Good morning, it's Paul here.

I'm trying out a slightly different format today, because I installed some voice recognition software called Dragon, and am dictating this into a microphone. The reason being RSI all the way up my right arm, which should be alleviated by reduced use of keyboard & mouse.

Satellite Solutions Worldwide (SAT), announces that it is part of a £2.1 million grant funded project to explore how to provide 5G wireless broadband. It doesn't sound financially significant, being EBITDA neutral this financial year, and positive EBITDA of £100,000 in year two.But it does increase their potential market penetration from 70% to 90% of customers, which sounds good longer term.

The first set of company results for y/e 31 Jan 2018 today which have caught my eye are those from...

French Connection (LON:FCCN)

Share price: 37.3p (up 10.7% today)

No. shares: 96.3m

Market cap: £35.9m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Jan 2018.

The share price rose 14% yesterday and I wondered why. So it might have been some insider dealing, or just speculative buyers hoping that the results will be good. Let's have a look.

Wow, this actually looks rather exciting! Bear in mind that most investors have completely written off this company years ago, expectations are extremely low.

Revenue is up 0.5% to £154 million, despite closing 11 loss-making shops

like-for-like sales up 0.8% for the year (not bad at all, many retailers have struggled to achieve positive LFLs)

wholesale revenue up 8.6%, very good

underlying operating loss reduced to -£0.6m, compared with a -£3.7m loss last year (note that in H1 underlying operating loss was -£5.7m. So the company made a profit of £5.1m in H2 - not bad going, but the usual seasonality)

The divisional split of performance is even more striking than in prior years;

Wholesale division made £12.5 million profit which is up 25% on last year

Licensing income made a profit of £6.3 million, flat against last year

But the retail division lost -£8.3 million, a terrible result, but a bit of an improvement against the -£9.8 million loss last year.

If only they could properly turn around the retail division, then this would be a nicely profitable business.

Group overheads of £10.4 million looks extremely high, and is up £1m on last year.

The loss before tax is -£2.3m, a £3m improvement on prior year. This includes £0.9m cost for store closures and £0.8m cost for other professional fees (seems strange, I wonder what that was for? [see below])

Balance Sheet - this remains extremely strong with net assets of £46.7 million. This includes £9.5 million in cash but that is down £4 million on last year. Note how this group has steadily burned its way through a much larger cash pile in recent years.

Current assets are £67.4 million, current liabilities of £31.4 million, giving net current assets of £36 million. This is the same as the company's market cap!

Does it have long-term liabilities? No, absolutely nothing. Therefore the business itself is valued at nothing. The share price just covers its working capital. That doesn't make sense to me, when parts of the business are highly profitable.

Outlook comments - sound rather upbeat;

We have made considerable progress across the Group over the last year and I enter the new financial year with renewed confidence off the back of that success.

Our goal has been to return the Group to profitability and I believe we are very close to achieving that aim, given the momentum that we are currently seeing within the business.

While it is clear that the retail market in which we are operating in the UK is unlikely to improve in the near future, we have clear visibility on the benefits we will obtain from the ongoing portfolio rationalisation.

In addition the reaction to our collections and strength of our wholesale orders both for the spring and winter seasons further underpins this performance going forward.

Although we are only early into the year, I believe we are in a very strong position to make further significant progress.

This strikes me as a considerably more bullish tone than previous outlook statements.

Wholesale outlook;

Spring 18 orders are well ahead of this time last year and the initial reaction to the Winter 18 collection from customers has been very positive; we expect the trends we have seen over the last year to continue.

Unsolicited takeover approach - this is news to me, and it would be nice to have more details, including what price was mooted by the potential bidder. It must have been a serious offer, for French Connection to have racked up £0.8 million in professional fees.

So it sounds like the company is in play as a potential takeover target. This makes sense, since the founder and largest shareholder must be at least considering retirement. I don’t understand how FCCN could incur such enormous fees, when it is the party being bid for. Sounds like an open chequebook was offered to lawyers & accountants, which is rather annoying.

Still, this means that the company is “in play”, and we could be in sight of the end game here, with a potential sale of the business, hopefully at a decent premium;

During the year we received an unsolicited approach about a potential offer for the Group from a third party in the US. In the interest of all shareholders, we entered a period of full due diligence and negotiation over a number of months. This ultimately did not lead to an offer for the Group. The professional fees in relation to this exercise have been recognised outside the underlying operating performance in this year's profit and loss account.

