Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Agenda -

Paul's section:

Joules (LON:JOUL) (I hold) - supply chain issues deferred some sales, and increased costs in H1, particularly November. Despite that, the company is guiding £9-12m profit (up on last year's £6.1m). Broker forecast is reduced by about a third, from previously punchy forecasts. Valuation looks reasonable, given recent slide.

Begbies Traynor (LON:BEG) (I hold) - interim figures are in line with the last trading update, so no surprises. A series of good acquisitions are delivering strong profit growth. There's a tailwind coming for insolvency practitioners once taxpayer support measures are phased out. BEG has a sound balance sheet. Yet it's only priced on a PER of about 13.4 by my calculations. Looks excellent value to me.

Cohort (LON:CHRT) - profit warning for the full year accompanies lacklustre interim results (profit down 60%). Given its lumpy, unpredictable profit track record, it's impossible to accurately value this share. Looks expensive, given the uncertainty.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Joules (LON:JOUL) (I hold)

135p (down 29% at 08:07) - mkt cap £151m

Joules, the British lifestyle group, provides a Pre-Close Trading Update in respect of the 26-week period ended 28 November 2021 (the first half of the Group's financial year ending 29 May 2022, or the "Period").

The Group is providing its trading performance on both a year-on-year and two-year comparative basis, as FY21 H1 was characterised by boosted e-commerce demand reflecting Covid-19-related social restrictions and the enforced closure of stores (both Joules and its wholesale partners) for approximately two months.

The revenues table below strikes me as positive - key points being that store revenues have bounced back strongly (up 80% vs H12 LY) from last year’s enforced restrictions/closures, and are now almost back to pre-pandemic levels (helped by 5 new openings in Centre Parcs, which have “performed particularly well”)

Also note that eCommerce has continued growing, albeit at a slower growth rate (5%) versus a very strong +41% growth rate last year -

.

The acquisition of Garden Trading has boosted the total group performance columns.

Supply chain - a very well-known issue by now, which is causing temporary disruption, and additional costs, as I would expect. JOUL experienced problems in the period - which is obviously why the share price has been weak of late -

The well-documented global supply chain issues have resulted in some higher costs and stock delays during the Period. In addition, labour shortages in our third-party operated distribution centre (DC) have resulted in extended product delivery times to online customers, stores and wholesale partners. These factors were particularly acute in November, including the Black Friday period, which alongside weaker year on year online traffic contributed to performance during this month being below expectations.

These problems are expected to continue, but a better performance is expected in H2 -

Global supply chain challenges are expected to remain during at least the second half of the Group's financial year and there is increased consumer uncertainty as a result of the emergence of the Omicron coronavirus variant. Supported by a strong stock position and wholesale orderbook, actions that have been taken to improve productivity at the DC, and the ongoing strong customer demand for the Group's products, the Board is confident that the Group will achieve continued strong revenue growth in H2 and an improved profit performance.

Guidance - this is problematic, as the main issue with today’s update is that it omits to tell us what market expectations are, although Liberum has just come to the rescue with an updated note on Research Tree - many thanks for that.

H1 profit guidance - down a bit on last year’s H1 -

Considering these factors, Group profit before tax and adjusting items for the Period is anticipated to be in the range of £2.0m - £2.5m (FY21: £3.7m).

Full year guidance - down on (unknown) market expectations, but signalling a much better H2 than H1 -

… full year profit before tax and adjusting items is now expected to be below current market expectations and in the region of £9m to £12m notwithstanding any further significant covid restrictions.

Stockopedia’s broker consensus shows £6.0m net profit forecast for FY 5/2022, which grossing up for 19% corporation tax would be £7.4m pre-tax. Joules is saying it’s below expectations, but it’s actually well above the Stockopedia broker consensus figure, even after I’ve added back corporation tax.

So the company has scored an own goal here, by not explaining what its market expectation numbers are.

