Good morning, it's Paul here with the SCVR for Tuesday.

Thank you to everyone involved in Mello Monday investor webinar last night. The numbers are steadily growing, not far off 500 investors attended last night, a new record. The highlights for me were veteran fund manager from Schroders, Andy Brough, who is always a terrific speaker, full of insights and often very amusing anecdotes! Also, Stephen Clapham continues to impress, with interesting perspectives. I must read his new book, The Smart Money Method. Has anyone here read it? Views please!

Our own Jack gave a good review of Foxtons (LON:FOXT) (I hold) which is an interesting share. I think a lot of people are coming round to the view that the work from home (WFH) trend could gradually reverse. Anecdotally, I'm hearing that the novelty, even joy, of being at home with their children all the time, has worn rather thin with many city workers, who can't wait to get back into the office & bars/restaurants, once normality returns later this year (April/May roughly, is looking likely, given good progress with vaccine roll out).

I almost forgot, of course the boss's review of 2021 Share competition picks was interesting too. A lot of subscribers here clearly share my conviction for Boohoo (LON:BOO) , Saga (LON:SAGA) , and Volex (LON:VLX) - three of my five largest personal holdings, which are at the top of the list of shares picked by subscribers in this year's competition. Let's hope we're right, otherwise I'll have to keep a low profile at investor conferences later in the year lol! However, if those shares do well, I'll be able to excitedly hold court in the bar again, without buying a single pint all day, and repeat my previous performance of accidentally spraying fragments of salt & vinegar crisps over my adoring fans (sorry about that again Peter!).

Timings - an all-day job today, to catch up with a backlog from yesterday. Today's report is now finished.

Agenda -

Dr Martens - intention to float, for this well-known brand of boots.

Appreciate (LON:APP) - Trading update

Accrol Group (LON:ACRL) - Half year results

Science (LON:SAG) - Trading, business, and board update from yesterday

.

Dr Martens

This iconic boots brand is going to float on the London main market. There were 2 announcements yesterday, a summary document, which I've reviewed, and a full 200-pager admission document style thing, which looked too daunting for me to get stuck into late yesterday afternoon, after I got back from my constitutional along Bournemouth beach - running the gauntlet of over-zealous rozzers, given that I took a thermos of coffee with me, dangerously close to constituting a solo picnic. Although as an aside, I note in today's paper that the Derbyshire Two have been pardoned by the police, for taking a stroll in the woods, 5 miles from home.

Here are my notes from an initial review, which mainly serves the purpose of flagging up areas to scrutinise in the main admission document. Although press reports of a £3bn price tag, look so high, I doubt it's worth pursuing this idea if the valuation is anything close to that.

Intention to Float - my notes

Main market

Revenues £672m FY 03/2020

Direct to consumer strategy - although this terminology confuses me, as it seems to include everything, i.e. retail, online, and wholesale. Confused!

Bought by private equity Permira, in 2014 - oh dear, PE exits via floats can often be horribly over-geared, need to check that.

Quotes EBITDA of £184.5m (high margins), but NB this is boosted by IFRS 16. The pre-IFRS 16 EBITDA is lower, at £164.4m. The press don't seem to have spotted this!

Very strong growth over last 3 years - can it continue, or is this an opportunist float after a good patch of trading?

Listing is all secondary - i.e. selling shareholders, not raising any fresh cash for the business itself, says it doesn't need it due to being highly cash generative, which it is, so maybe this is OK.

7 big name advisers! Fees? Likely to be huge.

Gross margin of 60% is very good. Up from 53.3% 2018 to 2020. Peaked maybe?

eCommerce is 24% of sales mix. Good, but not amazing.

Heavy finance expense on P&L - suggests high debt, as I would expect with a PE funded business. How much debt is being repaid as part of the listing process?

Balance sheet review threw up one large/unusual item - redeemable preference shares of £330.1m - a form of debt. This is probably what gives rise to the heavy finance charge on P&L. Key issue - what happens to this apparently expensive debt? Is it being repaid as part of the float? It needs to be.

Balance sheet - NAV: £100.4m, less intangibles of £259.8m, gives NTAV negative at £(159.4)m. Poor, but given how cash generative the business is, probably acceptable, providing trading remains strong.

