Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

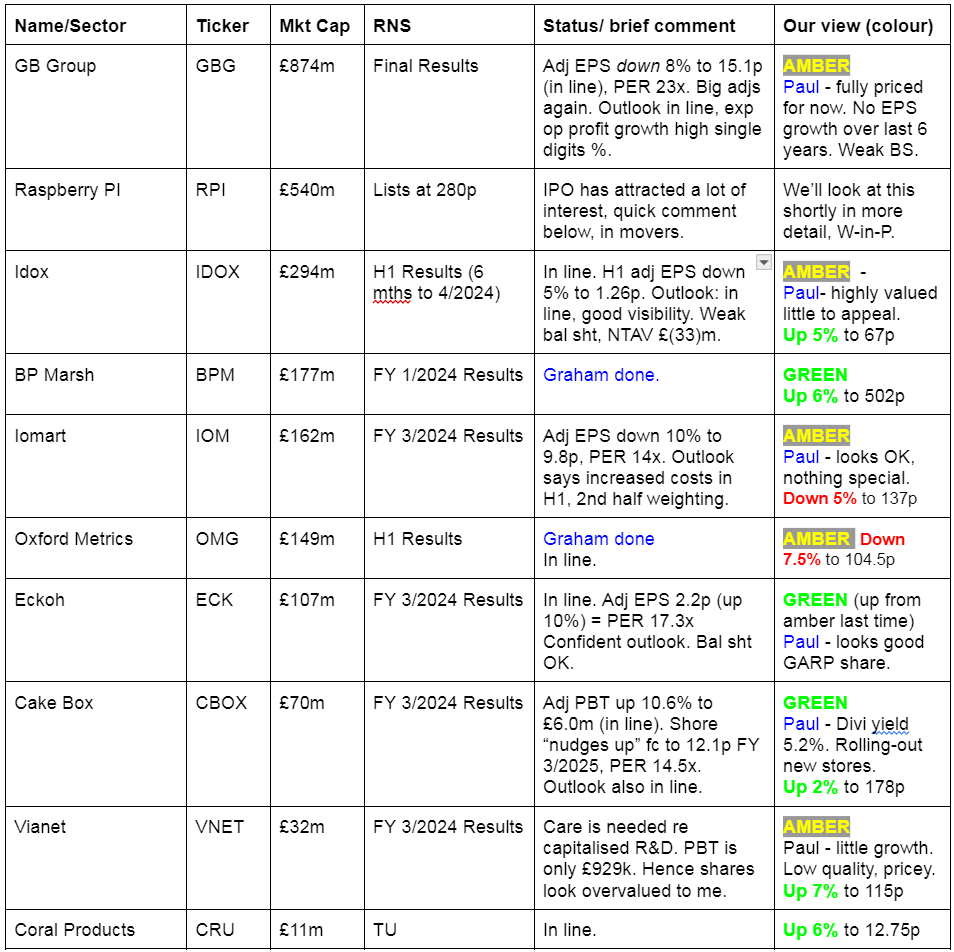

Companies Reporting

Other mid-morning movers (with news)

Raspberry PI (RPI) - up 34% to 375p (£724m) - IPO dealings commence -

It’s great to see an interesting company IPO on the London market. My view is that many of the problems in the London market have actually been caused by brokers floating overpriced junk, especially in 2021, killing off investor appetite for new issues. They killed the golden goose, chasing after fees, and it’s taken several years for that damage to be digested. Let’s hope RPI is the start of a new era of better quality, more credible UK floats. I started to review the prospectus last night, so we’ll get something up about it, maybe tomorrow.

In the meantime, in the first half hour of trading, RPI shares have gone to a lovely 34% premium - the float price was 280p, and it’s currently (08:35) at 375p. An excellent start! No colour yet, as I haven’t properly researched it yet.

Oxford Instruments (LON:OXIG) - up 9% to 2,685p (£1.55bn) - positive market reaction to FY 3/2024 results, which don’t look particularly exciting to me, with adj EPS down 3% to 109p (in line with expectations), a PER of nearly 25x, which looks a punchy rating. Outlook -

“Given our strong order book and pipeline, coupled with positive business improvement actions, we expect to make good constant currency progress in the full year ending March 2025."