Is it a profit warning? The company says so, but on the numbers we’ve got, it’s a profit beat! Ridiculous, honestly why can’t companies just include a footnote to say what it thinks market expectations are, then there wouldn't be any confusion?

Broker update - new forecasts out this morning from Liberum have clarified things. It previously had very punchy forecasts, so with supply chain problems being so widespread, it shouldn't be a great surprise that they've been trimmed. It's easiest to work on EPS numbers, which are -

FY 5/2021 actual: 4.6p

FY 5/2022 latest forecast today: 8.7p

FY 5/2023: 11.7p (also reduced today)

Once supply chain problems have been resolved, then clearly there should be good upside on these figures.

My opinion - personally I’m pleased with £9-12m profit guidance, that seems a good outcome to me, in a year when there’s been massive disruption to supply chains, and additional costs. Once those temporary factors have been resolved, maybe in 2022, maybe later, who knows, then it’s reasonable to assume profits would rise.

There’s already early evidence that the UK shortage of truck drivers may be starting to ease - with recent press reports showing increased numbers of HGV licences being issued, and testing centres busy. As you should expect - higher wages attracts lapsed staff to return, or retrain from other sectors.

The share price has (like so many other small caps) drifted down a lot. I don’t know how the market is likely to react to this update. It strikes me as pretty good in the circumstances.

Last year FY 5/2021 JOUL delivered £6.1m PBT (before exceptionals), so the way I read today’s RNS, it’s heading for improved profitability at £9-12m. That seems positive to me in the circumstances of a year dominated by supply chain delays & costs that are affecting everyone moving physical goods, and continuing covid uncertainty.

The market seems to latch onto any excuse to panic sell at the moment, so short -term prices are a very unreliable indicator of fundamentals right now. For long-term investors, I think JOUL is an outstanding company. It’s a unique brand, executing very well (particularly online, which is 63% of its total retail sales). I also really like the online marketplace, Friends of Joules, which has a lot of potential in my opinion.

The market cap of £151m strikes me as undervaluing the potential here.

I see the price has opened down 29%, which seems crazy, given that supply chain issues are already known, have already been reflected in a lower share price, yet the market acts surprised when the obvious is announced! This is a cracking buying opportunity in my opinion at 135p per share.

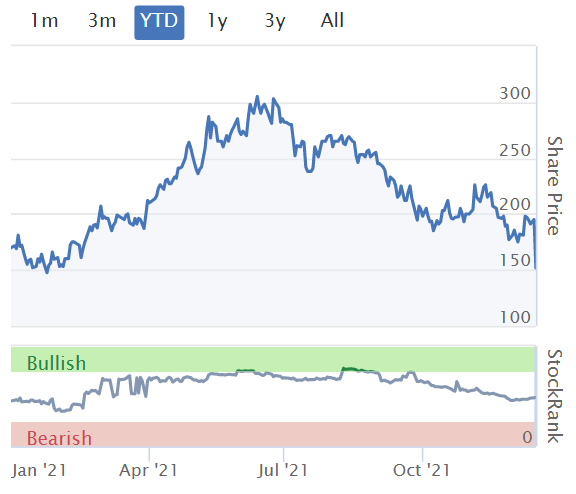

Note below that the share price has now given up all of 2021's gains - which doesn't make any sense to me, given that profitability has risen considerably, and the full year guidance is now usefully higher than last year's actual profits. Also of course, once supply chains are sorted out, then freight costs are likely to come down considerably, and delays disappear. This year's headwind is a future tailwind. At some point, it's like flicking a switch, the market suddenly turns from seeing only the downside, to focusing on the upside as temporary factors like supply chain, and covid, are perceived as lessening. These boom & bust cycles seem to be getting more intense at the moment, this feels like a market dominated by traders, rushing in & out of things. Quite unsettling for longer term investors, for sure. But that's what provides the buying opportunities, when Mr Market is having a deep depression.

.

.