Pension funds - query - any defined benefit schemes? I couldn't see any, but pension payments are mentioned somewhere. Need to check this.

My opinion - it all comes down to valuation. If it's £1bn, then I might be interested. If it's anywhere near £3bn, then forget it! Also, the post-float balance sheet needs a look (this should be somewhere in the full admission document), in particular what happens with the redeemable preference shares, which seem to be expensive debt.

Overall, a PE exit is likely to be over-priced, and overly burdened with debt, as that's what often happens. Hence needs a sceptical look before taking the plunge.

.

Covid vaccines thoughts

Matthew Lynn makes the point in today's Telegraph, that the only figure which matters to investors at the moment, is the vaccination rate. Social media seems to be full of armchair critics, lambasting the UK Govt for incompetence over everything they do. Yet such critics are strangely silent about the clear success of the UK authorities in ordering massive quantities of lots of different vaccines (seemingly obvious, but not done by our European cousins), and organising a fairly rapid roll out. Well done to everyone involved, as always especially to the front line medical people actually doing the hard work.

Looking back to last year, I was complacent about the risk of a more serious second wave, as things looked so positive in the summer of 2020, when it looked as if the virus had all but fizzled out. Sadly not the case, as we now know. Hence this is all a learning curve. I'm lucky to have daily notes here in these SCVRs, to refer back to once our memories have faded, which track the changing facts & mood throughout this crisis. Maybe we should do edited excerpts and put it into a booklet?

On the upside, last year I think a lot of us thought the idea of a vaccine by end 2020 seemed pie in the sky. Many experts seemed to be saying that the second half of 2021 was more likely. Hence it's been a wonder of modern scientists, that they've come up with vaccines so quickly, I'm sure everyone is immensely grateful, I know I am. Let's hope it inspires more people to focus their careers on life-saving science & care.

We clearly need to greatly increase the capacity of the NHS to deal with unexpected crises. I read a very interesting (if somewhat flawed) book recently called: Why the Germans Do It Better: Notes from a Grown-Up Country By: John Kampfner. It's a good, wide-ranging, overview of post-war modern Germany. Although spoiled somewhat by his fawning adulation for Germany, and scorn for the UK. The irony of that is lost on him, given that it's the UK's flawed system which helped liberate Germany and allowed it to become the success it is today.

Anyway, why did I mention that, other than as a book recommendation, it gets a 4.5 out of 5.0 from me, as it's a good read? Oh yes, in the section which looks at health, he points out that the German health system is better funded than ours, and has far greater emergency capacity. Whereas, as we're seeing at the moment, the UK system seems to be run & funded on the basis of just about getting by. We have regular winter crises every year, so clearly there's no spare capacity to cope with covid on top of everything else. Health spending is clearly going to have to go up a lot in future. Shutting down the economy, at a cost of hundreds of billions, because we've scrimped on maybe a few tens of billions of NHS funding, doesn't seem very clever now, does it?

As far as investors go, my view is that we need to keep focused on the vaccine numbers, above the awful & tragic short term news about high deaths & new cases figures. With the most vulnerable planned to be vaccinated fairly soon, then we should start to see a rapid decline in deaths in Feb-March. Despite the TV media always highlighting atypical cases (younger, healthy-looking people), the reality is that this virus overwhelmingly kills the old, the already sick, and obese. Hence once they are vaccinated in the next say 2 months, then that should allow restrictions to be eased, so that everything else can get back to normal. As long as companies have enough liquidity to survive the next 2-3 months, then their financial performance should rebound later in 2021, in my view.

Extended restrictions don't seem likely to me (e.g, into the summer/autumn), because once the death rate is very low, the public demand to return to normal is likely to be too strong for Governments to resist.

An article in the Guardian this week (you see, I don't just read the Telegraph!) said that far more people in the UK have already had covid, and hence probably have some level of immunity, than previously thought. It's talking about c.20%. That rings true to me. When my London household caught it, in Mar/Apr 2020, out of 4 of us who were sick with covid, 1 died (74 years old, lots of underlying health problems), and the 3 of us who survived are not on any statistics as having had it at all, because we didn't get tested or seek medical assistance. We just recuperated at home. I'm sure that is true for many other households. Plus of course all the people who have probably had covid, but with little to nothing in the way of symptoms.

