Good morning, it's Paul here again.

My initial review of the RNS has thrown up 5 interesting small cap sets of results for us to look at;

Zytronic (LON:ZYT) (in which I hold a long position) - full year results

Ted Baker (LON:TED) - another profit warning, and management leaving

Begbies Traynor (LON:BEG)

Photo-Me International (LON:PHTM)

Nexus Infrastructure (LON:NEXS)

Estimated time of completion - circa 4pm - let's see how we get on.

Update at 16:15 - fairly predictably, I'm running late. Should be finished by 17:30. Apologies for any inconvenience.

Update at 17:51 - today's report is now finished.

Zytronic (LON:ZYT)

Share price: 192.5p (pre-market open)

No. shares: 16.0m

Market cap: £30.8m

(at the time of writing, I hold a long position in this company)

Zytronic plc, a leading specialist manufacturer of touch sensors, announces its preliminary results for the year ended 30 September 2019.

I've braced myself for lousy results here, because the share price has been grinding relentlessly downhill since the profit warning, which I reported on here on 2 May 2019. However, the figures this morning are actually not that bad - only slightly below broker consensus forecast (16.8p actual EPS, versus 17.0p forecast). That's a PER of 11.5

Key numbers for FY 09/2019;

- Revenues £20.1m, down 9.2% on LY, and down 0.5% on forecast (near enough to not matter)

- Gross profit down 17.6% on last year

- Profit before tax down 27% in LY

- Dividends - final payout of 15.2p flat against last year, giving 22.8p total divis - which is only covered 74% by earnings, yielding a monstrous 11.8% yield - divis are under review, so it sounds like a cut might be on the cards in future.

Balance sheet - a stand-out feature of this share, is its astonishingly strong. It's tying up unnecessarily large amounts of surplus cash, and this really should be paid out to shareholders, or otherwise used (e.g. buybacks make a lot of sense at the current valuation), or used for a sensible acquisition.

Cash has fallen 10%, but is still way above what the company needs, at £13.1m. Management seems to large a massive (relative to the market cap) cash pile, as a comfort blanket. But it remains excessive.

The current ratio is a mind-bending 12.1 - normally I regard anything over 1.5 as being comfortable! So this is amazingly strong, with a ton of surplus cash that the company just doesn't need.

Put another way, net cash is 82p per share, or 43% of the share price. So we're only really paying about 110p for the business (if we deduct cash). That's an underlying PER of just 6.5

Outlook - not great, but hardly a disaster, given the lowly valuation;

On the basis of the first two months of trading being at lower levels than last year, we are cautious about the short term. However, as we have seen in prior years, trading results in the second half can improve as the year progresses and the level of enquiries for new projects are higher than last year.

My opinion - my initial skim of the figures has brought relief, as I hold a small long position in this share, and was expecting worse figures, given the very weak share price. There could be scope for a bit of a bounce today, possibly? It depends though - as the share is so illiquid, the price moves on tiny volume.

To my mind, there's a missed opportunity here. I would like to see ZYT change its strategy, and become an acquisitive vehicle like Judges Scientific (LON:JDG) or Tracsis (LON:TRCS) - both of which have had fantastic success by using the prodigious cashflows of their core businesses, to fund multiple acquisitions of cheap private companies.

Maybe institutional shareholders could push for a new Chairman, to focus on an acquisitions strategy, leaving operational management free to concentrate on managing the core business?

I'm just popping to McDonalds for a Sausage & egg McMuffin, and have printed off the full RNS to read over breakfast. I'll add more comments here if anything interesting crops up in the narrative.

Maybe I'm seeing it through rose-tinted glasses, but this share price looks overdue a bounce to me;

EDIT at 08:06 - I see the price has moved down 9% in early trade. That's the wrong reaction in my view, and could represent a potential buying opportunity.

