Good morning!

In times like this, when there is so much political news, I find that analysing individual stocks can be a sort of refuge.

Looking at a few small companies and trying to decide if they are good investments is not easy. But it is, I find, much more relaxing for the brain than trying to make sense of political news and its potential macroeconomic consequences. That is where things get really mind-boggling.

In this vein, I've finally started reading Lord Lee's book: How to Make a Million Slowly. One of his 12 rules is:

Ignore the overall level of the stock market. Don't make judgements on the macro outlook - leave that to commentators and economists. Focus on your particular selection.

To be honest, I do like to tweak my overall equity exposure based on my view of overall valuations. Cash and fixed income assets are my psychological buffer. They protect me from worrying too much about a general crash in the stock market, since I know I have some powder dry. So I don't follow Lord Lee's rule perfectly.

In the end, though, stock selection is where most of us are trying to gain our competitive edge. Selecting individual stocks is how I personally devote c. 90% of my time. Let's keep it this way!

Quite a few updates today. I am planning to take a look at:

- Begbies Traynor (LON:BEG) - final results

- MySale (LON:MYSL) - trading update

- Photo-Me International (LON:PHTM) - results

- Premier Asset Management (LON:PAM) - trading statement

- Robert Walters (LON:RWA) - trading statement

Elsewhere, I see that Ocado (LON:OCDO) has released interims. It's a bit too big for us, with a £7 billion market cap.

According to shorttracker.co.uk, there are only 2.2% of its shares declared as having been sold short. I suspect that there are still a lot of smaller, undeclared short positions outstanding.

Ocado's share price has more than doubled in 2018, and is up c. 3x from its value late last year.

My investing life has been so much more relaxing since I quit shorting. And a good thing too, as I might previously have been tempted into shorting this one!

Ocado raised £324 million in new cash during the most recent period and did that at a strong valuation, improving its balance sheet and making life more difficult for its shorters.

That's a real risk when you're short: a successful financing deal. I suffered it myself when Quindell (QPP) was taken over. I also wonder if it could be a possibility for Tesla ($TSLA): its debts are huge, but so is its market cap and also the wealth and connections of its CEO.

A bullish financing deal there could also be an issue for its shorters, who currently represent 22% of shares outstanding and 32% of the free float, according to Yahoo Finance. Those are some incredible metrics for a $54 billion stock. It's going to be popcorn-worthy, either way!

Begbies Traynor (LON:BEG)

- Share price: 68.4p (-1%)

- No. of shares: 110 million

- Market cap: £76 million

This insolvency practitioner has enjoyed a big re-rating higher over the past year. Investors are preparing for interest rate hikes and for zombie companies to start throwing in the towel en masse, driving up the demand for Begbies' services:

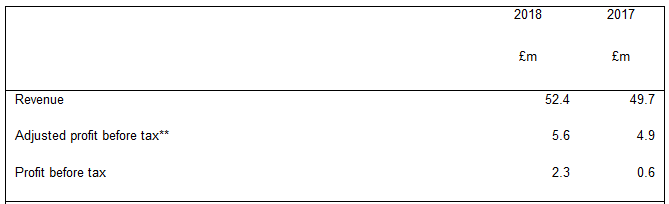

Results for the year to April 2018 are moving in the right direction:

The company made small acquisitions in February and March, and they will have contributed a sliver of the above revenues.

Its financial position has improved: net debt is at its lowest level since 2007, and the total dividend has increased for the first time since 2011.

Outlook

Given the valuation now attached to these shares, I'm a bit surprised that the outlook statement isn't more bullish.

Conditions are described as "stable". Expectations are unchanged, with continued growth to be seen from the pair of acquisitions and from organic investments being made:

Any further growth in earnings in the new financial year could be generated from a faster return on the investments we have made or an overall improvement in our counter-cyclical market conditions.

Corporate insolvencies fell slightly in 2017, according to statistics quoted by the company. Q1 2018 saw them ticking back up, but the company offers the appropriate caution:

"any sustained increase is likely to be as a result of either a marked change in interest rates or a change in the economic environment".

My view

I have mixed views on this one. I can see the argument for it playing a counter-cyclical role in a portfolio, and I agree with that.