Begbies Traynor (LON:BEG)

134p (roughly flat at 08:47) - mkt cap £203m

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, today announces its half year results for the six months ended 31 October 2021.

Acquisitions - insolvency practitioner BEG has made some chunky acquisitions, so it’s arguably more of a growth share, than the existing perception of a counter-cyclical, mature business. I wonder if it might re-rate in time, to reflect the excellent track record of management making decent acquisitions, and be viewed more like Sdi (LON:SDI) or Judges Scientific (LON:JDG) ? Who knows, it’s possible though.

In the past I always viewed acquisitive groups with suspicion, but having seen over the years examples of spectacular growth & shareholder value creation with SDI and JDG, acquisitive groups are an area that is worth looking at more closely I reckon. The key factor seems to be management competence and discipline, in only buying decent companies, and walking away from lousy deals. Management at BEG fit the bill there, with many years experience, and they don’t seem to have put a foot wrong with the acquisitions to date.

Today it says -

Following our recent acquisitions and organic development of the group, our broad range of complementary services provide a strong platform for growth. We continue to progress a pipeline of acquisition opportunities, which together with organic growth initiatives across the group, will enable us to build upon our track record and we remain confident in our outlook for the current year and beyond.

A minimalist financial overview table is provided, and these numbers tie in with the H1 trading update which I reviewed here on 18 Nov 2021 -

.

Note that adj PBT is +60%, but adj EPS is up a lesser amount, +32%, which either means there are more shares in issue, or the tax charge has risen a lot, or a combination of both.

The StockReport has a handy line which shows the average share count over a number of years, which I always check to see what dilution has occurred. In this case it’s not excessive, and the dilution has been used to fund good acquisitions -

.

.

Do remember to check the latest share count, which is near the bottom of the StockReport, as this will give the bang up-to-date figure, which may have increased further from the average numbers above, which it has here -

.

.

I thought it might be useful to flag this, for our newer subscribers.

Companies also often announce the total share count at the end of the month, so you can check the RNS as an alternative source for the latest share count figures.

Adjustments - note that statutory profit is much lower than adjusted profit, because the adjustments relate to acquisitions - transaction costs, and amortisation of goodwill. These are perfectly valid adjustments, because the adjusted numbers are intended to show the underlying performance of the business before one-off costs. So I don’t have any issue with that.

Balance sheet - the main danger with acquisitive groups is that goodwill becomes excessive at the top of the balance sheet, funded by excessive debt lower down.

BEG has avoided that pitfall. Whilst goodwill is a lot, at £77.3m intangible assets, NAV is higher at £83.1m. That leaves NTAV of £5.8m - not a lot, but as long as NTAV is positive, then I’m comfortable with the balance sheet for a profitable group like this.

There’s a £6.0m long term bank loan, but that’s more than offset by £7.2m cash. Maybe a bit flattered for the year end, but gross debt of £6m is negligible for the size & profitability of the business. Not a problem at all.

Valuation - many thanks to Shore Capital for providing us with an update note today on Research Tree. It’s forecasting 8.5p EPS for FY 4/2022, which looks undemanding.

As mentioned last time we looked at BEG, I see the forecasts as quite soft, so am happy to value BEG shares on 10.0p EPS which might be achieved next year.

At 134p per share, that gives a modest PER of only 13.4 - which I think is too cheap.

My opinion - all good - no surprises here, the figures are as expected.

BEG sees a wave of insolvencies on the horizon, as zombie companies relying on Govt support and the rent moratorium have to pull the plug in 2022 when such support ends.

What seems strange to me, is that the stock market doesn’t seem to have priced in that upside, which is good news for shareholders at BEG - there seems fairly obvious upside on this share in the pipeline. Hence the fundamentals look good to me.