ECommerce - is a significant part of the retail division, but growth of 3.1% sounds disappointing to me;

Ecommerce revenue grew by 3.1% and now represents 29.7% of retail revenue. Over the last year we have focused our online trading strategy to improve our full price revenue, although this has also resulted in a reduction in discounted sales.

We are currently in the middle of a programme of investment in the infrastructure of the site to provide greater flexibility and speed to the ongoing development and enhancements required in this fast moving channel. We anticipate seeing the benefits of this feed through during the current year and will move to increase our levels of digital marketing spend as this progresses. Mobile continues to be a growing proportion of our online activity generating 46.8% of traffic, up from 39.7% last year.

If more physical stores could be closed, and e-commerce growth accelerated, then that would be very good.

My opinion - I’ve been flagging up the potential here for a turnaround and restructuring, for years. A decently profitable business could emerge, if the heavily loss-making retail stores could be closed. It's a painfully slow process, but that does seem to be in progress.Bear in mind that this is happening against the backdrop of a depressed sector, where many fashion retailers are reporting poor figures and negative like for likes.

Today's results show a profit improvement against last year, a smaller loss, and I think the company looks likely to move into profit this year. The company is now effectively up for sale, and I think risk:reward looks to have improved considerably. So I think there's a strong case for the share price factoring in a bit of a bid premium. On that basis, I'm hopeful that today's share price rise might stick, or even continue.

Downside risk is still protected by a very strong balance sheet. Crushingly negative investor sentiment towards this company is wonderful, as it increases the potential profit for shareholders like me, if/when the business is sold. The founder is now in his 70’s, and hence likely to want to retire, which would probably mean a sale of the business.

Licensing revenues of £6.3m demonstrate that this is still a powerful brand. Now it’s stemmed the losses, the shares look very interesting to me. This is a special situation, so it won’t appeal to many readers. Sometimes good profits can come from unusual situations. It remains to be seen what the outcome here will be, time will tell.

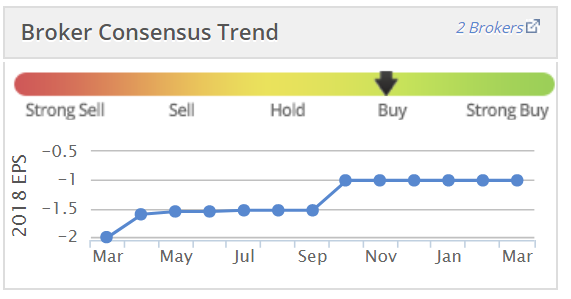

The broker forecasts have been improving over the last 12 months (still loss-making, but not much now);

A reader has been emailing me gibberish this morning, so I queried what was up? Got this rather amusing reply;

So sorry Paul, my 11 month old was playing with my phone and must have hit reply to one of your small cap emails! Look forward to hopefully catching up with you at Mello!

So you see, small cap stock pickers are starting younger & younger these days!

Tasty (LON:TAST)

Share price: 12.25p (down 2% today, at 10:47)

No. shares: 59.8m

Market cap: £7.3m

Preliminary results - for the 52 weeks ended 31 Dec 2017

I hadn't realised that the market cap of this 65-restaurants chain had dropped below our usual lower cut-off point of £10 million. However, I'm going to report on it anyway, as we've covered it before, and who knows there might be a buying opportunity at some point? This entire sector is totally bombed out, as I've mentioned before. My sector expert believes that there could be several more years of pain for the whole sector, and that sitting on the sidelines and waiting is probably the best strategy in his view.

- Restaurant roll-out has stopped – no new openings planned for 2018. This makes complete sense to me. If a rollout isn't working, then it should be stopped.

- 2017 profitability is in line with reduced expectations

- No improvement in demand is expected in 2018

- Operating profit "before highlighted items" fell from £4.8m in 2016, to £1.2m in 2017 - clearly a major deterioration, but we already knew that from previous trading updates.

- Highlighted items of £10.5 million are mainly impairments of fixed assets, this results in a loss before tax of £9.5 million

So the big question is whether the business can survive? If so, the next big question is whether it can extricate itself from loss-making sites at a reasonable cost? Therefore I will look at the balance sheet next, then the cash flow statement.

