Good morning! Paul & Jack here with the SCVR for Tuesday. Today's report is now finished.

Agenda -

Jack's section:

Calnex Solutions (LON:CLX) - I hold - acquisition of iTrinegy, which provides testing for gaming, military, tech, and financial organisations including JPMorgan and Ubisoft. Calnex has a plan for scaling the business up and expects this new addition to contribute significantly to profits in the years ahead. Beyond that, the group says FY22 results should be ahead of expectations. Arguably reflected in the price though, so the key thing to consider is whether you’re comfortable with the valuation.

Argentex (LON:AGFX) - shares down this morning despite full year revenue growth of 23%. Presumably the group has not matched expectations, but the valuation is now quite modest and it’s possible the fall is overdone. If management can begin to impress the market, then there’s a rerating opportunity as the valuation discount to peers is now quite wide.

Hornby (LON:HRN) - looks like solid Q4 results for the owner of Hornby Trains, with full year sales and margins in line with budget. There are supply chain challenges though and, while there are some positive developments (namely a return to profitability), I’m mindful that turnarounds can often take longer than expected but there is potential upside, so it stays on the watchlist.

Paul's section:

Cambridge Cognition Holdings (LON:COG) (I hold) - as expected, strong revenue growth of +50% (organic) has moved the company into profit. A much larger order book gives really good visibility for 2022. Forecasts are set low, so it should beat expectations as 2022 develops. Plenty of cash on the balance sheet, so no need for any more dilution. COG is benefiting from long-term sector tailwinds. Hence this looks an attractive growth share, and shouldn't be impacted by macro issues.

Warpaint London (LON:W7L) - a sparkling trading update, with very strong Q1 performance across all channels. Broker upgrades today look too cautious, so I think this company now looks set up to continue out-performing. This year's indiscriminate selling looks to have created a nice buying opportunity, and you get paid to wait, with an attractive divi.

Supreme (LON:SUP) - a strong performance for FY 3/2022 is reported. Shares are down 18% today on a mild profit warning for FY 3/2023, due to higher costs (hardly surprising). Broker forecastfor FY 3/2023 is reduced by 8%, and a lovely yield of 4.7% is forecast. This share looks good value now, so I give it a thumbs up.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Cambridge Cognition Holdings (LON:COG) (I hold)

175p (yesterday’s close)

Market cap £55m

Cambridge Cognition Holdings plc, a technology company which develops and markets patient-focused solutions to better assess brain health, is pleased to announce its unaudited preliminary results for the year ended 31 December 2021.

Revenue - up very strongly (+50%) to £10.1m - this is a step change, as revenue was previously always in the £5-7m range over the last 10 years.

It shouldn’t be a one-off either, as the contracted order book has been growing strongly, ending the year at £17.0m (up from £11.2m a year earlier)

Excellent visibility, with at least £7.5m of the order book expected to turn into revenue in 2022.

Moved into profit for FY 12//2021, of £0.5m after tax (versus £(0.4)m loss in FT 12/2020), reflecting R&D tax credits. PBT was £0.3m.

Ahead of expectations, says the commentary from COG, at 1.4p EPS (the StockReport shows consensus forecast of 1.28p).

Outlook - upbeat, but no figures provided on current trading -

We made excellent progress in 2021, delivering strong growth in orders, revenues and cash generation, together with moving into profitability and earnings ahead of market expectations. Furthermore, with a strong contracted order book providing excellent visibility of revenue through 2022 and well-beyond, we expect the company is well placed for further success. There does remain some uncertainty due to COVID-19 and the wider impact of the war in Eastern Europe, though these are considered limited at this time.

We have set out three growth strategies to expand market share in current markets, automate more assessments as demand increases for virtual clinical trials and seeking corporate business development opportunities. Each of these represents exciting growth opportunities for Cambridge Cognition.

With this clear growth strategy, together with a substantial pipeline of opportunities in an expanding market, leading market position and strong balance sheet, we believe Cambridge Cognition is positioned to deliver substantial, sustainable shareholder value in 2022 and beyond.

