Good morning, it's Paul & Jack here, with the SCVR for Tuesday.

Today's report is now finished.

BOO trading update discussion - please note that I've posted a separate article to look at & discuss the Boohoo (LON:BOO) (I hold) trading update this morning, which is here. So please let's keep the SCVR clear of BOO comments, as it doesn't fit the small caps remit here. Thanks.

Mello - There's a Mello on tonight, this one to do with Funds & Trusts specifically. So if that catches your interest you can read more in David's post here, or check out the web page here. Stockopedia subscribers can register for free with this code: STOCKO1506

Quick note - we said last week we would create a disclaimer for these posts. For now, just a friendly reminder that we don’t recommend any stocks. We aim to cover notable trading updates of the day and offer our opinions on them as possible candidates for further research if they pique your interest. We tend to stick to companies that have news out on the day.

A central assumption is that readers then DYOR (do your own research) and discuss in the comments below. The comments, incidentally, sometimes add just as much value as the blog post itself!

Agenda

Paul's Section:

Eckoh (LON:ECK) - results for FY 03/2021 lack sparkle (probably due to covid). Guidance is for a flat year in FY 03/2022, then growth thereafter. Price looks toppy to me, considering we're being asked to pay up-front for growth well into the future.

Cml Microsystems (LON:CML) - a special situation, where about half the current market cap is net cash mainly from the disposal of its storage division. Another 50p special divi is imminent. Upbeat outlook comments. Looks intriguing.

Vianet (LON:VNET) - as expected, FY 03/2021 was poor. Note the large amount of development costs capitalised onto the balance sheet. Funding position looking a little tight. A recovery in trading already seems priced in, so doesn't interest me.

Jack's Section:

Property Franchise (LON:TPFG) - Market conditions currently more favourable than before Covid, but are being helped by government initiatives which could at some point change; Hunters integration going well; cash generation should allow the group to continue funding organic and acquisitive growth opps

K3 Capital (LON:K3C) - acquisitive SME services provider once again beats expectations. Multiple acquisitions can be a risky strategy but the growth CAGRs here are impressive and institutions have been increasing their stakes.

Kin And Carta (LON:KCT) - strong positive reaction to these results. Improving pension fund and trading momentum.

Paul’s Section

Eckoh (LON:ECK)

69.5p (down 3.5%, at 10:00) - mkt cap £176m

Eckoh plc (AIM: ECK), the global provider of secure payment products and customer contact solutions, is pleased to announce its final results for the twelve months to 31 March 2021.

PR summary -

Strong revenue and order momentum in US Secure Payments; resilient performance in the UK

Trading in-line with market expectations - material growth in FY23, after FY22 comparable to current year due to the pandemic

That’s rather confusingly worded. I think what they’re trying to say, is that FY 03/2022 (current year) is likely to be similar to FY 03/2021. Then “material growth” is expected the following year, FY 03/2023.

Results for FY 03/2021 look uninspiring -

- Revenue down 8% to £30.5m

- Adj EBITDA flat at £6.4m

- Adj operating profit also flat at £4.7m

- Diluted EPS down 12% to 1.06p (due to a much higher taxation charge, up from £166k in FY03/2020, to £717k in FY 03/2021) - this is a lot lower than the adjusted EPS figure of 1.5p given in a note today from N+1 Singer, so i’m not sure why ECK is mixing adjusted & unadjusted figures in its headlines, which is confusing

- Net cash slightly up at £11.7m

Outlook -

· Shift to remote working driving opportunities and demand for Eckoh's products and model

· The Board expects revenue and profit for FY22 to be comparable to FY21, and material year-on-year revenue and profit growth in FY23. These expectations are subject to no further lockdowns in the UK or US, and ongoing uncertainty in the macro-economic climate because of the COVID-19 pandemic.

Balance sheet - looks OK, so risk of dilution is minimal, unless they decide to raise cash for acquisitions.

Broker update - many thanks to Kevin Ashton at N+1 for his update note today. This note explains that ECK has a rapidly expanding division , whose performance has been masked by declines in UK revenues. UK is expected to recover.