Put all this together - i.e. rapid vaccine roll out for the vulnerable, and probably higher herd immunity from undiagnosed cases, and we have a situation that could start to improve in a few weeks. Leading to easing of restrictions possibly in March? Then further easing in April, and maybe back to close to normal in May? Obviously that's just my estimate and may be wrong, based on trawling through lots of news & views from many sources.

At the time of peak crisis, some people tend to be too pessimistic, which may create opportunities now, if some shares sell off for no particular reason. Although I do agree with Andy Brough that many UK shares have recovered too much in the recent market bounce (since vaccine news came out), and now price-in maybe too much recovery before it's even started.

On the downside, the nightmare "sell everything" (or hedge everything) scenario would be if a virus mutation occurs which is very much more deadly than current strains, and is impervious to vaccines. Let's hope that doesn't happen.

Obviously the above comes with a disclaimer that I'm not purporting to be any kind of medical expert. These are just my personal opinions, based on sucking in & digesting lots of views from as many credible sources as I can find, and applying a bit of common sense also, hopefully. Plus a willingness to change our minds, if the facts change, or if we realise we're wrong. Very much the same skills we use for stock picking really.

Apologies for any repetition in the above. I just find it useful sometimes to collect my thoughts by writing up a section on covid developments.

.

Appreciate (LON:APP)

32p (down 1.5% at 08:55) - mkt cap £60m

Appreciate Group plc (the 'Group'), the UK's leading multi-retailer redemption product provider to corporate and consumer markets, today provides an update on its important Q3 trading period for the three months ended 31 December 2020 in the current financial year. [Paul: FY 03/2021]

Strong performance through Q3 peak trading period as momentum continues in digital

Background - Here are my notes from Aug 2020, where I reviewed APP’s results for FY 03/2020.

I didn’t cover it here, but another update on 29 Sept 2020 showed monthly billings very poor in April & May 2020, gradually improving in the following months, then turning positive in Sept 2020. Clearly it’s been impacted hard by covid/lockdowns, but was recovering.

Interim results for 6 months to 30 Sept 2020 look poor, an adjusted loss before tax of £4.6m, but the narrative talks it up, saying this result is ahead of the original mid-range scenario for covid.

Today’s update - this looks quite good, to summarise;

U/l Q3 billings £96.3m, up 13.1% vs LY - continuing the move into positive growth started in Sept 2020

Dec 2020 - best month ever - good, but possibly due to pent-up demand from poor sales earlier in the year?

Digital sales quadrupled to £22.5m - impressive. This shift to digital is the main bull argument for this share, and is a good investing theme in my view - businesses that are successfully shifting online can be very good investments (e.g. Best Of The Best (LON:BOTB) (I hold), which shifted from physical airports, to online, and multibagged as a result).

Outlook - mixed I would say;

The Group is expected to deliver a full year performance for the year ending 31 March 2021 at least in line with the mid-range scenario as set out in its 2020 annual report and accounts, although the latest lockdown measures may delay some revenue and profit until customers have more options to redeem their products.

Directorspeak -

"I'm delighted to report that the Group has delivered a strong performance during its important Q3 peak trading period. As a seasonal business, the Group's performance has reflected the swing to profitability that we typically see in the second half of the financial year and the acceleration of our strategy to strengthen our digital capability has ensured a Q3 performance well ahead of last year.

"We saw our busiest ever month in December. Our Corporate performance has been enhanced by companies seeking ways to reward their hard-working employees as an alternative to traditional Christmas parties.

"The accelerated implementation of our strategy over the last year has helped us deliver an improved performance through this key period, and has strengthened the Group's proposition for consumers and corporates, leaving it well positioned for sustainable growth beyond the current financial year."

My opinion - I’d be interested to know how much business is being achieved through covid? E.g. I know the ONS is giving out Love2shop cards from APP as rewards for people taking part in surveys. I got one for £10, but couldn't be bothered to redeem it, as it was taking up too much time in a complicated process to register, etc. together with worries about what they're going to do with my personal details?

