Hi, it's Paul here.

Estimated timings for today's report - similar to yesterday. I'll start writing sections from late morning, then will work mainly in the afternoon. Estimated completion time: 5 pm.

Update at 16:44 - today's report is now finished.

SimplyBiz (LON:SBIZ)

Share price: 200p

No. shares: 96.8m

Market cap: £193.6m

SimplyBiz (AIM: SBIZ), the independent provider of compliance and business services to financial advisers and financial institutions in the UK, today announces its unaudited results for the six months ended 30 June 2019.

The headline figures look great, but the growth has almost all come from an acquisition. Organic revenue growth was only 3%. Net debt looks a bit high too, so I'll check out the balance sheet below.

Very good adjusted EBITDA margin, of 23.4%

Note that exceptional costs are very high, at £3.0m in H1 TY, and £3.8m in H1 LY - that's worth checking out, to determine how exceptional these costs really are.

Outlook - sounds fine;

Trading has continued in line with the Board's expectations, since the end of the period. The Group remains on track to achieve market expectations for earnings for the full year.

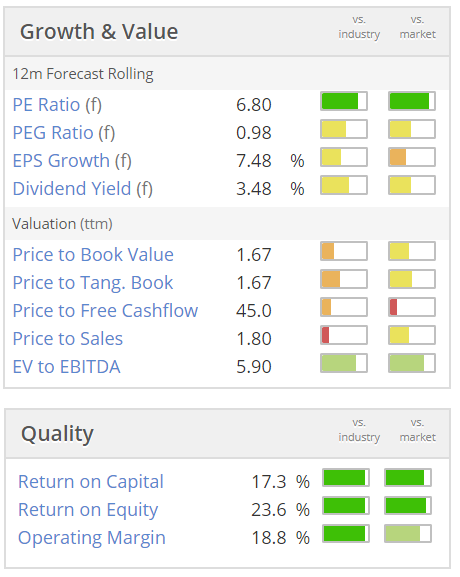

Stockopedia is showing 12.6p forecast EPS for FY 12/2019, giving a PER of 15.9 - probably about right.

Balance sheet - this is where it goes wrong for me. It's very top-heavy, with £106.6m intangibles.

NAV is £63.3m, so once we write off the intangibles that becomes heavily negative, with NTAV of -£43.3m

It has £11.6m of cash, and £41.5m of debt, giving net debt of £30.1m - that looks too high to me. Although the acquisition RNS in Mar 2019 indicated that net debt should reduce to under 2 times EBITDA by the end of 2019.

Given that revenues are recurring in nature, then maybe a stretched balance sheet doesn't matter that much? Although it makes me uneasy, as there's no cushion if anything were to go wrong.

Cashflow statement - it doesn't look very cash generative. Maybe there's an H2 weighting to cashflow? Note that £930k of development spending was capitalised in H1 2019, more than double the prior year H1 comparative.

My opinion - for me, the stretched balance sheet puts me off.

Did SBIZ over-pay for the large acquisition earlier this year? It seems to have been an aggressive price to pay.

I like the business model though, of providing subscription services for financial services companies. That makes obvious sense, given the complexity of regulation.

Arena Events (LON:ARE)

Share price: 20.5p (down 26% today, at 12:23)

No. shares: 152.7m

Market cap: £31.3m

Arena Events Group plc (www.arenagroup.com) is a provider of temporary physical structures, seating, ice rinks, furniture and interiors. The Group has operations across the UK, the US, the Middle East, and Asia, and current clients include Wimbledon Tennis, The Open, PGA European Tour and Ryder Cup.

I'm not familiar with this company. It floated in July 2017, and as you can see, it's been a flop;

H1 results today are lacklustre. It made an operating loss of -£0.8m, down from a profit of 0.3m in H1 LY. The company has a strong H2 seasonal weighting, and has decided to extend its year end to 31 Mar 2020, to better balance future half years.

Outlook - this looks like a mild profit warning;

...Given the increasing concerns about the general political and economic environment, which may affect several markets, we have taken a slightly more conservative view of the overall outlook for 2020, which we believe is prudent. Our core focus is on further organic and more profitable growth and the Board remains confident about the future prospects for the wider business.

The second half of 2019 contains a number of significant contracts that are under negotiation and not yet finalised that may or may not be secured over the coming months. Despite some project delays into 2020 and slight margin pressure due to the increased reliance on agency labour, the Board believes that adjusted EBITDA (excluding IFRS 16 adjustment) for the year ended 31 December 2019 will be approximately £13 million and we anticipate further significant growth in 2020.

