Good morning, it's Paul here!

Here is a catch-up section, before I look at today's news.

Superdry (LON:SDRY)

Share price: 447p

No. shares: 82.0m

Market cap: £366.5m

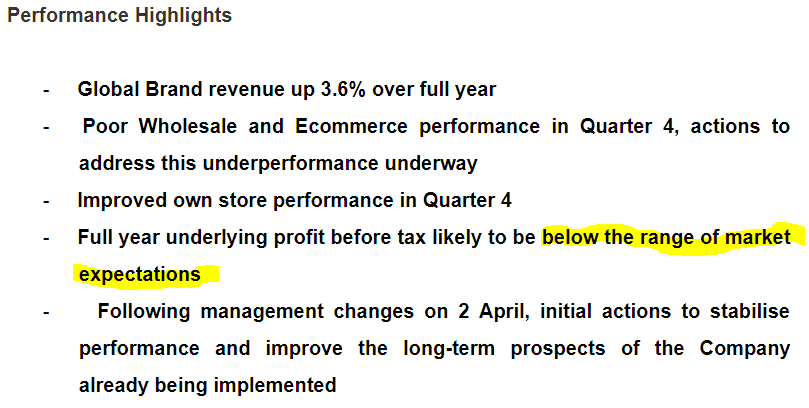

A reader asked me to comment on this most recent trading update from 9 May 2019. It is headed with this comment;

Trading performance continues to be weak; initiatives to stabilise and improve performance underway

This has to be seen in the context of the recent Board upheaval, where the founder came back, and kicked out the under-performing old Board. That struck me as a good thing. However, the voting figures made clear that shareholders did not agree, as there was little support for Dunkerton from outside shareholders. That's important as it could mean an overhang of potential sellers in the share, who don't like the new (returning) management. Hence I'm wary of buying into this share, as that overhang could persist for some time, perhaps?

The 9 May 2019 update covers this period;

Superdry announces a trading update for the 13-week period from 27 January 2019 to 27 April 2019 ('Quarter 4').

It's another profit warning;

That's not really a surprise, as new (returning) management has not had time to do much yet. Plus there's likely to be a desire to blame continued poor performance on the old management, and then do a kitchen-sink job in the figures, which lays the ground for a subsequent improvement in performance. That's what usually happens!

Revenues - are showing a deteriorating trend (i.e. Q4 worse than H2, and both worse than FY);

Group revenue flat year-on-year (0.0%), but declined 4.5% in Quarter 4.

Specifically: Wholesale revenue up 3.6% to £335.0m year-on-year, though declining 9.3% in Quarter 4. The Quarter 4 decline was driven by increased levels of returns, lower than anticipated in-season orders and decisions not to ship to customers that had reached their credit limits.

The last point, about customers reaching credit limits, concerns me in particular. This suggests that there could be elevated bad debt risk in SDRY's sales ledger. In my sector experience, if deliveries to customers have to be put on hold, due to credit limits being reached (or exceeded), then the customer is clearly in financial trouble. That is often a precursor to the customer going bust, and hence a bad debt for SDRY if it has not insured its debtor book.

It might be OK, if SDRY does have full bad debt insurance on its debtor book. That's a key question that needs to be asked. Does anyone know the answer to that?

Other points;

- Cost savings of £50m planned by FY22 - that must mean (at least in part) store closures, so presumably revenues would also fall

- "The Company will make a non-cash onerous lease and store impairment provision." - I'm worried this could be large, as the company has some big rent flagship stores that are probably loss-making. Onerous lease provisions are not actually non-cash. It's just banking future cash losses early

- Dunkerton says he has made some immediate improvements, in his first 5 weeks

The new Chairman says this, which I like the sound of;

The Company's financial performance won't be turned around overnight, but we know what we need to do, and we are wasting no time in addressing the challenges which the business faces...

My opinion - the company's problems are well-known, and may be baked into the valuation by now. However, I cannot shake off the feeling that it might have (at least) one more profit warning in it. This is not a simple, or quick turnaround plan, as the company admits above.

On the bull case, the brand is still very good, the balance sheet strong (so very unlikely to go bust), and the recovery potential could be excellent, if people are patient.

At this stage, I'm not sure enough to want to buy, but it's getting close, so is high on my watchlist as a possible future purchase.

7-8 am early (brief) comments

Greggs (LON:GRG)

A fantastic trading update today. This sandwich & convenience food chain seems to be going from strength to strength, based on product innovation (e.g. vegan sausage rolls), and increased customer repeat visits.

... Taking all this into account, the Board believes that underlying profits (before exceptional costs) for the year will be materially higher than its previous expectation.

Materiality is usually at least 10%. I see that forecasts have already been raised several times in the last year.

