Good morning, it's Paul here with the SCVR for Tuesday.

Estimated timings - lots already done, so plenty up by 1pm. I might do more in the afternoon, or might crash out in my hammock, it depends. Today's report is now finished. Thanks for the kind comments, much appreciated.

I've just ploughed through this 60-page Government publication, issued yesterday, 11 May 2020. I'll summarise it below, so that you don't have to!

I've followed the layout & headings in the original document (hyperlink below, in blue), so you can easily consult that particular section of the report if you want more detail.

If you're short of time, jump to "Section Four" below, which has the information that's most relevant to investors.

.

OUR PLAN TO REBUILD:

The UK Government's COVID-19 recovery strategy

Section 1 - the current situation

Phase 1 - this is what has happened until now. Graphics showing how the lockdown strategy was to reduce the peak to within what the NHS could cope with. Explains the principle of getting R (reproduction number) below 1, to prevent exponential growth. SAGE believes R is currently between 0.5 and 0.9, hence number of infected people is falling over time. Statistics & charts provided of number of people infected, and daily tests. Outlines economic risks of high unemployment & large fall in GDP.

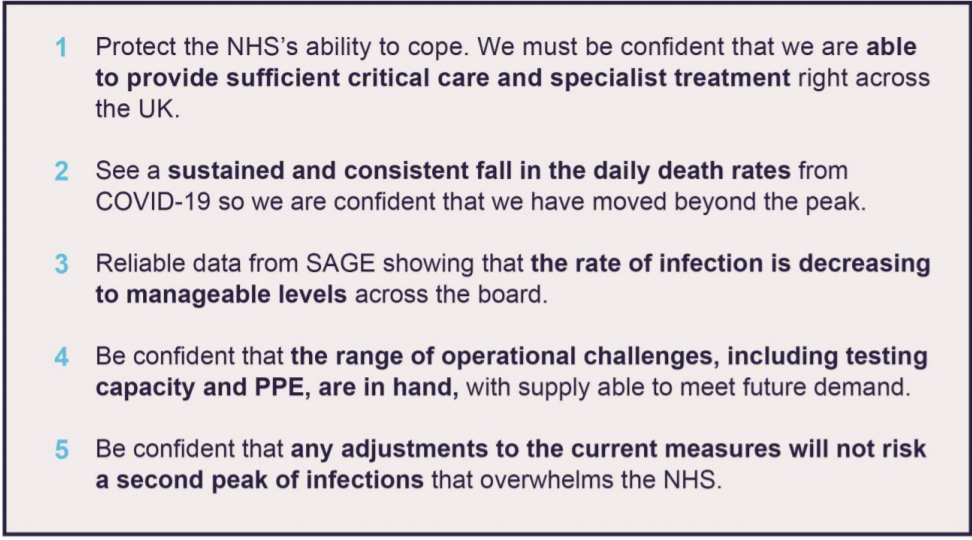

Moving to the next phase - worried about risk of triggering a second peak of infections, so will only lift restrictions cautiously. These are the five tests for easing measures, as announced on 16 April:

.

Graphic showing big falls in critical care beds being used for Covid (peaked at c.54% in England, c.12 April, now c.26%)

The challenges ahead - Covid-19 is likely to be a long term, recurring problem. No drastic changes (to restrictions) can be done in short term. No quick or easy solution. Vaccine and/or effective treatment is long-term solution. Herd immunity approach would overwhelm the NHS. Still learning about the virus. Difficult to detect because covid can spread without people having symptoms. Winter flu in 2020/21 will complicate matters, as symptoms similar to covid. Needs widespread compliance of the public to Govt measures, which so far has been the case. Graph showing large reduction in public travel, by all means, but car use now rising, public transport fairly flat & showing biggest fall from normal.

.

Section 2 - Our aims: saving lives; saving livelihoods

Govt needs to steadily redesign social distancing measures to reflect risk. carefully wind down economic support schemes. Will consider health, economic, and social impact. Outlines its overarching principles. Balancing risks, etc.