Balance sheet - Net assets has reduced from £30.2m at end 2016, to £22.1m at end 2017. The main reason being the write offs relating to fixed assets. The remaining £23.9m of fixed assets still looks very high to me. There is no freehold property within that figure. it's all fixtures & fittings & shopfits. The trouble, is that has little resale value, so I would be inclined to view the whole lot as worthless. Alternatively, you could attribute some value to the most profitable restaurants, which could be sold off individually.

Moving down the balance sheet, working capital looks OK to me. It has £10.9m in current assets, including £1.84m in cash. Current liabilities are £9.8m, so that's a current ratio of 1.11, which is fine for this sector (since restaurants don't usually need much in inventories, nor have much in debtors [other than prepayments on rent, etc] - ie. so a lowish current ratio is actually fine in this particular sector.

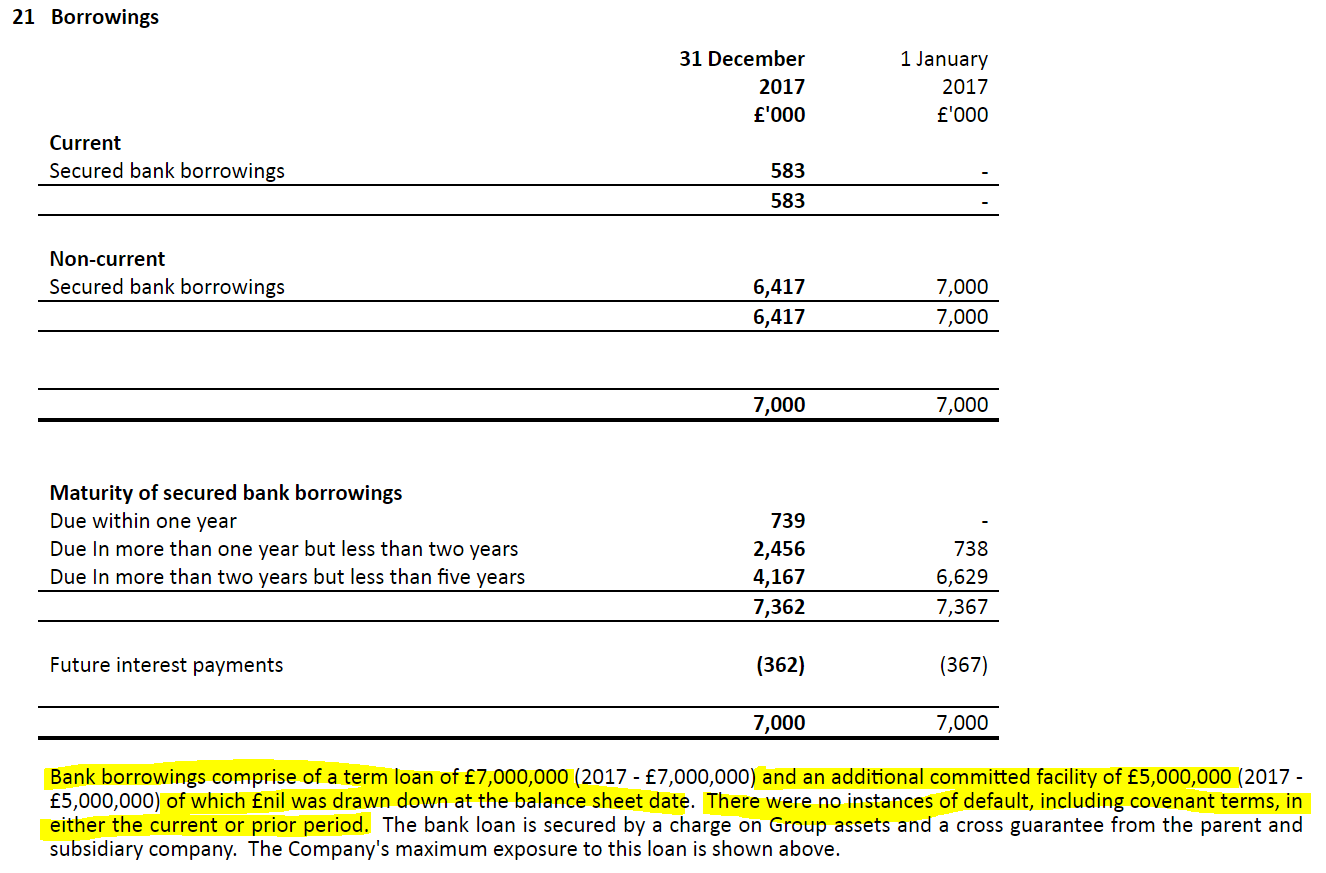

The problem lies with long-term creditors, in particular bank debt. Looking at note 21, it shows the bank borrowings of £7m;

The text which I have highlighted above indicates that there have been no defaults against the bank covenants to date. However my worry is more about the future. With trading deteriorating, and unlikely to improve in 2018, the company could potentially run into trouble.

