Good morning, it's Paul here.

Timing - as you've probably gathered, I've settled into a routine of writing in the afternoons, which works best for me. I'm trying to persuade the boss to change the timing of the daily SCVR email to something like 5pm, so that it doesn't go out half empty or blank.

Estimated time of completion today is 6pm. So by all means check in before that, as sections are added, but the finished article will be done by 6pm, as I have no meetings or other distractions today. Update at 17:33 - today's report is now finished.

IFRS 16

I've noticed one or two investors & commentators are getting into a panic about IFRS 16.

From the enquiries I've made so far, institutions & banks are taking as much notice of it as I am - i.e. seeing it as a nuisance, and wanting numbers to be presented to them in the old way.

I've also been assured that banking covenants, facilities, etc, will continue to be based on the old numbers. The idea that IFRS 16 adjustments will "wipe out" companies, is as daft as thinking that Brexit is going to wipe out cross channel trade!

When I met management of Revolution Bars (LON:RBG) earlier this week, of course I wanted to talk to them about IFRS 16, as the notes to the accounts showed that it's going to involve some big new entries on future accounts. The CFO ran through all the details, leaving me none the wiser, as it's all so complicated. So I thought for a moment, then asked this question;

How much cash losses do your problem leases cause you, compared with if you could theoretically just ditch them all?

The CFO replied that it's about £1m p.a..

That's easily affordable, in the context of c. £12m p.a. EBITDA, so I was happy with that issue addressed. The problem leases are a bit of a drag on profitability, which was a known factor before IFRS 16 anyway. Most multi-site retail/hospitality operations have a tail of loss-making sites, which they exit when they can (when leases expire, or can be assigned on commercially viable terms).

A good follow-up question would be to ask what the break clauses or lease expiry dates are for each site - or an average, i.e. how long will those liabilities go on for? The answer was a bit more complicated on that - basically that they're actively managing the estate, and getting rid of loss-making sites whenever they can. Which is what all retail/hospitality groups will tell you, because that's a normal part of their activities - they keep the profitable sites, and try to dispose of the loss-making sites.

Bottom line is this: the IFRS 16 adjustments have no effect on RBG's operations, cashflow, or solvency. Their bank and big investors are not interested in the accounting adjustments.

See the comments section below for more discussion of this topic between me & Gromley. Please feel free to join the debate, I'd like to hear what others think too.

Zotefoams (LON:ZTF)

Share price: 342p (down 36% today, at 11:57)

No. shares: 48.3m

Market cap: £165.2m

Trading update (profit warning)

3 October 2019. Zotefoams, a world leader in cellular materials technology, today provides an update on trading.

The company's year end is 31 Dec 2019.

There's been a drop off in trading in H2;

At the time of our interim results in August we stated that we were mindful of a difficult current trading environment in the European polyolefin foams markets and the less stable political and macroeconomic environment.

Since that time the market for polyolefin foams in continental Europe has deteriorated significantly while growth in the North American market has slowed and is now expected to be below our previous estimates.

Note that the polyolefin division is the biggest part of the business, at 68% of H1 revenues.

Helpfully, ZTF quantifies the anticipated downturn in sales;

We anticipate polyolefin foam sales are therefore likely to be around £6 million below current market estimates, resulting in Group sales for the second half of 2019 approximately £2m below the first half of the year. Anticipated profit for this period is impacted by our limited ability to change the operational gearing in the business in this timeframe.

Looking back to the H1 results, it achieved £42.3m in sales, a strong result up 12% on prior year comparative. Therefore, we're told today that H2 will be £2m below H1, giving c.£40.3m sales in H2, and £82.6m for the full year. ZTF says this is £6m below market estimates. That's a fairly significant miss, given that it's happened late in the year. Hence I can see why the share price is down 36% in response.

Other (smaller) business units are performing better;

Our High-Performance Products ("HPP") business unit is performing as expected with strong growth in T-FIT® insulation products and ZOTEK® technical foams mainly in aviation and footwear.

Outlook comments - confident in the long term, but by implication not the short or medium term?

Notwithstanding the near-term headwinds in the polyolefin foams business, the Board remains confident in the growth strategy and capacity enhancement investments the Company is making and in the long-term prospects of the business.