Actual/forecast EPS is now;

FY 03/2021 actual: 1.5p

FY 03/2022 forecast: 1.4p

FY 03/2023 forecast: 1.8p

At 69.5p per share, that gives PERs of 46.3, 49.6, and 38.6 - wow, toppy ratings for a company struggling to generate earnings growth.

My opinion - it’s just too expensive for me, and I’m not interested in sitting around for a year whilst it recovers, and paying up-front for future growth which may, or may happen.

It's difficult to see what would drive the valuation even higher, unless someone bids for it, or they start to smash forecasts.

.

.

Cml Microsystems (LON:CML)

385p (up c.4%, at 11:14) - mkt cap £64m

CML Microsystems Plc, which develops mixed-signal, RF and microwave semiconductors for global communications markets, announces its Full Year Results for the year ended 31 March 2021.

I don’t have any knowledge of this sector, so will only comment on the numbers, and not try to guess what the company’s prospects are like.

Revenue hit by pandemic, down 17% to only £12.5m (prior year restated to reflect disposal)

High gross profit margin though, at 74%

Breakeven overall result (down from £1.2m profit LY)

Cash pile - the stand out feature here, net cash of £31.9m - which mostly came from the disposal of its storage division for $49m. that's half the market cap!

Over £10m returned to shareholders via share buyback & divis - check the dates, to be sure if before or after the year end.

Special dividend to come of 50p per share (times 16.55m shares in issue = £8.3m) - using up about a quarter of remaining cash pile.

Record order book for continuing business as at 31 March 2021

Proposed move to AIM - which won’t matter to most private shareholders, and could be positive if it attracts IHT portfolio funds as repeat buyers

Outlook comments sound upbeat -

We start the new trading year in a much stronger position than one year ago. Headwinds remain, including the pandemic, trade uncertainty between China and the USA and the ongoing semiconductor capacity issues that are widely reported. That said, the underlying feeling within the Company is one of opportunity and optimism evidenced by our day-to-day activities and the pipeline of opportunity that we see.

As we move through the year ahead with an arsenal of new products, intellectual property, skills and market intelligence, the Group intends to capture share in much larger application areas. Economic uncertainty aside, the fundamental growth factors are positive and subject to unforeseen circumstances, we expect a good year of progress for the continuing business, both from a revenue and a profitability perspective."

My opinion - this looks an intriguing special situation. Anyone interested in buying would need to check the special dividend terms - ex-divi dates, etc. That special divi will use up about a quarter of the remaining cash pile. What the company decides to do with the rest of the surplus cash will be an important point to think about.

I like the upbeat-sounding outlook comments.

Stripping out the net cash, what we’re being asked to pay for the remaining business seems pretty modest, if it is able to rebuild profitability. I'm impressed that it was able to sell off the storage business for a considerable sum - is there hidden value in the remaining business I wonder? That said, the remaining business is very small.

This one could be worthy of readers doing some more research on it, it looks potentially interesting.

.

.

Vianet (LON:VNET)

95.5p (down c.3% at 14:12) - mkt cap £28m

Vianet Group plc (AIM: VNET), the international provider of actionable data and business insight through devices connected to its Internet of Things platform ("IOT"), is pleased to announce its final results for the year ended 31 March 2021.

PR heading -

Resilient financial performance in a challenging period with a solid platform to support growth

It’s had a bad year, as I would expect, due to the pandemic.

Revenue down 48% at £8.4m

The adjusted operating loss, pre-exceptionals (£343k), amortisation & share based payments, was £(0.69)m - not bad in the circumstances, although see below for heavy capitalised development costs.

The pre-tax loss of £(2.5)m looks a more realistic measure of performance. That’s softened by a £867k negative tax charge, so £(1.6)m loss after tax.

Dividends - a former reliable cash cow, the divis have been paused to conserve cash.