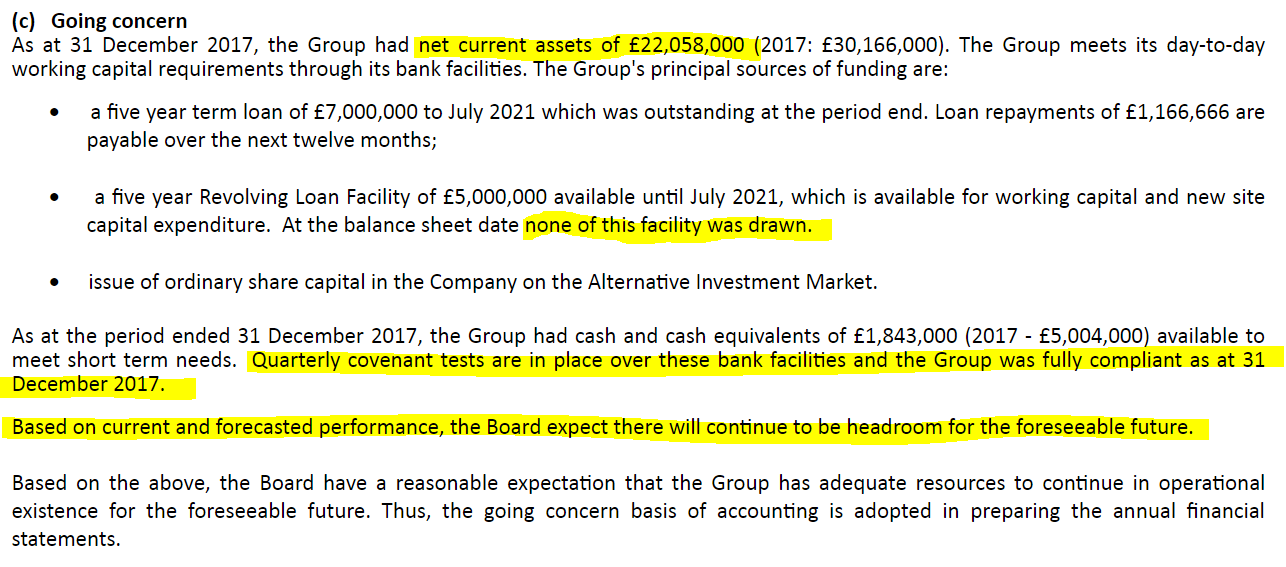

Therefore, I'll now look for a going concern note. Here it is;

There's actually a mistake in the first bit I've highlighted. Net assets are £22.058m, not net current assets. I've just called Cenkos & alerted them to this error. Hopefully this qualifies me for smart Alec of the day award!

I've checked the last Annual Report, but it does not disclose what the bank covenants are. In this type of situation, the usual one which causes problems, is Net Debt: EBITDA. A typical level is 2.5 times.

In this case, net debt was £5,157k at end December, although that would be likely to deteriorate during the sluggish months of Jan-Mar 2018. EBITDA is stated as being £3,524k. So I make that 1.46 times, which looks to be OK (and the company says it is OK).

Roll that forward to say the middle of 2018, and 12-month rolling EBITDA is likely to have dropped, and net debt might be about the same, which could mean that headroom might be getting a little tight. If trading badly deteriorates, more than forecast, then it's possible that a covenant breach might occur, perhaps? If so, then the company would be forced to do an equity fundraise, probably at a very low price, because who would want to support a struggling restaurant chain with sites that are probably over-rented for current market conditions?