Surely the risk is that increased production capacity coming on stream now, when demand is declining, looks rather unfortunate timing.

Balance sheet - is the group financially strong enough to withstand a downturn in demand? I think it is, yes. Whilst there is some debt, and a pension deficit, the working capital position is strong. So I don't have any concerns about solvency.

Valuation - without revised broker forecasts, I could only make a guess at the likely impact on profit. Obviously the current forecast of 20.7p EPS is now out of the window. At a guess, we might be looking at more like 15-18p EPS for this year now?

At the reduced price of 342p per share, that would put the PER at 19 to 23 times. Hardly a bargain, even after today's big fall.

My opinion - I've always liked this company (innovative products with good margins), but have repeatedly questioned the high valuation multiple. Most recently when I reported here on the recent interim results, asking why the shares were rated at 25 times forecast earnings, when the macro conditions were deteriorating?

This seems to be the latest canary in the mine to keel over. It really is starting to feel as if there's a global downturn coming on. I was watching CNBC yesterday afternoon, they were reporting on negative forward-looking measures for US industrials. Whether that spills over into a wider recession, nobody knows at this stage.

I really do think this is an important time for us all to review our portfolios, and ask serious questions about any highly rated (PER of 20 or above) shares. Are those premium ratings appropriate, now that macro conditions appear to be deteriorating? It looks as if many highly rated stocks could be accidents waiting to happen, hence why it might be best to sell some or all of our positions. That's for each subscriber to decide, of course, I'm just flagging up the risks, which seem elevated right now.

Is it worth catching the falling knife here? Definitely not, in my view. It's nowhere near the bargain basement in valuation terms.

Broker forecasts & recession risk

Thinking more broadly about broker forecasts, I think we're going into a stage of the cycle where we have to be super-sceptical about broker earnings forecasts.

The reason is that most broker research tends to make a blanket assumption that sales & profits will rise each year. That's fine in normal economic conditions. However, when the economy slows down, then you cannot make that assumption any more. Hence a big gap opens up between forecasts, and much weaker reality.

Yet brokers rarely factor in an economic downturn into their forecasts. Or rather, I've observed in previous bear markets, that broker research tends to be very late in recognising that the economy is deteriorating, and only slash future forecasts late in the day. That may be because of pressure from clients (who pay their fees after all) to support the share price with optimistic forecasts?

Therefore, I'd like to encourage readers to be much more sceptical about forecast profits, across the board, right now. If aggressive, possibly unrealistic, forecasts are combined with a high forward PER, then that share could well be an accident waiting to happen.

There need to be very good reasons (e.g. a strong outlook statement, with evidence for why management are optimistic [e.g. strong order book]) to back up optimistic broker forecasts. Even then, a strong order book could only delay the downturn in earnings, if it's not replenished as the economy deteriorates.

Instead of assuming a blanket (say) 10% uplift in sales, maybe brokers should now be thinking about assuming a blanket 5-10% downturn in sales? Or we should be re-working the broker forecasts ourselves manually, to arrive at a more realistic profit forecast.

Remember operational gearing too - a 10% drop in sales could cause a 30-50% drop in profits. Or more, even in some cases. Therefore, deteriorating macroeconomic conditions can have a highly leveraged, and ruinous impact on profitability.

That in turn can lead to highly indebted companies running into trouble with their banking covenants, and facing solvency issues quite quickly as a recession bites. Banks operate on very low margins, and I'm told are already getting nervous. As my old (business) bank manager used to say in my FD days, "We have to watch things like a hawk, because if you go bust, then that wipes out the bank's profits from 50 other customers".

My balance sheet analysis is becoming more relevant than ever. "Gear today, gone tomorrow" is a saying that's worth bearing in mind. Look at Thomas Cook - it's balance sheet was obviously insolvent for years, and eventually came home to roost. Therefore I urge subscribers here to brush up on your balance sheet skills, and be very careful about highly indebted companies - they're the first to run into trouble in an economic downturn, which can result in 100% losses for shareholders, or massive dilution in emergency fundraisings.

Therefore, I do think it's time to put on our tin hats, and to consider ditching anything that might be over-priced.