.

Section 3 - Our approach: a phased recovery

Phase 2 will be smarter social restrictions. Step by step to reduce restrictions. Will reimpose restrictions if needed. Reactive & localised restrictions in future. Fewer infections by: making contact safer (e.g. re-designing workspaces), testing & tracing, rapidly intervening if local hotspots emerge.

.

... it is likely that reopening indoor public spaces and leisure facilities (such as gyms and cinemas), premises whose core purpose is social interaction (such as nightclubs), venues that attract large crowds (like sports stadia), and personal care establishments where close contact is inherent (like beauty salons) may only be fully possible significantly later depending on the reduction in numbers of infections

[Paul: this is vague, and doesn't help owners of those type of businesses plan ahead. Looks like we'll be stuck with dodgy DIY haircuts for some time to come!]

Initially, the gap between steps will need to be several weeks, to allow sufficient time for monitoring. However, as the national monitoring systems become more precise and larger-scale, enabling a quicker assessment of the changes, this response time may reduce.

That sounds more positive. So once the Govt can properly monitor the situation accurately, then it might be able to move more quickly to ease some lockdown measures.

"COVID-19 Secure" safety guidelines will be released this week, Govt has been consulting relevant bodies. Measures will include advising use of face coverings on public transport, and restrictions on international travellers. Govt likes homeworking - reduces spread of virus, and better for the environment.

More measures needed to protect the vulnerable, eg care homes, prisons, sick & elderly.

Risk assessments will become more nuanced;

As the Government learns more about the disease and the risk factors involved, it expects to steadily make the risk-assessment more nuanced, giving confidence to some previously advised to shield that they may be able to take more risk; and identifying those who may wish to be more cautious. The Government will need to consider both risk to self, and risk of transmitting to others

People with symptoms must still self-isolate, but period of time should reduce as testing becomes more widely available.

Restrictions likely to be relaxed more in low risk regions.

Phase 3 will be lifting of more restrictions when there is effective medical treatment. Govt investing in R&D, partnerships, etc for this. An effective vaccine may not be developed "for a long time (or even ever)". Govt believes that effective treatments (i.e. not vaccines) will have to be designed specifically for Covid-19, time consuming.

.

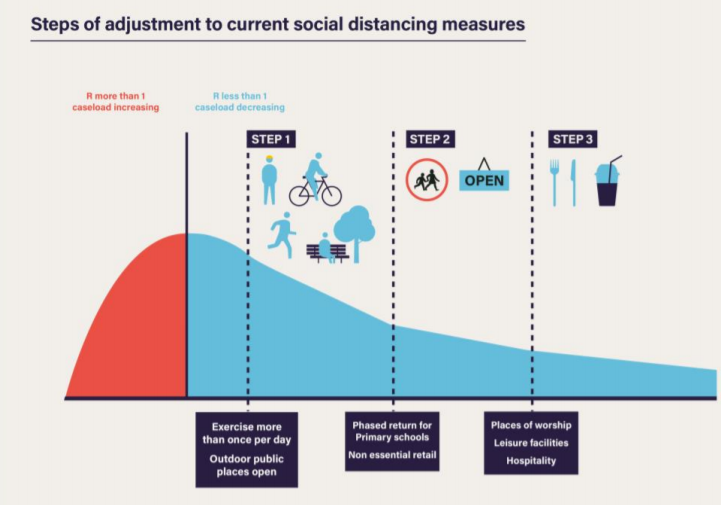

Section 4 - Our roadmap to lift restrictions step-by-step

The Government has a carefully planned timetable for lifting restrictions, with dates that should help people to plan. This timetable depends on successfully controlling the spread of the virus; if the evidence shows sufficient progress is not being made in controlling the virus then the lifting of restrictions may have to be delayed.

May have to reimpose restrictions, but in "specific geographic areas", or "in limited sectors".

Step One - from Weds 13 May (tomorrow)

Work from home where possible. Go into work if working from home not possible. NB does not apply to retail or hospitality, which remain closed. Follow "COVID-19 Secure" guidelines, which are about to be issued. Anyone with symptoms or anyone in their home has symptoms, must not leave their house.