On a standalone basis, however, it's another labour-intensive professional services outfit and its margins reflect this. The operating margin in today's income statement is a lukewarm 5.3%, an improvement compared to last year's lacklustre 3.3%.

Also, considering it purely on a standalone basis, higher insolvencies still haven't materialised yet. After such a long wait, there is still no guarantee that this will be occurring any time soon.

While I said at the top of this report that investors should try not to place too much emphasis on macro forecasts, Begbies is an example of a stock which is heavily influenced by economic conditions.

Apparently, the prospects of a rate hike at the Bank of England's next meeting have fallen from 69% to 62% in recent days. I would expect the Begbies share price to retreat, if interest rates do not rise soon.

But I can see why the share has attracted some interest. Probably the main attraction for some will be the 3.5% yield, with prospects for this to improve as Begbies continues to grow market share.

MySale (LON:MYSL)

- Share price: 68.7p (+15%)

- No. of shares: 154 million

- Market cap: £106 million

MySale Group plc (AIM: MYSL), the leading international online retailer, is pleased to provide a trading update for the 12 months to 30 June 2018 (''FY18'').

I've been following this one, on and off, since its 2014 IPO. It's always been a tricky one to figure out, as the business plan has evolved through a couple of iterations. Its share price volatility has reflected this.

When it started, it was all about flash sales of off-season stock between the UK and the Southern Hemisphere. More recently, it has started buying in its own inventory, rather than acting only as a middleman for other brands.

It has also created its own financial services product in the form of an installment plan, enabling customers to buy now and pay later.

Kudos to the company and its advisors for the simple act of stating what expectations were in this update:

The group expects to report underlying EBITDA at least in line with the top end of market expectations of A$11.8 million (FY17: A$8.7 million). This performance, which represents a significant year-on-year increase in profitability, has been driven by revenue growth of 10%, to approximately A$295 million (FY17: A$268 million), combined with improvements in the gross margin.

My view

I like the fact that the company is doing something a bit different with online fashion.

Flash sales are a big deal these days. The big US example is Groupon ($GRPN). While that one may have been horribly priced at IPO, several years later the market cap is still stubbornly sitting at $2 billion.

Perhaps there is a chance that Mysale's websites could do something similar with fashion, as Groupon has done with local deals? It's still too early to tell, and I have no idea how I might value it, but I'll be keeping an eye out for more positive news flow.

Photo-Me International (LON:PHTM)

- Share price: 115.1p (+5%)

- No. of shares: 377.5 million

- Market cap: £435 million

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces its results for the year ended 30 April 2018.

I had nearly finished this comment, and then closed the browser by mistake. Disaster! So I'm going to have to write it again.

This company has two major divisions: "Identification" (photo booths) and Laundry.

Photo booths are under pressure. These results show that revenue in photo booths is down 1.9% for the year. Japan was the worst performer, where the company says that the market has been oversupplied.

Indeed, the need to restructure Japan is what caused Photo-Me's nasty profit warning in May:

I suspect that Japan was not the only territory which saw a revenue decline in photo booths this year.

Laundry is doing much better. The number of machines being used is up 37% and revenue is up 69%. It's becoming an important part of the business, and is now 16% of revenue. Somewhat worryingly, I cannot find any reference to the margins or profits generated by Laundry, as the company uses a geographic breakdown of profitability instead of a functional breakdown.

If you look at the combined performance of all divisions, and focus on the constant currency growth rates (something I always do, to get a clearer picture), it's not terribly encouraging:

- revenues +5.9%

- EBITDA +1%

- underlying profit before tax -1.6%

- reported PBT +2.5%

Hopefully you can see that margins are falling: revenues are growing faster than everything else.

My view

I do think there is an argument for laundry units, or at least for launderettes, to make some kind of a comeback (Photo-Me does both).

People in cities might be getting richer, but they are increasingly cramped and time-poor. The increased outsourcing of the washing and drying of clothes could be a trend for many cities in the years ahead, perhaps?

So I think there is a chance that Photo-Me's Laundry strategy could work. I need to find out more about the profitability of their unattended machines, and margins generally in this business.

Stocko ranks this as a Contrarian. That makes sense. Momentum is dire, and lots of trend chasers have left the building.