That said, the Kayes are involved here, so I doubt they would want a business failure over relatively small amounts of money. Another risk is that they might decide that there's no point incurring the hassle & costs of a stock market listing, and just take it private.

EDIT: having had a think, and read the detail more thoroughly, I think my concerns over bank debt could be a red herring, in the short term anyway.

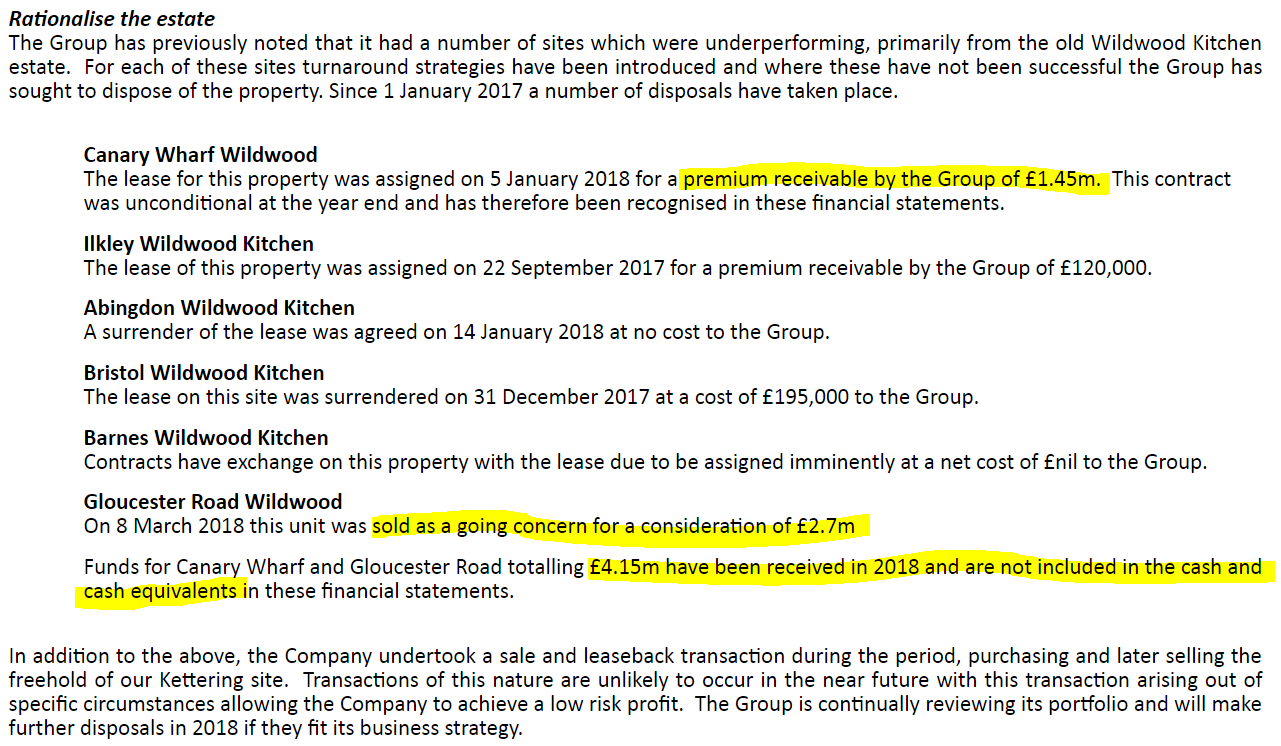

There's a section about property disposals, which indicates that £4.15m cash has been received since the year end, which changes the perspective. To get such large positive premiums on 2 main disposals (highlighted below), these would almost certainly have been strongly profitable units. Therefore, disposing of them will have certainly helped the short term cash/debt position, but is likely to depress EBITDA & profits in future. In other words, it could be that Tasty is selling off the family silver, in order to survive?