Schools - only 2% of pupils are attending at present. Schools should encourage more vulnerable children to attend, but too soon to re-open schools for all pupils.

Travel - avoid public transport where possible - walk, cycle or use car instead. Govt funding to encourage more cycling with funding for councils. Maybe this is why Halfords (LON:HFD) and Tandem (LON:TND) shot up today?! Strict social distancing must be done on public transport.

Face-covering - should be worn in enclosed spaces, e.g. public transport & in some shops. Purpose is to protect others, not yourself, e.g. might prevent asympomatic people spreading the virus. Should be made of cloth, not surgical type masks, which should be reserved for medics.

Public spaces - rules being relaxed, as risk is lower outside. Keep 2m apart, and only meeting up with 1 person outside your household. We can now exercise outside as much as we wish, but not team sports, outdoor gyms, etc. I like this sensible relaxation of the previous draconian rules;

People may drive to outdoor open spaces irrespective of distance, so long as they respect social distancing guidance while they are there, because this does not involve contact with people outside your household.

Don't have parties in parks, or we'll bring in tighter restrictions.

Measures to help vulnerable people who need to continue "shielding" from contact with others.

Enforcement - fines being increased for rule-breakers.

International travel - at long last the borders are being tightened up. 14-day self-isolation will be required for arrivals into the UK (how on earth they'll effectively police that, I do not know). This seems likely to deter all honest people from wanting to visit the UK. It's not specifically stated, but it sounds like this would apply to UK citizens wanting to go on holiday. Would they then have to self-isolate for 14 days at home, on their return? I could be wrong, but it sounds that way. Hence foreign holidays are still off the agenda for now. Exemption is CTA - Ireland, Isle of Man & Channel Islands. These measures will be introduced as soon as possible (i.e. not ready for 13 May).

Step Two - from 1 June

(at earliest, might be later, depending on circumstances, subject to 5 steps above)

Schools - return of some years children. "Schools should prepare to begin to open for more children from 1 June". More detail on page 34. I'll skip this, for our purposes here.

Retail - phased opening, of non-essential retail. More details to follow. Exclusions are;

All other sectors that are currently closed, including hospitality and personal care, are not able to re-open at this point because the risk of transmission in these environments is higher. The opening of such sectors is likely to take place in phases during step three, as set out below.

It's difficult to argue with the logic of that, but clearly more Govt support will be necessary, to prevent millions more people becoming unemployed.

Cultural/sporting events - only behind closed doors, for broadcast.

Re-opening more public transport.

Social contact - looking at options based on social bubbles, as used in New Zealand. Looking into small weddings becoming allowed. Govt will consult widely in coming weeks.

Step Three - 4 July at earliest

(subject to various tests, scientific advice, etc.)

The ambition at this step is to open at least some of the remaining businesses and premises that have been required to close, including personal care (such as hairdressers and beauty salons) hospitality (such as food service providers, pubs and accommodation), public places (such as places of worship) and leisure facilities (like cinemas). They should also meet the

COVID-19 Secure guidelines.

Some venues which are, by design, crowded and where it may prove difficult to enact distancing may still not be able to re-open safely at this point, or may be able to open safely only in part. Nevertheless the Government will wish to open as many

businesses and public places as the data and information at the time allows.

It will be interesting to see how this pans out. It will be tested with pilot openings.

.

Section Five - Fourteen supporting programmes

1. NHS and care system - just briefly, as it's not relevant for the purposes of the SCVR. Talks about improving supply of PPE, making it in the UK, improve distribution network. Also changes including more home-based consultations using the internet, tackling obesity (a big Covid-19 risk apparently), boost to cycling/walking infrastructure, more health screening, etc. More money for social care.

2. Protecting care homes - details more help being given to support care homes (a bit late for the many who've died)

3. Smarter shielding of the most vulnerable - guidance & additional help for 2.5m people identified as clinically extremely vulnerable.