Ted Baker (LON:TED)

Share price: 344p (down 14% today, at 10:29)

No. shares: 44.6m

Market cap: £153.4m

Directors stepping down

The Executive Chairman, David Bernstein, has stepped down with immediate effect.

The Chief Executive, Lindsay Page has also stepped down with immediate effect. He has been with the business since 1997, when it had just 7 shops.

This looks very bad to me. The problems must be getting worse. Checking our archive, I was very bearish on this share here on 3 Oct 2019, flagging serious concerns over excessive inventories, and whether it might even become insolvent in future, due to heavy debt (although note that it does hold a valuable freehold property).

Graham wrote an excellent (and very bearish) piece here on 2 Dec 2019, when the company revealed that it had been cooking the books - with inventories over-stated by £20-25m. That doesn't usually happen by accident, in my experience. At that point, this share became uninvestable as far as I'm concerned, since we cannot rely on the reported figures as being accurate.

Trading update today - more bad news. Seriously bad news. Poor trading has resulted in forecasts being deeply slashed. One broker has cuts its FY 01/2020 forecast from 52p to 10p! Similar scale cuts are also made to next year's forecast: from 59p to 15.4p.

The business is really operating just above breakeven now, with the trajectory strongly downwards. I imagine it is likely to actually be loss-making next year, and could get into trouble re going concern.

Action being taken -

Cost review - they've brought in consultants! Why? Do they not know their own business, and where the costs could be cut? This looks incredibly weak to me.

Asset review - I think this involves redevelopment of the large freehold property. A sale of that freehold could keep the bank happy for now, maybe?

Dividend suspended - no surprise.

My opinion - this looks a dreadful mess. I suspect that more, possibly deeper, inventories write-downs could be in the pipeline. As Graham explained in his 2 Dec 2019 article, the stock turn at TED is amazingly slow, i.e. the company is sitting on huge piles of dead stock that they cannot sell. That's the main problem. There's no alternative than to discount it to whatever level needed for it to sell. That means heavy losses, as the gross margin goes down the pan.

The product doesn't look anything special, and even with 40% off on their website, the prices still look ludicrously high. But there again, I buy most of my clothes from Primark, so perhaps I'm not the best judge of designer fashions?

The only hope for shareholders is that the founder (Mr "forced hugs", Ray Kelvin) might take it private. There was talk in July here of that possibility. But who would be interested in funding such a deal, now that profitability has collapsed. Does anyone know what assets (other than his 35% shareholding in TED that the founder has?

I agree with Graham that struggling retailers are probably best avoided altogether. TED looks a complete can of worms, and I reckon there's likely to be more bad news to come. New CEO/Chairman might kitchen-sink the next set of accounts, with a big inventories write-off being a likely happening, in my view.

That said, with the market cap now only £153m, the brand must be worth more than that? The problem is, if it's locked into uneconomic rents on its 425,000 sq.ft. of retail space (a lot of which is probably high rented, flagship type space), then those lease liabilities could pull down the whole company perhaps? I note from its store listings on the website, that it has 4 shops in Heathrow Airport (those will be on big rents, for sure), others in Knightsbridge and other big rent London locations. It also seems to have plenty of concessions in House of Fraser - that could be a bad debt in 2020 if (as seems likely) HoF ceases trading.

Overall, I wouldn't want to get involved here, it's too risky.

Begbies Traynor (LON:BEG)

Share price: 88p (price unchanged today, at 11:35)

No. shares: 127.6m

Market cap: £112.3m

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, today announces its half year results for the six months ended 31 October 2019.

Chairman Ric Traynor's comments neatly summarises the situation;

"I am pleased to report a strong half year financial performance with growth in revenue and earnings, together with improved operating margins. This reflects the benefit of the recent organic development of the group and our investment in acquisitions.

"The increased scale of the group's activities, favourable conditions in the UK insolvency market and our strong financial position leaves the group well placed to continue our track record of revenue and profit growth.