Taking this into account, then it looks as if the group is more financially stable than I first realised when looking purely at the numbers. Here's the detail on disposals;

End of EDIT

Remedial action - the company is doing all the things you would expect to improve performance, namely;

- trying to dispose of loss-making sites (and probably some profitable ones too, to raise cash)

- turnaround measures at poorly performing sites, which it says are producing encouraging results

- improving the food offering

- promotional pricing is matching what the competition are doing

- reviewing its cost base for savings

- halting the new store rollout

That all sounds pretty sensible. The trouble is, competitors are doing the same. So this is a war of attrition, in a sector with considerable over-capacity. The weakest participants will have to go bust, to enable the stronger companies to survive, and then eventually recover.

Outlook - this is rather concerning, but at least they're being straight with us;

The Board does not expect market conditions to improve in 2018 and believes that a further deterioration is likely.

Underlying input costs will continue to rise and consumer spending will face increased pressures. The Group's next round of operational improvements are targeting improvements in the areas of sales, food and labour margins, however it will be some time before the full benefit of these changes is felt and financial performance in 2018 is very unlikely to see any improvement on 2017 ...

The Group will undergo significant positive changes throughout 2018 which should allow for successful menu development, improved customer experience and, in the longer term, lower costs. The Group will also continue to investigate promotional options and pricing structures. Some of these changes will be disruptive to the business in the short term and the Group will incur a number of restructuring costs in 2018.

Market conditions have been increasingly challenging through 2017 and the Board's expectation is that there will be no improvement in this regard in 2018.

Quite a tale of woe. However, the business should remain EBITDA positive, I imagine. Therefore, with capex essentially switched off, with no new store openings, it should remain cash generative. Therefore, I wouldn't write-off this business just yet.

My opinion - the £7m market cap is only valuing it at just over £100k per site, which is far below the fit-out costs of its restaurants. I would have been tempted to have a little dabble here, were it not for the bank debt.

The big problem (aside from rising wages & input costs, etc), is the lease liabilities. It's really impossible for us to value this business, without being given detailed P&Ls for each site, and the lease liabilities of each site. Years ago I was involved with the acquisition of a chain of shops out of Administration. It was easy to select the profitable shops only, and jettison the rest. Then we could work out what the business was worth, and put in an offer well below that price.

Valuing retail/hospitality shares is very similar. If they're trading highly profitably, it's easy, you just value the business on the total profits. Whereas in distressed situations like this, when they need to exit from loss-making sites, a whole set of different considerations come into play. Is it possible to exit from loss-making shops? How long are the leases? Are there any break clauses? Ordinary investors like us simply don't have that information, therefore it's impossible to accurately value this share.

Funnily enough, the other share I've written about today, French Connection (LON:FCCN) is in the same boat. It has incurred multi-year losses from its retail division, because it has been locked into leases, unable to exit, and hence having no option but to continue funding those losses from its dwindling cash pile.

If Tasty succeeds in exiting from its loss-making sites, then we could see a smaller, but nicely profitable & cash generative business emerge. However, if it is locked into serious problem sites, which lose money hand over fist, then that could potentially pull down the whole company.

I simply haven't got the information I need to make an informed judgement. Also, if I was given that inside information, I wouldn't then be able to buy the shares anyway!

So it's really just a punt at this stage. It's tempting to have a little flutter on this, just for fun, but I must resist that urge. What catalyst would there be for the shares to rise from here, when management are telling us that things are only likely to get worse this year? Would they then just take it private, and buy it for peanuts, and do a CVA to get rid of the problem leases? That's probably the most logical route for management to take, but it could be bad for minority shareholders - as a de-listing announcement usually takes the price down by about 50% instantly. Why take that risk? I was tempted to buy some shares here, but have talked myself out of it, I think!

Telit Communications (LON:TCM)

Share price: 160p (down 5.4% today)

No. shares: 130.7m

Market cap: £209.1m

Banking covenant & 2017 update

Telit Communications PLC ("Telit", "the Group", AIM: TCM), a global enabler of the Internet of Things (IoT), has agreed a series of new and amended financial covenants with its lead financing bank and published an update on financial results for 2017 as well as for the first two months of 2018.

I've had a field day with this company's accounts in the past, picking apart its fake profits. My archive of bearish posts from Nov 2015 to date, on the company's dodgy accounts, and what specifically was wrong with them, can be found here. In a nutshell, they capitalised anything that moved onto the balance sheet, and then adjusted out anything that was left, in order to create bogus profits, designed to fool investors into valuing the shares too highly.