4. More effective, risk-based targeting of protection measures;

It is clear the virus disproportionally affects older people, men, people who are overweight and

people with some underlying health conditions. This is a complex issue, which is why, as set out in

Chapter 1, Public Health England is leading an urgent review into factors affecting health outcomes

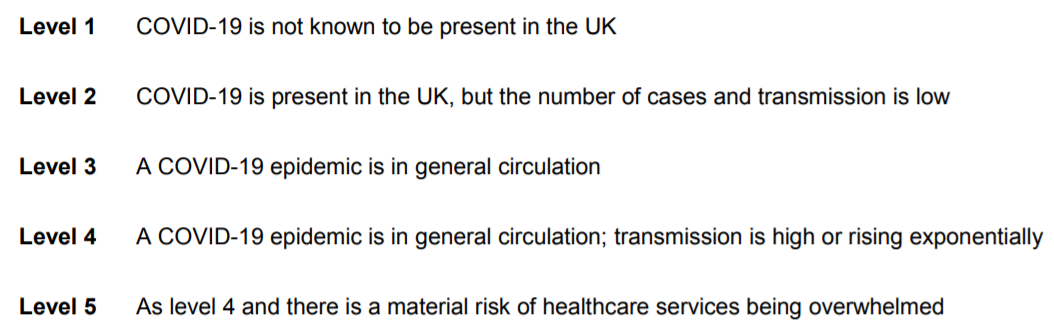

5. Accurate disease monitoring and reactive measures - Govt is establishing a new biosecurity monitoring system, and centre, to bring together medical experts & Govt. Will collect data widely & independently analyse it, to inform Govt. Response function, to tackle hotspots of virus outbreaks. As reported on TV news, 5-level alert system introduced, to be set by the new JBC (Joint Biosecurity Centre). Presumably we're currently at level 3, I'm guessing?

.

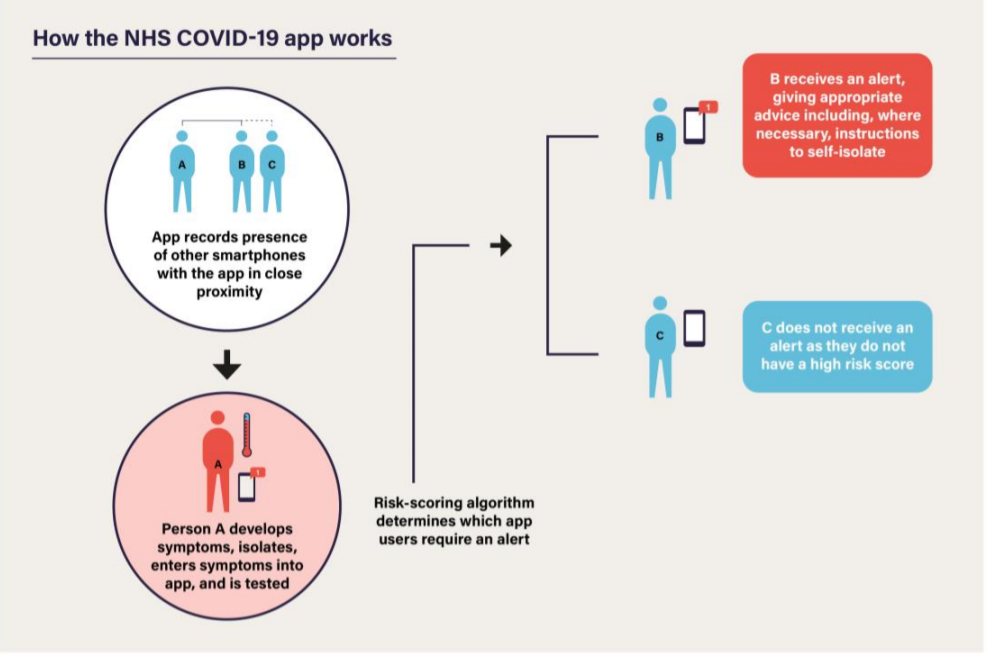

6. Testing and tracing - this is clearly the way forward. Explains what the Govt is trying to do. Testing capacity currently 100k per day, increasing to 200k by end May hopefully. The idea is to break the virus transmission chain by alerting people via smartphone if they have come into contact with anyone that is positive. The next person can then self-isolate and get tested.