"We are delighted to have delivered above-market growth and a profitable year of trading. The demand for digital outcomes assessments for clinical trials is forecast to continue to grow. With these tailwinds, we have evolved our strategy and plan further investment in developing digital biomarkers and corporate business development, as well as continuing with a focus on commercial execution. We believe we are well placed for more success in 2022 and beyond."

Balance sheet - adequate, with NTAV of £259k. There’s hardly anything in fixed assets, as it’s a knowledge-based company. Cash pile of £6.8m is healthy, and up from £3.0m a year earlier.

Receivables look high at £5.1m.

Current liabilities offset nearly all current assets, so COG seems to have a favourable working capital position - i.e. collecting in some cash up-front from customers.

Cashflow statement - amazing, there’s hardly anything in it! Strong cash generation in 2021.

My opinion - good progress, and profitable now. There’s a big order book, providing strong visibility.

The main thing with COG, and why I like this share, is that it’s benefiting from an industry tailwind, accelerated by the pandemic, to do cognitive testing (for drug development) via the internet, which is what COG specialises in. There’s little competition, and big barriers to entry.

How to value it? As it’s only just broken into profit, PER doesn’t make any sense at the moment.

I think we can safely anticipate increased future profits, Dowgate has issued a new forecast this morning (many thanks) raising 2022 profit guidance by 10%. It’s only showing modest revenue growth though, and profitability flat at £0.3m for 2022 & 2023, which seems way too conservative to me, so I’m expecting COG to be able to beat those numbers, hence out-perform trading updates should some through later in 2022.

.

.

Warpaint London (LON:W7L)

141p (up 13%, at 08:35)

Market cap £108m

Markets are incredibly tough for UK small caps right now, so W7L being up 13% this morning in reasonable volume, then this trading update must be good.

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to announce an update on current trading ahead of the release of the Company's results for the year ended 31 December 2021 on Tuesday 26 April 2022.

Strong trading performance continues into Q1 2022

We already knew FY 12/2021 trading was good, as announced on 1 Feb 2022, so no surprises there.

Q1 2022 continued positive momentum - sales up 60% vs 2021 (all brands up). I thought this might be due to soft prior year comparatives, but that’s incorrect - the 2021 trading update at this time last year was good, I’ve just checked. Last year’s update is so similar to this year’s update, that I had to double-check I wasn’t accidentally reading the wrong one! A notable difference is that last year gave the cash position, which this year’s does not.

Gross margin in Q1 2022 is up on the FY 12/2021 gross margin, despite higher input costs and freight costs. This seems to show that W7L has decent pricing power, and is able to pass on cost increases - absolutely key in this time of higher inflation.

Tesco shops - sales doing well, more shops being added.

Boots - performing in line with Boots & W7L’s expectations.

Significant new contract with another major grocer has been won.

USA - growth.

Online sales in Q1 up 29% on LY, helped by launch in China, which is expected to make a “meaningful contribution” in future.

Webinar is at 17:30 on 26 April - details in the RNS.

Broker upgrades - thanks to both Shore, and Singers for updated notes today. I’m struggling with poor wifi on a train at the moment, making my way to Malta for a break, given how miserable things have been this year I felt I would benefit from a change of scene, and some warmer weather. Anyway, I’ve managed to download Shore’s note, which is only forecasting a modest rise in EPS from 7.0p in 2021, to 8.0p in 2022. Revenue growth is assumed to only be 12% in 2022, which seems very cautious given that Q1 actual is +60%.

Hence I think we can probably assume that EPS is likely to come in well ahead of 8.0p for 2022, with further upgrades likely as 2022 progresses. That’s a nice setup.

My opinion - this looks really good, I’m impressed.

I reckon 2022 EPS is likely to come in a good bit higher than forecast, maybe 10p+?

At 141p, the share price therefore looks reasonable, maybe even cheap.

You get decent divis while you wait too, with a yield of c.4%

This looks an attractive share, at a reasonable price. It gets a thumbs up from me.

Even in poor macro conditions, companies selling attractive products at sensible prices, can still do well.

.