The share price is now 160p, against a peak of about 360p in May 2017. Actually, I'm very surprised the share price has remained as high as it has, given the severity of the problems here.

As regards its accounting procedures, today the company promises to be conservative from now on, which is nice;

Telit plans to publish its results for the year to 31 December 2017 in April.

The Group has resolved to adopt a conservative approach in the preparation of its results, and in particular with respect to the capitalisation of R&D expenditure.

This decision, taken in the course of preparing its results and after a review of its capitalised R&D assets, will have the effect of significantly increasing R&D expenditure charged to the income statement to a level higher than previously forecast.

In other words, they've admitted that previous profits were over-stated (which is obvious), but also that putting this right will mean lower profits than expected for 2017. So it's a profit warning.

They sort-of quantify things as follows;

This, combined with establishing a prudent level of provisions and other adjustments with its auditors and some component shortage issues which affected sales in the closing weeks of 2017, leads the Board to now expect to report revenue of approximately $374-376 million and adjusted EBITDA in the region of $20-23 million (excluding exceptional costs in relation to the restructuring of the business).

The Group's net debt position as at 31 December 2017 was $30.2 million (2016: $17.7 million).

Adjusted EBITDA has always been meaningless at this company. They don't tell us how much R&D is now going to be capitalised, so it's impossible for me to work out how bad this profit warning is.

Current trading - this sounds rather more positive - maybe the company is over the worst?

Trading over the first two months of 2018 has been considerably stronger than the comparable period in 2017 and ahead of the Board's early expectations.

The more positive current trading could explain why investors only punished the company with a 5.4% share price fall, on the profit warning today.

Banking covenants - the company is vague on this, just saying that it has agreed new covenants with its lead bank. No figures are given, so again it's impossible for me to work out how robust (or not) the financial position is.

My opinion - it would take a lot more than today's announcement to reassure me that this house of horrors has got anywhere close to being investable.

As mentioned before though, and in the interests of balance should be repeated, I have met a credible customer of Telit's who told me that their products are good, as is the customer support. I've just not yet seen any evidence that Telit generates any genuine profits or cashflow. So why is it still valued at £209m? So it remains, a bargepole stock for me.

I did take out a short position on it some time ago, but the price failed to collapse. So, as is so often the case with short positions, I got bored & moved on.

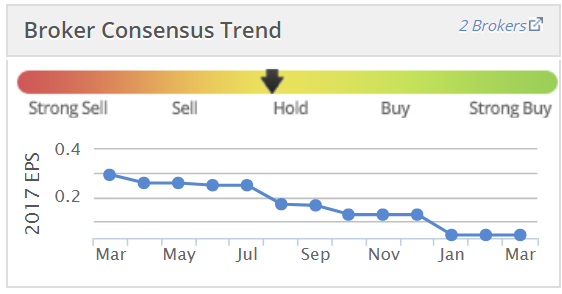

See below how the 2017 earnings forecasts have been relentlessly falling - and are likely to fall again, after today's statement. This very much looks like the bad news being gradually drip-fed into the market.

I cannot emphasise enough, that aggressive (and beyond) accounting techniques are incredibly easy to spot. So if you see a company bending every accounting rule, capitalising extreme amounts into intangibles, trying to focus you onto heavily adjusted EBITDA, etc, then be terribly careful that you're not being suckered into an over-priced share.

EBITDA is not always a bad thing. In some sectors (e.g. retail, hospitality) it's a very good proxy for cashflow - so that is an intelligent starting point for valuation. Then you have to take into account tax, maintenance capex, etc., and gradually develop a valuation that makes sense.

Whereas in cases like Telit, EBITDA can be a highly misleading figure. Why? Because of excessive capitalisation of internal costs into intangible assets on the balance sheet. So it's when you have a focus on EBITDA, and a huge amount of capitalised internal costs, that things can become very misleading.

That's everything for today.

A reader has emailed me to say that he's posted comments below on Zotefoams (LON:ZTF) - thanks for that. Sorry I didn't get round to looking at it.

I think it's best if we can ease off on the reader requests, on days I'm writing. I'd rather focus on things that interest me, rather than random stocks that people mention in the comments, which are boring & don't seem to have any upside.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.