Decent balance sheet, includes £84m net cash (excluding lease liabilities). A small acquisition is also announced.

Novacyt SA (LON:NCYT) - down 12% to 61.4p (£43m) - settles out of court its legal dispute with the Dept Health in UK (DHSC). NCYT will pay £5m to DHSC, without any admission of liability or wrongdoing. Strange, because on 21/4/2024 Novacyt told the market that DHSC’s case against it was weak, and it expected it to be thrown out.

Summaries

B.P. Marsh & Partners (LON:BPM) - Final Results - up 6% to 502p - Graham - GREEN

We already had a full-year update from BPM, but today’s announcement provides additional commentary on the excellent performance in FY Jan 2024. We also learn that this cash-rich company is launching a £1m share buyback and is willing to buy its shares at only a 15%+ discount to NAV (previously 20%+).

Oxford Metrics (LON:OMG) - Interim Results - down 8% to 104.2p (£137m) - Graham - AMBER

These are fine results in the sense that the company is on track to meet full-year expectations with a high degree of revenue visibility and excitement around its future plans. However, personally I’m disappointed with the fast rate of decline of the cash pile. Overall, the financial performance seems lacking to me.

Graham's Section

B.P. Marsh & Partners (LON:BPM)

Final Results - up 6% to 502p - Graham - GREEN

B.P. Marsh & Partners Plc (AIM: BPM), the specialist private equity investor in early stage financial services businesses, announces its audited Group Final Results for the year ended 31 January 2024.

I’ve been positive on this one for some time, e.g. in February when they published their full-year trading update.

At the time of that update, I covered the full-year performance (to Jan 24) in some detail. Here are the key bullet points we need to know:

PBT £43.6m (previous year: £27.6m)

NAV £229m (previous year: £189.5m)

Three new equity investments made during the year.

Since the new financial year began, BPM has made one new investment (and two follow-on investments).

BPM’s main problem has been what to do with all the cash it has been receiving.

£51m was received for a major disposal last year.

Another major disposal was announced in December 2023 (“Paladin”). This deal completed in the new financial year for an upfront payment of £42m.

In January, BPM released an RNS titled “Use of Proceeds of Sale and Strategy Confirmation”, in which they announced that £4m would be paid in dividends to shareholders every year for the next three years. After setting aside money for this purpose, they would still have £74.5m (!) for use in developing their investment portfolio.

Let’s turn back to today’s full-year results statement and see what management has to say.

Chairman Brian Marsh is as enthusiastic as ever about investment prospects::

"From inception over 30 years ago our investment philosophy has been consistent and continues to deliver strong returns. This latest increase in NAV is testament to our strategy, enabling the Company to continue to invest in high quality management teams as well as rewarding shareholders.

"Looking across our portfolio and the new opportunities we see, I am confident that B.P. Marsh remains the partner of choice for exciting start-up insurance intermediaries, which will drive further growth in the future."

Buyback policy:

The Group remains committed to its Share Buy-Back Policy of being able to purchase shares when able to. Following the strong Share Price Performance the Group has agreed to amend its Share Buy-Back Policy to reduce the discount to Net Asset Value threshold from 20% to 15% and has allocated up to £1m in the aggregate for this purpose.

In a separate RNS today, the company does announce a £1m share buyback, “subject to Ordinary Shares being available to purchase at a price representing a discount of at least 15% to the most recently announced diluted NAV per share prevailing at the time of repurchase.”

The most recently announced NAV per share is 629p, and a 15% discount to this is 534.65p. Therefore even after this morning’s increase in the share price, the company will be able to buy back its shares.

Investment activity (since year-end)

March 2024: 30% stake in Devonshire UW Limited and loan funding.

May 2024: existing 25% stake increased with a further 7% in Pantheon Specialty

Comments by Chief Investment Officer:

The insurance market is consolidating, giving rise to opportunities: “Both the Group and its portfolio companies continue to be approached by entrepreneurial individuals and teams who do not wish to be part of this consolidation process.”