The NHS is developing a contact tracing app. (Paul: apparently Google and Apple have developed contact tracing apps, so there's some confusion over whether the NHS app, or the others are likely to be best,a s they work differently and apparently don't work together).

.

7. Increased scientific understanding - various programmes launched, in basic genetic research, and clinical studies.

8. "COVID-19 Secure" guidelines - extensive consultations happening. Reiterates stuff we already know, like handwashing, social distancing, etc. Also mentions clothes washing, as "some evidence virus can stay on fabrics".

9. Better distancing measures - already mentioned earlier in the report.

10. Economic and social support to maintain livelihoods and restore the economy - reiterates what the Govt & Bank of England has done. Over 6 million jobs furloughed by 800k employers. I won't repeat it all, see page 46 of the report. Noteworthy that VAT deferral for one quarter is huge, at £30bn. Business rates holiday is worth £11bn. Direct grants of £12bn to small businesses in the retail hospitality or leisure sectors. Loans guarantee of c.£330bn! Plus another £16bn funding for public services so far, to respond to Covid-19. "Extraordinarily costly measures", which OBR says could rise above £100bn in 2020/21, plus the loan guarantees (some of which are bound to go bad & become write-offs).

Huge cost means Govt will need to wind down the economic support measures.

I reckon, if we take into account the huge reduction in tax measures, plus all the above, the total cost could be multiples of the £100bn estimate from the OBR.

11. Treatments and vaccines - explains what is going on to find a long-term medical solution.

12. International action and awareness - explains what is being done in co-operation with other countries, which sounds quite a lot.

13. Public communication, understanding and enforcement - "Stay at home" was a simple message that everyone understood. Now becoming more nuanced, and complex to explain. Govt needs to trust the public to understand & comply, with robust enforcement for "small minority who elect not to act responsibly".

14. Sustainable government structures - needs to improve & develop Govt processes to cope better with future diseases.

.

6. Section Six - how you can help

Exhorts us to work together.

Provides some useful hyperlinks for people/businesses that want to help in various ways.

.

ANNEX A: Staying safe outside your home - detailed guidelines on things we have to do, such as handwashing, avoid crowds, etc. All pretty obvious.

ANNEX B: table explaining definitions of "clinically extremely vulnerable people", and other categories.

.

That's it! I hope members here find this summary useful, and apologies for any errors or omissions.

Good morning, I'm back, after a few hours sleep! Loads of announcements today, so I'll rattle through them & cover as many as possible;

Treatt (LON:TET)

Share price: 497p (up 1.4% today, at 08:15)

No. shares: 59.4m

Market cap: 295.2m

Treatt Plc (the 'Group'), the manufacturer and supplier of innovative ingredient solutions for the beverage, flavour, fragrance and consumer products industries, announces its half year results for the six months ended 31 March 2020.