CHART

Supreme (LON:SUP)

155p (down 18% at 11:25)

Market cap £181m

Supreme (AIM:SUP), a leading manufacturer, supplier, and brand owner of fast-moving consumer products, provides a trading update for the twelve months ended 31 March 2022.

Here are my notes on today’s trading update -

FY 3/2022 guidance provided today is: revenue >£130m, and adj. EBITDA >£21m (up 9% on LY [last year]).

A note from Equity Development helpfully translates EBITDA into proper profit (before tax) of £17.8m.

Strong performance in FY 3/2022, the company says.

Core business (vaping products) doing well, with 10% revenue growth, expected to continue. Gross margin up, due to manufacturing improvements.

Batteries & lighting division is doing OK, modest growth, but improved gross margins.

Sports nutrition - this is small, but rapidly growing, revenue growth of over 100%. A key ingredient (whey) has sharply risen in price, thus denting profits.

Outlook for FY 3/2023 - cautioning on higher costs, as I would expect right now, because we’re in a period of elevated inflation.

Looking at FY23, the Group is expecting to deliver another year of profitable growth and increasing levels of cash generation, predominantly driven by Supreme's strong Vaping sales footprint. However, this performance will be tempered by commodity price inflation within Sports Nutrition & Wellness and the increases in the overhead base relating to wage and transport costs.

Management has already taken steps to mitigate the external factors, including buying forward whey, and will also be continually reviewing potential price increases and ongoing manufacturing and distribution rationalisation.

The Group remains fully focused on driving organic growth, closely balanced with strategic acquisitions, having agreed a new £25 million RCF facility with HSBC in March 2022.

The Board remains confident that the Group will continue to deliver both organic and acquisition led growth this financial year and beyond.

ED has trimmed its forecast EBITDA for FY 3/2023 by 8%, to £22m. Hardly a disaster, providing this is not the first in a series of downgrades.

Forecast EPS is 12.2p for FY 3/2022 (PER 12.7), and

13.3p EPS for FY 3/2023 (PER 11.7)

That strikes me as very good value.

Particularly as the forecast divis are set to rise from 2.1p, to 7.3p, giving a forecast 4.7% yield at 155p per share. That’s attractive, and when I’ve analysed Supreme before, I concluded that the cashflows look impressive, and are real, not accounting chicanery. It’s made some bolt on acquisitions from internal cashflow too.

The history of the company is very interesting, and the owner/manager, Sandeep Chadha still owns 57%. He seems to be a natural entrepreneur with real flair for spotting lucrative markets to enter.

My opinion - I think today’s fall looks a good buying opportunity, if you like this company.

It is dependent on vaping, which means potential risk, if for example it’s found to be dangerous, and gets banned.

A mild profit warning due to higher costs is fine in the current environment I think, and doesn’t undermine the fundamental attractions of this share - especially the decent ongoing growth from the core vaping product, plus explosive growth in sports nutrition. Yes, input costs are higher, but that’s likely to be passed on to customers in due course.

I’ve no idea what the short-term share price will do, your guess is as good as mine. In terms of fundamentals though, I think this share looks attractive at 155p. It’s going on my list of possible purchases, where typically at the moment I’m dipping my toe in with a small initial purchase, then adding more if it keeps falling. Some people like to wait for the price to start rising before buying, which is perfectly rational, as it shows improving investor sentiment. Everyone’s got their own strategy, so obviously that’s up to you to decide.

Overall though, SUP gets a thumbs up from me.

.

Jack’s section

Calnex Solutions (LON:CLX)

Share price: 157.5p (pre-open)

Shares in issue: 87,500,000

Market cap: £137.8m

(I hold)

Trading update and acquisition

This is a provider of test and measurement solutions for the global telecommunications sector. It’s been a rather rare successful IPO, with the shares now trading at multiples of the float price.

