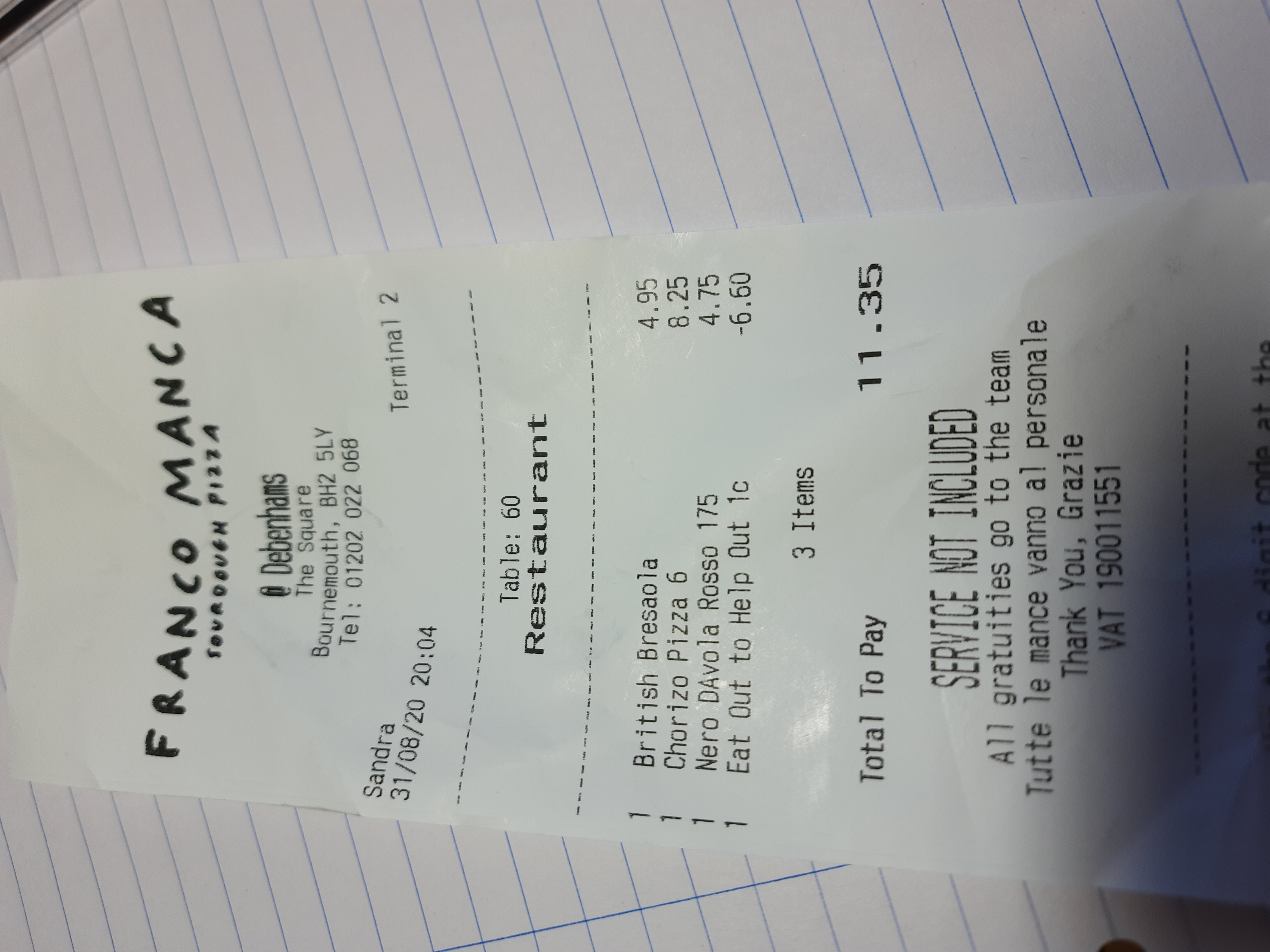

I got emails from both Franco Manca (owned by Fulham Shore (LON:FUL) ), and Revolution Bars (LON:RBG) (I hold) over the weekend, saying that they are extending EOTHO at their own cost, for September. That's really good news, as I enjoy eating at Franco Manca, and it's cheap at full price, so half price is a terrific bargain. I'm holding back on buying its shares though, as the valuation is far too high right now, given the risks ahead.

.

.

Here's my bill from last night. Bear in mind that the food & house red wine at Franco Manca is really good quality too, with a lot of emphasis placed on the provenance of ingredients. Anyone who claims it's just another pizza chain, clearly hasn't actually eaten there (or went when the chefs were having a bad day)! It's a nicely differentiated product offering. I think the business is likely to do very well, long-term, once the brand is better known outside of London.

Anyway, discounts are here to stay, for Mon-Weds. This is vital for restaurants to spread the business more evenly over the week, as peak trade on Fri & Sat is necessarily less busy than before, due to reduced density of tables required to social distance.