Balance sheet - is it financially distressed? NTAV is still positive at £1.8m, and the bank debt doesn’t look particularly bad at net debt of £2.67m. In normal times, its Brulines division is a good cash cow, so I imagine the bank would probably be fairly relaxed about this level of debt, and some has a partial taxpayer guarantee. Although you never can tell, banks can suddenly turn on companies, if someone at divisional office decides they don’t like the risk.

Cashflow statement - the figure that jumps out at me, is capitalised developments costs, a whacking great £2.3m. That’s highly material, and I think renders the adjusted operating profit number above a red herring.

Note the £3.54m of new borrowings taken on this year.

My opinion - it wouldn’t surprise me if the company does a small top-up placing, to reduce its reliance on bank debt. However, I don’t see that as a problem, because the likely size if it happens would probably only be less than 10% dilution, so it’s not a worry.

The core Brulines business should be a reasonable cash cow again, once hospitality recovers. I think we’re getting to a point where the public are sick of restrictions, and once vaccinated, it’s arguably up to each of us to assess personal risk (statistically very low after 2 jabs). For this reason, I am hopeful of proper re-opening in July, which should then herald a return to profits for Vianet.

Its vending business seems too small, and growth has been limited, so that doesn’t interest me.

Overall, to me, Vianet seems an OK niche business, with little growth potential overall. Therefore I can’t see any reason to get involved, and I cannot see the point in its stock market listing - all that complexity & cost, for very little in return. It’s been around for donkey’s years, and doesn’t really make much progress. The main attraction was always the divis, but with those paused for now, then there’s not really anything here to get excited about.

.

.

Jack’s section

Property Franchise (LON:TPFG)

Share price: 290p (-1.36%)

Shares in issue: 32,041,966

Market cap: £92.9m

Property Franchise (LON:TPFG) is the UK’s largest multi-brand lettings and estate agency franchising group. Its business model is similar to that of Belvoir (LON:BLV) , which has also done very well recently. This shouldn’t come as too much of a surprise, given that several financial characteristics here indicate a strong business model and a solid potential long term investment.

Some of these include:

- A Quality Rank of 99, with double digit ROCE and operating margins over multiple years,

- Steadily increasing revenue and net profit,

- High margin franchising operations,

- Typically more that 100% cash conversion,

- Rising dividend payments,

- Plenty of runway for growth, and

- A habit of maintaining a net cash position, with minimal equity dilution.

It’s easy to think an estate agency franchising group might have had a rough ride during a pandemic and lockdowns, but it seems you can’t keep a good company down.

Highlights:

- Revenue +90% including Hunters; +29% on 2020 and +26% on 2019 on a like-for-like basis,

- Group Management Service Fees (MSF) +54% on 2020. Like for like MSF +29% on 2020 and +16% on 2019.

Trading for the first five months of the financial year has been ‘strong’ and in line with management’s expectations.

Revenue was significantly higher year-on-year as the group laps Covid disruption. The results have also benefitted from the acquisition of Hunters, which completed on 19 March 2021.

The sales market continues to be buoyant.

House sales were up 89% in the TPFG high street-led offices and 126% in EweMove. This compares favourably to growth over 2019, which was between 36% and 97% respectively. The average sales fee charged has increased by over 10% in the last year, in-line with growth in UK house prices.

EweMove (Property’s hybrid estate agency) achieved record recruitment of 30 new franchisees in the period - almost as many as it has ever recruited in a year. It’s on track to double the size of EweMove territories to 230 by the end of 2022.

The integration of Hunters is progressing well with particular focus on finance, training, compliance, IT and key suppliers in the first three months.

Following the announcement of the strategic partnership with LSL in April 2021, the franchise network has shown extremely strong interest.

Whilst the residential housing market currently remains very busy, supported by the Government's stamp duty holiday and introduction of the 95% mortgage, TPFG believes its strategic initiatives will drive organic, like-for-like growth even when the external market begins to normalise.

The H1 trading update is expected in late July 2021.

Conclusion

Property Franchise has an extremely high Quality Rank, steady revenue and profit growth, and plenty of runway going forward. The financial data over many years now suggests a well run operation with a strong business model.