The group has acquired iTrinegy, which is a ‘developer of Software Defined Test Networks technology for the software application and digital transformation testing market’, for £2.5m in cash. A further £1m is payable dependent on meeting financial targets. This acquisition should be earnings enhancing in FY23 and will be ‘an important contributor to Calnex Group profit in subsequent years.’

iTrinegy was founded in 2006 and has its HQ in Stevenage, and its Network Emulation platforms provide tech, financial, military, and gaming organisations with the ability to recreate real-world network test environments. That means the company’s clients can verify the performance of applications before deployment, reducing the risk and improving the quality of their operations. The client list has some impressive names, including JPMorgan Chase, Ubisoft Games, and the UK and US government and military.

Calnex also notes that iTrinegy’s NE-ONE platform is also applicable to the ‘rapidly growing’ cloud-based and virtual development and testing environments sub-sector, meaning the company should benefit as more enterprises migrate from on-premise hosted solutions to cloud-based hosting.

Calnex plans to scale the business up by using its sales and marketing capabilities to support and grow a reseller network, which should accelerate sales (particularly in the US). In the year to 30 September 2021, around 60% of iTrinegy’s £1.4m revenue was from North American customers.

Trading update - Calnex continues to experience high demand for its solutions. The component availability shortages flagged in the update on 1 March have so far been successfully managed, with all planned orders shipped. Therefore, results for FY22 should be slightly ahead of expectations.

The order book is building and sits at record levels.

Conclusion

You’re paying up for a quality operator here. This is currently the most ‘expensive’ share I hold, but there are attractive long-term growth prospects to back it up.

That doesn’t entirely negate short term valuation risk, so I wouldn’t be surprised to see the shares come down should the market mood deteriorate. Calnex is also not afraid to sacrifice some short term profit in order to invest in the more significant longer term opportunity - that could at some point disappoint the market if shareholders are expecting a straight line upwards, forever. Which sometimes seems to be the case.

But this is a fundamentally attractive enterprise with good trading momentum. From a factor profile, it’s a classic ‘High Flyer’:

There’s no comment on the net income of iTrinegy, but the c80% gross margin is attractive and the price/sales of 2.5x is well below Calnex’s own punchy 7.06x. The group appears to have a solid strategy for growing the business, which has some notable customers already.

It’s all going well here, which is reflected in the valuation, so beyond that it comes down to whether or not you think Calnex can become a substantially larger enterprise over the medium to long term.

Argentex (LON:AGFX)

Share price: 72.81p (-7.6%)

Shares in issue: 113,207,547

Market cap: £82.4m

Trading update for the year to 31 March 2022

Argentex provides foreign exchange services to institutions, corporates and high net worth private individuals. There’s a growth opportunity in this market, but Argentex’s performance has recently lagged some of its peers by some margin.

Revenue growth for the year of 23% to £34.5m has been driven mainly by targeted investment in strengthening its team, broadening its geographic reach, and taking more market share. Corporate clients have grown from 1,385 to 1,624 and Argentex also continues to invest in its technology proposition.

That sounds positive to me, but the shares are down by around 5% this morning, so people must have been hoping for more. I can’t see any research for the company, so if anyone has access feel free to shed light in the comments, as I suspect this is a case of sub-optimal market expectations management.

Underlying profit margins are ‘broadly’ in line with last year at 30.9% (it would be good to have more detail here), the Netherlands office has grown half-on-half, and the Australian operation is set to launch in the current financial year. A new technology-enabled trading and client service platform has also been launched, ‘the first in a suite of upcoming developments underpinned by a new technology strategy’. So there’s plenty going on that might drive organic growth.

New appointments - David Christie appointed as Chief Operating Officer and David Winney as Global Chief Compliance and Risk Officer.

And a brief comment on exposure to the Russia-Ukraine conflict:

Our portfolio is matched with blue-chip institutional counterparties and remains heavily weighted to major currencies, with over 83% allocated to GBP, EUR and USD. The Group has no direct currency exposure to the Russian Rouble and continues to closely monitor the wider potential impacts of the Russia / Ukraine crisis.