Ted Baker (LON:TED)

Share price: 608p (down 34% today, at 14:06)

No. shares: 44.6m

Market cap: £271.2m

Interim results (corrected)

I'm amazed to see this excellent fashion brand back down into small caps territory. The share price has fallen so much, it's now back down to a level last seen in 2010. I shall resist the temptation to give a facetious comment about the title below, from the company's self description section today.

Ted Baker Plc - "No Ordinary Designer Label"

Ted Baker is a global lifestyle brand distributing across five continents through its three main distribution channels: retail (including e-commerce); wholesale; and licensing.

Ted Baker has 560 stores and concessions worldwide, comprised of 199 in the UK, 124 in Europe, 136 in North America, 96 in the Middle East, Africa and Asia, and 9 in Australasia. ...

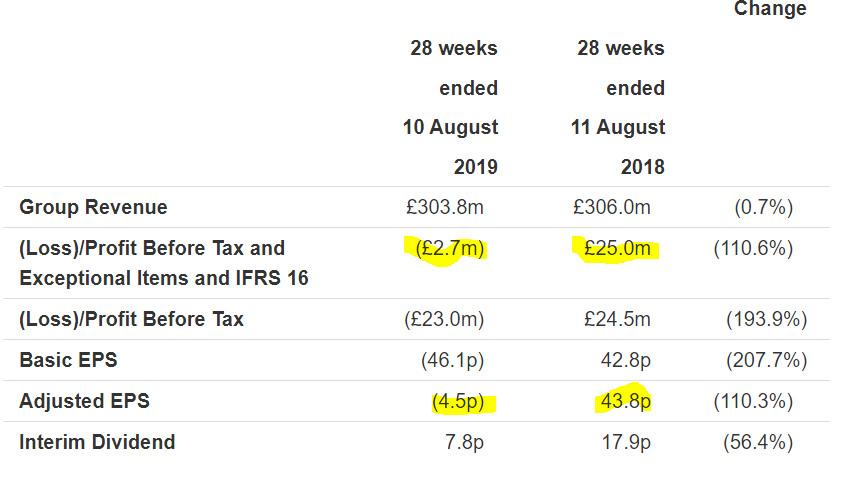

What's gone wrong? In a nutshell, profit has collapsed in H1. This looks awful;

The dividend has been cut 56%, but I don't suppose anybody cares too much about that, when the profit figures are so grim.

Outlook comments - sound weak also;

The financial results we delivered in the first half were behind our expectations. Trading in the second half has started slowly, not helped by the unseasonably warm weather in September, and this will have an impact on the full year outcome. If these trends continue, we will achieve a second half result below that of last year.

We also have a number of significant trading periods across the balance of the year with forward visibility significantly reduced in these evolving sector dynamics.

That's a serious warning. As I've mentioned before, if the key A/W season stock sells badly in September, then it usually means the product range is duff. Therefore the usual outcome is a poor overall season, and another profit warning.

Seasonality - looking at the figures for H1 and the FY last year, there doesn't seem to be much seasonality in profits. Therefore the H1 result this year (of a small adjusted loss) seems to imply that it might be loss-making overall for the full year. If so, that's a shockingly bad deterioration in performance.

This is a good example of when fashion retailers get the fashions wrong, the geared impact on profits from lower sales, and lower margins (since slow-selling stock has to be discounted to shift it) can be crippling.

Balance sheet - as always with profit warnings, my next port of call is to look at the balance sheet, to ascertain if the company is likely to go bust or not.

Remember that we saw with Bon Marche (opposite end of the fashion market, but still relevant) how an apparently strong balance sheet very quickly unravelled, after a couple of seasons poor performance.

Overall, I think the balance sheet looks a concern. As a reader {insert name} pointed out, the inventories figure looks wildly excessive, at £209.6m - remember that inventories are on the balance sheet at cost, not retail value. I cannot fathom why the business has such large stock-holdings? The bought in margin is high, so TED may still be able to sell this stock for more than cost, hence no write-down required by the auditors, but it might still need to be heavily discounted to shift it. I think this could be a precursor to a further decline in the gross margin, and hence increased future operating losses.