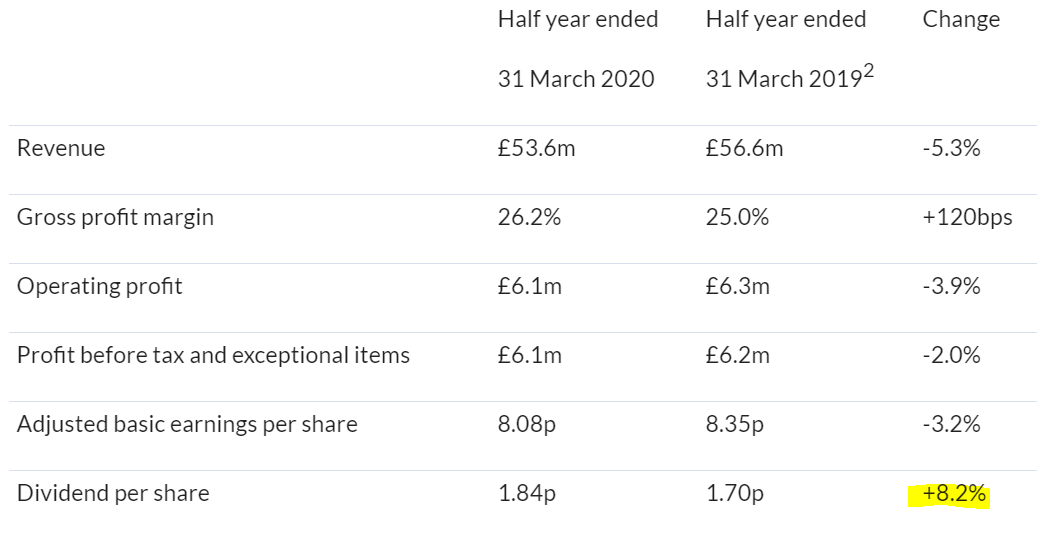

There's nothing interesting in these figures, although I note that the small divi has been increased - that's good at a time when many companies are pulling their divis due to uncertainty about the outlook.

.

The anticipated weakness of some citrus raw material markets impacted H1 numbers as expected, but H2 is likely to witness an improvement in this category.

Expansion - Treatt has been busy spending large amounts of capex to increase production capacity. Today it says;

Ø US expansion: doubled capacity for high growth categories - on stream for spring crops.... we are seeing early signs of success in utilising our additional capacity.

Ø UK site relocation well underway, move delayed until 2021 due to COVID-19 lockdown.... This delay is not expected to impact our ability to meet customer orders over the short to medium term.

Therefore, when trying to value this share, we need to factor in growth in revenues and hopefully profits, from the enlarged production capacity coming on stream this, and next years. Last time I looked, the broker forecasts didn't seem to factor in much growth, so there could possibly be upside there maybe?

Outlook/Covid - pleasing, and rare these days to see an in line outlook statement;

"Looking ahead it is difficult to determine the likely impact of COVID-19 on the demand for the Group's products and there may be a slowdown in some of our customers' new product development activities in the short term, reflecting the dramatic changes in consumption habits.

However, the Group has traded well since the half-year end and is encouraged by the level of its order book and the current demand for its products from beverage ingredients through to solutions for hand soaps and cleaning products. Therefore, whilst there remains much to do, the Board is pleased to report that, at this time, trading remains in line with its expectations for the financial year ending 30 September 2020."

The words "at this time" clearly introduce doubt, that things could deteriorate. But at the moment, it seems to be trading OK, and given lockdown means consumers are spending more on groceries, then it's conceivable that Treatt should be able to trade well throughout this crisis.

No staff have been furloughed, and no Govt assistance schemes used, which again gives me confidence that trading is OK & likely to remain so.

Bank borrowings - liquidity looks good.

As at 31 March 2020 the Group had a net cash balance of £6.1m, as compared with £15.6m1 at the beginning of the Period. This was made up of gross cash of £33.0m, bank loans and borrowings of £26.6m and net lease liabilities of £0.4m. The Group has borrowing facilities of £25.0m of which £24.9m was undrawn at the Period end.

I read that wrongly the first time, good thing I checked! The £25m bank facility is almost all available, i.e. undrawn.

Balance sheet - inventories look high again. Overall the balance sheet is strong, I'm happy with this. Note 12 says £10.7m is committed to further capex.

Cashflow - not as good las H1 LY - note that receivables are up £5m, despite revenues being down - the commentary says this is because of a strong finish to H1. Seems slightly odd to me - a rush to raise lots of invoices just before the period end can sometimes be a sign of trouble potentially, although probably not in this case. Heavy capex again, of £11.9m for production expansion.