Insurance rates are rising more slowly (1%-3%), due to market capacity increasing: “Overall, whilst the market is softening, the Group does not see the market returning to the pricing of the last soft market in the short to medium term. Given the portfolio predominantly operates in specialist risk areas, rates tend to be less volatile and therefore we remain confident that our portfolio is suitably prepared to weather a softening market.”

Graham’s view

No reason to change my positive view on this one. Besides the long and enviable track record of investment success, the valuation here remains attractive to me.

The company clearly thinks the same as it embarks on further buybacks. Note that the shares aren’t too liquid: Brian Marsh himself owns 38% of the company:

Checking the very useful Director Dealings tool, I see that Mr. Marsh (age 81) sold over 900,000 shares in Feb 2024. However, checking the details, I see that it was his charitable trust that sold the shares, not he personally. So I wouldn't read too much into that.

With a stable management team, a fine track record of investment success, a discount to NAV, and a clear plan to buy back shares at a discount to that NAV, I feel obliged to keep giving this one the thumbs up.

Oxford Metrics (LON:OMG)

Interim Results - down 8% to 104.2p (£137m) - Graham - AMBER

Oxford Metrics plc (LSE: OMG), the smart sensing and software company, servicing life sciences, entertainment and engineering markets, announces unaudited interim results for the six months ended 31 March 2024.

The headline here is “on track first half revenues, driven by strong execution”.

Despite being “on track” in terms of revenues, profits have gone into reverse:

Estimates: checking the estimates from Progressive Research this morning, I find that they have made no change to forecasts, and indeed they say that OMG are “well set to meet expectations”.

These expectations include adj. PBT of £7.9m for the current year. It’s hard to argue against that with £4.0m already in the bag in H1.

Revenues are up 10.5% but with huge divergence in different business lines, e.g. Life Sciences revenues were up 38% (to £8m) while Entertainment revenues were down 22.8% (to £8.5m), due to “the global games industry contraction”.

Net cash falls by nearly £9m to £54.8m.This is thanks to £3.6m in dividend payments and a £6.2m acquisition.

Additionally, according to the commentary, cash was “deployed for working capital purposes to augment inventory and underpin second half performance”.

Checking the cash flow statement, I see that there was a £1.5m drag from increased inventories.

Against that, the positive net cash flow from operations was £2.2m. That’s a better figure than last year but it doesn’t inspire me, especially considering that the company had other factors pulling on its cash pile even beyond those I’ve already mentioned (£1m in capex and £1.4m of spending on intangibles - these alone would be sufficient to wipe out the operating cash flow).

So it seems like a poor cash flow performance to me. Checking briefly the figures from the previous financial year (FY Sep 2023), I must say I’m a bit concerned about OMG’s free cash flow numbers.

Stockopedia’s calculations will back up what I'm saying here:

Management - the company has a new CEO (since Oct 2023, previously at the company’s main operating business Vicon) and a CFO who begins next month.

CEO comment:

"Now over halfway into delivering our five-year plan, our teams are in full execution mode..

Our recent acquisition of Industrial Vision Systems has been a successful move, it's performing well and we are excited about the opportunity to drive yet more applications into the smart manufacturing space…

As Vicon works towards commercialising markerless, which enables 3D motion capture without the need to wear motion capture suits or markers, we are working with seven cornerstone customers to make the product the gold standard.

Looking ahead, Oxford Metrics enters the second half with >90% visibility of full year revenues and with a growing pipeline, the Board believes the Group is well placed to deliver results in line with current market expectations."

The outlook statement repeats many of the above points.

Graham’s view

I want to like this stock, as it’s a cash-rich scientific business with a long track record of profitability.

However, there are a few points holding me back:

Weak free cash flow performance after capex and development spending.

Moderate revenue growth and falling profits.

A completely new management team always brings some uncertainty.

For what it’s worth, the new CFO was a Finance Director at Sprue Aegis Safety Products from 2010 before becoming CFO of FireAngel (the new name for Sprue Aegis plc) in 2019. Sprue Aegis and FireAngel are names that investors are unlikely to remember fondly.

Above all, the answer to the question of what OMG plans to do with its cash pile seems to be: a) spend it on acquisitions, b) spend it on internal capex/development spending, c) drip out the rest of it in dividends.

I’m not seeing enough here to take a positive stance, so I’m staying neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.