Which makes me wonder, how much profit comes from low value vouchers that are paid for, but never redeemed? A fair bit, I reckon. Also apparently quite large numbers of people are given vouchers (not sure if they’re from APP or not) for taking regular covid tests, and they’re quite decent amounts too, a family member tells me, who is on that scheme. That business is likely to dry up later this year.

APP is on my watch list. It looks potentially interesting, if the digital side of the business can continue growing fast. I haven’t really done enough research on the company to form a view either way, so am currently neutral on this one. Lord Lee speaks highly of APP, and his share ideas are always worth looking into, as he’s been highly successful in the long term.

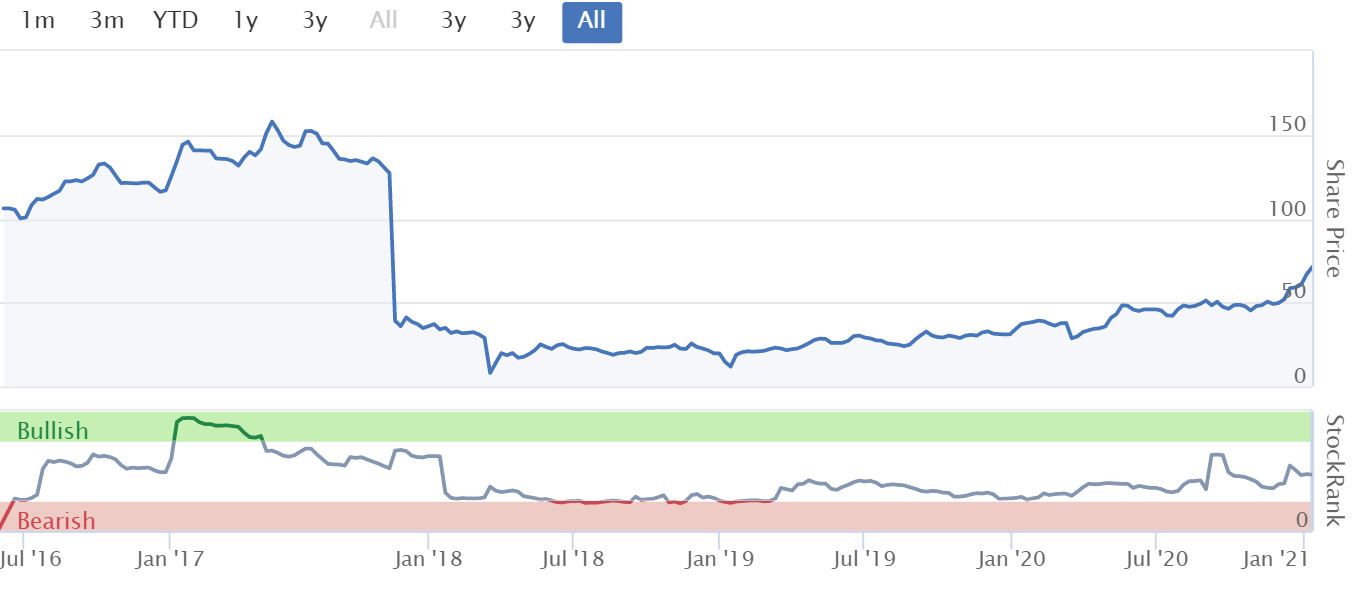

As you can see below, things were going badly before covid struck, and there's been little share price recovery since. So the market remains sceptical for now. That said, if this turnaround is going to work, and digital sales blossom, then the upside could be considerable. As a reader points out below, there doesn't seem to have been any share dilution, with the share count static at about 186m for the last 5 years. That means the share price could recover back up to previous highs, if the business trades well, possibly.

.

.

Retailers, brands, insolvencies, landlords

Jaeger

There’s lots of interesting news at the moment.

Marks And Spencer (LON:MKS) has bought the Jaeger brand from the administrators, which seems a very good fit to me. It’s a pity we’re not told how much they paid for the brand. Although the Guardian says;

The price it paid for the brand is understood to be in the low millions of pounds.