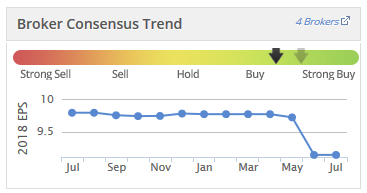

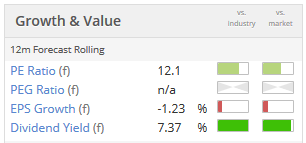

The PE ratio is now back at a level where I wouldn't hate buying shares in it:

So I am leaning towards the view that this share is "cheap" again. I think it's now at the sort of level where a value investor might want to research it in further detail and think about whether it is cheap on a 2- or 3-year horizon.

For what it's worth, brokers are forecasting PBT of c. £50 million 2020.

Premier Asset Management (LON:PAM)

- Share price: 270p (-2%)

- No. of shares: 106 million

- Market cap: £286 million

I am feeling a bit left behind with all these great results from fund managers. The only name I own in the space is Record (LON:REC), which hasn't achieved terribly much during the short period of time I've been holding it. At least I can console myself with its upcoming special dividend, for a total trailing dividend yield of 6.5% against the current share price (entirely covered by EPS).

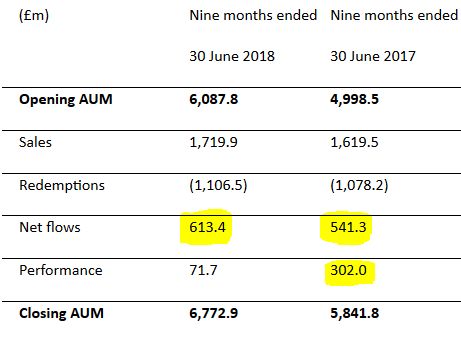

I'm not supposed to be writing about Record today, however. Today I need to cover Premier, which reports some very nice AuM growth. This is a Q3 update:

For the 9-month period, net inflows were £613 million or 10% of the starting amount: excellent. About one-third of this was delivered in Q3.

Last year was also boosted by £300 million of performance growth. That hasn't been in replicated in the current year, but is something the company has much less control over in the short-term.

65% of AUM has performed above the median over three years to June 2018. That means the same thing as being above the second quartile (see how Miton (LON:MGR) reported AUM as being "first or second quartile" - same thing).

65% is not a great proportion and we should always remember that depending on which specific asset class we are talking about, the peer group in question might not be outperforming the passive benchmark that investors can access with a cheap ETF.

It's actually quite startling, when you think about it: a company can handily outperform its peer group while still underperforming its benchmark index.

But I don't want to be harsh on Premier. If you stretch out to a 5-year view, 96% of its AUM is outperforming its peer group. That's a fine result.

Overall, AuM is up by £1 billion to £6.8 billion, compared to a year ago.

Its market cap is therefore 4.2% of AUM.

Miton (LON:MGR), which we covered yesterday, is trading at 2.4% of AUM.

Impax Asset Management (LON:IPX), covered last Friday, is trading at 2.2% of AUM.

We shouldn't automatically buy or sell fund management companies based on this yardstick. This yardstick is like a P/E ratio: it tells you where the quantitative value is, based on current AuM. But it doesn't tell you which companies have the best momentum or the best fee-earning abilities. I also haven't adjusted it for each company's cash balance.

Having said all of that, the large gap in valuation is a strong sign to me that MGR is better value at current levels, particularly when you consider that both companies are enjoying excellent momentum right now. IPX also looks good in this context. None of them look terrible!

Robert Walters (LON:RWA)

Trading Statement - a very good statement from this professional recruitment group. Net fee income is up 18% at constant currencies, led by Europe, North America and the Middle East. As far as I know, all of this growth is organic.

It's a nice little antidote to doom and gloom forecasts, when you see a global recruiter that is extremely busy!

I haven't got any opinion on these shares. They were requested by a reader, so I thought I would mention them in passing.

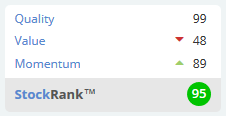

They do pass a whole bunch of quality and growth screens, and have a mighty StockRank, so you might wish to investigate further:

That's all I've got for today. Thanks for dropping by, and for your comments!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.