It is is highly cash generative and there are plenty of consolidation opportunities, while EweMove and the new financial division present good organic growth potential.

Even after the strong run, a forecast PEG of just 0.6 suggests there is good value here following the Hunters acquisition and, with the market remaining healthy, the company is in a good place.

Market conditions are actually more favourable than in 2019, before Covid. Admittedly this is helped by the government’s stamp duty holiday and mortgage initiatives.

Ultimately though, TPFG seems to be proving itself as a conservatively run, high quality, growing company and as such it’s hard to find fault with it.

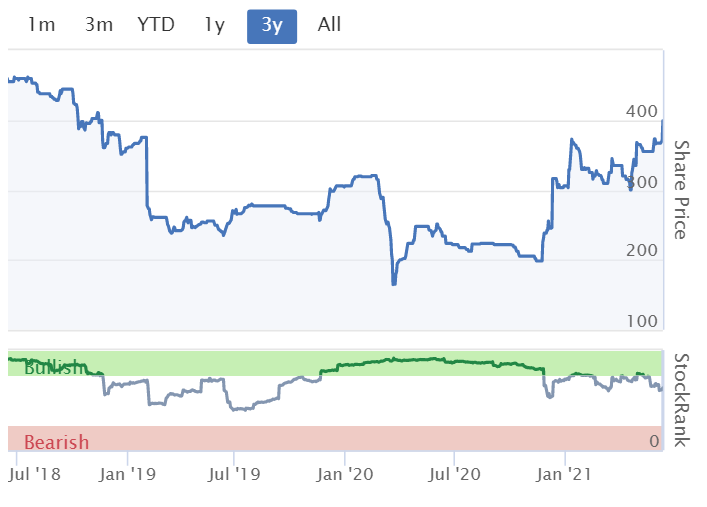

K3 Capital (LON:K3C)

Share price: 380p (+3.68%)

Shares in issue: 68,838,309

Market cap: £261.6m

K3 Capital (LON:K3C) is a ‘Multi-Disciplinary and complementary group of professional Services Businesses advising UK SMEs and with some operations overseas’. It provides advice to smaller companies in potentially tricky areas like mergers & acquisitions, tax, and restructuring.

The group listed on AIM in April 2017 and has since been busy acquiring and integrating complementary businesses. It looks like this strategy is gaining traction with the market following a period of underperformance.

And the group is now generating some impressive compound annual growth rates. Such acquisition-led growth brings execution risk, but if management is up to the task and these rates continue, then K3C stands to become a much larger business in the years ahead.

Trading update for the year ended 31 May 2021

K3 says it has delivered an ‘exceptionally strong performance’ and has grown revenues and profits across all divisions.

As a result, K3 now expects to report full year revenues of c£46m and adjusted EBITDA of not less than £14.25 million. These results exceed the full year guidance provided in recent trading updates, with adjusted EBITDA significantly ahead of current consensus market expectations.

Adjusted EBITDA is stated before acquisition related costs and share based payment charges, and current consensus analyst forecasts for revenue of £45.02m and adjusted EBITDA of £13.27m.

The M&A division had a strong year with material organic growth and a high profit margin contribution. The Quantum and randd acquisitions are described as ‘transformational’, while three additional bolt-on acquisitions have also contributed to profit growth and revenue diversification.

The balance sheet is fine, with cash of c£14m and undrawn debt facilities of £15m. The group will likely use these facilities to fund future bolt on acquisitions.

Conclusion

Shares in issue have increased as the business grows, and management must ensure that sustainable earnings and cash flows increase ahead of this rate of dilution. It looks like that’s happening for now.

Lots of acquisitions and integrations can be a tricky act to balance. Multiple studies from Mauboussin et al famously cite large acquisitions as the most value-destructive form of capital allocation. But for some it can be a very successful strategy.

K3C is clearly a company on the move though and as such it is worth looking at more closely. Even though the insolvency market has been suppressed by (arguably much-needed) government initiatives, these FY21 results are significantly ahead of initial market expectations and beat multiple upgrades throughout the year.