Conclusion

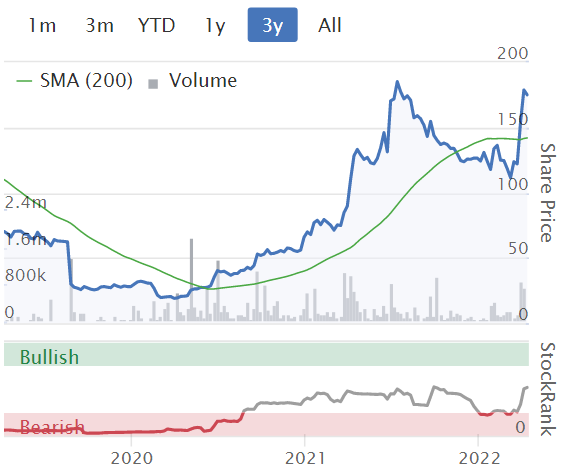

Argentex intends to grow its international operations, improve its technology, and invest in people. Revenue has been expanding, but the group’s share price chart shows a different story:

Relative performance lags that of Equals (LON:EQLS) and Alpha Fx (LON:AFX), but the shares also offer much better value. You can see the StockRank improving materially in the chart above as well, so from a purely quantitative perspective, there could be something worth digging into here.

If it can meet or surpass expectations and prove some momentum, then the shares could well rerate as there is a good growth opportunity facing these companies.

Setting and managing expectations is a peculiar confidence trick. More detail on profits, cash generation etc. would be welcome, but Argentex revenue is up 23% and the shares are down (and have now more than halved from the 2020 all-time high), with a single-digit forecast PER. That strikes me as harsh, but the company is not matching the kind of momentum shown by Alpha and Equals.

The Quality Rank of AGFX is 97, which is encouraging. There’s an interesting question here around which factor horse you’d rather back: Quality Value, or Quality Momentum?

Hornby (LON:HRN)

Share price: 34.99p (+6.03%)

Shares in issue: 166,927,838

Market cap: £58.4m

Trading update for Q4 to 31 March 2022

The share price has returned to a more realistic level after a brief spike upwards for this international models and collectibles group.

This is the owner of Scalextric and Hornby train sets, currently undergoing a deep turnaround with specialist investor Phoenix Asset Management on board as a majority shareholder. That means the free float is small and liquidity is poor, with a 606bps spread.

Group sales for the 4th quarter were very encouraging and ahead of the same period last year. As a result, cumulative group sales and margins for the financial year ended 31 March 2022 were in line with budget and ahead of the prior year. The Group will report a profit for the year having first returned to a position of profitability in the prior year.

However:

Managing supply chains continues to be challenging with extended shipping times from our partner factories and disruptions in UK deliveries into our warehouse due to a lack of drivers and fuel. Electronic components availability and lead times have also impacted our ability to increase sales further during the financial year ending 31 March 2022.

That’s an ongoing risk, but you could take it as a potential positive as well: if supply chains had been healthy, perhaps outperformance was on the cards.

Net cash of £3.9m, down from £4.7m in the previous quarter.

Conclusion

That’s it for now, more detail will be in the full year results announcement in June.

I’m genuinely curious about this situation, as there must be some value in leisure brands with such heritage, which appeal to hobbyists. There’s a surface comparison to be made with Games Workshop (LON:GAW) and its fantasy miniatures, although there is far less scope for world-building and intellectual property growth.

Previously, I’d considered the shares too expensive given where the group is in its turnaround, but now we’re back to nearly 1x sales. Turnarounds take time, so I continue to keep a watching brief here. There’s been a lot of equity dilution here, in order to finance the recovery. The hope is that these days are over now with a return to profitability.

Even now though, the share price factors in a degree of profit growth. And the world has moved on, in terms of toys and distractions. The group’s products don’t resonate with me personally, so I don’t have much of a feel for customer loyalty and stickiness. That’s important, because whether or not the shares represent good value depends on the potential scale of recovery.

One key point in the Games Workshop comparison is that Warhammer has a rich universe, virtually unparalleled, which can be licensed out to more modern media in order to retain relevance for younger generations.

I’ll stay on the sidelines for now, as other investors might have a far deeper understanding of this market and Hornby’s products than I do, so I doubt I have any kind of edge. The tightly held shares also suggest the price could move quite fast should the market’s perception change here, so it might never offer the kind of discount I would be looking for.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.