If true, then they’ve got a bargain I think, and obviously BOO didn’t want it!

A brand like that could have decent licensing potential, on top of rejuvenating its products. Whether MKS is good enough to turn it around, is a big question, given MKS’s hopeless multi-year performance in clothing.

MKS is not taking on the 63 Jaeger stores, very sensibly. This is the way of the world now, we’re likely to see lots more well-known brands go bust and then sold to the highest bidder (minus some or all of their physical stores) in the next few months, I think.

Jaeger was part of Philip Day’s group, Edinburgh Woollen Mill. It has been in administration, but a deal seems to be imminent to save parts of EWM. Drapers Record saying that a consortium is bidding, and “will pay for the business in instalments over the next few years” doesn’t sound like a very good proposition. To have accepted that deal, the administrator must have had few, if any other viable options.

It’s particularly interesting that MKS seems to have cottoned on to the multi-brand idea, which Next (LON:NXT) and Boohoo (LON:BOO) (I hold) have pursued so successfully. Maybe there could be more competition for buying failed retail brands in future? How Mike Ashley’s scatter-gun approach pans out, to buying brands & keeping some physical stores open, via Frasers (LON:FRAS) , who knows? It strikes me as the riskiest strategy out of the ones mentioned above.

Moral issue - I can’t help pondering the situation where billionaire owners of retail chains like Arcadia & others, milked the businesses for fancy lifestyles in the good times, but can just walk away from the wreckage when it fails, stuffing landlords & suppliers with the losses. Often they even get priority on the proceeds, as they secured their loans against assets. It doesn’t seem right, but I can’t think of any workable solution.

Ultimately, suppliers have to remember that all sales on credit are a gift until the invoice has been paid.

Landlords - I had a very lucky escape with Hammerson (LON:HMSO) last year, making a decent profit on a short squeeze. Although looking back, my fundamental analysis on the company was completely wrong. I didn’t factor in a second wave of covid, nor how dire conditions would become for landlords, with so many tenants unable, or unwilling, to pay rents, and demanding decreases or even rent-free periods.

I think it's important to beat yourself up, and learn the lessons from mistakes which made a profit, as well as mistakes that made a loss. If the analysis was wrong, but a profit was made purely through lucky timing, then that could lead to future losses, if the same flawed process is used again.

I started looking at Land Securities (LON:LAND) this morning, which put out a detailed announcement re rent collections. It seems to be cushioned by having a good mix of properties, with offices being the largest, and rent collections there being quite good.

Overall, I don’t have any confidence in my ability to pick winners or losers in this sector, so will steer well away from it. Large discounts to NAV for property companies are more likely to be a warning (of over-valued, distressed assets), than an opportunity, maybe.

Insolvency practitioners - thinking about all of the above, I've decided that it's time to take small opening positions in both Begbies Traynor (LON:BEG) and Frp Advisory (LON:FRP) . I couldn't decide between them, so have picked up a little bit of each. It seems to me that we could be coming into the crunch period where, even with Govt support measures, many retail/hospitality/leisure/ travel companies, must be reaching the end of the road. Many need to restructure, so it's not necessarily a negative thing, to call in insolvency practitioners to formally sort out an untenable situation.

Why did I only take small opening positions in BEG & FRP, which would barely move the dial for my portfolio, even if they went up say 50%? Well, I always think a profit is a profit. I scrimp over the price of basic food items when food shopping, and want the cheapest car insurance (via the meerkats), so why on earth would I then consider thousands of pounds in my shares portfolio to be insignificant, just because it's small relative to total assets? That's defective thinking, so in my view, every penny counts in shares portfolios too, when it's your own money.

Andy Brough made another great point last night about small position sizes. He's managing vast portfolios, over £3bn, so asks himself why buy or hold a small position in some tiny small cap, that wouldn't move the dial even if it 5-bagged? The answer is that it's a toe hold, and it means you read the RNSs about that company, hence are more likely to spot something significant happening. He gave the example of Xaar (LON:XAR) where he only spotted the turnaround starting because he already had a small holding, and was able to greatly increase that holding at the right time, because he already held some. Would he have spotted the turnaround if it hadn't been en existing holding? Probably not. Hence small position sizes are a nice low-risk way to closely monitor something potentially interesting. It's then easy to either ditch, or add to the position size as your knowledge about the company grows.