Look at the LFL increase, which is extraordinary, given falling High Street footfall;

Company-managed shop like-for-like sales in the first 19 weeks up 11.1% (2018: 1.0%)

My opinion - I'm pretty stunned by this update!

The share price has been very strong in the last year. On the back of this update, I think it could have further to run.

As it's a £1.8bn market cap, I won't write any more about it today. I wouldn't be surprised if it's a £2.0bn market cap by the end of today.

CML Microsystems (LON:CML)

Trading update - not madly exciting. Seems to be in line with the last update.

Sales down on prior year, as forecast, at £28m.

Big cash pile relative to the market cap.

Outlook comments potentially interesting;

The growing product portfolio and our expanded global sales coverage is driving the value of the Group's sales opportunity pipeline significantly higher. Despite the challenges associated with current market dynamics, the Board believes that the Company remains very well placed to benefit as these external situations normalise.

My opinion - possibly worth a closer look, if you understand the sector?

I won't write any more on this today.

OnTheBeach

Interim results look quite good.

Outlook comments vague, so I can only assume that it's trading in line with market expectations. Why can't they say so? An annoying omission, which introduces doubt.

Acquisitions helping to drive growth - balance sheet still look OK though, so it's good they haven't wrecked it.

Brexit uncertainty mentioned.

My opinion - this looks a good share to me. The valuation seems reasonable at a forward PER of 16.6.

The balance sheet has changed quite a lot, with most recent acquisitions - much bigger debtor & creditor balances.

I probably won't do any more work on this today, but it gets a moderate thumbs up from me, due to solid performance in a difficult market. Note that they've dialled down marketing spend, to boost profits.

Ideagen (LON:IDEA)

Positive trading update from this acquisitive software group;

The Board is pleased to report that trading for the year to 30 April 2019 has been strong and results are expected to be marginally ahead of market expectations representing the Group's tenth consecutive year of revenue and adjusted EBITDA** growth.

The Group expects to report revenue up 29% at approximately £46.7million, (FY2018: £36.1million) and adjusted EBITDA** up 30% at approximately £14.3 million (FY2018: £11.0 million).

This group has an excellent track record of making good acquisitions, and reporting results at least in line with expectations, year after year. That's a record that management is justifiably proud of.

There's also a confident outlook statement, which is valuable because of the company's great track record of meeting/beating previous expectations.

I'm looking forward to catching up with Executive Chairman, David Hornsby, this Thursday at Mello London, and congratulating him on another decent performance. David is speaking at 12:30 and 16:45.

I won't write any more about this share today, as the main points are covered above.

Later comments

Portmeirion (LON:PMP)

Share price: 910p (down 25% today, at 09:06)

No. shares: 10.63m

Market cap: £96.7m

Trading update (profit warning)

A nasty blow today for shareholders in this tableware (mainly ceramics) group. Crockery, candles, etc. A lot of its china is classic, or twee, depending on your point of view. The company has had a good track record of growing revenues & profits, until today.

This is the crux;

... the Board now expects profit before taxation for the full year will be significantly below market expectations.

Frustratingly, I now have to try to unravel what that actually means. I can't find any updated broker research, so am in the dark.

What's gone wrong? - its 2 largest markets are doing fine (UK & USA);

We have continued to experience good sales growth in our two largest markets - the UK is up 5% and the US up 8% against the prior period last year.

However, its 3rd largest market, South Korea, seems to have gone wobbly;

Having had a very strong finish to 2018, we anticipated slower demand in our export markets at the start of 2019, however actual export market sales, particularly for Korea, have been lower than we expected.

The RNS fails to properly explain what has gone wrong in South Korea. All it does say, is that the company is developing new products for this market. I'm assuming that the existing products must have fallen out of favour, for some reason which is not disclosed.

The financial impact is not explained clearly enough, but this is what we're told;

As a result, total Group sales for the first four months of the year are down 10% against the comparative period last year. While the total effect on Group sales is expected to be less than that for the full year, the Board now expects profit before taxation for the full year will be significantly below market expectations.

Portmeirion does have a very heavy sales & profit weighting for H2, which is due to some of its products being attractive Christmas gifts. So the H1 results have never been very important.

Dividends - not likely to be affected by this profit warning, the company says.

My opinion - there isn't enough information, or figures, given today for me to be able to properly assess the situation. The lack of broker updates means that I'm having to rely on semi-guesswork. Let's take a stab at this.

Stockopedia is currently showing 2019 EPS forecast of 77.2p. If we're now going to be "significantly below" that, what could it mean? I would guess that could mean anywhere between 50-70p EPS. With such a wide range of possible outcomes, how can we possibly value this share?

The forecast 2019 divi is 39.1p, so the company probably would have said that it needs to cut the divis, if performance is likely to be below 60p EPS. Therefore, I'm guessing that we might be looking at a 60-70p EPS range. If we take the mid-point of 65p, then at 910p per share, I make that a (guessed) PER of 14 - not especially cheap, given that there's now so much uncertainty, and profit growth appears to have stalled.