Debt - the overdraft of £108m, and term loan of £42m, look as if they could develop into a serious problem, now that profit has collapsed. The key question now, is what are the bank covenants? Is TED heading for a breach?

I've checked the last Annual Report, and TED owns a freehold that is in the books at £57m, and called the Ugly Brown Building! Apparently the plan is to redvelop this site, so I wonder if there might be some potential profit in the redevelopment? In any case, ownership of the freehold, and related term loan, takes the pressure off somewhat in terms of overall debt.

The going concern note reassures on this (for now anyway);

The Directors have prepared trading and cash flow forecasts for a period of one year from the date of approval of these interim financial statements. The Directors have a reasonable expectation that the Group has adequate cash headroom and expects to meet all banking covenant requirements. Accordingly, they continue to adopt a going concern basis in preparing the financial statements of the Group.

The wording on this is not particularly strong, and no figures are given to support the Directors optimism. So I'm sceptical about this. In my view TED needs to urgently reduce its inventories, in order to reduce gearing.

My opinion - I've got serious concerns about this business. It needs to turn around performance pretty soon, or there could be a question mark over its survival. Definitely not a falling knife to catch, in my view, based on current performance.

It might develop into a special situation at some point - i.e. the founder & major shareholder might buy it back, or agree some other kind of deal, who knows?

Speedy Hire (LON:SDY)

Share price: 53.4p (up c.3% at market close)

No. shares: 525.4m

Market cap: £280.6m

Speedy, the UK's leading provider of tools and equipment hire, and services to the construction, infrastructure and industrial markets provides an update on its trading performance for the period to 30 September 2019 ahead of publishing half year results, scheduled to be announced on 13 November 2019.

This update only gives revenue details (up 6%) for H1, but ends with an in line full year comment;

... The Group expects adjusted profit before tax for the full year to be in line with the Board's expectations.

Outlook - this chimes with my general comments above, that I like to see evidence for a positive outlook, which is given here;

A number of contract wins and extensions including CALA Homes and Peel Ports have been secured in the period. As a consequence, the second half of the year is anticipated to be stronger than the first half.

Net debt -

Net debt is expected to be c.£86m (31 March 2019: £89.4m), and reflects continued investment in hire fleet, which is predicted to reduce in the second half of the year.

I like to look at hire companies' debts as being akin to a property company. So the loan to value (LTV) is what interests me. In this case, the hire fleet was in the books at £217.5m in the last set of accounts. Therefore £86m net debt is just under 40% of the book value of the equipment, which strikes me as a reasonable.

Valuation - I'm never quite sure how to value equipment hire companies.

The forward PER of 8.8 looks reasonable. There's a 4.6% dividend yield. The balance sheet looks reasonable to me.

My opinion - it all depends on what the future holds for the economy.

If you think the economy will do fine, then this share is cheap.

If you think a recession is likely, then it's probably best to avoid this sector altogether, almost regardless of valuation.

Wincanton (LON:WIN)

Share price: 226p (up c.2% today, at market close)

No. shares: 124.5m

Market cap: £281.4m

Wincanton, the largest British third-party logistics company, today issues the following trading update ahead of its half year results for the six months ended 30 September 2019.

It's a reassuring update;

The Board continues to expect results for the financial year to 31 March 2020 to be in line with market expectations.

Other details;

- New contracts & renewals

- Two freeholds sold for £5.5m, including £2.0m exceptional profit

- Net debt reduced to £15m

My opinion - this share looks great value at first look, but the elephant in the room is the huge ongoing payments into its pension deficit, e.g. this taken from last published accounts;

... The annual deficit funding contributions have been agreed at £18.0m per annum increasing by RPI over the three years to March 2021, followed by £25.0m per annum increasing by RPI from April 2022 to March 2027....

Despite this, it has managed to make decent (5.5% yield) dividend payments, and reduce debt. Although note that it benefits from favourable working capital (customers paying up-front).

Credit where credit is due, Wincanton has managed to prove that it can operate normally with a very weak balance sheet.

Given that so much of its cashflow has to go into the pension fund, this negates the low PER. Or rather, the market has correctly priced-in the cash hungry pension scheme, hence why the PER is low for a good reason.

OK, that's me done for today. See you in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.