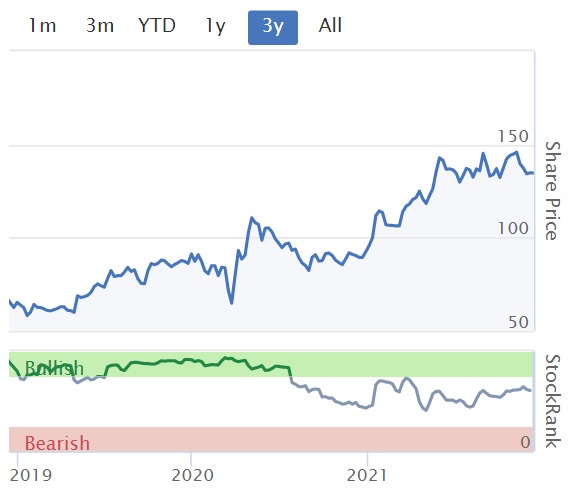

.

.

Cohort (LON:CHRT)

521p (down 13% at 10:20) - mkt cap £215m

Cohort plc, the independent technology group, today announces its half year results for the six months ended 31 October 2021

It’s immediately obvious why this share is down 13% today - despite positive figures on revenue, order intake, and order book, profitability has dropped 60% in H1 -

.

The commentary says H1 was disappointing, but that there’s good visibility for a better H2 -

"We anticipate a much stronger performance in the second half, but do not expect this to fully make up the shortfall. As a result, the Board now believes that Cohort's performance in 2021/22 will be materially below current market expectations.

Given the hideous market sentiment in small caps at the moment, I’m quite surprised the share price is only down 13%.

I can’t find any broker updates, so am not sure how much estimates are likely to be reduced.

Last year’s results showed a large H2 weighting to revenues and profitability (Adj operating profit - H1 LY: £4.3m, H2 LY: £14.3m), so it looks quite a lumpy business - which makes it difficult to forecast, and hence difficult to figure out what the shares are worth.

Balance sheet - intangible assets make up £63.5m, with £80.9m NAV. NTAV is therefore £17.4m - adequate, I would say.

Receivables strike me as high, at £54.2m. Given that H1 revenues were only £60.0m, then it looks as if customers may not be terribly keen to pay the company’s invoices. Hence this would need looking into before buying CHRT shares.

It holds a big cash pile of £35.5m, whilst also owing £29.5m in bank borrowings, which is unusual, and could suggest large swings in cash/debt during the year, perhaps?

My opinion - I can’t muster any enthusiasm for this share.

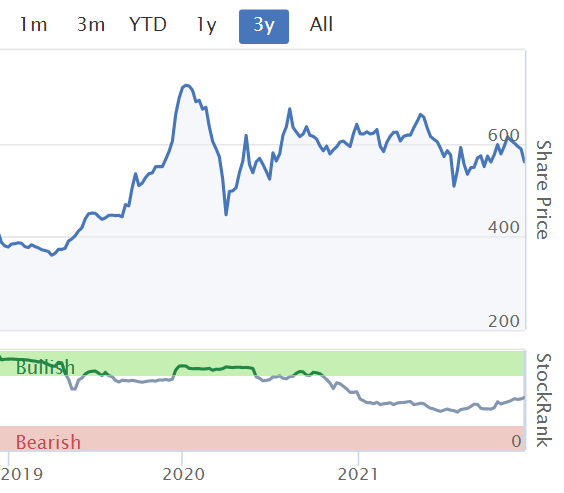

As you can see from the Stockopedia graphs below, historically CHRT has oscillated between about 10-20p EPS each year.

The lighter coloured forecast blobs will obviously be reduced by brokers, now the company has warned on profit today.

.

Graph 4 shows a re-rating onto high PERs over the last 5 years, which I’m struggling to justify based on performance.

Overall then, it looks too difficult to value accurately, and expensive given the lack of earnings growth, and profit volatility. This strikes me as the type of share where you would need to get into all the detail of contracts, which probably wouldn’t be possible for outside investors, and still not have an accurate idea of what profit it’s likely to make in future. Hence I have to file this one in the “too uncertain, and looks expensive” tray.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.