.

I'm just rambling on because the companies reporting today look so boring. Let's have a whizz through some of them, think I'll do shorter sections today.

Accrol Group (LON:ACRL)

68.5p (down c.6% at 13:53) - mkt cap £214m

Accrol (AIM: ACRL), the UK's leading independent tissue converter, announces its results for the six months ended 31 October 2020 ("H1 21" or the "Period").

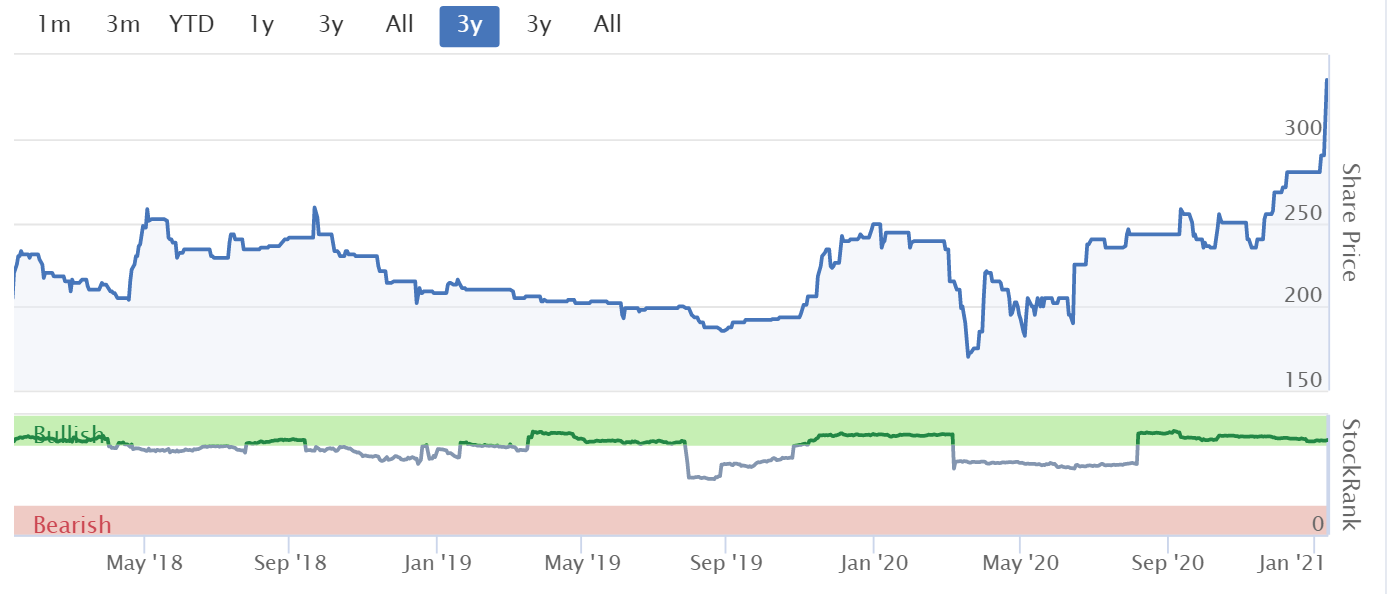

The share price here has more than tripled since 2014. The danger is, that when looking at the chart, you're not comparing apples with apples - i.e. 68p now is equivalent in market cap to 228p per share when it floated in 2016.

This looks a good update -

With margins continuing to improve, LTC contributing positively and the business continuing to deliver strong organic growth, the Board is confident that the Group is fully on track to deliver a strong H2 performance and results for FY21 will be at least in line with market expectations.

(no footnote provided to tell us what market expectations are)

Dividends - restoring a (tiny) final divi of "no less than 0.5p"

Net debt - strangely, it does give us market expectations here;

Net debt (pre IFRS 16) 30 April 2021 is expected to be below consensus market forecasts (currently £12.2m), even after the intended dividend payment.