Is this a quick & easily fixable situation? I don't know, as the company hasn't given us enough information to assess that. However, the UK & USA markets still doing well, is reassuring that there's not some general collapse in trading going on.

The balance sheet is strong, so there are not any solvency issues to worry about here.

The last commentary came out on 21 March 2019, being the 2018 results, and sounds upbeat about Korea. So I'm puzzled as to what's gone wrong in the last 2 months.

Overall, as you've probably gathered, I'm not tempted to buy any shares on this profit warning today. Whilst I like the company, and think it's a decent business, there is not enough information available for me to assess what the share is worth. My rough estimates above don't arrive at a particularly cheap valuation, hence this is going on my watchlist only at this stage.

Another consideration is that this share is very tightly held. With so little market liquidity, the price could go absolutely anywhere - e.g. if an institution starts trying to sell in the market, it could collapse. Is that likely to happen? Nobody knows!

On the upside, the reduced price might attract a takeover bid, again who knows?

Too many uncertainties for me to make a rational decision, so I'll pass on this one.

Incidentally, I've just read the more recent reader comments, and see that I'm not the only one confused by the PMP profit warning!

EDIT (the following day): many thanks for the additional information provided to me overnight, which gives me more to work on.

Broker consensus forecasts for 2019 have been revised to 66.1p. That's very close to my estimate of 65p (I love it when that happens!).

Therefore at yesterday's closing share price of 910p, the revised 2019 forecast EPS of 66.1p gives a PER of 14.

Earnings growth has gone into reverse (66.1p revised forecast is down 8% on last year's actual EPS of 71.9p). The question is whether this is a blip (which brokers think it is), or a more worrying trend? Or that the group has just gone ex-growth, in terms of profitability?

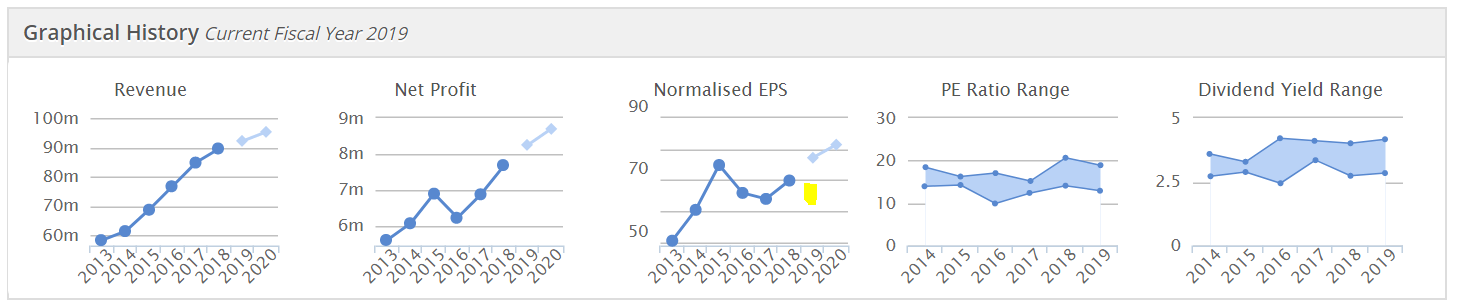

As you can see from the historic graphs below, there has been no earnings growth overall since 2014. I have put a yellow blob where the new broker forecasts are. EPS now looks to be trending flat. Bear in mind that a number of acquisitions have been made in that time too, with very few new shares issued, so the original business has really seen earnings fall.

For this reason, I don't think PMP can command a premium PER. To my mind, a PER of about 10-12 seems more appropriate at this stage. That equates to a share price of 661-793p, which is below the current share price.

You could argue that the company deserves a higher rating, as it has valuable brands, and could attract an overseas (USA?) takeover bid at some stage. So the 910p current share price looks reasonable to me - maybe that's about right, taking everything into account. Then there could be upside back up to say 1200p, if trading later this year improves?

Dividends - of 37.5p gives a yield of 4.1% - not bad. And it looks safe, being 1.76 times covered on the new, lowered forecasts.

My (revised) opinion - now that I've seen the updated broker notes (sorry I am not allowed to forward them to anyone), I'm a lot more comfortable with things.

The PER of 14 isn't quite cheap enough to attract me to buy any shares, but I'm happy to put it on my watchlist, and would consider a purchase in future if the price remains weak. There's not usually a rush to buy shares after a profit warning. I often like to bide my time, as that gives an opportunity to absorb & digest information, and to discuss with other investors.

Plus, I've lost money in the past usually, when I've dived in to catch a falling knife.

I'll put Zytronic results into tomorrow's report.

Thanks for dropping by, and leaving your comments - which are often very helpful & interesting.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.