The problem with that, is there's a large depreciation charge, due to this being a capital-intensive business. So EBITDA is pretty meaningless. There was a £5.2m depreciation charge in H1, so if we double that to annualise it, that's £10.4m, which consumes most of the forecast £13m EBITDA.

Balance sheet - has too much debt, in my view.

NTAV is £12.3m.

My opinion - it's not the sort of thing that attracts me at all. Lumpy, uncertain contracts, low margins, and tying up a lot of capital, funded by debt.

Having said that, the market cap is now quite low, so if it puts out good news re contract wins, then the share price might recover somewhat, perhaps.

It just looks a bit of a punt to me, hence not of interest.

RA International (LON:RAI)

Share price: 40p (down 12% today, at 15:05)

No. shares: 173.6m

Market cap: £69.4m

RA International Group plc (AIM: RAI), a leading provider of services to remote locations in Africa and the Middle East, is pleased to announce its interim results in respect of the six months ended 30 June 2019.

The description is enough to put me off. But since several readers have mentioned this company today, I'll check out the numbers, even though I wouldn't ever invest in something like this.

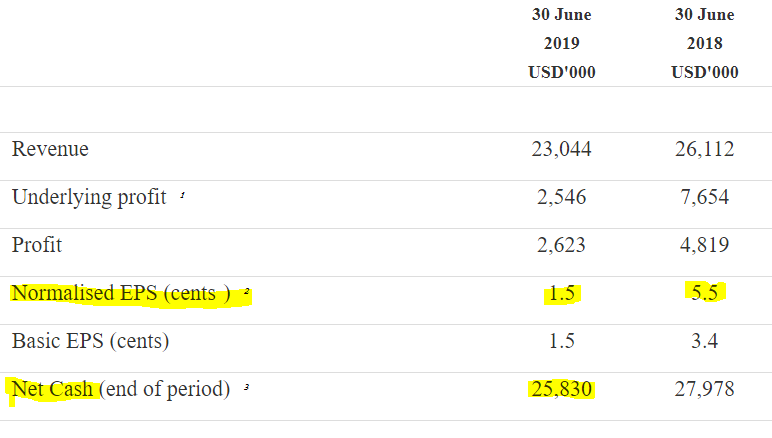

As you can see, the figures are poor (apart from the nice cash pile, which is good), with profitability having dropped by two thirds;

The contracted order book is looking healthy (although it would be useful to see a table of how the total breaks down into individual future years);

Contracted revenue backlog of USD 166m at 30 June 2019, up 39.5% from USD 119m at 31 December 2018

Outlook comments sound fairly decent;

We are pleased and encouraged by the value of contracts awarded to the Group in H1 19 and whilst the delay in being awarded a particular contract has impacted on first half financials, the Company is set for a strong second half of the year.

All contracts expected to significantly contribute to H2 19 revenue have now commenced and we continue to bid for large, long-term contracts in line with our strategic plan.

That last sentence seems to provide good evidence that a profit warning in H2 is probably unlikely.

Balance sheet - looks excellent;

NAV: $59.2m

NTAV: $59.1m (includes $25.8m cash, and no interest bearing debt, ignoring lease liabilities)

Current ratio (i.e. working capital) is outstandingly strong, at 7.39

Therefore a big thumbs up for this very strong balance sheet.

Dividends - given the strong balance sheet, it seems to me that the company has plenty of scope to increase future divis. The forecast yield is currently about 3.5%

Cashflow statement - unusual presentation, of 3 half years, which I quite like actually.

It looks a genuinely cash generative business, and is spending its cashflow mainly on capex.

My opinion - this actually looks quite good! My main worry is the whole issue of companies with overseas operations listing on AIM. And let's be honest here, Africa is not exactly low risk!

That said, the risk seems to be well factored into the valuation, which assuming it hits the full year numbers of 8 US cents EPS, puts it on a PER of 6.2 - which looks very cheap, considering it also has a lovely balance sheet with plenty of cash.

Investors also have the risk of large, lumpy contracts, and the possible problems that can cause - as indeed it has, with a delayed contract causing a two-thirds drop in interim profits.

If you're prepared to tolerate the risks, then this share certainly looks attractively priced.

EDIT: A reader helpfully pointed out that the 2 (presumably related) biggest shareholders are the CEO & COO, who combined own 79.4% of the company. This means that, since they hold over 75%, they have complete control over the company. Outside shareholders are therefore completely in their hands.