"Following a strong financial performance in the first half of the year, the board remains confident of delivering results at least in line with current market expectations for the full year, including the benefit of the first-time contribution in the second half from our recent acquisitions. We will provide an update on third quarter trading in early March 2020."

Valuation - Stockopedia is showing broker consensus of 5.78p normalised EPS for this year, pricing the shares at a PER of 15.2 - that looks a fair price to me.

Dividends - as you can see from the 3-year chart below, the share price has re-rated from a range of 40-50p, to the current level of 88p. Therefore this has pulled down the dividend yield, which used to be around 5%, to the current level of 3.3%. Therefore the share is not so attractive for income seekers as it used to be.

My opinion - I've been writing positively about this share for many years now. My impression is that it's well managed, and the insolvency practitioner sector is highly specialised, and quite lucrative.

The acquisition strategy, buying complementary businesses e.g. property services, seems to be working well.

Unfortunately, I sold my own shares some time ago, which is a pity as it would have been better to have held onto them.

** BREAKING NEWS **

KOOVS IS BUST - SHAREHOLDERS WIPED OUT.

As a secured creditor, Lord Alli is buying the business from the Administrator, in what looks like a pre-pack. He's certainly a gluten for punishment.

Koovs was never anywhere near a viable business, as our total of 25 bearish articles here about Koovs, from Graham and I, over the last 5 years, explained.

Photo-Me International (LON:PHTM)

Share price: 90p (up 4% today, at 16:19)

No. shares: 378.0m

Market cap: £340.2m

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces its results for the six months ended 31 October 2019.

We're presented with a long table of options in terms of profit.

Note how IFRS 16 has complicated matters, by distorting EBITDA. So both measures are given, before and after its impact. Although IFRS 16 has had little impact on profit. I'm happy to focus on the adjusted EPS of 6.0p, up a useful 9.1% on H1 LY. Adjustments are so minor, they're not worth detailing here.

H1 is the seasonally stronger half, so we cannot just double that to arrive at a full year figure, because that would be overly optimistic.

Dividends are what this stock is all about. The 3.7p interim payout is held. The full year yield is 9.8% - remarkable!

Outlook - note the focus on its launderette machines, which seems to be growing well;

The Group remains focused on its strategy to further diversify its product offering both organically through innovation, and through smaller bolt-on acquisitions.

Expansion of Laundry, particularly in new markets such as Germany, Austria and Switzerland, remains a key priority, including increasing the Group's presence in the B2B and the laundrette markets, which continue to represent a material opportunity for the Group. Looking ahead, this business area will continue to account for an increasing proportion of the Group's total revenue in the medium term.

KIS Food is an important component of the Group's future growth strategy and we will continue to progress with the development and rollout of the offer in this business area. Our initial focus will remain within French supermarkets, whilst the Group looks to expand into other Pan-European geographies in the future.

Whilst consumer uncertainty continues to weigh on our business in the UK, we remain confident that the Group will continue to perform well during the coming period, and in line with market expectations, in the current financial year.

Valuation - the forecast for this year FY 04/2020 is 9.77p adj EPS - for a PER of 9.2 - great value for such a cash generative business.