Mind you, last night in Bournemouth I saw plenty of groups of young people hugging & kissing each other, totally ignoring social distancing.

Also, the retail park (called Tower Park) was absolutely heaving on Saturday, with a full car park. M&S was many times busier than when I last visited, and plenty of middle aged & older people shopping, everyone wearing face coverings once inside the shops. It looks to me as if retail is getting back to normal, hence I'm toying with the idea of opening some new positions in that sector, if the valuations and balance sheets are attractive enough.

I am intrigued by the M&S/Ocado food offering, which is launching imminently. I suspect that could be a big success, and possibly lead to a re-rating of Marks And Spencer (LON:MKS) maybe? It's tempting to have a punt on that. Although I reckon M&S is likely to have made horrendous losses throughout the lockdown period.

.

Dunelm (LON:DNLM)

Very strong sales figures for July (up 59%!) and August (up 24%) are announced this morning, from this homewares retailer.

Dunelm confirms that its mainly retail park sites are performing strongly, which is clearly the best place to be located at the moment - with plentiful parking, and large, spaced out internally shops. We've seen from other company announcements that shopping centres & town centres are doing less well, and commuter city/towns. especially central London of course, are doing the worst, due to lack of commuters and tourists. Pret is really suffering apparently, given that it has sites approximately 50 yards apart throughout London, and footfall is still heavily down.

DNLM does point out that the July/August performance is pent-up demand, and that the outlook is uncertain. I'm wishing now that I held onto my DNLM shares, bought near the market bottom in March, but I banked the profit a while back. It's a fantastic business that should do really well long term.

.

Saga (LON:SAGA)

Share price: 19.0p (up 40%, at 08:34)

No. shares: 1,122.0m

Market cap: £213.2m

Statement re equity raise and strategic investment

Several newspapers ran stories over the weekend, saying that this insurance & travel group for seniors, has secured funding from a previous owner. This is confirmed with an RNS today;

Saga plc ("Saga" or the "Company") notes recent media speculation and today announces that it is at the advanced stage of a prospective £150 million equity capital raise (the "Proposed Equity Raise") in order to strengthen its balance sheet, improve liquidity and support the execution of its reinvigorated strategy under its strengthened management team.

Details;

- Raising £150m in fresh equity

- Firm placing, and placing/open offer to launch c. 10 Sept 2020

- Former CEO (20 years service), Sir Roger De Haan intends to invest up to £100m - of which;

- £60.6m at 27p per share (a 98% premium! [good, but why?!])

£14.9m at 15p or less (will be same price as open offer, TBC)

£24.5m at 15p or less, which looks like partial underwriting of the open offer (£74.5m total OO), subject to clawback for other shareholders participating in the OO, if I've understood this correctly - Sir Roger to become new Non-Exec Chairman, subject to a shareholder vote (who I imagine will welcome him with open arms & a thunderous round of applause, for rescuing the business!)

- Existing Board unanimously supports the above

Summary of progress made in last six months;

- Non-core disposals done, providing sufficient liquidity for severe disruption to travel business

- Costs cut by £20 p.a. run rate

- Amended debt facilities

- Sold Saga Sapphire cruise ship, but new ship "Spirit of Adventure" arriving end Sept 2020

- "continued progress" in insurance business

- Strategy review to be announced with interims c. 10 Sept 2020

- Focus on "investment" in brand, data & digital, efficiency, organisational & cultural change

Recent trading;

Recent trading has been in line with expectations and consistent with the commentary in the AGM trading statement, published on 22 June 2020.

Aborted bid approach;

... recently evaluated and rejected an unsolicited and highly conditional 33p indicative approach for the Company from a consortium of two US financial investors. This 33p offer followed several earlier indicative approaches from the consortium which commenced at a significantly lower valuation. The investors have since confirmed that they are no longer considering an offer for the Company.

How interesting. This provides a nice valuation benchmark.

My opinion - SAGA has been in my "potentially interesting, but I haven't had the time to properly go through the numbers in enough detail" tray for a while.

Whilst not yet a done deal, this looks close enough to justify a re-assessment of the risk (i.e. now much lower). I like the look of this, and think it could be worth a modest punt, but I'll try to do some more work on the numbers when time & energy permit.

Generally speaking, and I have no firm evidence to support this view, I like situations where a founder returns to a business, in order to sort it out. That Sir Roger is also injecting £100m of his own money, at a 98% premium for most of it, looks very encouraging to me.

I think a lot of people are itching to go back to cruise ships, when it's safer to do so. The brand loyalty generally to particular cruise lines, is remarkable to behold. I remember talking to some elderly neighbours years ago, and they loved cruising. One lady said, "We're very much P&O people", and another replied, "Oh we only go on Cunard", etc. . Hence I think the cruise line sector could bounce back very strongly at some point in the future. The trouble is, what shape will their balance sheets be in? Ruinous debt, currently being refinanced at exorbitant interest rates for the larger operators, could leave little upside for equity though. That probably won't stop a speculative frenzy in the shares though, as the US stock market (where Carnival & Royal Caribbean are listed) is very much in a speculative euphoria phase at the moment.