Valuation - the most recent note I've found is from Edison, forecasting 18.9p EPS for FY 09/2020. We have confirmation today that the company is in line, so we can rely on this. The PER is 26.3 - expensive, but remember the valuation is factoring in upside from the new production facilities, which should be kicking in soon.

My opinion - this seems a good company, making decent profit margins in a growing niche.

I'm impressed that it seems resilient in the face of Covid-19, although it won't be immune from any prolonged recession, if that happens.

The crux is what sort of upside is likely from the enlarged production facilities. I don't know anything about that, so it's up to readers to research that in more detail yourselves. If profit were to double, or triple, then clearly the current valuation would be very attractive. Existing broker forecasts show only modest increases in revenues & profits, which I don't understand. Why would the company have invested so much in expansion capex, for such paltry increases? There must be considerable upside on existing broker forecasts for next year, in my view, otherwise Treatt wouldn't have built the new factories!

Could get interesting, as new production comes on stream. EPS hasn't really gone anywhere for several years, so the company needs to demonstrate stronger growth in future.

Well done to anyone that was brave enough to buy the recent spike down!

.

Focusrite (LON:TUNE)

Share price: 580p (down 3.3% today, at 09:59)

No. shares: 58.1m

Market cap: £337.0m

Focusrite plc, the global audio products group of companies, today announces its half year results for the six months ended 29 February 2020.

These figures are pre-covid, so give us an idea how the company was trading before the present crisis.

The highlights leave me cold - revenue is up nearly 24%, but adj operating profit is down 12% - seems odd.

Also note that it's gone from a big net cash, to a net debt position - due to acquisitions. Note that Martin Audio, acquired for £39.6m in Dec 2019 seems to supply speakers for nightclubs, arenas, etc, so probably a really bad space to be in now, unluckily.

.

Directorspeak - mixed. As I suspected, Martin Audio is seeing reduced demand;

Since the half year, consumer demand for Focusrite and ADAM Audio products has been high especially via ecommerce and we have seen record levels of product registrations at Focusrite indicating positive sell-through to end-users.

Manufacturing in China is back up to speed and we are working hard to ensure that consumers can still get the product they wish to buy without delay.

Demand for Martin Audio products is being affected by the lack of live music events due to COVID-19 but we believe this will recover in time. Our people are adapting well to the unusual working conditions, supported by state-of-the-art IT and communications facilities that enable working at home. We are confident that the Group will come through this upheaval stronger than ever. However, for the time being we must remain appropriately cautious given the unprecedented circumstances in which we all find ourselves."

Online sales - this mirrors what Gear4music Holdings (LON:G4M) (I'm long) has said about online sales for musical equipment being strong;

While traditional retail stores are closed in many countries the online retail industry is fulfilling the demand so successfully that we are seeing record levels of product registrations at Focusrite, indicating positive sell-through to end-users.

That's really impressive. As many commentators are saying, the current crisis seems to be dramatically accelerating existing trends of sales moving online, work from home, etc. I concur, and this reinforces my general view that many conventional retailers might really struggle to survive, even when lockdown restrictions are lifted, as the business has shifted online.

Forecasts - the company doesn't seem to give any full year guidance, so I'm not sure if we can rely on broker forecasts or not.

There's a note from Edison dated 26 March, which does mention both supply and demand issues with Covid-19. Although it also notes that online sales are doing well, as the company reminds us today. Therefore it's tricky to know whether the 21.9p EPS forecast for FY 08/2020 is still achievable? Given that H1 was 9.3p, then doubling it, and we're not far off the full year forecast. Therefore it looks to me as if we can probably guess that full year earnings might be in the range of say 16-22p. That would be a PER of 26-36 if my estimate range is accurate. Hardly a bargain, given the macro uncertainty. Earnings could improve next year, or they might not, there's not much visibility right now.

Balance sheet - has dramatically changed, given the acquisitions. It's now top-loaded with intangibles totalling £59.1m. Subtract that from NAV of £55.0m, and NTAV is now actually negative, at £(4.1m). Not a disaster, as it's a decent, cash generative business, but I much preferred it when the balance sheet was bulletproof. The wisdom of the acquisition of Martin, is a big question mark, although to be fair that is mainly caused by something unforeseeable, covid.