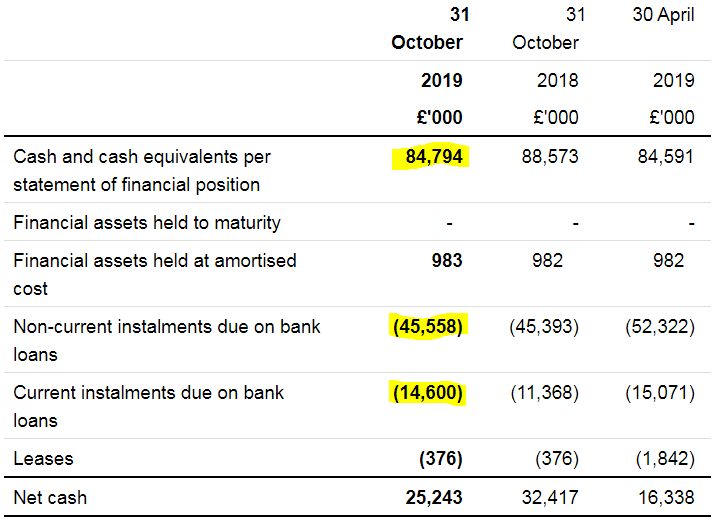

Balance sheet - looks fine to me. As noted last year at this time, it perplexes me as to why PHTM has a large cash balance of £84.8m, and bank debt of £60.2m. This seems inefficient, in terms of interest cost.

Maybe there are seasonal peaks & troughs which see the cash figure drop a lot lower than on the balance sheet dates?

My opinion - these are good figures, and full year performance is confirmed to be in line.

Why is this share so cheap? In a low interest rate environment, a PER of below 10 seems a bargain. The problem, I imagine, is that the market sees risk that the traditional photo-booths might become obsolete. E.g. in the UK, the public can now take their own smartphone photos for passports, instead of using a photo-booth.

Or, there could be upside if Govts require psychometric details, which could possibly be designed into PHTM's booths in future? Who knows. If you get the correct answer to this quandary, then you would be likely to either do well on this share, or avoid a dud. I don't know which it will be unfortunately, as predicting the future is difficult to do.

I'm leaning towards seeing this share as a bargain, as it has various strings to its bow, not just passport photos.

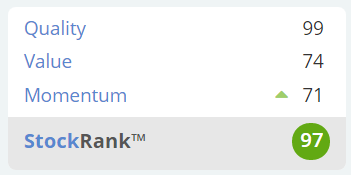

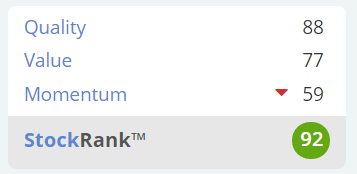

Stockopedia agrees, with "Super Stock" classification, and a lovely StockRank;

Nexus Infrastructure (LON:NEXS)

Share price: 162.5p (down 5% today, at market close)

No. shares: 38.1m

Market cap: £61.9m

For the year ended 30 Sept 2019.

Nexus, a leading provider of essential infrastructure services, utilities connections and electric vehicle infrastructure...

Nexus floated on AIM in July 2017

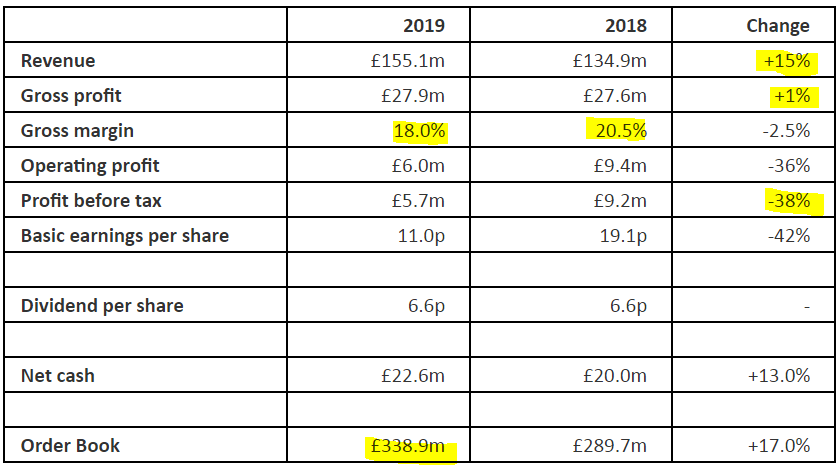

Here's the highlights table;

What stands out is that revenues are up 15%, but profit is down 38% - so margins are under pressure. Although note that the narrative says these figures are in line with revised expectations - sounds like it must have had a profit warning previously.