From the company's website;

TP (LON:TPG)

Share price: 6.8p (up 1% today, at 16:12)

No. shares: 779.2m

Market cap: £53.0m

TP Group (AIM: TPG), the providers of mission-critical solutions for a more secure world, today announces its unaudited interim results for the six months ended 30 June 2019.

That's a pretty useless self-description, telling us precisely nothing about what the company actually does. Thankfully there's a "note to editors" paragraph which is more useful, saying;

TP Group designs and develops advanced technologies, engineers complex equipment and systems, and provides support throughout their operational life. The Company's shares have been traded on AIM since July 2001.

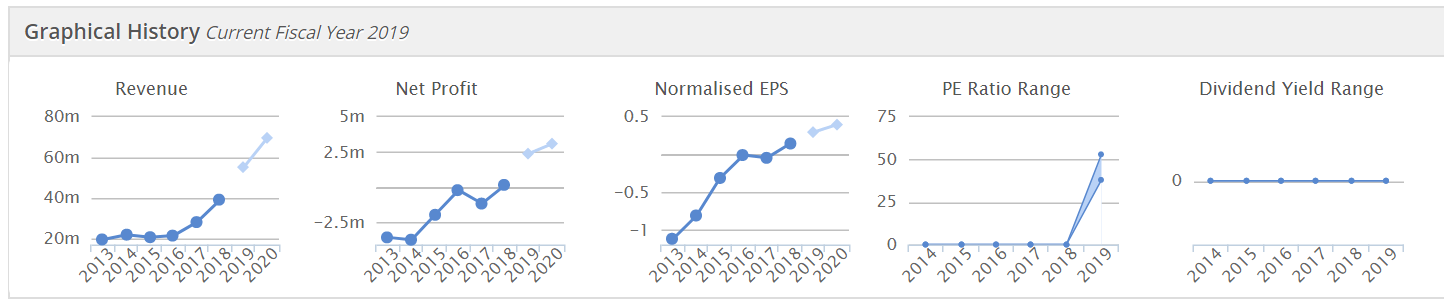

This used to be called Corac, but changed its name to TP Group in 2015. After years of poor performance, there seems to be a nice turnaround underway here;

H1 figures -

Very good revenue growth;

The Group generated record revenues in H1 2019 of £26.0m, up £10m (63%) on H1 2018 with growth in both of the Group's business streams. Of this, organic growth was £5.6m and revenue from the acquired companies contributed £4.4m.

Adjusted operating profit of £2.4m, up 161% - impressive stuff.

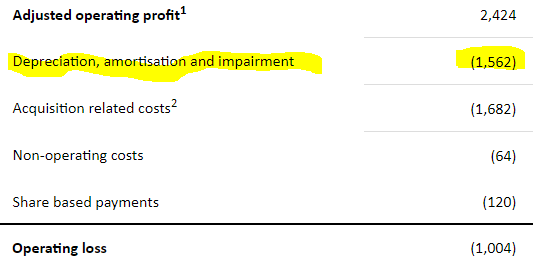

I am raising a query over the adjustments though. Here is the reconciliation, which seems to exclude depreciation in arriving at adjusted profit, which doesn't seem valid to me;

I'm not sure if this is the entire depreciation charge, or just some of it? Looking at the cashflow statement, the £1,562k seems to be the entire depreciation & amortisation charge.

Therefore I think readers need to check how realistic the adjusted profit figure actually is?

Order book statistics sound impressive too;

Pleasingly, the Group's order book continues to grow, increasing to £78.9m at the period end (31 December 2018: £48.3m). This includes £15.5m from Sapienza in addition to 31% organic growth from the existing business.

This strong order book provides visibility of approximately 94% of the full year 2019 market expectations for revenue. There is also approximately £50m in the order book that will carry forward into future years' revenues, alongside an expanding pipeline of sales opportunities valued in excess of £700 million over many years.

Outlook - the key part says;

...The Board is confident in the Company's prospects for the rest of this year and anticipates delivering a full-year performance in line with market expectations."

Given that 94% of revenues are already in the bag, then I wonder if there might be a chance of beating market expectations, if some more orders are won before the year end?

Balance sheet - reasonable, with c.£7.75m in NTAV.

The cash pile of £9m seems to have come from customers paying up-front - because there's an £11.5m creditor called "amounts due to contract customers". Therefore the cash balance makes the balance sheet look stronger than it really is.

My opinion - potentially interesting. I like the strong order book & upbeat commentary.

Worthy of a closer look, I think.

That's it for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.