Good afternoon, it's Paul here.

I see that Marks and Spencer (LON:MKS) has dropped about 5% today, on a soft-ish Q1 update. This is my largest short position, so good news for me. Shorting things seems rather unsporting, or downright evil. However, it can be a great, albeit dangerous, way to hedge long positions. It seems to me that the retail sector is facing such serious headwinds, that it's only sensible to bet against some of the weaker retail giants.

Costs are rising, but it's very difficult to achieve LFL sales increases, and maintain margins. That tends to squeeze out wafer thin profits. So the retail sector remains a blindingly obvious shorting opportunity, in my view.

Begbies Traynor (LON:BEG)

Share price: 49.7p (up 0.4% today)

No. shares: 127.7m

Market cap: £63.5m

(at the time of writing, I hold a long position in this share)

Final results - for the year ended 30 Apr 2017.

Begbies is a firm of insolvency practitioners, which is a highly regulated profession, something like specialist lawyer/accountants. They manage insolvency procedures, such as company administrations & liquidations, according to a strict & complex set of laws.

Begbies core insolvency market has been subdued since the financial crisis, because near-zero interest rates have allowed many struggling companies to survive. Banks have been more tolerant of struggling companies than in previous recessions, as recoveries of debts have often been better by allowing companies time to restructure.

I interviewed the Exec Chairman here in Oct 2016.

In recent years, Begbies has kept careful control of its overheads, and bought in some growth, by making complementary acquisitions - e.g. property auctioneers.

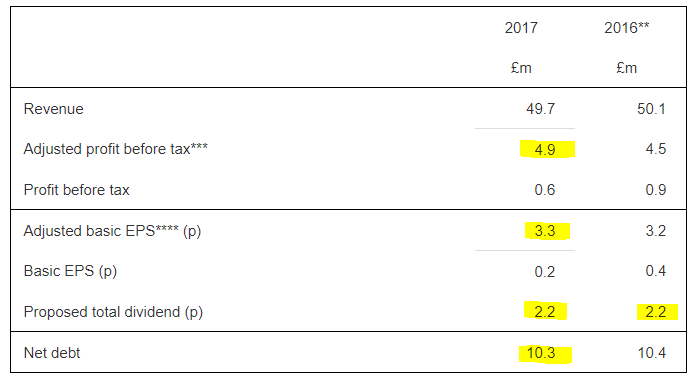

As you can see from the financial highlights section, progress has been steady, rather than spectacular;

The PER is 15.1 on the actual adjusted EPS. That may seem a tad pricey, given the tepid earnings growth. However, I think this should be seen in context, as possibly low point in the cycle for earnings. The company says insolvencies are at the lowest point since 2004.

One broker note I've seen had 3.2p forecast EPS for 4/2017, so it looks like a slight beat.

Dividends - the 2.2p divi is maintained, which has been static for many years now. That's a useful yield of 4.4%.

Outlook - more detail is given, but the key part says this;

Overall, we anticipate a growth in earnings in the new financial year. We will continue to look for further opportunities to develop and enhance the business, both organically and through selective acquisitions.

That sounds alright.

Forecasts - I've only seen one broker note, which has 3.7p adj. EPS pencilled in for 04/2018, and 4.2p for the following year. Therefore the PER should steadily drop to about 12, if these reasonable-looking forecasts are achieved. Plus divis on top, of course.

Balance sheet - this is a special case, due to the sector in which it operates.

Debtor days is extremely high, normally something which is a massive red flag. However, insolvency practitioners finance cases through bank debt, then they get paid at or near the end of a job. So a big debtor book, financed from unsecured bank loans, is perfectly normal.

Cashflow statement - looks good, and I don't see anything untoward.

My opinion - I like this stock, and hold some personally. The attraction is that it's counter-cyclical, i.e. the business should improve in a declining economy - so it acts as a natural hedge in a portfolio of shares. Plus it pays nice divis, even in the relatively lean times, such as now.

I like that management seem down-to-earth, and have a track record of steady success, in a sector where I think virtually all other listed competitors have gone bust over the years.

It's not a massive conviction position for me, but just something I like to have as a middle-sized position in my portfolio. I'd say the share looks priced about right for now, so am not in a rush to buy any more.

McBride (LON:MCB) - there's an in line update for the year ended 30 Jun 2017;

Adjusted operating profit for the full year is forecast to be in line with expectations.

As anticipated, trading conditions in the second half year remained challenging. Against that backdrop, McBride's ongoing initiatives to manage gross margins and maintain close control over its overhead cost base were effective in mitigating the impact of competitive markets and raw material price inflation.

This company (a manufacturer of household & personal goods) seems to have done a really good job in focusing on higher margin business. However, where's the growth? It's capital intensive too.

My opinion - it's been a really good turnaround, but I'm not sure where it goes from here, to achieve more earnings growth?

People who spotted the turnaround starting in early 2015 have done very well, more than doubling their money. I suspect it might be a lot harder to double your money again on it from here.

Ilika (LON:IKA) - this is a jam tomorrow, loss-making share. It has a facility near Southampton, which I visited in Jan 2014. Lots of high tech equipment was whirring away, with pipes and cables coming out of them all. Apparently all sorts of marvellous new materials for industrial processes were being developed. It all sounded great.

As you can see from the 5-year chart, the price is just drifting down. Every now and then, the company has to raise more cash, on promising-sounding progress, but then nothing much happens afterwards.

The figures today, for y/e 30 Apr 2017, look dreadful, as usual.

An operating loss of £3.9m (same as last year), on turnover of about £1m, most of which is grant income.

Retained losses are now £24.2m, with nothing much to show for it.

My opinion - this is a total punt. The company might come up with a blockbuster product, or it might just continue to promise that it's on the cusp of a breakthrough.

So, one for gamblers (who might one day get lucky), not investors.

Amino Technologies (LON:AMO) - Interim results look good, and a nice positive outlook statement;

Having delivered a strong performance in the first half, we expect to continue our progress in the remainder of the year and beyond. Our sales pipeline is robust and we are confident that we will deliver full year profits in line with market expectations.

The valuation seems undemanding. Worth a closer look, I'd say.

Bango (LON:BGO) - I looked into this one recently, and concluded that the valuation looks extremely aggressive, and relies almost entirely on jam tomorrow promises.

The £126m valuation looks crackers to me, for a business that's only forecast to do £5m turnover, and make a small loss in 2017.

That's it. See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.