Interim results - don't look very good to me.

Revenues down 4% to £62.3m

Loss before tax of £(0.5)m

Net debt (pre IFRS 16) of £18.1m

Underlying results are given, but only down to EBITDA, of £5.4m. We can't just ignore depreciation of £1.94m. EBITDA is not a meaningful number at capital intensive companies like this. Note that capex was £5.3m in H1, more than double the depreciation charge.

Gross margin usefully improved, but still extremely low, at 23.8% (LY H1: 19.7%) - so make no mistake, this is a product sold purely on low price, an unattractive business model in my view.

Integration of recent acquisition, LTC progressing "incredibly well"

Balance sheet - NAV: £46.0m, less intangibles of £26.8m, gives NTAV: £19.2m. This looks adequate, although I'd be more comfortable with the bank debt once ACRL has moved into proper profitability.

My opinion - I'm really struggling to connect these numbers with a £214m market cap. At the moment, it looks significantly over-priced to me. Investors must therefore believe in not only the turnaround delivering better results, but also the growth strategy explained in the commentary.

I find this business model unattractive, as it's capital-intensive, supplying low margin, low value-added products to ruthless, price-conscious customers (supermarkets).

The share price seems to hinge on big increases in EPS. Broker forecast is for 2.8p this year (FY 04/2021), then 4.7p and 5.7p in subsequent years. If you're confident that earnings are going to double in 2 years, then this share stacks up.

It's definitely not for me, but good luck to holders.

.

.

Science (LON:SAG)

340p - £138m market cap

The quoted market spread (bid-offer) looks very wide here, so it must be tightly held. Yes, here we are;

.

Even if a share does have a very wide quoted spread, we can usually deal within that spread, so it shouldn't necessarily put us off. This is due to the ridiculous, antiquated system we have in the London market, where real prices on illiquid shares are hidden from view. It's ridiculous, but there we go.

Trading, Business and Board Update

Science Group provides a trading update for the 12 months to 31 December 2020.

This update was issued yesterday.

It looks rather good;

Group revenue for the year is now anticipated to be in the order of £73 million (2019: £57.2 million). While the Board took the opportunity during the second half of the year to increase investment in infrastructure and personnel, early indications are that, subject to audit, the Group's adjusted operating profit for the year ended 31 December 2020 will exceed the previously upgraded expectations of £10 million (2019: £6.7 million).

Furlough of £0.1m was insignificant, and repaid to the Govt in H2. Very good.

Net funds of £10.6m looks healthy - gives scope to "explore further strategic opportunities, should they arise". It points out a strong track record;

Over the past decade, Science Group's self-funded model has enabled the Group to grow revenue more than 3-fold and adjusted operating profit 4-fold, without shareholder dilution.

Finance Director Rebecca Archer is moving on to a new role. A CFO Designate, Sameet Vohra has been appointed, previously interim FD at Ted Baker (LON:TED) during its restructuring, so he sounds a credible replacement. Changing CFOs can be a sign of trouble, but this one sounds OK, mainly because Rebecca is staying on to complete the 2020 audit, and formal handover is in April 2021. That suggests to me there's probably nothing to worry about.

Frontier - acquired in 2019, restructured, and now "strongly profitable". Orders in 2021 are "very healthy" and may be supply constrained - a good quality problem to have in a way, when demand exceeds supply for any reason, because supply problems can be fixed in time. Mgt are considering all options for Frontier - retain it, sell it, or make it bigger with acquisitions. Open minded, and advisers appointed. Sounds potentially interesting.

My opinion - many thanks to Liberum, for making an update note available on Research Tree - that's so helpful. It's raised 2020 forecast EPS by 5%, to 18.1p, that's a PER of 18.8 - maybe priced about right? Subsequent years' forecasts are basically saying earnings will be flat for the next 2 years. If that's the case, then it's difficult to justify a higher PE rating.

Therefore this looks a straightforward situation. If you think the company can grow earnings in future, then it's worth buying. If you don't, then it's probably fairly priced at the current level. Management sound shrewd, so could be worth backing, for future out-performance maybe?

.

.

That's all for today, see you in the morning.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.