With Saga I like the fact that it has a cash generative insurance business alongside the cruise line, thus balancing the risk a bit more.

As you can see from the 5-year chart below, management seem to have been making a hash of things well before covid kicked the company in the proverbials*, by forcing its ships to become stationary for an extended period of time.

Overall - looks potentially interesting.

(* = shins, before we start getting complaints from the usual offendees)

.

.

Aa (LON:AA.)

Share price: 31.1p (down 10%, at 13:01)

No. shares: 621.5m

Market cap: £193.3m

Today's deadline to put up or shut up, has been extended to 29 Sept 2020 by the Takeover Panel, at the request of the AA. It says it is still in discussions with 3 names parties re possible cash takeover bids.

As I mentioned here on 4 Aug 2020, it's far from clear that the equity in AA has any value at all. Given its debt mountain, of £2.65bn, then it would make sense for a bidder to just buy up the debt, possibly at a haircut from par, and then force a restructuring that involved wiping out equity holders.

There again, with private equity awash with cash, and 3 competing potential bidders, anything could happen.

It's such an inherently impossible situation to gauge, I think the equity must be considered uninvestable. Shareholders might get lucky, and receive a bumper payday, but would that be big enough, or likely enough, to justify the risk of being wiped out if it goes wrong?

I heard that there's been a bearish note from Jeffries, who must be avid readers of the SCVR, because they echoed my thoughts more recently, putting a price target of only 5p on this share.

Overall - way too risky, and I wouldn't want to touch it either long or short. It's pure guesswork at this stage - not a good strategy generally speaking. If there's a strong argument for valuing equity an nil, then personally I wouldn't go near it. That logic would still be intact, even if a blockbuster takeover bid does happen, because that would be a lucky outcome, not a logical outcome.

.

Gear4music Holdings (LON:G4M)

Share price: 580p (up 2.7% at 13:54)

No. shares: 20.95m

Market cap: £121.5m

This is a separate announcement, looks like a non-regulatory one, providing commissioned research on the company. I'll have a look at that later.

AGM Statement & Trading Update -

... the largest UK based online retailer of musical instruments and music equipment

This is one of those lovely shares, where we've had two chances to multi-bag our money, as you can see from the chart below. That's if you managed to sell before the profit warning in Dec 2018. The business is very much back on track now, and the focus on margin over sales growth has been very successful. Plus lockdown has helped this year. Even so, the recovery in earnings & forecasts has been really impressive this year, with a number of positive consecutive updates.

.

.

Today's update is pleasing, showing that positive momentum is continuing;

"Following the exceptional period of revenue growth during Q1 FY21, I am pleased to report that trading has remained strong throughout July and August, with the Group continuing to generate improved margins alongside proportionally lower marketing costs compared to the same period in the prior year.

Whilst still relatively early in the current financial year, the Board remains confident that results for the full year will be at least in line with our recently upgraded expectations."

My opinion - as regulars know, I'm positive on this share. It's a good GARP share (growth at reasonable price), in my view. Management are excellent, and it's operating in a good growth niche.

N+1 Singer research notes are very good, available on Research Tree. Forecasts are 23-24p EPS for this year, but it sounds like the company could beat that. I reckon we're probably looking at more like 25-30p for this year, with good momentum, hence at 580p we might be on a PER of only about 19, if the top end of that range s achieved. That's not at all expensive for an international eCommerce business that is now becoming decently profitable.

I'm kicking myself for selling out a while back, and will possibly buy back in if the price has a wobble at any stage, if that coincides with me having some spare cash. Existing holders should be feeling justifiably pleased with this latest positive update.

.

Cake Box Holdings (LON:CBOX)

Share price: 178p (up 2% at 15:23)

No. shares: 40.0m

Market cap: £71.2m

Trading Update

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces a trading update covering the first five months of its financial year, to 30 August 2020.

This update reads well, and the share price has now fully recovered to pre-covid levels - impressive for a (franchised) retailing business.

All stores closed for 6 weeks in the period

Trading very strong since re-opening: LFL +14.1%, and online +74%

Not clear if deliveries via Uber Eats, Just Eat, and Deliveroo are included in the online growth, I imagine they probably are

5 new stores opened since 1 June, I can't remember if they're all franchised stores or not, will check later & update this bit (am trying to type this whilst on my exercise bike LOL!)

£156k furlough monies returned

Good outlook

Special divi of 3.2p to be paid, replacing previously withdrawn final divi

My opinion - an impressive update in the circumstances.

That's me done for today. Thanks for all your interesting comments.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.