Working capital is fine, but note there's a thumping great £32.6m bank loan in longer term creditors. Not a problem if the business remains profitable, but loans have to be repaid at some point of course, which reduces the scope for future divis.

My opinion - I've always liked this business, but as mentioned before, I find the valuation too high to make it something I'd want to buy. We're in a time of massive uncertainty, so why on earth are people prepared to pay top whack for companies like this at the moment? Nice company though it is. I'd just rather sit on the sidelines, and see how the situation develops.

.

Frp Advisory (LON:FRP)

Share price: 126p (up 8% today, at 11:00)

No. shares: 237.5m

Market cap: £299.3m

FRP Advisory Group plc, a leading UK professional services firm specialising in advisory services, today announces a trading update for the year ended 30 April 2020.

This looks a very interesting recent float. It's like a bigger version of Begbies Traynor (LON:BEG) and apparently gets more of the lucrative middle market jobs, whereas Begbies is more low end, doing volume, cheaper restructuring/insolvency jobs.

Staff working from home, none furloughed, as team "busily engaged in active projects".

Traded strongly in H2 - ahead of expectations.

The Group traded strongly during the second half of the year to 30 April 2020, continuing to grow caseloads in both size and complexity, with a number of high-profile appointments during the period in the Group's Restructuring division, including the administrations of Carluccios and Debenhams.

FY 04/2020 - revenues £63.2m, up 16.4% vs LY.

Forecasts - I can't find any, so can't take this any further. Maybe the company could get its advisers to push some information about the company, and forecasts, to private investors?

My opinion - this is worth a closer look, I've heard good things about this float. As with Begbies, it's counter-cyclical, and likely to be overwhelmed with work as more companies go bust after Govt emergency funding is eased back.

Zytronic (LON:ZYT)

Share price: 105p (up 5% today, at 12:04)

No. shares: 16.0m

Market cap: £16.8m

Zytronic plc, a leading specialist manufacturer of touch sensors, announces its consolidated interim results for the six months ended 31 March 2020.

H1 revenue down 22% to £7.4m

Still profitable, but only £0.5m PBT (down 64%)

Divis - no interim divi due to Covid-19, but the company is sitting on a big cash pile still. This concerns me. Previously it has paid out divis, despite a downturn.

... extremely uncertain prospects for the remainder of the year as a whole and have decided that in these circumstances we should not pay an interim dividend

Net cash of £12.4m, or 74% of the market cap!

Limited visibility

Govt support - is this acceptable? I've got misgivings about this. Cash-rich companies should not abuse Govt support schemes, intended for struggling businesses, in my view;

Management will continue to respond accordingly to ensure operations are maintained in a safe manner and will utilise any Government assistance to safeguard the employment of our workforce ... Since 31 March we have in stages reduced factory hourly labour from 101 to 32 persons and staff from 63 to 35, principally through utilisation of the Government Job Retention Scheme (Furlough), and reduced other expenditure accordingly, with everything under constant review.

An alternative view might be that, if the company is entitled to claim the money, it should. That's a big reduction in staff numbers, which implies a fairly bleak trading outlook, at least in the short term.

Outlook/Covid-19 -

... we were expecting an upturn as the year progressed, and in February and March the order book and sales improved considerably and until the impact of COVID-19, we were well on track for a second half at significantly improved levels... in recent weeks the effect of the COVID-19 pandemic has begun to affect supplies, deliveries and a deferral in orders.

Balance sheet - is ridiculously over-capitalised. The cash pile is surplus to requirements, and for a tiny business like this to sit on £12.4m as a rainy day fund, strikes me as nuts. What are they planning on doing with it? Burning it through trading losses? Presumably not. This company could attract an activist investor, wanting to shake things up.

Still, at least thing means the risk of insolvency is basically zero, even if trading in future is terrible.

My opinion - it's an interesting special situation at this level.

That's me done for today. See you in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.