There is some degree of cyclicality in the group’s services to SMEs but the group is diversifying its revenue streams and says it is now ‘positioned to deliver robust performances across all economic cycles’.

It’s tempting to say the shares look fully valued at present, on a forecast PE ratio of 22.7x and 34.8x forecast free cash flow. But the group has good trading momentum and is consistently beating expectations, so there’s the possibility these valuations could be misleading, or another acquisition could change the picture.

I note institutional shareholders have been increasing their stakes and this continues to be a company of interest.

Kin + Carta (LON:KCT)

Share price: 242.03p (+22.24%)

Shares in issue: 168,845,628

Market cap: £408.7m

A big move up today from Kin And Carta (LON:KCT) , which offers digital transformation strategies focusing on four key elements of data, technology, experience, and organisational change.

The group is headquartered in London and Chicago and serves the healthcare, financial services, B2B, consumer, agriculture and transportation sectors.

It has three distinct ‘schools of specialist talent’:

- Kin + Carta Advise - management consultancy that helps the C-Suite better understand the shifts in their market and how their products and services need to evolve.

- Kin + Carta Create - cloud, data and software engineering studio. 800+ data scientists, software engineers and designers work to create new products and platforms for clients.

- Kin + Carta Connect - data-driven marketing technology agency.

The financials here look much less attractive than at K3 and Property Franchise on the face of it. There’s a big gap between (less flattering) reported and (more flattering) normalised EPS over the years.

Consistently large differences between reported and normalised figures can be a warning sign that management is attempting to produce an unduly positive interpretation of results. The group has a pension fund, so this might explain the difference.

It’s worth noting that the operating and free cash flows are much closer to the normalised figures in this instance though.

For the current financial year ending 31st July 2021, the company now expects net revenue growth of circa 10% to approximately £150m (£137.8m FY 2020) and growth in underlying profit before tax of circa 35-40% to approximately £14.5m (£10.5m FY 2020), comfortably ahead of market expectations for the current financial year.

Furthermore, a good backlog means Kin expects accelerating growth in net revenue to c20% and improving underlying operating margin of 12-13% for FY22.

In the medium term it anticipates continued organic net revenue growth of circa 15% compound annual growth rate along with increasing operating margins. That’s quite a strong outlook.

The company's operating cash flow generation continues to improve with growth, and net debt at 31 July 2021 will be substantially lower than the prior year with a resulting net debt to EBITDA ratio of circa 1.0x.

No return to dividend payments. The board instead wants to prioritise the allocation of capital to the ‘considerable’ organic and inorganic growth opportunities it sees ahead.

Paycheck Protection Program ("PPP") loan

Kin + Carta has been notified by the US government that a further £3.7m of the £6.7m PPP loan has been forgiven as expected, in addition to the £0.8m of forgiveness recognised in January 2021.

This will be recorded as other operating income in H2. The remaining balance on the PPP loan of £1.8m after adjusting for foreign exchange movements will be repaid in May 2022.

Pension fund

The situation here is improving as well. The value of assets have increased and a higher discount rate means the present value of liabilities has reduced. The net effect is a reduction in deficit from £28.4m to £8.8m. An actuarial valuation is scheduled for April 2022 and the accounting valuation actually shows a £4.9m surplus which is ‘likely to have increased’ since the last reporting date.

Things can always reverse here, but the direction of travel is encouraging.

Conclusion

Kin has surprised me. It’s a great update and a solid beat on expected earnings and revenue, with additional good news in its improving pension fund position and loan forgiveness.

Previously I had concerns about the group’s financial health so this is encouraging to see. I’ve also wondered about the trading momentum and falling revenue in the past (which predates Covid).

But it’s hard to argue with these results. I am surprised by the scale of today’s rise - perhaps that is the market showing us there’s something worth digging into here? I remain somewhat wary due to the track record of losses and the pension fund but investment propositions change all the time so it pays to keep an open mind.

The group’s medium term guidance of 15% pa organic revenue growth is promising, as is the desire to devote capital to ‘considerable’ growth opportunities.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.