The quickest way to find a profit warning, is to look for the red bar(s) on a candlestick chart. Here we can see that it dropped sharply in late April 2019, which must be the profit warning, took another tumble in July 2019, but has since regained its composure partially. With hindsight, it would have made a nice buy in late July.

Outlook - the order book is up 17% as shown above, which is good.

That's over 2 years' revenues, so good visibility there.

The potential for electric vehicle charging points looks interesting. I imagine these are likely to be ubiquitous in the relatively near future, especially for new housing estates that NEXS does the other infrastructure for.

We have continued to grow Group revenues and the order book growth provides good visibility for the future. The mitigating actions we have undertaken within Tamdown should ensure that the business is more resilient.

Confidence in maximising future opportunities is further enhanced by the high year end net cash balance, achieved through tightly controlling working capital, and the availability of the new revolving credit facility, along with the record order book.

We believe that the structural demand for housing in the UK, the low interest rate environment and Government-supported incentives in the sector from all major political parties, all play well to Nexus' strengths as a trusted supplier. On the basis that trading conditions remain stable, the Group is well placed to maximise opportunities within its chosen markets and deliver future value for shareholders.

Market conditions do look quite good for the house building sector, in terms of number of units being built & likely to be built in future.

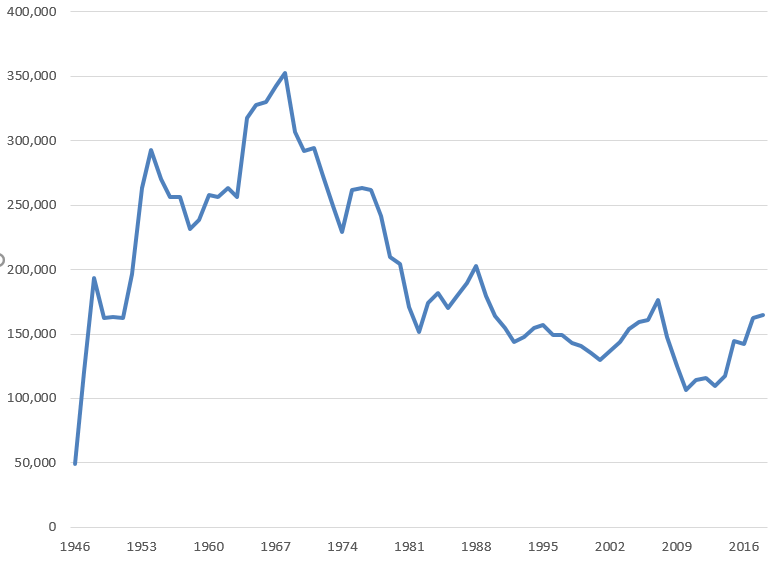

I did a bit of googling, and found this Govt website with statistics on the house building sector. I created a graph of UK housing completions since 1946, to get a longer term perspective, here it is;

[source: Table 213, Ministry of Housing, Communities & Local Government]

It's striking how few houses have been built in the last 40 years, compared with the much larger numbers in the post-war boom years. This is a hobby horse of mine - it's so obvious that we need a massive programme of council house/flat building in this country, to provide cheap but good quality housing for people on low incomes. That would not only solve economic, but also many social ills, in my view.

My opinion - I'm spooked by the plunge in profits. The group seems to have run into some problems, not a good look relatively soon after floating its shares.

Lowish margin contracting businesses are best avoided in my view. Sooner or later something serious seems to go wrong.

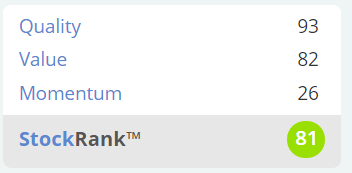

Stockopedia completely disagrees, so maybe I'm wrong? Super Stock classification, and an almost perfect StockRank;

OK, I'll leave it there for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.